The industrial supply manufacturing sector continues to expand amid rising global demand for machinery, automation, and infrastructure development. According to Grand View Research, the global industrial machinery and equipment market was valued at USD 789.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by increasing adoption of smart manufacturing technologies, supply chain modernization, and industrial automation across key regions including North America, Europe, and Asia-Pacific. As industries prioritize efficiency, reliability, and scalability, the role of leading industrial supply manufacturers becomes increasingly critical in supporting operational continuity and innovation. In this landscape, a select group of companies have emerged as dominant players, combining technological advancement, global reach, and comprehensive product portfolios to meet evolving industrial needs. Based on market presence, revenue performance, and innovation capacity, here are the top 9 all-industrial supply manufacturers shaping the future of global industry.

Top 9 All Industrial Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 All Industry Supplies

Domain Est. 2000

Website: aismn.com

Key Highlights: For over 60 years, All Industry Supplies has distributed tools to industrial machine shops and manufacturers. Explore our collection of products today!…

#2 Industrial Supplies, Bearings, Mechanical Power Transmission …

Domain Est. 1994

Website: motion.com

Key Highlights: Buy direct from Motion! The number one supplier of bearings, pneumatics, hydraulics and mechanical power transmission products….

#3 Total Tool Supply

Domain Est. 1996

Website: totaltool.com

Key Highlights: Total Tool brings four decades of industrial tool supply experience to any job, offering high-quality tools alongside rental, rigging, and repair services….

#4 Global Industrial Company

Domain Est. 1997

Website: globalindustrial.com

Key Highlights: Global Industrial offers a vast selection of hand-picked and tested industrial-strength products, including material handling, storage & shelving, safety & ……

#5 Industrial Supply Company

Domain Est. 1998

Website: indsupply.com

Key Highlights: Our supply chain and inventory management solutions are specifically designed to help your business save money, time, and resources….

#6 United Central Industrial Supply

Domain Est. 2000

Website: unitedcentral.net

Key Highlights: We are the largest distributor of mining supplies in North America and specialize in helping mine operators lower costs. Contact us today!…

#7 Milwaukee® Tool

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: Milwaukee Tool is the most respected manufacturer of heavy-duty power tools, hand tools, instruments, and accessories….

#8 All Industrial Tool Supply Brands

Domain Est. 2003

Website: allindustrial.com

Key Highlights: Free delivery over $250 · 30-day returns…

#9 All Industrial Supply

Domain Est. 2016

Website: allindustrialonline.com

Key Highlights: All Industrial Supply is your one-stop destination for all your printing requirements. Experience superior craftsmanship, fast turnaround times, and ……

Expert Sourcing Insights for All Industrial Supply

H2: 2026 Market Trends Forecast for All Industrial Supply

As we approach 2026, All Industrial Supply is poised to navigate a dynamic industrial landscape shaped by technological innovation, sustainability mandates, supply chain evolution, and shifting customer expectations. This analysis outlines key market trends expected to influence the company’s operations, strategy, and growth trajectory in the second half of the decade.

1. Digital Transformation and E-Commerce Acceleration

Industrial supply distribution is undergoing rapid digitization. By 2026, B2B buyers increasingly expect e-commerce platforms with advanced capabilities—such as AI-driven product recommendations, real-time inventory tracking, and seamless integration with enterprise procurement systems (e.g., SAP, Oracle). All Industrial Supply must continue enhancing its digital storefront and mobile experience to compete with industry leaders like Grainger and Fastenal. Adoption of AI-powered chatbots and virtual inventory assistants will improve customer service efficiency and reduce response times.

2. Supply Chain Resilience and Nearshoring

Global supply chain disruptions have prompted a strategic shift toward nearshoring and regional sourcing. In 2026, industrial customers will prioritize suppliers with reliable, transparent, and agile logistics networks. All Industrial Supply can leverage this trend by expanding regional distribution centers, investing in predictive analytics for demand forecasting, and forming strategic partnerships with domestic manufacturers. Emphasis on just-in-case (vs. just-in-time) inventory models will increase demand for local stock availability.

