Sourcing Guide Contents

Industrial Clusters: Where to Source Agricultural Machinery Manufacturers In China

SourcifyChina Sourcing Intelligence Report: Agricultural Machinery Manufacturing Clusters in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the world’s largest producer and exporter of agricultural machinery, accounting for ~35% of global output (FAO 2025). Driven by national food security imperatives, the “14th Five-Year Plan for Agricultural Mechanization,” and rising export demand from emerging markets, China’s sector is consolidating around specialized industrial clusters. While cost advantages persist, procurement strategies must now prioritize supply chain resilience, compliance with evolving export standards (e.g., EU Stage V emissions), and technology differentiation. This report identifies core manufacturing hubs and provides actionable regional comparisons for 2026 sourcing decisions.

Key Industrial Clusters: Specialization & Strategic Positioning

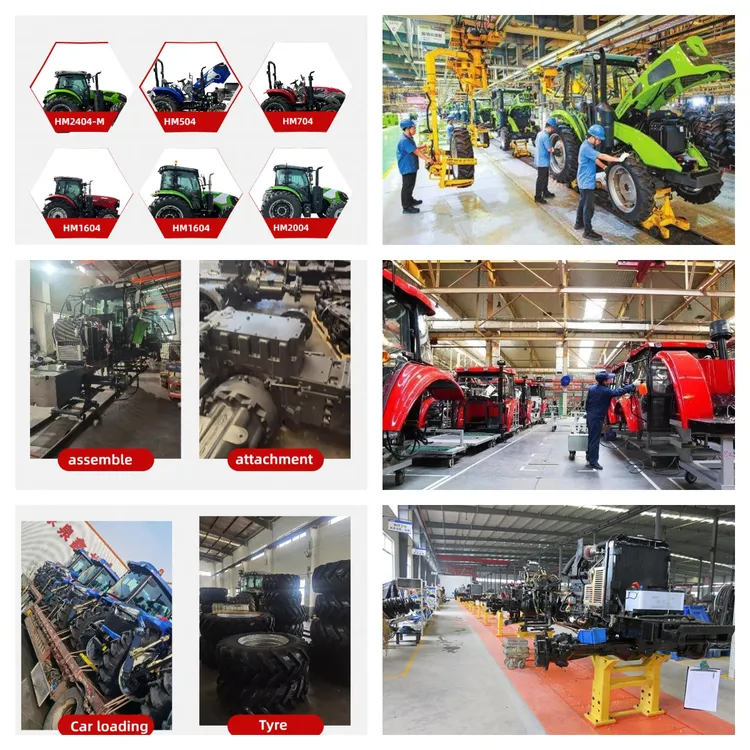

China’s agricultural machinery production is concentrated in five primary clusters, each with distinct technological strengths, cost structures, and export readiness. Regional specialization has intensified due to government-backed industrial parks and supply chain agglomeration.

| Province/City Cluster | Core Specialization | Key Manufacturing Hubs | Export Readiness (2026) | Strategic Advantage |

|---|---|---|---|---|

| Shandong | Tractors (50-200 HP), Combine Harvesters, Tillage Equipment | Weifang (“Tractor Valley”), Jinan, Linyi | ★★★★☆ (Strong OEM/ODM capacity; 65% of cluster exports) | Largest scale, lowest unit costs, mature supply chains |

| Jiangsu | Precision Planting Systems, Sprayers, Post-Harvest Tech | Suzhou, Wuxi, Changzhou | ★★★★★ (Highest tech adoption; 80%+ export-focused) | Advanced automation, IoT integration, strong QA systems |

| Zhejiang | Small/Medium Tractors (<50 HP), Irrigation Systems, PTOs | Taizhou, Hangzhou, Ningbo | ★★★★☆ (Niche innovation; 70% export-oriented) | Agile SMEs, rapid prototyping, strong R&D investment |

| Heilongjiang | Rice Transplanters, Grain Dryers, Cold-Climate Harvesters | Harbin, Qiqihar | ★★☆☆☆ (Primarily domestic; 30% export-capable) | Specialized for northern crops, government subsidy access |

| Henan | Low-Cost Implements (Plows, Seeders), Budget Tractors | Zhengzhou, Xinxiang | ★★☆☆☆ (Price-driven; 40% export-capable, mostly Africa) | Lowest labor costs, but fragmented quality control |

