The global air purifier market is experiencing robust growth, driven by rising awareness of air pollution and increasing demand for healthier indoor environments. According to a report by Mordor Intelligence, the market was valued at USD 7.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of approximately 8.5% from 2024 to 2029. Similarly, Grand View Research estimates that the market will expand at a CAGR of 8.3% from 2023 to 2030, reaching a value of USD 13.4 billion by the end of the forecast period. This surge is fueled by factors such as urbanization, increasing respiratory health concerns, and stringent government regulations on air quality. As consumer demand escalates, innovation and competition among manufacturers are intensifying. In this evolving landscape, the following ten companies stand out as leading air purifier manufacturers, combining technological advancement, market reach, and strong performance metrics.

Top 10 Air Purifier Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AAF International

Domain Est. 1997

Website: aafintl.com

Key Highlights: We design advanced air filtration systems and technology to give you more control over the air inside commercial, industrial, and residential living spaces….

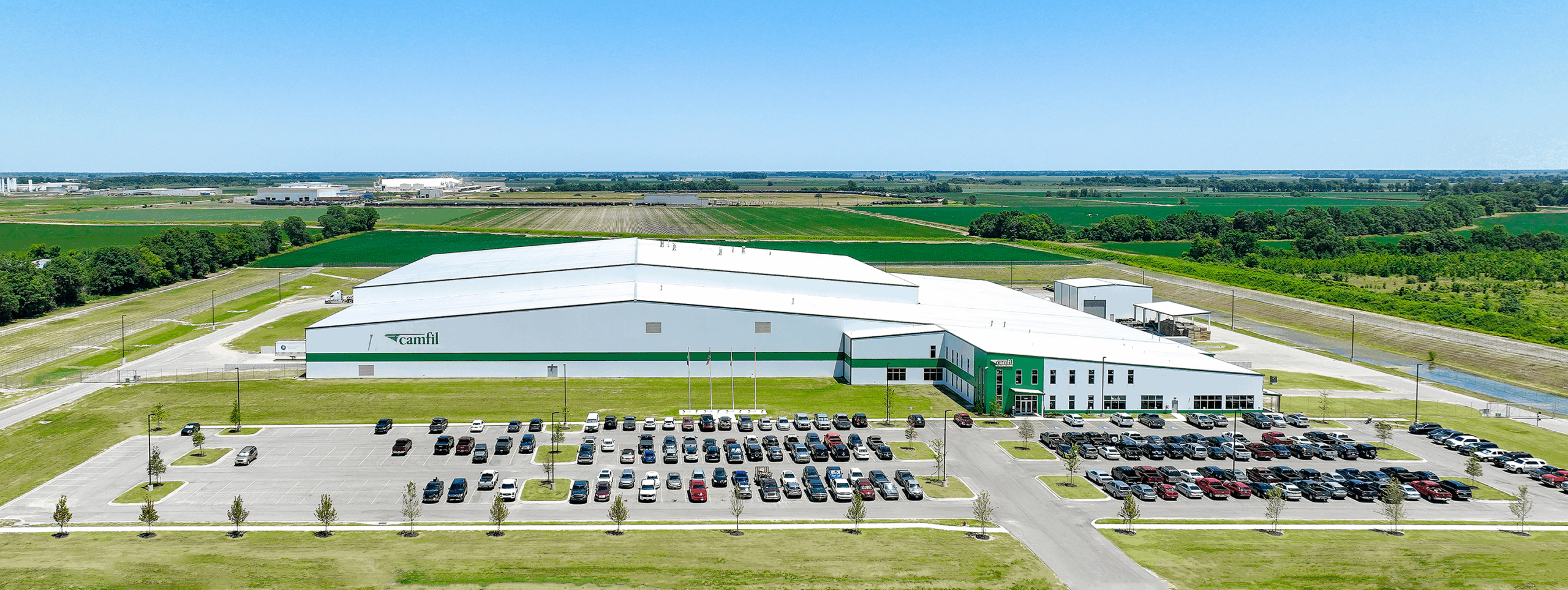

#2 Camfil: Air filters & air filtration solutions

Domain Est. 1998

Website: camfil.com

Key Highlights: As a leading manufacturer of premium clean air solutions, we provide commercial and industrial systems for air filtration and air pollution control that improve ……

#3 APC Filters

Domain Est. 2002

Website: apcfilters.com

Key Highlights: APC Filtration provides over 40 years experience as a manufacturer in filter design, engineering, and filter testing for global OEM’s….

