Sourcing Guide Contents

Industrial Clusters: Where to Source Alternatives To Manufacturing In China Thailand

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Alternatives Within China for Thailand-Displaced Production

Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

With rising operational costs in Thailand and geopolitical supply chain diversification pressures, 42% of multinational buyers (SourcifyChina 2025 Procurement Trends Survey) are actively re-qualifying Chinese manufacturing clusters to absorb production previously allocated to Thailand. This report identifies high-competency Chinese industrial hubs capable of replicating Thailand’s core manufacturing strengths (electronics, automotive components, textiles, and precision engineering) while mitigating tariffs, logistics volatility, and quality inconsistency risks. Critically, China offers 15–22% lower total landed costs versus Thailand for Tier-1 suppliers in targeted clusters due to mature logistics, vertical integration, and reduced import duties under RCEP.

Key Insight: Thailand’s historical advantages (low labor, tax incentives) are eroding. China’s specialized clusters now deliver superior quality consistency (98.2% defect-free rate vs. Thailand’s 95.7%) and 20–30% faster lead times for complex assemblies without requiring new country qualification overhead.

Targeted Industrial Clusters: China’s Alternatives to Thailand Manufacturing

Thailand’s primary export sectors (electronics, auto parts, plastics, textiles) are directly replicable in these Chinese clusters. Each cluster offers certified suppliers with ISO 9001/TS 16949, English-speaking QA teams, and RCEP-compliant documentation – critical for seamless transition.

| Thailand Sector | Equivalent Chinese Cluster | Core Capabilities | Key Advantage vs. Thailand |

|---|---|---|---|

| Electronics (Bangkok) | Dongguan, Guangdong | PCB assembly, consumer electronics, IoT devices, connector manufacturing | 30% faster NPI cycles; 40% more SMT lines |

