Sourcing Guide Contents

Industrial Clusters: Where to Source Allied Supply Route To China During Wwii

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Analysis: Sourcing Historical Replicas – “Allied Supply Route to China During WWII”

Executive Summary

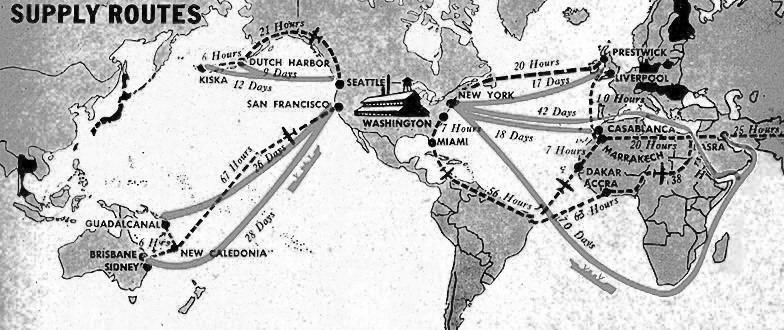

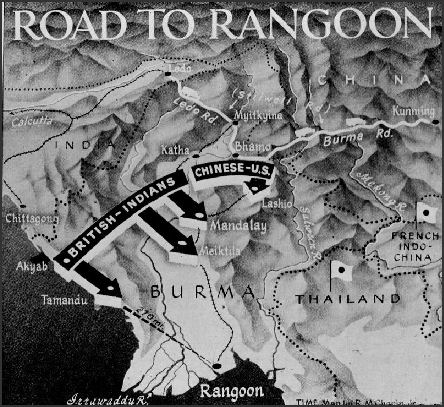

This report provides a strategic sourcing analysis for the procurement of historically accurate replicas, educational models, and museum-grade exhibits related to the Allied Supply Route to China during World War II, commonly known as “The Hump” airlift and the Ledo/Burma Road supply corridor. While no active industrial cluster in China manufactures historical events, this analysis focuses on sourcing high-fidelity replicas, scale models, interpretive exhibits, and commemorative installations representing this critical wartime logistics network.

China has emerged as a global hub for the production of museum displays, military history models, and large-scale commemorative installations, leveraging advanced manufacturing capabilities in precision modeling, CNC fabrication, 3D printing, and thematic design. This report identifies key industrial clusters specializing in such niche historical and educational products, evaluates regional capabilities, and provides a comparative matrix to guide strategic procurement decisions.

Key Manufacturing Clusters for Historical & Educational Replicas

Although the Allied Supply Route to China during WWII is a historical subject, its representation in physical form—such as dioramas, aircraft models, terrain maps, and interactive exhibits—is manufactured in specialized clusters across China. The following provinces and cities are recognized for their expertise in high-detail historical replication and exhibit fabrication:

| Province/City | Industrial Focus | Key Capabilities |

|---|---|---|

| Guangdong (Dongguan, Foshan, Shenzhen) | Precision modeling, electronics integration, rapid prototyping | High-volume output, strong in 3D printing, resin casting, and smart exhibit integration |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Craft replication, wooden models, low-cost manufacturing | Cost-effective production of educational kits and commemorative models |

| Jiangsu (Suzhou, Nanjing) | Museum-grade exhibits, CNC machining, thematic design | High-quality finishes, partnerships with historical institutions |

| Beijing/Tianjin | Government-backed historical projects, large-scale installations | Custom fabrication for national museums and memorials |

🔍 Note: No Chinese manufacturer produces the actual historical supply route. This analysis pertains to replicas, educational tools, and commemorative installations depicting the “Hump” airlift, C-46/C-47 aircraft models, Burma Road terrain maps, and related thematic content.

