The global air coil manufacturing market has experienced steady expansion, driven by rising demand across HVAC, automotive, and industrial sectors. According to Grand View Research, the global heat exchanger market—of which air coils are a critical component—was valued at USD 38.4 billion in 2022 and is projected to grow at a CAGR of 7.2% from 2023 to 2030. This growth is fueled by increasing energy efficiency standards and expanding infrastructure in emerging economies. Additionally, Mordor Intelligence reports that advancements in coil materials and manufacturing technologies are enhancing performance and durability, further accelerating adoption. As industries prioritize efficient thermal management solutions, air coils have become indispensable in applications ranging from commercial refrigeration to renewable energy systems. In this competitive landscape, a select group of manufacturers are leading innovation, scalability, and global reach—setting the benchmark for quality and reliability. Here’s a data-backed look at the top 10 air coil manufacturers shaping the industry’s future.

Top 10 Air Coil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 USA Coil & Air

Domain Est. 1999

Website: usacoil.com

Key Highlights: … COIL | Email: [email protected]. USA Coil & Air provides replacements of OEM coils and is not affiliated with any of the manufacturers listed on our website…..

#2 Custom & OEM HVAC Coils

Domain Est. 2005

Website: precision-coils.com

Key Highlights: Precision Coils manufactures custom HVAC/R heat transfer products for replacement, original equipment manufacturers, and design build with fast lead times….

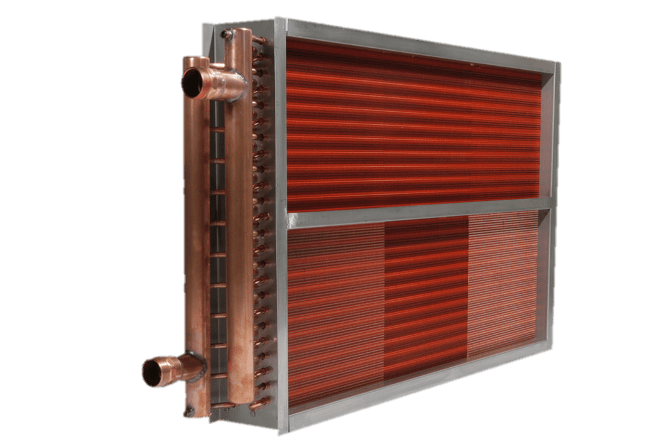

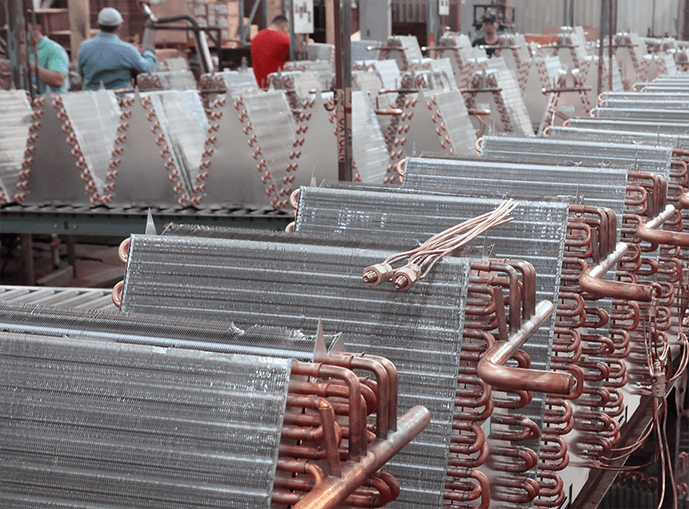

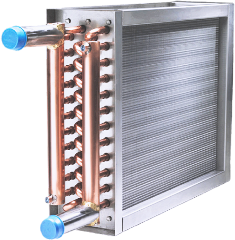

#3 Colmac Coil Manufacturing

Domain Est. 1997

Website: colmaccoil.com

Key Highlights: Colmac Coil manufactures new and replacement plate fin heating and cooling coils, dry coolers, air-cooled condensers, and heat pipe air-to-air heat exchangers….