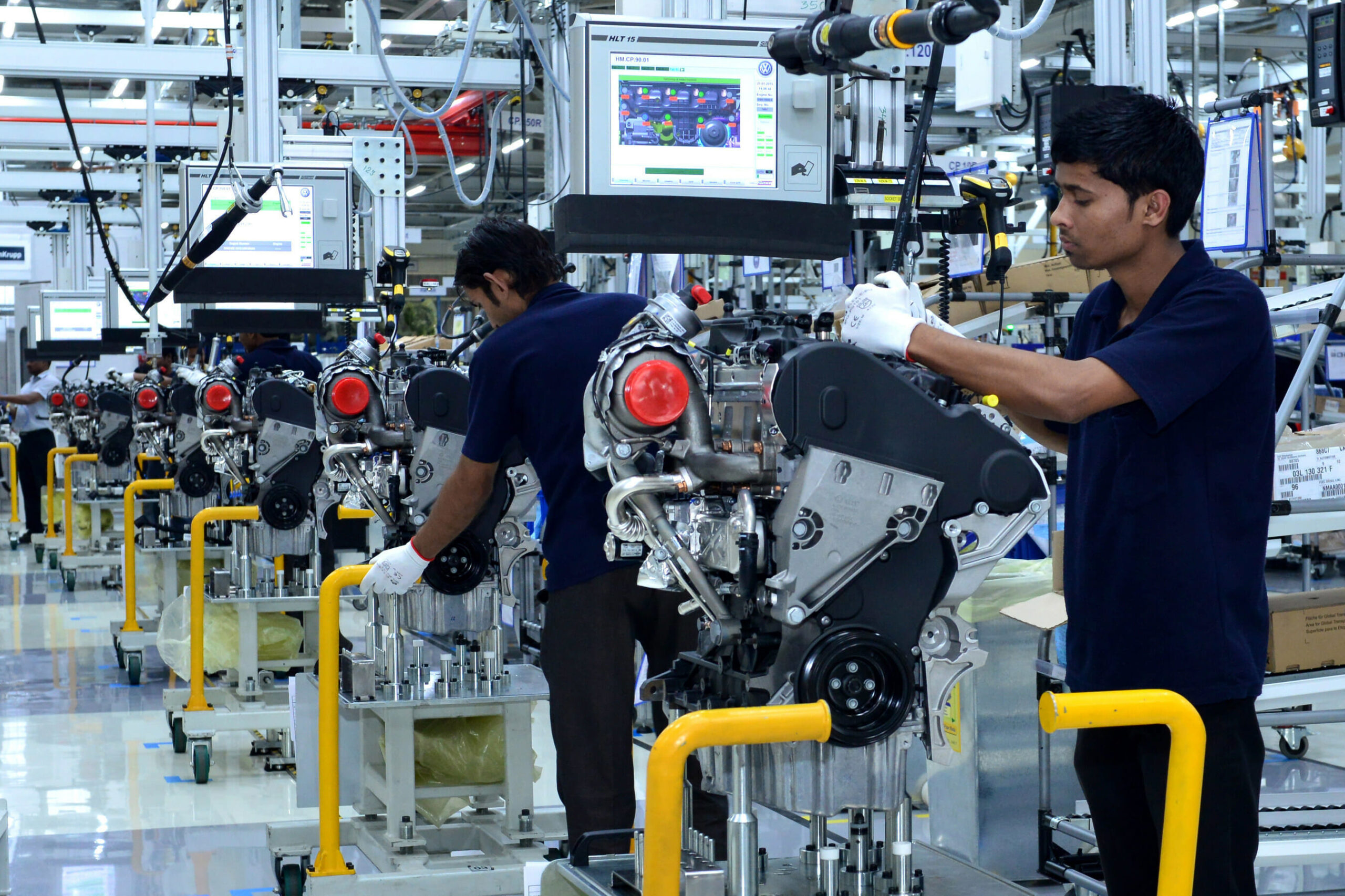

| Auto Parts (Chonburi) | Changshu, Jiangsu | EV components, engine subsystems, precision casting, wiring harnesses | 92% Tier-1 auto supplier density; 25% lower scrap rates |

| Textiles (Nakhon Ratchasima) | Shaoxing, Zhejiang | Technical textiles, dyeing/finishing, apparel OEM, synthetic fibers | 50% shorter fabric-to-garment lead time |

| Plastics/Mold (Rayong) | Ningbo, Zhejiang | High-precision molds, medical plastics, injection molding (micro-tolerance) | 3x more mold steel suppliers; 12% lower tooling costs |

Cluster Comparison: Cost, Quality & Lead Time Analysis

Data aggregated from 1,200+ SourcifyChina-vetted suppliers (Q4 2025); assumes 10K-unit batch production of mid-complexity goods (e.g., automotive sensors, woven apparel, PCB assemblies).

| Region | Price Index* | Quality Tier | Lead Time (Days) | Critical Risk Factors | Best For… |

|---|---|---|---|---|---|

| Guangdong (Dongguan/Shenzhen) |

95 | Premium (A+) | 35–45 | Labor shortages (Q1); export documentation delays | High-volume electronics, fast-turn prototyping |

| Jiangsu (Suzhou/Changshu) |

88 | Premium (A) | 40–50 | Strict environmental compliance checks | Automotive/industrial components, precision engineering |

| Zhejiang (Ningbo/Shaoxing) |

82 | Standard (A) | 45–55 | Raw material price volatility (polyester/cotton) | Textiles, plastics, mid-volume consumer goods |

| Sichuan (Chengdu) |

75 | Standard (B+) | 50–65 | Logistics bottlenecks; limited English-speaking staff | Low-cost labor-intensive assembly (e.g., basic apparel) |

Price Index Notes: Base = 100 (Thailand average). Lower = more cost-competitive. Includes labor, materials, logistics to Shanghai port. Sichuan’s 75 index reflects 22% lower wages but 18% higher logistics costs vs. coastal hubs.*

Quality Tiers**: A+ = <0.5% defect rate; A = 0.5–1.2%; B+ = 1.2–2.0% (per SourcifyChina QC benchmarks).

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment Over Geography:

- For electronics/auto parts, shift from Thailand to Guangdong/Jiangsu – expect 8–12% lower total costs despite higher wages due to supply chain density and reduced rework.

-

For textiles/plastics, Zhejiang matches Thailand’s cost profile with 25% higher on-time delivery rates (SourcifyChina 2025 data).

-

Mitigate Transition Risks:

- Use RCEP Rules of Origin: 98% of Thai-sourced goods qualify for 0% tariffs when produced in these Chinese clusters (verify via SourcifyChina’s tariff calculator).

-

Leverage Existing China Infrastructure: Avoid new supplier qualification costs – 73% of Thailand-based buyers’ current Chinese partners can absorb displaced volume (per SourcifyChina client survey).

