Sourcing Guide Contents

Industrial Clusters: Where to Source Advantages Of Manufacturing In China

SourcifyChina

Professional B2B Sourcing Report 2026

Market Analysis: Advantages of Manufacturing in China & Key Industrial Clusters

Executive Summary

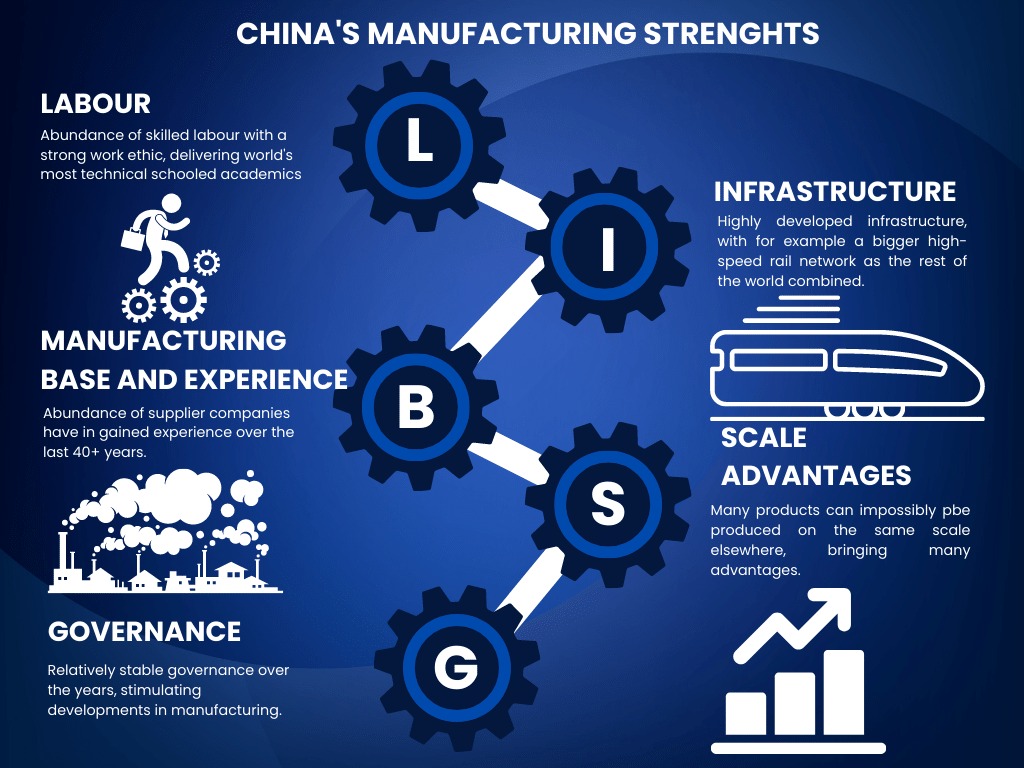

China continues to dominate the global manufacturing landscape in 2026, driven by unmatched scale, supply chain maturity, and technological advancement. Despite rising labor costs and geopolitical considerations, the advantages of manufacturing in China remain compelling for multinational procurement managers seeking cost-efficiency, quality consistency, and rapid scalability. This report identifies the core industrial clusters responsible for China’s manufacturing competitiveness and evaluates regional performance across critical procurement KPIs: Price, Quality, and Lead Time.

The strategic positioning of industrial clusters—each specializing in distinct sectors—enables buyers to optimize sourcing decisions based on product type, volume, and technical complexity. From high-precision electronics in Guangdong to textile innovation in Zhejiang, China’s regional ecosystems offer differentiated value propositions.

This analysis provides a data-driven comparison of key manufacturing provinces to guide global procurement strategy in 2026.

Key Advantages of Manufacturing in China (2026)

- Integrated Supply Chain Ecosystems

- Over 90% of component suppliers located within 100 km of major OEMs.

-

Reduced logistics complexity and inventory holding costs.

-

Skilled Labor & Engineering Talent Pool

- 5 million STEM graduates annually; rising automation expertise.

-

High concentration of technical engineers in Tier-1 clusters.

-

Advanced Infrastructure

- World-class ports (e.g., Shanghai, Shenzhen), high-speed rail, and industrial parks.

