The global aircraft cable hardware market is experiencing steady growth, driven by rising aircraft production, increasing demand for commercial aviation, and ongoing investments in aerospace infrastructure. According to Mordor Intelligence, the aircraft cable market was valued at USD 1.8 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2029. Similarly, Grand View Research estimates that the broader aerospace fasteners and hardware market—which includes critical components like cable connectors, turnbuckles, and pulleys—is expected to expand at a CAGR of over 6.0% during the same period, fueled by advancements in lightweight materials and the rising need for durable, high-performance parts in modern aircraft systems. With stringent safety regulations and a focus on operational reliability, demand for precision-engineered aircraft cable hardware is more critical than ever. As the industry scales to meet next-generation aerospace requirements, manufacturers specializing in high-quality cable components are playing a pivotal role in ensuring flight safety and mechanical efficiency across commercial, military, and general aviation sectors. Here are the top 9 aircraft cable hardware manufacturers leading innovation and market share in this growing landscape.

Top 9 Aircraft Cable Hardware Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fehr Bros.

Domain Est. 1996

Website: fehr.com

Key Highlights: Fehr Bros. is an Industry-Leading Supplier of Aircraft Cable, Wire Rope, Chain, Garage Door and Industrial Hardware to Thousands of Wholesale Customers….

#2 Gripple Inc

Domain Est. 1996

Website: gripple.com

Key Highlights: We are the original innovators and manufacturers of wire joining and tensioning devices, as well as anchoring, bracing, and suspension systems….

#3 to Loos & Co., Inc.

Domain Est. 1997

Website: loosco.com

Key Highlights: Loos and Company manufactures and stocks aircraft cable to commercial and military specifications in stainless steel, galvanized carbon steel, and a variety of ……

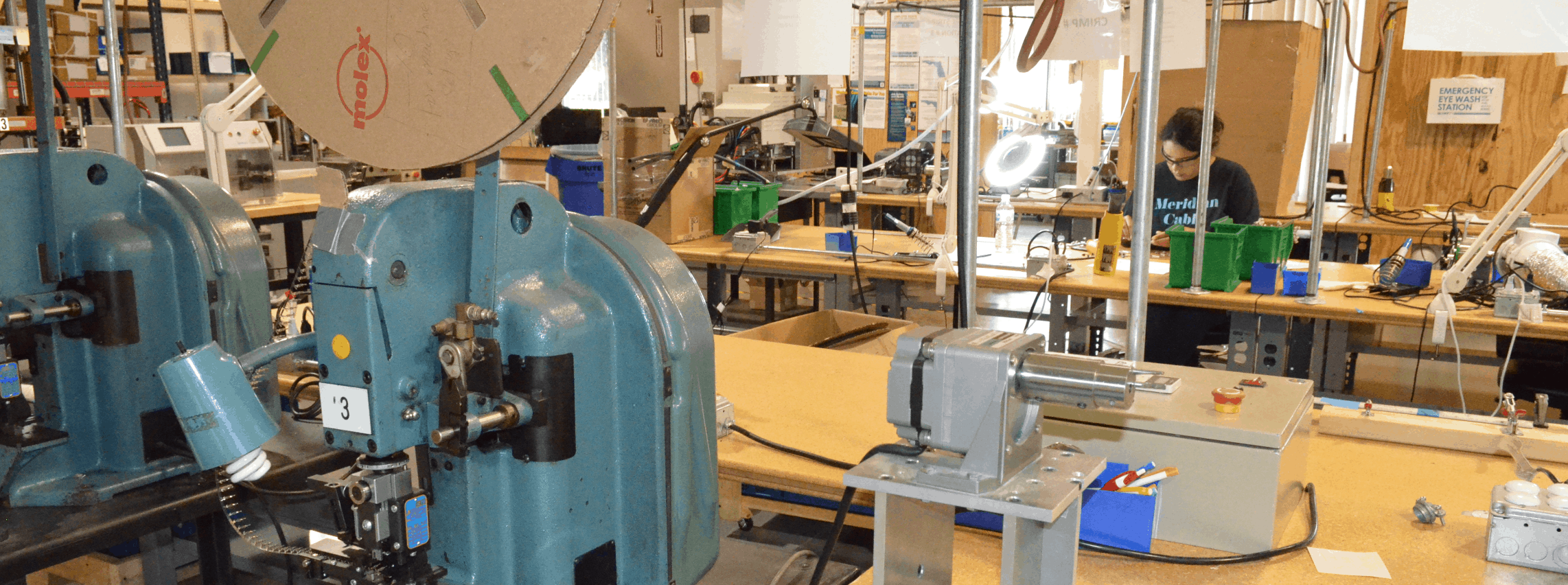

#4 – Aero Assemblies

Domain Est. 1999

Website: aeroassemblies.com

Key Highlights: Aero Assemblies, Inc specializes in providing a range of products and services designed to meet the individual requirements of OEM companies….

