The global air hydraulics market is experiencing steady growth, driven by increasing demand for energy-efficient fluid power systems across industrial and manufacturing sectors. According to Mordor Intelligence, the hydraulic equipment market was valued at USD 29.5 billion in 2023 and is projected to reach USD 40.1 billion by 2029, growing at a CAGR of approximately 5.2% during the forecast period. This expansion is fueled by rising automation, advancements in machinery technology, and the need for high-force transmission in compact systems—areas where air hydraulics excel. As industries from automotive to aerospace prioritize reliability and precision, leading manufacturers are innovating to meet evolving performance and sustainability standards. In this competitive landscape, three key players have emerged at the forefront, combining engineering excellence with global reach to shape the future of air hydraulic solutions.

Top 3 Air Hydraulics Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

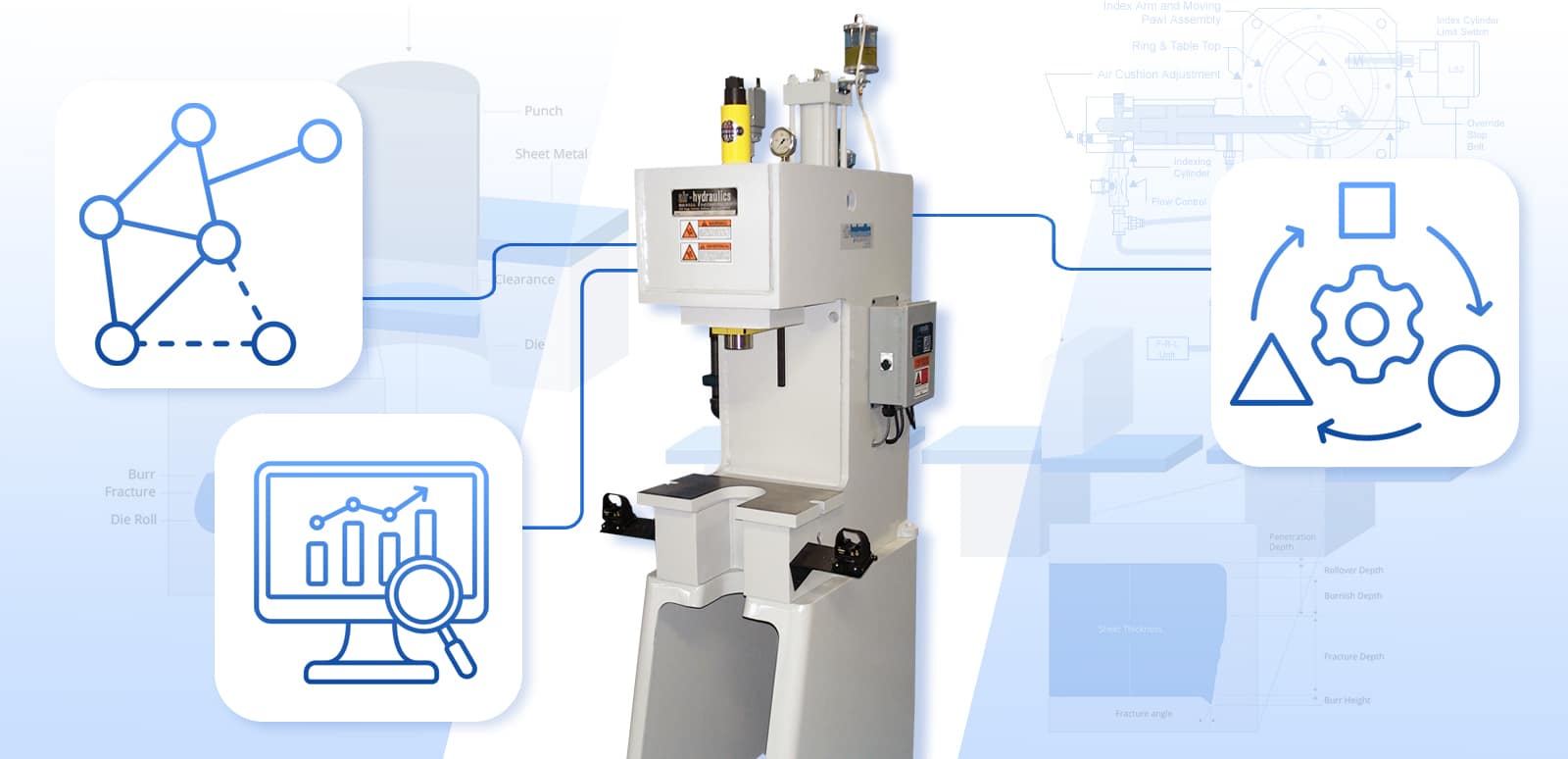

#1 Air

Domain Est. 1997

Website: airhydraulics.com

Key Highlights: Air Hydraulics is the leader in manufacturing and customizing reliable, quiet, safe, and low maintenance air and hydraulic-powered factory press equipment….

#2 Airline Hydraulics

Domain Est. 1996

Website: airlinehyd.com

Key Highlights: We offer components, engineered systems and service & repair for the technology fields of fluid power, automation, and more!…

#3 Air Hydraulics Co

Domain Est. 2008

Website: airhydraulicsco.com

Key Highlights: Air Hydraulics Co. is located in St. Louis, MO. We have been serving the midwest for over 50 years with superior service and the lowest prices on all hydraulic ……

Expert Sourcing Insights for Air Hydraulics

H2: 2026 Market Trends for Air Hydraulics

The air hydraulics market is poised for notable transformation by 2026, driven by technological innovation, growing demand for energy-efficient systems, and expanding industrial automation. As industries seek reliable, compact, and maintenance-efficient power transmission solutions, air hydraulics—hybrid systems combining the advantages of pneumatic and hydraulic technologies—are gaining strategic importance. Below is an analysis of key market trends expected to shape the air hydraulics sector in 2026.

Rising Demand in Industrial Automation

The global push toward smart manufacturing and Industry 4.0 is accelerating the adoption of air hydraulic systems. These systems offer precise control, high force output, and reliability in automated assembly lines, packaging, and material handling. With factories increasingly integrating robotics and IoT-enabled machinery, air hydraulics provide a robust solution for applications requiring both speed and power without the complexity of full hydraulic infrastructure.

