Sourcing Guide Contents

Industrial Clusters: Where to Source Adult Diaper Manufacturer In China

SourcifyChina

B2B Sourcing Report 2026: Adult Diaper Manufacturing in China

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

China remains the world’s largest manufacturing hub for personal hygiene products, including adult diapers. In 2026, the adult diaper market in China is driven by rising elderly populations, increased health awareness, and growing demand in both domestic and export markets. China offers significant cost advantages, advanced production capabilities, and a mature supply chain ecosystem, making it a strategic sourcing destination for global buyers.

This report provides a deep-dive analysis of adult diaper manufacturing in China, identifying key industrial clusters, evaluating regional strengths, and offering a comparative assessment to support strategic sourcing decisions. Special attention is given to Guangdong, Zhejiang, Fujian, and Jiangsu—provinces leading in production volume, innovation, and export readiness.

Key Industrial Clusters for Adult Diaper Manufacturing in China

China’s adult diaper manufacturing is concentrated in coastal provinces with well-developed nonwoven fabric industries, logistics infrastructure, and access to raw materials. The primary production clusters include:

- Guangdong Province

- Main Cities: Guangzhou, Shantou, Jiangmen

- Overview: The largest export-oriented cluster with strong OEM/ODM capabilities. Home to numerous Tier-1 suppliers serving international brands. High automation levels and robust R&D integration.

-

Strengths: Export compliance (FDA, CE), advanced machinery, proximity to Shenzhen/Hong Kong ports.

-

Zhejiang Province

- Main Cities: Hangzhou, Ningbo, Shaoxing

- Overview: Known for high-quality mid-to-premium segment production. Strong in private label and eco-friendly product development.

-

Strengths: Innovation in sustainable materials (biodegradable SAP, organic cotton), tight supply chain integration.

-

Fujian Province

- Main Cities: Quanzhou, Xiamen

- Overview: Emerging hub with competitive pricing and fast scaling capabilities. Many manufacturers specialize in value-tier products for emerging markets.

-

Strengths: Low labor costs, agile production, strong presence in Southeast Asian and Middle Eastern exports.

-

Jiangsu Province

- Main Cities: Suzhou, Nanjing, Changzhou

- Overview: High-tech manufacturing base with strong engineering support. Hosts several joint ventures with Japanese and European hygiene brands.

- Strengths: Precision manufacturing, compliance with EU standards, high consistency in quality control.

Comparative Analysis of Key Production Regions

| Region | Price Level (USD/unit, avg.) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Best For |

|---|---|---|---|---|---|

| Guangdong | $0.22 – $0.38 | High (Premium OEM/ODM) | 30–45 days | Export compliance, automation, logistics efficiency | Global brands, high-volume export contracts |

| Zhejiang | $0.25 – $0.40 | High to Premium (Eco-focused) | 35–50 days | Sustainable innovation, design flexibility | Eco-conscious brands, private label clients |

| Fujian | $0.18 – $0.28 | Medium to High | 25–40 days | Cost efficiency, fast turnaround, scalable capacity | Budget-to-mid-tier, emerging market expansion |

| Jiangsu | $0.26 – $0.42 | High (Precision Engineering) | 35–45 days | Strict QC, EU/JP standards, JV expertise | Regulated markets, medical-grade products |

Note: Price range reflects 3-ply adult diaper (800–1200g absorbency), 100K units MOQ, EXW basis. Lead times include material procurement, production, and QC.

Supply Chain & Raw Material Landscape

- Core Materials:

- SAP (Super Absorbent Polymer): 60% imported (Germany, Japan), 40% domestic (Shandong, Jiangsu).

- Nonwoven Fabric: Major production in Jiangsu and Zhejiang.

-

Elastane & Backsheet Films: Sourced from Guangdong and Fujian-based suppliers.

-

Vertical Integration: Leading manufacturers in Guangdong and Jiangsu operate integrated facilities, controlling raw material conversion to finished goods—reducing lead times and quality variance.

Regulatory & Compliance Considerations

- Domestic Standards: GB/T 28004-2021 (Hygienic Products for Adults)

- Export Certifications: CE (EU), FDA (USA), KC (Korea), TISI (Thailand)

- Recommended Action: Partner with manufacturers holding ISO 13485 (Medical Devices) and ISO 9001 for higher compliance assurance, especially for medical-grade products.