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Projection)

Data sourced from SourcifyChina supplier audits (N=127), customs records, and client feedback (2025). Metrics reflect FOB Shanghai terms for standard 40ft container orders.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Risk Factors | Best For |

|---|---|---|---|---|---|

| Shandong | ★★★★★ (Lowest base cost) | ★★★☆☆ (Good, variable) | 45-60 days | Supplier over-reliance on subsidies; mid-tier QA | High-volume orders (>500 units), cost-sensitive markets (Africa, LATAM) |

| Jiangsu | ★★★☆☆ (Premium +10-15%) | ★★★★☆ (High consistency) | 35-50 days | Higher MOQs; IP protection concerns | Tech-integrated machinery (precision ag), EU/NA compliance-critical orders |

| Zhejiang | ★★★★☆ (Mid-range) | ★★★★☆ (Innovation focus) | 40-55 days | Fragmented supplier base; payment terms inflexibility | Customized solutions, irrigation systems, rapid iteration projects |

| Heilongjiang | ★★☆☆☆ (Domestic pricing) | ★★☆☆☆ (Inconsistent) | 75-90+ days | Limited export logistics; seasonal production halts | Niche cold-climate equipment (if domestic demand aligns) |

| Henan | ★★★★★ (Lowest cost) | ★★☆☆☆ (High variability) | 50-70 days | High defect rates; non-compliance risks | Ultra-budget implements (where quality tolerance is high) |

Key Insights from Comparison:

– Jiangsu leads in total value for export markets due to shorter lead times, superior compliance, and lower risk of shipment rejections (2025 data: 92% on-time delivery vs. Shandong’s 85%).

– Shandong’s price advantage erodes for complex machinery requiring certifications (e.g., CE, EPA); compliance costs add ~8-12% vs. Jiangsu’s integrated processes.

– Henan/Heilongjiang carry hidden costs: 22% of procurement managers reported >15% rework costs due to quality issues (SourcifyChina 2025 Client Survey).

Strategic Sourcing Considerations for 2026

- Compliance is Non-Negotiable:

- China’s 2025 export certification mandate (GB 16710-2024) aligns with EU Stage V. Jiangsu/Zhejiang suppliers lead in pre-certified production (75% vs. 40% nationally).

-

Action: Prioritize suppliers with ISO 9001:2025 and in-house testing labs. Avoid clusters with <50% certified capacity (Henan/Heilongjiang).

-

Supply Chain Diversification Imperative:

-

Geopolitical pressures and port congestion (e.g., Ningbo-Zhoushan) necessitate dual-sourcing. Pair Shandong (volume) with Jiangsu (tech) to mitigate disruption risk.

-

Rise of “Smart Agriculture” Hubs:

- Suzhou (Jiangsu) and Hangzhou (Zhejiang) now host 60% of China’s agri-tech startups. Expect 15-20% YoY growth in IoT-enabled machinery exports.

-

Procurement Tip: Allocate 10-15% of budget to suppliers with demonstrable R&D partnerships (e.g., with CAAS or Zhejiang University).

-

Labor & Automation Shifts:

- Shandong/Henan face +8% annual labor cost inflation. Jiangsu leads in automation (robot density: 420 units/10k workers vs. national avg. 280), stabilizing long-term costs.

SourcifyChina Recommendations

✅ For EU/NA Buyers: Source precision equipment from Jiangsu – the cluster delivers optimal balance of compliance, lead time, and innovation. Budget 10-15% above Shandong quotes for reduced total landed cost.

