The global fragrance market is experiencing robust growth, driven by rising consumer demand for premium personal care products and an increasing preference for natural and sustainable ingredients—especially in niche perfumery. According to Mordor Intelligence, the global fragrance market was valued at USD 17.7 billion in 2023 and is projected to grow at a CAGR of 7.8% through 2029, with alcohol-based perfumes dominating commercial and artisanal segments alike. A key enabler of this expansion is the availability of high-purity, odorless alcohols tailored specifically for perfume formulation—offering stability, proper dispersion, and skin-safe delivery of aromatic compounds. As demand for luxury and custom fragrances intensifies across North America, Europe, and Asia-Pacific, manufacturers specializing in perfumery-grade alcohol are scaling production and innovation. This list highlights the top six manufacturers leading the charge in supplying premium alcohol for perfume making, selected based on production capacity, product purity standards, global reach, and compliance with ISO and IFRA regulations.

Top 6 Alcohol For Perfume Making Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TREATT

Domain Est. 1997

Website: treatt.com

Key Highlights: We craft natural extracts and cutting-edge solutions for the beverage, flavor, and fragrance industries — helping our customers solve real-world challenges ……

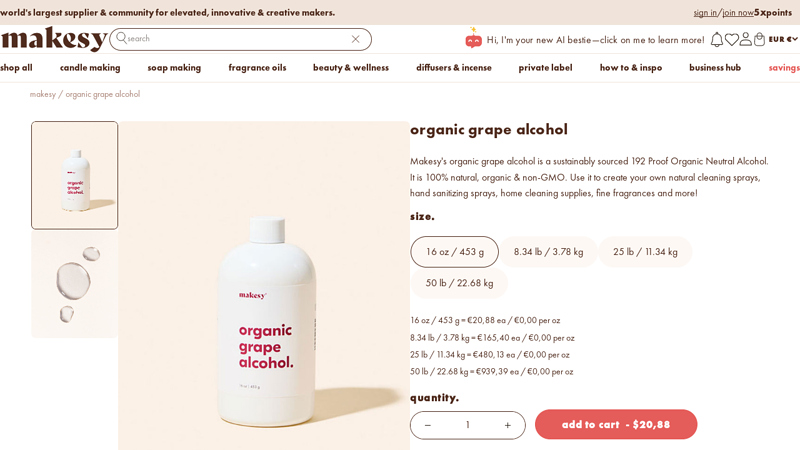

#2 Organic Grape Alcohol for Making Sprays and Perfume

Domain Est. 2014

Website: makesy.com

Key Highlights: Makesy’s organic grape alcohol is a sustainably sourced 192 Proof Organic Neutral Alcohol. It is 100% natural, organic & non-GMO….

#3 Lvnea Perfume

Domain Est. 2014

Website: lvnea.com

Key Highlights: Free delivery over $200Botanical perfumes made from 100% natural ingredients. Hand made in Montreal, Qc from raw essences, essential oils, absolutes, and plant extracts….

#4 Fraterworks

Domain Est. 2022

Website: fraterworks.com

Key Highlights: Beautifully crafted modern and classical perfumery bases, cutting edge aromachemicals and sublime naturals for cosmetics artisans and professionals….

#5 The Best Alcohol for Perfume Making and Why It Matters

Domain Est. 2002

Website: elchemy.com

Key Highlights: Discover the best alcohol for perfume making, why it’s essential for fragrance quality, longevity, and safe skin application….

#6 Top 100 Perfume Alcohol Suppliers in 2025

Domain Est. 2022

Website: ensun.io

Key Highlights: Makesy offers luxury perfumer’s alcohol, a 100% natural and organic grape alcohol, which serves as an ideal base for creating various fragrances….

