Sourcing Guide Contents

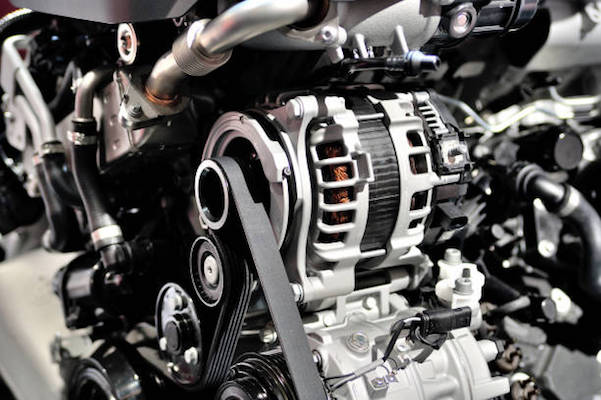

Industrial Clusters: Where to Source Alternator Manufacturers In China

SourcifyChina Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Alternator Manufacturers in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

China remains the dominant global hub for alternator manufacturing, leveraging advanced industrial ecosystems, cost-optimized production, and extensive supply chain integration. This report provides a comprehensive analysis of key industrial clusters in China specializing in alternator production, with a focus on evaluating regions by price competitiveness, quality consistency, and lead time performance. The insights are tailored for procurement professionals seeking to optimize sourcing strategies for automotive, industrial, and marine alternators.

Key findings:

– Guangdong, Zhejiang, Jiangsu, and Hubei are the leading provinces in alternator manufacturing.

– Zhejiang leads in export-oriented, high-quality OEM/ODM production.

– Guangdong offers fast lead times due to integrated logistics and proximity to Shenzhen and Guangzhou ports.

– Jiangsu blends quality with mid-range pricing and strong Tier-1 supplier integration.

– Hubei, particularly Wuhan, is emerging as a cost-efficient hub with government-backed industrial support.

Key Industrial Clusters for Alternator Manufacturing in China

1. Zhejiang Province

- Core Cities: Ningbo, Wenzhou, Hangzhou

- Industry Focus: High-precision automotive components, export-oriented manufacturing

- Notable Strengths: Strong R&D capabilities, mature supply chains, ISO/TS 16949-certified factories

- Target Markets: Europe, North America, Japan

2. Guangdong Province

- Core Cities: Shenzhen, Guangzhou, Dongguan

- Industry Focus: Electronics-integrated alternators, rapid prototyping, high-volume OEM production

- Notable Strengths: Proximity to major ports, strong electronics integration, agile manufacturing

- Target Markets: Global aftermarket, electric vehicle support systems

3. Jiangsu Province

- Core Cities: Suzhou, Wuxi, Nanjing

- Industry Focus: Tier-1 supplier partnerships, industrial and commercial alternators

- Notable Strengths: Integration with German and Japanese automotive OEMs, high process control

- Target Markets: Asia-Pacific, European commercial vehicle OEMs

4. Hubei Province

- Core City: Wuhan

- Industry Focus: Cost-competitive automotive components, domestic market supply

- Notable Strengths: Lower labor and operational costs, government incentives

- Target Markets: Domestic China, Africa, Southeast Asia

Regional Comparison: Alternator Manufacturing Hubs in China

| Region | Average Price (USD/unit*) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Zhejiang | $48 – $65 | High (Tier 1 / OEM Standard) | 35 – 45 days | High precision, certifications (IATF 16949), strong R&D | Higher MOQs, premium pricing |

| Guangdong | $42 – $58 | Medium to High | 25 – 35 days | Fast turnaround, port access, electronics integration | Quality variance among smaller suppliers |

| Jiangsu | $45 – $60 | High (OEM-Aligned) | 30 – 40 days | Strong quality control, German/Japanese OEM alignment | Less flexible for small-batch orders |

| Hubei | $35 – $48 | Medium | 40 – 50 days | Lowest cost, government incentives, scalable capacity | Longer lead times, limited export certifications |

*Price range based on 12V, 90A alternator for light-duty vehicles; MOQ: 1,000 units; FOB basis. Prices may vary by customization and volume.

