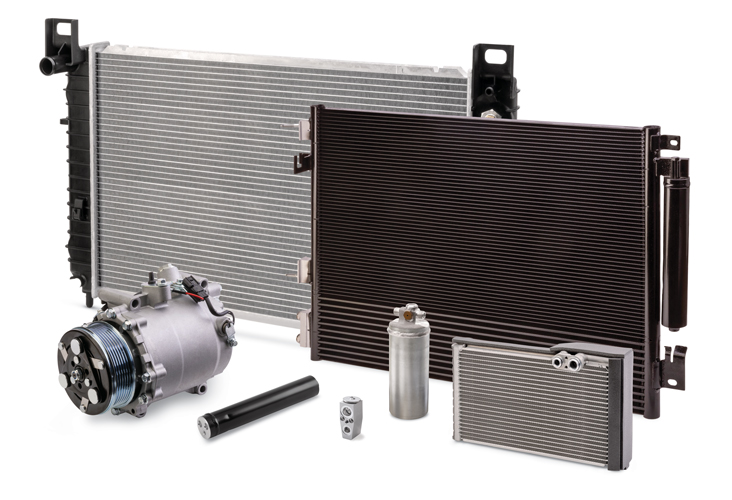

The global aftermarket vehicle air conditioning (AC) market is experiencing robust expansion, driven by rising vehicle ownership, increasing demand for cabin comfort, and growing penetration of AC systems in older and entry-level vehicles. According to Mordor Intelligence, the aftermarket automotive AC market was valued at USD 11.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6.2% from 2024 to 2029. This growth is further fueled by the aging vehicle fleet, particularly in regions like North America and Europe, where vehicle retention periods are extending, prompting higher demand for replacement and upgraded AC components. Additionally, Grand View Research highlights the increasing adoption of energy-efficient and environmentally friendly refrigerants as a key trend shaping product innovation in the sector. As consumer expectations for in-cabin climate control rise, the aftermarket continues to evolve—spurring advancements in compressor technology, condenser efficiency, and digital diagnostics. In this competitive landscape, nine manufacturers have emerged as leaders, combining technical expertise, broad product portfolios, and global distribution networks to meet the escalating demand for reliable and high-performance AC solutions.

Top 9 Aftermarket Vehicle Ac Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Vintage Air

Domain Est. 1996

Website: vintageair.com

Key Highlights: Our SureFit kits are complete, vehicle-specific integrated heat / cool / defrost systems designed to deliver a factory-installed look with modern performance….

#2 Nissens Automotive

Domain Est. 1996

Website: nissens.com

Key Highlights: As a market-leading manufacturer, Nissens offers a comprehensive thermal & efficiency systems spare parts selection for all vehicle segments….