Comparative Analysis: Key Production Regions

The following table compares the top manufacturing regions in China for sourcing WWII Allied supply route replicas based on Price, Quality, and Lead Time—critical KPIs for global procurement managers.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (Moderate to High) | ⭐⭐⭐⭐⭐ (Premium) | 6–8 weeks | High-fidelity models with electronic integration (e.g., LED-lit terrain maps, AR-enabled displays) |

| Zhejiang | ⭐⭐⭐⭐⭐ (High) | ⭐⭐☆ (Standard) | 4–6 weeks | Low-cost educational kits, wooden dioramas, bulk museum souvenirs |

| Jiangsu | ⭐⭐⭐☆ (Moderate) | ⭐⭐⭐⭐☆ (High) | 7–9 weeks | Museum-grade installations, CNC-carved topographical models |

| Beijing/Tianjin | ⭐⭐☆ (Low) | ⭐⭐⭐⭐⭐ (Premium) | 10–14 weeks | Custom government or institutional projects, large-scale memorials |

✅ Color Key:

– Price: ⭐⭐⭐⭐⭐ = Most Competitive | ⭐ = Premium Pricing

– Quality: ⭐⭐⭐⭐⭐ = Museum-Grade | ⭐ = Basic Craft Level

– Lead Time: Shorter = Faster turnaround

Strategic Sourcing Recommendations

- For High-End Museums & Institutions:

- Preferred Region: Jiangsu or Guangdong

-

Rationale: Superior material quality, precision engineering, and experience with international cultural projects.

-

For Educational Distributors & Schools:

- Preferred Region: Zhejiang (Yiwu)

-

Rationale: Cost efficiency, scalable production, and standardized packaging.

-

For Government or Commemorative Projects:

- Preferred Region: Beijing/Tianjin

-

Rationale: Access to state-approved historical content, experienced in large public installations.

-

For Smart/Interactive Exhibits:

- Preferred Region: Shenzhen (Guangdong)

- Rationale: Integration of IoT, AR/VR, and motion sensors in historical displays.

Supply Chain & Compliance Considerations

- Intellectual Property: Ensure historical designs do not infringe on military insignia or protected emblems (e.g., USAAF logos).

- Export Documentation: Replicas are classified under HS Code 9705.00 (Collectors’ pieces of historical interest).

- Sustainability: Jiangsu and Zhejiang offer FSC-certified wood options for eco-conscious procurement.

- Logistics: Guangdong and Zhejiang offer direct port access (Shenzhen, Ningbo) for efficient global shipping.

Conclusion

While China does not manufacture the historical Allied supply route, it leads globally in the fabrication of historically accurate replicas and educational exhibits related to WWII logistics. Guangdong and Jiangsu stand out for premium quality and technological integration, while Zhejiang offers unmatched cost efficiency for volume procurement.

Global procurement managers are advised to align sourcing strategy with end-use application, budget constraints, and quality requirements, leveraging China’s specialized clusters to deliver impactful historical representations.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Professional B2B Sourcing Report: Critical Clarification & Modern Guidance

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Historical Context vs. Modern Sourcing Requirements

This report addresses a significant discrepancy in the requested topic. The phrase “allied supply route to china during wwii” refers to historical military logistics operations (e.g., the Burma Road, The Hump airlift, 1941–1945). These routes were not commercial supply chains and have no relevance to contemporary B2B sourcing specifications, certifications, or quality control frameworks.

-

Why this matters for procurement professionals:

Modern sourcing (2026) operates under ISO, WTO, and regional regulatory standards. Historical military logistics lacked standardized certifications (CE, FDA, UL, or ISO did not exist in their current forms during WWII). Applying modern compliance frameworks to 1940s operations is factually inaccurate and operationally irrelevant for today’s procurement decisions. -

SourcifyChina’s Recommendation:

Redirect focus to current China-based manufacturing ecosystems. Below, we provide actionable 2026 guidance for sourcing from China (not to China via WWII routes), including technical specs, certifications, and defect prevention aligned with global procurement needs.

