The global alloy fabrication market is experiencing robust growth, driven by rising demand for high-performance materials across aerospace, automotive, energy, and industrial manufacturing sectors. According to Grand View Research, the global metal fabrication market was valued at USD 1.03 trillion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key contributor to this expansion is the increasing adoption of alloy-based components due to their superior strength, corrosion resistance, and thermal stability. Mordor Intelligence further highlights that the growing emphasis on lightweight materials in electric vehicles and the renewable energy sector is accelerating the need for precision alloy fabrication. With North America and Asia-Pacific emerging as key hubs for advanced manufacturing, the competitive landscape is evolving rapidly. In this dynamic environment, leading alloy fabricators are leveraging advanced technologies, automation, and sustainable practices to maintain a strategic edge. Below, we spotlight the top seven alloy fabricators shaping the future of the industry.

Top 7 Alloy Fabricators Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 2013

Website: alloyfabpa.com

Key Highlights: Alloy Fabrication is an innovative American contract manufacturer specializing in industrial metal fabrication services, complex welding projects, and ……

#2 Alloy Fabricators of New England, Inc.

Domain Est. 2006

Website: alloyfabne.com

Key Highlights: Alloy Fabricators of New England, Inc. is an expert manufacturer of furnace parts and fixturing, with expertise working with high-temperature alloys suited ……

#3 Custom Alloy Fabrication Manufacturer

Domain Est. 1998

Website: alloyengineering.com

Key Highlights: Alloy manufactures a variety of stainless steel and high-nickel alloy fabrications for the high temperature and high corrosion environments in the following ……

#4 Alloy Fabricators

Domain Est. 2001

Website: alloyfab.net

Key Highlights: Alloy Fabricators Inc. is your one stop shop for all your sheet metal and fabrication needs (including CNC metal punching, MIG, spot, AC and DC TIG welding)….

#5 Custom Metal Fabrication

Domain Est. 1997

Website: metalalloy.com

Key Highlights: Over 30 years of excellence in custom metal fabrication and machining. Experience top-tier service, precision, and results with MAF Fabrication….

#6 American Alloy Fabricators

Domain Est. 2000

Website: americanalloyfab.com

Key Highlights: American Alloy Fabricators specializes in designing and manufacturing custom, ASME-certified equipment for various industries….

#7 Alloy Fabrication

Domain Est. 2011 | Founded: 1974

Website: alloyfabrications.com

Key Highlights: We are a Fabrication and Machine Shop who has been in business without interruption of operations since 1974….

Expert Sourcing Insights for Alloy Fabricators

H2: 2026 Market Trends for Alloy Fabricators

As the global manufacturing and industrial sectors evolve, Alloy Fabricators are poised to experience significant shifts in demand, technology adoption, and competitive dynamics by 2026. Driven by advancements in materials science, sustainability mandates, and shifts in geopolitical and supply chain strategies, the alloy fabrication industry is entering a transformative phase. Below is an analysis of key market trends expected to shape the industry in 2026:

-

Increased Demand for High-Performance Alloys

The aerospace, defense, renewable energy, and electric vehicle (EV) sectors are driving demand for lightweight, high-strength, and corrosion-resistant alloys. Titanium, nickel-based superalloys, and advanced aluminum alloys are seeing growing adoption. By 2026, alloy fabricators specializing in these materials will benefit from long-term contracts with OEMs in high-growth industries. -

Expansion in Renewable Energy Infrastructure

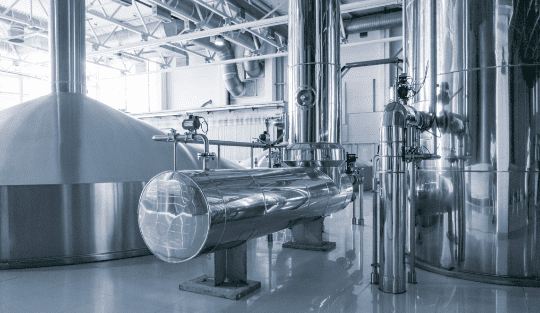

Global investments in wind turbines, solar farms, and hydrogen production facilities require durable metal components capable of withstanding extreme environments. Alloy fabricators are increasingly supplying custom-forged and welded components for turbine shafts, heat exchangers, and pressure vessels. The push for energy transition will elevate demand, particularly for stainless steels and specialized nickel alloys. -