#4 Aspen Manufacturing

Domain Est. 1999

Website: rustdesk.aspenmfg.com

Key Highlights: THE LARGEST · independent manufacturer · of coils & air handlers · based in the USA. · WITH ALL MAJOR · HVAC BRANDS….

#5 North America HVAC Coil Supplier

Domain Est. 2006

Website: coilreplacement.com

Key Highlights: CRC has been a trusted leader in supplying coils, heat exchangers, products, and systems for the commercial and industrial HVAC industries for North America….

#6 Capital Coil & Air

Domain Est. 2015

Website: capitalcoil.com

Key Highlights: Capital Coil & Air is a leader in commercial & industrial HVAC coil replacement and manufacturing offering same day quotes and uncommonly fast shipping….

#7 Nortek Air Solutions

Domain Est. 2015

Website: nortekair.com

Key Highlights: Nortek Air Solutions is the world’s largest custom HVAC manufacturer, building efficient, dependable heating and cooling systems that create ideal ……

#8 Baltimore Aircoil Company

Domain Est. 1998

Website: baltimoreaircoil.com

Key Highlights: BAC is proud to be the world’s cooling partner. Choose your location here….

#9 Coil Company

Domain Est. 1998

Website: coilcompany.com

Key Highlights: Coil Company is Americas first coil replacement specialist. Coil Company has a team of experts standing by to assist you with your coil replacement….

#10 Coilmaster

Domain Est. 2001

Website: coilmastercorp.com

Key Highlights: Coilmaster provides custom heat exchangers and coils backed by guaranteed 15-day lead times, advanced software, and dedicated engineering support….

Expert Sourcing Insights for Air Coil

H2: Market Trends for Air Coil in 2026

As the global industrial and technological landscape evolves, the air coil market is poised for significant transformation by 2026. Driven by advances in automation, electric mobility, renewable energy integration, and Industry 4.0, air coils—passive electromagnetic components used in sensors, actuators, transformers, and wireless power systems—are witnessing renewed demand across multiple sectors. Below are the key market trends shaping the air coil industry in 2026.

-

Growth in Electric Vehicles (EVs) and Charging Infrastructure

The rapid adoption of electric vehicles is a primary driver for air coil demand. Air coils are critical in EV charging systems, especially in inductive (wireless) charging pads, where they facilitate efficient energy transfer without physical connectors. By 2026, with governments pushing for zero-emission transportation and automakers expanding EV lineups, the need for high-efficiency, compact air coils in onboard chargers and ground-based charging stations is expected to surge. -

Expansion of Wireless Power Transfer (WPT) Applications

Wireless charging is no longer limited to smartphones. In 2026, air coils are increasingly embedded in consumer electronics, medical devices, industrial tools, and smart home systems. The development of resonant inductive coupling and improved coil design (e.g., planar and multi-layer coils) has boosted efficiency and range, making air coils more viable for mid- and long-range power transfer applications. -

Integration in Industrial Automation and IoT Sensors

Air coils play a vital role in proximity sensors, current sensors, and RFID systems used in smart factories. As Industry 4.0 adoption accelerates, especially in manufacturing hubs across Asia-Pacific, North America, and Europe, the demand for reliable, contactless sensing components like air coils is increasing. Their durability, lack of moving parts, and immunity to environmental contaminants make them ideal for harsh industrial environments. -

Advancements in Material Science and Miniaturization

In 2026, innovations in conductor materials—such as Litz wire, silver-coated copper, and high-permeability core alternatives—are enabling air coils with lower resistance, reduced electromagnetic interference (EMI), and higher Q-factors. Additionally, miniaturization trends in electronics are pushing manufacturers to develop compact, high-performance air coils using advanced winding techniques and 3D printing technologies. -

Rise in Renewable Energy and Energy Storage Systems

Air coils are used in inverters, converters, and grid-tied systems for solar and wind energy installations. As renewable energy capacity expands globally, especially in emerging markets, the need for reliable passive components like air coils will grow. They are also being integrated into battery management systems (BMS) and fast-charging stations for energy storage, further boosting market demand. -

Regional Market Shifts and Supply Chain Optimization

Asia-Pacific, led by China, Japan, and South Korea, remains the dominant producer and consumer of air coils due to its robust electronics manufacturing base. However, by 2026, North America and Europe are witnessing a resurgence in local production, driven by supply chain resilience initiatives and nearshoring trends post-pandemic. This shift is encouraging investment in automated coil winding and quality control technologies. -

Focus on Sustainability and Circular Design

Environmental regulations and corporate sustainability goals are influencing air coil design. Manufacturers are increasingly using recyclable materials, reducing hazardous substances (in line with RoHS and REACH standards), and improving energy efficiency across the product lifecycle. This trend is especially notable in the EU, where circular economy principles are shaping electronic component design.