Energy Efficiency and Environmental Regulations

Environmental sustainability is a major driver. Traditional hydraulic systems often involve oil-based fluids that pose environmental and maintenance challenges. Air hydraulics, which use compressed air to generate hydraulic pressure, reduce fluid leakage risks and lower energy consumption. By 2026, stricter emissions and energy efficiency standards—especially in Europe and North America—are expected to boost demand for cleaner, greener alternatives like air hydraulic technology.

Growth in Automotive and Aerospace Sectors

The automotive and aerospace industries are anticipated to be key adopters. In automotive manufacturing, air hydraulic presses and clamping systems enhance production line efficiency. In aerospace, where weight and reliability are critical, air hydraulics offer lightweight actuation solutions for testing and maintenance equipment. Increased investment in EV production and next-gen aircraft will further stimulate market growth.

Advancements in Compact and Modular Designs

OEMs are focusing on miniaturization and modularity to meet space constraints in modern machinery. By 2026, expect wider availability of compact air hydraulic power packs and integrated valve systems that simplify installation and reduce downtime. These innovations make air hydraulics more accessible for small and medium-sized enterprises (SMEs) across diverse sectors.

Regional Market Dynamics

Asia-Pacific is projected to lead market growth, fueled by rapid industrialization in China, India, and Southeast Asia. Meanwhile, North America and Western Europe will see steady growth driven by retrofitting of legacy systems and demand for high-performance industrial equipment. Government incentives for advanced manufacturing are expected to support regional expansion.

Challenges and Competitive Landscape

Despite the positive outlook, challenges remain. High initial costs and the need for skilled technicians to maintain hybrid systems may slow adoption in price-sensitive markets. However, leading players such as Parker Hannifin, Bosch Rexroth, and SMC Corporation are investing in R&D and digital diagnostics to improve system affordability and ease of use.

Conclusion

By 2026, the air hydraulics market is expected to experience strong growth, supported by technological advancements, regulatory pressures, and increasing automation. Companies that innovate in efficiency, integration, and sustainability will be well-positioned to capture value in this evolving landscape.