Adoption of Advanced Manufacturing Technologies

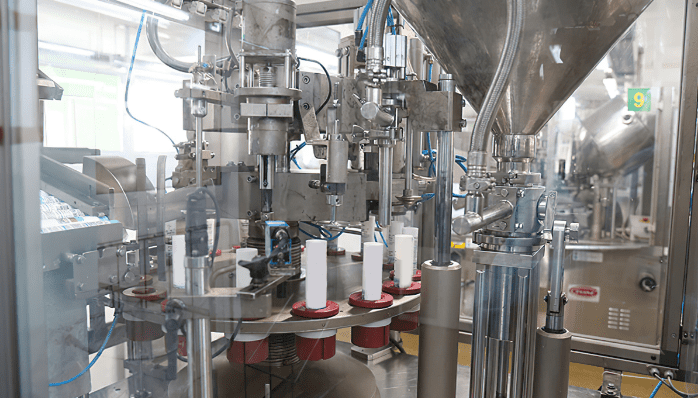

By 2026, digitalization and automation will be central to competitive advantage. Alloy fabricators are integrating: - Additive manufacturing (3D metal printing) for rapid prototyping and complex geometries.

- AI-driven quality control systems to reduce defects and improve yield.

-

Digital twins for real-time monitoring of fabrication processes.

These technologies enhance precision, reduce waste, and shorten lead times—critical factors in high-mix, low-volume production environments. -

Supply Chain Resilience and Regionalization

Geopolitical instability and trade tensions are pushing companies to nearshore or reshore fabrication operations. In North America and Europe, there is growing emphasis on domestic supply chains for critical alloys, especially those used in defense and infrastructure. Alloy fabricators with localized production capabilities and secure raw material sourcing will gain market share. -

Sustainability and Decarbonization Pressures

Regulatory frameworks such as the EU Green Deal and U.S. Inflation Reduction Act are pushing manufacturers toward lower-carbon operations. Alloy fabricators face pressure to: - Transition to electric arc furnaces (EAF) and hydrogen-based reduction technologies.

- Increase use of recycled scrap metal in alloy production.

-

Achieve third-party certifications for carbon footprint reduction.

Companies investing in green fabrication processes will gain favor with ESG-conscious clients. -

Customization and Niche Market Growth

As industries demand tailor-made solutions, alloy fabricators are moving toward high-value, low-volume production. Custom alloys engineered for specific thermal, mechanical, or chemical environments—such as in semiconductor manufacturing or medical devices—are emerging niches. Fabricators with R&D capabilities and metallurgical expertise will differentiate themselves. -

Labor and Skills Challenges

The industry continues to face a shortage of skilled welders, machinists, and metallurgists. By 2026, successful fabricators will invest heavily in workforce training, apprenticeship programs, and human-machine collaboration to maintain productivity amid labor constraints.

Conclusion

By 2026, Alloy Fabricators that embrace innovation, sustainability, and strategic market positioning will thrive. The convergence of technological advancement, regulatory shifts, and evolving customer needs will favor agile, vertically integrated, and environmentally responsible fabricators. Companies that proactively adapt to these trends will secure long-term growth in an increasingly competitive and specialized marketplace.

Common Pitfalls When Sourcing Alloy Fabricators: Quality and Intellectual Property Risks

Quality Inconsistencies

Working with alloy fabricators often exposes companies to significant quality risks, especially when suppliers lack rigorous process controls or material traceability. Inconsistent heat treatment, improper welding techniques, or substandard raw materials can lead to part failure, non-compliance with industry standards (e.g., ASME, ASTM), and costly rework. Without clear quality assurance protocols and third-party inspections, businesses may receive components that do not meet performance or safety requirements.

Lack of Material Traceability

Many alloy fabricators, particularly in cost-driven markets, fail to provide full material certification (e.g., Mill Test Reports or MTRs). This makes it difficult to verify alloy composition and mechanical properties, increasing the risk of counterfeit or off-spec materials. Without traceability, companies face compliance issues, safety hazards, and potential liability in regulated industries such as aerospace, oil & gas, or medical devices.

Inadequate Process Validation

Some fabricators may not validate critical processes such as welding (WPS/PQR), machining, or non-destructive testing (NDT). This can result in undetected defects like cracks, porosity, or dimensional inaccuracies. Sourcing from vendors without documented process qualifications increases the likelihood of field failures and project delays.

Intellectual Property (IP) Exposure

Sharing detailed engineering designs, proprietary alloys, or custom fabrication methods with external suppliers exposes companies to IP theft or unauthorized replication. Fabricators in certain regions may lack robust legal frameworks to enforce confidentiality, increasing the risk of designs being copied or sold to competitors.

Weak or Unenforceable IP Agreements

Even when non-disclosure agreements (NDAs) are signed, they may be poorly drafted or unenforceable in the supplier’s jurisdiction. Ambiguities in ownership of design modifications, tooling, or process innovations can lead to disputes. Without clear contracts specifying IP rights, businesses may lose control over critical technology.

