The global air purification filters market is experiencing robust growth, driven by rising concerns over air pollution, increasing urbanization, and heightened awareness of indoor air quality, particularly in the wake of recent public health crises. According to Grand View Research, the global air purifier market size was valued at USD 9.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. Similarly, Mordor Intelligence estimates a CAGR of over 9.5% during the forecast period of 2024–2029, citing strong demand from residential, commercial, and healthcare sectors. With air quality deteriorating in major urban centers and regulatory bodies tightening emissions standards, the demand for high-efficiency filtration systems—including HEPA, activated carbon, and electrostatic filters—is surging. This growth has spurred intense innovation and competition among manufacturers aiming to capture market share through advanced technologies, energy efficiency, and smart integration. As the industry expands, a select group of leading manufacturers are emerging as key players in shaping the future of clean air solutions.

Top 10 Air Purification Filters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engine and Industrial Air, Oil and Liquid Filtration

Domain Est. 1995

Website: donaldson.com

Key Highlights: Manufacturers worldwide use Donaldson filters for dust, fume, mist, hydraulic, air/oil separation, compressed air and gas, process, and every other filtration ……

#2 AAF International

Domain Est. 1997

Website: aafintl.com

Key Highlights: We design advanced air filtration systems and technology to give you more control over the air inside commercial, industrial, and residential living spaces….

#3 Camfil USA: High

Domain Est. 1998

Website: camfil.com

Key Highlights: As a leading manufacturer of premium clean air solutions, we provide commercial and industrial systems for air filtration and air pollution control that improve ……

#4 APC Filters

Domain Est. 2002

Website: apcfilters.com

Key Highlights: APC Filtration provides over 40 years experience as a manufacturer in filter design, engineering, and filter testing for global OEM’s….

#5 General Filters

Domain Est. 1999

Website: generalfilters.com

Key Highlights: General Filters is proud to offer a variety of humidifiers, dehumidifiers, air cleaners, UV air purifiers that keep indoor air clean, fresh, and healthy….

#6 Industrial Air Filtration & Dust Collection Systems

Domain Est. 2004

Website: airpurificationinc.com

Key Highlights: Air Purification is your single source supplier for industrial air filtration products and services, including dust or mist collection and fume extraction….

#7 Freudenberg Filtration Technologies

Domain Est. 2007

Website: freudenberg-filter.com

Key Highlights: Discover your world of filtration solutions. Freudenberg Filtration Technologies provides a wide range of air, gas and liquid solutions….

#8 MANN+HUMMEL for a cleaner planet

Domain Est. 1998

Website: mann-hummel.com

Key Highlights: Rating 4.4 (100) As a global leader and expert in the field of filtration MANN+HUMMEL develops innovative solutions for the health and mobility of people….

#9 Airpura Industries

Domain Est. 2004

Website: airpura.com

Key Highlights: 7–11 day delivery 30-day returnsUp to 26 lbs of large capacity activated carbon blends.Designed for maximum absorption.The only way to safely remove chemicals ,odors and harmful ga…

#10 Oransi Air Purifiers

Domain Est. 2009

Website: oransi.com

Key Highlights: Free delivery · 30-day returnsThe new Oransi AirMend air purifier is a compact system that packs a punch in air purification. Build quality is excellent with strong durable plasti…

Expert Sourcing Insights for Air Purification Filters

H2: Market Trends in Air Purification Filters for 2026

The global air purification filter market is poised for significant transformation by 2026, driven by increasing health awareness, tightening air quality regulations, and technological advancements. Several key trends are shaping the industry landscape:

-

Rising Demand Due to Air Quality Concerns

Urbanization and industrial emissions continue to deteriorate air quality in major global regions, particularly in Asia-Pacific and parts of Latin America. This has led to heightened consumer demand for residential and commercial air purification systems, directly boosting sales of high-efficiency particulate air (HEPA) filters, activated carbon filters, and hybrid filtration solutions. -

Integration of Smart Technology

By 2026, smart air purifiers equipped with IoT connectivity, real-time air quality sensors, and app-based controls are expected to dominate the market. Filters within these systems are being designed for longer lifespan and compatibility with predictive maintenance algorithms, enhancing user experience and reducing replacement frequency. -