#3 Air conditioning for passenger cars

Domain Est. 1997

Website: mahle.com

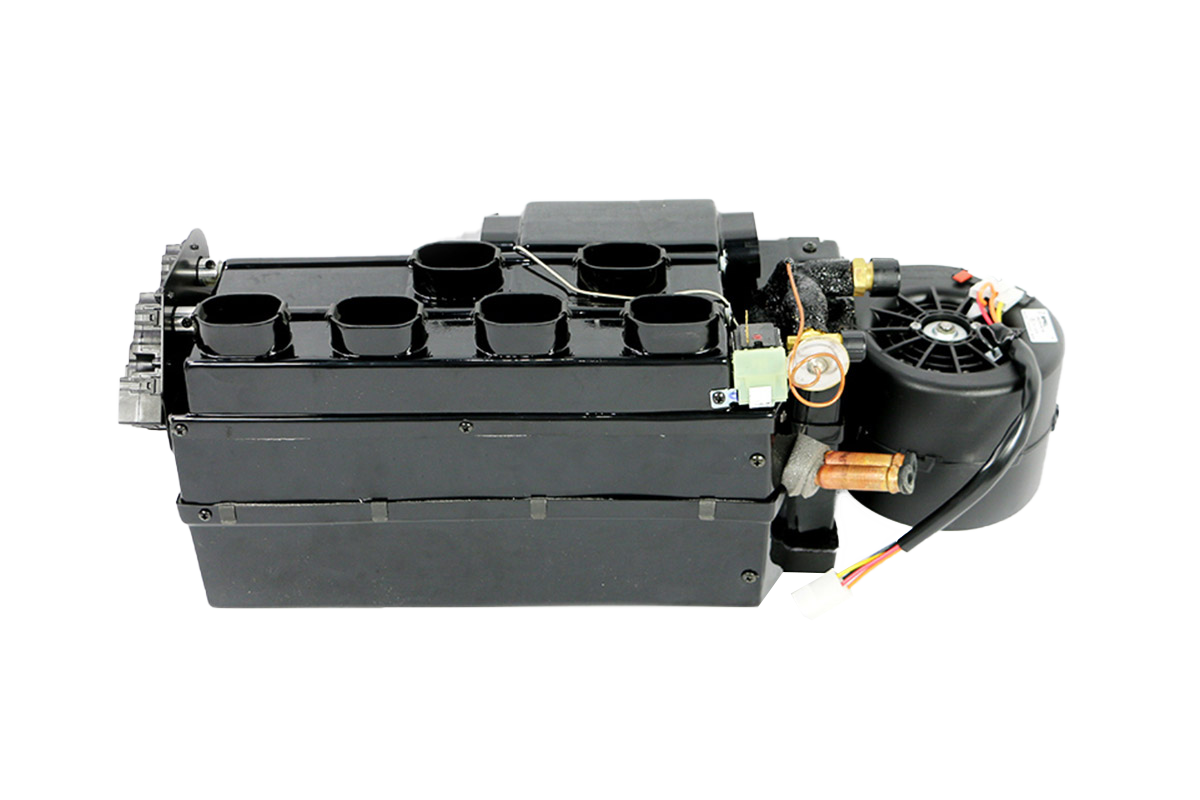

Key Highlights: Our HVAC modules are tailor-made to the specifications of vehicle manufacturers. Continuous improvements in efficiency, reductions in weight and pressure loss, ……

