The global air oil separator market is experiencing steady growth, driven by rising demand for energy-efficient compressed air systems across industries such as manufacturing, automotive, and pharmaceuticals. According to Grand View Research, the global compressed air treatment equipment market—of which air oil separators are a critical component—was valued at USD 8.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This growth is fueled by increasing industrial automation, stricter regulatory standards for air quality, and the growing need to extend the lifespan of compressors through effective oil separation. As reliability and system efficiency become paramount, manufacturers of air oil separators are under pressure to innovate and deliver high-performance filtration solutions. In this evolving landscape, a select group of suppliers has emerged as leaders, combining advanced materials, rigorous testing, and global distribution networks to meet expanding market demands. Here, we spotlight the top 9 air oil separator manufacturers shaping the industry’s future.

Top 9 Air Oil Separators Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engine and Industrial Air, Oil and Liquid Filtration

Domain Est. 1995

Website: donaldson.com

Key Highlights: Manufacturers worldwide use Donaldson filters for dust, fume, mist, hydraulic, air/oil separation, compressed air and gas, process, and every other filtration ……

#2 Air Oil Separator Elements Available at Walker Filtration Inc.

Domain Est. 2000

Website: walkerfiltration.com

Key Highlights: Walker Filtration is a world-class manufacturer of air oil separator elements (oil mist filters) for use in oil lubricated vacuum pumps and compressors….

#3 Pall Corporation

Domain Est. 1995

Website: pall.com

Key Highlights: From freshwater generators to oil purification units, Pall filtration and separation products help you protect your most critical systems from contamination ……

#4 Separators

Domain Est. 1995

Website: ph.parker.com

Key Highlights: |; Sign In · My Account Log Out · Home · Products · Adhesives, Coatings and Encapsulants Aerospace Systems and Technologies Air Preparation (FRL) and Dryers ……

#5 Air Oil Separators

Domain Est. 1996

#6 Air Compressor Oil, Oil Separator Elements, Exchangers …

Domain Est. 1998

Website: airengineering.com

Key Highlights: AIR COMPRESSOR PARTS for all air compressor brands. Source your oil separators, filters, compressor oil, heat exchangers and desiccant from one part store; ……

#7 Air/oil separators

Domain Est. 1998

Website: oem.mann-hummel.com

Key Highlights: Get more information about our air/oil separators ✓Efficient oil separation in compressors & vacuum pumps ✓Significant reduction of oil consumption….

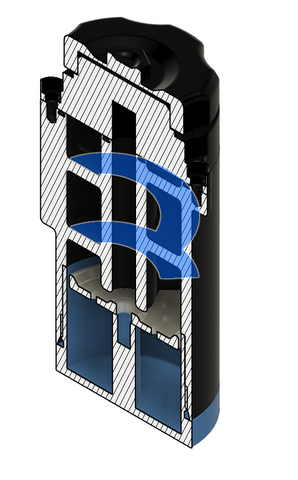

#8 Air/Oil Separators

Domain Est. 1998

Website: keltecinc.com

Key Highlights: KELTEC offers thousands of top-quality Air/Oil Separators for compressors, with the ability to engineer custom designs to suite any compressed air application….

#9 J&L Oil Separator Co.

Domain Est. 2021

Website: jlosc.com

Key Highlights: Shop J&L Oil Separator Co. for premium air oil separators. Our oil catch cans are trusted by enthusiasts for use in domestic and imported vehicles….

Expert Sourcing Insights for Air Oil Separators

H2: Projected Market Trends for Air Oil Separators in 2026

The global Air Oil Separator (AOS) market is anticipated to experience steady growth by 2026, driven by increasing industrial automation, stringent environmental regulations, and rising demand for energy-efficient compressed air systems across key end-use sectors. As industries prioritize operational efficiency and emission reductions, AOS technologies are becoming integral components in compressed air and engine systems.

