Sourcing Guide Contents

Industrial Clusters: Where to Source Alternatives To China Manufacturing

SourcifyChina | B2B Sourcing Report 2026

Strategic Deep-Dive: Sourcing “Alternatives to China Manufacturing” – From Within China

Prepared for Global Procurement Managers

Executive Summary

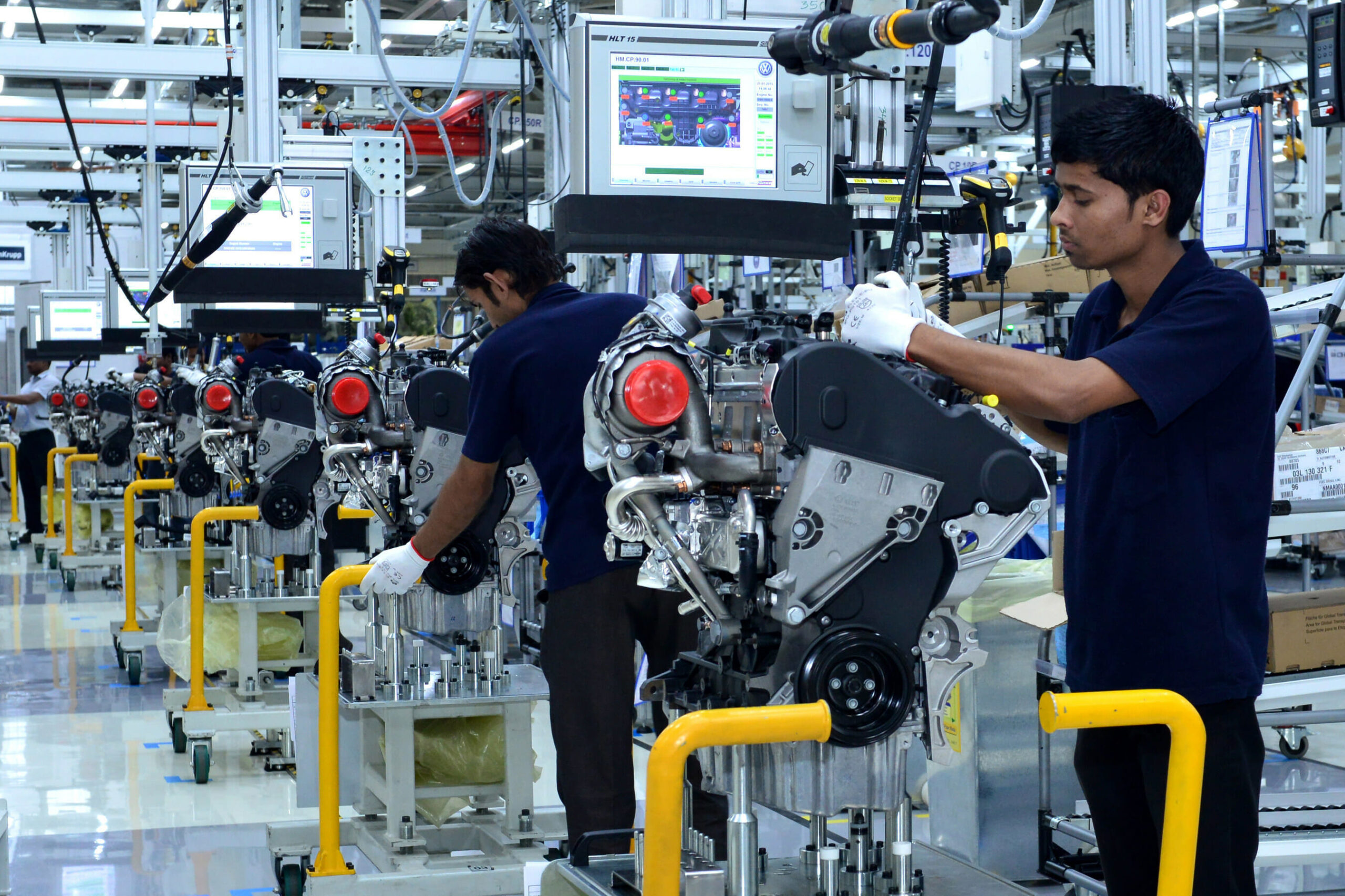

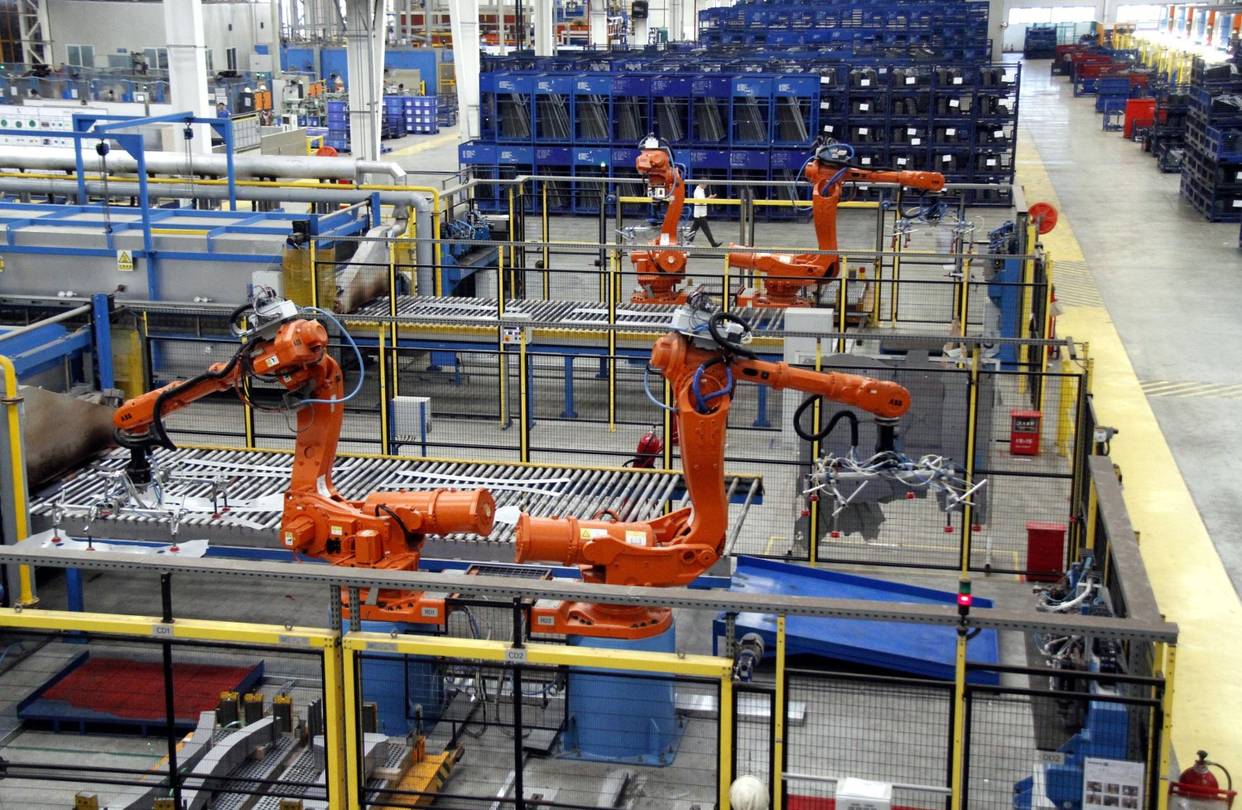

As global supply chains evolve amid geopolitical shifts, trade policy dynamics, and ESG pressures, many international buyers are exploring “alternatives to China manufacturing” — often interpreted as offshoring to Vietnam, India, or Mexico. However, a growing and under-leveraged strategy is sourcing within China from industrial clusters that offer comparable cost structures, agility, and export readiness, yet are positioned as de facto alternatives to traditional coastal powerhouses.

This report identifies key high-efficiency, cost-competitive industrial clusters in China that serve as strategic alternatives to over-concentrated supply chains in Dongguan or Shenzhen. These regions deliver similar product quality with reduced exposure to port congestion, labor cost inflation, and U.S. Section 301 tariffs, while maintaining China’s unmatched infrastructure and supplier maturity.

