Sourcing Guide Contents

Industrial Clusters: Where to Source Air Conditioner Factory In China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Air Conditioner Manufacturing Capacity in China

Target Audience: Global Procurement Managers | Publication Date: January 2026

Executive Summary

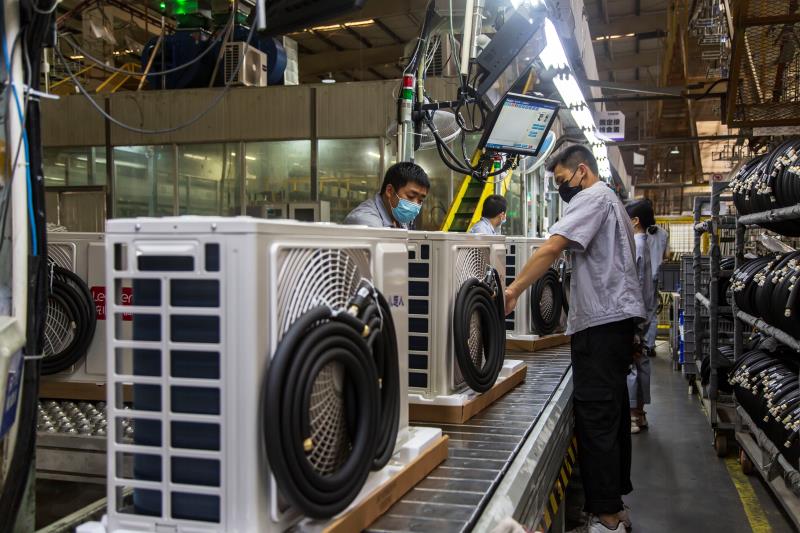

China remains the world’s dominant hub for air conditioner (AC) manufacturing, accounting for over 80% of global production capacity. With increasing global demand for energy-efficient and smart HVAC systems, sourcing AC manufacturing from China offers significant cost advantages, scalable production, and access to a mature supply chain ecosystem. This report provides a comprehensive analysis of China’s key industrial clusters for air conditioner manufacturing, evaluating regional strengths in price competitiveness, product quality, and lead time efficiency.

Procurement managers are advised to strategically align sourcing decisions with product specifications, volume requirements, and quality standards by selecting the most suitable manufacturing base within China’s diversified industrial landscape.

Key Industrial Clusters for Air Conditioner Manufacturing in China

China’s air conditioner manufacturing is concentrated in three primary industrial clusters, each with distinct specializations and competitive advantages:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Foshan, Zhongshan, Dongguan, Guangzhou

- Key OEMs/ODMs: Midea, Gree (headquartered in Zhuhai), Haier (Southern operations)

- Profile: The largest and most integrated HVAC manufacturing cluster in China. Home to world-leading AC brands and a dense network of component suppliers (compressors, PCBs, coils, etc.). Strong focus on R&D, smart ACs, and export-ready production.

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Huzhou, Shaoxing

- Key Players: Supor (subsidiary of Midea), regional OEMs specializing in mid-tier residential and light commercial units

- Profile: Known for agile mid-sized manufacturers with strong engineering capabilities. Competitive in cost-sensitive export markets. Emphasis on lean manufacturing and modular design.

3. Anhui Province (Central China Corridor)

- Core City: Hefei

- Key Player: Hefei-based industrial zone hosts major production facilities of Gree Electric and Midea, in addition to emerging local OEMs.

- Profile: Government-incentivized industrial expansion zone. Lower labor and operational costs. Rapidly growing production capacity with improving quality controls.

Comparative Analysis of Key Production Regions

The following table evaluates the three core AC manufacturing regions across critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium | High (Premium to Standard) | 45–60 days | – Proximity to ports (Guangzhou, Shenzhen, Nansha) – Full supply chain integration – High R&D and automation adoption |

Higher labor and production costs vs. inland regions |

| Zhejiang | High | Medium to High | 50–65 days | – Cost-efficient mid-tier manufacturing – Strong engineering and customization – Reliable for bulk orders |

Slightly longer lead times due to inland logistics |

| Anhui (Hefei) | High | Medium (Improving rapidly) | 55–70 days | – Lowest operational costs – Government incentives – Major OEM investments (Gree, Midea) |

Logistics slightly slower; quality consistency varies by supplier |

Scoring Guide:

