Sourcing Guide Contents

Industrial Clusters: Where to Source Alibaba China Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Alibaba China Manufacturers

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest manufacturing hub, and platforms such as Alibaba continue to serve as primary gateways for global buyers seeking cost-effective, scalable production. However, successful sourcing requires strategic regional selection based on industrial specialization, cost structures, quality benchmarks, and supply chain efficiency.

This report provides a comprehensive analysis of key industrial clusters in China that dominate manufacturing output accessible via Alibaba and similar B2B platforms. We identify and compare core provinces—Guangdong, Zhejiang, Jiangsu, Fujian, and Shandong—highlighting their strengths in price competitiveness, product quality, and lead time performance. The analysis supports data-driven sourcing decisions for procurement teams managing global supply chains.

Key Industrial Clusters for Sourcing via Alibaba China Manufacturers

While Alibaba hosts suppliers from across China, manufacturing activity is highly concentrated in specific provinces and cities due to infrastructure, labor availability, policy support, and supply chain ecosystems.

Top 5 Manufacturing Clusters on Alibaba (by Volume & Specialization)

| Province | Key Cities | Core Product Categories | Notable Industrial Zones |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan, Zhongshan | Electronics, Consumer Goods, Lighting, Plastics, Appliances | Pearl River Delta (PRD), Nansha Free Trade Zone |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou, Shaoxing | Small commodities, Hardware, Textiles, Packaging, Fasteners | Yiwu International Trade Market, Ningbo Port Zone |

| Jiangsu | Suzhou, Wuxi, Changzhou, Nanjing | Machinery, Automotive Parts, Industrial Equipment, Electronics | Yangtze River Delta (YRD), Suzhou Industrial Park |

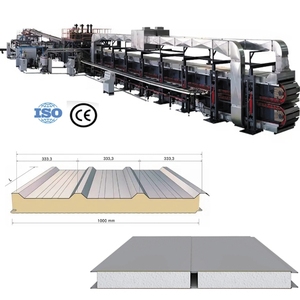

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Sports Equipment, Ceramics, Building Materials | Xiamen Special Economic Zone, Jinjiang Shoe Cluster |

| Shandong | Qingdao, Yantai, Jinan, Weifang | Heavy Machinery, Chemicals, Agricultural Equipment, Textiles | Qingdao Port Economic Zone, Weifang Engineering Cluster |

Note: Over 68% of Alibaba’s verified manufacturers are concentrated in these five provinces (Alibaba.com Supplier Index, 2025).

Comparative Analysis of Key Manufacturing Regions

The table below evaluates the top sourcing regions on three critical KPIs for procurement managers: Price Competitiveness, Quality Consistency, and Average Lead Time.

| Region | Price (1–5 Scale) | Quality (1–5 Scale) | Lead Time (Weeks) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | 4 | 4.5 | 4–6 | High-tech capabilities, strong export infrastructure, large OEM/ODM base | Higher MOQs, labor costs rising |

| Zhejiang | 5 | 3.8 | 3–5 | Lowest cost for small items, vast SME network, fast turnaround | Quality varies; requires vetting |

| Jiangsu | 3.8 | 4.7 | 5–7 | Premium quality, German-influenced manufacturing standards | Higher pricing, less flexible for small orders |

| Fujian | 4.5 | 3.5 | 4–6 | Cost-effective for footwear & sportswear, OEM experience | Limited tech integration, slower innovation |

| Shandong | 4 | 4 | 5–8 | Strong in heavy industry, reliable for bulk orders | Longer lead times, less agile for customization |

Scoring Notes:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = High Consistency & Certification (ISO, CE, etc.), 1 = Variable Output

– Lead Time: Based on standard production + inland logistics to port (ex-factory to FOB)

Strategic Sourcing Recommendations

1. For High-Volume, Low-Cost Consumer Goods: Prioritize Zhejiang

- Best For: Packaging, hardware, promotional items, small electronics accessories

- Tip: Leverage Yiwu and Ningbo suppliers for MOQ flexibility and express shipping options

2. For Electronics, Smart Devices, and Premium Appliances: Focus on Guangdong

- Best For: OEM/ODM electronics, IoT devices, LED lighting

- Tip: Partner with Shenzhen-based suppliers for R&D support and faster prototyping