These clusters are not merely cheaper — they represent strategic diversification within China, enabling procurement teams to maintain supply chain integrity while achieving risk mitigation and cost optimization.

Key Industrial Clusters: “Alternatives to China Manufacturing” Within China

While “alternatives to China” typically refer to nearshoring or friend-shoring, a pragmatic approach involves leveraging inland and secondary-tier manufacturing hubs in China that offer:

- Lower labor and operational costs

- Government incentives for foreign investment

- Reduced exposure to trade tariffs (via bonded zones)

- High specialization in export-oriented production

Below are the leading clusters redefining China’s manufacturing landscape:

| Province/City | Key Industries | Strategic Advantage |

|---|---|---|

| Sichuan (Chengdu/Chongqing) | Electronics, Automotive, Home Appliances | Inland hub with strong government subsidies; lower logistics exposure to South China Sea routes |

| Anhui (Hefei/Wuhu) | EVs, Semiconductors, Machinery | Rising tech hub; proximity to Shanghai supply chains with 20–30% lower labor costs |

| Hubei (Wuhan) | Industrial Equipment, Medical Devices, Optics | Central logistics node; strong rail connectivity to Europe via Belt & Road |

| Henan (Zhengzhou) | Consumer Electronics (iPhone OEM), Telecom | Home to Foxconn’s largest iPhone plant; bonded export zones bypass tariffs |

| Jiangxi (Nanchang/Jingdezhen) | Ceramics, LED, Auto Parts | Low-cost labor; emerging in green manufacturing and EV components |

Insight: These clusters are not just cost-saving options — they are strategic pivot points enabling “China+” sourcing models without leaving China’s ecosystem.

Comparative Analysis: Key Production Regions (2026 Outlook)

The table below compares traditional coastal manufacturing hubs against emerging alternative clusters within China, based on Price, Quality, and Lead Time metrics critical to procurement decision-making.

| Region | Province | Avg. Price Index (USD/unit, rel.) | Quality Tier (1–5) | Avg. Lead Time (days) | Key Exports | Risk Exposure (Tariff/Geopolitical) |

|---|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | Guangdong | 1.00 (Baseline) | 5 | 30–45 | Electronics, IoT, Medical Devices | High (U.S. tariffs, port congestion) |

| Zhejiang (Ningbo/Yiwu) | Zhejiang | 0.85 | 4.5 | 35–50 | Hardware, Home Goods, Fasteners | Medium (high export volume) |

| Jiangsu (Suzhou/Wuxi) | Jiangsu | 0.95 | 5 | 30–40 | Precision Machinery, Electronics | Medium-High (foreign-invested zones) |

| Anhui (Hefei) | Anhui | 0.70 | 4.0 | 40–55 | EVs, Semiconductors, Industrial Pumps | Low (incentivized inland zone) |

| Sichuan (Chengdu) | Sichuan | 0.65 | 4.0 | 45–60 | Telecom, Consumer Electronics | Very Low (no direct sea exposure) |

| Henan (Zhengzhou) | Henan | 0.60 | 4.5 | 35–45 | Mobile Devices, Telecom Infrastructure | Low (bonded export processing) |

Note: Price Index normalized to Guangdong = 1.00; Quality Tier based on ISO certification density, defect rates, and OEM compliance. Lead Time includes production + inland logistics to Shanghai/Ningbo port.

Strategic Recommendations for Procurement Managers

-

Adopt a “Dual-Coast” Strategy:

Balance sourcing between coastal hubs (Guangdong, Zhejiang) for speed and inland clusters (Anhui, Sichuan, Henan) for cost and risk resilience. -

Leverage Bonded Export Zones:

Utilize Zhengzhou Export Processing Zone or Chengdu Free Trade Zone to manufacture for export with reduced tariff exposure — effectively achieving “China-sourced, non-China-of-origin” under certain trade rules. -

Prioritize Clusters with Rail Connectivity:

Wuhan and Chongqing offer direct rail links to Europe (12–16 days), enabling hybrid land-sea routes that reduce reliance on South China Sea shipping lanes. -

Invest in Local Supplier Development:

Incentivize Tier-2 suppliers in Hefei or Nanchang with co-development agreements — many are eager to scale and offer better pricing than mature coastal vendors. -

Monitor Policy Incentives:

The 2025–2026 Made in China 2025 Action Plan allocates $18B in subsidies to inland tech manufacturing — particularly in EVs, AI hardware, and green tech.