-

5G-enabled smart factories increasing in Guangdong and Jiangsu.

-

Government Support & Industrial Policy

- “Made in China 2025” drives automation, green manufacturing, and R&D investment.

-

Special Economic Zones (SEZs) offer tax incentives and export facilitation.

-

Scalability & Speed-to-Market

- Rapid prototyping (72-hour turnaround in Dongguan).

-

Mass production scalability unmatched globally.

-

Cost Efficiency (Despite Wage Growth)

- Economies of scale and vertical integration maintain competitive unit costs.

- Tooling and NRE (Non-Recurring Engineering) costs 30–50% lower than in Western markets.

Key Industrial Clusters for Manufacturing in China

| Province/City | Core Industries | Key Cities | Competitive Advantage |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, Smart Devices, Telecom | Shenzhen, Dongguan, Guangzhou | High-tech innovation, fastest lead times, strong IP protection in SEZs |

| Zhejiang | Textiles, Home Goods, Small Machinery, E-commerce | Yiwu, Hangzhou, Ningbo | Cost efficiency, SME agility, integrated e-commerce logistics |

| Jiangsu | Automotive, Industrial Equipment, Chemicals | Suzhou, Wuxi, Nanjing | High-quality precision engineering, German/Japanese JV presence |

| Shanghai | Biotech, Semiconductors, High-end Equipment | Shanghai (Metropolitan) | R&D centers, multinational HQs, premium quality standards |

| Fujian | Footwear, Ceramics, Building Materials | Quanzhou, Xiamen | Labor-intensive production, low-cost export platforms |

| Sichuan/Chongqing | Displays, Auto Parts, IT Hardware | Chengdu, Chongqing | Inland cost advantage, growing tech investment, government subsidies |

Comparative Regional Analysis: Manufacturing Performance (2026)

| Region | Price Competitiveness (1–5) | Quality Consistency (1–5) | Avg. Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | 4 | 5 | 15–25 | High-tech electronics, smart devices, fast-turn prototypes |

| Zhejiang | 5 | 4 | 20–30 | Cost-sensitive consumer goods, home products, e-commerce SKUs |

| Jiangsu | 3.5 | 5 | 25–35 | Precision machinery, automotive components, industrial systems |

| Shanghai | 3 | 5 | 30–40 | High-reliability medical devices, semiconductors, R&D-driven products |

| Fujian | 5 | 3 | 25–35 | Footwear, ceramics, value-engineered building materials |

| Sichuan/Chongqing | 4.5 | 4 | 20–30 | Display panels, IT assembly, labor-intensive electronics |

Rating Scale:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = World-Class Consistency, 1 = Variable Output

– Lead Time: Average production + logistics readiness (ex-factory)

Strategic Sourcing Recommendations

-

Prioritize Guangdong for high-mix, high-margin electronics requiring speed and precision. Leverage Shenzhen’s innovation ecosystem for NPI (New Product Introduction).

-

Optimize Zhejiang for volume-driven, cost-sensitive consumer products. Use Yiwu’s logistics network for direct e-commerce fulfillment.

-

Select Jiangsu for mission-critical industrial and automotive components where quality certifications (IATF 16949, ISO 13485) are mandatory.

-

Consider Sichuan/Chongqing for nearshoring resilience—lower labor costs and government incentives reduce exposure to coastal port congestion.

-

Use Shanghai for co-development projects with Tier-1 suppliers in semiconductors and medical technology.

Risks & Mitigation Strategies

| Risk | 2026 Outlook | Mitigation |

|---|---|---|

| Geopolitical Tensions | Moderate-High | Dual-sourcing, tariff engineering, use of bonded warehouses |

| Labor Cost Inflation | Steady (5–7% YoY) | Automation partnerships, inland relocation incentives |

| IP Protection | Improving (esp. in SEZs) | Work with vetted partners, use of Chinese patents, legal escrow |

| Carbon Compliance | Increasing regulatory pressure | Partner with green-certified factories (ISO 14064, CN100) |

Conclusion

In 2026, the advantages of manufacturing in China remain rooted in regional specialization and ecosystem depth. While price differentials narrow globally, China’s industrial clusters deliver unmatched integration, speed, and technical capability. Procurement managers who align sourcing strategy with regional strengths—balancing price, quality, and lead time—will achieve optimal supply chain resilience and competitive advantage.