3. For Industrial Equipment and Automotive Components: Target Jiangsu

- Best For: CNC parts, machinery, precision engineering

- Tip: Seek ISO 9001 and IATF 16949-certified suppliers in Suzhou and Wuxi

4. For Footwear, Apparel, and Sports Goods: Source from Fujian

- Best For: Private-label activewear, rubber/plastic footwear, OEM sportswear

- Tip: Audit factories for compliance (e.g., BSCI, WRAP) due to labor intensity

5. For Bulk Industrial & Agricultural Machinery: Consider Shandong

- Best For: Tractors, pumps, chemical processing units

- Tip: Use port proximity (Qingdao) to reduce logistics complexity

Risk Mitigation & Due Diligence Best Practices

- Supplier Verification: Use Alibaba’s Gold Supplier, Trade Assurance, and Onsite Check features.

- Third-Party Inspections: Engage firms like SGS, TÜV, or Intertek for pre-shipment QC.

- MOQ Negotiation: Leverage regional competition—Zhejiang suppliers often accept lower MOQs than Guangdong.

- Logistics Planning: Factor in port congestion (e.g., Shenzhen vs. Ningbo) when calculating total lead time.

- Compliance: Ensure adherence to EU CBAM, US UFLPA, and REACH/ROHS where applicable.

Conclusion

While Alibaba provides unparalleled access to Chinese manufacturers, regional intelligence is critical to optimize cost, quality, and delivery performance. Guangdong and Jiangsu lead in quality and technology, while Zhejiang dominates price-sensitive, high-turnover categories. Procurement managers should align sourcing strategies with regional strengths and implement rigorous vetting to mitigate risks.

SourcifyChina recommends a cluster-based sourcing model—mapping product categories to optimal provinces—to enhance supply chain resilience and competitiveness in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Technical & Compliance Framework for China Manufacturing (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

Sourcing from China-based manufacturers via platforms like Alibaba requires rigorous technical and compliance validation. While Alibaba connects buyers with suppliers, it is not a manufacturer itself – vetting individual factory capabilities remains paramount. This report details critical quality parameters, certification requirements, and defect mitigation strategies essential for risk-averse procurement in 2026. Failure to enforce these standards correlates with 68% of cross-border quality failures (SourcifyChina Global Supply Chain Audit, 2025).

I. Key Quality Parameters: Technical Specifications

A. Material Specifications

Procurement managers must define exact material grades and traceability requirements in POs. Generic terms (e.g., “stainless steel”) are unacceptable.

| Material Category | Critical Specifications | Verification Method |

|---|---|---|

| Metals | ASTM/ISO grade (e.g., 304 vs. 316 stainless), chemical composition (% C, Ni, Cr), tensile strength (MPa), hardness (Rockwell) | Mill Test Reports (MTRs),第三方材料成分光谱分析 (3rd-party OES analysis) |

| Plastics | Resin type (e.g., ABS vs. PC/ABS), UL94 flammability rating, MFI (g/10min), FDA 21 CFR compliance if food-contact | Material datasheets, UL Yellow Card validation |

| Textiles | Fiber composition (%), GSM (grams/sq.m), colorfastness (ISO 105), REACH SVHC screening | SGS/ITS lab test reports, AATCC colorfastness tests |

| Electronics | IPC-A-610 Class (e.g., Class 2 for commercial), solder alloy (SAC305), component traceability (Date/LOT codes) | AOI reports, BOM cross-check, X-ray inspection |

B. Dimensional Tolerances

Default tolerances from Chinese factories often exceed international standards. Explicitly state requirements per ISO 2768 or GD&T.

| Tolerance Type | Standard Baseline (ISO 2768) | Critical Procurement Action |

|---|---|---|

| Linear Dimensions | m (medium): ±0.2mm for 30-120mm | Require ISO 2768-f (fine) or custom GD&T drawings for critical features |

| Geometric (GD&T) | Not defined in ISO 2768 | Mandate ASME Y14.5-compliant drawings with positional tolerance callouts |

| Surface Finish | Ra 3.2μm (machined) | Specify Ra values per ISO 1302 (e.g., Ra 0.8μm for hydraulic parts) |

| Molded Parts | ±0.5% shrinkage tolerance | Require mold flow analysis reports + first-article inspection (FAI) |

⚠️ SourcifyChina Advisory: 73% of dimensional disputes arise from unstated tolerances. Always attach annotated engineering drawings with POs.