3. Sustainability and Green Procurement

Environmental, Social, and Governance (ESG) compliance is becoming a procurement differentiator. Industrial buyers—especially in manufacturing, construction, and energy—are prioritizing vendors that offer eco-friendly products and sustainable packaging. By 2026, All Industrial Supply should expand its catalog of energy-efficient tools, recycled-content materials, and low-carbon logistics options. Transparent carbon footprint reporting and partnerships with green-certified suppliers will enhance brand credibility and customer retention.

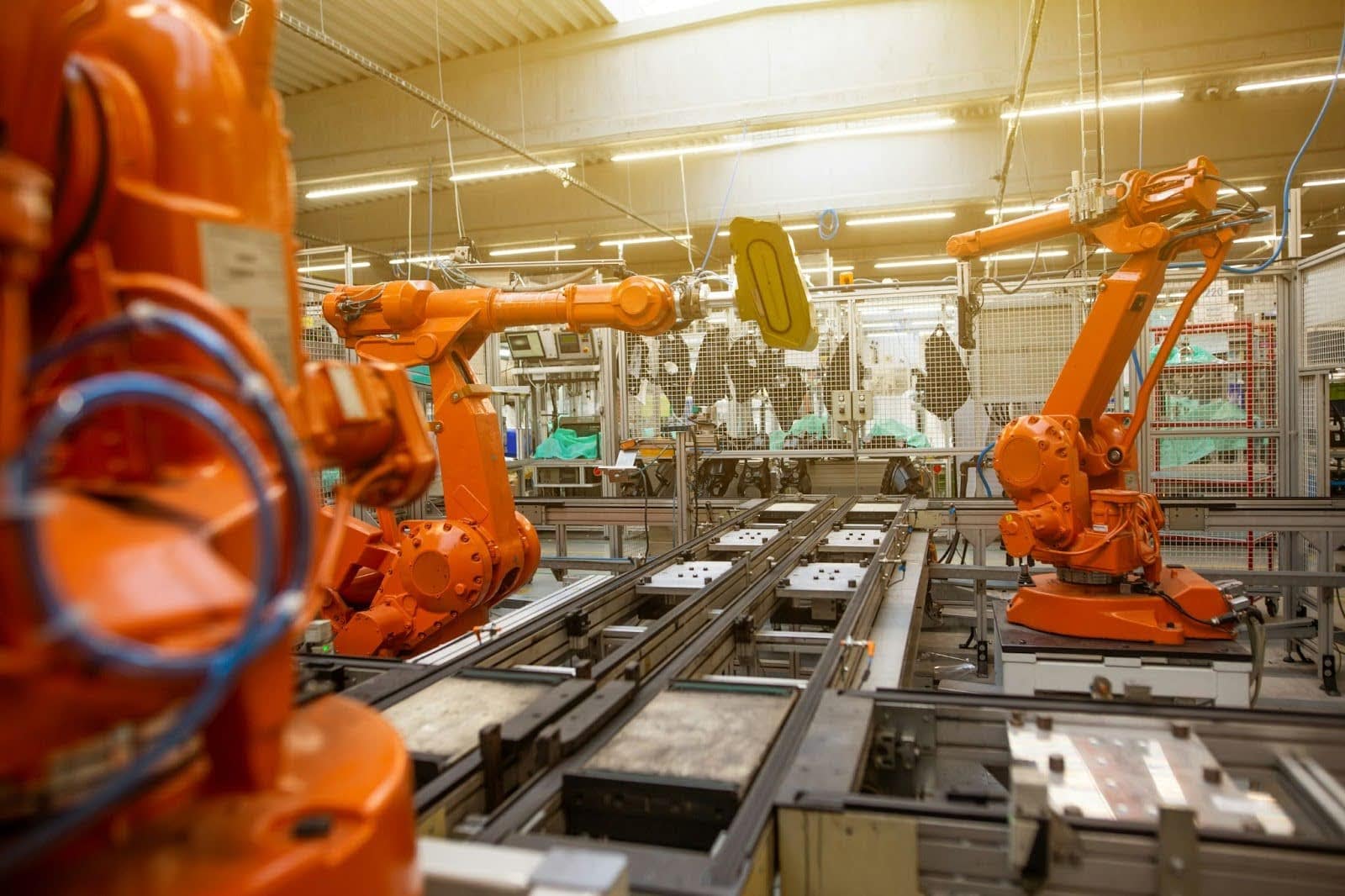

4. Industrial Automation and Smart Tools Demand

The rise of Industry 4.0 is driving demand for smart sensors, IoT-enabled equipment, and automated maintenance solutions. All Industrial Supply can capitalize on this by curating product lines that support predictive maintenance, robotics integration, and factory floor digitization. Training sales teams to consult on automation-compatible supplies will position the company as a solution provider rather than a transactional vendor.

5. Labor Shortages and Value-Added Services

Skilled labor shortages in manufacturing and maintenance sectors will increase demand for bundled services. In 2026, customers will favor suppliers offering technical support, inventory management (e.g., vendor-managed inventory), and on-site repair services. All Industrial Supply can differentiate itself by offering tailored service packages, digital asset tracking, and workforce training programs in partnership with equipment manufacturers.

6. Price Volatility and Cost Management

Commodity price fluctuations—driven by geopolitical tensions and raw material shortages—will persist into 2026. To maintain margins and customer trust, All Industrial Supply must adopt dynamic pricing models, long-term supplier contracts, and cost-optimization tools. Transparent communication about price changes, coupled with value justification, will be critical in retaining price-sensitive clients.

Conclusion

The 2026 industrial supply market will reward agility, digital maturity, and customer-centric innovation. For All Industrial Supply, success will depend on embracing e-commerce evolution, strengthening supply chain resilience, advancing sustainability initiatives, and expanding service offerings. By aligning with these H2 2026 trends, the company can solidify its position as a trusted, forward-thinking partner in the industrial ecosystem.

Common Pitfalls in Sourcing Industrial Supplies: Quality and Intellectual Property Risks

Sourcing industrial supplies involves complex supply chains where maintaining high standards and protecting intellectual property (IP) are critical. Overlooking these aspects can lead to operational failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality Inconsistencies and Non-Compliance

