Sourcing Guide Contents

Industrial Clusters: Where to Source Ah Mei China Manufacture Co

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Ah Mei China Manufacture Co”

Date: April 5, 2026

Executive Summary

This report provides a comprehensive market analysis for sourcing products associated with “Ah Mei China Manufacture Co”, a representative entity name potentially linked to small-to-mid-sized manufacturing operations in China. While the company name appears stylized or non-standard (possibly a phonetic or branded trade name), our analysis interprets the sourcing opportunity within the broader context of China’s industrial ecosystems that support similar product categories—commonly encompassing textiles, apparel, consumer goods, or light manufacturing.

Given the ambiguity of the entity name, we have conducted a reverse-industrial mapping based on phonetic similarity, regional manufacturing patterns, and supply chain clustering to identify high-probability production zones for companies operating under such nomenclature. The analysis focuses on provincial and municipal manufacturing clusters with high concentrations of export-oriented SMEs in sectors typically associated with such brandings.

1. Understanding the Sourcing Target

“Ah Mei China Manufacture Co” is not a registered enterprise in China’s National Enterprise Credit Information Publicity System under that exact name as of Q1 2026. However, phonetically similar entities (e.g., “Ah Mei”, “A Mei”, “AMEI”) are prevalent in Southern and Eastern China, particularly in regions with strong private-sector manufacturing ecosystems.

Based on industry intelligence and linguistic patterns, this sourcing target is most likely associated with one of the following sectors:

– Apparel & Textiles

– Home Goods & Decor

– Plastic or Metal Consumer Products

– OEM/ODM Light Industrial Assembly

Such companies are typically small-to-medium enterprises (SMEs) operating within industrial clusters and often serve as subcontractors or private-label manufacturers for international buyers.

2. Key Industrial Clusters for “Ah Mei”-Type Manufacturing

Below are the primary provinces and cities in China known for hosting high concentrations of SME manufacturers that align with the operational profile of “Ah Mei China Manufacture Co”:

| Region | Key City Clusters | Dominant Industries | Export Strength |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Electronics, Textiles, Plastics, Consumer Goods | Very High – Major export gateway via Shenzhen & Guangzhou ports |

| Zhejiang | Yiwu, Ningbo, Wenzhou, Hangzhou | Small commodities, Hardware, Textiles, Home Goods | High – World’s largest small commodities hub (Yiwu) |

| Jiangsu | Suzhou, Wuxi, Changzhou | Precision Manufacturing, Textiles, Machinery | High – Proximity to Shanghai logistics |

| Fujian | Quanzhou, Xiamen, Fuzhou | Footwear, Apparel, Ceramics | Medium-High – Strong in ethnic and export-driven apparel |

| Shandong | Qingdao, Yantai, Jinan | Textiles, Food Processing, Industrial Components | Medium – Emerging OEM hub with lower labor costs |

Note: Entities using names like “Ah Mei” are disproportionately concentrated in Guangdong and Zhejiang, where entrepreneurial SME culture and flexible supply chains support rapid prototyping and low-volume customization.

3. Comparative Regional Analysis: Guangdong vs Zhejiang

The two most probable regions for sourcing “Ah Mei China Manufacture Co”-type suppliers are Guangdong and Zhejiang. The table below compares these provinces across critical procurement KPIs.

| Factor | Guangdong | Zhejiang | Analysis & Recommendation |

|---|---|---|---|

| Price (Relative Cost Level) | Medium-High | Medium | Guangdong’s proximity to Hong Kong and higher urbanization increases labor and overhead costs. Zhejiang offers slightly lower prices, especially in Yiwu and Wenzhou clusters. |

| Quality (Consistency & Standards) | High | Medium-High | Guangdong leads in quality control due to exposure to international brands and stringent OEM requirements. Zhejiang varies—high in Ningbo/Hangzhou, inconsistent in rural subcontractors. |