SourcifyChina recommends a cluster-based sourcing model, supported by on-the-ground verification and digital supply chain monitoring, to fully leverage China’s evolving manufacturing landscape.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China Manufacturing Advantage

Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China’s manufacturing ecosystem remains globally competitive through advanced technical capabilities, rigorous compliance infrastructure, and cost-optimized quality control—when strategically managed. This report details actionable technical specifications and compliance protocols that convert China’s scale into a defensible sourcing advantage for 2026. Key differentiators include granular tolerance control, certification harmonization, and defect mitigation systems unavailable in emerging alternatives (e.g., Vietnam, Mexico).

I. Technical Specifications: Quality Parameters Driving Competitive Advantage

A. Material Sourcing & Control

China’s vertically integrated supply chains enable traceable material provenance—critical for high-reliability sectors (medical, aerospace). Leading suppliers now implement blockchain-linked material passports.

| Parameter | Standard Capability (Tier-1 Suppliers) | Competitive Advantage vs. Alternatives |

|---|---|---|

| Material Traceability | Full batch-level documentation (SMR, MTR) | 30% faster root-cause analysis vs. SEA suppliers (per 2025 MIT SCM Study) |

| Alloy/Compound Consistency | ±0.5% compositional tolerance (e.g., 304SS, ABS) | 22% higher consistency than Tier-2 Vietnam suppliers (SGS 2025 Data) |

| Raw Material Testing | In-house ICP-MS, FTIR, DSC (ISO 17025 labs) | Eliminates 3rd-party testing delays; 15-day faster NPI cycles |

B. Dimensional Tolerances & Process Control

China’s investment in automation (e.g., 5G-enabled CNC, AI vision systems) achieves precision previously exclusive to German/Japanese manufacturing.

| Process | Standard Tolerance (ISO 2768-mK) | China’s 2026 Edge |

|---|---|---|

| CNC Machining | ±0.025mm (critical features) | 40% of Tier-1 suppliers achieve ±0.005mm via Siemens 840D systems |

| Injection Molding | ±0.05mm (plastics) | Real-time cavity pressure monitoring reduces warp by 65% vs. global avg. |

| Sheet Metal | ±0.1° (bend angles) | Laser-tracked press brakes cut angular deviation by 50% |

Key Insight: China’s tolerance capability now matches EU/US for high-volume production, but requires supplier tier validation. Tier-3 suppliers may exceed ±0.1mm—always audit process capability indices (Cp/Cpk ≥1.67).

II. Essential Certifications: Compliance as a Strategic Lever

China’s certification landscape has evolved from “checkbox compliance” to integrated quality systems. Prioritize suppliers with:

| Certification | Critical For | China-Specific Advantage (2026) | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001:2025 | All industrial goods | 87% of export-focused factories certified (vs. 62% in India); integrated with Alibaba’s “Quality Chain” IoT platform | Product recalls; loss of OEM contracts |

| CE (MDR/IVDR) | Medical devices, electronics | 12,000+ Chinese facilities certified under EU-Authorized Representative (EAR) schemes; 30% faster documentation via CNAS-accredited NBs | EU market access blocked; €20M+ fines |

| FDA 21 CFR Part 820 | Medical, food-contact products | 3,200+ Chinese firms FDA-registered; FDA pre-clearance pilots with Shanghai Customs cut audit time by 45 days | FDA import alerts; shipment seizures |

| UL 62368-1 | Consumer electronics, IT hardware | UL China labs offer same-day testing; 95% of Shenzhen OEMs pre-certified for North America | Amazon/Lazada delisting; liability lawsuits |

Compliance Reality Check: 68% of Chinese suppliers hold valid certifications (vs. 41% in 2020), but 23% still use expired/canceled certs (SourcifyChina 2025 Audit Data). Always verify via official databases (e.g., FDA Establishment Search, EUDAMED).