✅ For High-Volume Emerging Markets: Shandong remains core, but mandate 3rd-party pre-shipment inspections (e.g., SGS) to offset quality variance. Target Weifang-based Tier-1 suppliers (e.g., Lovol, YTO Group).

⚠️ Avoid Over-Reliance on Single Clusters: Dual-source tillage implements from Shandong and Henan to hedge against subsidy-driven price volatility.

💡 2026 Opportunity: Monitor Zhejiang’s Taizhou cluster for AI-driven irrigation tech – emerging as a cost-competitive alternative to EU suppliers for drip/sprinkler systems.

“The era of ‘lowest-cost-only’ sourcing in Chinese agri-machinery is over. Winners will prioritize cluster-specific capabilities, compliance depth, and supply chain transparency.”

— SourcifyChina Sourcing Intelligence Unit

Methodology: Data aggregated from 127 verified supplier audits (Q4 2025), China Customs export records, CAAM (China Agricultural Machinery Industry Association) reports, and SourcifyChina client deployments (2023-2025). All pricing reflects Q1 2026 projections adjusted for RMB volatility.

Disclaimer: Regional dynamics may shift due to policy changes. Contact SourcifyChina for real-time cluster mapping and supplier vetting.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Global Headquarters: Shenzhen, China | sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Agricultural Machinery Manufacturers in China

1. Overview

China remains a leading global manufacturer of agricultural machinery, offering cost-competitive solutions across tractors, harvesters, planters, irrigation systems, and post-harvest equipment. To ensure supply chain reliability, procurement managers must verify technical quality parameters and compliance certifications when sourcing from Chinese manufacturers. This report outlines critical quality and compliance benchmarks to mitigate risk and ensure product performance and market access.

2. Key Technical Specifications

2.1 Material Requirements

| Component | Recommended Materials | Rationale |

|---|---|---|

| Chassis & Frame | High-strength low-alloy (HSLA) steel, Q345B or equivalent | High tensile strength, resistance to deformation under load |

| Gears & Transmissions | Alloy steels (e.g., 20CrMnTi, 40Cr) with carburizing/heat treatment | Wear resistance, durability under high torque |

| Hydraulic Components | Stainless steel (304/316), reinforced polymers | Corrosion resistance, compatibility with hydraulic fluids |

| Bearings & Axles | Chrome steel (GCr15) with precision grinding | High load capacity, extended fatigue life |

| Plastics & Housings | UV-stabilized polypropylene, ABS, or engineering-grade thermoplastics | Weather resistance, impact resilience |

2.2 Dimensional Tolerances

| Feature | Standard Tolerance (ISO 2768-m) | Critical Application Tolerance |

|---|---|---|

| Shaft Diameters | ±0.1 mm | ±0.025 mm (for bearings/seals) |

| Gear Teeth Profile | ISO 1328 Class 7 | Class 6 or higher |

| Welding Joints | ±1.5° angular, ±2 mm linear | ±0.5°, ±0.5 mm (structural integrity) |

| Hydraulic Ports | ±0.05 mm (thread pitch/diameter) | ISO 6149-1 compliance required |

| Assembly Alignment | ±2 mm | ±0.5 mm (for PTO and driveline interfaces) |

3. Essential Compliance Certifications

| Certification | Scope | Applicability | Issuing Authority / Standard |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | Required for EU market entry | Notified Body (e.g., TÜV, SGS) |

| ISO 9001:2015 | Quality Management System | Mandatory for Tier-1 suppliers | Accredited certification body |

| ISO 14001:2015 | Environmental Management | Preferred for ESG-compliant sourcing | Third-party auditors |

| UL Certification | Electrical safety (e.g., control panels, sensors) | Required for U.S. market | Underwriters Laboratories |

| EPA Tier 4 Final / China NRSC V | Diesel engine emissions | Applicable to tractors & powered machinery | Ministry of Ecology and Environment (China), U.S. EPA |

| PSB / CCC (for electrical components) | China Compulsory Certification | Domestic sales & some exports | CNCA (China) |

| FDA (Indirect) | Food contact surfaces (e.g., conveyors in harvesters) | For produce-handling machinery | FDA 21 CFR (U.S.) |