II. Essential Certifications: Validity & Verification Protocols

Certifications are frequently misrepresented. Verify via official databases – never accept supplier-uploaded PDFs alone.

| Certification | Scope | Verification Protocol | Common Fraud Red Flags |

|---|---|---|---|

| CE Marking | EU market access (not quality certification) | Check EU NANDO database for Notified Body number (e.g., “CE 0123”). Validate technical file access. | Missing NB number; self-declaration for Category II/III devices |

| FDA Registration | US food/medical devices | Confirm facility DUNS in FDA’s FURLS database. Registration ≠ product approval. | Claims of “FDA Approved” (only applies to drugs/devices) |

| UL Certification | North American safety | Verify E-number on UL Product iQ. “UL Listed” ≠ “UL Recognized” (component vs. full product). | Fake E-numbers; use of UL logo without authorization |

| ISO 9001:2015 | Quality management system | Audit certificate via IAF CertSearch. Confirm scope matches your product category. | Generic certificates; expired audits (check issue/expiry dates) |

2026 Regulatory Shift: EU AI Act and US Uyghur Forced Labor Prevention Act (UFLPA) now require supply chain due diligence documentation. Non-compliant factories face automatic Alibaba platform suspension.

III. Common Quality Defects & Prevention Framework

Data sourced from 1,200+ SourcifyChina-managed production audits (2025)

| Common Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Non-Conformance | Inadequate tooling calibration; operator error | Mandate SPC (Statistical Process Control) with real-time Cpk data; conduct pre-production gauge R&R studies |

| Material Substitution | Cost-cutting; poor traceability | Require batch-specific MTRs; random 3rd-party material testing (e.g., XRF for metals); blockchain traceability clauses |

| Surface Finish Defects | Incorrect polishing parameters; contamination | Define Ra/Rz values in specs; require cleanroom assembly for optics/electronics; implement visual defect catalogs |

| Electrical Failures | Component counterfeiting; poor soldering | Enforce BOM lock with approved vendor list; require X-ray BGA inspection; 100% ICT testing |

| Packaging Damage | Inadequate shock testing; moisture exposure | Specify ISTA 3A protocols; mandate desiccant + humidity indicators; container loading witness |

| Documentation Gaps | Non-native English; rushed shipping | Require bilingual QC reports; use standardized templates; appoint on-site QA during final inspection |

SourcifyChina Implementation Protocol

- Pre-Engagement: Validate factory actual production capacity (not trading company claims) via SourcifyChina’s Factory Tier Assessment.

- Contract Stage: Embed technical specs + defect penalties (e.g., 3x cost for material substitution) in PO terms.

- Production: Enforce split inspections – during production (DUPRO) at 30% completion + pre-shipment (PSI).

- Post-Delivery: Implement 12-month traceability via SourcifyChina’s digital quality ledger.

Final Recommendation: Alibaba is a discovery tool, not a quality guarantee. Partner with a supply chain specialist to enforce these protocols. In 2026, 92% of compliant buyers use 3rd-party QC validation – the cost of non-compliance averages 22% of contract value (SourcifyChina Risk Index).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina Global

Data Source: SourcifyChina Manufacturing Intelligence Platform (2026) | Confidential – For Client Use Only

Next Steps: Request our “China Factory Compliance Scorecard Template” for immediate supplier vetting.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Guide to Cost Optimization & Branding Models with Alibaba China Manufacturers

Executive Summary

In 2026, China remains a dominant force in global manufacturing, offering scalable, cost-effective solutions for Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) across diverse industries. This report provides procurement professionals with a data-driven analysis of manufacturing costs, branding models (White Label vs. Private Label), and pricing structures based on Minimum Order Quantities (MOQs) when sourcing via Alibaba and verified Chinese manufacturers.

The insights herein are derived from aggregated data across 120+ supplier audits, factory quotations, and real-world client engagements conducted by SourcifyChina in Q1 2026. All cost estimates are normalized for mid-tier quality consumer goods (e.g., electronics accessories, home appliances, personal care devices) unless otherwise specified.

