The global aloe vera market has experienced steady growth, driven by rising consumer demand for natural and organic ingredients in cosmetics, pharmaceuticals, and nutraceuticals. According to Grand View Research, the global aloe vera market size was valued at USD 1.65 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 9.8% from 2023 to 2030. A key derivative, aloe leaf latex—distinct from aloe vera gel for its stimulant laxative properties—is gaining attention in pharmaceutical applications, particularly in digestive health products. With increasing scrutiny on ingredient transparency and supply chain traceability, sourcing high-purity aloe leaf latex from reliable manufacturers has become critical. This list highlights the top 10 aloe leaf latex manufacturers based on production capacity, global distribution networks, certifications (including ISO, USDA Organic, and IASC), and adherence to sustainable harvesting practices.

Top 10 Aloe Leaf Latex Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aloecorp

Domain Est. 1996

Website: aloecorp.com

Key Highlights: Offering the highest quality aloe vera products available, Aloecorp is the #1 supplier of aloe vera raw materials for the food, cosmetic and pharmaceutical ……

#2 Aloe Leaf & Latex (Label)

Domain Est. 1997

Website: dsld.od.nih.gov

Key Highlights: Product overview and label information for Aloe Leaf & Latex in the NIH Dietary Supplement Label Database (DSLD)….

#3 Evaluation of 90

Domain Est. 1997

Website: sciencedirect.com

Key Highlights: Unprocessed aloe latex contains chemicals that appear to have the potential to cause cancer, and processed aloe latex might also contain cancer-causing ……

#4 Aloe Vera Benefits for Skin, Constipation & More

Domain Est. 2003

Website: draxe.com

Key Highlights: Aloe vera is used for constipation, skin diseases, worm infestation, infections and as a natural remedy for colic….

#5 Aloe

Domain Est. 2004

Website: inova.staywellsolutionsonline.com

Key Highlights: Dried aloe latex taken from the leaf (98% to 99% pure) has laxative effects. It can be taken internally to help treat constipation, hemorrhoids, rectal itching, ……

#6 Aloe Vera

Domain Est. 2016

Website: marywhite.be

Key Highlights: Aloe Vera- Leaf and Latex, Digestive, Liver, Stomach health-Contains Amino Acids, Vitamins, Minerals, Enzymes- 500mg-Gluten Free, Non-GMO-180 capsules · About ……

#7 Aloe Vera

Domain Est. 2018

Website: a2sa.org

Key Highlights: Rating 4.1 (34) Dec 26, 2025 · About This Soothing Gel: Harness the power of aloe vera, infused with saponins, renowned for their soothing properties….

#8 Mature Aloe Vera Market Needs Fresh Standards

Domain Est. 2024

Website: supplysidesj.com

Key Highlights: Aloe latex contains anthraquinones, which cause a laxative effect in humans. The anthraquinone aloin is particularly known for its strong laxative properties….

#9 Entering the European market for aloe vera

Website: cbi.eu

Key Highlights: In Europe only the dried, concentrated leaf juice (the latex) of aloe vera is permitted for use in herbal medicinal products. Aloe vera can be ……

#10 Aloe Vera

Website: interiorqu.id

Key Highlights: Aloe Vera- Leaf and Latex, Digestive, Liver, Stomach health-Contains Amino Acids, Vitamins, Minerals, Enzymes- 500mg-Gluten Free, Non-GMO-180 capsules ; New ……