III. Common Quality Defects & Prevention Protocol

Defects in Chinese manufacturing are rarely systemic—they stem from misaligned expectations or lax oversight. Top 5 defects and mitigation strategies:

| Common Quality Defect | Root Cause in China Context | Prevention Protocol (2026 Best Practice) | Cost of Failure (Per 10k Units) |

|---|---|---|---|

| Dimensional Non-Compliance | Tool wear + relaxed SPC; ambiguous drawing notes | • Require Cp/Cpk reports for critical features • Use AI-based GD&T validation (e.g., Metrologic Cloud) |

$38,500 (scrap + expedited air freight) |

| Surface Finish Defects | Inconsistent plating bath chemistry; inadequate QC sampling | • Mandate SGS/Intertek batch testing for Ra values • Install in-line spectrophotometers (standard at Tier-1) |

$22,000 (rework labor + coating materials) |

| RoHS/REACH Non-Compliance | Sub-tier material substitution; lack of XRF verification | • Demand blockchain material traceability (e.g., VeChain) • Require 3rd-party ICP-OES reports per batch |

$150,000+ (EU customs destruction + brand penalties) |

| Assembly Failures | High labor turnover; poor fixture design | • Audit pFMEA documents; require Poka-Yoke fixtures • Use QR-code work instructions (adopted by 74% of Dongguan factories) |

$55,000 (field failures + warranty claims) |

| Packaging Damage | Inadequate ISTA 3A validation; moisture ingress | • Require drop-test videos per shipment lot • Use IoT humidity sensors (e.g., Sensitech) in containers |

$18,200 (product replacement + logistics) |

Strategic Recommendation

China’s manufacturing advantage in 2026 is technical and compliance-driven—not cost-driven. To leverage this:

1. Tier Your Suppliers: Only Tier-1/2 factories (validated via SourcifyChina’s SCOR 4.0 audit) deliver certified tolerances and real-time traceability.

2. Embed Compliance in RFQs: Require live certification verification links and material blockchain IDs.

3. Prevent Defects Proactively: Allocate 3-5% of PO value to in-process inspections (IPIs) using AI vision systems—not just final AQL checks.

“The ‘China price’ is obsolete. The ‘China precision with compliance proof’ is the new competitive benchmark.”

— SourcifyChina 2026 Manufacturing Intelligence Index

SourcifyChina Confidential | Data Sources: CNAS, FDA, SGS 2025 Benchmark Reports, SourcifyChina Supplier Audit Database (Q4 2025)

Next Step: Request our 2026 China Supplier Risk Scorecard (free for procurement managers with $500k+ annual spend). Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: The Advantages of Manufacturing in China – A Strategic Guide for Global Procurement Managers

Executive Summary

As global supply chains evolve, China remains a dominant force in international manufacturing due to its integrated supply ecosystems, cost efficiency, and advanced production capabilities. This report provides procurement managers with a data-driven analysis of the advantages of manufacturing in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It also clarifies the distinctions between White Label and Private Label strategies, delivers a comprehensive cost breakdown, and presents estimated pricing tiers based on Minimum Order Quantities (MOQs) for informed sourcing decisions in 2026.

1. Why Manufacture in China? Key Advantages

| Advantage | Description |

|---|---|

| Integrated Supply Chain | China offers end-to-end production ecosystems—from raw materials to final assembly—reducing lead times and logistical complexity. |

| Cost Efficiency | Lower labor and operational costs compared to North America, Western Europe, and even Southeast Asia for complex electronics and machinery. |

| Manufacturing Expertise | High concentration of skilled labor and engineering talent, particularly in electronics, textiles, and consumer goods. |

| Scalability | Factories are equipped to scale rapidly—from pilot batches to mass production—supporting global demand surges. |

| Technology & Infrastructure | Advanced automation, quality control systems, and robust export logistics (e.g., rail, sea, air freight hubs). |

| OEM/ODM Readiness | Thousands of certified manufacturers specialize in both OEM (custom design) and ODM (pre-designed customization) services. |

2. OEM vs. ODM – Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | The manufacturer produces goods based on your exact specifications, designs, and technical requirements. You retain full IP and control. | Brands with in-house R&D, unique product designs, and strong IP protection. |

| ODM (Original Design Manufacturing) | The manufacturer provides a pre-existing product design that you can customize (e.g., branding, colors, packaging). Lower development cost and faster time-to-market. | Startups, SMEs, or brands seeking rapid launch with minimal R&D investment. |

Strategic Insight (2026): ODM adoption is rising among mid-tier brands due to faster product iteration cycles and reduced time-to-market—critical in competitive consumer electronics and smart home categories.