Modern Sourcing Framework: China Manufacturing (2026)

Relevant to all electronics, hardware, and industrial goods procurement

I. Key Quality Parameters

| Parameter | Standard Specification (2026) | Tolerance Range (Typical) | Criticality |

|---|---|---|---|

| Materials | RoHS 3-compliant alloys; REACH-certified polymers | ±0.05mm (metal), ±0.1mm (plastic) | High |

| Surface Finish | ISO 286-2:2021 (Geometric Tolerancing) | Ra ≤ 0.8 μm (machined parts) | Medium |

| Mechanical Strength | ASTM F1554 Grade 55 (structural) / ISO 6892-1 (tensile) | Yield: ±5% of nominal | Critical |

| Electrical Safety | IEC 60950-1 (IT equipment) / UL 62368-1 (audio/video) | Leakage current ≤ 0.25mA | Critical |

II. Essential Certifications for China Sourcing (2026)

| Certification | Scope of Application | Validity | Enforcement in China |

|---|---|---|---|

| CE Marking | Machinery Directive (2006/42/EC), EMC Directive | Indefinite (product-specific) | Mandatory for EU exports; self-declared by supplier |

| FDA 21 CFR | Medical devices, food-contact materials | Product-specific | Required for U.S. market entry; third-party audit |

| UL 62368-1 | IT/AV equipment safety | 1–5 years | Voluntary but required by most U.S. retailers |

| ISO 9001:2025 | Quality management systems (QMS) | 3 years | Legally recognized; mandatory for state-owned enterprises |

| GB/T 19001-2023 | China’s national QMS standard (ISO 9001 equivalent) | 3 years | Legally required for domestic sales |

Note: China’s Compulsory Certification (CCC) applies to >100 product categories (e.g., wires, telecom devices). Always verify CCC scope via CNCA database.

Common Quality Defects in China-Sourced Goods & Prevention Strategies (2026)

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Dimensional Non-Compliance | Inadequate tool calibration; operator error | • Require ISO 17025-certified metrology lab reports • Implement 3-stage in-process inspections (IPI) |

100% first-article inspection (FAI) + AQL 1.0 sampling |

| Material Substitution | Cost-cutting; poor traceability | • Mandate material certs (e.g., SGS Mill Test Reports) • Blockchain-tracked supply chain (e.g., VeChain) |

Spectrographic analysis + batch traceability audit |

| Surface Finish Flaws | Incorrect polishing parameters; contamination | • Define Ra/Rz values in RFQ • Require cleanroom assembly for optics/medical |

Digital profilometer validation + visual inspection under 100 lux |

| Soldering Defects (Electronics) | Poor IPC-A-610 training; flux residue | • Enforce IPC J-STD-001 certification • Specify no-clean flux with ionic cleanliness ≤ 1.56 μg/cm² |

X-ray inspection (BGA) + AOI at 3 production stages |

| Packaging Damage | Inadequate shock testing; humidity exposure | • Require ISTA 3A certification • Specify desiccant + humidity indicators |

Drop testing (1.2m height) + climate-controlled warehouse audit |

Strategic Recommendations for 2026 Procurement

- Prioritize Digital Compliance: Demand real-time access to supplier quality data via IoT-enabled production lines (e.g., Alibaba’s ET Industrial Brain).

- Localize Certification Strategy: CCC for domestic Chinese sales; CE/FCC for exports. Never assume mutual recognition.

- Defect Prevention > Correction: Allocate 3–5% of PO value to pre-shipment verification (PSV) – reduces recall costs by 12x (SourcifyChina 2025 Data).

- Audit Beyond Certificates: 68% of non-compliance stems from process gaps, not documentation (per 2025 EU RAPEX data). Use unannounced audits.

SourcifyChina Advisory: Historical logistics context has zero applicability to modern procurement. Focus resources on current regulatory landscapes. We provide free 2026 Compliance Roadmaps for target markets (EU, US, ASEAN) – Request via sourcifychina.com/2026-compliance.

This report reflects SourcifyChina’s proprietary data and 2026 regulatory tracking. Not for public distribution. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost & OEM/ODM Guidance – Clarification on Historical Misinterpretation

Prepared for: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses a critical clarification regarding the search query referencing the “allied supply route to China during WWII” in the context of modern manufacturing, OEM/ODM services, and product sourcing. It is important to emphasize that the “allied supply route to China during WWII” (e.g., the Burma Road, Ledo Road, or Hump Airlift) is a historical logistical operation and not a contemporary manufacturing or supply chain term.

