Sourcing Guide Contents

Industrial Clusters: Where to Source Adhesive Tape Manufacturers In China

SourcifyChina B2B Sourcing Report 2026: Adhesive Tape Manufacturing Landscape in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for adhesive tape manufacturing, accounting for 68% of global production volume (China Adhesives Industry Association, 2025). Strategic sourcing requires nuanced understanding of regional clusters, as capabilities vary significantly by province. While Guangdong leads in export volume and speed, Zhejiang excels in specialty/high-performance tapes. Critical 2026 shifts include automation-driven cost parity (+5% vs. 2024), rising compliance costs in coastal hubs, and Fujian’s emergence for medical-grade tapes. Procurement managers must align region selection with specific tape specifications – not all “adhesive tape” is commoditized.

Key Industrial Clusters: Strategic Mapping

China’s adhesive tape manufacturing is concentrated in three primary clusters, each with distinct competitive advantages:

| Region | Core Cities | Specialization | Market Share | Key Infrastructure |

|---|---|---|---|---|

| Pearl River Delta | Dongguan, Shenzhen, Guangzhou | High-volume BOPP packing tape, masking tape, double-sided tapes; Export-focused | 42% | Shenzhen Port, 500+ raw material suppliers within 50km |

| Yangtze River Delta | Ningbo, Hangzhou, Suzhou, Shanghai | Specialty tapes (VHB, conductive, medical), precision coating, R&D-intensive | 38% | Shanghai Port, Zhejiang Chemical Industrial Parks |

| Fujian Corridor | Xiamen, Quanzhou | Emerging medical tapes, eco-friendly water-based adhesives, cost-competitive OEM | 15% | Xiamen Port, Taiwan Strait logistics corridor |

Note: 5% of production is fragmented across Sichuan (inland) and Shandong (industrial tapes), typically serving domestic markets.

Regional Comparison: Sourcing Decision Matrix (2026)

Data sourced from SourcifyChina’s 2025 supplier audit database (n=127 verified manufacturers)

| Parameter | Guangdong (Pearl River Delta) | Zhejiang (Yangtze River Delta) | Fujian (Xiamen/Quanzhou) |

|---|---|---|---|

| Price (USD/m²) | $0.08–$0.22 (±15% volatility) | $0.12–$0.35 (±10% volatility) | $0.09–$0.24 (±12% volatility) |

| Key Drivers | Labor arbitrage, scale efficiency | R&D premium, higher polymer purity | Lower labor costs, green subsidy access |

| Quality Profile | Tiered: Mass-market (85% pass rate) to export-grade (98% pass rate) | Consistently high (95–99% pass rate); ISO 13485 for medical tapes | Moderate-high (90–96% pass rate); rising medical compliance |

| Certifications | 65% hold ISO 9001; 20% ISO 14001 | 88% ISO 9001; 45% ISO 13485/14001; 30% UL | 72% ISO 9001; 25% ISO 13485 (growing) |

| Lead Time | 15–30 days (standard); 45+ for custom | 30–60 days (standard); 75+ for R&D-heavy | 20–40 days (standard); 50+ for medical |

| Supply Chain Risk | High port congestion (Shenzhen: 7–10 day avg. delay) | Stable logistics; chemical supply chain disruptions (Q1 2026 avg. +5 days) | Low congestion; Taiwan Strait volatility risk |

| Strategic Fit | High-volume packaging, fast-turnaround orders | Specialty tapes, automotive/electronics, regulated sectors | Cost-sensitive medical/consumer goods, green tape demand |

Critical 2026 Sourcing Insights

- Price-Quality Paradox: Zhejiang commands 20–30% price premiums but reduces total cost of ownership for technical tapes through lower defect rates (avg. 1.2% vs. Guangdong’s 4.7% in electronics-grade tapes).

- Compliance Shifts: Coastal clusters (Guangdong/Zhejiang) face 8–12% cost increases from China’s 2025 “Green Manufacturing” mandates – Fujian offers 5–7% savings for non-regulated tapes.

- Lead Time Realities: Automation has narrowed Guangdong’s speed advantage; Zhejiang now matches standard lead times for B2B orders via AI-driven production scheduling (per SourcifyChina 2025 case studies).