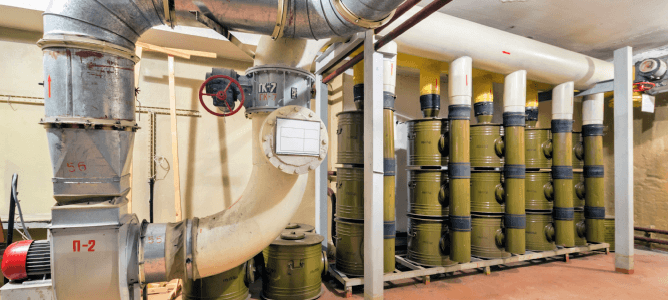

Growth in Healthcare and Industrial Applications

The healthcare sector continues to adopt advanced filtration systems post-pandemic, especially in hospitals, clinics, and laboratories. Similarly, industries such as pharmaceuticals, food processing, and electronics manufacturing are investing in cleanroom technologies, increasing demand for ULPA (Ultra-Low Particulate Air) and specialty filters. -

Sustainability and Eco-Friendly Materials

Environmental regulations and consumer preferences are pushing manufacturers toward sustainable filter designs. Biodegradable filter media, recyclable housings, and energy-efficient systems are gaining traction. Companies are also focusing on reducing plastic content and improving end-of-life disposal processes. -

Emergence of Antiviral and Antimicrobial Filters

With ongoing concerns about airborne pathogens, including viruses and bacteria, there is growing demand for filters with antimicrobial coatings, UV-C integration, and photocatalytic oxidation (PCO) capabilities. These advanced filters are increasingly common in both consumer and institutional settings. -

Regional Market Expansion

While North America and Europe remain key markets due to stringent air quality standards, the Asia-Pacific region is expected to witness the highest growth rate, led by countries like China, India, and South Korea. Government initiatives to combat pollution and rising middle-class disposable income are key drivers. -

Supply Chain Localization and Resilience

In response to pandemic-related disruptions, manufacturers are localizing filter production and diversifying raw material sources. This trend is expected to continue, improving supply chain resilience and reducing dependency on single-source suppliers.

In summary, by 2026, the air purification filter market will be characterized by innovation, sustainability, and expanding application scope, positioning it as a critical component in global health and environmental strategies.

Common Pitfalls Sourcing Air Purification Filters (Quality, IP)

Sourcing air purification filters involves navigating complex quality standards and intellectual property (IP) risks. Overlooking these aspects can lead to product failures, legal disputes, and reputational damage. Below are the most common pitfalls in these two critical areas:

Quality-Related Pitfalls

-

Inadequate Filtration Efficiency Verification

Many suppliers claim high efficiency (e.g., HEPA H13) without providing certified test reports from accredited laboratories. Relying solely on supplier claims without third-party validation (e.g., IEST or EN 1822 standards) can result in underperforming filters that fail to meet required air quality standards. -

Poor Material and Construction Quality

Substandard media, weak seals, or inconsistent pleat spacing can compromise filter integrity. Filters may collapse under airflow, leak unfiltered air, or have a significantly reduced lifespan. Insufficient durability testing (e.g., for humidity or prolonged use) exacerbates these issues. -

Inconsistent Batch-to-Batch Performance

Sourcing from manufacturers without robust quality control systems leads to variability in filter performance. Without incoming inspection protocols or batch traceability, end products may perform inconsistently, affecting customer satisfaction and regulatory compliance. -

Mismatched Specifications for Application

Using filters not designed for specific environments (e.g., high humidity, industrial contaminants) leads to premature failure. For example, standard HEPA filters may not resist microbial growth in medical or food processing settings without antimicrobial treatment. -

Lack of Long-Term Performance Data

Short-term testing may not reveal issues like media shedding, pressure drop increases, or efficiency degradation over time. Sourcing without access to lifecycle performance data risks early product obsolescence or increased maintenance costs.

Intellectual Property (IP) Pitfalls

-

Inadvertent Use of Patented Filter Designs

Many advanced filter configurations (e.g., specific pleating patterns, sealing methods, or composite media layers) are protected by patents. Sourcing generic equivalents without freedom-to-operate (FTO) analysis can lead to infringement lawsuits, especially in regulated markets like healthcare or aerospace. -

Unauthorized Use of Trademarked Technologies

Terms like “True HEPA,” “HyperHEPA,” or “ULPA” are often trademarked or associated with specific certification standards. Using such labels without authorization—even if the filter meets performance criteria—can result in legal action and brand damage. -

Supplier Misrepresentation of IP Ownership

Some suppliers may falsely claim ownership or rights to use certain technologies. Without contractual IP warranties and indemnification clauses, buyers may be held liable for infringement committed by the supplier. -

Reverse Engineering Risks

Attempting to replicate proprietary filter designs to reduce costs can violate design or utility patents. Even slight modifications may not circumvent IP protection, leading to costly litigation and product recalls. -

Lack of IP Clarity in Custom Designs

When co-developing custom filters, failure to define IP ownership in contracts can result in disputes. Suppliers may claim rights to improvements or designs, limiting your ability to manufacture or source elsewhere.