-

Expansion in Industrial and Automotive Applications

By 2026, the manufacturing, automotive, and oil & gas sectors are expected to dominate AOS demand. In the automotive industry, the growing adoption of turbocharged engines—especially in performance and heavy-duty vehicles—will boost the need for efficient crankcase ventilation systems, where AOS units play a critical role in separating oil mist from blow-by gases. Additionally, industrial manufacturing facilities are upgrading compressed air systems to reduce maintenance costs and improve air quality, further stimulating AOS adoption. -

Stringent Emission Regulations

Environmental regulations, particularly in North America and Europe, are pushing manufacturers to minimize oil emissions and improve air quality. Regulatory frameworks such as Euro 7 and EPA Tier 4 standards are compelling OEMs to integrate advanced AOS solutions to meet emission targets. This regulatory push is expected to accelerate innovation in high-efficiency, low-emission separator designs, especially in diesel engines and pneumatic systems. -

Growth in Aftermarket and Retrofit Demand

The aftermarket segment is projected to expand significantly by 2026, fueled by the increasing number of aging industrial compressors and vehicles requiring maintenance and upgrades. Retrofitting existing systems with modern AOS units offers cost-effective improvements in performance and compliance, making it an attractive option for operators in mining, construction, and energy sectors. -

Technological Advancements and Material Innovation

Advancements in filtration media, such as multi-layer coalescing filters and synthetic nanofiber materials, are enhancing the efficiency and service life of AOS units. By 2026, smart AOS systems equipped with sensors for real-time monitoring of pressure drop and oil carryover are expected to gain traction, especially in smart factory environments where predictive maintenance is prioritized. -

Regional Market Dynamics

Asia-Pacific is forecasted to be the fastest-growing market for AOS, driven by rapid industrialization in China, India, and Southeast Asia. Increased infrastructure development and government initiatives to boost manufacturing are creating robust demand for reliable compressed air systems. Meanwhile, North America and Europe will maintain strong market shares due to high regulatory standards and advanced industrial infrastructure. -

Sustainability and Circular Economy Integration

Sustainability trends are influencing AOS design, with a focus on recyclable materials and reduced waste. By 2026, manufacturers are expected to emphasize eco-friendly production processes and offer take-back programs for used separators, aligning with broader circular economy goals in the industrial sector.

In conclusion, the 2026 Air Oil Separator market will be shaped by regulatory pressures, technological innovation, and expanding applications across industries. Companies that invest in high-performance, sustainable, and smart AOS solutions are likely to capture significant market share in this evolving landscape.

Common Pitfalls When Sourcing Air Oil Separators (Quality, IP)

Sourcing Air Oil Separators (AOS) is critical for the performance and longevity of compressed air systems. Poor choices can lead to excessive oil carryover, contamination, increased maintenance, and even system failure. Below are key pitfalls related to quality and intellectual property (IP) that buyers should avoid.

Quality-Related Pitfalls

-

Prioritizing Low Cost Over Performance

Choosing the cheapest AOS unit often leads to inferior materials, poor filtration media, and inadequate design. Low-quality separators may fail prematurely, resulting in higher total cost of ownership due to frequent replacements and downtime. -

Inadequate Filtration Efficiency

Some AOS units are not tested to industry standards (e.g., ISO 8573-1) and may claim unrealistic oil carryover rates (e.g., <0.1 ppm) without certification. Always verify performance claims with test reports from accredited laboratories. -

Poor Material and Construction

Substandard AOS units may use low-grade metals, weak welds, or non-durable seals, leading to leaks, structural failure, or contamination. Ensure the housing is corrosion-resistant (e.g., stainless steel or properly coated carbon steel) and meets pressure rating requirements. -

Lack of Compatibility with Operating Conditions

Sourcing an AOS without considering operating pressure, temperature, flow rate, and oil type can lead to inefficient separation or component damage. Ensure specifications match your compressor system’s actual operating envelope. -

Insufficient Testing and Certification

Reputable manufacturers provide documentation such as CE marking, pressure vessel certification (e.g., PED, ASME), and third-party efficiency testing. Avoid suppliers who cannot provide verifiable compliance data. -

Ignoring Drainage Mechanism Quality

A high-efficiency separator is compromised by a faulty or poorly designed auto-drain system. Low-quality solenoid or float drains can fail, causing oil/water buildup and re-entrainment into the air stream.

