The global air conditioning market is experiencing robust growth, driven by rising urbanization, increasing construction activities, and escalating demand for comfort cooling—particularly in emerging economies. According to Mordor Intelligence, the global aircon copper pipe market is projected to grow at a CAGR of over 5.8% between 2023 and 2028, fueled by the expanding HVAC industry and the superior thermal conductivity and durability of copper in refrigerant lines. With air conditioner installations surging across residential, commercial, and industrial sectors, the demand for high-quality copper piping—critical for efficient system performance and leak prevention—has intensified. This growth trend is further supported by Grand View Research, which highlights that the global HVAC market size was valued at USD 153.3 billion in 2022 and is expected to expand at a CAGR of 6.3% through 2030. As manufacturers strive to meet evolving efficiency standards and environmental regulations, selecting reliable copper pipe suppliers has become a strategic priority. Based on production capacity, global reach, product innovation, and market presence, here are the top 9 aircon copper pipe manufacturers shaping the future of HVAC infrastructure.

Top 9 Aircon Copper Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mueller Industries

Domain Est. 1996

Website: muellerindustries.com

Key Highlights: Mueller Industries, Inc. is an industrial manufacturer that specializes in copper and copper alloy manufacturing while also producing goods made from aluminum, ……

#2 China Copper Pipe Ac Unit Manufacturer, Factory

Domain Est. 2012

Website: scottfrio.com

Key Highlights: Looking for a reliable supplier of China Copper Pipe AC Unit? Contact Scottfrio Technologies Co., Ltd. for top-quality products and superior service….

#3 Cerro Flow Products

Domain Est. 1996

Website: cerro.com

Key Highlights: Welcome to Cerro Flow Products LLC®. We manufacture world-class copper tube and supply fittings for the Plumbing, HVAC/Refrigeration, and Industrial markets….

#4 Copper tubes for heating, air

Domain Est. 1997

Website: silmet.com

Key Highlights: Silmet is the world leader in the production of copper tubes for water, heating, air-conditioning and sanitary applications and industrial use in Level Wound ……

#5 Copper Tube

Domain Est. 2001

Website: en.hongtai-copper.com

Key Highlights: Hongtai is top 5 China copper tube manufacturer of Air Conditioning Copper tube, Straight Pipe, Copper tube Coil, Water & Medical Gas Pipe, Inner Grooved ……

#6 Mehta Tubes Limited

Domain Est. 2002

Website: mehtatubes.com

Key Highlights: Mehta Tubes Limited is a leading manufacturer of superior copper and copper alloy tube, copper bar, copper pipe, copper rod and copper strip….

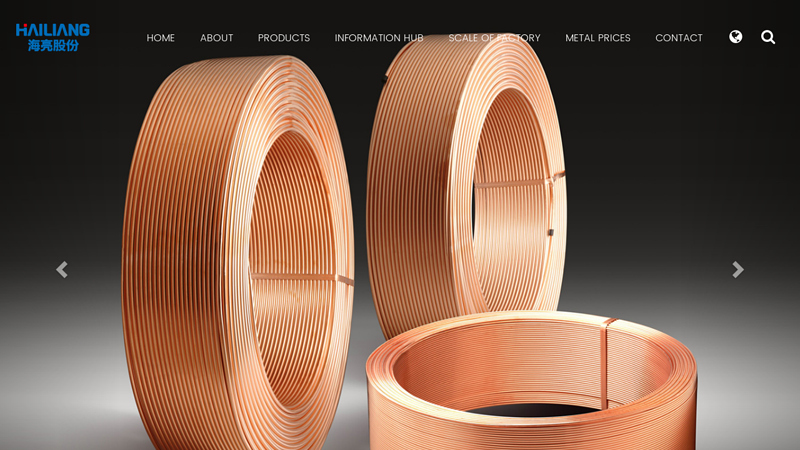

#7 China Hailiang Group – Copper Pipe & Tube

Domain Est. 2008

Website: hailiang.us

Key Highlights: China Hailiang is one of the world’s largest manufacturer & supplier for copper and copper alloy products including tubing.rods fittings etc,inculuding ……

#8 Totaline Copper Tubes

Domain Est. 1995

Website: carrier.com

Key Highlights: Premium quality copper pipes from Totaline, a brand of Carrier Airconditioning and Refrigeration Ltd. Suitable for use with R-410A,R32 Refrigerants with high ……

#9 Streamline Your System

Domain Est. 2013

Website: muellerstreamline.com

Key Highlights: From tubing and fittings to line sets, valves, and more, trust your piping systems to the proven performance and reliability of the industry leader….