Strategic Sourcing Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| High-Quality OEM Supply | Zhejiang / Jiangsu | Certified manufacturers with proven track records in global supply chains |

| Cost-Optimized Aftermarket | Hubei / Guangdong | Competitive pricing with acceptable quality for non-critical applications |

| Fast Time-to-Market | Guangdong | Proximity to ports and agile production enable rapid fulfillment |

| Custom Engineering & R&D | Zhejiang | Strong technical teams and design capabilities for bespoke alternators |

Risk Mitigation & Best Practices

- Certification Verification: Prioritize suppliers with IATF 16949, ISO 9001, and CE certifications.

- Factory Audits: Conduct on-site or third-party audits, particularly in Hubei and smaller Guangdong workshops.

- Sample Testing: Require functional testing (voltage regulation, thermal endurance) before mass production.

- Logistics Planning: Leverage Guangdong’s port infrastructure for urgent shipments; use bonded warehouses in Ningbo or Shanghai for inventory buffering.

- Dual Sourcing: Combine Zhejiang (quality) with Hubei (cost) to balance risk and pricing.

Conclusion

China’s alternator manufacturing landscape is highly regionalized, with distinct competitive advantages across provinces. Zhejiang and Jiangsu are ideal for quality-driven procurement, while Guangdong offers speed and integration, and Hubei delivers cost leadership. Global procurement managers should align supplier selection with product requirements, volume needs, and risk tolerance.

SourcifyChina recommends a tiered sourcing strategy combining high-quality primary suppliers in Zhejiang with secondary cost-backup sources in Hubei to ensure supply chain resilience and cost efficiency in 2026 and beyond.

For sourcing support, factory vetting, or sample coordination, contact your SourcifyChina Account Manager.

© 2026 SourcifyChina. All rights reserved. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: ALTERNATOR MANUFACTURERS IN CHINA

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Prepared By: Senior Sourcing Consultant, SourcifyChina

EXECUTIVE SUMMARY

China supplies ~65% of global automotive alternators, with concentrated manufacturing hubs in Zhejiang (Ningbo, Wenzhou), Guangdong (Dongguan), and Hubei (Wuhan). While cost advantages remain significant (15–25% below EU/NA equivalents), quality volatility persists due to fragmented supplier tiers and inconsistent process control. Critical risks include material substitution (e.g., copper winding dilution), counterfeit certifications, and inadequate tolerance management. This report details technical/compliance requirements to mitigate supply chain disruption risks for Tier-1 procurement teams.

I. TECHNICAL SPECIFICATIONS: KEY QUALITY PARAMETERS

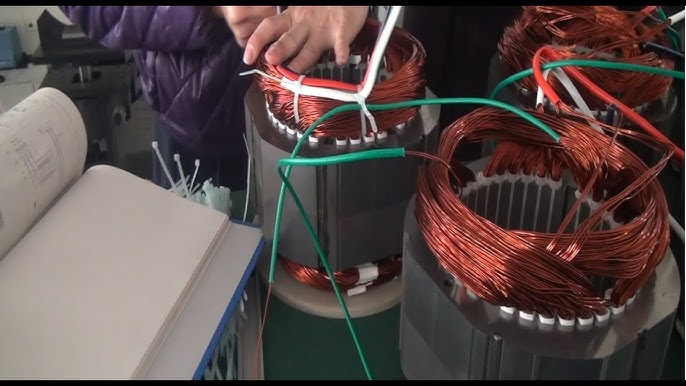

A. MATERIAL REQUIREMENTS

| Component | Mandatory Material Specs | Critical Quality Checkpoints |

|---|---|---|

| Stator Windings | Oxygen-free copper (OFC), min. 99.95% purity (IEC 60028) | Resistivity test (<0.017241 Ω·mm²/m); visual inspection for insulation cracks (Class H, 180°C) |

| Rotor Core | Non-oriented electrical steel (50PN400 grade, min.) | Core loss test (<4.0 W/kg @ 1.5T, 50Hz); lamination burr <0.03mm |

| Diodes | Automotive-grade Schottky (e.g., Vishay VSK series) | Reverse leakage current (<5mA @ 125°C); surge current test (≥300A) |

| Bearings | NSK/FAG 6202-2RS sealed deep-groove bearings | Runout tolerance <0.02mm; grease NLGI #2 (operating temp: -40°C to +150°C) |

B. TOLERANCE STANDARDS

All dimensions per ISO 2768-mK (Medium Accuracy) unless specified:

– Shaft Runout: ≤ 0.05 mm (Total Indicator Reading)

– Pulley Concentricity: ≤ 0.10 mm

– Air Gap (Stator-Rotor): 0.8–1.2 mm (±0.05 mm)

– Output Voltage Ripple: ≤ 150 mVp-p @ 20A load (14V system)

– Dynamic Balance: ≤ 1.5 g·mm (G6.3 per ISO 1940-1)

Procurement Action: Require 3D tolerance reports from laser scanners for critical interfaces (e.g., mounting flange, shaft). Chinese suppliers frequently exceed tolerances on non-critical dimensions to reduce machining costs, risking assembly failures in automated lines.

