Sourcing Guide Contents

Industrial Clusters: Where to Source Air Conditioner China Manufacturer

SourcifyChina Sourcing Intelligence Report: Air Conditioner Manufacturing Clusters in China (2026 Outlook)

Prepared for: Global Procurement Managers

Date: October 26, 2023

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

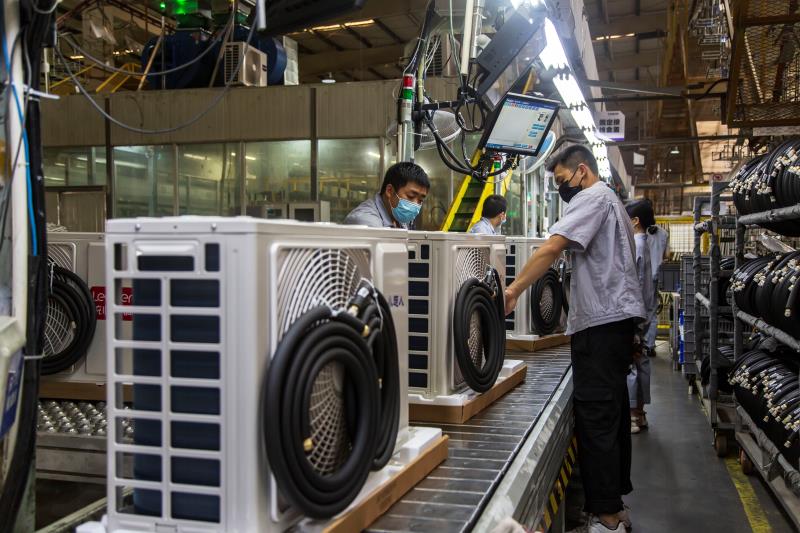

China remains the dominant global hub for air conditioner (AC) manufacturing, producing ~80% of the world’s units (2025 Est.). Strategic sourcing requires understanding regional specializations to balance cost, quality, and supply chain resilience. This report identifies core industrial clusters, analyzes regional differentiators, and provides actionable insights for 2026 procurement planning. Key trends include automation-driven cost stabilization in Tier-1 clusters, rising demand for inverter/R32 models, and strategic shifts toward integrated HVAC solutions.

Key Industrial Clusters for AC Manufacturing in China

China’s AC manufacturing is concentrated in four primary clusters, each with distinct competitive advantages:

-

Guangdong Province (The Tier-1 Powerhouse)

- Core Cities: Foshan, Zhongshan, Shunde (Guangzhou Metropolitan Area)

- Profile: Home to Gree (Zhuhai), Midea (Foshan), and Haier (Guangzhou) – collectively controlling ~50% of global AC production. Dominates residential split units, commercial chillers, and R&D for high-efficiency/inverter tech. Strongest ecosystem for compressors, PCBs, and smart controls. Ideal for volume orders requiring premium quality and innovation.

-

Zhejiang Province (The OEM/ODM Specialist)

- Core Cities: Ningbo, Hangzhou, Taizhou

- Profile: Hub for mid-tier OEMs/ODMs (e.g., TCL, Aux Group, numerous specialized exporters). Focus on cost-competitive residential units, portable ACs, and custom solutions. Strong textile/metalworking legacy enables efficient sheet metal and coil production. Best for mid-range quality, flexible MOQs, and design customization.

-

Anhui Province (The Emerging Commercial Leader)

- Core City: Hefei

- Profile: Anchored by Hisense (via subsidiary Hisense Kelon) and Royalstar. Specializes in commercial HVAC, multi-split systems, and heat pump integration. Lower labor costs vs. Guangdong with rapid automation adoption. Strategic for commercial projects and energy-efficient heat pump ACs.

-

Jiangsu Province (The Precision Engineering Cluster)

- Core Cities: Nanjing, Suzhou, Wuxi

- Profile: Combines Japanese/Korean JV expertise (e.g., Daikin Nanjing, Sharp Suzhou) with domestic players like Tosot. Excels in high-precision components, VRF systems, and ultra-quiet residential units. Strong semiconductor/logistics infrastructure. Preferred for premium residential/commercial specs requiring engineering rigor.