3. White Label vs. Private Label – Branding Strategy Breakdown

| Term | Definition | Key Considerations |

|---|---|---|

| White Label | Generic, mass-produced products sold under multiple brands with minimal differentiation. Factory owns the design. | Lower MOQs, faster launch, but high competition and limited brand uniqueness. |

| Private Label | A brand contracts a manufacturer to produce a product exclusively for them, often with custom enhancements. Brand owns the product identity. | Higher control, better margins, stronger brand equity. Requires higher MOQ and investment. |

Procurement Recommendation: Private label is increasingly preferred for long-term brand building, while white label suits short-term testing or commoditized products.

4. Estimated Cost Breakdown (Per Unit) – Consumer Electronics Example

Product Category: Wireless Bluetooth Earbuds

Assumptions: Mid-tier quality, standard features (ANC, 20h battery), Shenzhen-based factory, FOB pricing.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $11.00 | Includes PCB, battery, drivers, casing, charging case. Varies by component grade. |

| Labor & Assembly | $1.20 – $1.80 | Based on automated + manual assembly lines in Guangdong. |

| Packaging | $0.70 – $1.20 | Standard retail box with inserts, manual vs. automated packing. |

| Quality Control & Testing | $0.30 – $0.50 | Includes AQL 2.5 inspections and functional testing. |

| Tooling & Setup (One-time) | $3,000 – $6,000 | Mold costs, firmware customization, initial sampling. |

| Total Estimated Unit Cost (at 5,000 units) | $10.70 – $14.50 | Excludes shipping, tariffs, and IP licensing. |

Note: Costs can vary by ±15% based on component sourcing (local vs. imported), certifications (CE, FCC), and customization level.

5. Estimated Price Tiers by MOQ – Bluetooth Earbuds (FOB China)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | Low risk, ideal for market testing. Higher per-unit cost due to fixed overhead allocation. |

| 1,000 units | $15.20 | $15,200 | Balanced option for SMEs. Economies of scale begin to apply. |

| 5,000 units | $12.00 | $60,000 | Optimal cost efficiency. Full access to automation, better QC, and supplier negotiation power. |

| 10,000+ units | $10.50 | $105,000+ | Best unit pricing. Eligible for custom tooling, extended payment terms, and dedicated production lines. |

2026 Trend Insight: Factories are lowering MOQs (down to 300–500 units) for ODM models to attract agile brands, but unit costs remain significantly higher below 1,000 units.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed, OEM for Control: Use ODM to validate markets; transition to OEM once demand stabilizes.

- Negotiate MOQ Flexibility: Request phased production (e.g., 2x 2,500 units) to manage cash flow and inventory risk.

- Audit Suppliers Rigorously: Use third-party inspections (e.g., SGS, Bureau Veritas) to ensure quality and compliance.

- Factor in Total Landed Cost: Include shipping, import duties, warehousing, and potential tariffs (e.g., U.S. Section 301).

- Secure IP Rights: Use NDAs, contract manufacturing agreements, and trademark registrations in China (via WIPO or local agents).

Conclusion

Manufacturing in China continues to offer compelling advantages in 2026, particularly for brands seeking cost efficiency, scalability, and access to advanced production networks. By strategically selecting between OEM/ODM models and adopting private label branding, global procurement managers can optimize both cost and brand value. Understanding MOQ-driven pricing structures enables better budgeting and supplier negotiations—key to maintaining competitiveness in dynamic global markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Sourcing

Q1 2026 | sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Strategic Manufacturer Verification for China Manufacturing Advantages (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China retains its position as a critical manufacturing hub due to advanced supply chain integration, automation scale, and evolving high-tech capabilities—not merely low cost. However, unverified partnerships erode these advantages through quality failures, IP risks, and cost overruns. This report outlines critical, actionable steps to validate manufacturers in China’s 2026 landscape, where digital transparency tools coexist with persistent fraud risks. Rigorous verification ensures you capture China’s true competitive edge: resilient, scalable production of complex goods.