Common Pitfalls in Sourcing Air Hydraulics: Quality and Intellectual Property (IP) Risks

Sourcing air hydraulic components—systems that combine pneumatic and hydraulic technologies for high-force, controlled motion—presents unique challenges. While these systems offer advantages like compact design and high power density, organizations often encounter significant pitfalls related to component quality and intellectual property (IP) protection. Failure to address these issues can lead to operational failures, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Use of Substandard Materials and Components

A common issue when sourcing air hydraulics, especially from low-cost suppliers, is the use of inferior materials that compromise performance and longevity. For example, seals made from non-standard elastomers may degrade rapidly when exposed to oils or temperature fluctuations, leading to leaks and system failure. Similarly, cylinders constructed with unhardened piston rods are prone to corrosion and scoring, reducing efficiency and lifespan.

2. Inconsistent Manufacturing Processes

Air hydraulic components require tight tolerances and precision engineering. Suppliers lacking robust quality control systems may produce parts with inconsistent dimensions or surface finishes. This variability can cause erratic actuator behavior, increased wear, and premature failure—especially under high-pressure or cyclic loading conditions.

3. Inadequate or Misleading Performance Specifications

Some suppliers may overstate performance metrics such as maximum pressure rating, force output, or cycle life. Without third-party validation or test data, buyers risk integrating components that fail under actual operating conditions. For instance, a power unit rated for 5,000 psi may not sustain that pressure over time due to internal leakage or thermal drift.

4. Lack of Certification and Compliance

Reputable air hydraulic systems should meet international standards such as ISO 4414 (pneumatic systems), ISO 4413 (hydraulic systems), or CE, UL, or ATEX certifications where applicable. Sourcing from suppliers who cannot provide documentation of compliance increases the risk of non-conformance, safety violations, and regulatory penalties.

Intellectual Property (IP) Risks

1. Unintentional Use of Infringing Designs

Some suppliers, particularly in regions with weak IP enforcement, may replicate patented air hydraulic technologies without authorization. Sourcing such components—even unknowingly—can expose the buyer to legal liability for contributory infringement. For example, a compact intensifier design protected by patent may be reverse-engineered and sold as generic, putting downstream users at risk.

2. Lack of IP Ownership Clarity in Custom Designs

When working with suppliers on custom air hydraulic solutions, contracts often fail to explicitly assign IP rights. This can lead to disputes over ownership of design improvements, tooling, or proprietary configurations. Without clear agreements, the supplier may retain rights to reuse or resell the design to competitors.

3. Reverse Engineering and Technology Leakage

Sharing detailed technical specifications or CAD files with suppliers increases the risk of IP theft. In some cases, suppliers have been known to reverse engineer designs, replicate them, and sell them independently. This is particularly concerning when sourcing from regions with limited legal recourse for IP protection.

4. Inadequate Protection in Joint Development Projects

Collaborative development of air hydraulic systems can blur IP boundaries. Without robust non-disclosure agreements (NDAs) and clearly defined IP clauses, both parties may claim ownership of innovations, resulting in stalled projects or litigation.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct thorough supplier audits, including factory inspections and quality system reviews (e.g., ISO 9001).

– Require material certifications, test reports, and compliance documentation.

– Perform independent performance validation through lab or field testing.

– Engage legal counsel to draft clear IP clauses in contracts, ensuring ownership and confidentiality.

– Use NDAs and limit the distribution of sensitive design data.

– Source from reputable suppliers with a proven track record and strong IP compliance.

By proactively addressing quality and IP concerns, companies can ensure the reliability, safety, and legal integrity of their air hydraulic systems.

Logistics & Compliance Guide for Air Hydraulics

Overview

This guide outlines the essential logistics and compliance requirements for the safe and legal handling, transportation, storage, and disposal of air hydraulic components and systems. Adherence to these protocols ensures operational efficiency, regulatory compliance, and workplace safety.

Regulatory Compliance

Air hydraulic systems may be subject to international, national, and regional regulations depending on their application and components. Key regulatory frameworks include:

- OSHA (Occupational Safety and Health Administration) – Ensures workplace safety during handling and maintenance.