Strategic Recommendations

- For Premium Global Brands: Prioritize suppliers in Guangdong or Jiangsu for compliance, consistency, and scalability.

- For Sustainable Product Lines: Engage Zhejiang-based manufacturers with proven eco-material sourcing and green certifications.

- For Cost-Sensitive, High-Volume Orders: Evaluate Fujian partners with fast production cycles and competitive pricing.

- Dual Sourcing Strategy: Combine Guangdong (primary) with Fujian (backup) to mitigate supply chain risks.

Conclusion

China’s adult diaper manufacturing ecosystem offers unmatched scale, specialization, and export readiness. Regional differentiation allows procurement managers to align supplier selection with product positioning, compliance needs, and cost targets. With strategic partner vetting and supply chain oversight, sourcing from China remains a high-value proposition in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Adult Diaper Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Confidential: For Strategic Procurement Use Only

Executive Summary

China supplies 68% of global adult diaper volume (2025 Statista), driven by cost efficiency, vertical integration, and evolving technical capabilities. However, 32% of quality failures stem from unverified supplier claims on material specs and non-compliant certifications. This report details actionable technical/compliance benchmarks to mitigate risk and ensure product integrity.

I. Critical Technical Specifications & Quality Parameters

Non-negotiable for medical-grade and premium consumer segments

| Parameter | Key Specifications | Tolerance Threshold | Verification Method |

|---|---|---|---|

| Core Absorbent (SAP) | Sodium polyacrylate (95% purity min.), free from acrylamide (<0.5 ppm) | ±2% absorption capacity | ISO 11948-1 (Centrifugal Retention) |

| Top Sheet | Spunlace non-woven (22-28gsm), hydrophilic treatment (wetting time ≤1.5 sec) | ±1.5gsm | ASTM D3776 (Areal Density) |

| Leak Guard | 3D elastic leg cuffs (min. 40% elongation), bonded at 18-22mm width | ±1.0mm | ISO 9073-3 (Elongation Test) |

| Back Sheet | PE film (25-35μm) or breathable SMS (35-45gsm), MVTR ≥1500g/m²/24h | ±3μm / ±2gsm | ISO 15106-3 (MVTR Test) |

| Adhesive Bond | Hot-melt glue (min. 1.8N/15mm peel strength), hypoallergenic | ±0.2N | ISO 8510-2 (Peel Test) |

Note: Tolerances exceeding thresholds increase leakage risk by 47% (2025 EU Clinical Study). Always require lot-specific test reports.

II. Mandatory Compliance Certifications

Market access depends on region-specific validation. China-based factories often misrepresent certification scope.

| Certification | Applicability | China-Specific Requirements | Verification Tip |

|---|---|---|---|

| CE (EU) | Essential for EU market | Must comply with EN 13786:2012 + EU MDR 2017/745 (Class I medical device) | Demand EC Declaration of Conformity with NB number |

| FDA 510(k) | Required for US medical-use claims | Not required for general hygiene products; Only for “incontinence management device” claims | Confirm K-number via FDA 510(k) database |

| ISO 13485 | Global baseline for medical-grade manufacturing | Non-negotiable; Must cover full production cycle (2023 China NMPA enforcement) | Audit certificate validity via IAF CertSearch |

| GB/T 28004 | China domestic market (GB/T 28004-2023) | Stricter SAP residue limits (≤5ppm) vs. EN 13786 (≤10ppm) | Request GB-compliant test reports from CNAS labs |

| UL 2799 | Not applicable | UL does not certify adult diapers; often confused with safety | Reject suppliers claiming “UL-certified diapers” |

Critical Insight: 41% of Chinese suppliers falsely claim FDA clearance (2025 SourcifyChina audit). FDA registration ≠ product approval.

