The global aluminum channel market is experiencing robust growth, driven by rising demand in construction, transportation, and renewable energy sectors. According to Grand View Research, the global aluminum profiles market—encompassing channels, angles, and custom extrusions—was valued at USD 59.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. This growth is fueled by aluminum’s lightweight, corrosion-resistant properties and increasing adoption in sustainable building practices. Mordor Intelligence further highlights a CAGR of over 5% for the aluminum extrusion market through 2028, with Asia-Pacific leading in both production and consumption. As demand for precision-engineered alum channels climbs across industries, manufacturers are scaling innovation in alloy development, surface finishing, and sustainable production methods. In this competitive landscape, the following ten companies stand out for their technical capabilities, global reach, and consistent market performance.

Top 10 Alum Channel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Alcoa

Domain Est. 1986

Website: alcoa.com

Key Highlights: Aluminum. Our aluminum segment includes smelting, casting and select energy assets. · Alumina. We are the world’s largest third-party producer of alumina….

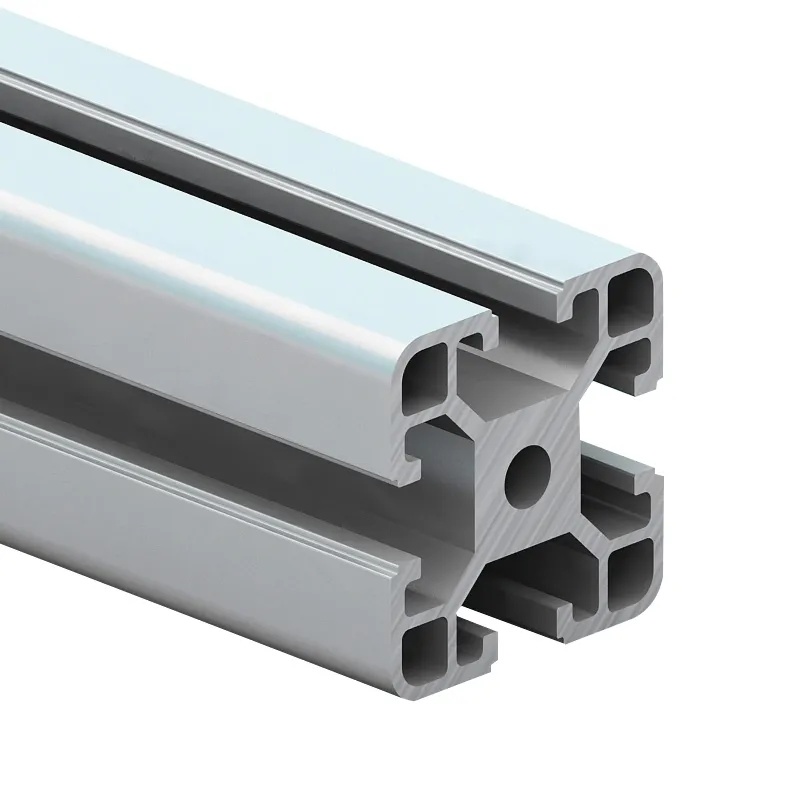

#2 80/20 Aluminum Extrusions

Domain Est. 1997

Website: 8020.net

Key Highlights: T-Slots, aluminum extrusions, and parts. Architectural solutions and frames for industrial machine guards, workstations, data center enclosures, and more….

#3 Channel Aluminum Extrusions

Domain Est. 1992

Website: saf.com

Key Highlights: SAF has one of the largest stocked selections of 6063 architectural (square corner) aluminum channel extrusions in the nation….

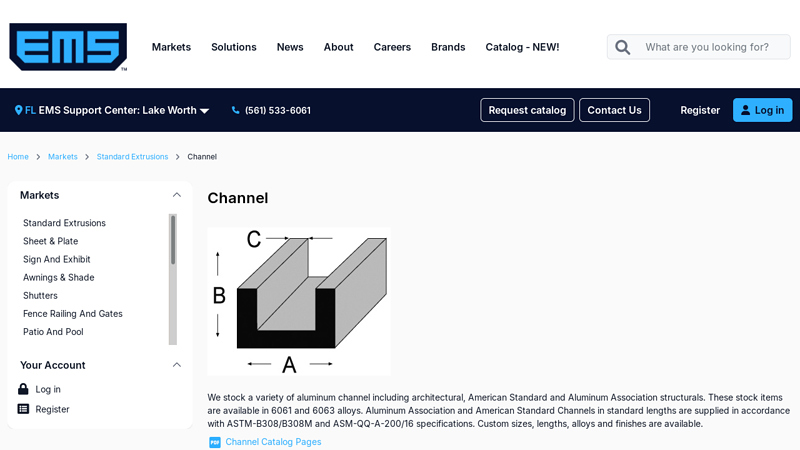

#4 Aluminum Channel Extrusions

Domain Est. 1996

Website: easternmetal.com

Key Highlights: We stock a variety of aluminum channel including architectural, American Standard and Aluminum Association structurals. These stock items are available in 6061 ……

