The demand for industrial and specialty tubing continues to rise across key sectors such as aerospace, automotive, and energy, fueling regional manufacturing growth—including in Alabama. According to a 2023 report by Grand View Research, the global metal tubing market was valued at $139.7 billion and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, driven by increasing infrastructure investment and demand for high-performance materials. Alabama, with its strategic location, skilled labor force, and strong industrial base, has emerged as a key hub for tube manufacturing in the southeastern United States. Home to both established producers and innovative suppliers, the state supports critical supply chains in automotive, HVAC, and defense industries. Below are six leading tube manufacturers in Alabama leveraging this growth, combining precision engineering, scalable production, and certifications to serve domestic and global markets.

Top 6 Alabama Tube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

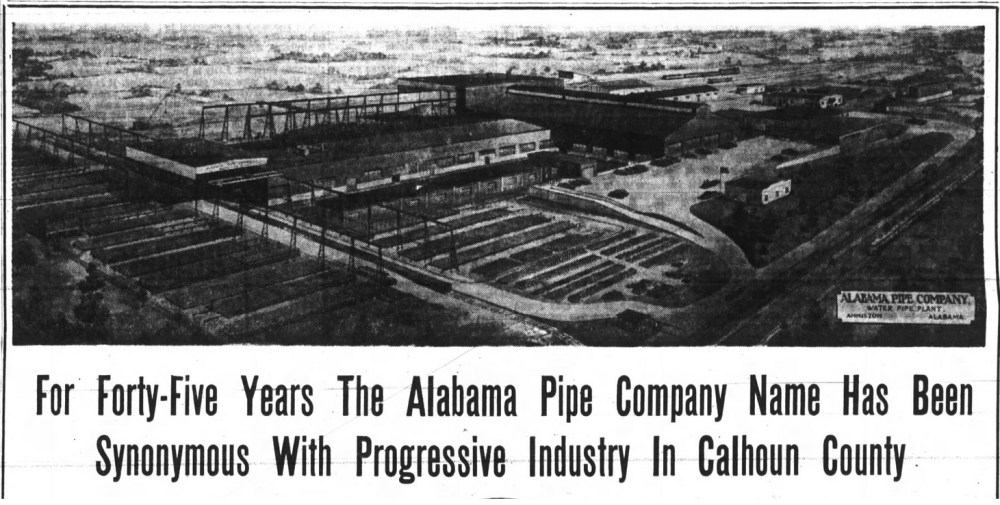

#1 Alfiniti, Inc. Acquires Alabama Tube Corporation, the Only Welded…

Domain Est. 2002

Website: aluminiumtoday.com

Key Highlights: Alfiniti, Inc. have announced the acquisition of Alabama Tube Corporation, the sole manufacturer of welded aluminum tube in the United ……

#2 Alfiniti, Inc. Acquires Alabama Tube Corporation, the Only Welded …

Domain Est. 2006

Website: alfiniti.com

Key Highlights: As the only manufacturer of welded aluminum tube in the U.S., Alabama Tube Corporation serves a wide range of industries such as outdoor ……

#3 Atlas Tube

Domain Est. 1995

Website: atlastube.com

Key Highlights: As the leading manufacturer of structural steel tube, we’re here to help you. From conceptual design through project completion, our engineering team, design ……

#4 Germany’s Butting selects Alabama for HQ and its first U.S. …

Domain Est. 2000

Website: madeinalabama.com

Key Highlights: Pipe manufacturer Butting plans to establish its North American headquarters and first U.S production facility in Baldwin County….

#5 Alabama Tube Corp

Domain Est. 1996

Website: mapquest.com

Key Highlights: Alabama Tube Corp, located in Fort Payne, AL, specializes in high-quality welded aluminum tubes that are recognized for their durability, lightweight ……

#6 Alabama Tube Corporation

Domain Est. 2002

Website: alabamatube.com

Key Highlights: Welcome to Alabama Tube, your source for versatile and high-quality welded aluminum tube. With its wide range of applications, welded aluminum tube plays an ……

Expert Sourcing Insights for Alabama Tube

H2: Market Trends Shaping Alabama Tube’s Industry Landscape in 2026

As Alabama Tube, a leading manufacturer of steel tubular products, looks toward 2026, several macroeconomic, technological, and sector-specific trends are expected to shape its market environment. The company operates in a highly cyclical industry tied to construction, energy, automotive, and infrastructure markets—each undergoing significant transformation. Below are the key trends likely to influence Alabama Tube’s operations, strategy, and competitive positioning in 2026.