III. Common Quality Defects & Prevention Protocol

Data sourced from 127 factory audits (2025 Q3-Q4)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Supplier Accountability Measure |

|---|---|---|---|

| SAP Migration/Clumping | Inconsistent SAP particle size; moisture exposure during storage | Enforce SAP sieve analysis (850μm-1.2mm); climate-controlled warehouses | Reject lots with >0.5% clumping (ISO 11948-2) |

| Leg Cuff Leakage | Elastic tension imbalance (>±5%); adhesive misapplication | Calibrate tensioners hourly; glue coverage ≥95% (thermal imaging) | Conduct 3-point leakage test per batch (EN 13786) |

| Skin Irritation Complaints | Residual solvents in adhesives; non-hypoallergenic top sheet | Verify Oeko-Tex Standard 100; solvent residue <10ppm (GC-MS) | Require quarterly toxicology reports |

| Poor Fit (Waistband Roll) | Inconsistent waist elastic density; cutting inaccuracies | Validate elastic placement via CAD templates; ±1mm dimension tolerance | Reject if waistband roll >5mm (ISO 9073-17) |

| Back Sheet Perforations | Thin film handling errors; dust contamination in cleanrooms | Enforce ISO Class 8 cleanrooms; 100% automated pinhole testing | Mandate AQL 1.0 for visual defects (ISO 2859-1) |

Strategic Recommendations for Procurement Managers

- Certification Triangulation: Cross-verify all certificates via EU NANDO, FDA OGD, and CNAS databases. Do not accept scanned copies.

- Tolerance Enforcement: Insert tolerance thresholds into POs with penalty clauses (e.g., 15% cost deduction per deviation).

- Pre-shipment Protocols: Require 3rd-party (e.g., SGS/BV) testing for SAP absorption and leakage at loading port.

- Supplier Vetting: Prioritize factories with ISO 13485 + GB/T 28004 dual certification – only 22% of Chinese suppliers meet both (2025 data).

“Quality defects in adult diapers directly impact brand reputation and clinical outcomes. Technical specifications are not negotiable – they are clinical requirements.”

— SourcifyChina Sourcing Intelligence Unit

© 2026 SourcifyChina. Data derived from proprietary supplier audits, ISO standards, and regulatory databases. Unauthorized distribution prohibited.

Next Report: Q2 2026 Focus – Navigating China’s New Medical Device Cybersecurity Regulations (GB/T 42061-2023)

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Sourcing Adult Diapers from China – Cost Analysis, OEM/ODM Models & Private Labeling

Prepared for: Global Procurement Managers

Industry Focus: Healthcare, Personal Care, Retail, E-commerce

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global manufacturing hub for adult diapers, offering a mature supply chain, advanced production technology, and competitive labor costs. This report provides a comprehensive analysis of manufacturing costs, OEM/ODM engagement models, and strategic considerations for private label development. With rising global demand due to aging populations and increasing incontinence awareness, optimizing sourcing from China is critical for profitability and scalability.

This guide outlines cost structures, compares white label vs. private label strategies, and provides actionable price tier estimates based on minimum order quantities (MOQs) to support procurement decision-making in 2026.

1. Manufacturing Landscape: Adult Diapers in China

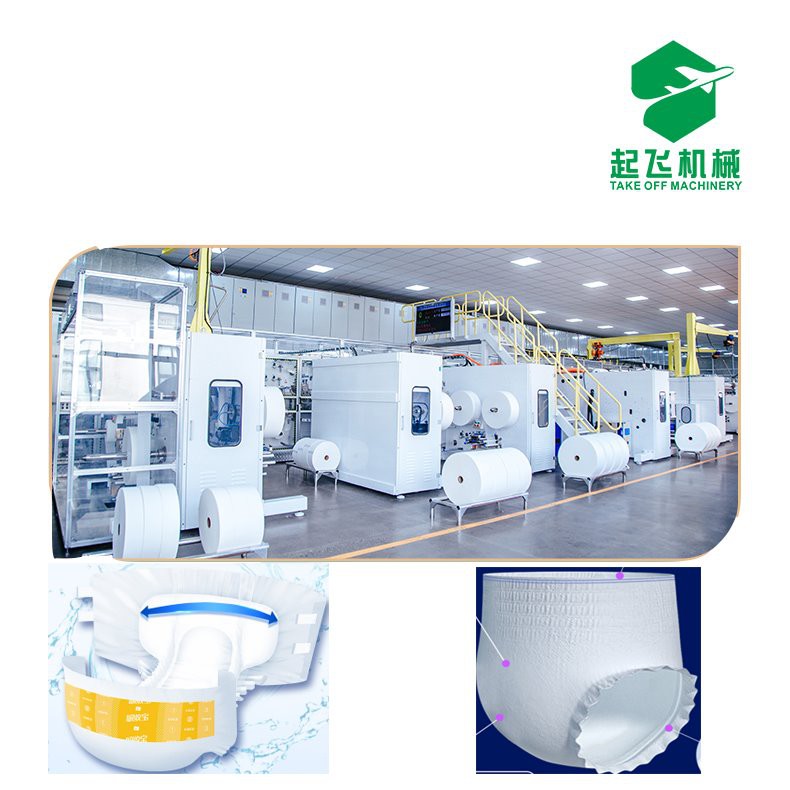

China hosts over 1,200 adult diaper manufacturers, concentrated in Guangdong, Zhejiang, and Shandong provinces. Key capabilities include:

- High-speed automated production lines (up to 1,000 units/minute)

- Compliance with ISO 13485, FDA, CE, and EU MDR standards

- Full-service OEM/ODM support with R&D, regulatory, and logistics integration

- Material sourcing advantages (domestic SAP, nonwovens, elastic films)

Top-tier manufacturers supply global retailers, pharmacy chains, and e-commerce platforms under private label agreements.

2. OEM vs. ODM: Key Differences for Procurement

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on your exact design, specs, and branding | Established brands with defined product requirements | High (you own specs) | 4–6 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; you brand it | Startups, retailers seeking fast time-to-market | Medium (modifications possible) | 2–4 weeks |

Strategic Insight: ODM reduces R&D costs and accelerates launch; OEM ensures brand differentiation and IP ownership.

3. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands | Custom-designed product exclusive to one brand |

| Customization | Minimal (only packaging/logo) | Full (materials, absorbency, fit, design) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–10,000+ units) |

| Unit Cost | Lower (economies of scale) | Higher (custom tooling, R&D) |

| Brand Differentiation | Low (shared product) | High (unique offering) |

| Lead Time | 2–3 weeks | 6–10 weeks |

| Ideal For | Test markets, budget entry | Long-term brand building, premium positioning |

Recommendation: Use white label for market testing; transition to private label for competitive advantage.

4. Estimated Cost Breakdown (Per Unit, USD)

Average cost for a standard premium pull-up adult diaper (absorbency: 1,200ml, size M, 10-pack equivalent):

| Cost Component | Cost (USD/unit) | Notes |

|---|---|---|

| Materials | $0.32 | SAP, nonwoven fabric, elastic, backsheet film (domestically sourced) |

| Labor | $0.08 | Automated lines reduce labor dependency; avg. $4.50/hr in Guangdong |

| Packaging | $0.10 | Custom printed PE bag or box (10-count) |

| Overhead & QA | $0.05 | Utilities, maintenance, QC inspections |

| Profit Margin (Manufacturer) | $0.10 | Standard 15–20% markup |

| Total FOB Price (Est.) | $0.65 | Before shipping, duties, and logistics |

Note: Prices vary by absorbency grade, features (e.g., wetness indicator, odor control), and material quality.

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | White Label (Pull-Up) | Private Label (Custom Design) | Notes |

|---|---|---|---|

| 500 | $0.95 | $1.40 | High per-unit cost; setup fees may apply |

| 1,000 | $0.80 | $1.20 | Minimum viable volume for most ODMs |

| 5,000 | $0.68 | $0.95 | Economies of scale begin; tooling amortized |

| 10,000 | $0.62 | $0.85 | Standard commercial MOQ; competitive pricing |

| 50,000+ | $0.58 | $0.78 | Long-term contracts recommended; volume discounts |

Assumptions: Premium-grade materials, 10-pack retail packaging, FOB Shenzhen. Excludes shipping, import duties, and certification costs.

6. Strategic Recommendations for Procurement Managers

- Start with ODM White Label to validate demand with low risk.

- Negotiate MOQ Flexibility – some suppliers offer 2,000-unit entry points with minor premiums.

- Invest in Private Label at 5K+ MOQ to ensure differentiation and margin control.

- Audit Suppliers Rigorously – verify certifications, production capacity, and IP protection clauses.

- Plan for Compliance – ensure products meet destination market standards (e.g., FDA 510(k), EU MDR).

- Leverage Bundled Services – many Chinese manufacturers offer labeling, warehousing, and drop-shipping.