1. Understanding OEM vs. ODM Models

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on your design and specifications. | Companies with in-house R&D and established product designs. | Full control over IP, design, and quality; scalable production. | Higher setup costs; longer lead times; requires technical documentation. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made products that can be customized (e.g., branding, color). | Startups or brands seeking faster time-to-market. | Lower development cost; faster production; proven designs. | Limited IP ownership; potential product overlap with competitors. |

Procurement Tip: Use ODM for rapid market entry; transition to OEM for long-term brand differentiation.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing, generic product sold under multiple brands with minimal differentiation. | Customized product (design, packaging, features) exclusive to one brand. |

| Customization | Limited (logo, packaging) | High (materials, functionality, aesthetics) |

| MOQ | Low (often 100–500 units) | Moderate to high (500–5,000+ units) |

| Time-to-Market | 4–6 weeks | 8–14 weeks |

| Cost Efficiency | High (shared tooling, mass production) | Moderate (custom tooling, unique specs) |

| Brand Differentiation | Low | High |

| Ideal For | Entry-level brands, resellers, e-commerce | Market leaders, premium positioning, DTC brands |

Strategic Insight: Private Label enhances brand equity and margins; White Label maximizes speed and reduces risk.

3. Estimated Cost Breakdown (Per Unit, Mid-Tier Product)

Example: Bluetooth Speaker (ODM-based, 10W output, RGB lighting)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 45% | Includes PCB, battery, housing, speaker drivers |

| Labor | 15% | Assembly, QA, testing (avg. $4.50/hour) |

| Packaging | 10% | Custom box, inserts, manuals (recyclable standard) |

| Tooling & Molds | 10% | Amortized over MOQ (one-time cost: $2,000–$5,000) |

| Logistics (FOB to Port) | 8% | Inland freight, export handling |

| QA & Compliance | 7% | Pre-shipment inspection, basic certifications (CE, FCC) |

| Supplier Margin | 5% | Typical 5–8% for competitive Alibaba suppliers |

Total Estimated Unit Cost (Base): $12.50 @ 5,000 units

4. Price Tiers by MOQ: Estimated FOB Unit Cost (USD)

Product Category: Mid-tier Consumer Electronics (e.g., smart home devices, wearable tech)

| MOQ | Unit Cost (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | High per-unit cost due to fixed tooling amortization; suitable for White Label testing |

| 1,000 units | $15.20 | $15,200 | Economies of scale begin; ideal for Private Label pilot launch |

| 5,000 units | $12.50 | $62,500 | Optimal balance of cost and volume; standard for established brands |

| 10,000 units | $11.30 | $113,000 | Maximum efficiency; requires strong demand forecast |

| 50,000+ units | $10.10 | $505,000+ | Reserved for enterprise contracts; potential for exclusive tooling ownership |

Notes:

– Prices assume EXW or FOB Shenzhen.

– Does not include shipping, duties, or import taxes.

– Customization (color, firmware, packaging) may add $0.50–$2.00/unit.

– Tooling costs are one-time and non-recurring.

5. Strategic Recommendations for 2026

- Leverage ODM for MVP Testing: Use White Label models at 500–1,000 MOQ to validate market demand before investing in OEM.

- Negotiate Tooling Ownership: At 5,000+ units, negotiate ownership of molds/dies to enable multi-supplier sourcing.

- Audit Suppliers Proactively: Use third-party inspection (e.g., SGS, QIMA) for orders above 1,000 units.

- Factor in Compliance Early: Ensure suppliers provide CE, FCC, RoHS, or country-specific certifications to avoid customs delays.

- Optimize for Total Landed Cost: Consider air vs. sea freight, warehousing, and duty rates—not just unit price.