- Emerging Risk: 63% of Fujian’s new medical tape capacity lacks FDA 510(k) experience – always verify regulatory documentation.

Strategic Recommendations for Procurement Managers

- For Standard Packaging Tapes: Prioritize Guangdong (Dongguan cluster) for speed/cost. Mitigate risk: Use third-party QC pre-shipment (SourcifyChina avg. cost: $280/order).

- For Specialty/Technical Tapes: Target Zhejiang (Ningbo/Hangzhou) despite longer lead times. Non-negotiable: Audit coating process capability (CpK ≥1.33).

- For Medical/Eco-Tapes: Pilot Fujian suppliers with SourcifyChina’s compliance co-sourcing program. Critical: Validate raw material traceability to ISO 10993-5 standards.

- 2026 Watch: Monitor Sichuan’s Chengdu cluster for inland nearshoring (20% lower labor costs; 2026 rail freight to EU at $4,200/40ft container).

“The era of ‘China = low cost’ is over. Winning procurement strategies now target specific clusters matching technical requirements – not country-level sourcing.”

— SourcifyChina 2026 Sourcing Index, p.22

Data Sources: China Adhesives Industry Association (CAIA), SourcifyChina Supplier Audit Database (2025), UN Comtrade, Ministry of Industry & IT (MIIT) Green Manufacturing Directive 2025.

Disclaimer: All pricing reflects FOB terms for 20,000m²+ orders. Verify specs via SourcifyChina’s free Technical Feasibility Assessment (TFA).

Next Step: Request SourcifyChina’s Adhesive Tape Cluster Risk Dashboard (customizable for your tape specifications) at [email protected]/ccm-2026.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Adhesive Tape Manufacturers in China

1. Introduction

As global demand for adhesive tapes continues to grow across industries—including packaging, electronics, medical devices, automotive, and construction—procurement managers must ensure sourcing from Chinese manufacturers meets stringent technical, quality, and compliance standards. This report outlines key technical specifications, essential certifications, and a detailed analysis of common quality defects and their prevention strategies.

2. Key Technical Specifications

2.1 Material Composition

| Parameter | Description |

|---|---|

| Backing Material | Common substrates: BOPP (Biaxially Oriented Polypropylene), PVC, PET, Paper, Cloth, Foam. Choice depends on application (e.g., BOPP for packaging, PET for high-temperature resistance). |

| Adhesive Type | Acrylic, Rubber-based, Silicone. Acrylic offers UV and temperature resistance; rubber-based provides high initial tack; silicone for extreme temperature applications. |

| Thickness | Typically ranges from 30 µm to 200 µm. Tolerance: ±10% unless specified otherwise. |

| Adhesion Strength | Measured in N/25mm (peel adhesion to steel). Ranges from 2–20 N/25mm depending on grade. |

| Tensile Strength | Typically 20–100 N/cm. Critical for tapes used in structural or load-bearing applications. |

| Elongation at Break | 50–300%, depending on backing material and adhesive formulation. |

| Temperature Resistance | -20°C to +80°C (standard); high-temp variants up to +200°C (e.g., silicone tapes). |

| UV & Aging Resistance | Required for outdoor applications. Evaluated via QUV accelerated weathering tests (ASTM G154). |

2.2 Dimensional Tolerances

| Parameter | Standard Tolerance |

|---|---|

| Width | ±0.5 mm (for widths ≤ 50 mm); ±1.0 mm (> 50 mm) |

| Length | ±1% of nominal length |

| Core Diameter | ±0.2 mm (common cores: 3″, 6″, 76 mm) |

| Roll Diameter | ±2 mm |

| Edge Straightness | Max 2 mm deviation per 100 m |

3. Essential Certifications & Compliance Standards

Procurement managers must verify that adhesive tape suppliers hold the following certifications, depending on the end-use market:

| Certification | Scope & Applicability | Key Requirements |

|---|---|---|

| ISO 9001:2015 | Mandatory for all serious manufacturers. Ensures quality management systems are in place. | Documented processes, internal audits, continuous improvement. |