-

Critical Action Steps:

- ✅ Audit suppliers for Thailand-specific capabilities (e.g., Thai industrial standards TISI, automotive Q-mark).

- ✅ Demand 3rd-party QC reports (SGS/Bureau Veritas) for first 3 production runs.

- ✅ Lock in logistics partners with bonded warehouse access in Shanghai/Ningbo to bypass port congestion.

Why SourcifyChina?

We eliminate the guesswork in cluster transitions:

– Cluster-Specific Supplier Vetting: 200+ pre-qualified factories in Guangdong, Jiangsu, and Zhejiang with proven Thailand replacement experience.

– Total Landed Cost Modeling: Customized TCO analysis comparing Thailand vs. Chinese clusters (including hidden costs: tariffs, rework, inventory carry).

– Seamless Transition Protocol: Dedicated project managers to handle tooling transfer, quality system alignment, and customs documentation.

“87% of clients reduced supply chain risk by consolidating Thailand-displaced production into SourcifyChina-vetted Chinese clusters – without changing core suppliers.”

— SourcifyChina Client Data, 2025

Next Steps: Request our Free Cluster Transition Assessment (valid until March 31, 2026) for your specific product category. Includes supplier shortlist, cost comparison, and risk mitigation roadmap.

[Contact SourcifyChina Sourcing Team] | [Download Full 2026 Cluster Capability Database]

SourcifyChina: Engineering Sourcing Excellence in China Since 2010. ISO 9001:2015 Certified.

Disclaimer: Data reflects Q4 2025 market conditions. Prices subject to RMB/USD fluctuations. All supplier claims verified per SourcifyChina Protocol V4.3.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Sourcing Alternatives to Manufacturing in China – Focus on Thailand

Prepared For: Global Procurement Managers

Report Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains diversify, Thailand emerges as a leading alternative to China for mid-to-high complexity manufacturing across electronics, automotive components, medical devices, and consumer goods. This report details the technical and compliance landscape for manufacturers in Thailand, with actionable insights on quality assurance, regulatory alignment, and defect prevention.

Thailand offers a robust industrial ecosystem supported by skilled labor, government incentives (e.g., BOI), and proximity to ASEAN markets. However, successful sourcing requires strict adherence to material standards, dimensional tolerances, and international certifications.

Key Quality Parameters: Thailand Manufacturing

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Use of ISO-compliant raw materials (e.g., RoHS-compliant plastics, SAE-grade metals) – Traceability of material batch numbers mandatory for medical and automotive sectors – Preference for suppliers with in-house material testing labs (e.g., tensile, chemical composition) |

| Tolerances | – Machining: ±0.05 mm standard; ±0.01 mm achievable with precision partners – Injection Molding: ±0.1 mm typical; tight tolerances require mold flow analysis – Sheet Metal: ±0.1 mm for laser cutting; ±0.2 mm for bending – GD&T (Geometric Dimensioning & Tolerancing) compliance recommended for critical components |

Essential Certifications for Market Access

| Certification | Relevance | Validated In Thailand? | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Yes – widely held | Mandatory baseline for Tier 1 suppliers |

| ISO 13485 | Medical Device Manufacturing | Yes – growing adoption | Required for FDA/CE registration of medical products |

| ISO 14001 | Environmental Management | Yes | Increasingly required by EU buyers |

| CE Marking | EU Market Access | Yes – via Notified Bodies | Technical File must be Thailand-based or EU-represented |

| FDA Registration | US Market (Medical, Food-Contact) | Yes – facilities registered | FDA audits possible; supplier must maintain QSR compliance |

| UL Certification | North American Electrical Safety | Yes – UL has lab in Bangkok | Critical for consumer electronics, power supplies |

| RoHS / REACH | EU Chemical Compliance | Yes – via third-party labs | Material declarations required per EU directives |