Intellectual Property (IP)-Related Pitfalls

-

Purchasing Counterfeit or Copycat Products

Some suppliers sell AOS units that mimic well-known OEM designs but lack the engineering and testing behind the original. These clones often infringe on patents or trademarks and offer inferior performance. -

Lack of Traceability and Documentation

IP-compliant manufacturers provide detailed technical documentation, part numbering, and design history. Be wary of suppliers who withhold information or cannot prove design ownership, as this may indicate IP violations. -

Using Non-Licensed Designs in Regulated Industries

In sectors like food & beverage, pharmaceuticals, or aerospace, using unapproved or infringing components may violate regulatory standards (e.g., FDA, ISO) and expose your organization to legal liability. -

Risk of Legal Exposure

Sourcing AOS units that infringe on patented technology (e.g., unique baffle designs, coalescing media arrangements) can expose your company to litigation, especially if you are a large end-user or system integrator. -

No Access to Technical Support or Warranty

Genuine IP-protected products come with manufacturer support, warranty, and accountability. Clone or pirated products often lack these, leaving buyers without recourse in case of failure.

Best Practices to Avoid Pitfalls

- Verify supplier credentials and request test reports, certifications, and compliance statements.

- Choose reputable manufacturers with proven track records and transparent design processes.

- Demand traceability—ask for material certifications, design patents, and quality control procedures.

- Perform due diligence on IP status, especially when sourcing from low-cost regions.

- Consider total cost of ownership, not just initial purchase price.

By focusing on quality assurance and respecting intellectual property, organizations can ensure reliable performance, regulatory compliance, and long-term system efficiency.