Expert Sourcing Insights for Alcohol For Perfume Making

2026 Market Trends for Alcohol in Perfume Making

The market for alcohol used in perfume making is poised for significant evolution by 2026, driven by shifting consumer preferences, sustainability imperatives, and technological advancements. As perfumery continues to grow globally, particularly in emerging markets, the demand for high-quality, specialized alcohols will intensify, accompanied by new challenges and opportunities.

Sustainability and Eco-Conscious Sourcing as Core Drivers

By 2026, sustainability will no longer be a niche concern but a fundamental requirement across the fragrance supply chain. Consumers and regulators alike are demanding transparency and environmental responsibility. This will push perfume alcohol suppliers and fragrance houses to prioritize ethanol derived from renewable, non-food sources such as sugarcane, corn, or even cellulose waste. Certification schemes (like ISCC, Bonsucro) will become standard, ensuring traceability and compliance with environmental standards. Brands will increasingly highlight “carbon-neutral” or “low-impact” alcohol sourcing as a key selling point, aligning with broader corporate ESG goals.

Demand for Ultra-High Purity and Customization

Performance remains paramount. The trend toward more complex, long-lasting, and natural-feeling fragrances will drive demand for ultra-pure, specially denatured alcohols (e.g., SDA 40B) with minimal impurities that could affect scent integrity or cause skin irritation. Suppliers will focus on advanced distillation and filtration technologies to achieve exceptional consistency and clarity. Furthermore, customization will grow—perfumers may request alcohols with specific denaturing agents (compliant with regulations) or tailored properties (e.g., optimized evaporation rates, enhanced solubility for natural extracts) to differentiate their olfactory creations.

Regulatory Complexity and Compliance Focus

Global regulatory landscapes, particularly REACH in Europe and evolving TTB guidelines in the US, will continue to shape the market. By 2026, stricter controls on volatile organic compounds (VOCs) and specific denaturants may emerge, requiring suppliers to innovate with compliant formulations. Increased scrutiny on allergens and ingredient transparency will cascade down to raw materials, meaning alcohol suppliers must provide comprehensive documentation. Investment in robust compliance infrastructure and proactive engagement with regulatory bodies will be essential for market access.

Rise of Artisanal and Niche Perfumery

The booming niche and artisanal fragrance segment will significantly influence alcohol demand. These brands often prioritize premium, traceable ingredients and unique sensory experiences. This creates a growing market for small-batch, specialty alcohols—potentially including organic-certified or regionally sourced options. Suppliers catering to this segment will need flexible production, smaller packaging options, and strong technical support for indie perfumers.

Supply Chain Resilience and Regionalization

Geopolitical tensions and lessons from recent disruptions (pandemic, logistics) will drive efforts to build more resilient supply chains. By 2026, there will likely be increased investment in regional alcohol production facilities closer to key perfume manufacturing hubs (e.g., France, UAE, India, USA). This reduces transportation emissions and dependency on single-source suppliers, enhancing security of supply. Digital platforms for tracking ethanol origin and quality in real-time may become more prevalent.

Innovation in Alternative Solvents and Carrier Systems

While ethanol remains the dominant solvent, research into alternatives will gain traction by 2026, driven by demands for non-flammable, skin-friendly, or water-based delivery systems. Alcohols like phenethyl alcohol (naturally occurring) or innovative bio-based solvents might see increased use in specific product types (e.g., mists, roll-ons, skincare-infused fragrances). However, traditional ethanol is expected to retain its dominance in fine fragrance due to its unparalleled performance in diffusion and stability.

In conclusion, the 2026 market for alcohol in perfume making will be defined by a convergence of sustainability, purity, regulatory rigor, and customization. Success will depend on suppliers’ ability to provide traceable, high-performance, and responsibly sourced ethanol while adapting to the diverse needs of a dynamic global fragrance industry.