- DOT (Department of Transportation) – Governs the transportation of pressurized components and hazardous materials (if applicable).

- EPA (Environmental Protection Agency) – Regulates disposal of hydraulic fluids and contaminated materials.

- REACH & RoHS (EU Regulations) – Apply to material composition and environmental impact of components shipped to or used in Europe.

- IATA/ICAO – Relevant if shipping pressurized gas cylinders or hazardous fluids by air.

Ensure all components and fluids meet applicable standards for pressure vessels, fluid compatibility, and material safety.

Handling & Storage Procedures

Proper handling and storage prevent damage, leaks, and safety hazards.

- Depressurization: Always release system pressure before handling or transporting components.

- Sealing Open Ports: Use protective caps or plugs on hydraulic lines and fittings to prevent contamination.

- Fluid Containment: Store hydraulic fluids in approved, labeled containers away from heat sources and direct sunlight.

- Environmental Controls: Store components in dry, temperature-controlled environments to prevent corrosion and seal degradation.

- Segregation: Keep hydraulic fluids separate from flammable materials and incompatible chemicals.

Transportation Guidelines

Air hydraulic components—especially those containing pressurized gas or hydraulic fluid—require special shipping considerations.

- Packaging: Use robust, shock-resistant packaging with internal bracing to prevent movement.

- Labeling: Clearly label packages containing pressurized components or fluids with appropriate hazard warnings (e.g., “Pressurized Container,” “Flammable Fluid” if applicable).

- Documentation: Include Safety Data Sheets (SDS), shipping manifests, and compliance certificates.

- Carrier Requirements: Confirm carrier-specific rules, especially for air freight (IATA Dangerous Goods Regulations may apply for pressurized systems or certain fluids).

- International Shipments: Ensure customs compliance with proper Harmonized System (HS) codes and export documentation.

Fluid Management & Disposal

Hydraulic fluids must be managed responsibly to comply with environmental regulations.

- Fluid Selection: Use environmentally acceptable fluids (e.g., biodegradable hydraulic oils) where possible.

- Leak Prevention: Implement regular inspection and maintenance schedules.

- Spill Response: Maintain spill kits and train personnel in containment procedures.

- Disposal: Dispose of used hydraulic fluid and contaminated materials through licensed waste handlers in accordance with local EPA or equivalent regulations.

Training & Documentation

Personnel involved in logistics must be trained and documentation maintained.

- Training Programs: Conduct regular training on safe handling, emergency response, and regulatory compliance.

- Record Keeping: Maintain logs for inspections, maintenance, training, and waste disposal.

- Compliance Audits: Perform periodic audits to ensure adherence to internal policies and external regulations.

Emergency Preparedness

Prepare for potential incidents during logistics operations.

- Emergency Contacts: Maintain a list of response agencies, hazmat teams, and internal contacts.

- Spill Kits & PPE: Equip transport vehicles and storage areas with personal protective equipment (PPE) and spill response materials.

- Incident Reporting: Establish procedures for reporting accidents, leaks, or regulatory violations immediately.

Conclusion

Compliance with logistics and regulatory standards is critical for the safe and responsible management of air hydraulic systems. By following this guide, organizations can mitigate risks, avoid penalties, and ensure reliable system performance across the supply chain.

Conclusion on Sourcing Air Hydraulics

Sourcing air-hydraulic systems requires a strategic approach that balances performance requirements, cost efficiency, reliability, and long-term maintenance needs. These hybrid systems combine the advantages of pneumatic speed and cleanliness with the high force output of hydraulics, making them ideal for applications in industries such as manufacturing, automotive, and aerospace.

When sourcing air-hydraulic components, it is essential to evaluate suppliers based on quality certifications, technical expertise, product compatibility, and after-sales support. Prioritizing energy efficiency, system integration capabilities, and durability will ensure optimal performance and reduced operational downtime. Additionally, considering customization options and scalability can future-proof operations as demands evolve.

In conclusion, successful sourcing of air-hydraulic systems hinges on selecting reliable partners, understanding application-specific needs, and investing in high-quality, well-supported components. A well-sourced air-hydraulic solution enhances productivity, safety, and efficiency, delivering strong returns on investment over the system’s lifecycle.