#4 AllerAir

Domain Est. 1998

Website: allerair.com

Key Highlights: Manufacturer of Home & Office air purifiers and air cleaners. Quality activated carbon filters and HEPA filters available. Improve indoor air quality with ……

#5 General Filters

Domain Est. 1999

Website: generalfilters.com

Key Highlights: General Filters is proud to offer a variety of humidifiers, dehumidifiers, air cleaners, UV air purifiers that keep indoor air clean, fresh, and healthy….

#6 Pyure Dynamic Protection

Domain Est. 2005

Website: pyure.com

Key Highlights: Pyure is proven to reduce odor and pathogens in a challenging, high-touch, real environment · Purifying Air for Diverse Markets · Proven Air Purifying Technology….

#7 Airpura Industries

Domain Est. 2004

#8 Oransi Air Purifiers

Domain Est. 2009

#9 Colorado Air Filter LLC

Domain Est. 2022

Website: coloradoairfilter.com

Key Highlights: Colorado Air Filter is a leading HVAC air filtration supply company serving Colorado, Wyoming, and New Mexico. For more than 25 years, we have specialized in ……

#10 Commercial Indoor Air Quality Solutions

Domain Est. 2023

Website: airboxamerica.com

Key Highlights: AirBox provides compliant commercial indoor air quality solutions, ensuring trusted, clean air and energy savings for commercial spaces….

Expert Sourcing Insights for Air Purifier

H2: Projected Market Trends for Air Purifiers in 2026

The global air purifier market is poised for significant transformation by 2026, driven by increasing awareness of air quality, technological innovation, and evolving consumer behavior. Key trends shaping the industry include heightened demand in urban and emerging markets, integration of smart technology, regulatory influences, and a growing emphasis on health and wellness.

-

Rising Health Consciousness and Urbanization

Continued urbanization and rising pollution levels—especially in developing regions like Asia-Pacific and parts of Africa—are expected to fuel demand for residential and commercial air purifiers. As respiratory health becomes a top priority post-pandemic, consumers are more proactive in safeguarding indoor air quality. This trend is particularly strong among households with children, elderly individuals, or people suffering from allergies and asthma. -

Smart and IoT-Enabled Air Purifiers

By 2026, smart air purifiers equipped with IoT (Internet of Things) capabilities are projected to dominate the market. These devices offer real-time air quality monitoring, remote control via mobile apps, voice assistant integration (e.g., Alexa, Google Assistant), and automatic adjustment of purification modes. Manufacturers are increasingly focusing on connectivity and user experience, enabling predictive maintenance and personalized air quality reports. -

Focus on Energy Efficiency and Sustainability

Environmental concerns are pushing manufacturers to develop energy-efficient models and sustainable products. In 2026, air purifiers with ENERGY STAR certification or low power consumption will gain consumer preference. Additionally, brands are adopting eco-friendly packaging, recyclable filters, and longer filter life to reduce waste and appeal to environmentally conscious buyers. -

Advancements in Filtration Technologies

HEPA (High-Efficiency Particulate Air) filters remain the gold standard, but innovations such as activated carbon filters, UV-C light sterilization, and photocatalytic oxidation (PCO) are gaining traction. By 2026, hybrid systems combining multiple purification technologies will be more common, offering enhanced removal of viruses, bacteria, VOCs (volatile organic compounds), and ultrafine particles. -

Expansion in Commercial and Industrial Applications

Beyond homes, air purifiers are increasingly being adopted in offices, schools, healthcare facilities, and hospitality sectors. The demand for centralized or large-scale purification systems is rising, especially in regions with high pollution or stringent indoor air quality regulations. The post-pandemic emphasis on creating safer indoor environments will sustain this growth. -

Regional Market Growth

Asia-Pacific is expected to lead the global air purifier market in 2026, driven by severe air pollution in countries like China and India, rising disposable incomes, and government initiatives promoting clean air. North America and Europe will see steady growth due to strict air quality standards and high consumer awareness, while Latin America and the Middle East present emerging opportunities. -

Competitive Landscape and Brand Differentiation

With increasing competition, brands are differentiating through design, noise reduction, filter replacement ease, and app-based analytics. Premiumization is a growing trend, with consumers willing to pay more for high-performance, aesthetically pleasing models. Private-label and direct-to-consumer (DTC) brands are also gaining share by leveraging e-commerce platforms. -

Regulatory and Policy Support

Governments and international bodies are expected to implement stricter indoor air quality standards by 2026. Policies promoting healthier buildings and public spaces may mandate air purification systems in schools, hospitals, and public transport, creating new market avenues.