#5 Wire Rope, Aircraft & Steel Cable

Domain Est. 2000

Website: tylermadison.com

Key Highlights: We have the ability to create fully customized cable assemblies with standard or custom aircraft cable fittings….

#6 Fortune Rope Wire Cable, Aircraft Cable and Handrail Cables

Domain Est. 2001

Website: fortunerope.com

Key Highlights: Fortune Rope is an industry-recognized supplier of aircraft cable, wire rope, chain, coated cable, and hardware fittings to a wide range of industrial and ……

#7 Lexco Cable

Domain Est. 2002

Website: lexcocable.com

Key Highlights: Lexco Cable is a wire rope and cable manufacturer that provides custom solutions for a variety of industries including aircraft and architecture…

#8 Wire Rope, Fittings & Tools

Domain Est. 1995

#9 Aerospace, Defense & Military Aircraft Cable Connectors & Tools

Domain Est. 1997

Website: nicopress.com

Key Highlights: We manufacture a full line of oval splicing sleeves, connectors, and tools for wire rope rigging and termination, aircraft control, synthetic cable, and ……

Expert Sourcing Insights for Aircraft Cable Hardware

H2: 2026 Market Trends for Aircraft Cable Hardware

The global aircraft cable hardware market is poised for significant transformation by 2026, driven by advancements in aerospace technology, increasing air travel demand, and a growing emphasis on aircraft safety and efficiency. This analysis explores key trends shaping the industry over the coming years.

-

Rising Demand from Commercial Aviation

With the recovery and expansion of global air travel post-pandemic, commercial airlines are placing new aircraft orders and upgrading existing fleets. This surge in aircraft production—especially narrow-body jets from manufacturers like Airbus and Boeing—directly increases demand for high-performance cable hardware, including turnbuckles, cable terminals, push-pull tubes, and conduit fittings. -

Emphasis on Lightweight and High-Strength Materials

Aircraft manufacturers are prioritizing weight reduction to improve fuel efficiency and reduce carbon emissions. As a result, there is a growing shift toward advanced materials such as titanium, high-grade stainless steel alloys (e.g., 300 series and 17-7 PH), and composite-based cable systems. Suppliers of aircraft cable hardware are investing in R&D to develop lighter, corrosion-resistant components without compromising strength or reliability. -

Growth in Regional and Low-Cost Carriers

The proliferation of low-cost carriers, particularly in Asia-Pacific and Latin America, is fueling demand for cost-effective yet reliable aircraft systems. These carriers often operate high-utilization models, necessitating durable cable hardware that requires minimal maintenance. This trend is prompting hardware manufacturers to offer standardized, modular solutions with enhanced durability. -

Expansion of MRO (Maintenance, Repair, and Overhaul) Activities

As the global aircraft fleet ages, MRO services are becoming a critical market segment. Cable hardware, which requires periodic inspection and replacement, benefits from increased maintenance cycles. By 2026, the MRO sector is expected to account for a substantial share of aircraft cable hardware demand, particularly in North America and Europe. -

Integration with Fly-by-Wire and Electromechanical Systems

While traditional mechanical cable systems remain prevalent in smaller aircraft and secondary flight controls, the rise of fly-by-wire technology in modern commercial and military aircraft is altering hardware requirements. However, hybrid systems still rely on robust cable hardware for backup systems and specific control mechanisms, ensuring continued relevance and innovation in this niche. -

Stringent Regulatory and Safety Standards

Regulatory bodies such as the FAA and EASA are enforcing stricter safety and certification protocols for aircraft components. By 2026, compliance with AS9100, MIL-DTL-7213, and other standards will be non-negotiable for hardware suppliers. This trend is driving consolidation among manufacturers and encouraging investments in quality assurance and traceability systems. -

Supply Chain Resilience and Localization

Ongoing geopolitical tensions and supply chain disruptions have prompted aerospace companies to localize production and diversify suppliers. Aircraft cable hardware manufacturers are responding by establishing regional production hubs and strengthening partnerships with domestic aerospace OEMs to ensure timely delivery and reduce dependency on single-source imports. -

Technological Innovation and Smart Components

Emerging trends include the integration of sensors and monitoring systems into cable hardware for real-time performance tracking. While still in early adoption, smart cable terminals and tension-monitoring systems could gain traction by 2026, particularly in military and business aviation, where predictive maintenance is a priority.