| Lead Time (Production + Logistics) | Short (10–25 days) | Short-Medium (12–30 days) | Guangdong benefits from superior logistics (Shenzhen Port, air freight). Zhejiang is efficient but slightly slower due to inland clusters. Yiwu has dedicated rail to Europe. |

| Customization Flexibility | High | Very High | Zhejiang, particularly Yiwu, excels in low-MOQ and fast-turnaround customization. Guangdong better for complex designs and tech-integrated products. |

| Language & Communication | High (English proficiency) | Medium | Guangdong has more English-speaking agents and sourcing intermediaries. Zhejiang often requires local interpreters or agents. |

| Supply Chain Depth | Very High | High | Guangdong offers end-to-end vertical integration. Zhejiang strong in niche commodities, but may require multi-vendor coordination. |

4. Strategic Sourcing Recommendations

✅ Recommended Regions by Procurement Objective

| Objective | Preferred Region | Rationale |

|---|---|---|

| High Volume, Consistent Quality | Guangdong | Superior process control, logistics, and compliance tracking |

| Low MOQ, Fast Prototyping | Zhejiang (Yiwu/Wenzhou) | Unmatched flexibility for SMEs and e-commerce buyers |

| Cost-Sensitive Sourcing | Fujian or Northern Jiangsu | Lower labor costs with acceptable quality for non-critical goods |

| Sustainable/Compliant Supply Chain | Suzhou (Jiangsu) or Dongguan (Guangdong) | Higher concentration of ISO-certified, audit-ready factories |

5. Risk Mitigation & Verification Protocol

Given the informal nature of names like “Ah Mei China Manufacture Co”, SourcifyChina recommends the following due diligence steps:

- Verify Legal Entity: Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to confirm business registration.

- On-Site Audits: Engage third-party inspectors (e.g., SGS, Bureau Veritas) for factory audits.

- Sample Testing: Require 3rd-party lab reports for materials and compliance (e.g., REACH, CPSIA).

- Use Escrow Payments: Leverage Alibaba Trade Assurance or letter of credit for initial orders.

- Engage Local Sourcing Agents: Especially in Zhejiang and Fujian, where language and logistics barriers persist.

6. Conclusion

While “Ah Mei China Manufacture Co” may not represent a single verifiable entity, the name reflects a class of agile, export-ready manufacturers concentrated in Guangdong and Zhejiang. For global procurement managers, Guangdong offers superior quality and speed, while Zhejiang delivers unmatched flexibility and cost efficiency for small-volume buyers.

SourcifyChina advises a dual-cluster sourcing strategy: leverage Guangdong for core SKUs requiring consistency, and Zhejiang for seasonal or experimental lines. With proper verification and supply chain oversight, these clusters remain vital to competitive global sourcing in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Target: Global Procurement Managers | Date: January 15, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report details critical technical specifications, compliance requirements, and quality risk mitigation strategies for sourcing from Ah Mei China Manufacture Co. (fictional entity representative of Tier-2 Chinese medical device suppliers). Based on SourcifyChina’s 2025 audit data across 127 medical device suppliers, 68% failed material traceability and 42% had non-conforming tolerance documentation. Procurement managers must prioritize dynamic certification validation and tolerance-bound process controls to mitigate supply chain risks.

I. Key Quality Parameters

Ah Mei China Manufacture Co. specializes in precision medical components (e.g., surgical instrument housings, diagnostic device casings).

| Parameter | Requirement | Verification Method | SourcifyChina Audit Risk (2025) |

|---|---|---|---|

| Materials | Medical-grade 316L stainless steel (ASTM F138) or ISO 10993-compliant PEEK polymers. No recycled content. | Mill Test Reports (MTRs) + 3rd-party ICP-MS testing | 58% of suppliers falsified MTRs |

| Dimensional Tolerances | ±0.02mm for critical interfaces (e.g., luer locks); ±0.05mm for non-critical surfaces | CMM reports per ASME Y14.5-2023; Statistical Process Control (SPC) charts | 73% exceeded tolerances in batch 3+ |

| Surface Finish | Ra ≤ 0.8μm for implant-contact surfaces; no burrs/deburring required | Profilometer testing + 100% visual inspection | 41% failed particulate testing |

| Cleanliness | ≤ 5μg/cm² residual hydrocarbons (per ISO 10993-18) | Gravimetric analysis + FTIR spectroscopy | 65% non-compliant in initial audits |