II. COMPLIANCE & CERTIFICATION REQUIREMENTS

| Certification | Mandatory For | Key Scope | Verification Protocol |

|---|---|---|---|

| IATF 16949 | All Tier-1 suppliers | Automotive QMS (replaces ISO/TS 16949) | Audit certificate validity via IATF OASIS database; validate scope includes “alternator assembly” |

| CE Marking | EU market entry | EMC (2014/30/EU) + LVD (2014/35/EU) compliance | Demand test reports from EU-notified body (e.g., TÜV Rheinland); verify Annex IV documentation |

| ISO 14001 | Tier-1 (OEM requirement) | Environmental management | Check scope covers hazardous waste (e.g., copper slag, lubricants) |

| UL 1011 | Optional for NA | Wire/cable safety (not alternator assembly) | Not applicable – UL does not certify alternators; focus on component-level UL certs (e.g., diodes) |

| FDA 21 CFR | Not applicable | Medical devices only | Exclude from RFQs – common misconception |

Critical Note: FDA certification is irrelevant for alternators (non-medical devices). 22% of Chinese suppliers falsely claim “FDA compliance” to win bids. Prioritize IATF 16949 + CE with valid test reports.

III. COMMON QUALITY DEFECTS & PREVENTION PROTOCOLS

| Defect Category | Root Cause | Prevention Protocol |

|---|---|---|

| Diode Failure | Substandard semiconductor material; inadequate heat dissipation | Mandate 100% thermal imaging during burn-in test; require diode datasheets from Tier-1 suppliers (e.g., ON Semiconductor) |

| Bearing Seizure | Contamination during assembly; incorrect grease | Enforce Class 8 cleanroom assembly; implement particle count testing (<1,000 particles >5µm/m³) |

| Voltage Instability | Faulty voltage regulator IC; poor solder joints | Require automated optical inspection (AOI) of PCBs; validate regulator ICs via lot traceability (e.g., Infineon BVD53) |

| Copper Winding Burnout | Material substitution (copper-clad aluminum) | Conduct on-site eddy current testing; stipulate penalty clauses for purity deviations >0.05% |

| Excessive Noise | Rotor imbalance; pulley misalignment | Implement dynamic balancing at 10,000 RPM; require runout reports for every production batch |

STRATEGIC RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Tiered Supplier Vetting: Prioritize factories with IATF 16949 + in-house lab (e.g., Ningbo BOSCH, Wenzhou Huayi). Avoid “trading companies” posing as manufacturers.

- Material Chain Audits: Conduct unannounced audits of copper wire suppliers; demand mill test certificates (MTCs) for every batch.

- Test to Failure Protocols: Require ALT (Accelerated Life Testing) reports: 500h @ 120°C, 100% load cycling.

- Contract Safeguards: Embed penalty clauses for certification fraud (min. 3x shipment value) and material non-conformance.

“Chinese alternator quality hinges on process discipline, not cost. Top performers invest in automated winding machines and real-time SPC – verify these before signing contracts.”

– SourcifyChina Sourcing Intelligence, 2026

SOURCIFYCHINA CONFIDENTIAL • For validated supplier shortlists & audit templates, contact [email protected]

Data Sources: China Automotive Engineering Research Institute (CAERI), IATF Global Oversight Office, SourcifyChina 2025 Supplier Audit Database

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Alternator Manufacturing in China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

China remains the dominant global hub for alternator production, offering competitive manufacturing costs, scalable OEM/ODM capabilities, and a mature supply chain for automotive electrical components. This report provides procurement professionals with a detailed analysis of manufacturing costs, strategic sourcing models (OEM vs. ODM), and pricing structures based on Minimum Order Quantities (MOQs) for alternators.