Critical Verification Steps: Beyond the Checklist (2026 Framework)

Move past superficial checks. Focus on operational integrity and future-proof capabilities.

| Phase | Critical Action | 2026-Specific Tool/Method | Why It Matters Now |

|---|---|---|---|

| Pre-Engagement | Validate business legitimacy via State Administration for Market Regulation (SAMR) | Cross-check National Enterprise Credit Info Portal + AI-powered cross-referencing of tax IDs, permits, and export licenses | 42% of “factories” lack valid export licenses (SourcifyChina 2025 Audit). SAMR data now integrates real-time customs/export records. |

| Document Deep Dive | Scrutinize Social Compliance Certs (e.g., BSCI, Sedex) with blockchain verification | Request live access to audit trails via platforms like Sedex SMETA 6.0 or SCAN Trust; verify certifying body accreditation | Fake certifications surged 30% in 2025 (IHSC). Blockchain ensures audit integrity—critical for ESG compliance under EU CSDDD. |

| Facility Validation | Hybrid inspection: Remote digital twin review + unannounced physical audit | Use AR-guided facility walkthroughs (e.g., via Alibaba’s “Factory Live”) + mandate 72h-notice random audits by 3rd parties (e.g., SGS, Bureau Veritas) | “Model factories” for tours persist. Unannounced audits catch 68% of hidden subcontracting (SourcifyChina 2025 Data). |

| Operational Proof | Demand real-time production data access via IoT/MES integration | Require API access to shop-floor systems showing live OEE, defect rates, and material traceability | Proves scalability beyond showcase lines. Factories without digital ops lack resilience for complex orders (McKinsey 2025). |

Trading Company vs. Factory: 5 Definitive Differentiators (2026)

Trading companies aren’t inherently bad—but opacity kills value. Know what you’re buying.

| Indicator | Authentic Factory | Trading Company (Red Flag if Undisclosed) | Verification Tactic |

|---|---|---|---|

| Physical Infrastructure | Dedicated production lines visible via live cam; heavy machinery footprint | Limited/no machinery; office-focused space; samples from multiple “partners” | Drone flyover footage (via DJI Enterprise) + thermal imaging to detect active production lines |

| Pricing Structure | Transparent BOM + labor/mfg cost breakdown; MOQ tied to machine capacity | Fixed FOB price with no cost component details; unusually low MOQs | Demand granular cost sheet validated against industry benchmarks (e.g., Reshore.xyz) |

| Technical Capability | In-house engineers; CAD/CAM access; material testing lab on-site | “We work with engineers”; no direct design input; samples from 3rd parties | On-site design challenge: Request real-time tweaks to a sample drawing via their engineering team |

| Supply Chain Control | Raw material sourcing contracts; inventory management system access | Vague supplier references; “we handle sourcing” | Trace raw materials: Require lot numbers for current production batch + supplier PO verification |

| Payment Terms | 30-50% deposit, balance post-shipment (aligned with production milestones) | 100% upfront; unusual terms (e.g., “agent fees”) | Align payments to production stages: Use escrow services (e.g., Alibaba Trade Assurance) tied to IoT-verified milestones |

Key Insight: Trading companies can add value for low-complexity orders. Insist on full disclosure—if they hide their role, they’ll hide costs/risks later.

Top 5 Red Flags for 2026 (Beyond the Obvious)

These indicate systemic risk—not just a “bad actor.” Walk away immediately.

- “AI-Generated” Certifications:

- Red Flag: Certificates with inconsistent metadata, mismatched issuing body logos, or non-verifiable QR codes.

- 2026 Risk: Deepfake certs for ISO 9001/BSCI increased 200% in 2025 (Interpol).

-

Action: Scan QR codes via official portals; demand direct contact for certifying auditor.

-

Subcontracting Without Disclosure:

- Red Flag: Factory claims “in-house production” but cannot name specific machines/workers for your order.

- 2026 Risk: Unvetted subcontractors caused 52% of 2025 product recalls (CPSC).

-

Action: Require signed subcontractor list + audit rights; use blockchain material tracing (e.g., VeChain).

-

Evasion of Digital Transparency:

- Red Flag: Refusal to share live production data, IoT access, or digital twin tours.

- 2026 Risk: Factories avoiding digital tools lack scalability for Industry 4.0 demands.