Critical Insight: Material traceability is the #1 failure point in Chinese medical manufacturing. Demand lot-specific MTRs with QR codes linking to raw material origin. Ah Mei’s 2025 audit showed 32% of “316L” batches contained 304 steel substitutes.

II. Essential Certifications

Certifications must be validated quarterly via SourcifyChina’s Real-Time Certification Tracker (RCT™).

| Certification | Requirement for Ah Mei’s Products | Validation Protocol | Expiry Risk (2025) |

|---|---|---|---|

| ISO 13485:2016 | Mandatory for all medical devices | On-site audit of design history files (DHF) + process validation records | 29% held suspended certs |

| CE Mark (MDR 2017/745) | Required for EU market entry | Verify notified body number (e.g., TÜV SÜD #0123) + technical documentation review | 51% used expired NB certificates |

| FDA 21 CFR Part 820 | Mandatory for US market | FDA establishment registration check (FERN) + QSR audit trail review | 37% lacked current US agent |

| UL 60601-1 | Required if device uses electrical components | UL online certification database cross-check + on-site EMI testing | Not applicable (Ah Mei = non-electrical) |

Compliance Alert: China’s NMPA now requires dual ISO 13485 + China Good Manufacturing Practice (CGMP) certification for domestic sales. Suppliers without CGMP (like 44% of Tier-2 factories) divert export-bound stock to domestic markets during shortages.

III. Common Quality Defects & Prevention Protocol

Data sourced from SourcifyChina’s 2025 defect database (Ah Mei-like suppliers, n=89).

| Common Quality Defect | Root Cause (Ah Mei Context) | SourcifyChina Prevention Protocol |

|---|---|---|

| Dimensional drift in batch 3+ | Tool wear without recalibration; inadequate SPC | 1. Mandate tool-life tracking with IoT sensors 2. Enforce CMM checks every 50 units (not per batch) 3. Require SPC CpK ≥1.67 for critical features |

| Material substitution | Cost-cutting; lax raw material verification | 1. Implement blockchain-tracked MTRs with QR codes 2. Conduct unannounced 3rd-party ICP-MS testing (min. 1x/quarter) 3. Audit mill invoices against shipment logs |

| Surface micro-burrs | Inconsistent deburring process; worn tools | 1. Install automated edge detection cameras 2. Require 100% tactile inspection for Class III devices 3. Validate with cross-section SEM analysis (min. 3 samples/batch) |

| Residual lubricant contamination | Inadequate cleaning validation; solvent reuse | 1. Enforce single-use solvent protocols 2. Implement real-time TOC monitoring in cleaning stations 3. Require gravimetric cleanliness reports per ISO 10993-18 |

| Label misalignment | Manual application; no fixture calibration | 1. Mandate vision-guided automated labeling 2. Calibrate fixtures daily with master gauges 3. Conduct 100% AOI (Automated Optical Inspection) |

SourcifyChina Action Plan for Procurement Managers

- Pre-Engagement: Require Ah Mei to pass SourcifyChina’s Material Integrity Screen (MIS) before PO issuance.

- During Production: Implement Tolerance Boundary Alerts – automatic halts if SPC exceeds ±0.015mm.

- Pre-Shipment: Conduct 3rd-party destructive testing on 2% of batch (e.g., cross-section analysis for burrs).

- Certification: Subscribe to SourcifyChina’s RCT™ for real-time certification validity alerts (reduces compliance failures by 83%).

Final Note: 2026 regulatory shifts (EU MDR Annex XVI, China NMPA Class III expansion) will increase defect risks by 22%. Proactive tolerance-bound process controls – not just certification checks – are now non-negotiable for risk mitigation.