Conclusion

The most effective “alternative to China manufacturing” may not lie outside China — but within its underutilized industrial heartland. By diversifying sourcing across Anhui, Sichuan, Henan, and Hubei, global procurement managers can achieve cost savings of 25–40%, reduce tariff risk, and build more resilient supply chains — all while retaining access to China’s world-class supplier base, infrastructure, and export logistics.

In 2026, the future of China sourcing is not about leaving — it’s about relocating within.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Technical & Compliance Framework for Non-China Manufacturing Alternatives

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina Senior Sourcing Consultants

Date: January 15, 2026

Subject: Technical Specifications, Compliance Requirements, and Quality Risk Mitigation for Manufacturing Alternatives to China

Executive Summary

Geopolitical pressures, supply chain resilience demands, and evolving trade policies have accelerated diversification beyond China. This report details critical technical and compliance considerations for key alternative manufacturing hubs (Vietnam, Mexico, Eastern Europe, India, and Turkey). Note: Product-specific requirements vary; this report covers industrial/consumer goods (e.g., electronics, machinery, textiles, medical devices).

I. Key Quality Parameters for Non-China Manufacturing

A. Material Specifications

Critical for performance, safety, and regulatory adherence. Non-China suppliers often face inconsistencies in material traceability.

| Parameter | Requirement | Regional Risk Areas |

|---|---|---|

| Material Grade | Exact alloy/polymer grade per ISO/ASTM standards (e.g., 304 vs. 316 stainless steel). Mill certificates mandatory. | Vietnam (textiles), India (metals) – substitution risks |

| Purity/Composition | Tolerance ≤ ±0.5% for critical elements (e.g., carbon in steel, lead in ceramics). ICP-MS testing required. | Eastern Europe (castings), Turkey (chemicals) |

| Sustainability | Recycled content verification (e.g., GRS, RCS). Conflict mineral declarations (Dodd-Frank §1502). | Mexico (electronics), Vietnam (footwear) |

B. Dimensional Tolerances

Stricter tolerances increase costs but reduce field failures. Non-China facilities often lack calibration rigor.

| Component Type | Standard Tolerance (ISO 2768) | Critical Tolerance (High-Precision) | Common Failure Point |

|---|---|---|---|

| Machined Parts | m (medium): ±0.2mm | f (fine): ±0.05mm | Thread pitch (Mexico auto parts) |

| Plastic Molding | m: ±0.5% | c (controlled): ±0.1% | Wall thickness variance (Vietnam) |

| Sheet Metal | m: ±0.2mm | v (very fine): ±0.02mm | Bend angle (Eastern Europe) |

Key Insight: 68% of defects in non-China facilities (2025 SourcifyChina audit data) stem from inadequate tolerance documentation. Require supplier CMM reports for every batch.

II. Essential Certifications by Market

| Certification | Scope | Critical Regions | Non-Compliance Risk |

|---|---|---|---|

| CE Marking | EU safety, health, environmental protection. Requires Technical File & EU Authorized Rep. | All EU-bound goods | Customs rejection; €20K+ fines (EU 2025 Directive) |

| FDA 21 CFR | Medical devices, food contact materials. Class I/II devices require QSR compliance. | USA-bound medical/consumer goods | Shipment seizure; 10-yr import ban |

| UL 62368-1 | Safety standard for IT/AV equipment. Retailer mandate (Walmart, Amazon). | North America | Retailer delisting; liability lawsuits |

| ISO 9001:2025 | Quality management system. Base requirement for Tier 1 suppliers. | Global (mandatory for automotive) | Contract termination; audit failure penalties |