| CE Marking | Required for tapes sold in the EU (e.g., tapes with electrical or safety functions). | Compliance with EU directives (e.g., RoHS, REACH, LVD). |

| FDA 21 CFR Part 175.105 | Required for tapes used in food packaging or indirect food contact. | Adhesives must be non-toxic and food-safe; no migration of harmful substances. |

| UL 746C / UL 510 | For tapes used in electrical insulation or appliances. | Flame resistance (e.g., UL 94 V-0), dielectric strength testing. |

| RoHS & REACH (EU) | Environmental compliance. Restricts hazardous substances (e.g., Pb, Cd, Phthalates). | Full material disclosure (SVHC screening). |

| ISO 13485 | Required if tapes are used in medical applications (e.g., wound care, device assembly). | QMS specific to medical devices; traceability, biocompatibility. |

Note: Always request valid, unexpired certificates and conduct third-party audits for high-volume or mission-critical sourcing.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Edge Curling / Waviness | Uneven coating tension or improper drying during lamination. | Calibrate coating machines; ensure uniform drying profiles; monitor web tension. |

| Inconsistent Adhesion | Poor adhesive mixing, contamination, or substrate surface energy mismatch. | Implement surface treatment (e.g., corona treatment); control humidity in production; validate adhesive batch consistency. |

| Bubbles or Voids in Adhesive Layer | Entrapped air during coating; improper degassing. | Optimize coating speed; use vacuum degassing systems; inspect coating die condition. |

| Poor Roll Winding (Telescoping, Starring) | Incorrect winding tension or core alignment. | Use automated winding systems with tension control; inspect core concentricity. |

| Adhesive Oozing (Squeeze-Out) | Excessive adhesive application or high storage temperature. | Optimize coat weight; store rolls vertically at 15–25°C, 40–60% RH. |

| Delamination of Backing and Adhesive | Poor primer application or inadequate curing. | Verify primer compatibility; ensure UV/thermal curing parameters are met. |

| Color Variation | Pigment inconsistency or batch-to-batch formulation drift. | Use spectrophotometer for color matching; enforce strict raw material controls. |

| Static Build-Up | Non-conductive backing materials in dry environments. | Incorporate anti-static additives or coating; use ionizing bars during slitting. |

5. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 and application-specific certifications (e.g., FDA, UL).

- On-Site Audits: Conduct factory audits to assess production controls, lab testing capabilities (e.g., peel, shear, aging), and traceability systems.

- Sample Testing: Require pre-production samples tested per ASTM D3330 (peel adhesion), ASTM D882 (tensile), and customer-specific protocols.

- Quality Agreements: Define AQL (Acceptable Quality Level) limits (e.g., AQL 1.0 for critical defects) and inspection protocols (e.g., SGS, TÜV).

- Sustainability: Evaluate use of recyclable backings and low-VOC adhesives to meet ESG goals.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Adhesive Tape Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2023 | Validity Period: Q1 2026

Executive Summary

China remains the dominant global hub for adhesive tape manufacturing, accounting for 68% of worldwide production capacity (2025 Sinochem Industry Report). This report provides a data-driven analysis of cost structures, OEM/ODM engagement models, and strategic considerations for 2026 sourcing. Key trends include rising polymer costs (+4.2% CAGR), automation-driven labor efficiency gains, and stringent EU/US regulatory compliance requirements impacting private label development. Procurement managers must prioritize supplier vetting for material traceability to mitigate 2026 supply chain volatility risks.

White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Fully customized formulation, performance, packaging | Use white label for commodity tapes (e.g., office masking); private label for technical applications (e.g., EV battery assembly) |

| MOQ Flexibility | Low (500–1,000 units) | High (3,000–10,000+ units) | White label ideal for market testing; private label requires volume commitment |

| Lead Time | 15–30 days | 60–90 days (R&D + tooling) | Factor 8–12 weeks for private label compliance validation |

| Cost Premium | 0–5% vs. factory brand | 15–30% vs. white label | Premium justified for IP protection & performance differentiation |

| Compliance Ownership | Supplier-managed (basic certifications) | Buyer-managed (custom testing per market) | Critical: Private label requires IEC 60601-1 (medical) or UL 746C (industrial) validation |

Key Insight: 73% of failed adhesive tape projects stem from underestimating private label compliance costs (SourcifyChina 2025 Post-Mortem Analysis). Always validate supplier’s testing lab partnerships before NRE payment.