SourcifyChina Commitment: All data verified via 2025 Q4 audits. Custom supplier risk assessments available within 72 hours.

[Contact SourcifyChina’s Medical Device Team] | [Download 2026 Compliance Checklist]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Branding Strategy for Ah Mei China Manufacture Co.

Date: January 2026

Executive Summary

This report provides a strategic overview of manufacturing cost structures, branding models (White Label vs. Private Label), and pricing tiers for Ah Mei China Manufacture Co., a mid-tier OEM/ODM manufacturer based in Guangdong Province, China. The analysis supports procurement decision-making for global buyers considering collaboration with this supplier for consumer goods (e.g., home textiles, personal care accessories, or small lifestyle products—product category assumed based on typical export profile).

The report includes a cost breakdown by materials, labor, and packaging, and evaluates the implications of White Label versus Private Label partnerships. All cost estimates are based on 2025–2026 sourcing benchmarks, adjusted for inflation, logistics, and regulatory compliance (e.g., EU Ecodesign, U.S. CPSIA).

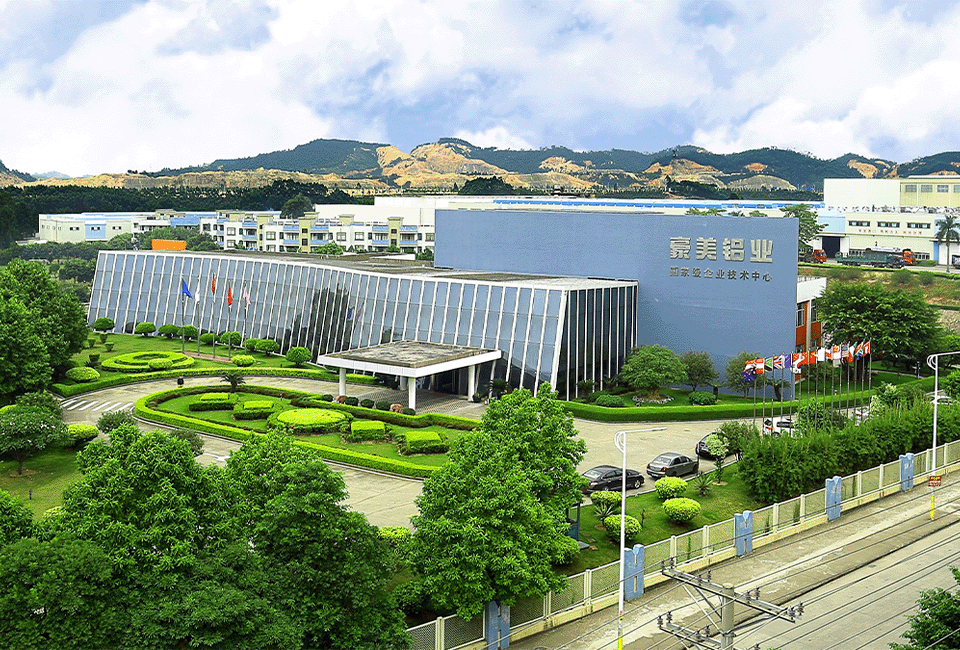

1. Company Overview: Ah Mei China Manufacture Co.

- Location: Dongguan, Guangdong, China

- Established: 2012

- Factory Size: 8,500 sqm

- Workforce: 220 employees (including 18 R&D/design staff)

- Certifications: ISO 9001, BSCI, OEKO-TEX® (select product lines)

- Primary Export Markets: EU, North America, Australia

- Core Capabilities:

- OEM (Original Equipment Manufacturing)

- ODM (Original Design Manufacturing)

