The global air jet filter market is experiencing steady expansion, driven by increasing industrialization, stringent emission regulations, and growing demand for clean air solutions across manufacturing, automotive, and pharmaceutical sectors. According to Grand View Research, the global industrial air filtration market was valued at USD 12.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. Similarly, Mordor Intelligence reports a CAGR of approximately 5.8% for the air filter market during the forecast period 2024–2029, citing rising investments in HVAC systems and pollution control as key drivers. With demand surging in both developed and emerging economies, innovation and scalability have become critical differentiators among manufacturers. As industries prioritize efficiency and regulatory compliance, the following eight companies have emerged as leaders in the air jet filter space, combining advanced filtration technologies, global reach, and a strong track record of performance.

Top 8 Air Jet Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Filtration Solutions Built for Performance

Domain Est. 1996

Website: micronicsinc.com

Key Highlights: A global provider of customized industrial filtration solutions for demanding applications from Mining & Mineral Processing, Chemicals, and Cement to Recycling….

#2 Manufacturer of Bag Filter, Bag House Dust Collector, ESP & Pulse …

Domain Est. 2003

Website: himenviro.com

Key Highlights: Worlds Best Pollution Control Equipments Manufacturer – Bag Filters, Dust Collector and ESP & Pulse Jet Filters · Electrostatic Precipitators · Fabric Filters….

#3 Industrial filtration, gas filters, gas treatment

Domain Est. 2024

Website: airjet-filtration.com

Key Highlights: AIR JET offers a wide range of solutions to control the emission of pollutants into the atmosphere across a range of industries….

#4 Air Filtration – Metalworking

Domain Est. 1995

Website: jettools.com

Key Highlights: Breathe easier in your metalworking environment with JET air filtration systems. Explore models like the IAFS-1700, IAFS-2400, and IAFS-3000….

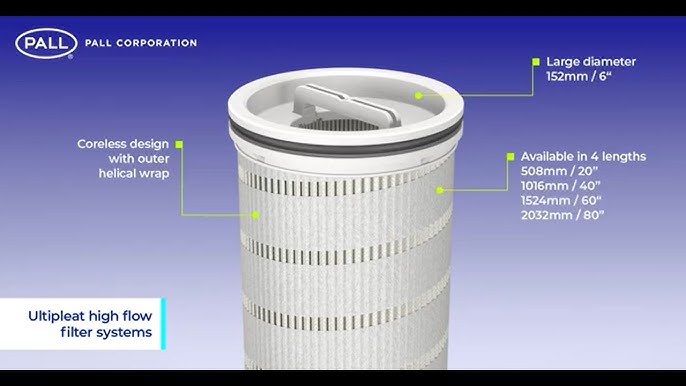

#5 Pall Corporation

Domain Est. 1995

Website: pall.com

Key Highlights: Pall offers innovative purification and filtration technologies for new and expanding markets, leading the way with consistent, reliable performance for state- ……

#6

Domain Est. 1999

Website: jetincorp.com

Key Highlights: If you want to experience honest, dependable, responsive, service-oriented wastewater treatment specialists, you want Jet—a company founded on innovation and ……

#7 Weaving machines

Domain Est. 2004

Website: lindauerdornier.com

Key Highlights: DORNIER weaving machines are designed for a wide range of applications and offer maximum flexibility and precision….

#8 JetBlack Safety

Domain Est. 2018

Website: jetblacksafety.com

Key Highlights: The JetBlack range of high performance products for personnel cleaning and de-dusting are OSHA compliant – offering companies a safe, cost effective……

Expert Sourcing Insights for Air Jet Filter

H2: Projected 2026 Market Trends for Air Jet Filters

The global air jet filter market in 2026 is expected to be shaped by several converging trends, driven by industrial growth, environmental regulations, technological innovation, and evolving end-user demands. Here’s an analysis of the key developments anticipated for that year:

1. Sustained Growth in Industrial Automation & Manufacturing

- Impact: The continued global push toward Industry 4.0 and smart manufacturing will drive demand for reliable, high-efficiency filtration. Air jet filters are critical for protecting sensitive equipment (like robotics, CNC machines, and sensors) from dust and particulates in automated production lines.

- 2026 Outlook: High-growth sectors like electric vehicles (EVs), semiconductors, and advanced electronics manufacturing will require stringent cleanroom and process air quality, boosting demand for high-performance air jet filters, particularly pulse-jet baghouses and cartridge filters. Expect robust market expansion in manufacturing hubs (Asia-Pacific, North America, Europe).

2. Stricter Environmental Regulations & Emission Control

- Impact: Governments worldwide are tightening air quality standards (e.g., updates to EPA regulations in the US, EU Industrial Emissions Directive, China’s “Blue Sky” initiatives). This forces industries (power generation, cement, steel, chemicals, waste incineration) to invest in more efficient emission control technologies.

- 2026 Outlook: Air jet filters, especially fabric filters (baghouses) using pulse-jet cleaning, remain the gold standard for capturing fine particulate matter (PM2.5, PM10). The market will see significant demand driven by regulatory compliance, particularly for retrofitting older facilities and new installations meeting stricter limits. Focus will be on filters with higher capture efficiencies (>99.9%).