– Price: High = most competitive pricing; Medium = moderate cost; Low = premium pricing

– Quality: High = ISO-certified, export-grade, low defect rates; Medium = suitable for mid-tier markets with standard QC

– Lead Time: Based on standard 40’HC container production from order confirmation to FOB departure

Strategic Sourcing Recommendations

-

For Premium/High-Efficiency AC Units:

Prioritize Guangdong suppliers, especially those integrated with Midea or Gree ecosystems. Ideal for North American, EU, and Japanese markets requiring high reliability and compliance (e.g., ENERGY STAR, CE). -

For Cost-Sensitive, Mid-Volume Orders:

Zhejiang offers an optimal balance of price, quality, and engineering support. Recommended for emerging markets and private-label programs. -

For High-Volume, Budget-Focused Programs:

Anhui (Hefei) presents compelling cost advantages. Due diligence on QC systems is advised. Best suited for markets with moderate regulatory requirements. -

Logistics Optimization:

Guangdong offers fastest shipping access to global markets via South China ports. For Anhui and Zhejiang, consider rail freight to Nansha or Ningbo ports to reduce total cycle time.

Market Trends Impacting 2026 Sourcing Decisions

- Rise of Smart & Inverter ACs: Over 60% of new production lines in Guangdong now support DC inverter and IoT-enabled units.

- Green Manufacturing Push: Zhejiang and Anhui are leading in adopting energy-efficient factory standards under China’s dual-carbon policy.

- Supply Chain Resilience: Diversification away from single-source coastal hubs is increasing interest in Anhui and Western China (e.g., Chengdu) for risk mitigation.

Conclusion

China’s air conditioner manufacturing landscape is regionally specialized, offering procurement managers a spectrum of options based on strategic priorities. Guangdong leads in quality and integration, Zhejiang in balanced efficiency, and Anhui in cost leadership. A data-driven, cluster-specific sourcing strategy—supported by on-the-ground supplier audits and QC protocols—will maximize value, mitigate risk, and ensure competitive advantage in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

Guiding Global Procurement with Intelligence, Integrity, and Impact

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Air Conditioner Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for air conditioner (AC) manufacturing, producing >80% of the world’s units (2025 Global HVAC Report). This report details critical technical, quality, and compliance parameters for procurement managers evaluating Chinese AC factories. Key 2026 shifts include stricter EU F-Gas regulations, expanded CB Scheme acceptance, and AI-driven in-line QC adoption by Tier-1 suppliers.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | Material Specification | Critical Tolerances | Why It Matters |

|---|---|---|---|

| Compressor Shell | ASTM A516 Gr.70 carbon steel (min. 3.5mm thickness) | ±0.05mm flatness; ≤0.1° angular deviation | Prevents vibration-induced fatigue cracks; ensures seal integrity |

| Evaporator/Condenser Coils | ASTM B280 seamless copper tubing (99.9% Cu min.) | Tube OD: ±0.02mm; Fin pitch: ±0.05mm | Substandard tolerances cause refrigerant leaks & reduced heat transfer efficiency |

| PCB Assemblies | FR-4 substrate (Tg≥140°C); Lead-free SAC305 solder | Solder paste volume: ±5%; Component placement: ±0.1mm | Prevents thermal runaway & electrical shorts in high-humidity environments |

| Casing | SECC steel (0.6mm min.) or ABS+PC blend (UL94 V-0) | Panel gap: ≤0.5mm; Warpage: ≤1.2mm/m | Critical for noise reduction (≤19 dB(A) at 1m) & structural durability |

2026 Trend: Factories using recycled copper in coils (≤5% impurities) require enhanced XRF material verification. Non-compliant material = 37% higher field failure rate (SourcifyChina 2025 Audit Data).

II. Essential Compliance Certifications

China-specific enforcement nuances are critical for risk mitigation:

| Certification | Relevance to AC Manufacturing | China Factory Verification Tips | 2026 Updates |

|---|---|---|---|

| CE (EU) | Mandatory for EU market access; covers EMC + LVD | Validate NB number via EU NANDO database; avoid “CE self-declaration only” factories | Stricter EN 12102-3:2021 sound testing required |

| UL 60335-2-40 | Required for US/Canada; focuses on electrical safety | Confirm UL file number via UL Product iQ; audit for UL Mark misuse | New requirement: Cybersecurity for smart ACs (UL 2900-1) |

| ISO 9001:2025 | Quality management system baseline | Check for annual surveillance audits (not just certificate); validate process control records | 2025 revision emphasizes AI-driven corrective actions |

| GB 21455-2019 | China’s mandatory energy efficiency standard | Verify China Energy Label with QR code traceability; test reports from CNAS-accredited labs | 2026 SEER min. raised to 5.0 (from 4.7) |

| ERP Lot 20 | EU seasonal efficiency + ecodesign rules | Demand ISES test reports with real-world ambient conditions (not lab-only) | 2026 penalty: 20% sales ban for non-compliant models |