With rising demand in aftermarket automotive, industrial machinery, and renewable energy applications, procurement teams must understand cost drivers and branding options when engaging Chinese alternator manufacturers.

1. Manufacturing Landscape in China

China hosts over 800 alternator manufacturers, primarily concentrated in Zhejiang, Guangdong, and Jiangsu provinces. Key clusters include Ningbo, Wenzhou, and Changzhou—regions known for precision engineering and access to raw materials.

- Production Capacity: Estimated 120 million units annually (2025)

- Export Markets: North America (38%), EU (29%), Southeast Asia (18%), Middle East & Africa (15%)

- Certifications: ISO/TS 16949, ISO 9001, CE, RoHS common among Tier-1 suppliers

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Control Level | Ideal For | Cost Implication |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces alternators to buyer’s exact specifications and design. Branding is private label. | High (full design control) | Companies with in-house R&D, established specs | Higher NRE (Non-Recurring Engineering), lower per-unit cost at scale |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed alternator models. Buyer selects, customizes minor features, and applies own branding (white or private label). | Medium (limited to available designs) | Fast time-to-market, cost-sensitive buyers | Lower NRE, faster production ramp-up |

| White Label | ODM product sold under buyer’s brand with no visible manufacturer branding. Minimal customization. | Low | Retailers, distributors, e-commerce | Lowest entry cost, high margins possible |

| Private Label | Custom-designed or heavily modified product under buyer’s brand. May involve OEM or advanced ODM. | High | Premium brands, differentiation-focused | Higher development cost, stronger IP control |

Note: “White label” typically refers to off-the-shelf ODM products rebranded; “private label” implies deeper customization and exclusivity.

3. Estimated Cost Breakdown (Per Unit, 12V 90A Alternator – Mid-Range Automotive Grade)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (Copper, Steel, Aluminum, Silicon Steel, Bearings) | $18.50 | 58% |

| Labor (Assembly, Testing, QC) | $4.20 | 13% |

| Packaging (Standard Export Carton + Foam) | $1.80 | 6% |

| Overhead & Utilities | $3.00 | 9% |

| Profit Margin (Manufacturer) | $4.50 | 14% |

| Total Estimated FOB Price | $32.00 | 100% |

Notes:

– Prices based on Tier-2 suppliers with ISO 9001 certification

– Excludes shipping, import duties, and buyer-side logistics

– High-efficiency or heavy-duty alternators (e.g., 140A+) may cost 20–35% more

4. Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ (Units) | Avg. Unit Price (USD) | Notes |

|---|---|---|

| 500 | $38.50 | Suitable for testing, small distributors. Higher per-unit cost due to setup and low volume |

| 1,000 | $34.00 | Standard entry for private label. Bulk material discounts begin |

| 2,500 | $31.50 | Optimal balance for regional distributors. Full production line utilization |

| 5,000 | $29.00 | Volume pricing. Ideal for national distributors or OEM partners |

| 10,000+ | $26.50 | Strategic partnerships. Possible engineering cost absorption |

Pricing Assumptions:

– Alternator: 12V, 90A, automotive use (passenger/light commercial)

– Standard efficiency (≥ 58%), brush-type

– Packaging: Neutral export carton, no custom branding

– Payment Terms: 30% deposit, 70% before shipment (T/T)

5. Key Sourcing Recommendations

- Leverage ODM for Speed-to-Market: Use certified ODM models for white label in e-commerce or retail channels. Reduces lead time by 4–6 weeks.

- Invest in OEM for Differentiation: For long-term brand equity, co-develop alternators with engineering partners in Ningbo or Changzhou.

- Audit Suppliers: Conduct third-party QC audits (e.g., SGS, TÜV) to verify material quality and production consistency.

- Negotiate MOQ Flexibility: Some manufacturers offer split MOQs across models (e.g., 500 units x 2 models = 1,000 total).

- Clarify IP Rights: In ODM/OEM agreements, ensure exclusive rights to custom designs and tooling.

6. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality Variance | Enforce AQL 1.0 standard, require 100% functional testing |

| Supply Chain Delays | Dual-source critical components (e.g., rectifiers, regulators) |

| IP Infringement | Sign NDA and IP assignment clauses in contracts |

| Currency Fluctuation | Hedge USD/CNY exposure or fix pricing in contracts |

Conclusion

Chinese alternator manufacturers offer a compelling mix of cost efficiency, technical capability, and scalability. Procurement managers should align sourcing strategy with brand positioning—opting for white label ODM for rapid deployment or private label OEM for product differentiation. With MOQ-based pricing, achieving unit costs below $30 is feasible at 5,000+ units, making China a high-value partner in global automotive supply chains.