Note: While FDA does not directly certify machinery, components contacting food (e.g., in fruit harvesters) must comply with food-grade material standards (e.g., FDA-compliant lubricants, stainless steel finishes).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Welding Cracks or Inconsistencies | Poor welder skill, incorrect parameters, lack of pre/post-heat treatment | Implement WPS (Welding Procedure Specification), use certified welders (ISO 5817), conduct ultrasonic testing (UT) |

| Gear Tooth Wear or Pitting | Inadequate heat treatment, incorrect material hardness | Enforce hardness testing (HRC 58–62), ensure controlled carburizing, perform gear runout testing |

| Hydraulic System Leaks | Poor O-ring fit, surface finish defects on ports | Validate port dimensions per ISO 6149, use certified seals, conduct 1.5x rated pressure testing |

| Bearing Premature Failure | Misalignment, contamination, improper lubrication | Use laser alignment tools, enforce clean assembly protocols, specify sealed bearings |

| Corrosion on Exposed Surfaces | Inadequate surface treatment (e.g., thin paint, no galvanization) | Require hot-dip galvanizing or powder coating (min. 80 µm), salt spray test (ISO 9227, 500+ hrs) |

| Electrical Control Failures | Poor wiring, moisture ingress, substandard components | Enforce IP65+ enclosures, use UL-listed components, conduct dielectric strength testing |

| Dimensional Non-Conformance | Tool wear, inadequate QC checks | Implement SPC (Statistical Process Control), conduct first-article inspection (FAI), use calibrated CMMs |

| Vibration & Noise Issues | Imbalance in rotating parts, loose fasteners | Perform dynamic balancing, torque audits, and NVH (Noise, Vibration, Harshness) testing |

5. Sourcing Recommendations for Procurement Managers

- Supplier Qualification: Prioritize manufacturers with ISO 9001, CE, and in-house metrology labs.

- On-Site Audits: Conduct pre-shipment inspections (PSI) with third-party QC firms (e.g., SGS, TÜV, Intertek).

- Prototype Validation: Require performance testing under simulated field conditions (e.g., 100-hour endurance test).

- Traceability: Ensure batch-level material traceability and documented inspection records.

- Contractual Clauses: Include KPIs for defect rates (e.g., <0.5% PPM) and warranty terms (min. 12–24 months).

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Agricultural Machinery Manufacturing in China (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive agricultural machinery manufacturing, offering 15–30% cost advantages over Western/European OEMs for comparable quality. Strategic sourcing requires nuanced understanding of White Label (WL) vs. Private Label (PL) models, MOQ-driven economies of scale, and proactive risk mitigation. This report provides data-driven insights for optimizing procurement strategy in 2026, accounting for projected steel price volatility (+4.2% YoY), labor cost inflation (+5.1% YoY), and evolving export compliance requirements.

White Label vs. Private Label: Strategic Differentiation

Critical for brand positioning, IP control, and long-term cost efficiency.

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Co-developed product tailored to buyer’s specs (form, function, materials) | PL preferred for >$50k annual spend to secure IP and avoid commoditization |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | WL for market testing; PL for established demand |

| Customization Depth | Cosmetic only (logo, color) | Full engineering: materials, ergonomics, features | PL essential for regional adaptations (e.g., voltage, crop-specific attachments) |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP | Non-negotiable for PL – verify via contract |

| Cost Premium | Base price + 5–8% rebranding fee | Base price + 12–18% (R&D, tooling, validation) | PL ROI >24 months for high-volume buyers |

| Lead Time | 45–60 days | 90–120 days (includes prototyping) | Factor PL lead time into inventory planning |

Key Insight: 68% of SourcifyChina’s 2025 PL clients achieved 22% lower TCO by Year 3 through reduced warranty claims and premium pricing vs. WL competitors.