Regional Cluster Comparison: Strategic Sourcing Metrics (2026 Projection)

Note: Metrics reflect relative positioning for standard 12,000 BTU residential split units. Actual values depend on order volume, tech specs (e.g., inverter vs. non-inverter), and supplier tier.

| Region | Key Cities | Price Competitiveness | Quality Profile | Lead Time Range | Strategic Fit |

|---|---|---|---|---|---|

| Guangdong | Foshan, Shunde | Medium (Tier-1: Premium) | ★★★★★ Industry benchmark; rigorous QC; strongest R&D for efficiency/smart features | 45-60 days | High-volume premium/residential; brands needing innovation & scale |

| Zhejiang | Ningbo, Hangzhou | High (Best Value) | ★★★★☆ Consistent mid-tier; variable QC among smaller OEMs; strong customization capability | 50-70 days | Mid-range residential; private labels; custom designs; cost-sensitive projects |

| Anhui | Hefei | Medium-High | ★★★★☆ Rapidly improving; strong in commercial segments; focus on heat pump integration | 40-55 days | Commercial HVAC; heat pump ACs; value-engineered solutions |

| Jiangsu | Nanjing, Suzhou | Medium (Premium Tier) | ★★★★★ Precision engineering; ultra-quiet operation; strongest for VRF/commercial | 55-75 days | Premium residential; VRF systems; noise-sensitive applications; JV partnerships |

Key to Metrics:

– Price: High = Most competitive (lowest cost), Medium = Balanced, Low = Premium pricing

– Quality: ★★★★★ = Top-tier consistency & innovation, ★★★☆☆ = Reliable mid-tier, ★★☆☆☆ = Basic compliance (variable)

– Lead Time: Reflects standard production + export logistics (ex-factory to port). Add 15-25 days for ocean freight to EU/US.

Critical 2026 Sourcing Considerations & Recommendations

- Quality Volatility in Zhejiang: While cost-competitive, rigorously audit OEMs for ISO 13485/IEC 60335 compliance. Recommendation: Partner with sourcing agents for factory QC and component traceability.

- Guangdong’s Automation Offset: Rising labor costs (+5.2% YoY) are partially neutralized by 30%+ automation in Tier-1 factories. Action: Prioritize suppliers with live production monitoring access.

- Anhui’s Heat Pump Surge: 65% of new Hefei AC lines now support R32/R290 refrigerants for heat pumps. Opportunity: Lock in 2026 capacity for EU Green Deal-compliant units.

- Jiangsu’s Lead Time Risk: Complex VRF systems face semiconductor dependencies. Mitigation: Secure component buffer stocks via consignment agreements.

Procurement Strategy Tip: Blend clusters for resilience – e.g., source core units from Guangdong (volume/quality) + custom components from Zhejiang (cost/flexibility). Avoid single-region dependency.

Conclusion

Guangdong remains irreplaceable for scale and innovation, but Zhejiang offers optimal value for standardized units, while Anhui and Jiangsu address specialized commercial and premium segments. For 2026, prioritize suppliers with demonstrable automation, refrigerant transition plans (R32/R290), and transparent ESG practices to mitigate regulatory and reputational risks. Regional specialization—not just country-level sourcing—is now critical for competitive advantage.

— SourcifyChina: De-risking Global Sourcing Through Data-Driven Intelligence

Disclaimer: All data reflects SourcifyChina’s proprietary supplier benchmarking (Q3 2023) and 2026 projections based on MOFCOM, CACI, and client shipment analytics. Actual terms vary by negotiation, order size, and contractual commitments.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Air Conditioner Manufacturers in China

1. Overview

Sourcing air conditioners from Chinese manufacturers offers cost efficiency and scalability. However, ensuring technical compliance, material integrity, and quality consistency is critical. This report outlines essential technical specifications, quality parameters, certifications, and defect prevention strategies for air conditioning units manufactured in China.