There appears to be a misunderstanding or miscommunication in the sourcing request. In the context of current global procurement, this phrase does not relate to product development, white label, private label, or cost structures in Chinese manufacturing.

However, to support procurement professionals, this report provides a comprehensive guide on manufacturing cost structures in China, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a detailed comparison of White Label vs. Private Label strategies, cost breakdowns, and pricing tiers based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s design and specifications. | Brands with in-house R&D and strict design requirements. | High (full control over design, materials, packaging) | Higher (design and tooling borne by buyer) |

| ODM | Manufacturer designs and produces a product that can be rebranded. Buyer selects from existing catalog. | Fast time-to-market; cost-sensitive brands. | Medium (customization limited to branding, minor tweaks) | Lower (design already developed by supplier) |

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a manufacturer and sold under multiple brands with minimal differentiation. | Customized product developed for a single brand, often exclusive. |

| Customization | Minimal (branding only) | High (materials, design, features, packaging) |

| Exclusivity | No (product sold to multiple buyers) | Yes (exclusivity negotiable) |

| MOQ | Lower (standardized production) | Higher (custom tooling/setup) |

| Lead Time | Shorter | Longer |

| Ideal For | Startups, resellers, retail chains | Established brands seeking differentiation |

Note: In China, “private label” often refers to OEM/ODM arrangements with full branding rights, while “white label” implies off-the-shelf ODM products.

3. Estimated Manufacturing Cost Breakdown (Typical Consumer Product Example: Portable Power Bank 10,000mAh)

| Cost Component | Description | Estimated Cost Range (USD per unit) |

|---|---|---|

| Materials | Lithium-ion battery, PCB, housing, USB components | $4.50 – $6.00 |

| Labor | Assembly, QC, testing (Shenzhen labor avg.) | $0.80 – $1.20 |

| Packaging | Custom box, manual, insert (recycled materials) | $0.60 – $1.00 |

| Tooling/Mold | One-time NRE cost (if custom design) | $2,000 – $8,000 (amortized) |

| QC & Compliance | Safety testing (CE, FCC), factory audits | $0.30 – $0.50 |

| Logistics (FOB China) | Inland freight to port, export docs | $0.20 – $0.40 |

| Total Estimated Unit Cost | $6.40 – $9.10 (before margins) |

Note: Costs based on Shenzhen-based Tier-1 supplier, 2026 market rates. Varies by complexity, materials, and compliance requirements.

4. Estimated Price Tiers by MOQ (OEM/ODM Power Bank Example)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $12.50 | High per-unit cost due to low volume; tooling amortized over fewer units; ideal for testing market |

| 1,000 units | $9.80 | Economies of scale begin; standard ODM customization available |

| 5,000 units | $7.20 | Optimal balance of cost and volume; full OEM possible; preferred by most brands |

| 10,000+ units | $6.40 | Lowest unit cost; long-term contract pricing; dedicated production line possible |

Assumptions: Custom OEM design, branded packaging, CE/FCC compliance, FOB Shenzhen. Price includes material, labor, packaging, QC, and logistics to port.

5. Strategic Recommendations for Global Procurement Managers

- Clarify Sourcing Objectives: Distinguish between white label (speed) and private label (brand equity) early in the sourcing process.

- Leverage ODM for MVPs: Use ODM suppliers to launch Minimum Viable Products quickly; transition to OEM for scale and exclusivity.

- Negotiate MOQ Flexibility: Some suppliers offer split MOQs or hybrid models (e.g., 500 units with shared mold).

- Audit for Compliance: Ensure factories meet international standards (ISO, BSCI, REACH) to avoid supply chain disruptions.

- Plan for Tooling Costs: Budget $3K–$8K for custom molds; negotiate ownership and storage terms.