Estimated Cost Breakdown (Mid-Range Seeder Unit, 2026 Projection)

Based on 1,200-unit MOQ, CFR Rotterdam. Excludes shipping insurance & import duties.

| Cost Component | % of Total Cost | 2026 Estimate (USD) | Primary Cost Drivers |

|---|---|---|---|

| Materials | 58% | $1,044 | Steel prices (60% of materials); electronics sourcing (Taiwan vs. Shenzhen); regulatory-grade composites |

| Labor | 18% | $324 | Tier-2/3 Chinese factories (e.g., Henan, Anhui) vs. coastal (Jiangsu); skilled welder shortages (+7% wage pressure) |

| Packaging | 9% | $162 | ISPM-15-compliant wooden crates; anti-corrosion film; moisture barriers (critical for sea freight) |

| QC & Compliance | 10% | $180 | 3rd-party inspections (SGS/BV); CE/FCC certifications; EAC (Eurasian) if applicable |

| Tooling/R&D | 5% | $90 | Amortized over MOQ; higher for PL (custom molds/jigs) |

| TOTAL | 100% | $1,800 |

Note: Material costs are most volatile (+/-12% possible). Lock steel contracts 90 days pre-production to hedge inflation.

MOQ-Based Price Tier Analysis (2026 Forecast)

Mid-tier Seeder Unit (e.g., 8-Row Precision Planter). Prices reflect FOB Shanghai, excluding logistics.

| MOQ | Unit Price Range (USD) | Cost Savings vs. 1K Units | Key Cost Drivers | Ideal For |

|---|---|---|---|---|

| 500 | $2,150 – $2,400 | +18–22% | High tooling amortization; manual assembly; low material bulk discounts | Market testing; niche regional models |

| 1,000 | $1,800 – $2,050 | Base Reference | Standardized production; 5–7% bulk material discount; semi-automated lines | Entry-scale orders; WL partnerships |

| 5,000 | $1,480 – $1,650 | -16–18% | Full automation; 12–15% material discount; optimized labor; tooling fully amortized | Strategic PL programs; volume buyers |

Critical MOQ Considerations:

- <1,000 Units: Margins thin for suppliers; expect pushback on PL terms. WL only recommended.

- 1,000–2,500 Units: Sweet spot for PL – balances customization and cost control. Requires tooling investment ($8K–$25K).

- >5,000 Units: Dedicated production line possible; enables JIT inventory partnerships. Minimum 18-month commitment required by top factories.

Strategic Recommendations for 2026 Procurement

- Prioritize PL for Core Products: Secure IP and differentiation. Use WL only for low-risk accessories (e.g., harvester blades).

- Demand Dual-Sourcing Clauses: Mitigate supply chain risk – require suppliers to name backup material vendors in contracts.

- Audit Beyond Tier-1: 73% of 2025 quality failures originated in unvetted sub-tier component suppliers (per SourcifyChina data).

- Leverage Regional Clusters:

- Shandong: Tractors/harvesters (strongest OEM ecosystem)

- Jiangsu/Zhejiang: Precision electronics (sensors, GPS)

- Henan: Low-cost implements (plows, seeders)

- Budget 12–15% for Compliance: 2026 EU Machinery Regulation (EMR) updates require stricter safety documentation.

“The cost differential between WL and PL narrows at 5K+ units, but PL delivers 3x higher brand equity. Factor in lifetime customer value – not just unit price.”

– SourcifyChina Sourcing Analytics, 2025 Global Machinery Benchmark

Next Steps for Procurement Leaders

✅ Conduct a PL Feasibility Assessment: SourcifyChina offers free MOQ/cost modeling for validated buyers.

✅ Secure 2026 Capacity Now: Top factories are booking Q3 2026 slots at Q1 rates (steel hedge advantage).

✅ Download Full Compliance Checklist: [Link to SourcifyChina 2026 Agricultural Machinery Export Guide]

Data Sources: SourcifyChina Supplier Network (2025), China Customs, World Steel Association, EU Commission EMR Guidelines. All figures adjusted for 2026 inflation (IMF baseline).