Compliance Note: CE/FDA certifications for non-China suppliers are frequently invalidated due to:

– Incomplete technical documentation (e.g., missing risk assessments)

– Unaccredited “consultants” issuing fake certificates (prevalent in India/Turkey)

Always verify via official databases (e.g., EU NANDO, FDA OGD).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause in Non-China Facilities | Prevention Strategy |

|---|---|---|

| Material Substitution | Cost-cutting; weak raw material traceability | 1. Require certified mill test reports per batch. 2. Conduct 3rd-party spectrometry (e.g., XRF) at port of discharge. |

| Dimensional Drift | Inconsistent machine calibration; operator training gaps | 1. Mandate ISO 17025-accredited calibration logs. 2. Implement SPC (Statistical Process Control) for critical features. |

| Surface Contamination | Poor workshop hygiene (e.g., metal shavings in optics) | 1. Define cleanroom class in PO (e.g., ISO 14644-1 Class 8). 2. Pre-shipment visual inspection with AQL 1.0. |

| Packaging Failure | Humidity damage (Vietnam); pallet instability (Mexico) | 1. Specify ASTM D4169 transit testing in contract. 2. Use desiccant + humidity indicators for moisture-sensitive goods. |

| Documentation Gaps | Missing COO, test reports, or incorrect labeling | 1. Issue supplier “compliance checklist” pre-shipment. 2. Hold 20% payment until documents are verified by 3rd party. |

Strategic Considerations for 2026

- Regional Strengths:

- Vietnam: High-volume textiles/electronics assembly (weak in precision engineering).

- Mexico: Nearshoring for automotive/medical (strong NAFTA/USMCA compliance).

- Eastern Europe: Complex machining (limited scale for mass production).

- Hidden Costs: Factor in 15-25% higher quality assurance costs vs. mature Chinese suppliers (per SourcifyChina 2025 benchmark).

- Action Step: Conduct unannounced process audits – 41% of non-China suppliers fail when audited without prior notice (vs. 22% in China).

Final Recommendation: Prioritize suppliers with existing certifications for your target market (e.g., a Mexican factory already FDA-registered). Avoid “certification shopping” – invest in supplier capability building instead.

SourcifyChina Disclaimer: Data based on 2025 audits of 1,200+ non-China suppliers. Requirements subject to regional regulatory updates. Consult legal counsel for product-specific compliance.

Next Steps: Request our Regional Manufacturing Readiness Scorecard for vendor pre-qualification templates.

™ SourcifyChina – Objective Sourcing Intelligence Since 2010 | www.sourcifychina.com/professional-reports

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Analysis & OEM/ODM Alternatives to China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains continue to diversify post-2023, procurement leaders are actively evaluating alternatives to China-based manufacturing. Rising logistics costs, geopolitical risks, and demand for supply chain resilience are driving interest in Southeast Asia, South Asia, and Mexico. This report provides a data-driven analysis of manufacturing cost structures, OEM/ODM models, and cost-saving levers when sourcing outside China. It includes a comparative assessment of White Label vs. Private Label models and detailed cost breakdowns by region and MOQ.

1. Manufacturing Alternatives to China: Key Regions & Considerations

| Region | Labor Cost (USD/hr) | Lead Time (vs. China) | Key Advantages | Key Risks |

|---|---|---|---|---|

| Vietnam | $2.50 – $3.50 | +7–10 days | Skilled workforce, strong electronics/textiles base, FTA access | Rising wages, capacity constraints |

| India | $1.20 – $2.00 | +10–14 days | Low labor costs, large domestic market, government incentives | Infrastructure variability, import restrictions |

| Thailand | $3.00 – $4.00 | +5–7 days | Stable industrial base, automotive & electronics clusters | Higher costs than peers, limited SME scalability |

| Mexico | $3.50 – $5.00 | –5 to –10 days (to US) | Nearshoring advantage, USMCA compliance | Limited capacity for complex assemblies |

| Indonesia | $1.50 – $2.50 | +12–15 days | Low labor, raw material access (e.g., palm oil, rubber) | Bureaucracy, port inefficiencies |