1. Infrastructure Investment Driving Demand

The continued rollout of the U.S. Infrastructure Investment and Jobs Act (IIJA), signed in 2021, will reach peak funding levels by 2026. This federal investment—targeting roads, bridges, water systems, and broadband—will significantly boost demand for structural and mechanical steel tubing. Alabama, with its strategic Southeast location and growing transportation projects, is poised to benefit. Alabama Tube is well-positioned to supply tubular products for bridge supports, culverts, and utility installations, potentially increasing regional market share.

2. Energy Sector Shifts: LNG and Renewables Growth

While traditional oil and gas markets remain important, the energy transition is reshaping steel tube demand. Liquefied natural gas (LNG) export infrastructure projects along the Gulf Coast are accelerating, requiring high-specification welded and seamless tubes. Alabama Tube can capitalize on this with its proximity to Gulf ports and pipeline corridors. Simultaneously, renewable energy projects—such as wind turbine towers and solar farm support structures—are increasing demand for large-diameter, high-strength steel tubing. By 2026, Alabama Tube may need to adapt product specifications and production lines to meet these evolving technical requirements.

3. Supply Chain Resilience and Onshoring

Geopolitical tensions and past supply chain disruptions have accelerated the trend toward domestic manufacturing. U.S. policies promoting “Buy American” provisions and reshoring of critical industries will favor domestic producers like Alabama Tube. In 2026, customers across construction and energy sectors will prioritize reliable, local suppliers to reduce lead times and logistical risks. Alabama Tube can leverage its U.S.-based production facilities as a competitive advantage, especially in markets sensitive to import tariffs and trade volatility.

4. Sustainability and Decarbonization Pressures

Environmental, Social, and Governance (ESG) expectations are rising across industrial sectors. By 2026, steel buyers—including large contractors and energy firms—will increasingly demand low-carbon steel products. Alabama Tube may face pressure to reduce its carbon footprint through energy-efficient furnaces, increased scrap utilization, or investments in alternative fuels. Additionally, certifications like Environmental Product Declarations (EPDs) could become standard bidding requirements, pushing the company to enhance transparency in its manufacturing processes.

5. Technological Advancements in Manufacturing

Industry 4.0 technologies—such as predictive maintenance, AI-driven quality control, and digital twin modeling—are becoming mainstream in steel manufacturing. By 2026, Alabama Tube that adopts smart factory solutions will gain operational efficiencies, reduce downtime, and improve product consistency. Automation in welding and finishing lines can also help meet tighter tolerances required by advanced construction and energy applications.

6. Labor and Workforce Challenges

The skilled labor shortage in U.S. manufacturing persists. By 2026, Alabama Tube may face competition for welders, machinists, and maintenance technicians. Investing in workforce development—through partnerships with community colleges and apprenticeship programs—will be critical to sustaining growth. Additionally, integrating more automation can help offset labor constraints while improving productivity.

7. Competitive Dynamics and Consolidation

The steel tubing industry is consolidating, with larger players acquiring regional manufacturers to expand capacity and geographic reach. Alabama Tube may face increased competition from national and international firms. To maintain its independence or enhance value, strategic options such as vertical integration, niche product specialization (e.g., corrosion-resistant or custom-diameter tubes), or regional alliances could become important.

Conclusion

By 2026, Alabama Tube will operate in a dynamic environment shaped by federal policy, energy transformation, and sustainability imperatives. Success will depend on the company’s ability to align its production capabilities with infrastructure and energy trends, embrace technological innovation, and respond to growing ESG expectations. Proactive adaptation to these H2 market trends will position Alabama Tube for sustained growth and resilience in the mid-decade industrial landscape.

Common Pitfalls When Sourcing Alabama Tube (Quality, IP)

Sourcing industrial components like tubing from Alabama—or any region—requires careful due diligence to avoid issues related to quality control and intellectual property (IP). Below are key pitfalls to watch for:

Quality Inconsistencies

Tubing suppliers in Alabama may vary significantly in manufacturing standards. Some smaller or less-regulated facilities might lack rigorous quality assurance processes, leading to inconsistencies in dimensions, material composition, or structural integrity. Without proper certifications (e.g., ISO, ASTM), buyers risk receiving substandard products that fail under operational stress or do not meet industry specifications.

Lack of Traceability and Documentation

A common issue is insufficient material traceability, including missing mill test reports (MTRs) or heat numbers. This opacity makes it difficult to verify compliance with required standards and can pose risks in regulated industries like aerospace, oil and gas, or medical devices where documentation is critical for audits and safety.

Intellectual Property Risks

When sourcing custom-designed tubing, there is a risk of IP infringement if the supplier reuses or replicates proprietary designs without authorization. Some manufacturers may not have strong IP protection policies, increasing the chance of design theft or unauthorized production, especially if molds, drawings, or specifications are shared without proper legal safeguards.

Inadequate Compliance with Industry Standards

Not all Alabama-based tube producers adhere strictly to national or international standards (e.g., ASME, API, or NACE). Assuming compliance without verification can result in receiving products unsuitable for high-pressure, high-temperature, or corrosive environments, leading to safety hazards and costly failures.