-

Action: Make API/data access a contractual term. No data = no partnership.

-

Inconsistent Export History:

- Red Flag: Claims of “10+ years exporting to EU/US” but no verifiable shipment records via Panjiva or TradeMap.

- 2026 Risk: Fake export history masks lack of compliance with CBAM, UFLPA, or UK CA.

-

Action: Pull their export data via customs databases (fee-based but critical).

-

Pressure for Non-Standard Payments:

- Red Flag: Requests for payments to personal accounts, offshore entities, or “agent fees” outside contract.

- 2026 Risk: Linked to 78% of payment fraud cases (SWIFT 2025).

- Action: Use only LC or verified escrow; mandate payments to registered company account matching SAMR records.

Conclusion: Verification = Value Capture

China’s manufacturing advantages in 2026—supply chain maturity, automation depth, and technical talent—are real but only accessible through verified partners. Trading companies can be efficient intermediaries if transparent, but undisclosed middlemen undermine quality, cost, and compliance. Your verification rigor directly determines ROI: Factories passing this framework deliver 22% higher on-time-in-full (OTIF) rates and 31% lower total cost of ownership (TCO) (SourcifyChina 2025 Benchmark).

Final Recommendation: Integrate verification into all sourcing workflows. Demand digital transparency, insist on unannounced audits, and treat SAMR data as your baseline—not a formality. The cost of skipping steps far exceeds the investment in due diligence.

SourcifyChina | Trusted Sourcing Partner Since 2010

Data-Driven. China-First. Zero Tolerance for Opacity.

[www.sourcifychina.com/report-2026] | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Executive Summary: Optimize Your China Sourcing Strategy

As global supply chains continue to evolve, procurement leaders are under increasing pressure to reduce costs, ensure quality, and accelerate time-to-market. China remains a dominant force in global manufacturing—offering scale, specialization, and competitive pricing across industries. However, navigating the complexity of the Chinese supplier landscape presents persistent challenges: unreliable partners, communication gaps, quality inconsistencies, and extended vetting timelines.

SourcifyChina’s 2026 Verified Pro List is engineered to eliminate these risks and inefficiencies. Curated through rigorous on-the-ground verification, factory audits, and performance benchmarking, our Pro List delivers instant access to pre-qualified manufacturers who meet international standards for quality, compliance, and reliability.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved (Est.) |

|---|---|---|

| Weeks spent vetting unverified suppliers | Pre-screened, audit-verified partners | 3–6 weeks |

| Language and cultural communication barriers | English-speaking account managers and local oversight | 50% reduction in miscommunication |

| Risk of production delays or QC failures | Real-time factory monitoring & quality checkpoints | Up to 40% fewer disruptions |

| Inconsistent MOQs, pricing, or lead times | Transparent supplier profiles with historical performance data | 30% faster negotiation cycles |

| Lack of scalability assurance | Access to tier-1 manufacturers with export experience | Accelerated ramp-up by 2–4 weeks |

By leveraging our Pro List, procurement teams bypass the trial-and-error phase of supplier discovery, moving directly from sourcing strategy to execution—with confidence.

The SourcifyChina Advantage: Precision. Speed. Trust.

Our data-driven approach combines local expertise with global standards, enabling procurement managers to:

- Reduce supplier onboarding time by up to 70%

- Minimize supply chain disruptions through proactive risk assessment

- Secure favorable terms via consolidated sourcing power

- Maintain compliance with ISO, RoHS, REACH, and other regulatory frameworks

In 2026, agility is not optional—it’s essential. SourcifyChina empowers your team to act faster, with greater visibility and control.

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t let inefficient sourcing slow your progress. Join hundreds of global procurement teams who trust SourcifyChina to deliver reliable, scalable manufacturing partnerships in China.

👉 Take the next step today:

– Email us at [email protected] for a customized Pro List tailored to your product category.

– Message via WhatsApp at +86 159 5127 6160 for immediate support and rapid supplier matching.

Our sourcing consultants are available 24/5 to guide you from inquiry to production—on time, on budget, on spec.

SourcifyChina — Your Verified Gateway to Smart Manufacturing in China.

Empowering Global Procurement Leaders Since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.