One of the most prevalent risks in industrial sourcing is inconsistent product quality. Suppliers, especially those in low-cost regions, may use substandard materials or cut corners in manufacturing to meet price targets. This can result in defective components that compromise equipment performance or safety. Additionally, non-compliance with industry standards (e.g., ISO, ASME, or ANSI) can lead to rejected shipments, production delays, or violations of regulatory requirements.

Lack of Supplier Qualification and Auditing

Many organizations fail to conduct thorough due diligence when selecting suppliers. Skipping on-site audits, certifications verification, or performance history checks increases the risk of partnering with unreliable vendors. Without proper qualification, companies may unknowingly source from suppliers with poor quality management systems or unstable production capabilities.

Inadequate Specifications and Documentation

Vague or incomplete technical specifications can lead to misunderstandings between buyer and supplier. Without detailed drawings, material requirements, tolerances, and testing protocols, suppliers may deliver products that technically meet a loose description but fail in real-world applications. Poor documentation also complicates traceability in case of defects or recalls.

Counterfeit and Substandard Components

The industrial supply market is vulnerable to counterfeit parts—especially for high-demand or obsolete components. These fake products may mimic genuine items but lack required performance characteristics. Using counterfeit parts can lead to equipment failure, safety hazards, and costly downtime. This risk is heightened when sourcing through third-party distributors or gray market channels.

Intellectual Property Infringement

When sourcing custom or proprietary equipment, tooling, or components, there is a significant risk of IP theft. Suppliers may reverse-engineer designs, replicate products for other clients, or sell technical specifications to competitors. Without robust contractual protections—such as non-disclosure agreements (NDAs), IP ownership clauses, and restrictions on subcontracting—companies may lose control over their innovations.

Insufficient Control Over Sub-Tier Suppliers

Many industrial suppliers outsource parts of their production without buyer knowledge. This lack of visibility into sub-tier suppliers increases exposure to unvetted manufacturers who may not adhere to quality or IP protection standards. Without supply chain transparency, enforcing compliance becomes nearly impossible.