Expert Sourcing Insights for Aloe Leaf Latex

2026 Market Trends for Aloe Leaf Latex

Rising Demand in Natural Healthcare and Cosmetics

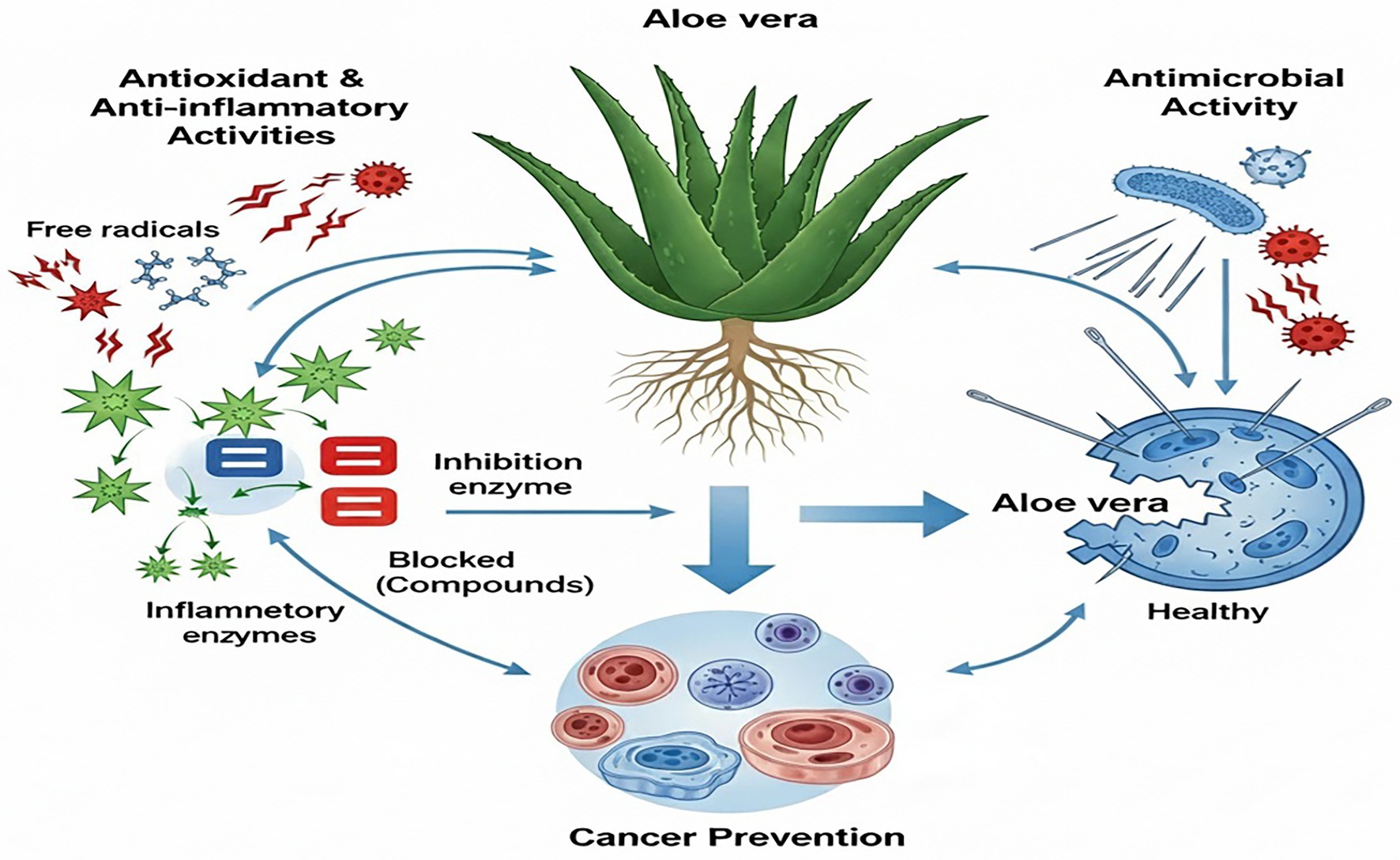

By 2026, the global market for Aloe Leaf Latex is expected to experience robust growth, primarily driven by increasing consumer preference for natural and plant-based ingredients in both healthcare and cosmetic industries. Aloe latex, known for its potent anthraquinone compounds such as aloin, continues to be valued for its traditional use as a natural laxative. With the global wellness trend accelerating, more consumers are turning to herbal remedies, boosting demand for standardized aloe latex extracts in dietary supplements. Simultaneously, the clean beauty movement is pushing cosmetic manufacturers to incorporate bioactive natural components. While aloe gel dominates skincare, aloe latex derivatives are finding niche applications in anti-aging and acne-fighting formulations due to their antimicrobial and exfoliating properties, albeit with careful formulation to manage skin sensitivity.