Conclusion

By 2026, the air purifier market will be characterized by technological sophistication, health-driven demand, and sustainability-focused innovation. Companies that prioritize smart features, energy efficiency, and consumer education are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Air Purifiers (Quality & IP)

Sourcing air purifiers involves navigating complex supply chains and technical specifications. Overlooking key aspects related to quality and intellectual property (IP) can lead to product failures, legal disputes, and reputational damage. Here are the most common pitfalls to avoid:

Quality-Related Pitfalls

1. Overreliance on Manufacturer Claims Without Independent Verification

Suppliers often exaggerate performance metrics such as CADR (Clean Air Delivery Rate), filter efficiency (e.g., claiming “HEPA-like” instead of true HEPA), or noise levels. Relying solely on datasheets without third-party testing or lab reports can result in underperforming products. Always demand certified test results from reputable labs (e.g., Intertek, UL, AHAM).

2. Substandard or Inauthentic Filter Materials

A major quality risk is receiving filters made with inferior media that don’t meet HEPA (H13/H14) or activated carbon standards. Some suppliers substitute lower-grade materials to cut costs. Ensure material certifications (e.g., EN 1822 for HEPA) and conduct random batch testing.

3. Poor Build Quality and Component Sourcing

Low-cost manufacturers may use cheap plastics, weak welds, or underpowered fans, leading to high failure rates and safety hazards (e.g., overheating). Assess the durability of housings, motor quality, and internal wiring. Visit factories or use third-party inspections (e.g., QIMA, SGS) during production.

4. Inadequate or Missing Safety Certifications

Air purifiers are electrical devices and must comply with regional safety standards (e.g., UL 867/2998 in the US, CE in Europe, CCC in China). Sourcing units without proper certifications risks product recalls, customs rejection, or liability in case of fire or electric shock.

5. Inconsistent Performance Across Units

Mass production inconsistencies—especially in fan calibration or filter fitment—can result in variable air purification performance. Implement strict incoming quality control (IQC) and in-process inspections to catch deviations early.

IP-Related Pitfalls

1. Unintentional Infringement of Patented Technologies

Many air purifier components—such as ionization systems, sensor algorithms, fan designs, or smart connectivity features—are protected by patents. Sourcing generic versions of patented tech (e.g., Dyson’s bladeless fan or Blueair’s HEPASilent) without proper licensing exposes your company to lawsuits and import bans.

2. Copying Branded Designs Leading to Design Patent or Trademark Issues

Replicating the aesthetic design or user interface of popular models (e.g., cowling shape, button layout, app interface) can violate design patents or trademark rights. Even color schemes and logos must be original to avoid brand confusion and legal action.

3. Use of Proprietary Firmware or Software Without Permission

Many OEMs embed proprietary firmware (e.g., air quality algorithms, IoT connectivity) in their units. Copying or modifying this software without authorization may breach copyright or software licensing agreements. Ensure firmware is either open-source, licensed, or custom-developed.

4. Supplier Misrepresentation of IP Ownership

Some suppliers claim they own the design or technology they offer, but in reality, they may be reselling or copying designs from others. Conduct due diligence: request proof of IP ownership, design documents, and patent filings. Use IP search tools (e.g., USPTO, WIPO) to verify claims.

5. Lack of IP Clauses in Sourcing Agreements

Failing to include clear IP ownership and indemnification clauses in contracts with suppliers leaves you vulnerable. Always specify that any custom designs or modifications are your exclusive property and require the supplier to indemnify you against third-party IP claims.

By proactively addressing these quality and IP pitfalls—through rigorous vetting, testing, legal review, and contractual safeguards—you can mitigate risks and ensure a reliable, compliant, and defensible air purifier sourcing strategy.