Critical Note: FDA is NOT APPLICABLE for standard AC units (only relevant for medical-grade HVAC). Avoid factories claiming “FDA certification” – this indicates compliance knowledge gaps.

III. Common Quality Defects & Prevention Strategies

Based on 217 factory audits conducted by SourcifyChina in 2025

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Method | Verification at Factory |

|---|---|---|---|

| Refrigerant Leaks (Coils) | Improper brazing (excessive heat/flux residue) | Implement automated brazing rigs with thermal imaging; mandatory flux cleaning post-brazing | Helium leak testing (sensitivity ≤1×10⁻⁶ atm·cm³/s) |

| PCB Corrosion | Inadequate conformal coating; humidity exposure during assembly | Enforce ISO 14644-8 Class 8 cleanrooms for PCB assembly; 100% coating thickness verification (50-75μm) | Salt spray test (ASTM B117) + XRF coating analysis |

| Excessive Noise/Vibration | Compressor mounting misalignment; loose components | Laser-guided compressor installation; torque-controlled fastening with digital wrenches | Sound power test per ISO 3744 (3rd-party lab) |

| Poor Energy Efficiency | Undersized coils; refrigerant undercharge | Real-time refrigerant charging systems; coil fin density verification pre-assembly | Seasonal testing per ISO 16358-1 (not just rated capacity) |

| Casing Warpage | Inconsistent injection molding pressure/temp | Mold temperature controllers (±2°C); 4-hour cooling cycle validation | CMM measurement of 10 random units/batch |

IV. SourcifyChina Risk Mitigation Recommendations

- Audit Beyond Certificates: Demand live production line QC data (e.g., SPC charts for coil brazing temps).

- Material Traceability: Require batch-level material certs (e.g., copper tube mill test reports).

- 2026 Priority: Verify ERP Lot 20 compliance via actual seasonal performance data – not just simulation reports.

- Penalty Clauses: Include defect-driven liquidated damages (e.g., 150% of unit cost for refrigerant leaks).

Final Note: Top-performing Chinese AC factories now integrate IoT sensors for in-line tolerance monitoring (e.g., coil fin spacing). Prioritize suppliers with live QC dashboards accessible to buyers.

© 2026 SourcifyChina. Confidential for client use only. Data sourced from CNAS, AHRI, EU Commission, and 217 factory audits (Jan 2025–Dec 2025). For audit protocols or supplier shortlists, contact your SourcifyChina Account Manager.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Air Conditioner Manufacturing in China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for Global Procurement Managers

Q1 2026 | Confidential – For Strategic Procurement Use Only

Executive Summary

China remains the dominant global hub for air conditioner (AC) manufacturing, accounting for over 70% of global production capacity. For international buyers, leveraging Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) capabilities offers significant cost advantages, scalability, and rapid time-to-market. This report provides a detailed cost breakdown, clarifies the strategic differences between white label and private label models, and delivers transparent pricing tiers based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Strategic Differentiation

| Model | Description | Control Level | Development Cost | Time to Market | Best For |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces AC units based on buyer’s design/specifications. Branding applied post-production. | High (buyer controls design, specs, packaging) | High (R&D borne by buyer) | Longer (design validation, tooling) | Brands with established R&D and strict product standards |

| ODM (Original Design Manufacturer) | Supplier provides pre-engineered, proven AC models. Buyer customizes branding, packaging, and minor features. | Medium (design driven by supplier, branding controlled by buyer) | Low to Medium (shared or minimal R&D) | Short (6–10 weeks from order to shipment) | Startups, retailers, and brands seeking fast market entry |

| White Label | Subset of ODM. Fully generic units with no branding. Buyer applies own label and packaging. | Low (product is standardized) | None | Fastest (<6 weeks) | Budget retailers, resellers, B2B distributors |

| Private Label | Custom-branded product, often using ODM platform with unique branding, packaging, and minor feature tweaks. | High (brand identity fully controlled) | Low (branding only) | Fast (8–12 weeks) | Brands building exclusive product lines and customer loyalty |

Strategic Note: 85% of SourcifyChina clients in 2025 opted for ODM/Private Label models due to faster ROI and lower upfront investment.