Supply Chain Transparency Gaps

Limited visibility into subcontracting practices can be problematic. Some suppliers may outsource production to third parties without notification, introducing unveted quality risks and weakening control over both product consistency and IP protection.

To mitigate these pitfalls, conduct thorough supplier audits, require comprehensive quality documentation, establish clear IP agreements, and consider third-party inspections before large-scale procurement.

Logistics & Compliance Guide for Alabama Tube

This guide outlines the essential logistics and compliance considerations for Alabama Tube, a manufacturer of steel and aluminum tubing products. Adhering to these guidelines ensures efficient operations, regulatory compliance, and customer satisfaction.

Supply Chain & Procurement

Alabama Tube must establish reliable supply chains for raw materials such as steel coils, aluminum billets, and alloying elements. Key considerations include:

- Vendor Qualification: Source materials only from certified suppliers meeting ASTM, ASME, or other applicable industry standards.

- Material Traceability: Maintain complete documentation (mill test reports, certifications) for all incoming materials to support quality assurance and compliance.

- Inventory Management: Implement just-in-time (JIT) or lean inventory practices to minimize storage costs while ensuring production continuity.

Manufacturing & Quality Control

Compliance with product specifications and industry standards is critical during manufacturing:

- Process Controls: Monitor tube forming, welding, heat treating, and finishing processes per established standard operating procedures (SOPs).

- Quality Inspections: Conduct in-process and final inspections, including dimensional checks, non-destructive testing (NDT), and mechanical testing as required.

- Certifications: Provide certified material test reports (CMTRs) and compliance documentation with each shipment upon request.

Transportation & Distribution

Efficient and compliant logistics are essential for timely delivery and product integrity:

- Packaging Standards: Securely bundle and package tubes to prevent damage during transit; use protective wraps, dunnage, and strapping as needed.

- Carrier Selection: Partner with carriers experienced in handling long or heavy metal products. Ensure carriers comply with DOT regulations and have appropriate equipment (e.g., flatbeds, side kits).

- Routing & Delivery: Optimize shipping routes to minimize transit time and fuel consumption. Provide advance shipping notices (ASNs) to customers.

Regulatory Compliance

Alabama Tube must comply with federal, state, and local regulations:

- Environmental Regulations: Follow EPA and ADEQ guidelines for emissions, wastewater discharge, and hazardous material handling (e.g., coolants, oils).

- OSHA Standards: Maintain a safe workplace with proper training, machine guarding, PPE enforcement, and hazard communication programs.

- DOT & FMCSA: Ensure compliance when transporting goods, including proper load securement and documentation (e.g., bills of lading, hazardous materials if applicable).

- ITAR/EAR Considerations: If producing tubes for defense or aerospace applications, adhere to export control regulations as applicable.

Trade & Customs Compliance

For international shipments:

- HTS Classification: Accurately classify products using Harmonized Tariff Schedule codes.

- Export Documentation: Prepare commercial invoices, packing lists, certificates of origin, and export licenses when required.

- Trade Agreements: Leverage benefits under USMCA or other trade pacts where eligible.

Recordkeeping & Audits

Maintain accurate records to support compliance and operational efficiency:

- Retention Policy: Keep procurement, quality, shipping, safety, and compliance records for a minimum of seven years, or as required by regulation.

- Internal Audits: Conduct regular audits of logistics and compliance processes to identify gaps and drive continuous improvement.

- Third-Party Audits: Prepare for customer or regulatory audits with organized documentation and trained personnel.

Continuous Improvement

Alabama Tube is committed to ongoing enhancement of logistics and compliance practices through:

- Employee training and certification programs

- Adoption of digital tools (e.g., ERP, TMS, track-and-trace systems)

- Participation in industry associations (e.g., PTDA, MDM) for best practice sharing

By following this guide, Alabama Tube ensures reliable delivery, regulatory adherence, and sustained competitiveness in the tubular products market.

In conclusion, sourcing tubing from Alabama offers several strategic advantages for businesses requiring high-quality, reliable metal or plastic tubular products. The state’s robust manufacturing infrastructure, skilled workforce, proximity to key transportation networks, and supportive business environment make it an attractive location for both domestic and international procurement. Reputable suppliers in Alabama often adhere to stringent industry standards, ensuring product consistency, durability, and compliance with specifications. Additionally, sourcing locally within Alabama can reduce lead times, lower shipping costs, and enhance supply chain resilience. However, due diligence is essential—evaluating supplier certifications, production capabilities, and customer service responsiveness will ensure a successful sourcing partnership. Overall, Alabama stands out as a competitive and reliable source for tubing across industries such as aerospace, automotive, oil and gas, and construction.