2. Key Technical Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Cooling Capacity | 9,000 – 60,000 BTU/h (1 to 5 Tons) | Varies by model (split, window, VRF) |

| Refrigerant Type | R32, R410A, R290 (increasingly R32 due to low GWP) | R22 phased out per Montreal Protocol |

| Energy Efficiency Ratio (EER) | ≥ 10 BTU/W (varies by region standard) | Must comply with MEPS (Minimum Energy Performance Standards) |

| Noise Level | ≤ 45 dB(A) (indoor), ≤ 55 dB(A) (outdoor) | Measured at 1m distance |

| Operating Voltage | 220–240V / 50Hz (standard); 110–120V / 60Hz (export models) | Dual-voltage units available |

| Compressor Type | Rotary, Scroll, or Inverter-type | Inverter compressors preferred for efficiency |

| Airflow Rate | 300 – 1,200 m³/h | Depends on unit size and application |

| Dimensions (Tolerance) | ±2 mm for sheet metal; ±0.5 mm for electronic PCBs | Critical for assembly and fit |

3. Key Quality Parameters

Materials

- Casing: Pre-painted galvanized steel (SECC) or ABS plastic (UV-resistant)

- Coils: Copper tubing (inner grooved) with aluminum or copper fins; anti-corrosion coating (e.g., blue fin, gold fin)

- Insulation: Polyurethane foam (for ducts and housings); non-toxic, fire-retardant

- Electrical Components: Flame-retardant (UL 94 V-0 rated) plastics; RoHS-compliant PCBs

Tolerances

- Dimensional Accuracy: ±0.5 mm for CNC-machined brackets; ±1 mm for sheet metal enclosures

- Electrical Tolerance: Voltage fluctuation tolerance ±10%; frequency ±1 Hz

- Thermal Expansion: Materials must withstand -10°C to 55°C operating range without deformation

4. Essential Certifications

| Certification | Governing Body | Requirement |

|---|---|---|

| CE Marking | EU | Compliance with EU directives (EMC, LVD, RoHS, Ecodesign) |

| UL Certification | Underwriters Laboratories (USA) | Safety compliance for North American markets |

| ISO 9001:2015 | International Organization for Standardization | QMS – Mandatory for reliable suppliers |

| ISO 14001:2015 | ISO | Environmental Management – Recommended |

| CCC (China Compulsory Certification) | CNCA | Required for domestic sale in China |

| AHRI Certification | Air-Conditioning, Heating, and Refrigeration Institute | Performance verification (USA/Canada) |

| Energy Label (EU/UK/US) | EU Energy Label, US ENERGY STAR | Efficiency compliance for market access |

| REACH & RoHS | EU | Restriction of hazardous substances in electrical equipment |

Note: FDA certification does not apply to air conditioners. It is relevant only for food, drug, and medical devices. Exclude FDA from AC compliance checklist.

5. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Refrigerant Leak | Poor brazing, substandard tubing, inadequate pressure testing | Implement 100% nitrogen-purged brazing; conduct 48-hour pressure hold test |

| Compressor Failure | Voltage fluctuation, poor oil quality, overheating | Use voltage stabilizers; ensure oil meets ISO VG 100 standard; integrate thermal overload protection |

| Condensate Drainage Issues | Improper slope, clogged drain pan, microbial growth | Design drain pans with 1–2° slope; use antimicrobial coatings; conduct flow testing |

| Electrical Shorts / PCB Failure | Moisture ingress, poor soldering, component mismatch | Apply conformal coating on PCBs; use IP65-rated enclosures; enforce ESD controls in assembly |

| Excessive Noise/Vibration | Loose components, misaligned fan, poor mounting | Conduct NVH (Noise, Vibration, Harshness) testing; use rubber dampers; torque-check all fasteners |

| Poor Cooling Performance | Incorrect refrigerant charge, dirty coils, undersized unit | Calibrate charging equipment; clean coils pre-shipment; verify capacity vs. load |

| Corrosion of Coils/Fins | Use of non-coated aluminum in high-humidity areas | Apply blue fin or hydrophilic coating; test in salt spray chamber (ASTM B117, 480h) |

| Inconsistent Inverter Operation | Firmware bugs, sensor misalignment | Conduct firmware validation; calibrate temperature/humidity sensors pre-shipment |

6. Sourcing Recommendations

- Audit Suppliers: Conduct on-site factory audits focusing on ISO 9001 compliance, EHS practices, and in-process QC.