Logistics & Compliance Guide for Air Oil Separators

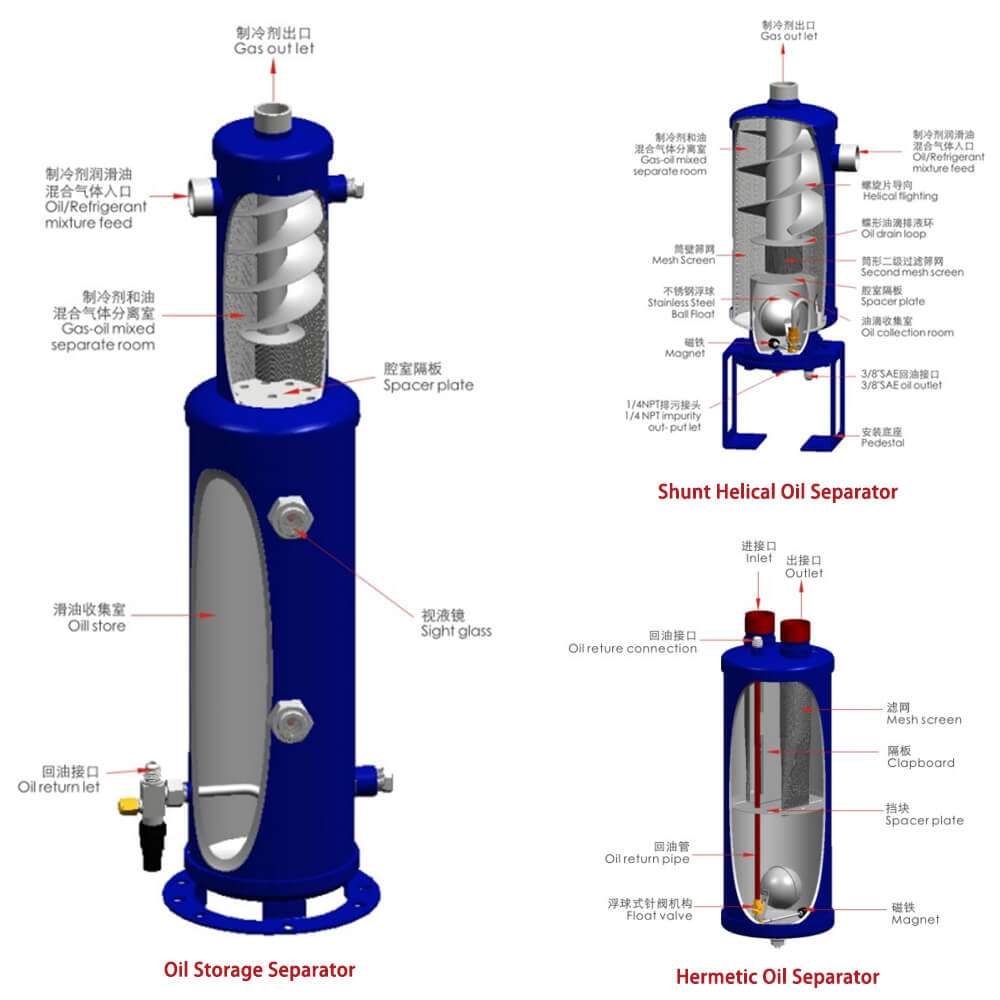

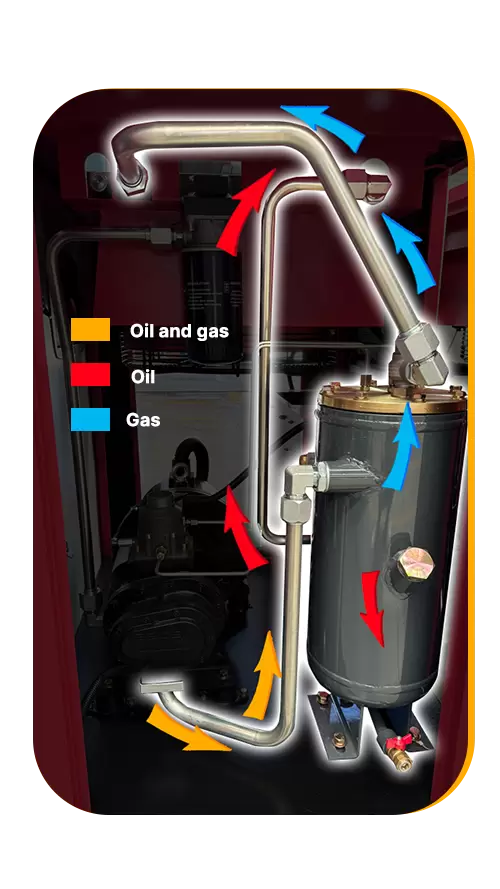

Overview and Purpose

Air Oil Separators (AOS) are critical components in crankcase ventilation systems, particularly in performance and modified internal combustion engines. They function by capturing oil vapors and contaminants from the crankcase gases before they are recirculated into the intake system, thereby improving engine efficiency, reducing carbon buildup, and supporting emissions compliance. This guide outlines the essential logistics and regulatory compliance considerations for the transportation, handling, import/export, and installation of Air Oil Separators.

Regulatory Compliance Requirements

Emissions and Environmental Regulations

Air Oil Separators may fall under emissions control device regulations depending on jurisdiction:

– United States (EPA): Under 40 CFR Part 85, tampering with emissions control systems is prohibited. While AOS units are not original equipment on most vehicles, installing them may be viewed as modifying the crankcase ventilation system. Aftermarket AOS units should be certified by the California Air Resources Board (CARB) if sold or used in California (look for an Executive Order number).

– European Union: Compliance with Euro emissions standards is mandatory. AOS units used in road vehicles may require approval under ECE Regulation 83 or national type-approval frameworks. Non-road applications (e.g., industrial engines) follow different directives such as Stage V.

– Other Regions: Countries like Canada, Australia, and Japan have emissions standards that may restrict or regulate modifications to factory emissions systems. Always verify local regulations before installation.

Road Vehicle Modifications and Legal Use

- In many jurisdictions, modifying the Positive Crankcase Ventilation (PCV) system with an AOS may void vehicle emissions compliance.

- Use of AOS units is typically permitted only on off-road, racing, or competition vehicles not registered for public road use.

- For street-legal applications, ensure the AOS is CARB-exempt or certified and does not bypass or disable OEM emissions components.