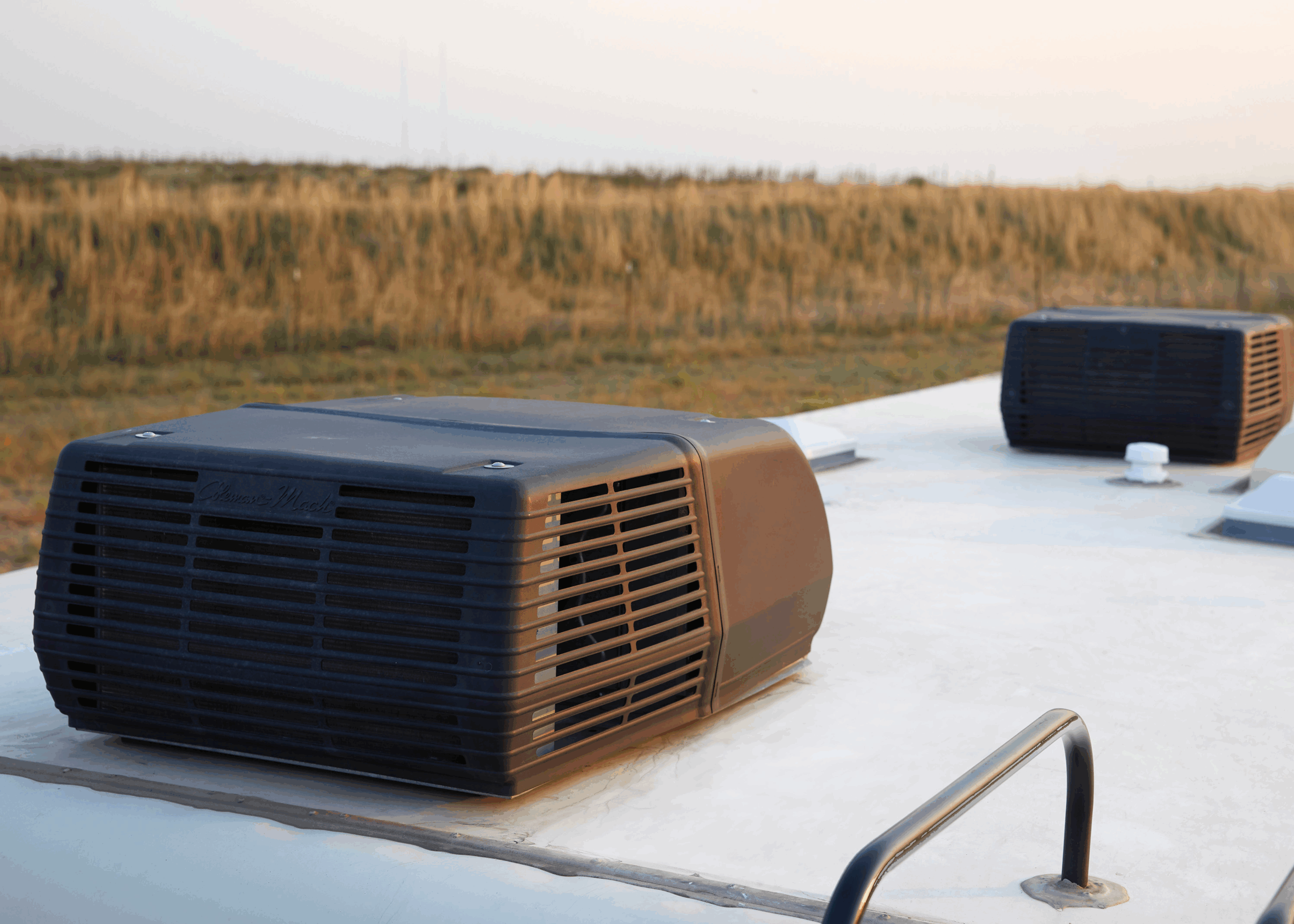

#4 Airxcel

Domain Est. 1998

Website: airxcel.com

Key Highlights: Airxcel has been the proud leader in RV & industrial HVAC solutions for over 50 years. Learn more about products for consumer and industrial applications….

#5 Sanden USA

Domain Est. 1998

Website: sanden.com

Key Highlights: Automotive Air Conditioning. We are the creative, innovative leaders in technology, delivering products and capabilities as HVAC systems experts, manufacturing ……

#6 Classic Auto Air

Domain Est. 1999

Website: classicautoair.com

Key Highlights: Classic Auto Air is your source for factory air conditioning parts & AC systems for 70’s & older Ford, GM, Mopar, Porsche, Custom Street Rods & more….

#7 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: Aftermarket Parts Built at or Above Spec. The quality of DENSO parts is guaranteed because every component that leaves a DENSO factory has been designed with ……

#8 DENSO

Website: denso-am.eu

Key Highlights: Providing OE quality parts to the Aftermarket. Empowering professionals with FREE technical trainings. Leading manufacturer of advanced systems and components….

#9 MAHLE Aftermarket North America

Domain Est. 2000

Website: mahle-aftermarket.com

Key Highlights: MAHLE Service Solutions, specializes in developing, manufacturing, and distributing vehicle diagnostics, ac service, fluid exchange, hydraulic and pneumatic ……