Avoiding these pitfalls requires due diligence: verify performance with independent testing, audit supplier quality systems, conduct IP landscape analyses, and secure clear contractual terms on IP ownership and liability.

Logistics & Compliance Guide for Air Purification Filters

Product Classification and HS Codes

Air purification filters are typically classified under specific Harmonized System (HS) codes depending on their composition, intended use, and form. Common classifications include:

– 8421.39: Air filtering or purifying apparatus and parts, not electrically powered.

– 8509.80: Electric air purifiers and components, including filters.

– 6307.90: Other made-up textile articles, potentially applicable for fabric-based filter media.

Accurate classification is essential for determining import duties, taxes, and regulatory requirements. Consult local customs authorities or a licensed customs broker to confirm the correct HS code for your specific filter type.

Import/Export Regulations and Documentation

Compliance with international trade regulations is critical when shipping air purification filters. Required documentation typically includes:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (if claiming preferential tariff treatment)

– Product Specifications and Safety Data Sheets (SDS), especially for filters containing activated carbon or chemical treatments

Some countries may require additional permits or conformity assessments. Ensure all paperwork clearly describes the product, material composition, and intended use to avoid customs delays.

Packaging and Labeling Requirements

Proper packaging safeguards filters during transit and meets regulatory standards. Key considerations include:

– Use moisture-resistant and crush-proof packaging to protect filter media integrity.

– Clearly label packages with product details, handling instructions (e.g., “Fragile,” “This Side Up”), and compliance markings such as CE (for EU), UKCA (for UK), or FCC (for electronic components).

– Include language-compliant labeling per destination country requirements.

– For hazardous materials (e.g., filters with antimicrobial treatments), adhere to IMDG (maritime) or IATA (air) dangerous goods regulations if applicable.

Environmental and Safety Compliance

Air purification filters may be subject to environmental regulations, particularly if they contain restricted substances. Key compliance areas include:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals — ensure no banned substances are present in filter media.

– RoHS (EU/UK): Restriction of Hazardous Substances — applies to electronic air purifier components.

– TSCA (USA): Toxic Substances Control Act — verify compliance for chemical substances used in filter treatments.

Dispose of used filters according to local waste management regulations, as some may be classified as hazardous waste.

Transportation and Handling

Due to their lightweight but sensitive nature, air filters require careful handling during logistics:

– Avoid exposure to dust, moisture, and extreme temperatures during storage and transit.

– Stack packages properly to prevent deformation of filter frames or media.

– Use sealed containers for international shipments to prevent contamination.

– Coordinate with carriers experienced in handling filtration or HVAC products to ensure proper care.

Certification and Market Access

Before entering a target market, verify required certifications:

– CE Marking: Mandatory for sale in the European Economic Area (EEA), indicating compliance with health, safety, and environmental protection standards.

– UL/ETL Listing: Common in North America for electrical safety, especially for filters used in powered air purifiers.

– Energy Star or AHAM Verifide®: Voluntary but valuable labels indicating performance efficiency in the U.S.

Maintain up-to-date test reports and conformity documentation to support claims and facilitate customs clearance.

Recordkeeping and Audit Preparedness

Retain all compliance and shipping documentation for a minimum of 5–7 years, depending on jurisdiction. Records should include:

– Product testing and certification reports

– Supplier compliance declarations (e.g., RoHS, REACH)

– Customs filings and import/export declarations

Regular internal audits help ensure ongoing compliance with evolving regulations and reduce the risk of penalties or shipment seizures.

In conclusion, sourcing air purification filters requires a comprehensive evaluation of several key factors, including filter type (such as HEPA, activated carbon, or electrostatic), compatibility with existing HVAC or air purifier systems, air quality needs, cost-effectiveness, and supplier reliability. It is essential to prioritize high-efficiency filtration that meets industry standards (e.g., HEPA H13/H14) to ensure optimal removal of airborne pollutants, allergens, and pathogens. Additionally, considering sustainability—through recyclable materials or longer-lasting filters—can enhance environmental and operational benefits. Establishing partnerships with reputable suppliers who offer consistent quality, timely delivery, and technical support further ensures long-term performance and cost efficiency. Ultimately, a strategic and informed sourcing approach will significantly contribute to improved indoor air quality, occupant health, and system longevity.