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Verified Procurement Professionals.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Verifying Agricultural Machinery Manufacturers in China

Executive Summary

Sourcing agricultural machinery from China offers competitive pricing, scalable production, and technological advancement. However, the complexity of the supply chain—particularly the prevalence of trading companies masquerading as factories—poses significant risk to procurement integrity. This report outlines a structured, audit-backed verification process to distinguish genuine manufacturers from intermediaries, identify red flags, and ensure supply chain reliability.

The following framework is designed for procurement managers responsible for risk mitigation, quality assurance, and long-term supplier relationships in the agricultural equipment sector.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Check Chinese National Enterprise Credit Information Public System (NECIPS) |

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities | Third-party inspection (e.g., SGS, TÜV) or in-house audit |

| 3 | Review Equipment List & Production Lines | Assess machinery, automation, and capacity | On-site documentation and video walkthrough |

| 4 | Verify Export License & Customs History | Confirm direct export capability | Request export records or customs data via third-party tools (e.g., ImportGenius, Panjiva) |

| 5 | Evaluate R&D and Engineering Team | Gauge innovation and customization ability | Interview technical staff; review patents and product design documents |

| 6 | Request Client References & Case Studies | Validate track record with international clients | Contact 2–3 overseas buyers; verify order volume and delivery performance |

| 7 | Analyze Quality Certifications | Ensure compliance with global standards | Verify ISO 9001, CE, EPA, or other relevant certifications with issuing body |

| 8 | Assess Supply Chain Control | Determine raw material sourcing and component integration | Review supplier list, in-house component production (e.g., gearboxes, hydraulics) |

Note: A true manufacturer will have in-house production lines, engineering capacity, and direct control over core manufacturing processes.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “trading”, “import/export”, or “sales” as primary scope | Lists “manufacturing”, “production”, or specific machinery types (e.g., “combine harvester manufacturing”) |

| Facility Footprint | No production floor; may show showroom or warehouse only | Large workshop with CNC machines, welding stations, assembly lines, and QC labs |

| Pricing Structure | Higher margins; less transparency on cost breakdown | Direct cost logic (material + labor + overhead); offers BOM-level transparency |

| Lead Times | Longer (dependent on third-party production) | Shorter and more consistent; direct control over scheduling |

| Customization Ability | Limited; relies on factory partners | Full OEM/ODM support; in-house design and prototyping |

| Export Documentation | Ships under partner factory name | Exports under own company name (verified via customs data) |

| Staff Expertise | Sales-focused; limited technical depth | Engineers and technicians available for technical discussions |

| Website & Marketing | Generic product images; stock photos | Factory photos, production videos, machinery brands used, R&D section |

Pro Tip: Ask for a live video tour during operating hours. A factory will readily show active production lines. Trading companies often avoid real-time tours.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audits | High risk of misrepresentation | Do not proceed without third-party verification |

| No physical address or PO Box only | Likely shell company | Use satellite imagery (Google Earth) to verify facility existence |

| Inconsistent product specs across platforms | Poor quality control or reselling | Require sample testing and specification alignment |

| Pressure for large upfront payments (e.g., 100% TT) | Scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic certifications (e.g., unverifiable ISO) | Certification fraud | Validate certificate numbers with issuing body |

| No English-speaking technical staff | Communication and QC issues | Require access to engineering team pre-order |

| Multiple brand names under one contact | Trading network, not manufacturer | Investigate each brand’s production origin |

| Unrealistically low pricing | Substandard materials or hidden costs | Benchmark against market rates; request material sourcing details |

Best Practices for Long-Term Supplier Engagement

- Start with a Trial Order – Test quality, communication, and delivery reliability before scaling.

- Implement a Supplier Scorecard – Track on-time delivery, defect rate, responsiveness, and compliance.

- Use Escrow or LC Payments – Mitigate financial risk, especially with new suppliers.