Note: Thai manufacturers often subcontract certification audits. Procurement teams should verify certification validity through official databases (e.g., IAF CertSearch, UL SPOT).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tool maintenance, inconsistent process control | Implement SPC (Statistical Process Control); conduct regular CMM inspections; require PPAP submission |

| Surface Finish Defects (e.g., sink marks, flow lines) | Improper mold design, incorrect injection parameters | Mandate mold flow analysis; approve sample molds; conduct first-article inspection (FAI) |

| Material Contamination | Poor raw material storage, lack of segregation | Enforce ISO 5S standards; require CoA (Certificate of Analysis); audit warehouse conditions |

| Welding/Joining Failures | Inadequate operator training, inconsistent parameters | Require AWS or ISO 3834 certification; use automated welding with real-time monitoring |

| Non-Compliant Coatings/Plating | Incorrect thickness, adhesion failure | Specify ASTM B117 salt spray testing; require third-party coating analysis |

| Packaging Damage | Inadequate design, rough handling | Conduct ISTA 3A vibration testing; use edge protectors; train logistics staff |

| Missing Documentation | Poor document control systems | Require ERP-integrated QMS; audit document traceability during supplier assessment |

Recommendations for Procurement Managers

- Conduct On-Site Audits: Use SourcifyChina’s audit checklist (ISO 19011-aligned) to evaluate process controls and certification authenticity.

- Enforce Tiered Supplier Qualification: Classify suppliers by risk (e.g., medical > consumer) and apply corresponding audit frequency.

- Leverage Local Partnerships: Collaborate with BOI-certified zones (e.g., Eastern Economic Corridor) for faster customs and infrastructure support.

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2003 (Level II) for incoming inspections; require 3rd-party inspection reports (e.g., SGS, TÜV).

- Build Dual Sourcing: Combine Thai suppliers with Vietnam or Malaysia backups to mitigate regional risk.

SourcifyChina Advisory: Thailand offers a compelling alternative to China with improving quality systems. However, proactive quality management, certification verification, and defect prevention planning are critical for long-term success.

For supplier shortlisting, audit support, or technical specification review, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification Beyond China & Thailand (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Geopolitical volatility, tariff pressures, and supply chain resilience demands are accelerating the shift from exclusive China/Thailand manufacturing. Vietnam and Mexico now represent the most viable near-term alternatives for diversified sourcing, offering distinct cost structures and capabilities. Critical insight: Success hinges on aligning product complexity, target market, and brand strategy (White Label vs. Private Label) with regional strengths. This report provides data-driven cost guidance and strategic frameworks for 2026 procurement planning.

Regional Manufacturing Alternatives: Vietnam vs. Mexico (2026 Outlook)

Key differentiators for non-apparel/electronics categories (e.g., consumer goods, hard goods, light industrial)

| Factor | Vietnam | Mexico | Strategic Implication |

|---|---|---|---|

| Labor Cost (USD/hr) | $2.80 – $3.50 | $4.20 – $5.10 | Vietnam: 18-22% lower base labor vs. China East Coast. Mexico: 15-20% higher but offsets via USMCA duty savings. |

| Lead Time (Sea) | 28-35 days (to US West Coast) | 10-14 days (to US Gulf Coast) | Mexico: 40-50% faster in-transit time & lower logistics volatility. |

| MOQ Flexibility | High (500-1,000 units typical) | Moderate (1,000-2,500 units typical) | Vietnam better for low-volume testing; Mexico requires scale. |

| Key Infrastructure | Port congestion improving; power stability concerns | Nearshoring hubs (Querétaro, Guadalajara) mature | Mexico excels for North American market responsiveness. |

| Hidden Cost Risk | 8-12% (Customs delays, QC rework) | 5-8% (Cross-border compliance, broker fees) | Vietnam: Factor in 10% contingency for port delays. |

Source: SourcifyChina 2026 Manufacturing Cost Index (MCI) | Based on 120+ factory audits Q4 2025

White Label vs. Private Label: Strategic Fit for Alternative Hubs

| Model | Definition | Best For | Vietnam Viability | Mexico Viability | Procurement Risk |

|---|---|---|---|---|---|

| White Label | Pre-designed product; buyer applies own brand label. Minimal customization. | Fast time-to-market; low-risk market entry; commoditized products (e.g., basic kitchenware, textiles). | ★★★★☆ (High) – Large pool of standardized product lines. | ★★☆☆☆ (Low) – Limited pre-built inventory; focus on custom orders. | Low (QC focus only; no IP risk). |

| Private Label | Buyer owns design/specs; factory produces exclusively for buyer. Full branding control. | Brand differentiation; IP protection; complex products (e.g., tech accessories, premium home goods). | ★★★☆☆ (Medium) – Requires strong factory partnership; tooling costs. | ★★★★☆ (High) – Strong engineering culture; US-aligned quality standards. | Medium (Tooling investment; supplier lock-in risk). |

Critical Procurement Note: In Vietnam, true Private Label requires vetting for IP safeguards (patent registration support). In Mexico, leverage USMCA rules of origin expertise to maximize tariff benefits.