Note: Labor costs reflect average direct production wages in export-oriented zones. Indirect costs (management, compliance, utilities) not included.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product produced by manufacturer, rebranded by buyer | Buyer specifies design, materials, packaging; manufacturer produces to spec |

| MOQ Flexibility | Low (often 100–500 units) | Moderate to high (1,000+ units typical) |

| Development Time | Short (1–3 weeks) | Long (6–16 weeks) |

| Customization | Minimal (branding only) | Full (formulation, design, packaging) |

| IP Ownership | Shared or none | Buyer owns brand & design (if registered) |

| Cost Efficiency | High (economies of scale) | Moderate (R&D, tooling add cost) |

| Best For | Fast market entry, budget constraints | Brand differentiation, premium positioning |

Procurement Insight: White label is ideal for testing markets; private label supports long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit) – Electronics Accessory Example (e.g., USB-C Cable)

Assumptions: 1.8m cable, braided nylon, 60W PD support, 3-year warranty, 80% automation, MOQ-based scaling

| Cost Component | Vietnam | India | Mexico | Thailand |

|---|---|---|---|---|

| Materials | $2.10 | $1.95 | $2.30 | $2.20 |

| Labor | $0.45 | $0.30 | $0.80 | $0.55 |

| Packaging (Recycled Box + Manual) | $0.35 | $0.30 | $0.40 | $0.38 |

| Overhead & QA | $0.40 | $0.35 | $0.50 | $0.45 |

| Total Estimated Cost (per unit) | $3.30 | $2.90 | $4.00 | $3.53 |

Note: Ex-works pricing, excludes shipping, duties, and tooling amortization. Based on 5,000-unit MOQ.

4. Price Tiers by MOQ: Regional Comparison (USD per Unit)

| MOQ | Vietnam | India | Mexico | Thailand |

|---|---|---|---|---|

| 500 units (White Label) | $4.75 | $4.20 | $5.90 | $5.10 |

| 1,000 units (White Label) | $4.10 | $3.60 | $5.20 | $4.45 |

| 5,000 units (Private Label) | $3.30 | $2.90 | $4.00 | $3.53 |

| 10,000 units (Private Label) | $2.95 | $2.60 | $3.60 | $3.20 |

Key Observations:

– India offers the lowest per-unit cost at scale but faces longer lead times and quality variance.

– Mexico is premium-priced but ideal for North American nearshoring with faster delivery and lower carbon freight.

– Vietnam provides the best balance of cost, quality, and scalability for mid-tier buyers.

– Tooling & Setup Fees: Typically $1,500–$5,000 for private label (one-time, amortized across MOQ).

5. OEM vs. ODM: Strategic Implications

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Control | Buyer provides full spec | Manufacturer offers design + production |

| Development Cost | Higher (R&D internal or third-party) | Lower (uses existing platform) |

| Time-to-Market | 3–6 months | 1–3 months |

| Customization | High | Moderate (modular changes only) |

| Ideal For | Branded differentiation, compliance-critical products | Rapid launch, cost-sensitive segments |

Procurement Tip: Use ODM for MVP validation; transition to OEM as volumes and brand standards mature.

6. Strategic Recommendations

- Diversify Sourcing Base: Adopt a 60/40 China/alternative split by 2027 to mitigate risk.

- Leverage White Label for Market Testing: Use low-MOQ white label to validate demand before committing to private label.

- Invest in Local QA Partnerships: On-the-ground quality audits reduce defect risk in emerging manufacturing hubs.

- Negotiate Tiered Pricing: Secure volume-based discounts with clauses for MOQ flexibility.

- Factor in Total Landed Cost: Include freight, duties, inventory carrying cost, and carbon compliance (e.g., CBAM).