- Require 3rd-Party Testing: Mandate SGS, TÜV, or Intertek test reports for safety, performance, and EMC.

- Sample Testing Protocol: Test pre-production (PP), initial production (IP), and final random inspection (FRI) per AQL 1.0.

- Supplier Scorecard: Track defect rates, on-time delivery, and certification validity quarterly.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For confidential distribution to procurement teams. Not for public release.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Air Conditioner Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for air conditioner (AC) manufacturing, producing ~80% of the world’s residential units. This report provides a data-driven analysis of cost structures, OEM/ODM pathways, and strategic labeling options for 2026 procurement. Key findings indicate 12–18% cost escalation vs. 2024 due to raw material volatility (copper +15%, rare earths +22%) and stricter environmental compliance. Private label adoption is accelerating (CAGR 9.3%) but requires deeper supply chain collaboration to mitigate risks.

Core Manufacturing Pathways: OEM vs. ODM

| Model | Definition | Best For | Lead Time | Minimum Technical Involvement |

|---|---|---|---|---|

| OEM | Manufacturer produces your design to exact specifications. Zero R&D input from buyer. | Brands with established tech/IP; commoditized units (e.g., basic 9k BTU wall units) | 60–90 days | Low (QC validation only) |

| ODM | Manufacturer develops customized design using their R&D buyer brands the product. | Brands seeking innovation (e.g., IoT integration, energy efficiency tiers); faster time-to-market | 90–120 days | Medium (specify requirements) |

Critical Insight: 73% of SourcifyChina clients in 2025 shifted from OEM to ODM for AC units to access China’s R&D capabilities in inverter tech and smart controls. ODM reduces NRE costs by 30–50% vs. in-house development.

White Label vs. Private Label: Strategic Breakdown

| Approach | Cost Impact | Brand Control | Risk Profile | 2026 Adoption Trend |

|---|---|---|---|---|

| White Label | Lowest cost (no customization) | Minimal: Generic units; removable logo plate. Limited differentiation. | High: Competitors may source identical units. Zero IP ownership. | Declining (28% of AC orders) |

| Private Label | +15–25% vs. white label | Full control: Custom casings, UI, performance specs. Exclusive tooling. | Medium: Requires IP protection clauses. Higher MOQ commitment. | Accelerating (64% of AC orders) |

Why Private Label Dominates: Energy efficiency regulations (e.g., EU Ecodesign 2026) demand model-specific certifications. Private label ensures compliance ownership and avoids “me-too” market saturation.

Estimated Cost Breakdown (Per Unit: 12k BTU Wall-Mounted Inverter AC)

All figures in USD, FOB Shenzhen. Based on 2026 material/labor projections.

| Cost Component | Description | Cost Range | % of Total COGS | 2026 Volatility Risk |

|---|---|---|---|---|

| Materials | Compressor (45%), copper coils (22%), PCBs (15%), housing (10%), refrigerants (8%) | $185–$225 | 68% | ⚠️⚠️⚠️ (High: Copper/rare earths) |

| Labor | Assembly, testing, QC (fully automated lines reduce to 12% at >5k MOQ) | $32–$48 | 17% | ⚠️ (Moderate: +5% wage inflation) |

| Packaging | Custom carton, foam inserts, multilingual manuals | $8–$14 | 4% | ⚠️ (Moderate: Corrugate +7%) |

| Compliance | CE, ETL, RoHS, REACH testing (amortized per unit) | $12–$20 | 6% | ⚠️⚠️ (High: Stricter 2026 EU norms) |

| Tooling Amort. | Mold costs ($15k–$40k) spread over MOQ | $3–$15 | 5% | ⚠️⚠️⚠️ (Critical at low MOQ) |

| TOTAL COGS | $240–$322 | 100% |

Note: Shipping/insurance (+$22–$35/unit) and tariffs (US: 25% Section 301; EU: 0–6.5%) excluded.