#5 Aluminum Channel

Domain Est. 1998

Website: piercealuminum.com

Key Highlights: Pierce Aluminum supplies a full inventory of aluminum channel extrusions, as well as complete processing and fabrication services, at its 10 U.S. locations….

#6 High-Quality Aluminum Channel

Domain Est. 1998

Website: extrude-a-trim.com

Key Highlights: Discover premium aluminum channel from Extrude-A-Trim, designed for durability and precision. Ideal for construction, framing, and more….

#7 Jindal Aluminium Limited

Domain Est. 1999

Website: jindalaluminium.com

Key Highlights: Discover quality downstream aluminium products from Jindal Aluminium, India’s largest aluminium extruded and second-largest aluminium flat-rolled product ……

#8 Channel Manufacturing

Domain Est. 2000

Website: channelmfg.com

Key Highlights: At Channel Manufacturing, we manufacture the highest quality aluminum and stainless-steel food and material handling equipment, right here in our United States ……

#9 Aluminum Channel Supplier

Domain Est. 2013

Website: thyssenkrupp-materials-na.com

Key Highlights: thyssenkrupp Materials NA has Aluminum Channel in-stock of 6061 and 6063 alloys. We offer these products in many grades, sizes, and lengths to suit your ……

#10 Extruded Aluminum Channel Supplier

Domain Est. 2016

Website: wellste.com

Key Highlights: Wellste is your single resource for extruded aluminum channels,from exsiting standard tooling to customzied design, Get your cost-effective products today….

Expert Sourcing Insights for Alum Channel

H2: Analysis of 2026 Market Trends for Aluminum Channels

As we approach 2026, the global market for aluminum channels is poised for significant transformation driven by technological advancements, shifting industrial demands, sustainability imperatives, and evolving supply chain dynamics. Aluminum channels—structural profiles widely used in construction, transportation, electronics, and renewable energy—benefit from aluminum’s lightweight, corrosion-resistant, and recyclable properties. This analysis explores key market trends expected to shape the aluminum channel industry in 2026, based on current trajectories and macroeconomic indicators.

-

Rising Demand in Green Construction and Infrastructure

The global push for sustainable building practices is significantly boosting demand for aluminum channels. With energy efficiency and low-carbon materials becoming central to green building certifications (e.g., LEED, BREEAM), architects and developers increasingly favor aluminum framing systems for windows, curtain walls, and modular construction. In 2026, urbanization in emerging markets—particularly in Southeast Asia, India, and Africa—combined with infrastructure modernization in developed economies, will drive robust growth in aluminum channel applications. -

Expansion in Electric Vehicles (EVs) and Lightweight Transportation

The automotive sector, especially the EV industry, is a major driver of aluminum channel demand. As automakers strive to improve battery range through weight reduction, aluminum extrusions—including channels used in battery enclosures, chassis components, and interior frameworks—are being adopted at an accelerating pace. By 2026, increased EV production targets in North America, Europe, and China are expected to elevate aluminum channel consumption, with OEMs partnering closely with aluminum extruders for custom designs. -

Growth in Renewable Energy Applications

Aluminum channels are critical components in solar panel mounting systems due to their durability and resistance to environmental degradation. With global solar capacity projected to double by 2026 (according to IEA forecasts), demand for structural aluminum profiles will surge. Utility-scale solar farms and rooftop installations alike rely on prefabricated aluminum channel systems for efficient, scalable deployment—making this sector a cornerstone of future market growth. -

Technological Innovations in Extrusion and Surface Treatment

Advancements in aluminum extrusion technology—such as precision die design, high-speed extrusion, and thermal break integration—are enabling lighter, stronger, and more thermally efficient channel profiles. Additionally, improved anodizing and powder coating techniques enhance corrosion resistance and aesthetic versatility, expanding applications in consumer-facing industries. By 2026, digitalization of extrusion processes (Industry 4.0) will improve yield rates and customization capabilities, supporting just-in-time manufacturing models. -

