The global air assisted airless spray technology market is experiencing robust growth, driven by rising demand for efficient, high-quality coating solutions across industries such as automotive, construction, and industrial manufacturing. According to Grand View Research, the global spray painting equipment market was valued at USD 8.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This expansion is fueled by increasing emphasis on reducing overspray, improving transfer efficiency, and meeting stringent environmental regulations. Air assisted airless (AAA) systems, which combine the high output of airless sprayers with the atomization control of conventional air spray, have emerged as a preferred solution for professional finishers seeking precision and productivity. With innovation accelerating among key players, the competitive landscape is evolving to meet the needs of both commercial contractors and industrial end-users. Based on market presence, technological capabilities, and customer reach, here are the top 9 air assisted airless manufacturers shaping the future of spray application technology.

Top 9 Air Assisted Airless Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Airmix® spray technology

Domain Est. 1999

Website: sames.com

Key Highlights: Airmix® HVLP (HVLP air-assisted airless) with the Xcite®+ soft trigger is ideal for small to large productions (kitchen cabinets, industrial equipment). Painter ……

#2 Air

Domain Est. 1994

Website: graco.com

Key Highlights: Air-Assisted Airless Spray Guns. An air-assisted airless spray gun can produce fine atomization when spraying medium to high viscosity fluids….

#3 Air Assist Airless (AAA) Technology

Domain Est. 1997

#4 Air

Domain Est. 1995

Website: binks.com

Key Highlights: We offer a complete line of pressure tanks, pneumatic and electric pumps as well as plural component metering equipment to provide your coating materials to the ……

#5 WAGNER AirCoat

Domain Est. 1998

Website: wagner-group.com

Key Highlights: AirCoat is an air assisted process for applying paints and varnishes with a paint sprayer. The material is atomised at the nozzle of the unit using the airless ……

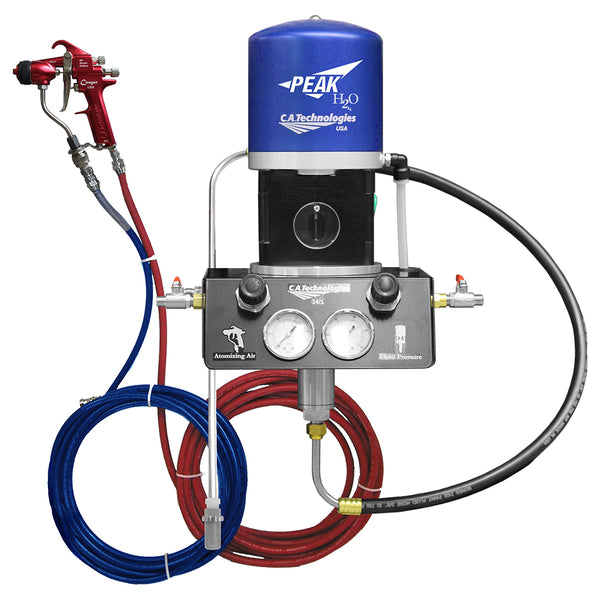

#6 C.A. Technologies

Domain Est. 1999

Website: spraycat.com

Key Highlights: Applying. Air Assist Airless Equipment · Automatic Spray Guns · CAT Packs · Conventional Spray Guns · H2O Equipment · HVLP Spray Guns · Pressure Reduced ……

#7 Air Assisted Airless Painting Systems

Domain Est. 2000

Website: mcsupply.org

Key Highlights: Airless Atomization is assisted by air atomization to provide a finer finish and break up the tailing effect at the edge of the spray pattern….