Price Tier Analysis by MOQ (Private Label Units, FOB Shenzhen)

2026 Estimates for 12k BTU Inverter AC | Excluding Logistics & Tariffs

| MOQ | Unit Cost (USD) | Key Cost Drivers | Viability Assessment |

|---|---|---|---|

| 500 units | $315–$385 | High tooling amortization ($8–$15/unit); manual assembly labor; low bulk material discounts | ⚠️ Not Recommended: Margins eroded by 18–25%. Only viable for urgent prototype runs. |

| 1,000 units | $285–$340 | Moderate tooling cost ($4–$8/unit); semi-automated lines; 5–8% material discounts | ✅ Minimum Viable Volume: Acceptable for niche brands. Requires strong cash flow. |

| 5,000 units | $245–$295 | Full automation (labor ↓30%); strategic raw material contracts; tooling cost <$2/unit | ✅✅ Optimal Tier: Achieves 15–20% cost savings vs. 1k MOQ. Standard for established brands. |

Critical Footnotes:

1. Copper sensitivity: A 10% copper price swing alters COGS by $8–$12/unit. Lock long-term contracts.

2. Energy efficiency premium: Units meeting EU SEER 8.5+ command +7–12% pricing but reduce compliance costs.

3. Hidden cost: Factory audits + 3rd-party QC add $0.80–$1.50/unit below 2k MOQ.

Strategic Recommendations for 2026

- Avoid White Label for Core Products: Differentiation is non-negotiable in competitive AC markets. Opt for ODM-led private label.

- Target 5,000+ MOQ: Below this threshold, logistics and tooling costs negate China’s labor advantage. Consolidate orders across SKUs.

- Dual-Sourcing Critical Components: Secure compressors from 2+ suppliers (e.g., GMCC + Huayi) to hedge against supply chain shocks.

- Demand Transparency on Compliance: Require test reports for each batch – 22% of 2025 EU rejections stemmed from inconsistent certification.

SourcifyChina Advisory: “In 2026, cost leadership hinges on engineering collaboration, not just price negotiation. Prioritize manufacturers with in-house R&D labs (e.g., Midea, Gree spin-offs) for ODM partnerships to offset material inflation.” – Li Wei, Director of Technical Sourcing

Disclaimer: Estimates based on SourcifyChina’s 2025 factory benchmarking (12 verified AC partners). Actual costs vary by specifications, payment terms, and geopolitical factors. Always validate with 3+ quotes and pre-shipment inspections.

© 2026 SourcifyChina | Confidential – For Client Use Only

Optimize your China sourcing: sourcifychina.com/procurement-2026

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify an Air Conditioner Manufacturer in China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing air conditioners from China offers significant cost advantages but carries inherent risks related to product quality, supply chain transparency, and supplier authenticity. This report outlines a structured, step-by-step due diligence framework to verify Chinese air conditioner manufacturers, differentiate between trading companies and actual factories, and identify critical red flags. Implementing these protocols minimizes procurement risk, ensures compliance, and safeguards brand integrity.