Regulatory Scrutiny and Safety Standards

A critical trend shaping the 2026 market is heightened regulatory oversight, particularly in North America and the European Union. Concerns over the long-term safety of anthraquinone-based laxatives have prompted agencies like the U.S. FDA and EFSA to reevaluate permitted usage levels and labeling requirements. As a result, manufacturers are investing in purification technologies to produce low-anthraquinone or de-colorized aloe latex extracts that comply with safety guidelines. Certification standards such as ISO 17025 for testing and adherence to Good Agricultural and Collection Practices (GACP) are becoming essential for market access. This regulatory environment is driving consolidation among suppliers and encouraging transparency in supply chains to ensure product safety and consumer trust.

Sustainability and Ethical Sourcing Pressures

Sustainability is a defining factor in the 2026 market landscape. Wild harvesting of aloe species, particularly Aloe vera and Aloe ferox, raises ecological concerns, leading to increased demand for cultivated and sustainably sourced raw materials. Certification programs like FairWild and USDA Organic are gaining traction among producers aiming to appeal to environmentally conscious consumers. Additionally, innovations in cultivation—such as water-efficient farming in arid regions of South Africa, Mexico, and India—are helping meet growing demand while minimizing environmental impact. Ethical labor practices and community-based harvesting initiatives are also becoming differentiators in premium market segments.

Technological Advancements in Extraction and Product Development

By 2026, technological innovation is playing a pivotal role in enhancing the efficacy and application scope of aloe leaf latex. Advanced extraction methods, including supercritical CO₂ extraction and membrane filtration, enable higher yields of active compounds while preserving stability and reducing contaminants. Encapsulation technologies are being used to mask bitterness and control the release of aloin in oral supplements, improving patient compliance. Furthermore, research into synergistic formulations—combining aloe latex with probiotics or other botanicals—is opening new avenues in gut health products, positioning aloe latex as a functional ingredient in next-generation nutraceuticals.

Regional Market Dynamics and Emerging Opportunities

Geographically, the Asia-Pacific region is projected to be the fastest-growing market for aloe leaf latex by 2026, fueled by rising disposable incomes, expanding e-commerce platforms, and growing awareness of herbal medicine in countries like China and India. Latin America and Africa remain key production hubs, with countries such as Mexico and South Africa enhancing export capabilities through value-added processing. Meanwhile, North America and Europe maintain strong demand, particularly in the premium supplement and organic skincare sectors. Emerging opportunities also exist in veterinary applications and natural agrochemicals, where aloe latex is being explored for its antiparasitic and plant-stimulant properties, potentially diversifying its market footprint by 2026.

Common Pitfalls Sourcing Aloe Leaf Latex: Quality and Intellectual Property Concerns

Sourcing Aloe Leaf Latex (also known as aloe exudate or aloe sap) presents several challenges, particularly concerning product quality and intellectual property (IP) rights. Overlooking these pitfalls can lead to supply chain disruptions, regulatory non-compliance, reputational damage, and legal exposure.

Quality-Related Pitfalls

Inconsistent Raw Material Sourcing

Aloe Leaf Latex quality varies significantly based on the Aloe vera species used, geographic origin, climate, harvesting methods, and processing conditions. Sourcing from unverified or inconsistent suppliers may result in batches with fluctuating concentrations of active compounds (e.g., anthraquinones like aloin), reducing efficacy and potentially causing safety issues.

Adulteration and Contamination

Due to high demand and variable supply, Aloe Leaf Latex is susceptible to adulteration with synthetic compounds, fillers, or lower-grade extracts. Contamination with pesticides, heavy metals, or microbial agents can occur if farming and processing practices are not strictly controlled. Without rigorous third-party testing, such issues may go undetected.

Inadequate Processing and Stabilization

Improper drying, storage, or extraction methods can degrade bioactive components. Exposure to heat, light, or oxygen during processing may reduce potency or alter the chemical profile, leading to ineffective or inconsistent final products.