Logistics & Compliance Guide for Air Purifier

Product Classification and HS Code

Air purifiers are typically classified under the Harmonized System (HS) Code 8508.11 or 8508.19, depending on design and function. These codes generally cover “Electro-mechanical appliances with a self-contained electric motor.” Accurate classification is essential for customs clearance, duty calculation, and import/export compliance. Verify the specific HS code with local customs authorities or a licensed customs broker to ensure alignment with regional tariff schedules.

Regulatory Compliance and Safety Standards

Air purifiers must comply with regional safety and electromagnetic compatibility (EMC) standards. In the United States, products must meet UL 867 or UL 507 standards and be FCC-certified for electromagnetic interference. In the European Union, CE marking is mandatory, requiring compliance with the Low Voltage Directive (LVD), EMC Directive, and RoHS (Restriction of Hazardous Substances). Additional certifications such as Energy Star (for energy efficiency) or CARB (California Air Resources Board) may be required, especially for ozone-emitting models.

Packaging and Shipping Requirements

Use robust, anti-static packaging to protect sensitive electronic components during transit. Include clear labeling with product name, model number, voltage rating, and compliance marks (e.g., CE, FCC, UL). Ensure packaging materials comply with environmental regulations such as REACH (in the EU) and avoid restricted substances. For international shipments, include multilingual user manuals and safety warnings. Use temperature-controlled logistics if shipping through extreme climates to prevent damage to filters or electronics.

Import/Export Documentation

Prepare complete documentation for smooth customs processing. Required documents typically include a commercial invoice, packing list, bill of lading or air waybill, and certificate of origin. For regulated markets, include product compliance certificates (e.g., FCC Declaration of Conformity, CE Declaration, RoHS compliance statement). Some countries may require additional permits or pre-shipment inspections. Ensure all documents accurately reflect product specifications and declared value to avoid delays or penalties.

Battery and Filter Compliance (If Applicable)

If the air purifier includes lithium-ion batteries (e.g., for portable models), comply with IATA Dangerous Goods Regulations for air transport. Batteries must be properly installed, protected from short circuits, and labeled accordingly. For units with HEPA or activated carbon filters, ensure materials meet environmental and safety standards. Replaceable filters may be subject to additional labeling or recycling requirements under WEEE (Waste Electrical and Electronic Equipment) directives in the EU.

After-Sales and Warranty Logistics

Establish a service and spare parts distribution network to support warranty claims and repairs. Maintain an inventory of common replacement components (filters, power adapters) in key markets. Provide clear instructions for consumers on product registration, warranty activation, and return procedures. Coordinate with third-party logistics (3PL) providers if offering reverse logistics for defective units or end-of-life recycling.

Environmental and Disposal Regulations

Design air purifiers for recyclability and comply with regional take-back laws. In the EU, adhere to WEEE regulations requiring producers to finance the collection and recycling of electronic waste. In other regions, follow local e-waste guidelines. Communicate proper disposal methods to consumers through user manuals and product labeling. Avoid using materials restricted under global initiatives like RoHS or China RoHS.

Conclusion: Sourcing Air Purifier Supplier

In conclusion, selecting the right air purifier supplier is a critical decision that directly impacts product quality, cost-efficiency, and customer satisfaction. After a thorough evaluation of potential suppliers based on criteria such as manufacturing capabilities, product certifications, compliance with international standards, pricing, lead times, and after-sales support, it is evident that a balanced approach—considering both cost and quality—is essential.

The chosen supplier demonstrates strong production capacity, consistent adherence to air quality and safety standards (e.g., HEPA, CARB, CE, RoHS), and a proven track record in delivering reliable air purification solutions. Additionally, their willingness to customize products, provide transparent communication, and offer scalable order fulfillment aligns well with our business objectives and market demands.

Moving forward, establishing a long-term partnership with this supplier will not only ensure a stable supply chain but also support brand credibility and customer trust. Continuous performance monitoring, regular quality audits, and open collaboration will be key to maintaining high standards and adapting to evolving market needs. Ultimately, this strategic sourcing decision positions us to deliver high-performance air purifiers that meet consumer expectations for health, safety, and value.