Sustainability and Circular Economy Pressures

Environmental regulations and ESG (Environmental, Social, Governance) reporting are pushing aluminum producers and fabricators to reduce carbon footprints. Aluminum recycling, which requires only 5% of the energy needed for primary production, is gaining momentum. In 2026, market leaders are expected to emphasize the use of post-consumer recycled aluminum in channel production. Certifications like the Aluminium Stewardship Initiative (ASI) will become differentiators in competitive bidding, particularly in public infrastructure projects. -

Geopolitical and Supply Chain Dynamics

The aluminum channel market remains sensitive to raw material costs, energy prices, and trade policies. As of 2024–2025, fluctuations in bauxite supply, electricity costs for smelting, and tariffs (e.g., U.S.-China trade tensions) are prompting regionalization of supply chains. By 2026, manufacturers are likely to diversify sourcing and increase regional production capacity—especially in North America and Southeast Asia—to mitigate risks and improve delivery timelines. -

Competitive Landscape and Market Consolidation

The aluminum channel market is expected to see increased consolidation as larger players acquire niche extrusion firms to expand product portfolios and geographic reach. Simultaneously, smaller, agile manufacturers are focusing on high-value, customized solutions for specialized applications (e.g., aerospace, medical devices). Digital platforms for B2B procurement and inventory management will enhance market transparency and streamline distribution.

Conclusion

The 2026 market for aluminum channels will be shaped by converging forces of sustainability, technological innovation, and sectoral demand—especially in construction, EVs, and renewable energy. Companies that invest in low-carbon production, advanced extrusion capabilities, and strategic supply chain resilience will be best positioned to capture growth. As aluminum continues to outperform traditional materials in performance and lifecycle value, the channel segment is set for sustained expansion in a decarbonizing global economy.

Common Pitfalls Sourcing Aluminum Channel: Quality and Intellectual Property Risks

Sourcing aluminum channels—whether for construction, manufacturing, or design—can present several challenges, particularly concerning material quality and intellectual property (IP) protection. Falling into these common pitfalls can lead to project delays, increased costs, legal complications, and compromised product performance. Below are key areas to watch for.

Quality-Related Pitfalls

1. Inconsistent Material Specifications

One of the most frequent issues is receiving aluminum channels that do not meet specified grades (e.g., 6061-T6 vs. 6063-T5). Suppliers may substitute lower-grade alloys to cut costs, resulting in reduced strength, corrosion resistance, or machinability. Always verify material certifications (e.g., mill test reports) and conduct third-party testing if necessary.

2. Poor Surface Finish and Tolerances

Offshore or unverified suppliers may deliver products with rough finishes, warping, or dimensional inaccuracies. This can affect fit, finish, and assembly in precision applications. Ensure clear technical drawings with GD&T (Geometric Dimensioning and Tolerancing) are provided and inspected upon receipt.

3. Inadequate Anodizing or Coating

Improper or substandard surface treatments—such as thin anodized layers or non-uniform powder coating—can compromise durability and aesthetics. Specify coating thickness (e.g., 25µm for architectural anodizing) and test for adhesion and corrosion resistance (e.g., salt spray testing).

4. Lack of Traceability and Certification

Reputable suppliers provide full traceability, including alloy composition, temper, and manufacturing origin. Avoid suppliers who cannot provide mill certificates or ISO certifications (e.g., ISO 9001), as this increases the risk of counterfeit or non-compliant materials.

Intellectual Property (IP) Pitfalls

1. Unauthorized Production of Patented Profiles

Some aluminum extrusion profiles are protected by design patents or utility models. Sourcing custom or branded channels (e.g., from知名品牌 like 80/20, Bosch Rexroth) from unauthorized manufacturers may result in IP infringement, even if the buyer is unaware. Always confirm the supplier has rights to produce the profile or obtain legal clearance.

2. Reverse Engineering Without Permission

Copying a competitor’s extrusion profile without authorization—even if slightly modified—can lead to legal action for design patent or trade dress infringement. Invest in original design or license existing IP when required.

3. Supplier Misrepresentation of IP Status

Suppliers may falsely claim that a profile is “generic” or “freely usable.” Conduct due diligence by searching patent databases (e.g., USPTO, EUIPO) or consult IP counsel before mass production or importation.

4. Risk of Counterfeit or Grey Market Goods

Purchasing through unofficial distribution channels increases the chance of receiving counterfeit or diverted products that infringe IP and lack quality control. Use authorized distributors or direct contracts with reputable extruders.

Mitigation Strategies

- Require material test reports (MTRs) and production samples before bulk orders.

- Conduct factory audits or use third-party inspection services (e.g., SGS, Intertek).