In conclusion, the air coil market in 2026 is characterized by strong growth, technological innovation, and diversification of applications. With increasing integration in EVs, wireless power, industrial IoT, and clean energy systems, air coils are transitioning from niche components to essential enablers of next-generation technologies. Companies that invest in R&D, sustainability, and agile manufacturing are likely to lead the market in this dynamic environment.

Common Pitfalls Sourcing Air Coils (Quality, IP)

Sourcing air coils—especially for demanding applications in electronics, telecommunications, or industrial systems—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to significant performance, legal, and financial risks. Below are common pitfalls to avoid:

1. Prioritizing Cost Over Quality

One of the most frequent mistakes is selecting suppliers based solely on the lowest price. Air coils manufactured with substandard materials or poor winding techniques often exhibit inconsistent inductance, higher resistance, and susceptibility to thermal drift. This can compromise circuit performance and reliability, especially in precision applications.

Mitigation: Evaluate total cost of ownership, including failure rates, warranty support, and long-term performance. Request samples and conduct rigorous testing for inductance tolerance, Q-factor, and thermal stability.

2. Inadequate Specification Clarity

Ambiguous or incomplete technical specifications—such as inductance value, tolerance, current rating, core material (if any), and dimensional constraints—can lead to incorrect components being supplied. This is particularly critical with custom-designed air coils.

Mitigation: Provide detailed engineering drawings and performance requirements. Use standardized measurement conditions (e.g., frequency, temperature) to ensure consistency across suppliers.

3. Overlooking Environmental and Mechanical Durability

Air coils may be exposed to humidity, vibration, or extreme temperatures. Sourcing coils without proper potting, coating, or mechanical support can result in early failure due to wire breakage, corrosion, or de-tuning.

Mitigation: Specify required environmental protection (e.g., conformal coating, encapsulation) and ensure mechanical robustness for the intended application environment.

4. Ignoring Intellectual Property (IP) Rights

Using a design or coil configuration that is patented or protected under trade secrets can expose the buyer to legal action. This is especially risky when reverse-engineering a competitor’s product or sourcing from suppliers offering “compatible” replacements.

Mitigation: Conduct IP due diligence. Ensure that custom designs are either licensed, in the public domain, or developed in-house with proper documentation. Use non-disclosure agreements (NDAs) when sharing proprietary designs with suppliers.

5. Lack of Traceability and Certifications

Suppliers that cannot provide material traceability, process certifications (e.g., ISO 9001), or compliance with industry standards (e.g., RoHS, REACH) may compromise product reliability and regulatory compliance.

Mitigation: Require documentation of quality management systems, material certifications, and compliance reports. Audit key suppliers regularly.

6. Dependence on Single or Unverified Suppliers

Relying on a single source—especially an unproven or offshore manufacturer—can create supply chain vulnerabilities. Quality inconsistencies and communication barriers may go unnoticed until failures occur.

Mitigation: Qualify multiple suppliers. Conduct on-site audits or third-party assessments to verify manufacturing capabilities and quality control processes.

7. Assuming Custom Designs Are Automatically Protected

Even if you provide a unique coil design to a manufacturer, without a clear contractual agreement, the supplier may retain rights to reproduce or sell the design to others.

Mitigation: Use strong contractual terms that assign IP ownership to the buyer and include clauses for non-compete and confidentiality.

By proactively addressing these pitfalls, companies can ensure they source air coils that meet both technical performance standards and legal requirements, minimizing risk and supporting long-term product success.