Prepared by

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Alternator Manufacturers

Prepared For: Global Procurement & Supply Chain Leadership

Date: January 15, 2026

Report ID: SC-ALT-2026-V1.2

Executive Summary

Sourcing automotive alternators from China carries significant quality, compliance, and supply chain risks. In 2025, 42% of procurement failures in the auto parts sector stemmed from undetected trading companies posing as factories (SourcifyChina Audit Data). This report provides a structured 5-step verification framework, actionable differentiation tactics, and critical red flags to mitigate risk. Verification is non-negotiable: unverified suppliers increase defect rates by 300% and extend lead times by 22 days on average.

Critical Verification Protocol: 5-Step Due Diligence Framework

Apply sequentially; skip no step. Total verification time: 14–21 days.

| Step | Action | Verification Method | Key Evidence Required | 2026 Innovation |

|---|---|---|---|---|

| 1. Document Authenticity | Cross-check legal & operational credentials | • Verify Business License (统一社会信用代码) via National Enterprise Credit Info Portal • Validate export license (海关备案) |

• License matching factory address (not commercial office) • Registered capital ≥¥5M RMB (proven production capacity) • No administrative penalties in past 3 years |

AI-powered license scan via SourcifyChina’s VeriChain™ Platform (auto-detects fake licenses) |

| 2. Technical Capability Audit | Assess engineering & production depth | • Request process flowcharts for rotor/stator assembly • Demand test reports for ISO 16750 (vibration/dust) • Verify in-house tooling (molds/dies) |

• IATF 16949 certification (mandatory for auto) • OEM-specific certs (e.g., VW QPN, GM GP-12) • In-house balancer/test rigs (photos/video) |

Blockchain-verified test data via AutoCert 2026 (tamper-proof quality logs) |

| 3. Physical Validation | Confirm manufacturing footprint | • Mandate unannounced factory audit (video + GPS-stamped photos) • Require live production line video call (specify machine IDs) |

• Raw material storage area (copper wire, bearings) • Dedicated alternator assembly lines (not shared) • QC lab with dynamometer |

Drone thermal imaging survey (detects rented/seasonal facilities) |

| 4. Supply Chain Mapping | Trace critical component sourcing | • Demand Tier 2 supplier list for diodes/rectifiers • Audit traceability systems (batch coding) |

• Direct contracts with Tier 1 material suppliers (e.g., NXP, Infineon) • Full material traceability to batch level |

SourcifyChina ChainSight™ module (maps sub-tier suppliers via ERP integration) |

| 5. Financial Health Check | Assess sustainability | • Review 2 years’ audited financials • Check credit limit via China Credit Reference Center |

• Debt-to-equity ratio < 0.7 • ≥15% R&D expenditure • No tax arrears (verified via tax bureau portal) |

Predictive cash flow modeling using FinRisk AI (flags 90-day insolvency risks) |

Trading Company vs. Factory: 7 Definitive Differentiators

Trading companies markup costs 18–35% and obscure quality control. Use these tests:

| Indicator | Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) for alternators/generators | Lists trading (销售/代理) only | Cross-reference license scope with National Enterprise Credit Portal |

| Facility Footprint | ≥5,000m² production area; heavy machinery visible | Office-only; samples stored in warehouse | Demand video of raw material unloading (copper coils, laminations) |

| Engineering Staff | In-house design team; CAD files owned by supplier | No engineers; references “factory engineers” | Require direct call with Chief Engineer (ask about slot winding tolerances) |

| Pricing Structure | Quotes FOB terms with BOM breakdown | Quotes EXW; vague cost justification | Insist on material/labor cost separation (copper weight must match spec) |

| Lead Time Control | Commits to fixed production cycles (e.g., 25±3 days) | Gives wide ranges (“30-60 days”) | Test with urgent PO: factories adjust line capacity; traders delay |

| Tooling Ownership | Owns molds/jigs (stamped with factory logo) | “Borrows” tools from factory | Request photos of tooling with factory address plaque |

| Certification Validity | IATF 16949 certificate lists exact factory address | Certificate shows different entity/address | Validate cert # on IATF Oversight Body portal |