3. Advancements in Filter Media Technology

- Impact: The core performance of air jet filters hinges on the filter media. Innovation focuses on durability, efficiency, lower pressure drop (saving energy), and resistance to harsh conditions (high temperature, moisture, chemical corrosion).

- 2026 Outlook: Expect wider adoption of advanced synthetic media (e.g., ePTFE membrane laminates, nano-fiber coatings, hybrid fabrics). These offer superior fine particle capture, longer service life, reduced cleaning frequency, and lower energy consumption. Demand for specialized media for specific applications (e.g., high-temp PPS, P84, fiberglass; chemical-resistant PTFE) will grow.

4. Focus on Energy Efficiency & Sustainability

- Impact: High operating pressure drops in filters consume significant compressed air and energy for cleaning. Sustainability goals and rising energy costs are pushing demand for energy-optimized solutions.

- 2026 Outlook: There will be a strong market shift towards:

- Low-Pressure Drop Filters: Designs and media that minimize resistance, reducing fan energy.

- Optimized Cleaning Systems: Smarter pulse-jet control systems using sensors and algorithms to clean only when necessary and with the minimal effective air pulse, drastically cutting compressed air usage.

- Sustainable Materials: Increased interest in recyclable or bio-based filter components and longer-lasting media to reduce waste.

5. Integration of IoT and Predictive Maintenance

- Impact: Downtime for filter replacement or cleaning is costly. Real-time monitoring enables proactive maintenance.

- 2026 Outlook: “Smart” air jet filters integrated with IoT sensors (monitoring differential pressure, temperature, humidity, vibration) will become more prevalent. Data analytics and AI will enable predictive maintenance, optimizing cleaning cycles, scheduling replacements before failure, and improving overall system efficiency and reliability. This is a key value proposition for OEMs and service providers.

6. Growth in Emerging Markets & Infrastructure Development

- Impact: Rapid industrialization and urbanization in regions like Southeast Asia, India, and parts of Africa are increasing industrial activity and pollution control needs.

- 2026 Outlook: These regions will represent significant growth opportunities for air jet filter suppliers. Demand will be driven by new power plants, cement factories, steel mills, and waste management facilities. While price sensitivity might be higher, the sheer volume of new installations will be a major market driver.

7. Consolidation and Competition

- Impact: The market features established players (e.g., Donaldson, Parker Hannifin, Cummins Filtration, Freudenberg, Lydall) and numerous regional/niche suppliers.

- 2026 Outlook: Expect continued consolidation as large players acquire innovative tech companies (e.g., specializing in smart sensors or advanced media) to enhance their offerings. Competition will intensify on total cost of ownership (TCO), not just initial price, emphasizing energy savings, longevity, and service support. Innovation in design and digital services will be key differentiators.

Conclusion for 2026:

The air jet filter market in 2026 will be characterized by strong, regulation-driven growth, particularly in industrial and emission control segments. Success will depend on offering high-efficiency, energy-saving solutions leveraging advanced media and smart technology. Suppliers who focus on sustainability, digital integration (IoT/predictive maintenance), and providing value beyond the filter element itself (e.g., monitoring, optimization services) will be best positioned to capture market share. The trend towards smarter, more efficient, and longer-lasting filtration systems will be paramount.

Common Pitfalls When Sourcing Air Jet Filters (Quality, IP)

Sourcing Air Jet Filters—critical components in pneumatic systems for removing contaminants from compressed air—requires careful attention to both performance quality and intellectual property (IP) considerations. Overlooking these aspects can lead to system failures, safety hazards, and legal risks. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

One of the most frequent issues is selecting filters based solely on price, leading to substandard materials and manufacturing. Low-quality filters may use inferior filtration media, weak housings, or poorly sealed joints, resulting in:

- Inadequate particulate, oil, or moisture removal

- Premature clogging or breakthrough

- Risk of filter element collapse under pressure

- Reduced equipment lifespan due to contaminated air

Ensure suppliers adhere to international standards (e.g., ISO 8573) and provide test certifications. Request samples and conduct independent performance validation before large-scale procurement.

Misunderstanding IP Protection and Risk of Infringement

Air Jet Filters often incorporate patented designs, especially in advanced filtration media, housing configurations, or automatic drain mechanisms. Sourcing from generic or unverified suppliers increases the risk of:

- Purchasing counterfeit or IP-infringing products

- Legal liability for using unauthorized designs

- Supply chain disruptions due to IP enforcement actions

Always verify the original equipment manufacturer (OEM) status or licensing agreements. Conduct due diligence on suppliers’ IP compliance and avoid “reverse-engineered” alternatives unless proper licensing is confirmed.

Inadequate Ingress Protection (IP) Ratings

The IP rating defines a filter’s resistance to dust and moisture ingress—critical in harsh industrial environments. A common mistake is assuming all filters are suitable for wet or dusty conditions without verifying the IP code.