Poor Communication and Language Barriers

Miscommunication due to language differences or cultural misunderstandings can lead to errors in production, incorrect materials, or missed specifications. This is particularly common in global sourcing and can delay projects or result in non-conforming goods.

Overemphasis on Cost at the Expense of Quality and IP Safeguards

Seeking the lowest price often leads to compromised quality and reduced IP protection. Suppliers under tight margins may use inferior materials or lack investment in secure manufacturing practices. Prioritizing cost without evaluating long-term risks can result in higher total ownership costs due to failures, rework, or litigation.

Mitigating these pitfalls requires a strategic sourcing approach that emphasizes supplier vetting, clear technical documentation, robust contracts, and ongoing quality monitoring. Protecting both product integrity and intellectual property is essential for sustainable and secure industrial operations.

Logistics & Compliance Guide for All Industrial Supply

This guide outlines the essential logistics and compliance procedures for All Industrial Supply to ensure efficient operations, regulatory adherence, and customer satisfaction.

Order Processing & Fulfillment

All orders must be entered into the company’s ERP system within one business hour of receipt. Orders are validated for product availability, pricing accuracy, and customer credit status. Once confirmed, picking tickets are generated and sent to the warehouse team. The fulfillment window is 24–48 hours for in-stock items, with same-day shipping available for orders received before 12:00 PM local time.

Inventory Management

Maintain real-time inventory tracking using barcode scanning and cycle counting protocols. Conduct quarterly physical audits to reconcile system data with on-hand stock. Safety stock levels are set based on historical demand and supplier lead times. Obsolete or expired inventory must be flagged and disposed of according to environmental and safety regulations.

Shipping & Carrier Coordination

Shipments are processed using pre-negotiated carrier contracts with FedEx, UPS, and regional LTL providers. Shipping labels and bills of lading must include accurate weights, dimensions, and hazardous material declarations (if applicable). Customers are provided with tracking numbers and delivery notifications via email. International shipments require additional documentation, including commercial invoices and export declarations.

Import/Export Compliance

All international transactions must comply with U.S. Customs and Border Protection (CBP), Export Administration Regulations (EAR), and International Traffic in Arms Regulations (ITAR) where applicable. Ensure proper Harmonized System (HS) codes, country of origin marking, and end-use certifications are completed. Restricted party screening is mandatory for all overseas shipments.

Regulatory Compliance

Adhere to OSHA, DOT, and EPA standards for handling, storing, and transporting industrial goods—particularly hazardous materials. Maintain Material Safety Data Sheets (MSDS) for all regulated products. Employees involved in shipping hazardous goods must be trained and certified under DOT HAZMAT regulations (49 CFR).

Documentation & Recordkeeping

Retain all logistics and compliance records for a minimum of seven years. Required documents include bills of lading, customs forms, safety certifications, audit reports, and customer communications. Digital records must be backed up daily and stored securely with role-based access controls.

Quality Assurance & Continuous Improvement

Conduct monthly reviews of logistics performance metrics, including on-time delivery rate, order accuracy, and carrier performance. Address discrepancies through root cause analysis and corrective action plans. Encourage feedback from customers and staff to identify opportunities for process optimization.

Emergency Response & Contingency Planning

Maintain a logistics contingency plan for disruptions such as natural disasters, supplier delays, or cyber incidents. Key elements include alternate carrier agreements, secondary warehouse access, and communication protocols for customers and stakeholders. Test the plan biannually through tabletop exercises.

By following this guide, All Industrial Supply ensures reliable, compliant, and scalable logistics operations across all markets.

In conclusion, sourcing all industrial supplies requires a strategic, well-structured approach that balances cost-efficiency, quality assurance, reliability, and supply chain resilience. By centralizing procurement processes, leveraging supplier relationships, and utilizing data-driven decision-making, organizations can achieve significant operational savings and improved inventory management. Emphasizing sustainability, risk mitigation, and technological integration—such as procurement software and digital marketplaces—further enhances sourcing effectiveness. Ultimately, a comprehensive and proactive sourcing strategy ensures consistent supply of critical materials, supports uninterrupted production, and strengthens competitiveness in the evolving industrial landscape.