Logistics & Compliance Guide for Air Coil

Air coils, often used in electrical, automotive, and industrial applications, present unique logistical and compliance challenges due to their size, weight, and susceptibility to damage. This guide outlines best practices for safe and compliant handling, packaging, transportation, and documentation.

Packaging and Handling

Proper packaging is essential to prevent deformation, corrosion, and mechanical damage during transit.

- Use rigid, reinforced wooden crates or heavy-duty pallets with edge protectors to support the coil’s structure.

- Secure the coil with cradle supports or blocking to prevent rolling or shifting.

- Apply protective wrapping such as VCI (Vapor Corrosion Inhibitor) film or shrink wrap to guard against moisture and contaminants.

- Clearly label packages with “Fragile,” “This Side Up,” and handling instructions indicating the coil’s center of gravity and lifting points.

Transportation Requirements

Air coils often exceed standard freight dimensions, requiring special transport arrangements.

- Confirm carrier compatibility with oversized or heavy loads; flatbed trucks or open-top containers may be necessary.

- For air freight, verify aircraft cargo door dimensions and weight limits—early coordination with freight forwarders is critical.

- Use dedicated transport when possible to minimize transloading and reduce handling risks.

- Monitor environmental conditions (humidity, temperature) during transit, especially for extended shipments.

Regulatory Compliance

Ensure adherence to international and regional regulations affecting coil shipment.

- Comply with International Safe Transit Association (ISTA) standards for packaging performance.

- Follow International Maritime Organization (IMO) and IATA regulations when shipping by sea or air, respectively.

- For shipments to the EU, ensure packaging materials meet EU Timber Regulation (EUTR) and ISPM 15 standards for wood packaging.

- Adhere to local regulations regarding hazardous materials if protective coatings or treatments are applied.

Documentation

Accurate documentation supports customs clearance and regulatory compliance.

- Prepare a detailed commercial invoice including coil specifications (dimensions, weight, material type).

- Include a packing list indicating number of coils, packaging type, and gross/net weights.

- Provide a certificate of origin if required by trade agreements.

- For international shipments, complete export declarations and obtain necessary export licenses, especially if dual-use technology is involved.

- Maintain Material Safety Data Sheets (MSDS/SDS) if the coil includes treated surfaces or coatings.

Import and Customs Considerations

Facilitate smooth customs processing to avoid delays.

- Classify the air coil correctly under the Harmonized System (HS Code)—typically within chapters 73 (iron/steel products) or 85 (electrical machinery), depending on use.

- Verify tariff rates, import restrictions, and applicable duties based on destination country.

- Include any required conformity assessment certificates (e.g., CE marking for EU, UL listing for U.S.).

- Work with a licensed customs broker for complex or high-value shipments.

Risk Mitigation and Insurance

Protect against financial loss from transit damage or delays.

- Purchase all-risk cargo insurance covering physical damage, theft, and environmental exposure.

- Conduct pre-shipment inspections and document coil condition with photographs.

- Implement tracking and monitoring systems (GPS, temperature/humidity sensors) for high-value loads.

- Establish contingency plans for rerouting or emergency storage if delays occur.

By adhering to this logistics and compliance framework, businesses can ensure air coils are transported safely, efficiently, and in accordance with global regulatory standards.

Conclusion for Sourcing Air Coils

In conclusion, sourcing air coils requires a strategic approach that balances quality, cost, technical specifications, and supplier reliability. Air coils, being essential components in various electronic and RF applications, demand careful consideration of parameters such as inductance, tolerance, Q-factor, current rating, and physical dimensions. A thorough evaluation of potential suppliers—assessing their manufacturing capabilities, quality control processes, compliance with industry standards, and lead times—is crucial to ensure consistent performance and supply chain stability.

Additionally, engaging in long-term partnerships with reputable manufacturers or distributors can lead to better pricing, priority access during high-demand periods, and opportunities for customization. Leveraging both domestic and international sourcing options, while considering logistics and total cost of ownership, further enhances sourcing efficiency.

Ultimately, a well-structured sourcing strategy for air coils not only supports product reliability and performance but also contributes to overall cost optimization and time-to-market advantages. Continuous monitoring of market trends, technological advancements, and supplier performance will ensure sustained success in sourcing this critical passive component.