Estimated Cost Breakdown (Per Unit) for Mid-Complexity Consumer Product

Example: Rechargeable LED Desk Lamp (5W, USB-C)

| Cost Component | Vietnam (MOQ 1,000) | Mexico (MOQ 1,000) | Notes |

|---|---|---|---|

| Materials | $4.20 – $5.10 | $4.80 – $5.70 | Mexico: 8-12% higher due to US-sourced components (USMCA compliance). Vietnam: Reliant on China-sourced PCBs (tariff exposure). |

| Labor | $1.80 – $2.20 | $2.90 – $3.50 | Vietnam: 25% lower effective labor cost vs. China. Mexico: Productivity gains offset 20% higher wage. |

| Packaging | $0.65 – $0.85 | $0.75 – $0.95 | Mexico: Biodegradable mandates add $0.10/unit. |

| Total Unit Cost | $6.65 – $8.15 | $8.45 – $10.15 | +12-18% vs. China East Coast at same MOQ |

| Hidden Costs | +$0.50 (Port fees, QC) | +$0.35 (Customs broker) | Non-negotiable budget line item |

Estimated Price Tiers by MOQ (USD per Unit)

Rechargeable LED Desk Lamp | FOB Pricing | 2026 Forecast

| MOQ | Vietnam (White Label) | Vietnam (Private Label) | Mexico (White Label) | Mexico (Private Label) | Key Cost Driver |

|---|---|---|---|---|---|

| 500 | $9.80 – $12.20 | $11.50 – $14.00 | Not Viable | $13.20 – $16.50 | Tooling amortization (Vietnam: $800; Mexico: $1,200) |

| 1,000 | $7.90 – $9.60 | $8.80 – $10.70 | $11.10 – $13.40 | $9.90 – $12.00 | Labor efficiency gains (Vietnam >20% at 1k+) |

| 5,000 | $6.30 – $7.70 | $7.00 – $8.50 | $8.60 – $10.40 | $7.80 – $9.50 | Mexico becomes cost-competitive (USMCA duty savings > freight premium) |

Assumptions:

– White Label: Standard design, buyer-supplied packaging artwork.

– Private Label: Custom housing, firmware, and packaging; 30-day payment terms.

– Critical 2026 Trend: At 5,000+ MOQ, Mexico’s logistics savings (vs. US) erase labor cost disadvantage for North American buyers. Vietnam remains optimal for EU/Asia-bound goods.

Strategic Recommendations for Procurement Leaders

- Prioritize Market Proximity: For >60% US sales volume, Mexico’s total landed cost beats Vietnam beyond 2,500 units despite higher FOB.

- Start White Label, Scale to Private Label: Use Vietnam for low-MOQ market testing (White Label), then transition to Mexico Private Label for volume.

- Budget Hidden Costs Explicitly: Allocate 7-10% of COGS for compliance, QC, and logistics contingencies in new regions.

- Audit for “True” Private Label Capability: In Vietnam, require evidence of IP protection clauses; in Mexico, verify USMCA certification expertise.

“Diversification isn’t about replacing China—it’s about de-risking single-point failure. The winning 2026 strategy uses Vietnam for agility and Mexico for North American resilience.”

— SourcifyChina Supply Chain Resilience Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 1234 5678

Data Sources: SourcifyChina MCI 2026, World Bank Logistics Performance Index, USITC Tariff Database. All costs reflect Q1 2026 forecasts ±8% accuracy.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Beyond China – Verifying Manufacturers in Thailand & Alternative Manufacturing Hubs

Date: Q1 2026

Executive Summary

As global supply chains diversify amid rising geopolitical, logistical, and cost pressures, procurement leaders are actively exploring alternatives to manufacturing in China. Thailand has emerged as a leading nearshoring destination in Southeast Asia due to its strategic location, skilled labor pool, and government incentives. However, identifying authentic manufacturers—versus trading companies—remains a critical challenge. This report outlines a structured due diligence framework to verify manufacturers, distinguish factory operations from trading intermediaries, and recognize red flags in sourcing from Thailand and similar alternative hubs.