Expert Sourcing Insights for Aftermarket Vehicle Ac

H2: 2026 Market Trends for Aftermarket Vehicle AC

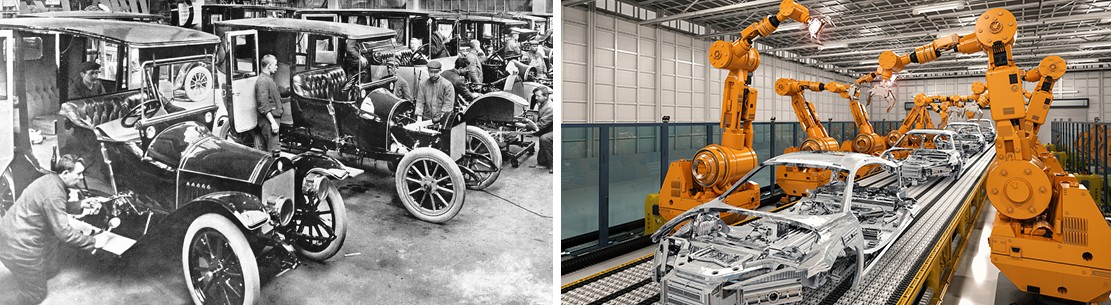

As we approach 2026, the global aftermarket vehicle air conditioning (AC) sector is undergoing a significant transformation driven by technological advancements, environmental regulations, evolving consumer preferences, and shifts in vehicle production trends. The market is poised for steady growth, with key trends shaping the demand, innovation, and competitive landscape.

1. Regulatory Pressure and Environmental Compliance

One of the most influential factors shaping the 2026 aftermarket AC market is stringent environmental regulation. Governments worldwide are phasing out high-global-warming-potential (GWP) refrigerants like R-134a in favor of more eco-friendly alternatives such as R-1234yf and natural refrigerants like CO₂ (R-744). By 2026, compliance with these standards will be widespread, driving demand for retrofit kits, specialized service tools, and technician training in the aftermarket. Regions like the European Union and North America are leading this shift, but emerging markets are expected to follow suit, creating a global ripple effect on AC component sales and servicing.

2. Growth in Electric Vehicle (EV) Adoption

The surge in electric vehicle sales is significantly impacting the aftermarket AC sector. Unlike internal combustion engine (ICE) vehicles, EVs require electric compressors and advanced thermal management systems to balance cabin comfort with battery efficiency. As the EV fleet ages by 2026, a growing number of vehicles will enter the maintenance and repair phase, creating new demand for EV-specific AC components. Aftermarket suppliers are responding by developing compatible compressors, condensers, and control modules tailored for EV platforms, representing a key growth vector.

3. Increased Demand for High-Efficiency and Smart AC Systems

Consumers are increasingly prioritizing comfort, energy efficiency, and connectivity. In response, the aftermarket is seeing a rise in demand for high-efficiency compressors, advanced filtration systems (e.g., HEPA and activated carbon), and smart climate control upgrades. By 2026, integration with smartphone apps, automatic cabin air quality monitoring, and AI-driven temperature regulation will become common aftermarket offerings, especially in premium and retrofit segments.

4. Expansion of E-Commerce and Digital Distribution Channels

The digitalization of the automotive aftermarket continues to accelerate. Online marketplaces, mobile apps, and direct-to-consumer platforms are becoming primary channels for AC parts distribution. By 2026, enhanced product visualization (AR/VR), AI-powered diagnostics, and online certification for technicians will streamline procurement and installation, allowing consumers and repair shops quicker access to quality components. This shift is also fostering competition, pushing brands to enhance transparency, pricing, and customer support.

5. Focus on Technician Training and Service Quality

With increasingly complex AC systems—especially in hybrids and EVs—there is a growing skills gap in the repair ecosystem. In 2026, OEMs and aftermarket leaders are expected to invest heavily in certified training programs, mobile diagnostic tools, and subscription-based technical support services. Partnerships between parts manufacturers and vocational schools or online learning platforms will become more common, ensuring a qualified workforce to support the evolving service demands.

6. Regional Market Dynamics

- North America and Europe: Mature markets with high vehicle ownership and strong regulatory frameworks will lead in premium and eco-friendly AC product adoption.