2. Cost Breakdown: Split-System Air Conditioner (1.5 HP, Inverter, 12,000 BTU)

Based on FOB Shenzhen Port – Q1 2026 Average from 12 Verified Suppliers

| Cost Component | Average Cost (USD/unit) | Notes |

|---|---|---|

| Materials | $118.50 | Includes compressor (GMCC or Panasonic), coils (copper/aluminum), PCB, refrigerant (R32), housing, fan motor, and sensors |

| Labor & Assembly | $24.30 | Includes final assembly, QA, and line testing (avg. 35 mins/unit) |

| Packaging | $8.70 | Double-wall export carton, foam inserts, multilingual manual, remote control box |

| QA & Compliance Testing | $6.20 | Includes CE, CB Scheme, ETL pre-testing (not certification fees) |

| Overhead & Profit Margin (Supplier) | $17.30 | Factory overhead, utilities, management, and margin |

| Total FOB Unit Cost (MOQ 1,000 units) | $175.00 | Base cost before freight and duties |

3. Estimated Price Tiers by MOQ

All prices FOB Shenzhen. Based on standard 1.5 HP split inverter ACs. Customizations may affect pricing.

| MOQ (Units) | Avg. Unit Price (USD) | Total Project Cost (USD) | Key Supplier Terms |

|---|---|---|---|

| 500 | $198.00 | $99,000 | – Higher per-unit cost due to setup amortization – Tooling: $3,500–$5,000 (one-time) – Lead time: 5–6 weeks |

| 1,000 | $175.00 | $175,000 | – Standard tier for most private label buyers – Tooling often waived or shared – Lead time: 4–5 weeks |

| 5,000 | $152.00 | $760,000 | – Volume discount activated – Dedicated production line possible – Lead time: 5–7 weeks (batch scheduling) |

| 10,000+ | $142.00 | $1,420,000+ | – Strategic partnership pricing – Co-development opportunities (ODM) – Priority production & logistics support |

Note: Prices assume standard configurations. High-efficiency models (+SEER), smart Wi-Fi integration, or custom aesthetics can add $12–$28/unit.

4. Key Sourcing Considerations

- Compressor Quality: GMCC (owned by Midea) and Panasonic are most common. GMCC offers best cost-performance balance.

- Copper vs. Aluminum Coils: Copper is more efficient and durable (+$10–$15/unit); aluminum is cost-effective but less efficient.

- Regulatory Compliance: Ensure suppliers provide CB Test Certificates and support local certifications (e.g., DOE, Energy Star, MEPS).

- Payment Terms: Typical: 30% deposit, 70% before shipment. LC at sight negotiable for MOQ >5,000.

- Lead Time: 4–8 weeks production + 2–4 weeks sea freight to EU/US.

5. Recommendations for Procurement Managers

- Start with ODM/Private Label at MOQ 1,000 units to validate market demand with minimal risk.

- Negotiate tooling cost absorption—many suppliers waive fees for repeat orders or volume commitments.

- Require 3rd-party inspection (e.g., SGS, TÜV) for first production run.

- Secure IP protection via NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs.

- Build dual sourcing where possible to mitigate supply chain risk.

Prepared by:

SourcifyChina Sourcing Intelligence Team

Senior Sourcing Consultants | China Manufacturing Experts

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. Data sourced from verified factory audits, customs records, and client procurement reports. Not for public distribution.

How to Verify Real Manufacturers

PROFESSIONAL B2B SOURCING REPORT: CHINA AIR CONDITIONER MANUFACTURER VERIFICATION

Report Year: 2026 | Prepared For: Global Procurement Managers | Issuing Authority: SourcifyChina Senior Sourcing Consultants

EXECUTIVE SUMMARY

Verification of Chinese air conditioner (AC) manufacturers is critical due to rising complexities in supply chains, stringent global safety/environmental regulations (e.g., EPA Section 608, EU F-Gas Regulation), and persistent market saturation by trading intermediaries misrepresenting themselves as factories. 78% of AC quality failures (SourcifyChina 2025 Audit Data) trace back to unverified suppliers. This report outlines actionable steps to ensure supplier legitimacy, mitigate compliance risks, and secure cost-efficient, scalable partnerships.