#8 Air

Domain Est. 2005

Website: elcometerusa.com

Key Highlights: 3-day delivery 7-day returnsElcometer Air-assisted airless pumps engineered for precision and durability in coating applications. Deliver consistent, pulse-free performance and ……

#9 Air Assisted Airless Spray Guns (AAA) Archives

Domain Est. 2008

Website: sagolausa.com

Key Highlights: 2-day delivery 7-day returnsSagola Mini Xtreme Mix – Air Assisted Airless Spray Gun · Categories · Price · Featured · Sagola 2100 XD Spray Gun · Sagola 3600 XPT Spray Gun · Sagola …

Expert Sourcing Insights for Air Assisted Airless

H2: Projected 2026 Market Trends for Air Assisted Airless Spray Technology

The air assisted airless (AAA) spray technology market is poised for significant evolution by 2026, driven by advancements in coating efficiency, sustainability mandates, and growing demand across key industrial sectors. This H2 section outlines the major market trends expected to shape the AAA landscape in 2026.

-

Increased Adoption in High-Performance Coating Applications

By 2026, air assisted airless systems are anticipated to gain stronger traction in industries requiring precision and high transfer efficiency, such as automotive refinishing, aerospace, and heavy equipment manufacturing. The technology’s ability to deliver a finer atomization than traditional airless systems—while maintaining high material throughput—makes it ideal for achieving smooth, professional finishes with reduced overspray. OEMs and industrial coaters are expected to increasingly favor AAA systems to meet stringent quality and environmental standards. -

Integration of Smart and IoT-Enabled Systems

A defining trend in 2026 will be the integration of smart technologies into AAA equipment. Manufacturers are investing in IoT-connected spray guns and automated control systems that monitor pressure, fluid flow, and spray patterns in real time. These advancements will allow for predictive maintenance, remote diagnostics, and process optimization, improving operational efficiency and reducing downtime—especially in large-scale production environments. -

Emphasis on Sustainability and VOC Reduction

Environmental regulations, particularly in North America and Europe, are tightening around volatile organic compound (VOC) emissions. Air assisted airless technology supports compliance by enabling higher transfer efficiency (typically 60–70%), thereby reducing paint waste and airborne emissions. By 2026, demand for eco-friendly coating solutions will drive AAA adoption in green manufacturing initiatives and water-based coating applications, where precise control is essential. -

Growth in the Refinish and MRO (Maintenance, Repair, and Overhaul) Sectors

The automotive refinish and industrial MRO markets are projected to be key growth drivers for AAA systems. As repair shops seek faster turnaround times and lower material costs, the balance of speed, finish quality, and efficiency offered by AAA technology will make it a preferred choice over conventional airless or HVLP systems. -

Regional Market Expansion

While North America and Western Europe remain dominant markets due to advanced manufacturing infrastructure and regulatory support, the Asia-Pacific region—especially China, India, and Southeast Asia—is expected to witness accelerated growth. Rapid industrialization, urban construction, and infrastructure development will increase demand for efficient coating technologies, including AAA systems. -

Competitive Landscape and Innovation

By 2026, leading manufacturers such as Graco, Wagner, and ANEST IWATA are likely to intensify R&D efforts, focusing on lightweight materials, ergonomic designs, and modular systems that enhance user experience and reduce operator fatigue. Increased competition may also lead to more affordable entry-level AAA systems, broadening market access for small and mid-sized enterprises.

In summary, the 2026 outlook for air assisted airless technology is characterized by technological innovation, regulatory compliance, and expanding industrial applications. As industries prioritize efficiency, sustainability, and finish quality, AAA systems are expected to become a cornerstone of modern spray finishing solutions.

Common Pitfalls When Sourcing Air Assisted Airless (AAA) Equipment: Quality and Intellectual Property Concerns

Sourcing Air Assisted Airless (AAA) spray equipment offers advantages in finish quality and transfer efficiency, but buyers often encounter significant pitfalls related to product quality and intellectual property (IP) protection. Understanding these risks is crucial for making informed procurement decisions and avoiding long-term operational and legal issues.