- Asia-Pacific: Rapid urbanization, rising middle-class income, and increasing vehicle penetration—especially in India and Southeast Asia—will drive robust growth in both volume and value segments.

- Latin America and Africa: These regions will see demand for affordable, durable AC components, with a focus on re-gas services and basic repairs due to higher shares of older vehicle fleets.

7. Sustainability and Circular Economy Initiatives

By 2026, sustainability will be central to the aftermarket AC value chain. Remanufactured compressors, recyclable materials in condensers and hoses, and closed-loop refrigerant recovery programs will gain traction. Consumers and regulators alike are pushing for reduced waste and lower carbon footprints, encouraging suppliers to adopt circular economy models.

Conclusion:

The 2026 aftermarket vehicle AC market is characterized by innovation, regulatory adaptation, and digital transformation. Success will depend on players’ ability to align with EV trends, comply with environmental standards, leverage digital platforms, and support a skilled service network. Companies that invest in sustainable, smart, and vehicle-specific solutions will be best positioned to capture value in this dynamic and expanding market.

Common Pitfalls Sourcing Aftermarket Vehicle AC Components (Quality, IP)

Sourcing aftermarket vehicle air conditioning (AC) components presents several challenges, particularly concerning product quality and intellectual property (IP) risks. Avoiding these pitfalls is critical for maintaining performance, safety, and legal compliance.

Quality Inconsistencies and Failures

Many aftermarket AC parts—such as compressors, condensers, and evaporators—lack rigorous manufacturing standards, resulting in premature failures, refrigerant leaks, or inefficient cooling. Poor material selection and substandard assembly processes often lead to reduced system reliability and increased warranty claims.

Counterfeit and Non-OEM Compliant Parts

A significant portion of the aftermarket includes counterfeit or imitation parts that mimic original equipment manufacturer (OEM) designs. These components frequently fail to meet performance or safety benchmarks, risking system damage and vehicle downtime. Buyers may unknowingly install parts that do not adhere to industry specifications like SAE or ISO standards.

Intellectual Property (IP) Infringement Risks

Sourcing aftermarket AC units that replicate patented OEM designs—such as proprietary compressor mechanics or housing configurations—can expose suppliers and distributors to legal liability. Unauthorized use of protected designs, trademarks, or technical specifications may result in cease-and-desist orders, litigation, or import bans.

Lack of Traceability and Certification

Many aftermarket suppliers operate with limited transparency, making it difficult to verify component origins, testing procedures, or compliance certifications. This lack of traceability increases the risk of deploying non-compliant or unsafe parts, especially in regulated markets.

Inadequate Testing and Validation

Unlike OEM components, aftermarket AC parts are often not subjected to comprehensive environmental, durability, or performance testing. This can lead to compatibility issues across different vehicle models and climates, undermining customer trust and increasing return rates.

Supply Chain Vulnerabilities

Reliance on unverified global suppliers increases exposure to inconsistent quality control, delayed shipments, and potential customs issues—particularly when IP concerns trigger inspections or seizures at borders.

Mitigating these pitfalls requires thorough supplier vetting, third-party quality audits, and legal review of product designs to ensure compliance with both technical standards and intellectual property laws.

Logistics & Compliance Guide for Aftermarket Vehicle AC

This guide provides a structured overview of key logistics and compliance considerations when handling, distributing, and installing aftermarket automotive air conditioning (AC) systems and components. Ensuring adherence to regulations and efficient logistics operations is essential for safety, environmental responsibility, and market access.

Regulatory Compliance

Environmental Regulations

Aftermarket vehicle AC systems often involve refrigerants regulated under environmental laws. Key compliance areas include:

– EPA Section 608 (U.S.): Requires certification for technicians handling refrigerants to prevent ozone depletion.

– F-Gas Regulation (EU): Mandates tracking, reporting, and phasedown of fluorinated greenhouse gases like R134a and R1234yf.