Common Pitfalls in Sourcing Alcohol for Perfume Making (Quality & IP)

Sourcing the right alcohol is critical for perfume formulation, but several pitfalls can compromise both the quality of the final product and intellectual property (IP) integrity. Here are the key areas to watch for:

Poor Alcohol Purity and Quality

Using substandard or inappropriate alcohol can ruin a fragrance’s character, stability, and safety. Common issues include:

- Presence of Impurities: Alcohols containing aldehydes, ketones, or other contaminants can react with fragrance components, leading to off-notes, discoloration, or reduced shelf life.

- Incorrect Alcohol Type: Using denatured alcohol with harsh denaturants (e.g., methanol, denatonium benzoate) can compromise scent integrity and pose safety risks. Perfumers should use high-purity, perfumer’s-grade ethanol (typically 190–200 proof) that is specifically denatured for cosmetic use (e.g., with isopropyl alcohol or bitterants approved by IFRA).

- Inconsistent Batches: Suppliers that lack rigorous quality control may deliver variable alcohol quality, leading to inconsistencies in fragrance performance and spray characteristics across production runs.

- Adulteration or Dilution: Some suppliers may dilute ethanol with water or substitute lower-cost alternatives, affecting the solubility of aromatic compounds and altering the evaporation rate.

Intellectual Property and Sourcing Transparency Risks

Sourcing alcohol from unreliable or non-transparent suppliers can expose a brand to IP vulnerabilities:

- Lack of Traceability: If the alcohol source or production method is not fully disclosed, it may be difficult to ensure compliance with regulations (e.g., EU REACH, FDA) or to defend IP claims related to formulation purity and exclusivity.

- Hidden Additives: Some suppliers may include proprietary additives (e.g., stabilizers, UV absorbers) without clear labeling. These can interfere with fragrance chemistry or inadvertently become part of a patented formula, leading to IP disputes or formulation instability.

- Counterfeit or Grey Market Alcohol: Sourcing from unauthorized channels increases the risk of counterfeit ethanol, which may not meet safety or quality standards and could introduce unknown contaminants affecting the fragrance profile.

- Failure to Protect Trade Secrets: Working with suppliers who do not sign confidentiality agreements may risk exposure of proprietary perfume formulations, especially if alcohol blending or customization is involved.

To mitigate these risks, perfumers and brands should source from reputable, certified suppliers who provide certificates of analysis (CoA), full ingredient disclosure, and compliance with cosmetic and fragrance industry standards. Establishing clear contracts with IP protection clauses and conducting regular quality audits are essential steps in safeguarding both product quality and intellectual property.

Logistics & Compliance Guide for Alcohol Used in Perfume Making

Regulatory Classification and Legal Considerations

Alcohol used in perfume making—typically ethanol (ethyl alcohol) or specially denatured alcohol—is subject to strict regulations due to its flammable nature and potential for human consumption. In most jurisdictions, including the United States, European Union, and UK, alcohol intended for industrial or cosmetic use must be denatured to render it unfit for drinking and avoid excise taxation.

- Denatured Alcohol Requirements: In the U.S., the Alcohol and Tobacco Tax and Trade Bureau (TTB) regulates denatured alcohol under the Standards of Denaturation. Common formulations include SDA 40-B (denatured with denatonium benzoate and isopropyl alcohol) for cosmetics.

- Excise and Taxation: Undenatured ethanol is heavily taxed as an alcoholic beverage. Using tax-free denatured alcohol for perfume production requires proper registration with tax authorities (e.g., TTB in the U.S., HMRC in the UK).

- Permits and Licensing: Businesses must obtain permits to purchase, store, and use alcohol in manufacturing. In the EU, REACH and CLP regulations may also apply.

International and Domestic Transportation

Transporting alcohol for perfume making involves compliance with hazardous materials (hazmat) regulations due to its flammability (Class 3 Hazardous Material).

- UN Number and Proper Shipping Name: Ethanol solutions are typically classified under UN 1170, ETHANOL or ETHYL ALCOHOL SOLUTION, with packing group II or III depending on concentration.