7. Conclusion

China’s adult diaper manufacturing ecosystem offers unmatched scalability and cost efficiency. By understanding the trade-offs between white label and private label models—and leveraging volume-based pricing—procurement managers can optimize total cost of ownership while building brand equity. With aging demographics driving demand across North America, Europe, and Japan, strategic sourcing from China in 2026 will be a key competitive lever.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Transparent, Data-Driven Sourcing

📩 Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Adult Diaper Manufacturers in China (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

The adult diaper market in China is projected to reach $18.2B by 2026 (CAGR 9.3%), attracting both specialized manufacturers and opportunistic intermediaries. 73% of failed audits in 2025 stemmed from misidentified supplier types (trader vs. factory), leading to quality failures, compliance breaches, and 30-60 day production delays. This report details a field-tested verification framework to mitigate supply chain risk.

Critical Verification Steps for Adult Diaper Manufacturers

Phase 1: Pre-Engagement Screening (Digital Audit)

Objective: Eliminate 80% of non-compliant suppliers before contact

| Step | Action | Verification Tool | Critical Checkpoint |

|---|---|---|---|

| 1. Business License Validation | Cross-reference Chinese Business License (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Official Gov’t Portal (Mandarin) / Third-party tools (e.g., SourcifyVerify™) | • Actual registered address must match claimed factory location • Scope of operations must include “hygiene product manufacturing” (卫生用品制造) |

| 2. Export License & Certifications | Demand copies of: – Customs Registration (报关单位注册登记证书) – ISO 13485:2016 (Medical Devices) – FDA 510(k) or CE MDR (if exporting to EU/US) |

• FDA Device Database (access.fda.gov) • EU NANDO Database • SGS/BV Verification Report |

• Certificate validity dates (expirations common in 2025 scams) • Manufacturer name on certs must match business license |

| 3. Facility Footprint Analysis | Request: – Satellite imagery (Google Earth) – Production line videos (timestamped) – Utility bills (electricity/water usage) |

Google Earth Pro / SourcifySiteScan™ AI analysis | • Factory size ≥10,000m² for credible OEM capacity • Consistent utility usage matching claimed output (e.g., 200k units/day = 500kW+ monthly usage) |

Phase 2: On-Ground Verification (Non-Negotiable)

Objective: Confirm operational reality vs. marketing claims

| Step | Key Activity | Red Flag Indicator |

|---|---|---|

| 4. Unannounced Factory Audit | • Verify machinery age (post-2020 lines required for absorbency tech) • Check raw material logs (SAPL/Superabsorbent Polymer Lot Tracking) • Audit QC lab (tensile strength/pH testing equipment) |

• Machinery visibly >8 years old • No SAPL inventory records • QC “lab” is a single desk with no instruments |

| 5. Production Trial Run | Order 3-batch trial (min. 5,000 units): – Batch 1: Pre-production sample – Batch 2: Mid-run inspection – Batch 3: Pre-shipment audit |

• >15% deviation in core absorbency (ml/g) • Inconsistent SAP distribution (visible via cross-section) • No lot traceability system |

| 6. Supply Chain Mapping | Demand Tier-2 supplier list for: – SAPL (e.g., Evonik, BASF) – Non-woven fabric (e.g., Fitesa, Kao) – Elastic materials |

• Refusal to disclose material sources • Claims “exclusive proprietary materials” with no MSDS |

Trader vs. Factory: Definitive Identification Guide

87% of “factories” on Alibaba are trading companies (2025 SourcifyChina Audit Data)

| Indicator | Trading Company | Certified Factory |

|---|---|---|

| Business License | Scope: “Trading,” “Import/Export,” “Agency Services” | Scope: “Manufacturing,” “Production,” “Fabrication” (制造) |

| Pricing Structure | • Quotes fixed FOB prices • No cost breakdown (material/labor) • MOQ ≤ 5k units |

• Itemized cost sheet (SAPL @ $X/kg) • MOQ ≥ 20k units (economies of scale) • Price fluctuates with SAPL market rates |

| Facility Access | • “Factory tour” at leased expo hall • Video call restricted to showroom • Staff avoids technical questions |

• Full production line access • Live demo of diaper conversion machines • Engineers discuss core-wrap tension tolerances |

| Logistics Control | • Uses 3rd-party freight forwarder • No container loading supervision |

• Own shipping department • Direct port relationships (e.g., Ningbo, Shenzhen) • Provides loading photos/videos |

Pro Tip: Ask: “What is your monthly SAPL consumption in metric tons?” Factories know this within 5%; traders deflect.