Expert Sourcing Insights for Aircon Copper Pipe

H2: 2026 Market Trends for Aircon Copper Pipe

The global air conditioning (aircon) copper pipe market is poised for significant transformation by 2026, driven by evolving technological advancements, regulatory standards, regional demand shifts, and material alternatives. As a critical component in HVAC (heating, ventilation, and air conditioning) systems—used primarily for refrigerant transfer—copper pipes remain essential despite increasing competition from alternative materials. Below is an analysis of key market trends expected to shape the aircon copper pipe industry in 2026.

1. Rising Global Demand for HVAC Systems

Urbanization, rising disposable incomes, and increasing temperatures due to climate change are accelerating demand for air conditioning, especially across emerging economies in Asia-Pacific (India, Southeast Asia), the Middle East, and Africa. This growth directly fuels demand for copper piping, as new installations and replacements in residential, commercial, and industrial sectors rely heavily on copper due to its thermal conductivity, durability, and compatibility with refrigerants.

2. Regulatory Push for Energy Efficiency and Environmental Standards

By 2026, global regulations under the Kigali Amendment to the Montreal Protocol will continue phasing down high-global warming potential (GWP) refrigerants. This shift is promoting the adoption of next-generation HVAC systems that require tighter, more reliable piping—favoring copper for its leak resistance and compatibility with new refrigerants like R-32. Energy efficiency mandates are also reinforcing the use of high-performance copper tubing in systems designed to meet stringent efficiency standards.

3. Material Competition and Cost Pressures

Copper prices remain volatile due to supply chain constraints and increased demand from other sectors (e.g., EVs, renewable energy). This volatility has spurred interest in alternative materials such as aluminum and PEX (cross-linked polyethylene) pipes, particularly in cost-sensitive markets. However, copper maintains a competitive edge in high-reliability applications due to its superior performance under pressure, temperature fluctuations, and long-term durability. By 2026, hybrid solutions or coated copper pipes may emerge to mitigate cost and corrosion issues.

4. Regional Market Dynamics

– Asia-Pacific: Expected to dominate global demand, driven by massive construction activities and government-led cooling initiatives (e.g., India’s Cooling Action Plan). China and Japan remain major producers and consumers of copper pipes.

– North America and Europe: Growth will be moderate but steady, supported by HVAC system retrofits and green building codes. Emphasis on sustainability may boost recycled copper usage.

– Middle East and Africa: Rapid urban development and extreme climates will sustain strong demand for efficient cooling systems, increasing copper pipe consumption.

5. Technological Innovations and Smart HVAC Integration

The rise of smart HVAC systems and IoT-enabled building management technologies requires reliable and precise refrigerant flow—copper pipes remain the preferred choice for ensuring system integrity. Innovations such as pre-insulated copper tubing, antimicrobial coatings, and leak-detection-integrated piping may gain traction by 2026, enhancing system safety and efficiency.

6. Sustainability and Recycling Trends

With growing emphasis on circular economy principles, the reuse and recycling of copper will become more prominent. Copper’s 100% recyclability without loss of quality positions it favorably against synthetic alternatives. By 2026, manufacturers may increasingly adopt closed-loop recycling practices and eco-labeling to meet corporate sustainability goals.

Conclusion

While facing challenges from material substitution and price volatility, the aircon copper pipe market is expected to maintain robust growth through 2026. Its irreplaceable performance characteristics, combined with tightening environmental regulations and expanding cooling needs, will sustain demand. Strategic investments in innovation, recycling, and regional market expansion will be key for stakeholders to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Aircon Copper Pipe (Quality and Intellectual Property)

Logistics & Compliance Guide for Aircon Copper Pipe

Aircon copper pipe is a critical component in HVAC systems, requiring careful handling during logistics and strict adherence to regulatory standards. This guide outlines key considerations for safe, efficient transportation and compliance with international and local regulations.