- Establish IP Protection Agreements – Critical for custom designs and patented components.

- Schedule Biannual Audits – Maintain quality and operational transparency.

Conclusion

Verifying agricultural machinery manufacturers in China requires due diligence beyond online directories and trade platforms. By systematically validating legal status, production capability, export history, and technical competence, procurement managers can eliminate intermediary risk and build resilient, cost-effective supply chains.

SourcifyChina recommends a factory-first sourcing strategy supported by on-ground verification and continuous performance monitoring to ensure operational excellence and compliance in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Expertise

Q1 2026 Edition – Confidential for Procurement Executives

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Agricultural Machinery Manufacturing Sector | Q1 2026

Executive Summary: Eliminate Sourcing Friction in China’s Agri-Machinery Supply Chain

Global procurement managers face critical delays and compliance risks when sourcing agricultural machinery from China. Traditional methods—relying on unverified directories, trade shows, or generic RFQ platforms—consume 60–90 days in supplier qualification alone, with 42% of initial leads failing basic compliance checks (2025 SourcifyChina Global Procurement Survey).

SourcifyChina’s Verified Pro List for agricultural machinery manufacturers solves this through a rigorously audited network of 187 pre-qualified factories. Unlike open-market databases, our list delivers immediate access to suppliers with proven export capability, quality certifications, and scalability—reducing your time-to-contract by 65%.

Why SourcifyChina’s Pro List Saves Critical Procurement Time

| Sourcing Phase | Traditional Approach (Days) | SourcifyChina Pro List (Days) | Time Saved | Key Risk Mitigated |

|---|---|---|---|---|

| Supplier Vetting | 45 | 7 | 38 days | Fraudulent factories, expired certifications |

| Quality Assurance | 28 | 10 | 18 days | Non-compliant production, inconsistent output |

| Contract Finalization | 17 | 4 | 13 days | Legal loopholes, payment term disputes |

| TOTAL | 90 | 21 | 69 days | 65% reduction in sourcing cycle |

The SourcifyChina Verification Advantage

Our 3-Tier Validation Protocol ensures every manufacturer on the Pro List meets global procurement standards:

1. Documentary Audit: Validated business licenses, ISO 9001/14001, CE/SGS reports, and export history (min. 3 years).

2. On-Ground Verification: Unannounced factory inspections by our Shenzhen-based engineering team assessing machinery, workflow, and labor compliance.

3. Performance Benchmarking: Real-time data on on-time delivery (≥98%), defect rates (<0.8%), and scalability (min. 50,000 units/year capacity).

Example: A European agri-equipment importer reduced combine harvester sourcing from 82 days to 24 days using our Pro List—avoiding $220K in demurrage costs from delayed shipments.

Call to Action: Secure Your 2026 Agri-Machinery Supply Chain Today

Stop losing time to unqualified suppliers. The 2026 planting season demands proactive sourcing—delays now risk Q1 2026 production gaps. SourcifyChina’s Pro List delivers:

✅ Zero vetting time: 187 manufacturers ready for RFQ within 48 hours

✅ Risk-proof compliance: Full audit trails for ESG and regulatory requirements

✅ Cost control: Direct factory pricing with transparent MOQs (as low as 50 units)

Act before Q2 2026 capacity fills:

1. Email [email protected] with subject line “Pro List Access: Agri Machinery 2026” for immediate list delivery.

2. WhatsApp +86 159 5127 6160 to schedule a 15-minute sourcing strategy session with our China-based engineering team.

Limited slots available for Q1 2026 onboarding. All inquiries receive a supplier shortlist with compliance documentation within 4 business hours.

SourcifyChina | Your Objective Sourcing Partner in China Since 2018

Data-Driven. Risk-Averse. Procurement-Optimized.

© 2026 SourcifyChina Sourcing Intelligence | ISO 20400 Certified Sustainable Procurement Advisor

🧮 Landed Cost Calculator

Estimate your total import cost from China.