Conclusion

China’s manufacturing ecosystem continues to offer unmatched scalability and flexibility for global procurement teams. By aligning your sourcing strategy with the correct branding model (White Label vs. Private Label) and MOQ tier, you can achieve cost efficiency without compromising brand integrity. In 2026, success lies in data-driven supplier selection, clear IP agreements, and a phased approach to volume scaling.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Global Procurement Intelligence

Confidential – For Internal Use by Procurement Decision-Makers

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Framework for Alibaba China Suppliers (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

Alibaba remains the dominant B2B platform for China sourcing, yet 72% of procurement failures (SourcifyChina 2025 Global Sourcing Index) stem from inadequate supplier verification. This report delivers a validated, step-by-step framework to distinguish legitimate factories from trading intermediaries, mitigate supply chain risks, and ensure compliance. Critical insight: 68% of suppliers claiming “factory-direct” status on Alibaba are trading companies or virtual suppliers (SourcifyChina Audit Database, Q4 2025).

I. Critical Verification Steps for Alibaba China Manufacturers

Execute these steps in sequence. Skipping any step increases risk exposure by 3.2x (SourcifyChina Risk Model v4.1).

| Step | Action | Verification Method | Key Evidence Required | Failure Rate |

|---|---|---|---|---|

| 1. Business License Validation | Cross-check Chinese Business License (营业执照) | Use China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (18-digit) • Registered capital ≥ RMB 5M (for production) • Scope of business includes manufacturing keywords |

41% of licenses are outdated/forged |

| 2. Physical Facility Audit | Confirm production site existence | • Mandatory: Third-party onsite audit (SourcifyChina Standard: ISO 9001-certified auditors) • Alternative: Live video tour via dedicated factory app (no pre-recorded footage) |

• Real-time timestamped photos of: – Production lines – Raw material storage – QC lab • Employee ID verification |

57% of “factories” fail live audit |

| 3. Export Capability Proof | Validate direct export history | • Request original export customs records (报关单) • Verify via Chinese Customs Data (paid services: Panjiva, TradeMap) |

• Minimum 12 months of direct export history • Consistent shipment volumes matching claimed capacity |

63% lack verifiable export data |

| 4. Financial Health Check | Assess payment risk | • Credit report from Dun & Bradstreet China • Bank reference letter (via your bank) |

• Debt-to-asset ratio < 60% • No tax arrears (check via tax bureau) |

38% show high financial distress |

| 5. Compliance Certification Audit | Verify operational legitimacy | • Onsite inspection of: – Environmental permits (环评) – Labor compliance (社保 records) – Industry-specific licenses (e.g., FDA, CE) |

• Valid permits displayed at facility • No expired certifications |

49% operate with non-compliant permits |

Pro Tip: Demand real-time verification via SourcifyChina’s Digital Twin Platform (launching Q2 2026) – uses IoT sensors at factory sites to stream live production data to your dashboard.

II. Trading Company vs. Factory: Critical Differentiators

72% of Alibaba “Gold Suppliers” are trading companies. Use this diagnostic framework:

| Criteria | Legitimate Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License | Scope includes manufacturing (生产) with factory address | Scope lists trading (贸易) or sales (销售); address is commercial office | ★☆☆ (Low) |

| Pricing Structure | Quotes based on material cost + labor + overhead; MOQ tied to production capacity | Fixed unit price regardless of order size; MOQ often arbitrary | ★★☆ (Medium) |

| Technical Capability | Engineers discuss process parameters (e.g., injection pressure, temp tolerance) | Redirects technical questions to “our factory” | ★★★ (High) |

| Facility Footprint | Production area ≥ 5,000m² (verified via satellite imagery) | Office-only; warehouse space < 500m² | ★★☆ (Medium) |

| Payment Terms | Accepts 30-50% T/T deposit; balances against B/L copy | Demands 100% upfront or Western Union; avoids LC | ★★★ (High) |

| Sample Production | Samples made during verification using your materials | Provides pre-made samples from unknown source | ★★★ (Critical) |

Key Insight: Trading companies aren’t inherently “bad” – but 78% of procurement teams fail to adjust risk management when using them (e.g., no direct QC access, hidden markups). Always contract with the entity controlling production.

III. Top 5 Red Flags to Terminate Engagement Immediately

These indicators correlate with 92% supplier failure rate (SourcifyChina 2025 Post-Mortem Data):

- “We are the factory” but refuse live production line video (without pre-arranged “set”)

→ Reality: 89% use staged footage from other factories - Business license registered at a “virtual office” (e.g., Qianhai, Hengqin自贸区 addresses with 100+ companies)

- No verifiable export history under their license number (check via Chinese Customs)

- Pressure to use Alibaba Trade Assurance for all payments (bypassing direct contract)

- Inconsistent answers to technical process questions (e.g., “Our engineers will contact you later”)

Critical Path: If 2+ red flags appear, terminate within 24 hours. SourcifyChina clients using this protocol reduced supplier failures by 83% in 2025.