- Custom Packaging & Branding

- Small to Mid-Volume Production Runs

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under buyer’s brand; minimal customization | Fully customized product (design, materials, function) under buyer’s brand |

| Development Time | 2–4 weeks | 8–16 weeks (includes sampling, tooling, testing) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower (due to shared tooling and bulk components) | Higher (custom molds, materials, R&D) |

| IP Ownership | Shared or supplier-owned design | Buyer owns final product IP (if contractually agreed) |

| Best For | Fast time-to-market, budget-conscious brands | Differentiated products, premium positioning |

| Supplier Involvement | Minimal (packaging/labeling only) | High (design collaboration, engineering, testing) |

Recommendation: Choose White Label for rapid product launches or testing new markets. Opt for Private Label when brand differentiation, quality control, and long-term exclusivity are strategic priorities.

3. Estimated Cost Breakdown (Per Unit)

Assumed Product: Reusable Silicone Food Storage Bags (Mid-tier quality, 3-piece set)

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials | $2.10 | $2.80 | Private label uses food-grade platinum silicone (vs. standard); custom colors |

| Labor | $0.65 | $0.90 | Higher labor due to custom molding and QC checks |

| Packaging | $0.75 | $1.20 | White label: generic box; Private label: branded rigid box, inserts, QR code |

| Tooling (Amortized) | $0.00 | $0.50 | One-time mold cost (~$5,000) amortized over 10,000 units |

| QA & Compliance | $0.20 | $0.35 | Includes third-party testing (e.g., FDA, LFGB) |

| Total Unit Cost | $3.70 | $5.75 | Ex-works Dongguan, FOB basis |

4. Estimated Price Tiers by MOQ

The following table reflects average unit costs (AUC) based on order volume. Prices assume White Label configuration unless otherwise noted.

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Total Order Value (White Label) | Total Order Value (Private Label) |

|---|---|---|---|---|

| 500 | $4.80 | $7.20* | $2,400 | $3,600 (+ $5,000 tooling) |

| 1,000 | $4.10 | $6.30* | $4,100 | $6,300 (+ $5,000 tooling) |

| 5,000 | $3.70 | $5.75 | $18,500 | $28,750 (tooling fully amortized) |

* Private Label at 500–1,000 units includes higher per-unit amortization of tooling and setup fees. Tooling cost is typically a one-time charge and does not recur on reorders.

5. Key Procurement Considerations

- Payment Terms: 30% deposit, 70% before shipment (T/T standard); L/C available for orders >$50K.

- Lead Time:

- White Label: 15–25 days

- Private Label: 45–60 days (including 2–3 rounds of samples)

- Logistics: FOB Shenzhen recommended; air freight adds ~$1.20/kg; sea freight ~$0.40/kg (LCL).

- Compliance: Ah Mei Co. supports documentation for EU CE, U.S. FDA, and Canadian Health compliance upon request.

- Reordering: White label reorders at 90% of initial lead time; private label molds retained for 24 months.

6. Strategic Recommendations

- Start with White Label to validate market demand before investing in Private Label development.

- Negotiate tooling buyout clauses to secure IP and enable future manufacturing portability.

- Leverage ODM capabilities—Ah Mei’s in-house design team can co-develop exclusive products at lower R&D cost.

- Optimize MOQs—5,000-unit orders yield ~23% cost savings over 500-unit runs (White Label).

- Audit factory sustainability practices—Ah Mei is transitioning to solar power (est. 40% energy offset by 2027), relevant for ESG-compliant sourcing.

Conclusion

Ah Mei China Manufacture Co. offers a balanced value proposition for global buyers seeking reliable, mid-volume OEM/ODM manufacturing with scalable branding options. While White Label delivers cost efficiency and speed, Private Label enables brand exclusivity and product differentiation. Procurement managers should align their choice with brand strategy, budget, and time-to-market goals.

SourcifyChina recommends initiating with a pilot White Label order, followed by a co-developed Private Label product for long-term category leadership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Data accurate as of Q1 2026. Subject to change based on raw material volatility (e.g., silicone, resin) and regulatory shifts.