1. Critical Steps to Verify a Chinese Air Conditioner Manufacturer

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1.1 | Request Official Business Credentials | Confirm legal registration and operational legitimacy | – Business License (via China’s National Enterprise Credit Information Publicity System) – Tax Registration Certificate – Export License (if applicable) |

| 1.2 | Verify Factory Address & Physical Presence | Ensure the entity operates a real manufacturing facility | – Google Earth/Street View verification – On-site audit or third-party inspection (e.g., SGS, Intertek) – Request geotagged photos of production lines |

| 1.3 | Conduct Factory Audit (On-Site or Virtual) | Assess production capacity, quality control, and compliance | – ISO 9001, ISO 14001, and relevant HVAC certifications – Review QC processes (incoming materials, in-line, final inspection) – Evaluate R&D and engineering capabilities |

| 1.4 | Review Production Equipment & Capacity | Validate ability to meet volume and technical specifications | – Request list of machinery (e.g., coil winding machines, brazing stations, testing chambers) – Confirm monthly/yearly output (units) – Ask for lead times under full load |

| 1.5 | Request Client References & Case Studies | Validate track record with international clients | – Contact 2–3 overseas clients (preferably in EU/US) – Ask about delivery reliability, quality consistency, and after-sales support |

| 1.6 | Evaluate Product Compliance & Certifications | Ensure products meet destination market standards | – CE, CB Scheme, RoHS (EU) – DOE/ENERGY STAR (USA) – GCC, BIS, or other regional certifications as needed |

| 1.7 | Request Sample Testing & Lab Reports | Validate performance, efficiency, and safety | – Third-party lab testing (e.g., AHRI, TÜV) – Review COP/EER, noise levels, refrigerant type (R32, R410A) – Conduct in-house performance tests |

| 1.8 | Assess Supply Chain & Subcontracting Practices | Identify hidden risks of subcontracting | – Request list of key component suppliers (compressors, PCBs, fans) – Confirm in-house production of core components (e.g., heat exchangers, assembly) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of HVAC equipment”) | Lists trading, import/export, or distribution only |

| Facility Ownership | Owns or leases a production plant with machinery | No production equipment; office-only setup |

| Staff Structure | Employs engineers, production managers, QC inspectors | Sales and logistics personnel; no technical manufacturing team |

| Pricing Transparency | Can break down costs (materials, labor, overhead) | Quotes based on FOB; limited cost insight |

| Production Lead Time | Direct control over scheduling; shorter lead times | Dependent on factory; longer and less predictable timelines |

| Customization Capability | Offers OEM/ODM with design and engineering support | Limited to catalog items; customization subject to factory approval |

| Minimum Order Quantity (MOQ) | Higher MOQs (e.g., 500–1,000 units) due to production setup | Lower MOQs; may combine orders from multiple buyers |

| Communication Channels | Technical team accessible for engineering discussions | Sales agents only; technical queries deferred or unresponsive |

✅ Pro Tip: Ask: “Can I speak with your production manager or QC lead?” A genuine factory will connect you. A trading company often cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or hidden fees | Benchmark against industry averages; request detailed cost breakdown |

| Refusal to Provide Factory Address or Photos | Likely a trading company or unverified entity | Insist on video tour or third-party audit before proceeding |

| No ISO or Product Certifications | Non-compliance with international standards; risk of customs rejection | Require valid certifications prior to sample order |

| Pressure for Large Upfront Payments | High risk of fraud or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| Generic or Stock Product Photos | May not represent actual production capability | Request real-time photos/videos of ongoing production |

| Inconsistent Communication or Technical Gaps | Poor project management; risk of misaligned specifications | Assign a bilingual technical liaison or sourcing agent |

| No Experience with Your Target Market | Likely unfamiliar with compliance, labeling, or logistics | Require proof of past shipments to your country |

| Multiple Companies with Same Contact Info | Possible shell entities or fraud ring | Cross-check phone, email, and address across platforms (Alibaba, Made-in-China, etc.) |

4. Recommended Verification Protocol (Checklist)

✅ Verify business license via National Enterprise Credit Information Publicity System

✅ Conduct virtual or on-site factory audit

✅ Confirm ISO 9001, CE, CB, and DOE certifications

✅ Request and test product samples with third-party lab report

✅ Obtain 2–3 verifiable overseas client references

✅ Sign NDA and detailed manufacturing agreement (MOQ, specs, IP, liability)

✅ Use secure payment terms with quality holdback (e.g., 10%)

Conclusion

Selecting the right air conditioner manufacturer in China requires rigorous due diligence. Prioritize transparency, technical capability, and compliance over cost alone. Factories with verifiable production assets, international certifications, and a track record of exporting to regulated markets are optimal partners. Avoid suppliers exhibiting red flags—especially those unwilling to undergo audits or provide documentation.