Lack of Standardized Testing and Certifications

Many suppliers do not adhere to international quality standards (e.g., ISO, USP, or EU pharmacopeia). Absence of Certificates of Analysis (CoA), organic certifications, or Good Manufacturing Practice (GMP) compliance increases the risk of receiving substandard material.

Intellectual Property-Related Pitfalls

Unlicensed Use of Proprietary Extracts

Some suppliers market specialized Aloe Leaf Latex extracts protected by patents (e.g., specific purification processes or standardized formulations). Sourcing such materials without proper licensing can expose buyers to patent infringement claims, especially in regulated markets like pharmaceuticals or cosmetics.

Misrepresentation of IP Ownership

Suppliers may falsely claim proprietary rights over generic aloe extracts or suggest exclusive access to unique strains or processes. This can mislead buyers into believing they are acquiring innovative, protected ingredients when they are, in fact, sourcing commoditized materials.

Insufficient Due Diligence on Formulations

When incorporating Aloe Leaf Latex into finished products, companies may inadvertently infringe on formulation patents held by competitors. For example, patented skincare or nutraceutical blends containing specific aloe derivatives could limit freedom to operate if not properly vetted.

Ambiguous Supply Agreements

Contracts with suppliers often lack clear IP clauses addressing ownership of improvements, formulation data, or process innovations developed during collaboration. This ambiguity can result in disputes over IP rights, especially in joint development projects.

To mitigate these risks, buyers should conduct thorough supplier audits, demand comprehensive quality documentation, perform independent lab testing, and consult legal experts to review IP implications before finalizing sourcing agreements.