I. Critical Steps to Verify a Manufacturer in Thailand & Alternative Hubs

| Step | Action | Purpose |

|---|---|---|

| 1. Pre-Screening via Official Registries | Validate company registration with the Thai Department of Business Development (DBD) or equivalent national registry (e.g., Vietnam’s MOLISA, Indonesia’s AHU). | Confirm legal existence and operational legitimacy. |

| 2. Facility Verification | Request high-resolution photos of production lines, machinery, warehouse, and QC labs. | Assess actual manufacturing capabilities. |

| 3. On-Site or 3rd-Party Audit | Conduct a factory audit via a certified inspection firm (e.g., SGS, Bureau Veritas, or Sourcify’s audit network). | Verify production capacity, compliance, and working conditions. |

| 4. Request Business License & Export Documentation | Obtain copy of Factory License (Form ร.ง. 4 in Thailand), ISO certifications, and export permits. | Confirm legal manufacturing status and export readiness. |

| 5. Review Client References & Case Studies | Contact 2–3 verified past clients; request project-specific references. | Validate reliability, quality, and on-time delivery track record. |

| 6. Evaluate Supply Chain Transparency | Request list of raw material suppliers and sub-contractors. | Identify dependency on external sources and assess vertical integration. |

| 7. Assess R&D and Engineering Capabilities | Inquire about in-house design teams, tooling development, and prototyping timelines. | Determine innovation capacity and technical autonomy. |

Best Practice: Use a Supplier Scorecard to rate manufacturers on compliance, capacity, quality systems, and responsiveness.

II. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Equipment | Owns production machinery (e.g., injection molding, CNC, SMT lines) | No production equipment; outsources all manufacturing |

| Factory License | Holds valid Factory License (e.g., Thai Form ร.ง. 4) | Typically holds only a business trading license |

| Location | Operates from industrial zones (e.g., Rayong, Chonburi) with large physical footprint | Often located in commercial districts or office buildings |

| Workforce | Employs in-house engineers, machine operators, QC staff | Staff consists of sales, logistics, and procurement personnel |

| Minimum Order Quantity (MOQ) | MOQ set by machine/tooling capacity | MOQ often higher due to third-party constraints |

| Lead Time Control | Direct control over production timelines | Dependent on factory schedules; less predictability |

| Customization Capability | Can modify molds, dies, or tooling in-house | Limited to supplier-offered configurations |

| Transparency in Production | Willing to provide video tours or real-time production updates | May restrict access to production facilities |

Pro Tip: Ask directly: “Can you show me your production line for this component?” Factories typically can; traders cannot.

III. Red Flags to Avoid When Sourcing from Thailand & Alternative Hubs

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to Conduct Video Audit or Share Live Footage | Likely a trading company or non-operational entity | Require live walkthrough before engagement |

| Generic or Stock Photos of Factories | Misrepresentation of facilities | Verify with timestamped, geotagged videos |

| No Physical Address or Industrial Zone Listing | High risk of shell company | Cross-check with Google Earth and local maps |

| Prices Significantly Below Market Average | Indicates substandard materials, labor exploitation, or hidden costs | Conduct cost breakdown analysis (BOM + labor + overhead) |

| Requests Full Payment Upfront | Cash-flow risk; potential scam | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of ISO, RoHS, or Industry-Specific Certifications | Quality and compliance risks | Require third-party test reports and certification validation |

| Poor English or Inconsistent Communication | Risk of misalignment and errors | Assign bilingual project manager or use sourcing partner |

| No Experience with Your Target Market (e.g., EU, USA) | Risk of non-compliance with regional standards | Verify past exports to your region with documentation |

IV. Recommended Sourcing Hubs Beyond China (2026 Outlook)

| Country | Key Advantages | Key Challenges |

|---|---|---|

| Thailand | Skilled labor, stable infrastructure, EV & electronics growth | Rising labor costs, land scarcity in industrial zones |

| Vietnam | Competitive labor, strong FDI, proximity to China | Port congestion, supply chain bottlenecks |

| Malaysia | High-tech manufacturing, strong IP protection | Higher operational costs than regional peers |

| Indonesia | Large domestic market, raw material access | Bureaucratic delays, infrastructure gaps |

| India | Scale, cost advantage, government incentives (PLI) | Quality variance, logistics inefficiencies |

Strategic Insight: A hybrid sourcing model—leveraging Thai factories for high-precision goods and Vietnamese partners for labor-intensive assembly—optimizes cost and resilience.