- Packaging Requirements: Must be in UN-certified, leak-proof containers with vapor-tight closures. Use of absorbent material and secondary containment is recommended.

- Labeling and Documentation: Packages must display GHS hazard pictograms (flammable, health hazard), hazard statements, and transport labels. A Safety Data Sheet (SDS) must accompany shipments.

- Air, Sea, and Ground Transport: IATA (air), IMDG (sea), and ADR (road in Europe) each have specific rules. For example, IATA limits the quantity per package and requires special packaging for concentrations above 24% alcohol by volume.

Storage and Handling Best Practices

Safe storage is critical to prevent fire hazards and ensure regulatory compliance.

- Storage Conditions: Store in a cool, well-ventilated area away from ignition sources, direct sunlight, and incompatible materials (oxidizers, acids). Use flammable liquid storage cabinets if volumes exceed local thresholds.

- Container Requirements: Use only approved containers (e.g., HDPE, metal, or glass with proper sealing). Label containers with contents, hazards, and date received.

- Spill Management: Maintain spill kits with absorbents suitable for alcohol. Train staff in emergency procedures, including fire response and ventilation.

Environmental and Workplace Safety Compliance

Manufacturers must comply with environmental protection and occupational safety regulations.

- Ventilation and Exposure Limits: Ensure adequate ventilation in production areas. Monitor airborne ethanol levels; OSHA PEL is 1000 ppm (1880 mg/m³) as an 8-hour TWA.

- Waste Disposal: Spent alcohol or contaminated materials may be classified as hazardous waste. Follow local regulations for disposal—do not pour down drains.

- Employee Training: Provide training on SDS, fire safety, PPE (gloves, goggles, respirators if needed), and emergency procedures.

Import and Export Compliance

Cross-border movement of alcohol-based perfume ingredients requires careful documentation and adherence to international standards.

- Customs Documentation: Provide commercial invoices, packing lists, SDS, and certificates of origin. Declare alcohol content accurately.

- Tariff Classification: Classify goods under the correct HS code (e.g., 2207.10 for denatured ethyl alcohol in many countries).

- Import Permits: Some countries require import licenses for alcohol-containing products, even for non-consumptive use.

Labeling and Product Compliance

Finished perfumes containing alcohol must also comply with cosmetic regulations.

- EU Cosmetics Regulation (EC) No 1223/2009: Requires ingredient listing (INCI names), responsible person designation, and product safety assessments.

- FDA (U.S.): While not pre-approved, cosmetics must be safe and properly labeled under the FD&C Act. Alcohol must be listed in descending order of predominance.

- GHS Compliance: If sold in bulk or as raw material, ensure labels meet GHS standards including signal words, hazard statements, and precautionary measures.

Recordkeeping and Audits

Maintain accurate records to demonstrate compliance during inspections.

- Purchase and Usage Logs: Track all alcohol received, used, and disposed of. Include supplier, quantity, denaturing formula, and date.

- Regulatory Filings: Retain copies of permits, tax filings, and safety certifications for the required period (typically 3–5 years).

- Internal Audits: Conduct regular reviews of storage, handling, and documentation practices to ensure ongoing compliance.

By adhering to this guide, businesses can ensure safe, legal, and efficient handling of alcohol in perfume manufacturing across the supply chain.

In conclusion, sourcing alcohol for perfume making requires careful consideration of quality, purity, and suitability for fragrance formulation. The ideal alcohol—typically ethanol of high purity (such as perfumer’s alcohol or SD Alcohol 40-B)—must be free from impurities that could alter scent integrity or cause skin irritation. It should also possess the right balance of volatility and solvency to effectively carry and disperse aromatic compounds. Reliable sourcing from reputable suppliers, compliance with regulatory standards, and proper storage are essential to ensure consistency and safety in the final product. Ultimately, selecting the right alcohol is a crucial step in creating professional, long-lasting perfumes that meet both aesthetic and functional expectations.