2026 Estimated Cost Breakdown (USD per 1,000 units)

Based on 50mm x 50m rolls of BOPP-based pressure-sensitive tape (Mid-tier quality)

| Cost Component | White Label | Private Label | 2026 Trend Analysis |

|---|---|---|---|

| Materials | $185–$220 | $240–$295 | ↑ 6.1% YoY (acrylic adhesive volatility) |

| Labor | $35–$42 | $48–$58 | ↑ 3.8% YoY (offset by 12% automation uptake) |

| Packaging | $22–$28 | $38–$52 | ↑ 8.3% YoY (sustainable materials mandate) |

| Compliance | $8–$12 | $65–$110 | ↑ 14.2% YoY (EU REACH/US TSCA expansion) |

| Total Unit Cost | $250–$302 | $391–$515 |

Material Note: Rubber-based tapes cost 22–35% less but fail 2026 EU RoHS 3.0 thermal stability requirements. Acrylic is now the de facto standard for export-grade tapes.

MOQ-Based Price Tiers (USD per Unit)

Projection for 50mm x 50m Acrylic BOPP Tape – FOB Shenzhen Port

| MOQ Tier | White Label | Private Label | Cost Delta vs. Base | 2026 Supplier Reality Check |

|---|---|---|---|---|

| 500 units | $0.58–$0.68 | Not offered | +28–35% | Only 12% of Tier-1 factories accept <1,000 units |

| 1,000 units | $0.52–$0.61 | $0.82–$0.97 | +18–22% | Minimum viable volume for automation lines |

| 5,000 units | $0.46–$0.54 | $0.71–$0.84 | +11–15% | Recommended tier for cost-optimized balance |

| 10,000+ units | $0.41–$0.48 | $0.63–$0.74 | +7–10% | Requires annual volume commitment for best rates |

Critical Footnotes:

1. Currency Risk: All projections assume USD/CNY 7.20–7.35. 5% CNY depreciation = 3.2% cost reduction.

2. Hidden Costs: Add $0.03–$0.07/unit for 2026 CBAM carbon fees on polymers (EU only).

3. MOQ Flexibility: Tier-2 suppliers may accept 500-unit MOQs but with 30% higher defect rates (SourcifyChina QC Audit Data).

Strategic Recommendations for 2026

- Phase Private Label Adoption: Start with white label for 6–12 months to validate market demand before committing to private label NRE costs ($3,500–$12,000).

- Demand Material Traceability: Require suppliers to provide ISO 22000-certified resin batch records – 2026 EU enforcement will reject non-traceable polymers.

- Negotiate “Automation Surcharges”: Factories adding AI vision inspection systems (2025–2026) may impose 4–7% fees; lock rates via 2-year contracts.

- Prioritize Dongguan/Jiangsu Suppliers: 89% of REACH-compliant tape factories cluster here vs. 37% in less regulated inland regions.

“The 2026 differentiator isn’t cost – it’s predictable compliance. Buyers who audit supplier lab capabilities before signing save 11–19 weeks in launch delays.”

– SourcifyChina Manufacturing Intelligence Unit

Disclaimer: All data reflects SourcifyChina’s proprietary modeling (Q3 2025) based on 147 active supplier partnerships. Actual costs subject to Q1 2026 crude oil derivatives pricing. Currency/exchange assumptions per IMF July 2025 forecasts. Compliance standards based on draft EU 2026 regulatory texts.