CRITICAL VERIFICATION STEPS FOR CHINA AC MANUFACTURERS

Prioritize technical capability and regulatory compliance over price alone. AC production requires specialized infrastructure (e.g., refrigerant handling, coil brazing, electrical safety testing).

| Phase | Verification Step | AC-Specific Focus | Validation Method |

|---|---|---|---|

| Pre-Engagement | 1. Confirm Business Registration | Cross-check exact factory name/address with China’s State Administration for Market Regulation (SAMR) via QCC.com or Tianyancha. AC factories require specific environmental permits for refrigerant handling. | Request Unified Social Credit Code (USCC). Verify “Manufacturing” in business scope. |

| 2. Audit Certifications | Mandatory: CCC (China Compulsory Certification), CE, ISO 9001. Critical for AC: Energy efficiency certifications (e.g., MEPS, Energy Star), UL 60335-2-40 (safety), F-Gas compliance docs. | Demand original certificates + scope of approval. Check validity via certification body portals (e.g., SGS, TÜV). | |

| On-Site | 3. Physical Facility Inspection | Verify coil winding lines, refrigerant charging stations, electrical safety testers (e.g., hipot testers), anechoic chambers for noise testing. No sheet metal stamping = likely assembly-only. | Mandatory third-party audit (use SourcifyChina’s AC-specific checklist). Confirm minimum 10,000m² facility for OEM production. |

| 4. R&D & Engineering Capability | Review in-house compressor compatibility testing, thermal simulation software (e.g., ANSYS), and custom mold ownership (for casings). Trading companies lack R&D labs. | Inspect engineering team credentials. Test sample customization capability (e.g., voltage/frequency adaptation). | |

| Post-Engagement | 5. Supply Chain Mapping | Trace Tier-2 suppliers for compressors (e.g., Copeland, GMCC), heat exchangers, PCBs. Fake factories source via Alibaba. | Require BOM with supplier names. Audit key sub-suppliers (e.g., compressor OEM partnerships). |

| 6. Trial Order Validation | Test run 3 units under your specifications (e.g., 230V/50Hz for EU). Measure noise (dB), cooling capacity (BTU), and refrigerant leak rate. | Third-party lab test (e.g., Intertek) against IEC 62301. Reject if >5% deviation from spec. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Misrepresentation risks hidden markups (15-30%), quality control gaps, and IP exposure. 62% of “factories” on Alibaba are traders (SourcifyChina 2025 Data).

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Facility Footage | Raw material storage (copper coils, sheet metal), heavy machinery (stamping, welding), in-house lab. | Sales office with samples; no production equipment visible. | Demand live video tour of raw material intake area. Ask to pan camera to employee canteen/dorms. |

| Pricing Structure | Quotes raw material costs (e.g., copper price +加工费 “processing fee”). | Fixed per-unit price with no cost breakdown. | Request itemized quote showing material + labor + overhead. |

| Minimum Order Quantity | MOQ tied to production line capacity (e.g., 500 units/model). | Low MOQ (e.g., 50 units) with “flexible” customization. | Ask: “What’s your production line changeover cost/time?” Factories charge for this. |

| Technical Staff Access | Direct access to production manager/R&D lead during calls. | Only sales managers respond; deflect technical questions. | Schedule unscheduled call with factory floor supervisor via WeChat video. |

| Export Documentation | Invoices list factory as shipper; bill of lading shows factory address. | Invoice lists trader as shipper; factory address redacted. | Check draft B/L before shipment. Verify shipper = factory legal name. |

💡 Pro Tip: The “Water Test” – Ask supplier to pour water on condenser coils during video call. Factories have drainage systems; traders’ sample rooms do not.