- Include IP indemnification clauses in supplier contracts.

- Register custom extrusion designs for patent or design protection where applicable.

By proactively addressing these quality and IP risks, businesses can ensure reliable supply chains, maintain product integrity, and avoid costly legal disputes.

Logistics & Compliance Guide for Alum Channel

This guide outlines the essential logistics and compliance procedures for managing the Alum Channel. Adhering to these standards ensures smooth operations, regulatory adherence, and supply chain integrity.

1. Product Specifications and Documentation

Ensure all alum products meet the defined technical specifications, including chemical composition, purity levels, moisture content, and physical form (e.g., granular, powdered). Maintain up-to-date Safety Data Sheets (SDS) compliant with GHS standards and provide product certifications (e.g., ISO, REACH, FDA, if applicable) for every shipment.

2. Packaging and Labeling Requirements

Use packaging materials that prevent contamination, moisture absorption, and physical damage during transit. Clearly label each package with:

– Product name and grade

– Net weight

– Batch/lot number

– Manufacturer details

– Hazard communication symbols (if applicable)

– Storage and handling instructions

Ensure labels comply with local and international regulations (e.g., OSHA, CLP, TDG).

3. Transportation and Handling

Transport alum in dry, enclosed vehicles to prevent exposure to moisture and contamination. Use forklifts or material handlers with clean, non-reactive surfaces. Avoid co-loading with incompatible materials (e.g., strong acids, bases, or oxidizers). Implement proper stacking and load securing practices to prevent damage.

4. Storage Conditions

Store alum in a cool, dry, well-ventilated area away from direct sunlight and sources of moisture. Keep containers sealed when not in use. Prevent contact with reactive substances. Implement FIFO (First In, First Out) inventory management to maintain product quality.

5. Regulatory Compliance

Comply with all relevant international and local regulations, including:

– REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) – EU

– TSCA (Toxic Substances Control Act) – USA

– WHMIS (Workplace Hazardous Materials Information System) – Canada

– Local environmental and occupational safety laws

Maintain records of import/export documentation, permits, and customs declarations.

6. Import/Export Documentation

Prepare and retain the following for cross-border shipments:

– Commercial Invoice

– Packing List

– Bill of Lading/Air Waybill

– Certificate of Origin

– SDS and Product Compliance Certificates

– Export/Import Licenses (if required)

Ensure Harmonized System (HS) codes are correctly classified (e.g., 2833.29 for other aluminum sulfates).

7. Environmental and Safety Compliance

Adhere to environmental protection standards for waste disposal and emissions. Report any spills or releases according to local regulatory requirements. Provide appropriate PPE (gloves, goggles, masks) for personnel handling alum. Conduct regular safety training and audits.

8. Audit and Recordkeeping

Maintain comprehensive records of:

– Supplier qualifications and audits

– Product testing and quality control

– Transportation logs

– Regulatory submissions

– Training records

Retain all documentation for a minimum of 5 years or as required by jurisdiction.

9. Supplier and Carrier Qualification

Only partner with certified suppliers and logistics providers who meet quality and compliance standards. Conduct periodic audits of suppliers and carriers to ensure continued adherence to environmental, safety, and regulatory requirements.

10. Incident Response and Reporting

Establish a clear protocol for responding to logistics incidents (e.g., spills, delays, regulatory violations). Report incidents to relevant authorities promptly and document root cause analysis and corrective actions taken.

By following this guide, stakeholders in the Alum Channel can ensure efficient, compliant, and responsible handling of alum throughout the supply chain.

Conclusion for Sourcing Alum Channel

In conclusion, sourcing aluminum channels requires a strategic approach that balances quality, cost, availability, and supplier reliability. Aluminum channels offer excellent strength-to-weight ratio, corrosion resistance, and versatility, making them ideal for applications in construction, manufacturing, transportation, and electronics. When sourcing, it is essential to define precise specifications—including alloy type (e.g., 6061, 6063), temper, dimensions, and surface finish—to ensure compatibility with the intended application.

Evaluating suppliers based on certifications, manufacturing capabilities, lead times, and customer service is crucial for maintaining supply chain efficiency and product integrity. Additionally, considering both domestic and international suppliers can provide cost advantages and flexibility, though logistics and import regulations must be factored in. Establishing long-term relationships with reputable suppliers, coupled with regular quality audits and performance reviews, helps mitigate risks and supports sustainable procurement.

Ultimately, a well-structured sourcing strategy for aluminum channels enhances project efficiency, ensures material consistency, and contributes to overall cost savings and operational success.