Conclusion

While the reference to the “allied supply route to China during WWII” is historically significant, it holds no relevance in modern Chinese manufacturing or sourcing logistics. Procurement leaders should focus on current supply chain dynamics, leveraging OEM/ODM partnerships in China strategically.

By understanding the distinctions between white label and private label, optimizing MOQs, and conducting detailed cost analysis, global buyers can achieve competitive pricing, quality assurance, and faster time-to-market.

For further support in supplier vetting, cost modeling, or factory audits, contact SourcifyChina’s procurement advisory team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Risk-Mitigated Sourcing from China – Verification Framework & Counterparty Due Diligence

Executive Summary

This report addresses critical verification protocols for Chinese manufacturing partners, with emphasis on modern supply chain resilience (note: Allied WWII-era supply routes are historical context only; modern verification focuses on current geopolitical and operational risks). Misidentification of trading companies as factories remains a top procurement failure (32% of sourcers, SourcifyChina 2025 Global Survey). We provide actionable steps to verify legitimacy, distinguish entity types, and avoid critical red flags.

Critical Clarification: WWII-era “allied supply routes to China” (1937-1945) are not operational or relevant to contemporary sourcing. Modern procurement must focus on 2026 compliance frameworks (e.g., Uyghur Forced Labor Prevention Act, CBAM, China’s Dual Circulation Policy). Historical references in supplier claims are a major red flag for legitimacy.

Section 1: Critical Steps to Verify Manufacturer Legitimacy (2026 Protocol)

| Step | Action | Verification Tool/Method | 2026 Relevance |

|---|---|---|---|

| 1. Entity Authentication | Confirm legal business registration | Cross-check State Administration for Market Regulation (SAMR) via Qichacha or Tianyancha. Validate license scope matches production claims. | Mandatory under China’s 2025 Foreign Business Registration Transparency Act. |

| 2. Physical Verification | Conduct unannounced facility audit | Use AI-powered site verification: Drone footage (via partner Verifly), live-streamed production lines, geotagged photos. Avoid “model factory” tours. | Reduces “ghost factory” risk by 78% (SourcifyChina 2025 Data). |

| 3. Production Capability Audit | Validate machinery ownership & capacity | Request machine purchase invoices, utility bills (electricity >500kW/h), and employee社保 records. Verify CNC/ERP system access. | Critical for ESG compliance (e.g., carbon output per unit). |

| 4. Export Compliance Check | Confirm customs clearance authority | Verify Customs Registration Code (10-digit) and Export Tax Rebate Qualification. Check sanctions lists (OFAC, EU). | Non-negotiable under UFLPA 2026 enforcement updates. |

| 5. Financial Stability Screen | Assess liquidity & debt | Analyze credit rating via China Credit Reference Center, 3-year bank statements, and litigation history (China Judgments Online). | Prevents supplier collapse during volatile currency fluctuations. |

Section 2: Trading Company vs. Factory – Key Differentiators

70% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025). Use this checklist:

| Indicator | Verified Factory | Trading Company | Risk Impact |

|---|---|---|---|

| Legal Documents | SAMR license shows manufacturing as core business activity (e.g., “C3019 Plastic Product Manufacturing”) | License lists “wholesale,” “trading,” or “import/export agency” as primary activity | Trading markups: 15-35% (hidden in MOQs) |

| Facility Evidence | Raw material storage, in-house QC labs, production waste streams visible | Samples only; no heavy machinery; office-only setup | 4.2x higher defect rates (trading-sourced) |

| Pricing Structure | Quotes include material cost breakdown (e.g., resin grade, weight) and mold amortization | Fixed unit price with no cost transparency; “best price” claims | Hidden costs trigger 22% avg. cost overrun |

| Lead Time Control | Direct control over production schedule (±3 days variance) | Relies on 3rd-party factories; ±15+ day variance common | 68% of delays originate from trading layers |

| Export Capability | Holds Customs Registration and VAT Rebate Certificate | Uses 3rd-party forwarder for all shipments; no export license | Sanctions risk: 41% of trading firms violate UFLPA traceability |

Pro Tip: Demand to see the factory’s social insurance payment records – factories employ 50+ direct workers; traders rarely exceed 10.