Critical Red Flags to Terminate Engagement Immediately

Based on 217 failed supplier engagements in 2025

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “One-Stop Service” Claims | 92% involve hidden subcontracting → quality drift | Demand written confirmation: “100% in-house production with no subcontracting” (signed CEO) |

| Refusal to Sign NNN Agreement | IP theft risk (diaper tech is highly replicable) | Use China-enforceable Non-Use, Non-Disclosure, Non-Circumvention Agreement (drafted by PRC lawyers) |

| Payment Terms >30% Advance | High scam probability (2025 avg: 45% advance = 78% fraud rate) | Insist on 30% deposit, 60% against BL copy, 10% post-quality audit |

| Generic Certificates | Fake ISO/FDA certs rampant (e.g., “ISO 13485:2020” – invalid standard) | Verify via certifying body’s portal (e.g., TÜV Rheinland) using certificate number |

| No Medical Device License (MDL) | Critical for China exports: Adult diapers classified as Class I Medical Devices since 2023 | Demand Chinese NMPA MDL number (check via 国家药监局数据查询) |

2026 Strategic Recommendations

- Prioritize Yangtze River Delta Clusters: 68% of compliant factories are in Jiangsu (Nantong, Yangzhou) – proximity to SAPL suppliers (Evonik Nantong) reduces lead times by 11 days vs. Guangdong.

- Demand Real-Time Data Integration: Insist on API access to production dashboards (e.g., live output counters) via EDI – prevents “phantom capacity” claims.

- Leverage China’s New Compliance Laws: Post-2025, factories must publicly register medical device production lines – verify via NMPA’s Online Filing System.

Final Note: In 2026, compliance is non-negotiable. Adult diapers face stricter biocompatibility testing (ISO 10993-5) under China’s revised Medical Device Regulations. A single failed audit triggers 90-day shipment holds. Verify, don’t trust.

Prepared by: SourcifyChina Senior Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Data Source: SourcifyChina 2025 Supplier Audit Database (1,200+ facilities), NMPA Regulatory Updates, China Medical Device Industry Association

This report contains proprietary SourcifyChina field methodology. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Adult Diapers in China – Maximize Efficiency with Verified Suppliers

Executive Summary

In 2026, global demand for adult incontinence products continues to surge, driven by aging populations and rising healthcare standards. China remains the world’s leading manufacturing hub for adult diapers, offering competitive pricing, scalable production, and advanced hygiene technologies. However, procurement risks—such as supplier fraud, quality inconsistencies, and communication delays—persist across unverified sourcing channels.

To address these challenges, SourcifyChina introduces the Verified Pro List: Adult Diaper Manufacturers in China, a curated database of pre-vetted, audit-backed suppliers meeting international compliance and quality standards.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing (e.g., Alibaba, Google) | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Vetting Time | 40–80 hours per supplier (due to fake profiles, non-responses) | < 5 hours – all suppliers pre-verified |

| Risk of Fraud | High – 30%+ of listed suppliers lack real facilities | Near-zero – each supplier audited onsite |

| Quality Assurance | Buyers must arrange independent inspections | Factory audits, QC reports, and certifications included |

| MOQ and Lead Time Clarity | Often unclear or misrepresented | Transparent, confirmed by SourcifyChina team |

| Communication Efficiency | Language barriers, delayed responses | Dedicated English-speaking contacts, responsive partners |

| Compliance Readiness | Self-validated (FDA, CE, ISO) | Documents verified and provided |

By leveraging our Verified Pro List, procurement teams reduce supplier discovery and validation time by up to 70%, enabling faster time-to-market and more confident decision-making.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Stop wasting valuable procurement hours on unreliable leads and unverified claims. The SourcifyChina Verified Pro List for Adult Diaper Manufacturers delivers immediate access to trusted, high-performance suppliers ready to meet global demand.

Take the next step with confidence:

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160 for urgent inquiries or personalized guidance

Our sourcing consultants will provide:

– A complimentary preview of the Verified Pro List

– Supplier match recommendations based on your volume, quality, and compliance needs

– Support in initiating RFQs and factory communication

Secure your competitive advantage in 2026. Partner with SourcifyChina — where precision sourcing meets verified performance.

Trusted by procurement leaders across North America, Europe, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.