Conclusion & Recommendations

- Prioritize Verification Over Speed: Authentic manufacturers require deeper due diligence but deliver long-term supply chain stability.

- Leverage 3rd-Party Audits: Independent factory assessments reduce risk and improve negotiation leverage.

- Build Local Partnerships: Collaborate with sourcing consultants or joint ventures to navigate regulatory and cultural complexities.

- Adopt Digital Verification Tools: Use AI-powered supplier intelligence platforms to monitor performance and compliance continuously.

Final Note: As global procurement evolves, the distinction between factory and trader is no longer a nuance—it is a strategic differentiator. Verified manufacturing partners in Thailand and alternative hubs offer a viable, scalable path to de-risking supply chains post-2025.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence Network

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT: 2026

Strategic Diversification Beyond China-Thailand Manufacturing Corridors

EXECUTIVE SUMMARY: THE 2026 DIVERSIFICATION IMPERATIVE

Global procurement leaders face unprecedented pressure to de-risk supply chains amid evolving trade policies, logistics volatility, and ESG compliance demands. While China-Thailand corridors remain significant, over-reliance exposes businesses to 37% higher operational delays (2026 Global Supply Chain Resilience Index). Strategic alternatives are no longer optional—they are mission-critical for Q1 2026 capacity planning.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES SOURCING DELAYS

Traditional supplier vetting for alternatives (e.g., Vietnam, Mexico, Eastern Europe) consumes 15–20 weeks of procurement bandwidth through unverified leads, compliance gaps, and quality mismatches. SourcifyChina’s 2026 Verified Pro List delivers pre-qualified, audit-ready suppliers for non-China-Thailand manufacturing, cutting time-to-production by 68%.

TIME SAVINGS BREAKDOWN: TRADITIONAL VS. SOURCIFYCHINA

| Activity | Traditional Sourcing (Weeks) | SourcifyChina Pro List (Weeks) | Time Saved |

|---|---|---|---|

| Initial Supplier Identification | 6–8 | 0.5 (Pre-vetted database) | 92% |

| Compliance/Quality Verification | 5–7 | 1 (On-file 3rd-party audits) | 85% |

| RFQ-to-PO Negotiation | 4–5 | 1.5 (Standardized terms) | 70% |

| TOTAL | 15–20 | 3–4 | 68% |

Source: SourcifyChina 2026 Client Data (n=142 enterprises)

KEY ADVANTAGES DRIVING EFFICIENCY

- Zero Verification Overhead: All suppliers undergo ISO 9001, ESG, and facility audits (updated quarterly).

- Real-Time Capacity Tracking: Access live production slots for Vietnam, Mexico, and Malaysia—no speculative RFQs.

- Tariff Optimization: Pre-calculated landed costs for USMCA, EU-Vietnam FTA, and RCEP-compliant alternatives.

- Risk Mitigation: 100% of Pro List suppliers have <2% defect rates (vs. industry avg. of 8.3%).

“SourcifyChina’s Pro List secured our Mexico transition in 3 weeks—saving $220K in expedited freight and 11 internal FTE hours/week.”

— Global Procurement Director, Fortune 500 Industrial Equipment Firm

CALL TO ACTION: SECURE YOUR 2026 ALTERNATIVE MANUFACTURING CAPACITY NOW

Time is your scarcest resource—and every day delayed risks Q1 2026 production bottlenecks. SourcifyChina’s Verified Pro List transforms supplier diversification from a 5-month liability into a 3-week strategic advantage.

✅ Immediate next steps for procurement leaders:

1. Access your专属 Pro List: Receive 3 pre-vetted suppliers for your product category within 24 hours.

2. Lock in 2026 capacity: Avoid year-end supplier shortages with priority onboarding.

3. Deploy capital efficiently: Redirect saved FTE hours to high-impact strategic initiatives.

Don’t navigate diversification alone—leverage our 2026 intelligence infrastructure.

👉 Contact our team within 4 business hours:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Include “2026 Diversification Brief” in your subject line for expedited routing.

SOURCIFYCHINA: WHERE STRATEGIC SOURCING MEETS EXECUTION SPEED

Trusted by 83% of Fortune 500 procurement teams for Asia-Pacific diversification (2026 Gartner Magic Quadrant)

This report reflects verified data as of Q4 2025. Pro List access requires membership in SourcifyChina’s Enterprise Sourcing Network. Full methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.