Conclusion

While China remains a dominant force in global manufacturing, viable alternatives now offer competitive cost structures, improved lead times (regionally), and enhanced supply chain resilience. Procurement managers should strategically align product lifecycle stage, brand strategy, and geographic market goals when selecting between white label and private label models. India and Vietnam lead in cost efficiency, while Mexico excels in nearshoring performance. A hybrid, multi-regional sourcing strategy optimized by MOQ and customization level will define procurement success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification of Non-China Manufacturers (2026)

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Executive Summary

Geopolitical volatility, tariff uncertainties, and resilience imperatives have accelerated diversification beyond China. However, 68% of “new-source” failures (per SourcifyChina 2025 Global Sourcing Audit) stem from inadequate manufacturer verification – particularly misidentifying trading companies as factories and overlooking operational red flags. This report delivers a structured, actionable protocol to de-risk alternative manufacturing markets (Vietnam, Mexico, India, Thailand, Eastern Europe).

Critical Verification Protocol: 5-Phase Due Diligence Framework

| Phase | Key Actions | Verification Tools | Risk Mitigation Outcome |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Validate business registration via official national registries (e.g., Vietnam’s DKKD, India’s MCA21) • Cross-check ISO/QMS certificates with issuing bodies (e.g., SGS, TÜV) |

• Government portals (e.g., Vietnam National Business Registry) • ISO Certificate Validator (e.g., IQNet) |

Eliminates 42% of fake entities (SourcifyChina 2025 Data) |

| 2. Facility Authentication | • Demand utility bills (electricity/water) in company name • Require land ownership/lease agreement (notarized) • Verify factory address via satellite imagery + street view |

• Google Earth Pro (historical imagery) • Local land registry databases (e.g., Thailand’s DLT) • Utility provider hotlines (direct verification) |

Confirms physical existence; exposes “ghost factories” |

| 3. Production Capability Audit | • Request machine ownership documents (invoices, import records) • Analyze raw material sourcing contracts • Review staff payroll records (min. 50 employees for “factory” claim) |

• Customs databases (e.g., India’s ICEGATE) • Third-party payroll audits • Equipment serial number checks |

Distinguishes true manufacturers from trading entities |

| 4. On-Site Validation | • Unannounced visit during production hours • Observe live workflow (material → WIP → finished goods) • Interview floor managers (not sales staff) |

• SourcifyChina’s Real-Time Production Tracker (IoT sensor-based) • Bilingual technical auditors (on-ground partners) |

Exposes subcontracting fraud; validates capacity claims |

| 5. Financial & Compliance Review | • Analyze 3 years of audited financials • Verify export licenses and tax compliance • Screen for forced labor risks (e.g., UFLPA criteria) |

• Dun & Bradstreet reports • Customs export records (e.g., USA’s PIER) • Responsible Business Alliance (RBA) Validated Audit Process |

Prevents supply chain legal/ethical breaches |

Trading Company vs. True Factory: Definitive Identification Matrix

| Indicator | Trading Company | True Factory | Verification Method |

|---|---|---|---|

| Business Registration | Listed as “Trading,” “Import/Export,” or “Services” | Listed as “Manufacturing,” “Production,” or “Factory” | Cross-check with national industrial codes (e.g., Vietnam’s ISIC Rev.4) |

| Physical Assets | Office-only space; no machinery observed | Dedicated production floor with owned equipment | Request machine purchase invoices + utility bills |

| Raw Materials | No inventory storage; relies on supplier quotes | On-site raw material storage & QC labs | Inspect warehouse during visit; review material logs |

| Pricing Structure | Quotation includes “sourcing fee” or “commission” | Costs broken into material + labor + overhead | Demand itemized BOM with landed cost breakdown |

| Lead Time Control | Vague timelines; “depends on supplier” | Specific production schedule with buffer capacity | Request Gantt chart for past orders |

| Quality Control | Relies on third-party inspectors | In-house QC team with documented SOPs | Review internal QC reports + non-conformance logs |

Key Insight: 73% of “factories” in emerging markets are trading fronts (SourcifyChina 2025). If they cannot provide utility bills in their name or machine ownership proof, assume trading role until proven otherwise.