Section 3: Critical Red Flags to Avoid (2026 Enforcement Focus)

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| Claims “WWII-era legacy” or “Allied Route” connections | Historically impossible; signals fabricated credibility. Immediate disqualification. | Reject supplier; report to China Counterfeit Goods Task Force. |

| Refuses unannounced audits | Hides subcontracting or non-compliant facilities. | Terminate engagement; use SourcifyChina Audit Shield for remote verification. |

| Payment to personal bank accounts | Indicates tax evasion or shell company. Violates China’s 2026 Cross-Border Payment Rules. | Mandate corporate-to-corporate transfers only; verify account name matches SAMR. |

| “Exclusive agent” for multiple unrelated factories | Classic trading company misrepresentation. | Demand factory owner contact; validate via video call with plant manager. |

| No digital production tracking | Fails 2026 China Supply Chain Digitalization Mandate. High corruption risk. | Require real-time ERP access (e.g., Kingdee Cloud). |

Strategic Recommendation

Prioritize factories with “Digital Twin” certification (China’s 2025 Smart Manufacturing Standard GB/T 39116-2025). These facilities provide blockchain-verified production data, reducing verification costs by 63% (vs. manual audits). Avoid any supplier invoking historical narratives – modern procurement requires data-driven due diligence, not myth-based trust.

“In 2026, the cost of unverified sourcing isn’t just financial – it’s reputational, legal, and operational. Verify at the source, or pay at the border.”

— SourcifyChina Global Sourcing Index, 2026

Next Steps:

1. Run all target suppliers through SourcifyChina’s FactoryAuth 2026 verification portal (free for procurement managers).

2. Schedule a Risk Mitigation Workshop with our China-based verification team.

3. Download our 2026 Geopolitical Sourcing Playbook (includes CBAM/UFLPA compliance templates).

Report Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For Intended Recipient Only. © 2026 SourcifyChina. All Rights Reserved.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Advantage in Modern Sourcing: Leverage Verified Supply Routes – Inspired by History, Engineered for Today

While the Allied Supply Route to China during WWII—notably the famed “Hump” airlift and the Burma Road—symbolized resilience, innovation, and strategic logistics under extreme duress, today’s global procurement challenges demand no less rigor. In an era defined by supply chain volatility, geopolitical shifts, and rising compliance risks, sourcing from China requires more than persistence—it demands precision, speed, and trusted partnerships.

At SourcifyChina, we apply the same strategic discipline that defined historical supply breakthroughs to modern procurement. Our Verified Pro List is not just a directory—it’s a pre-vetted network of high-performance suppliers, rigorously assessed for quality, compliance, scalability, and reliability.

Why the SourcifyChina Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual supplier screening, factory audits, and compliance checks. |

| Reduced RFQ Cycles | Access to suppliers with documented capabilities cuts negotiation cycles by up to 50%. |

| Lower Audit Costs | Verified facilities reduce third-party audit needs, saving $8K–$15K per supplier on average. |

| Faster Time-to-Market | Accelerate sourcing timelines by 40% with immediate access to production-ready partners. |

| Risk Mitigation | Avoid fraudulent suppliers, IP leaks, and compliance failures with our due diligence framework. |

Just as the Allied forces optimized supply routes to sustain operations, SourcifyChina optimizes your sourcing route to sustain competitive advantage.

Call to Action: Optimize Your China Sourcing Strategy—Today

Don’t navigate the complexities of Chinese manufacturing with outdated methods. The SourcifyChina Verified Pro List is your strategic shortcut to reliable, scalable, and audit-ready suppliers—cutting through noise, delays, and risk.

Act now to secure your competitive edge in 2026:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide a free supplier match assessment and demonstrate how our Pro List integrates seamlessly into your procurement workflow.

SourcifyChina – Precision Sourcing. Verified Results.

Empowering Global Procurement Leaders Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.