Product Characteristics and Handling Requirements

Copper pipes used in air conditioning systems are typically soft (annealed) or hard-drawn, available in coils or straight lengths. They are susceptible to damage from moisture, contamination, and physical impact. Proper packaging—usually in sealed plastic with desiccants and protective end caps—is essential to prevent oxidation and debris ingress. Coils must be stored upright and secured to avoid deformation during transit.

Packaging and Labeling Standards

Ensure all copper pipe shipments comply with international packaging standards such as ISO 6780 for pallet dimensions and ISTA 3A for transit durability. Each package must be clearly labeled with:

– Product specifications (diameter, wall thickness, temper)

– ASTM B280 or EN 12735-1 compliance marking

– Batch/lot number and manufacturer information

– Handling symbols (e.g., “Fragile,” “This Way Up”)

– Country of origin

Transportation Modes and Considerations

Aircon copper pipes are commonly transported via sea, road, or rail. For sea freight, use moisture-resistant containers and silica gel desiccants to prevent condensation. Road transport requires secure strapping and protection from weather. Avoid mixed loads with corrosive or abrasive materials. Temperature-controlled environments are not required, but prolonged exposure to high humidity should be minimized.

Import/Export Regulations and Documentation

Compliance with customs and trade regulations is mandatory. Required documentation includes:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Material Test Certificate (MTC) confirming compliance with ASTM B280 or equivalent

– REACH and RoHS declarations (for shipments to the EU)

Verify export controls—copper products may be subject to reporting requirements in some jurisdictions (e.g., U.S. Census AES filings for exports over $2,500).

Environmental and Safety Compliance

Copper itself is not classified as hazardous, but logistics operations must comply with environmental regulations. Prevent oil or chemical contamination during handling. Workers should use appropriate PPE (gloves, safety shoes) to avoid injury from sharp pipe edges. Follow local OSHA or equivalent workplace safety standards.

Quality Assurance and Inspection Protocols

Implement pre-shipment inspections to verify:

– Dimensional accuracy

– Surface integrity (no dents, scratches, or corrosion)

– Packaging integrity

– Correct labeling

Use third-party inspection services if required by the buyer or regulatory body, especially for large commercial shipments.

Storage and Inventory Management

Upon arrival, store copper pipes in a dry, indoor environment away from direct ground contact. Use racks to prevent bending and maintain separation from dissimilar metals to avoid galvanic corrosion. Rotate stock using FIFO (First In, First Out) to minimize aging and oxidation risk.

Regulatory Compliance by Region

- United States: Comply with ASTM B280 standards; EPA regulations for material handling; CBP import requirements.

- European Union: Adhere to EN 12735-1; REACH and RoHS compliance; CE marking may be required depending on application.

- ASEAN and Middle East: Follow local building and HVAC codes; SIRIM, SASO, or ESMA certifications may be needed.

- Australia/New Zealand: Comply with AS/NZS 1571; obtain necessary import permits from the Department of Agriculture.

Ensure all suppliers provide traceable, certified materials to meet regional certification demands.

Conclusion

Effective logistics and compliance for aircon copper pipe require attention to material protection, accurate documentation, and adherence to international standards. By following this guide, stakeholders can ensure product integrity, regulatory compliance, and smooth cross-border operations. Regular audits and supplier evaluations are recommended to maintain consistent quality and compliance.

Conclusion for Sourcing Aircon Copper Pipe

Sourcing high-quality copper pipes for air conditioning systems is a critical factor in ensuring the efficiency, durability, and reliability of HVAC installations. After evaluating various suppliers, material standards, and pricing models, it is evident that choosing copper pipes that meet international standards—such as ASTM B280 or ISO 18861—is essential for optimal thermal conductivity, corrosion resistance, and leak-free performance.

Reliable suppliers should offer consistent material quality, proper certification, and technical support, while also providing cost-effective solutions without compromising on safety or performance. Local availability, lead times, and after-sales service further influence sourcing decisions, especially for large-scale or urgent projects.

In conclusion, a strategic sourcing approach—balancing quality, cost, and supplier reliability—will not only enhance system performance but also reduce long-term maintenance and operational costs. Investing in premium-grade copper pipes from reputable suppliers ultimately supports energy-efficient, sustainable, and long-lasting air conditioning systems.