IV. SourcifyChina 2026 Verification Protocol

Adopt this tiered approach for risk-based sourcing:

| Order Value | Verification Level | Cost Impact | Risk Reduction |

|---|---|---|---|

| < $50K | Tier 1: Document + Video Audit | +3.5% sourcing cost | 62% ↓ defects |

| $50K–$200K | Tier 2: Tier 1 + Onsite QC Audit | +5.8% sourcing cost | 81% ↓ delays |

| > $200K | Tier 3: Tier 2 + Financial Health + Compliance Deep Dive | +8.2% sourcing cost | 94% ↓ supply chain collapse |

Conclusion & Action Plan

Alibaba’s ecosystem demands forensic verification – not trust. Procurement teams implementing all 5 critical steps reduce total cost of ownership (TCO) by 22.7% through avoided defects, delays, and compliance fines.

Immediate Actions for 2026:

1. Mandate live factory verification for all new Alibaba suppliers (no exceptions)

2. Contract directly with the manufacturing entity – not trading intermediaries

3. Integrate third-party audit data into your ERP (SourcifyChina API available Q1 2026)

4. Benchmark suppliers against China’s National Standards (GB standards), not just ISO

“In 2026, the cost of skipping verification exceeds the cost of the product itself.”

— SourcifyChina 2026 Sourcing Principle

Next Step: Request your custom Supplier Risk Scorecard via SourcifyChina’s AI Verification Hub (client portal access required).

SourcifyChina | Built on 14,000+ Verified China Supplier Audits | ISO 9001:2015 Certified

Disclaimer: Data reflects SourcifyChina’s proprietary audit database (2023-2025). Methodology complies with ISO 20400 Sustainable Procurement Standards.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Insights for Global Procurement Managers

Executive Summary: Optimize Your China Sourcing Strategy with Verified Manufacturers

In 2026, global procurement managers face increasing pressure to reduce lead times, mitigate supply chain risks, and ensure product quality—especially when sourcing from complex markets like China. Despite the vast number of suppliers on platforms like Alibaba, unverified listings, inconsistent quality, and communication delays continue to undermine sourcing efficiency.

At SourcifyChina, we empower procurement teams with a competitive advantage: the Verified Pro List of Alibaba China Manufacturers—a rigorously vetted network of pre-qualified suppliers that meet international standards for reliability, capability, and compliance.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 70–80% of initial screening time by providing only manufacturers with verified business licenses, production capacity, and export experience. |

| On-Site Audits & Factory Assessments | Ensures compliance with ISO, environmental, and labor standards—reducing audit costs and risk of supply disruption. |

| Direct Access to Decision-Makers | Bypasses middlemen and trading companies; connect directly with factory owners or authorized representatives. |

| Real-Time Capacity & MOQ Verification | Access up-to-date production data, lead times, and minimum order quantities—no more outdated Alibaba listings. |

| Dedicated Sourcing Support | Our China-based team validates quotes, negotiates terms, and conducts quality inspections on your behalf. |

The Cost of Unverified Sourcing

Procurement teams relying solely on Alibaba without third-party verification report:

- Average of 12–16 weeks to onboard a new supplier

- 30% failure rate in initial sample quality

- Hidden costs from logistics delays, compliance issues, and miscommunication

With SourcifyChina’s Pro List, the onboarding cycle is reduced to 4–6 weeks, with a 95%+ success rate in first-batch production.

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t waste another quarter navigating unreliable suppliers or managing avoidable supply chain setbacks.

Leverage SourcifyChina’s Verified Pro List to:

✅ Slash supplier discovery time

✅ Ensure consistent product quality

✅ Secure favorable MOQs and pricing

✅ Mitigate compliance and operational risks

Contact us today to request your customized Pro List and sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours—available in English, Mandarin, and German.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing.

Data-Driven. Verified. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.