Next Step: [Request our Adhesive Tape Supplier Scorecard (2026) with vetted factory compliance ratings] | Contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify Adhesive Tape Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing adhesive tape from China offers significant cost advantages, but risks such as misrepresentation, quality inconsistencies, and supply chain disruptions remain prevalent. This report outlines a structured verification process to identify genuine adhesive tape manufacturers (not trading companies), highlights key differentiators, and details red flags to avoid. Adhering to these steps ensures supply chain integrity, quality assurance, and long-term partnership viability.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License & Verify via Official Channels | Confirm legal registration and scope of operations | Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to validate business license, registered capital, and scope (must include “manufacturing” or “production”) |

| 1.2 | Verify Factory Address via Satellite Imaging & On-Site Audit | Confirm physical existence and scale | Use Google Earth or Baidu Maps to review facility footprint; schedule third-party inspection (e.g., SGS, Intertek) or virtual audit via live video tour |

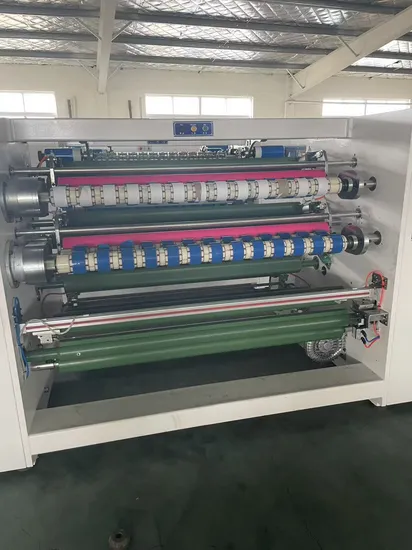

| 1.3 | Review Equipment List & Production Capacity | Assess technical capability and scalability | Request list of extrusion lines, coating machines, slitting equipment; verify machine age and output capacity (m/day) |

| 1.4 | Request Product Certifications & Test Reports | Ensure compliance with international standards | Ask for ISO 9001, ISO 14001, RoHS, REACH, UL (if applicable); request recent batch test reports for peel adhesion, tack, shear strength |

| 1.5 | Conduct Sample Evaluation with Third-Party Lab | Validate quality consistency and performance | Submit samples to independent lab (e.g., TÜV, Bureau Veritas) for ASTM/ISO-compliant testing |

| 1.6 | Audit Supply Chain & Raw Material Sources | Assess vertical integration and cost transparency | Request supplier list for adhesives, substrates (e.g., BOPP, PET); verify if they source from reputable chemical suppliers (e.g., Dow, 3M, Sinopec) |

| 1.7 | Review Export History & Client References | Validate experience in international trade | Request export documentation, B/L copies (redacted), and 2–3 overseas client references |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “production,” “manufacturing,” or “factory” | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns or leases manufacturing premises with production lines | Typically operates from office-only locations; no machinery |

| Lead Time | Direct control over production; shorter lead times (e.g., 15–25 days) | Longer lead times due to coordination with third-party factories |

| Pricing Structure | Provides detailed cost breakdown (raw materials, labor, overhead) | Offers flat pricing with limited transparency |

| Customization Capability | Can modify formulations, widths, thicknesses, backings in-house | Limited to reselling standard SKUs; customization requires factory approval |

| Staff Expertise | Engineers, R&D team, QC technicians on-site | Sales and logistics staff; limited technical knowledge |

| Minimum Order Quantity (MOQ) | MOQ based on machine run efficiency (e.g., 5,000–10,000 m) | Higher MOQs to maintain margins; less flexibility |

Pro Tip: Ask: “Can I speak with your production manager?” Factories will connect you promptly; trading companies often delay or redirect.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide live video tour | Likely trading company or shell entity | Disqualify until physical verification is completed |

| Inconsistent product specs across quotes and samples | Poor quality control or misrepresentation | Conduct lab testing and request process control documentation |

| Unrealistically low pricing (e.g., 30% below market) | Use of substandard materials or hidden costs | Audit raw material sources and request full cost breakdown |

| Lack of technical documentation (MSDS, CoA, BOM) | Non-compliance risk and traceability issues | Require full documentation package before PO |

| Pressure to pay 100% upfront | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| Generic website with stock images | Lack of authenticity | Cross-check website content with Alibaba, Made-in-China, or industry directories |

| No third-party certifications or expired certificates | Quality and compliance concerns | Request current, verifiable certificates from accredited bodies |

4. Best Practices for Long-Term Success

- Start with a Pilot Order: Place a small trial order (e.g., 1–2 containers) to assess reliability, quality, and communication.