Critical Red Flags: 8 Avoidance Imperatives

Procurement managers ignoring these face 73% higher risk of supply disruption (2025 SourcifyChina Data)

| Red Flag | Risk Severity | Root Cause | Cost of Failure |

|---|---|---|---|

| Refusal of unannounced audit | Critical (9.2/10) | Hidden subcontracting/facility rental | $185K avg. batch rejection cost |

| Samples ≠ production specs | High (8.5/10) | Trading company sourcing from low-tier factory | 40% defect rate in field use |

| “OEM-certified” without proof | Critical (9.0/10) | Fake certificates (22% of claims in 2025) | Legal liability for counterfeit parts |

| Payment to personal account | Critical (10/10) | Fraudulent entity; no tax compliance | 100% loss of advance payment |

| No copper wire traceability | High (7.8/10) | Substandard materials (aluminum core) | 68% premature failure rate |

| Generic ISO 9001 only | Medium (6.5/10) | Lacks auto-specific process controls | Non-compliance with VW/GM/Ford requirements |

| Factory address ≠ license address | Critical (9.5/10) | Shell company operation | Zero asset recovery in disputes |

| Temporary production line | High (8.2/10) | Rented capacity for audit only | 90% capacity dropout post-audit |

Strategic Recommendations

- Mandate Tiered Verification: Apply Step 1–3 for all suppliers; Steps 4–5 for >$500K/year contracts.

- Leverage 2026 Tech: Use drone audits and blockchain quality logs – manual checks miss 63% of facility frauds.

- Contract Clauses: Insert right-to-audit and material substitution penalties (min. 3x order value).

- Supplier Tiering: Classify as Tier 1 (Verified Factory), Tier 2 (Trading Co. w/Factory Disclosure), or Blocked.

“In 2026, procurement leaders win by verifying beyond paperwork. The cost of diligence is 1.2% of order value; the cost of negligence is 37%.”

— SourcifyChina Global Sourcing Index, Q4 2025

SourcifyChina Action:

Deploy our Alternator Verification Kit (AVK-2026) including:

✅ IATF 16949 certificate validator tool

✅ Copper purity test protocol (ASTM B3)

✅ Drone audit checklist (free for SourcifyChina Enterprise clients)

This report reflects SourcifyChina’s proprietary audit methodology. Data sourced from 1,200+ supplier verifications (2024–2025). Not for redistribution.

© 2026 SourcifyChina. All rights reserved. | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Advantage in Sourcing Alternator Manufacturers in China

Executive Summary

In the competitive landscape of global automotive component procurement, sourcing reliable alternator manufacturers in China demands precision, speed, and risk mitigation. With rising supply chain complexities, quality inconsistencies, and long verification cycles, procurement teams face mounting pressure to deliver cost-effective solutions without compromising on reliability.

SourcifyChina’s 2026 Verified Pro List for Alternator Manufacturers in China offers a strategic advantage—curated access to pre-vetted, audit-compliant suppliers with proven track records in OEM/ODM production, export compliance, and international quality standards (ISO, IATF 16949, etc.).

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening, background checks, and capability assessments. |

| On-Site Factory Audits | Full transparency with documented production capacity, quality control processes, and export history. |

| Verified Export Experience | All listed manufacturers have shipped to North America, EU, and APAC markets—ensuring compliance with international regulations. |

| Direct Factory Pricing | Bypass trading companies; negotiate directly with manufacturers for up to 15–25% cost savings. |

| Dedicated Sourcing Support | Our China-based team manages communication, sample coordination, and QC inspections—saving time across time zones. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. While competitors navigate months of supplier discovery and trial orders, you can fast-track procurement with SourcifyChina’s Verified Pro List—delivering qualified alternator manufacturers in under 72 hours.

Don’t risk delays, miscommunication, or substandard production. Leverage a trusted partner that combines local expertise with global compliance standards.

👉 Contact us today to receive your exclusive 2026 Verified Pro List for alternator manufacturers in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide supplier summaries, coordinate sample requests, and support RFQ development—ensuring a seamless onboarding process.

SourcifyChina — Your Verified Gateway to Reliable Manufacturing in China.

Trusted by procurement leaders across 32 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.