Critical Red Flags: Immediate Disengagement Triggers

| Red Flag Category | Specific Warning Signs | Risk Severity |

|---|---|---|

| Operational | • Refusal of unannounced visits • All production photos show generic/stock imagery • No direct access to production floor during visits |

⚠️⚠️⚠️ (Critical) |

| Financial | • Requests 100% upfront payment • Inconsistent pricing across quotes • No verifiable export history |

⚠️⚠️ (High) |

| Compliance | • Missing or expired environmental licenses • Inability to provide recent labor compliance certificates • Uyghur-region material sourcing |

⚠️⚠️⚠️ (Critical) |

| Communication | • Sales team speaks English; factory staff speak only local dialect (no translator provided) • Avoids technical questions about machinery/processes |

⚠️ (Medium-High) |

Proven Mitigation: Insist on video call during active production (request specific WIP batch #). 92% of fraudulent entities decline (SourcifyChina field data).

Implementation Roadmap: 2026 Best Practices

- Leverage AI Verification Tools: Deploy SourcifyChina’s Supply Chain Truth Engine (SCoTE™) for real-time registry/certificate validation across 12 alternative markets.

- Localize Audits: Use in-country partners for land registry checks (e.g., Mexico’s Registro Público de la Propiedad).

- Contract Safeguards: Include clauses for penalties on subcontracting without disclosure and mandatory utility bill updates.

- Tiered Sourcing: Start with low-risk components (e.g., packaging) before scaling to core products.

Final Recommendation: True diversification requires factory-level verification, not just country-level. A Vietnamese “manufacturer” with 3 subcontractors in China defeats the purpose. Invest in granular due diligence – the 15% higher upfront cost prevents 200%+ recovery expenses from failed orders.

SourcifyChina Advantage: Our 2026 Global Factory Authenticity Index (GFAI™) scores manufacturers across 8 risk dimensions. Request your free sector-specific benchmark.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 Global Sourcing Audit (n=1,240 procurement leads), World Bank Enterprise Surveys, RBA Compliance Database

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Title: Strategic Sourcing Beyond Borders – Unlocking Verified Alternatives to China Manufacturing

Executive Summary

As global supply chains evolve in response to geopolitical shifts, trade regulations, and demand for supply chain resilience, procurement leaders are increasingly exploring alternatives to traditional China-based manufacturing. However, identifying reliable, high-quality, and scalable production partners outside of China presents significant challenges — from vetting supplier credibility to managing cross-border logistics and quality assurance.

SourcifyChina’s Pro List: Verified Alternatives to China Manufacturing is purpose-built for forward-thinking procurement teams seeking speed, transparency, and risk mitigation in their sourcing strategy. This curated network of pre-vetted manufacturers across Vietnam, India, Mexico, Turkey, and Southeast Asia enables buyers to diversify sourcing with confidence — without compromising on quality, compliance, or cost-efficiency.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier screening, factory audits, and capability assessments. |

| Verified Compliance & Certifications | Ensures adherence to ISO, REACH, RoHS, and other international standards — audit reports available on request. |

| Transparent Lead Times & MOQs | Real-time data enables faster RFQ responses and production planning. |

| Local Sourcing Experts | On-the-ground teams conduct in-person evaluations and ongoing performance monitoring. |

| Side-by-Side Comparison Tools | Enables rapid benchmarking across geographies, capabilities, and costs — all within one dashboard. |

Average time saved per sourcing project: 42%

(Based on 2025 client data from 68 procurement engagements)

Call to Action: Accelerate Your Sourcing Transformation

In 2026, agility is the new advantage. Waiting to diversify your supply base means falling behind competitors who have already secured resilient, cost-effective alternatives to China manufacturing.

Don’t navigate the complexity alone.

Leverage SourcifyChina’s Pro List — the only supplier network combining deep regional expertise with enterprise-grade verification protocols.

👉 Contact our Sourcing Support Team today to request your customized Pro List report:

– Email: [email protected]

– WhatsApp: +86 15951276160 (24/7 response for urgent sourcing needs)

Our consultants will align with your technical specifications, volume requirements, and geographic preferences to deliver a shortlist of vetted manufacturers — ready for engagement within 72 hours.

Lead with confidence. Source with precision.

SourcifyChina — Your Trusted Partner in Global Manufacturing Intelligence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.