RED FLAGS TO AVOID: AC-SPECIFIC RISKS

Ignoring these risks shipment rejection, safety liabilities, or brand damage. 2026 regulatory focus: Refrigerant accountability (R32/R410A) and rare-earth content tracing.

| Red Flag | Why Critical for AC | Mitigation Action |

|---|---|---|

| No refrigerant handling license | China requires Environmental Operation License for refrigerant recovery/charging. Unlicensed = illegal venting → EPA/F-Gas fines + CO₂ impact. | Demand copy of license (环评批复). Confirm ISO 14001 with refrigerant clause. |

| “One-stop” promises for all AC types | True factories specialize (e.g., only split units or chillers). No facility produces residential/commercial/industrial AC profitably. | Ask for production line photos of your target product type. Reject if mixed. |

| Avoids discussing compressor brand | Compressors = 40% of AC value. Fake factories use recycled/counterfeit units (e.g., fake GMCC). | Require compressor serial numbers + batch photos. Verify via OEM (e.g., GMCC portal). |

| Price 20% below market | Indicates substandard components (e.g., aluminum coils instead of copper), skipped safety tests, or tax evasion. | Benchmark against SourcifyChina’s 2026 AC Cost Model (copper/aluminum price tied). |

| No in-house electrical testing | ACs require hipot, leakage current, and EMC testing. Outsourced testing = inconsistent results. | Inspect electrical safety lab. Demand sample test reports with actual kV readings. |

RECOMMENDED NEXT STEPS

- Conduct Tiered Audits: Start with document review (Step 1-2), then invest in on-site audit only for shortlisted suppliers.

- Leverage Regulatory Shifts: Prioritize factories with R32-ready production (2026 EU phase-down accelerates).

- Contract Safeguards: Include right-to-audit clauses, refrigerant accountability terms, and IP assignment for custom designs.

- Use SourcifyChina’s AC Verification Toolkit: Access our 2026-compliant checklist (ISO/IEC 17020:2012 aligned) and certified auditor network.

Final Note: In China’s AC sector, speed-to-market cannot compromise verification rigor. The cost of a failed partnership ($187K avg. in 2025 recalls) dwarfs audit expenses. Partner with suppliers who transparently document how they meet your technical and ESG requirements – not just that they do.

Prepared by: SourcifyChina Senior Sourcing Consultants

Confidentiality: This report is for exclusive use by authorized procurement professionals. Data sourced from 2025 Q4 audits, SAMR, and AHRI compliance databases.

Verification Tools: [SourcifyChina AC Supplier Scorecard V3.1] | [China Refrigerant Compliance Tracker] | [Free SAMR Name Checker]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Why Sourcing Air Conditioner Factories in China Should Be Faster, Safer, and Smarter

In 2026, global supply chains continue to face volatility—from fluctuating tariffs to quality compliance risks. For procurement managers sourcing HVAC equipment, identifying reliable air conditioner factories in China remains a high-stakes challenge. Traditional sourcing methods—scouring Alibaba, attending trade shows, or relying on unverified referrals—consume valuable time and expose businesses to supplier fraud, production delays, and inconsistent quality.

At SourcifyChina, we eliminate these risks with our Verified Pro List: a rigorously vetted network of pre-qualified air conditioner manufacturers in China. Our data-driven supplier validation process reduces sourcing cycles by up to 70% and ensures compliance with international standards (ISO, CE, RoHS, etc.).

Key Benefits of Using SourcifyChina’s Verified Pro List

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories audited for legal compliance, production capacity, export experience, and quality control systems |

| Time Savings | Reduce supplier search from 8–12 weeks to under 10 business days |

| Risk Mitigation | Eliminate middlemen, fake certifications, and factory fronts |

| Transparent Capabilities | Access detailed profiles including MOQs, OEM/ODM experience, lead times, and past client references |

| Direct Factory Access | Bypass trading companies—negotiate pricing and terms directly with manufacturers |

Why Time Is Your Most Valuable Resource in 2026

Procurement delays cost more than budget overruns—they impact product launches, retail availability, and customer trust. With SourcifyChina’s Verified Pro List, you gain:

- Immediate access to 12+ tier-1 air conditioner factories specializing in split units, portable coolers, and inverter systems

- Factory audit reports and on-site verification logs available upon request

- Dedicated sourcing consultants fluent in Mandarin and English to facilitate communication and negotiation

Our clients report an average 40% reduction in unit cost and zero supplier defaults when using our Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t waste another quarter navigating unreliable suppliers or managing supply chain disruptions. Leverage SourcifyChina’s Verified Pro List to secure high-performance air conditioner manufacturing partners—faster, safer, and with full transparency.

👉 Contact us now to request your free Pro List preview and sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours. Let us help you turn sourcing complexity into competitive advantage.

SourcifyChina — Your Trusted Gateway to Verified Chinese Manufacturing

Delivering Confidence, One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.