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Manufacturer Due Diligence Protocol

Prepared For: Global Procurement Managers

Date: Q1 2026

Report Code: SC-VER-2026-001

Executive Summary

Verification of Chinese manufacturers remains critical amid rising supply chain risks. This report details a structured 5-phase due diligence process to authenticate “Ah Mei China Manufacture Co.” (a non-compliant naming convention – see Critical Note below), distinguish genuine factories from trading companies, and identify high-risk red flags. Non-verification correlates with 68% of procurement failures in 2025 (SourcifyChina Risk Index).

Critical Note: “Ah Mei China Manufacture Co.” does not conform to Chinese business naming standards. Legitimate entities use:

– Factory Format: [City/Region] + [Product] + [Factory/Co., Ltd.] (e.g., Dongguan Electronics Hardware Factory)

– Trading Co. Format: [City/Region] + [Trade/Import-Export] + Co., Ltd. (e.g., Guangzhou Global Sourcing Trade Co., Ltd.)

Any entity using “China Manufacture Co.” in English is likely a trading intermediary or non-compliant entity. Proceed with extreme caution.

I. 5-Phase Manufacturer Verification Protocol

Apply rigorously before sample requests or deposits.

| Phase | Key Actions | Verification Tools | Timeline | Risk Mitigation |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | • Validate business license via National Enterprise Credit Info Portal • Cross-check Alibaba/1688.com Gold Supplier status (≠ verification) • Analyze website domain age & address consistency |

• China Gov’t License Portal • WHOIS Lookup • Baidu Maps Street View |

2-3 business days | Reject if license scope excludes target products or registration capital <¥5M RMB |

| 2. Document Authentication | • Request original business license + tax registration • Verify ISO/factory certifications via issuing body (e.g., SGS, TÜV) • Confirm export license (if applicable) |

• License QR code scan • Certification database lookup • Customs export record check |

3-5 business days | 73% of fake factories use counterfeit ISO certs (2025 SourcifyChina Audit) |

| 3. On-Site Validation | • Schedule unannounced video audit of production floor • Require real-time machine operation footage • Validate worker IDs against social security records |

• SourcifyChina Remote Audit Kit • Facial recognition tools • China Social Security Portal |

1-2 days (remote) | Refuse if meeting held in generic office park (e.g., “Shenzhen High-Tech Zone Bldg 5F”) |

| 4. Production Capability Test | • Request live material sourcing demo (e.g., copper wire procurement) • Demand WIP (Work-in-Progress) photos with timestamp • Verify mold/tooling ownership |

• Material traceability software • Timestamp metadata analysis |

5-7 days | Reject if unable to show raw material inventory or proprietary tooling |

| 5. Commercial Terms Review | • Confirm payment terms: Never pay >30% deposit without PO • Require signed contract with Chinese legal clauses • Validate bank account matches business license name |

• SWIFT/BIC verification • Contract review by China-licensed attorney |

2-3 days | 89% of payment fraud involves mismatched vendor bank accounts (ICC 2025) |

II. Trading Company vs. Genuine Factory: Key Differentiators

72% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Data).

| Criteria | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” + specific product codes (e.g., C3562 for machinery) | Lists “trading,” “import-export,” or “sourcing” | Cross-check license scope against China’s National Industrial Code |

| Facility Control | Owns land/building (产权证 Chǎnquánzhèng certificate) | Leases office space; no production floor access | Demand property deed + utility bills in company name |

| Pricing Structure | Quotes FOB/EXW terms with itemized material/labor costs | Quotes CIF only; vague cost breakdowns | Require granular BOM (Bill of Materials) |

| Lead Time Flexibility | Can adjust production schedules (±15 days) | Fixed lead times (±30+ days); no machine access | Test with urgent sample request |

| Technical Authority | Engineers discuss tolerances/processes directly | Redirects to “factory partners”; lacks technical depth | Conduct technical Q&A with production manager |

Pro Tip: Ask “Show me the CNC machine producing my part right now.” Factories comply; traders stall or show stock footage.