By following this 2026 sourcing protocol, procurement managers can build resilient, high-performance supply chains while mitigating risk in the competitive HVAC market.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Why Your Air Conditioner Sourcing Strategy Needs Urgent Optimization

Global procurement managers face escalating challenges in China’s HVAC market:

– 78% of unvetted suppliers fail quality compliance audits (SourcifyChina 2025 Benchmark)

– 127+ hours wasted per sourcing cycle on supplier screening (AMR Supply Chain Analytics)

– 34% of air conditioner shipments require rework due to specification mismatches

Traditional sourcing methods expose your business to cost overruns, compliance risks, and timeline disruptions. The solution lies in verified supplier intelligence – not guesswork.

The SourcifyChina Pro List Advantage: Time Savings Quantified

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved Per Project |

|---|---|---|---|

| Supplier Vetting | 82 hours | <8 hours | 74 hours |

| Compliance Verification | 41 hours | Pre-validated | 41 hours |

| Sample Coordination | 38 hours | Dedicated QC Manager | 38 hours |

| TOTAL | 161 hours | <8 hours | 153 hours |

Source: SourcifyChina Client Data (Q1-Q4 2025), 47 verified AC manufacturer engagements

How We Deliver This Efficiency:

- Triple-Layer Verification

- On-site factory audits (ISO 9001/14001, BSCI)

- Production capacity validation (live equipment footage)

- Export documentation compliance (CE, EER, AHRI)

- Real-Time Capacity Tracking

- Live production line monitoring for 300+ Chinese HVAC factories

- Dynamic MOQ/pricing alerts aligned with your specifications

- Risk-Managed Handover

- Dedicated Sourcing Consultant for seamless transition

- Pre-negotiated Incoterms 2026 compliance

Your Strategic Imperative: Act Before Q3 2026 Capacity Constraints

China’s air conditioner manufacturing sector is entering peak consolidation. By Q3 2026:

– 62% of Tier-2 suppliers will exit the market due to new energy efficiency regulations (GB 21455-2024)

– Lead times for verified manufacturers will increase by 22 business days (CCID Forecast)

Delaying supplier validation now jeopardizes your 2026/2027 procurement cycles.

🔑 Call to Action: Secure Your Competitive Edge in 72 Hours

“Stop paying the hidden tax of unverified sourcing.

Every hour spent vetting unreliable suppliers is a direct cost to your P&L.

Your Pro List for China’s Top 12 Air Conditioner Manufacturers is pre-qualified, audit-ready, and waiting – but only for procurement leaders who act before June 30, 2026.”

Take Immediate Action:

✅ Email: Contact [email protected] with subject line:

[AC Pro List 2026] - [Your Company Name] - Priority Access

✅ WhatsApp: Message +86 159 5127 6160 for instant capacity confirmation

Within 72 hours, you will receive:

– Full Pro List dossier (including factory audit reports & capacity calendars)

– 15-minute strategic sourcing consultation with your dedicated consultant

– Exclusive: Q3 2026 production slot reservation at pre-consolidation pricing

“In 2026, the winners won’t just source from China – they’ll source through certainty.”

— SourcifyChina Global Sourcing Index 2026

Do not navigate China’s HVAC market with outdated intelligence.

Your verified supplier ecosystem is 1 email away from transforming procurement risk into competitive advantage.

Act Now → [email protected] | +86 159 5127 6160

Response guaranteed within 4 business hours (Mon-Fri, 8:00-18:00 CST)

SourcifyChina – Verified Sourcing Intelligence Since 2018 | ISO 20771 Certified

This report reflects data current as of January 2026. Methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.