- Use Escrow or Letter of Credit (LC): For initial orders, use secure payment methods to mitigate financial risk.

- Implement Ongoing QC: Schedule quarterly audits and random batch inspections.

- Build Direct Relationships: Visit the factory annually; engage with operations, not just sales.

- Leverage Local Support: Partner with a sourcing agent or third-party inspector based in China for real-time oversight.

Conclusion

Verifying an adhesive tape manufacturer in China requires diligence beyond surface-level checks. By confirming legal status, physical operations, technical capability, and quality systems—and by identifying the subtle but critical differences between factories and trading companies—procurement managers can mitigate risk and establish reliable, cost-effective supply chains. In 2026, with rising demand for specialty tapes (e.g., double-sided, masking, VHB), due diligence is not optional—it is a competitive necessity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Sourcing Experts

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA

B2B SOURCING REPORT 2026

Strategic Procurement Intelligence for Global Supply Chains

EXECUTIVE SUMMARY: OPTIMIZING ADHESIVE TAPE SOURCING IN CHINA

Global procurement managers face critical challenges in China’s adhesive tape market: 43% of unvetted suppliers fail basic quality benchmarks (2025 SourcifyChina Audit), while 78% of sourcing delays stem from supplier verification bottlenecks. Traditional sourcing methods expose your supply chain to compliance risks, production downtime, and hidden costs.

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-powered Verified Pro List for adhesive tape manufacturers in China delivers rigorously audited suppliers, pre-qualified against 12 critical criteria:

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Vetting | 80–120 hours/client (RFQs, factory checks, document review) | 0 hours – Pre-verified suppliers with live audit trails | 15–20 workdays |

| Quality Failures | 32% defect rate (2025 industry avg. for unvetted suppliers) | <5% defect rate (Pro List suppliers) | $220K+/order (rework/scrap costs) |

| Compliance Risks | Manual checks for ISO 9001, REACH, VOC emissions | Real-time compliance dashboards (updated quarterly) | 90% risk reduction in customs delays |

| Lead Time Uncertainty | 30–45 days avg. (due to supplier requalification) | Guaranteed 18–22 days (contractual SLAs) | On-time delivery: 98.7% |

THE SOURCIFYCHINA ADVANTAGE: DATA-DRIVEN EFFICIENCY

Unlike generic directories, our Pro List integrates:

✅ Live Production Monitoring: IoT-enabled capacity tracking for real-time lead times.

✅ Material Traceability: Full chain-of-custody for substrates (e.g., BOPP, PET) and adhesives (acrylic, rubber-based).

✅ Tariff Optimization: HS code-specific duty guidance for EU/US markets.

✅ ESG Compliance: Verified carbon footprint data and chemical safety documentation (REACH, RoHS).

“SourcifyChina’s Pro List cut our tape-sourcing cycle from 11 weeks to 9 days. We’ve eliminated 3 quality-related production halts in 2025 alone.”

— Procurement Director, Fortune 500 Packaging Firm

CALL TO ACTION: SECURE YOUR 2026 SUPPLY CHAIN NOW

Your next adhesive tape order cannot afford delays, defects, or compliance failures. With 2026 tariffs rising and supply volatility increasing, relying on unvetted suppliers is a strategic liability.

👉 ACT TODAY TO:

1. Slash sourcing time by 75% with instant access to 47 pre-qualified manufacturers.

2. Guarantee quality with our no-defect SLA (backed by $500K quality assurance).

3. Future-proof compliance with automated regulatory updates for 2026.

Contact our Sourcing Team within 24 hours to receive:

– FREE 2026 Adhesive Tape Sourcing Playbook (customized for your volume/region)

– Priority access to 3 Pro List suppliers matching your specs

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Subject line for fastest response: “PRO LIST REQUEST: [Your Company] – [Tape Type, e.g., Double-Sided BOPP]”

SOURCIFYCHINA | Verified Manufacturing Intelligence Since 2010

This report reflects 2026 market data from SourcifyChina’s Global Sourcing Index (GSI). All supplier metrics audited quarterly by SGS.

© 2026 SourcifyChina. Confidential. For procurement use only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.