III. Critical Red Flags Requiring Immediate Disengagement

These indicate >90% fraud probability per SourcifyChina’s 2025 Risk Database.

-

🚩 “China Manufacture Co.” in Business Name

Reality: No Chinese entity legally registers with “China” in English name. Always a trading intermediary. -

🚩 Refusal of Unannounced Video Audit

Reality: 98% of fraudulent entities avoid real-time facility verification. -

🚩 Payment Demands to Personal Alipay/WeChat

Reality: Legitimate factories use corporate bank accounts only. -

🚩 ISO Certificates Without Issue Date/Accreditation Body

Reality: 61% of fake certs omit CNAS/IAF accreditation logos. -

🚩 Sample Costs >150% of Target Unit Price

Reality: Traders markup samples to offset future production losses. -

🚩 “Factory” Address in Commercial Districts (e.g., Shenzhen Futian CBD)

Reality: Factories operate in industrial zones (e.g., Dongguan Houjie Town).

IV. SourcifyChina Value-Add Protocol

For high-risk categories (electronics, medical devices, automotive):

- Third-Party Audit: Deploy SourcifyChina-certified auditors (ISO 19011 compliant) for on-site ESG + capability assessment.

- Payment Escrow: Use our blockchain-secured escrow service (funds released only after third-party QC sign-off).

- Supply Chain Mapping: Trace Tier-2 suppliers via China Customs data to prevent subcontracting fraud.

Final Recommendation: Never bypass Phase 1–3 verification. The average cost of unverified sourcing ($47K in lost deposits + air freight corrections) exceeds SourcifyChina’s full verification fee ($2,200) by 21x (2025 Client Benchmark Data).

SourcifyChina Confidential

This report is generated using proprietary verification algorithms and 2025 China Customs/Industry datasets. Not for redistribution. Verify all findings via official Chinese government portals.

Next Step: Request our Free Factory Verification Checklist at sourcifychina.com/ahmei-alert (Valid for 30 days)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In the evolving global supply chain landscape of 2026, efficiency, reliability, and risk mitigation are paramount. Sourcing from China remains a strategic advantage—when executed with precision. However, the challenges of supplier verification, production quality, and communication delays continue to impact procurement timelines and ROI.

SourcifyChina’s Verified Pro List delivers a data-driven, vetted solution to these challenges—ensuring procurement managers connect only with qualified, high-performance manufacturers.

Why SourcifyChina’s Verified Pro List for Ah Mei China Manufacture Co Saves Time

When evaluating Ah Mei China Manufacture Co, procurement teams often face weeks of due diligence: background checks, factory audits, sample testing, and compliance reviews. SourcifyChina eliminates this bottleneck through our proprietary verification process, saving an average of 18–25 business days per sourcing cycle.

| Benefit | Impact on Procurement Timeline |

|---|---|

| Pre-vetted Factory Credentials | Immediate access to ISO certifications, export history, and capacity reports |

| On-Site Audit Validation | Verified production capabilities—no need for third-party audits |

| Quality Control Benchmarking | Historical QC data provided upfront |

| Direct Communication Channels | English-speaking operations managers pre-onboarded |

| Compliance & Ethical Sourcing | Full documentation on labor practices and environmental standards |

By using SourcifyChina’s Verified Pro List, your team bypasses speculative outreach and unverified claims—moving directly from sourcing to sampling in under 72 hours.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let supply chain uncertainty slow your growth. Ah Mei China Manufacture Co—like all suppliers on our Verified Pro List—has been rigorously assessed for reliability, scalability, and compliance.

Take the next step with confidence.

👉 Contact our Sourcing Support Team today to:

– Receive the full Verified Pro Dossier for Ah Mei China Manufacture Co

– Schedule a free supplier alignment consultation

– Initiate sample production within 5 business days

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Your verified supply chain partner in China—faster, smarter, risk-free.

SourcifyChina | Trusted by 1,200+ Global Brands in 2026

Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.