Supply Chain Transparency Gaps

Limited visibility into subcontracting practices can result in unapproved second- or third-tier suppliers handling sensitive components. This not only dilutes quality control but also increases the risk of IP leakage, as designs may be exposed to entities outside the original agreement.

Mitigation Strategies

To avoid these pitfalls, companies should conduct thorough due diligence, require documented quality management systems (e.g., ISO 9001, AS9100), enforce robust IP protections through legally sound contracts, and perform regular on-site audits. Utilizing escrow agreements for critical designs and limiting access to only essential data can further reduce exposure.

Logistics & Compliance Guide for Alloy Fabricators

This guide outlines essential logistics and compliance considerations specific to alloy fabrication operations. Adhering to these standards ensures operational efficiency, regulatory adherence, safety, and customer satisfaction.

Supply Chain & Material Handling

Alloy fabrication relies on precise material inputs. Effective management of raw materials—from metals and alloys to consumables like shielding gases and welding rods—is critical. Implement a robust supplier qualification program to ensure material certifications (e.g., mill test reports, MTRs) meet required specifications (ASTM, ASME, EN, etc.). Maintain a documented traceability system for all materials entering the facility, including batch/heat numbers, certifications, and storage conditions. Use proper handling equipment (e.g., cranes, lifting magnets) to prevent damage to sensitive alloys and ensure worker safety. Segregate materials by alloy type and grade to avoid cross-contamination.

Transportation & Distribution

Coordinate transportation of raw materials and finished fabricated components with certified carriers experienced in industrial freight. For high-value or precision components, utilize climate-controlled or shock-monitored shipping containers as needed. Ensure all shipments comply with domestic and international transportation regulations (e.g., DOT, IATA, IMDG for hazardous materials if applicable). Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include necessary documentation such as packing lists, commercial invoices, and export declarations where required. Conduct regular audits of carrier performance and compliance records.

Regulatory Compliance

Adhere to all applicable local, national, and international regulations, including but not limited to:

- OSHA Standards: Ensure workplace safety in fabrication areas (e.g., PPE, machine guarding, ventilation for fumes).

- EPA Regulations: Manage hazardous waste (e.g., spent coolants, metal shavings, coatings) according to RCRA guidelines; secure necessary permits for emissions or wastewater discharge.

- DOT/PHMSA: Comply with pipeline and hazardous materials transport rules if involved in related fabrication.

- International Trade Laws: Follow export controls (e.g., ITAR, EAR) when shipping defense-related or dual-use alloy components.

Maintain up-to-date compliance records and conduct periodic internal audits to verify adherence.

Quality Assurance & Documentation

Implement a certified Quality Management System (e.g., ISO 9001, AS9100 for aerospace) to standardize fabrication processes. Document all critical steps, including heat treatment, welding procedures (WPS/PQR), non-destructive testing (NDT), and final inspection. Retain records for traceability and customer validation. Provide comprehensive documentation packages with shipments, including material certifications, inspection reports, and compliance statements.

Import/Export Procedures

For global operations, ensure accurate classification of fabricated goods under the Harmonized System (HS) codes. Prepare complete export documentation, including certificates of origin, and comply with customs requirements in destination countries. Monitor changes in trade agreements, tariffs, and sanctions that may affect material sourcing or product delivery. Utilize licensed customs brokers when necessary to ensure smooth clearance.

Environmental & Sustainability Practices

Minimize environmental impact through recycling of scrap metal, energy-efficient machinery, and responsible use of consumables. Establish a sustainability policy that includes waste reduction goals and lifecycle assessments for key products. Communicate environmental compliance and initiatives to stakeholders as part of corporate responsibility.

Continuous Improvement & Training

Provide regular training for staff on logistics procedures, safety protocols, and regulatory updates. Encourage feedback from operations and logistics teams to identify bottlenecks or compliance risks. Use key performance indicators (KPIs) such as on-time delivery rate, material traceability accuracy, and compliance audit scores to drive continuous improvement in logistics and compliance performance.

Conclusion for Sourcing Alloy Fabricators:

In conclusion, sourcing reliable alloy fabricators requires a strategic approach that balances quality, cost, technical capability, and supply chain consistency. Identifying fabricators with proven expertise in handling specific alloy types—such as stainless steel, aluminum, titanium, or nickel-based alloys—is critical to ensuring the integrity and performance of the final product. Thorough due diligence, including evaluations of certifications (e.g., ISO, ASME, NADCAP), production capacity, quality control processes, and past project experience, enables informed decision-making. Additionally, fostering strong partnerships with fabricators who demonstrate innovation, responsiveness, and scalability supports long-term supply chain resilience. Ultimately, the successful sourcing of alloy fabricators hinges on aligning supplier capabilities with project specifications and business objectives to deliver durable, high-performance fabricated components.