Conclusion

By 2026, the aircraft cable hardware market will be shaped by a confluence of technological innovation, regulatory demands, and evolving aerospace needs. While traditional mechanical systems will remain essential, manufacturers must adapt to trends in lightweighting, digital integration, and supply chain agility to maintain competitiveness in a dynamic global market.

Common Pitfalls Sourcing Aircraft Cable Hardware (Quality, IP)

Sourcing aircraft cable hardware—such as turnbuckles, cable fittings, swages, clevises, and end fittings—requires extreme diligence due to the critical safety implications. Mistakes in quality or intellectual property (IP) compliance can lead to catastrophic failures, regulatory violations, and legal liabilities. Below are key pitfalls to avoid:

Poor Quality Control and Non-Compliant Materials

One of the most significant risks is procuring hardware that does not meet aerospace-grade specifications. Substandard materials (e.g., incorrect alloy grades, improper heat treatment) or poor manufacturing processes (e.g., inadequate dimensional tolerances, flawed surface finishes) can compromise structural integrity. Always verify that components conform to recognized standards such as AMS (Aerospace Material Specifications), MIL-SPEC, or NAS (National Aerospace Standards), and demand full traceability via mill test reports and CoCs (Certificates of Conformance).

Lack of Proper Certification and Documentation

Aircraft hardware must be accompanied by rigorous documentation proving compliance with airworthiness requirements. A common pitfall is accepting parts without valid certification, such as FAA Form 8130-3, EASA Form 1, or manufacturer-issued release certificates. Counterfeit or undocumented parts not only violate regulatory standards but also invalidate aircraft certification and insurance.

Intellectual Property (IP) and Trademark Infringement

Sourcing non-OEM (original equipment manufacturer) parts from unauthorized suppliers can lead to IP violations. Many aircraft hardware designs are protected by patents, trademarks, or technical data rights. Using or distributing reverse-engineered or unlicensed copies—even if dimensionally similar—can result in legal action, supply chain disruptions, and reputational damage. Always source from authorized distributors or licensed manufacturers.

Inadequate Traceability and Supply Chain Transparency

Without full traceability from raw material to finished product, it’s impossible to verify authenticity or respond effectively to recalls or audits. A fragmented supply chain involving brokers or uncertified resellers increases the risk of counterfeit or diverted parts entering the system. Insist on suppliers who maintain a transparent, auditable chain of custody.

Overlooking Environmental and Regulatory Compliance

Certain hardware may need to comply with environmental regulations such as REACH (EU) or conflict minerals reporting (e.g., Dodd-Frank Act). Failure to address these requirements, particularly in global supply chains, can lead to customs delays, fines, or exclusion from markets.

Assuming “Equivalent” Performance Without Validation

Some buyers assume that non-certified or industrial-grade hardware can substitute for aerospace parts. Even if a part looks identical, differences in load ratings, fatigue resistance, or corrosion protection can lead to premature failure. Never substitute without formal engineering approval and compliance validation.

Avoiding these pitfalls requires rigorous supplier qualification, third-party audits, and a commitment to sourcing only from reputable, certified sources with full documentation and IP compliance.

Logistics & Compliance Guide for Aircraft Cable Hardware

Overview

Aircraft cable hardware—comprising components such as turnbuckles, cable terminals, swaged fittings, clevises, and pulleys—plays a critical role in flight control systems, rigging, and structural support. Due to its safety-critical function, the logistics and compliance surrounding these components are highly regulated. This guide outlines best practices and regulatory requirements for the handling, storage, transportation, and certification of aircraft cable hardware.

Regulatory Compliance Requirements

FAA and EASA Regulations

All aircraft cable hardware must comply with Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) regulations. Key standards include:

– FAA Part 21: Certification procedures for products and parts.

– FAA Part 43: Maintenance, preventive maintenance, rebuilding, and alteration.

– EASA Part-21G: Production organization approvals (POA).

– Technical Standard Order (TSO): Components must meet applicable TSOs (e.g., TSO-C22 for aircraft control cables).