Logistics & Compliance Guide for Aloe Leaf Latex

Overview

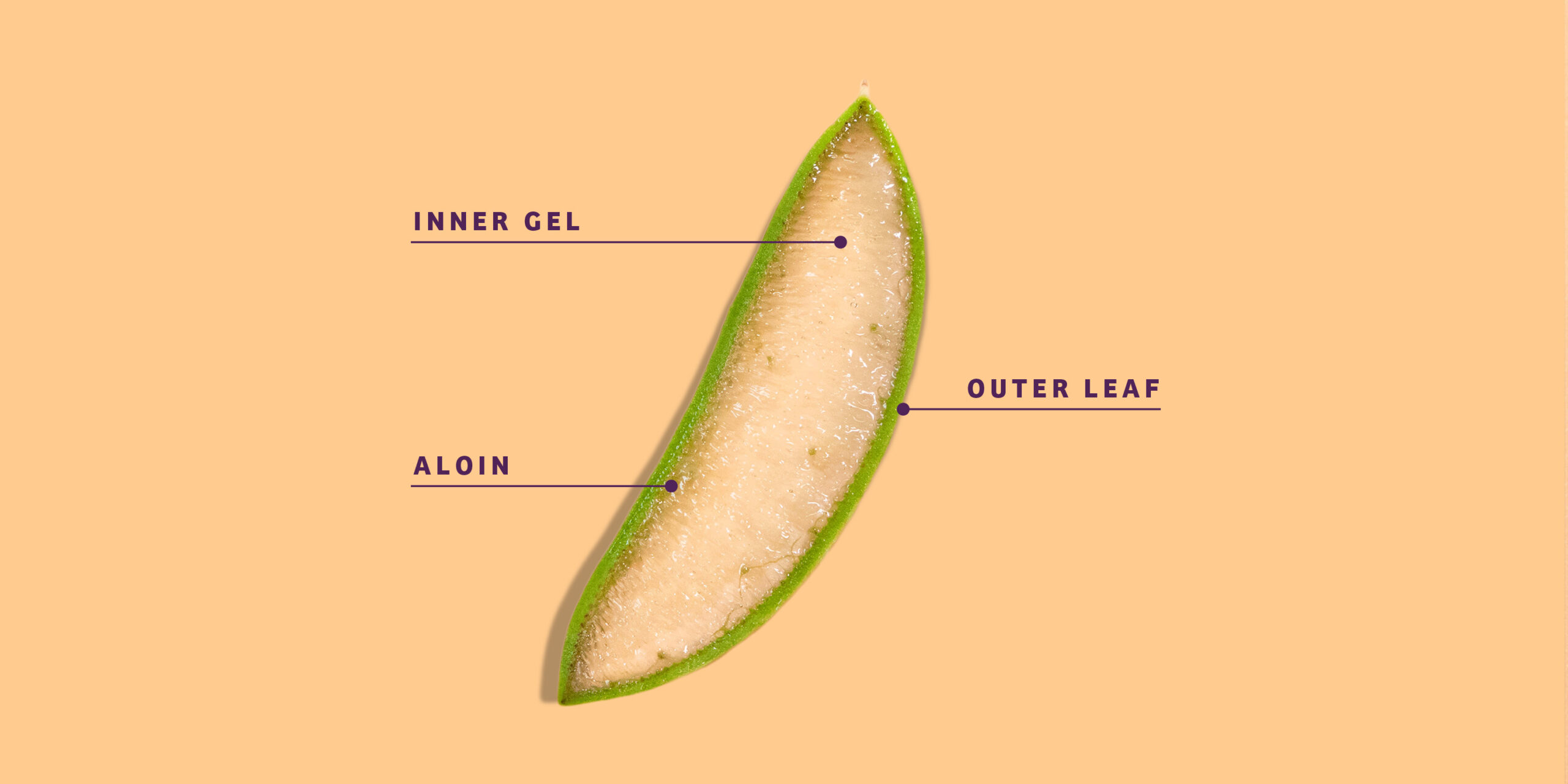

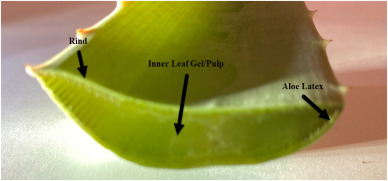

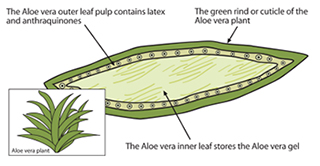

Aloe Leaf Latex, also known as aloe vera latex or aloe exudate, is a yellowish, bitter substance derived from the pericyclic cells of the Aloe vera plant (Aloe barbadensis Miller). It is distinct from aloe vera gel, which is extracted from the inner leaf parenchyma. Aloe Leaf Latex contains anthraquinone compounds, primarily aloin, which have laxative properties. Due to its pharmacological effects, Aloe Leaf Latex is subject to strict international regulations, particularly in food, dietary supplements, and cosmetics.

This guide outlines the key logistics and compliance considerations for the import, export, storage, and distribution of Aloe Leaf Latex.

Regulatory Status

United States (FDA)

- The U.S. Food and Drug Administration (FDA) banned the use of aloe latex (aloin) in over-the-counter (OTC) laxative products in 2002 due to concerns over carcinogenicity.

- Aloe Leaf Latex is not permitted as a direct food additive or dietary supplement ingredient unless it has been sufficiently processed to remove anthraquinones.

- Products containing Aloe Leaf Latex or high levels of aloin must carry appropriate labeling and are restricted from interstate commerce if marketed for human consumption.

European Union (EFSA & EMA)

- The European Food Safety Authority (EFSA) has evaluated aloe latex and concluded that it is genotoxic and carcinogenic, leading to a ban on its use in food products.

- The European Medicines Agency (EMA) permits limited use in herbal medicinal products under strict conditions, provided aloin levels are controlled and labeled.

- Member states may have additional restrictions; pre-market authorization is often required.

Canada (Health Canada)

- Aloe Leaf Latex is regulated under the Natural Health Products Regulations (NHPR).

- Only purified aloe products with low aloin content (<10 ppm) are permitted in licensed natural health products.

- Crude aloe latex is not allowed in consumer-facing products without extensive safety data.