- Selecting a filter with IP54 instead of IP65/67 in outdoor or washdown areas can lead to internal contamination and failure.

- Misinterpreting IP ratings (e.g., ignoring the second digit for water resistance) compromises reliability.

Always match the filter’s IP rating to the environmental conditions of the installation site, especially in food processing, chemical plants, or outdoor applications.

Lack of Traceability and Documentation

Poor documentation—missing batch numbers, material certifications, or compliance reports—makes quality audits and failure analysis difficult. This is particularly problematic in regulated industries (e.g., pharmaceuticals, automotive).

Ensure suppliers provide full traceability, including material data sheets (MDS), conformity certificates, and maintenance guidelines.

Overlooking Compatibility and System Integration

Even high-quality filters can fail if they are not compatible with system pressure, flow rates, or connection types. Mismatches can cause:

- Pressure drops affecting system performance

- Leaks at connection points

- Incompatibility with existing filter housings or automation controls

Always confirm technical specifications match your system requirements and consult OEM guidelines when replacing or upgrading filters.

By addressing these pitfalls—focusing on verified quality, IP compliance, correct environmental protection, and full documentation—procurement teams can ensure reliable, legal, and efficient sourcing of Air Jet Filters.

Logistics & Compliance Guide for Air Jet Filter

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence of Air Jet Filters. These industrial components require careful management to ensure product integrity, timely delivery, and conformity with international and local standards.

Product Handling & Packaging

Air Jet Filters must be packaged securely to prevent damage during transit. Use robust, moisture-resistant packaging with internal cushioning to protect filter media and housings. Clearly label packages with handling instructions such as “Fragile,” “This Side Up,” and “Protect from Moisture.” Avoid stacking heavy items on top of filter packages.

Transportation Requirements

Use enclosed, climate-controlled vehicles when transporting Air Jet Filters, especially in regions with extreme temperatures or high humidity. Ensure secure loading to minimize vibration and movement during transit. For international shipments, coordinate with carriers experienced in handling industrial filtration equipment.

Import/Export Compliance

Air Jet Filters may be subject to export controls depending on destination country and technical specifications. Verify Harmonized System (HS) code classification—typically under 8421.39 for air filtering equipment. Complete all required documentation, including commercial invoices, packing lists, and certificates of origin. For shipments to regulated markets (e.g., EU, USA), ensure compliance with export licensing requirements if applicable.

Regulatory Standards & Certifications

Air Jet Filters must meet relevant industry standards such as ISO 16890 for air filter classification and EN 779 (where still in use). Confirm that products bear necessary certifications (e.g., CE marking for Europe, UL or ANSI for North America). Maintain documentation proving compliance for audits and customs clearance.

Hazardous Materials Considerations

Standard Air Jet Filters are generally non-hazardous. However, if filters contain treated media (e.g., antimicrobial coatings) or are classified as waste after use, consult SDS (Safety Data Sheets) and follow local hazardous material transport regulations (e.g., ADR for road, IATA for air).

Customs Clearance Procedures

Provide accurate product descriptions, declared value, and country of origin to avoid delays. Use licensed customs brokers for complex international shipments. Be prepared to present conformity declarations, test reports, or certification documents upon request.

Storage Guidelines

Store Air Jet Filters in a dry, clean environment with stable temperatures (10°C to 30°C recommended). Keep filters in original packaging until installation to prevent contamination. Follow FIFO (First In, First Out) inventory practices to ensure older stock is used first.

Documentation & Traceability

Maintain detailed records for each batch, including manufacturing date, serial number (if applicable), test results, and shipping details. This supports warranty claims, recalls, and compliance audits.

Environmental & Disposal Compliance

Used Air Jet Filters may be classified as industrial waste. Follow local environmental regulations for disposal or recycling. If filters have captured hazardous particulates, handle as contaminated waste in accordance with EPA, EU WEEE, or equivalent standards.

Contact & Support

For logistics or compliance inquiries, contact your designated supply chain manager or compliance officer. Keep updated on regulatory changes through official channels such as customs authorities, ISO, and industry associations.

Conclusion for Sourcing an Air Jet Filter:

In conclusion, sourcing an air jet filter requires a comprehensive evaluation of technical specifications, performance requirements, quality standards, and supplier reliability. The air jet filter plays a critical role in maintaining the efficiency and longevity of pneumatic and filtration systems by removing contaminants and ensuring clean, consistent airflow. Key factors such as filtration efficiency, compatible materials, operating pressure and temperature ranges, maintenance needs, and cost-effectiveness must be carefully assessed to select the most suitable product.

Additionally, choosing a reputable supplier with a proven track record in industrial filtration solutions ensures access to high-quality components, technical support, and timely delivery. Evaluating total cost of ownership—beyond initial purchase price—to include energy efficiency and maintenance intervals further supports a sustainable and economical decision.

Ultimately, a well-informed sourcing strategy for air jet filters contributes to improved system performance, reduced downtime, and enhanced operational efficiency across manufacturing and industrial applications.