Compromised Equipment Quality and Performance

Many suppliers, particularly those offering low-cost alternatives, cut corners on materials, design, and manufacturing processes. This results in equipment prone to premature wear, inconsistent spray patterns, clogging, and reduced durability. Inferior pumps, nozzles, and fluid pathways degrade quickly under high pressure and abrasive coatings, leading to frequent maintenance, downtime, and increased total cost of ownership. Poorly engineered air and fluid mixing systems fail to deliver the fine atomization AAA is known for, undermining the technology’s primary benefits.

Lack of Genuine Technology and Reverse Engineering

A major concern is sourcing equipment that falsely claims to use proprietary AAA technology. Some manufacturers reverse-engineer leading brands without replicating core innovations, resulting in substandard performance. These knock-offs may resemble authentic AAA systems but lack the precise engineering required for optimal air-fluid interaction, leading to overspray, poor finish quality, and inefficient material usage. Buyers may unknowingly invest in non-functional or underperforming systems.

Intellectual Property Infringement Risks

Procuring AAA equipment from unauthorized or unverified suppliers can expose companies to legal liability for IP infringement. Patented nozzle designs, pump mechanisms, and control systems are often protected, and using counterfeit or cloned products may violate these rights. Companies found using infringing equipment could face lawsuits, fines, or be forced to replace entire systems—resulting in significant financial and reputational damage.

Absence of Technical Support and Spare Parts

Low-cost or counterfeit AAA equipment is frequently sold without adequate technical support, training, or access to genuine spare parts. When issues arise, users face prolonged downtime due to limited repair options or incompatible components. Reputable manufacturers protect their IP by controlling distribution and support channels; unauthorized copies inherently lack this ecosystem, leaving buyers stranded when service is needed.

Hidden Costs from Poor Performance and Downtime

While initial purchase prices for questionable AAA systems may be attractive, hidden costs quickly accumulate. Poor atomization increases material waste, higher rejection rates due to finish defects, and frequent repairs all erode savings. In regulated industries, inconsistent application can lead to compliance failures. The absence of IP-backed performance guarantees means buyers have limited recourse when systems underperform.

To mitigate these risks, buyers should verify supplier credentials, request proof of IP ownership or licensing, consult industry references, and prioritize long-term value over initial cost. Investing in genuine, IP-protected AAA technology from reputable manufacturers ensures performance reliability, legal compliance, and sustainable operational efficiency.

Logistics & Compliance Guide for Air Assisted Airless (AAA) Spray Systems

Overview of Air Assisted Airless Technology

Air Assisted Airless (AAA) spray systems combine the high transfer efficiency of airless spraying with the atomization control of conventional air spray. These systems use hydraulic pressure to atomize paint while introducing a low volume of compressed air at the spray tip to refine the spray pattern and improve finish quality. Understanding the logistics and compliance requirements for AAA systems is essential for safe, efficient, and legally compliant operations.

Equipment Handling and Transportation

AAA spray systems consist of high-pressure pumps, hoses, spray guns, and filtration components. During transportation, ensure all components are securely packed to prevent damage. Use protective caps on fluid nozzles and air fittings. Store and ship pumps and hoses in temperature-controlled environments when possible to avoid seal degradation. Always follow manufacturer guidelines for orientation during transit—some pumps must remain upright.

Storage Requirements

Store AAA equipment in a clean, dry, and well-ventilated area. Keep fluid hoses drained and capped after use to prevent contamination and internal corrosion. Power units and control panels should be protected from dust and moisture. Store solvents and cleaning agents used with AAA systems in approved, labeled containers within compliant flammable liquid storage cabinets if applicable.

Fluid Compatibility and Material Safety

Verify compatibility between the AAA system’s wetted parts (pumps, seals, hoses) and the coatings being sprayed (e.g., waterborne, solvent-based, high-solids). Consult chemical resistance charts provided by equipment and coating manufacturers. Always review Safety Data Sheets (SDS) for all materials used. Implement proper labeling and segregation of incompatible substances.