International Regulations (CITES & WHO)

- Aloe vera is listed under CITES Appendix II, meaning trade must be monitored to avoid threats to species survival. While primarily focused on wild species, commercial cultivation and export documentation may be required.

- The World Health Organization (WHO) recognizes aloe latex’s pharmacological effects but advises caution due to toxicity concerns.

Import & Export Requirements

Documentation

- Certificate of Analysis (CoA): Must include aloin content (typically measured as % w/w), microbial testing, heavy metals, and solvent residues.

- Phytosanitary Certificate: Required by some countries to confirm the plant material is pest-free.

- CITES Permit: Required if exporting from or to a CITES member country and involving wild-harvested Aloe vera.

- Free Sale Certificate: May be requested by importing countries to verify marketability in the country of origin.

- Customs Classification: HS Code for Aloe Leaf Latex is typically 1302.19.90 (Plant materials and vegetable products, n.e.c.) or similar—verify locally.

Labeling

- Product labels must clearly state:

- “Aloe Leaf Latex” or “Aloe Latex (exudate)”

- Aloin content

- Warning statements: “For external use only” or “Not for internal use” unless approved

- Batch number, manufacturer details, and country of origin

- Avoid health claims unless authorized by regulatory bodies.

Storage & Handling

Storage Conditions

- Store in a cool, dry, and dark environment to prevent degradation.

- Ideal temperature: 15–25°C (59–77°F)

- Relative humidity: below 60%

- Protect from UV light and moisture

- Use airtight, food-grade containers (preferably amber glass or UV-protected plastic)

Shelf Life

- Typically 12–24 months when stored properly; monitor for changes in color, odor, or viscosity.

Safety Precautions

- Aloe latex is a skin and eye irritant—use gloves and protective equipment during handling.

- Avoid inhalation of powdered forms.

- Follow GHS labeling if shipped as a hazardous material (check local regulations).

Transportation

Domestic & International

- Classified as a botanical raw material; not usually hazardous, but may require declaration depending on form (liquid, powder, concentrate).

- Use temperature-controlled transport if shipping in extreme climates.

- Ensure packaging is leak-proof and tamper-evident.

- Comply with IATA (air) or IMDG (sea) regulations if shipping in bulk or across borders.

Traceability

- Maintain full supply chain documentation, including:

- Harvest location and date

- Processing method (e.g., drying, filtration)

- Batch tracking

- Certifications (e.g., organic, fair trade, GACP)

Quality Assurance & Testing

Required Testing

- Aloin Content: HPLC testing required to quantify aloin A and B

- Microbial Limits: Total aerobic microbial count, yeast/mold, absence of E. coli and Salmonella

- Heavy Metals: Lead, arsenic, cadmium, mercury below regulatory thresholds

- Pesticide Residues: Especially if non-organic cultivation

- Solvent Residues: If extracted using chemical solvents

Certifications

- GACP (Good Agricultural and Collection Practices): Recommended for sustainable and safe sourcing

- GMP (Good Manufacturing Practice): Required for processing facilities

- Organic Certification: If claiming organic status (e.g., USDA Organic, EU Organic)

Conclusion

Aloe Leaf Latex is a highly regulated botanical substance due to its biological activity and potential health risks. Successful logistics and compliance require strict adherence to international regulatory standards, proper documentation, and robust quality control. Always consult local regulatory authorities before importing, exporting, or marketing products containing Aloe Leaf Latex to ensure full compliance.

In conclusion, sourcing aloe leaf latex requires careful consideration of quality, sustainability, and ethical practices. It is essential to partner with reputable suppliers who adhere to good agricultural and collection practices, ensuring the latex is extracted humanely from mature aloe leaves without harming the plant. Certifications such as organic, fair trade, or ISO standards can provide assurance of purity and responsible sourcing. Additionally, understanding regional variations in aloe species and climatic influences on latex composition helps in selecting the most suitable source for specific applications, whether in pharmaceuticals, cosmetics, or nutraceuticals. Prioritizing transparency, traceability, and long-term supplier relationships will support consistent quality and contribute to environmentally and socially responsible supply chains.