– Refrigerant Reclamation: Used refrigerants must be recovered, recycled, or reclaimed using EPA- or EU-approved equipment.

Vehicle Emissions and Safety Standards

- Components must not interfere with original vehicle emissions systems.

- Installation must comply with FMVSS (Federal Motor Vehicle Safety Standards) in the U.S. and UNECE Regulations in Europe.

- Aftermarket AC systems should not void original manufacturer warranties under the Magnuson-Moss Warranty Act (U.S.).

Product Certification and Labeling

- Ensure products carry necessary certifications such as DOT, SAE, or CE marking where applicable.

- Clearly label refrigerant type, capacity, and handling instructions on packaging and components.

Logistics Operations

Inventory Management

- Store refrigerants and AC components in climate-controlled environments to prevent degradation.

- Segregate hazardous materials (e.g., refrigerants in cylinders) per OSHA and local fire codes.

- Use inventory tracking systems that support lot/batch traceability for recalls and compliance reporting.

Transportation and Shipping

- Refrigerant cylinders must be shipped in accordance with DOT 49 CFR (U.S.) or ADR/RID/ADN (Europe) for dangerous goods.

- Use certified hazardous materials shippers with proper labeling, packaging, and documentation.

- Ensure temperature-sensitive components (e.g., seals, hoses) are not exposed to extreme conditions during transit.

Import/Export Compliance

- Verify HTS codes for accurate tariff classification of AC components.

- Comply with EPA Import Certification and CBP requirements when importing into the U.S.

- For EU imports, ensure compliance with REACH and RoHS directives regarding chemical and hazardous substance restrictions.

Installation and Technician Requirements

Certified Technicians

- Only EPA Section 608-certified technicians (Type I, II, or Universal) may handle refrigerant recovery and charging in the U.S.

- In the EU, technicians must hold F-Gas certification per Regulation (EU) No 517/2014.

Proper Installation Practices

- Follow OEM and aftermarket manufacturer guidelines for retrofitting AC systems.

- Use calibrated equipment for refrigerant charging to avoid over/undercharging.

- Perform leak testing using electronic detectors or UV dye after installation.

Recordkeeping and Audits

Documentation Requirements

- Maintain records of refrigerant purchases, sales, recovery, and disposal for a minimum of 3 years (EPA requirement).

- Keep logs of technician certifications and training.

- Retain shipping manifests and import/export documentation.

Internal Audits

- Conduct periodic compliance audits to verify adherence to environmental and safety standards.

- Review logistics workflows for efficiency and regulatory alignment.

Conclusion

Successfully managing aftermarket vehicle AC systems requires careful attention to both logistical efficiency and regulatory compliance. By following this guide, distributors, installers, and suppliers can ensure safe operations, avoid penalties, and support environmental sustainability. Stay updated on evolving regulations in your region to maintain continued compliance.

Conclusion: Sourcing Aftermarket Vehicle Air Conditioning Systems

Sourcing aftermarket vehicle air conditioning (A/C) systems presents a cost-effective and flexible solution for vehicle owners and repair services seeking to maintain or upgrade cooling performance. Aftermarket A/C components offer a wide range of options in terms of compatibility, features, and price points, often providing alternatives where original equipment manufacturer (OEM) parts may be expensive or unavailable. Advances in manufacturing and quality control have significantly improved the reliability and efficiency of aftermarket units, making them a viable option for both routine replacements and performance enhancements.

However, careful consideration must be given to factors such as part quality, vehicle compatibility, and adherence to environmental regulations (e.g., refrigerant types like R-134a or R-1234yf). Choosing reputable suppliers and certified products ensures long-term performance and minimizes the risk of premature failure or improper installation.

In conclusion, aftermarket vehicle A/C systems are a practical and economical choice when sourced responsibly. By balancing cost, quality, and technical specifications, stakeholders can achieve optimal cooling performance, extend vehicle longevity, and support efficient, sustainable repair practices.