Regulatory Compliance – Environmental Standards

AAA systems help reduce overspray and VOC emissions due to higher transfer efficiency. Ensure compliance with local, state, and federal environmental regulations such as the U.S. EPA National Emission Standards for Hazardous Air Pollutants (NESHAP) and VOC limits set by agencies like CARB. Maintain records of coating usage, VOC content, and emission controls. Use permitted coatings and document compliance for audits.

Regulatory Compliance – Workplace Safety

Adhere to OSHA regulations regarding respiratory protection, ventilation, and hazardous chemical exposure. Operators must use appropriate PPE, including respirators, gloves, and eye protection. Ensure spray booths are equipped with explosion-proof lighting and grounding systems to prevent static discharge. Follow lockout/tagout (LOTO) procedures during maintenance.

Pressure System Safety and Certification

AAA systems operate at high fluid pressures (up to 500+ bar). Only trained personnel should operate or service equipment. Regularly inspect high-pressure hoses, fittings, and seals for wear or damage. Use only manufacturer-approved replacement parts. In some regions, pressure equipment may require periodic inspection and certification under standards such as ASME or PED (Pressure Equipment Directive) in the EU.

Waste Management and Disposal

Collect waste solvents, filters, and overspray in approved containers. Label waste clearly and store in designated accumulation areas with secondary containment. Dispose of hazardous waste through licensed waste handlers in accordance with RCRA (Resource Conservation and Recovery Act) or local regulations. Maintain waste manifests and disposal records.

Training and Operator Certification

Provide comprehensive training for all operators on AAA system operation, maintenance, emergency procedures, and hazard recognition. Document training completion. Encourage certification through recognized industrial painting programs (e.g., NACE, SSPC) where applicable.

Recordkeeping and Documentation

Maintain logs for equipment maintenance, fluid usage, emissions reporting, employee training, and incident reports. Retain SDS for all materials on-site and ensure easy access. Digital record management systems can streamline compliance tracking and audit preparedness.

International Shipping and Import Compliance

When shipping AAA systems internationally, comply with IATA, IMDG, or ADR regulations if hazardous components or fluids are included. Declare electrical components and pressure systems appropriately. Ensure equipment meets CE, UKCA, or other regional conformity standards as required. Include technical documentation and user manuals in the correct language.

Emergency Preparedness and Spill Response

Develop and post spill response procedures. Equip work areas with spill kits containing absorbents, containment booms, and PPE. Train staff in spill containment and reporting. Establish emergency shutoff procedures for pumps and fluid supply lines.

Conclusion for Sourcing Air-Assisted Airless Spray Systems:

Sourcing air-assisted airless spray technology presents a strategic advantage for industries requiring high-quality, efficient, and cost-effective painting solutions. This hybrid spraying method combines the high transfer efficiency and high material output of airless systems with the superior atomization and finish quality provided by compressed air. As a result, it delivers a fine, uniform spray pattern suitable for achieving smooth, professional finishes on a wide range of substrates, from wood and metal to complex industrial surfaces.

When sourcing these systems, it is essential to consider factors such as production volume, coating viscosity, desired finish quality, and operator skill level. Leading manufacturers offer models with adjustable air and fluid pressures, making them versatile for various applications. Additionally, evaluating total cost of ownership—including equipment cost, maintenance, energy consumption, and material savings through improved transfer efficiency—is crucial for making a cost-effective decision.

Furthermore, partnering with reputable suppliers who provide comprehensive technical support, training, and spare parts availability ensures long-term reliability and optimal performance. Advances in eco-friendly coatings and regulations on VOC emissions also make air-assisted airless systems increasingly relevant, as they reduce overspray and material waste.

In conclusion, sourcing air-assisted airless spray systems is a sound investment for operations seeking a balance between productivity, finish quality, and sustainability. With the right selection and support, these systems can enhance finishing capabilities, improve efficiency, and contribute to a cleaner, more profitable operation.