Material and Manufacturing Standards

Hardware must be manufactured in accordance with:

– MIL-DTL-7884 or AS1575: Specifications for aircraft cable.

– AS8879: Swaged fittings for aircraft control cables.

– AMS (Aerospace Material Specifications): For raw materials (e.g., stainless steel, carbon steel).

Manufacturers must provide Certificates of Conformance (CoC) and Material Test Reports (MTRs) with each shipment.

Traceability and Part Marking

Each component must be permanently marked with:

– Part number

– Lot or serial number

– Manufacturer’s name or CAGE code

– Heat number (for metallic parts)

Full traceability from raw material to final assembly is required under AS9100 and NADCAP standards.

Logistics and Handling Procedures

Packaging and Labeling

- Use anti-corrosive packaging (VCI paper or vapor barrier bags) for metal components.

- Label packages with:

- Part number and revision

- Quantity

- CoC and MTR reference

- Handling symbols (e.g., “Fragile,” “Do Not Drop”)

- Include tamper-evident seals for sealed containers.

Storage Conditions

- Store in a climate-controlled environment (15–25°C, 30–50% RH).

- Use non-porous shelving to prevent contamination.

- Protect from moisture, salts, and direct sunlight.

- Implement a first-in, first-out (FIFO) inventory system.

- Conduct periodic inspections for corrosion, deformation, or packaging damage.

Transportation Requirements

- Use shock-resistant containers with internal cushioning.

- Avoid extreme temperatures during transit (e.g., no unheated cargo holds in winter).

- Air freight shipments must comply with IATA Dangerous Goods Regulations if applicable (e.g., for greased or oiled parts).

- Ensure real-time tracking and chain-of-custody documentation for high-value or mission-critical shipments.

Quality Assurance and Documentation

Inspection and Testing

- Incoming inspections must verify dimensions, surface finish, and markings.

- Perform visual and dimensional checks per AS9102 First Article Inspection (FAI) requirements.

- Non-destructive testing (NDT) such as magnetic particle inspection (MPI) may be required for critical fittings.

Documentation Retention

Maintain records for a minimum of:

– 10 years (FAA/EASA recommended for aviation hardware)

Include:

– CoC and MTRs

– Inspection reports

– Calibration records for measurement tools

– Traceability logs

Export Controls and International Compliance

ITAR and EAR Compliance

- Determine if hardware falls under ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations).

- Many aircraft control system components are listed on the USML (United States Munitions List), requiring export licenses.

- Use proper ECCN (Export Control Classification Number) or USML category in shipping documentation.

Customs and Import Regulations

- Provide accurate HS codes (e.g., 7318.19 for threaded fasteners, 8803.30 for aircraft parts).

- Include airworthiness statements and conformity declarations for customs clearance.

- Comply with REACH, RoHS, and other environmental regulations in the EU and other regions.

Best Practices Summary

- Partner only with FAA/EASA-approved suppliers and distributors.

- Conduct regular audits of logistics partners for compliance with AS6478 (Aerospace Logistics Management).

- Train staff on handling, inspection, and documentation procedures.

- Use digital tracking systems (e.g., ERP with lot traceability) to manage inventory and compliance.

- Stay updated on regulatory changes through industry associations (e.g., AIA, GAMA).

Proper logistics and compliance for aircraft cable hardware ensure airworthiness, regulatory approval, and operational safety. Adherence to this guide minimizes risk and supports efficient supply chain performance in the aviation sector.

Conclusion: Sourcing Aircraft Cable Hardware

Sourcing aircraft cable hardware requires a meticulous approach due to its critical role in the safety, reliability, and performance of aerospace systems. Given the high-stakes environment of aviation, it is imperative to procure hardware that meets stringent industry standards such as AS9100, MIL-SPEC, and FAA regulations. Key considerations include material quality (typically stainless steel or corrosion-resistant alloys), precision engineering, traceability, and certification from reputable suppliers.

Establishing relationships with trusted, certified suppliers—preferably those with a proven track record in the aerospace industry—ensures compliance and reduces risks associated with component failure. Additionally, factors like lead times, cost-effectiveness, and supply chain resilience must be balanced without compromising on quality.

In conclusion, successful sourcing of aircraft cable hardware hinges on a combination of regulatory adherence, supplier credibility, material integrity, and proactive supply chain management. Investing time and resources into due diligence during the procurement process ultimately supports flight safety, operational efficiency, and long-term maintenance of aircraft systems.