Transportation and Shipping Logistics

Packaging and Handling

- AOS units are typically made from aluminum or stainless steel and contain internal baffles, filters, or coalescing media.

- Pack in protective, non-abrasive materials to prevent scratching or damage to finish and fittings.

- Include moisture-absorbing desiccant if shipping to humid climates or over long distances.

- Clearly label packages as “Fragile” and “Protect from Moisture.”

Domestic and International Shipping

- Classify AOS units correctly under the Harmonized System (HS) Code. Common classifications include:

- HS 8414.90 — Parts of air or vacuum pumps, air compressors, or fans.

- HS 8409.91 — Parts of internal combustion piston engines.

- Note: Classification may vary by design and intended use; consult a customs broker.

- Declare accurate product description, value, and country of origin (e.g., “Aftermarket Air Oil Separator for Automotive Engines, Made in USA”).

- For lithium-containing components (e.g., electronic sensors), comply with IATA Dangerous Goods Regulations if applicable. Most AOS units do not contain regulated materials, but verify design.

Import and Export Compliance

- Import Duties and Taxes: Determine applicable tariffs based on destination country and HS code. Duty rates vary (e.g., 2.5%–5% in the U.S. for HS 8414.90).

- Documentation Required: Commercial invoice, packing list, bill of lading/air waybill, and certificate of origin.

- Export Controls: Most AOS units are not subject to ITAR or EAR restrictions, but confirm if integrated with sensors or data systems.

Installation and Operational Compliance

Installation Best Practices

- Follow manufacturer instructions to ensure proper orientation, hose routing, and secure mounting.

- Use appropriate fittings and hose materials (e.g., silicone, reinforced rubber) rated for oil and temperature exposure.

- Ensure the AOS is installed downstream of the PCV valve if emissions compliance is required, or fully replace the factory system only in off-road applications.

Maintenance and Waste Disposal

- Drain collected oil regularly to maintain efficiency.

- Dispose of waste oil in accordance with local environmental regulations (e.g., EPA 40 CFR Part 279 in the U.S.).

- Do not discharge separated oil into drains or soil. Use licensed hazardous waste handlers where required.

Certification and Documentation

Required Certifications

- CARB EO Number: Mandatory for street use in California; verify on the CARB website.

- ECE Approval: Required for use in EU member states on road vehicles.

- CE Marking: Required if marketed in the EU as part of a system.

- DOT/SAE Standards: Not typically applicable, but structural integrity and pressure ratings should meet industry norms.

Record Keeping

- Retain copies of certifications, import documentation, and compliance declarations.

- Distributors and installers should maintain records to demonstrate due diligence in regulatory compliance.

Summary and Recommendations

Air Oil Separators offer performance benefits but carry regulatory responsibilities. Key actions include:

– Verify emissions compliance for the intended application and jurisdiction.

– Use only CARB-certified units for on-road vehicles in regulated areas.

– Package and ship units properly to prevent damage.

– Maintain accurate import/export documentation.

– Follow proper installation and waste handling procedures.

When in doubt, consult with regulatory authorities or legal counsel to ensure full compliance with local, national, and international requirements.

Conclusion on Sourcing Air Oil Separators

Sourcing air oil separators requires a strategic approach that balances performance, cost, reliability, and compatibility with existing compressed air systems. These components play a critical role in ensuring air quality, system efficiency, and compliance with environmental and safety standards. When selecting suppliers, it is essential to evaluate not only product specifications and filtration efficiency but also the manufacturer’s reputation, technical support, and after-sales service.

OEM parts offer guaranteed compatibility and performance but may come at a higher cost, while aftermarket alternatives can provide cost savings if sourced from reputable suppliers with proven quality control. Consideration of factors such as separator lifespan, pressure drop, oil carryover rates, and ease of installation is crucial for minimizing operational downtime and maintenance costs.

In conclusion, a well-informed sourcing decision—based on thorough supplier evaluation, total cost of ownership analysis, and alignment with system requirements—ensures long-term reliability, improved air quality, and optimal performance of compressed air systems. Establishing relationships with trusted suppliers and staying updated on advancements in filtration technology further supports effective procurement and system sustainability.