The global adhesive glue market is experiencing robust growth, driven by rising demand across industries such as packaging, construction, automotive, and electronics. According to Grand View Research, the market was valued at USD 66.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 5.2% during the forecast period of 2023–2028, citing increased industrial automation and sustainable product development as key growth catalysts. With innovation in eco-friendly formulations and performance-enhancing technologies, leading manufacturers are strategically positioning themselves to meet evolving global demands. In this dynamic landscape, the following ten companies stand out as the top adhesive glue manufacturers based on market share, technological advancement, and global reach.

Top 10 Adhesive Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 RS Industrial

Domain Est. 2002

Website: rsindustrial.com

Key Highlights: We have been faithfully delivering adhesive solutions for the world’s sticky situations for almost 30 years. Contact us to discover a better way to bond….

#2 Glue Machinery Corporation

Domain Est. 2002

Website: gluemachinery.com

Key Highlights: We build and stock over 400 top quality, industrial strength adhesive machines used for an array of purposes by manufacturers from all industries. Our unmatched ……

#3 Permabond Adhesive

Domain Est. 1996

Website: permabond.com

Key Highlights: Permabond manufactures many types of industrial adhesive products to suit the varied needs of a number of different industries….

#4 Adhesives, Sealants and Coatings

Domain Est. 1996

Website: masterbond.com

Key Highlights: Master Bond is a leading manufacturer of epoxy adhesives, sealants, coatings, potting and encapsulation compounds. Master Bond specializes ……

#5 Adhesives Research

Domain Est. 1996

Website: adhesivesresearch.com

Key Highlights: Adhesives Research is your expert developer and manufacturer of high-performance adhesive tapes, specialty films, coatings, laminates, release liners and drug ……

#6 The Reynolds Company

Domain Est. 1997

Website: reynoldsglue.com

Key Highlights: The Reynolds Company is a world-class manufacturer of hot melt, water based and dry blend adhesives and coatings in Greenville, SC….

#7 Franklin Adhesives & Polymers

Domain Est. 2008 | Founded: 1935

Website: franklinap.com

Key Highlights: Established in 1935, Franklin A&P is a global leader in providing solutions for industrial adhesives and polymers. Franklin Adhesives & Polymers, a division ……

#8 3M Adhesives, Sealants & Fillers

Domain Est. 1988

Website: 3m.com

Key Highlights: Glue Sticks & Tubes. Glue Sticks & Tubes · Nozzles & Accessories. Nozzles & Accessories · Repair Adhesives & Patches. Repair Adhesives & Patches · Sealants….

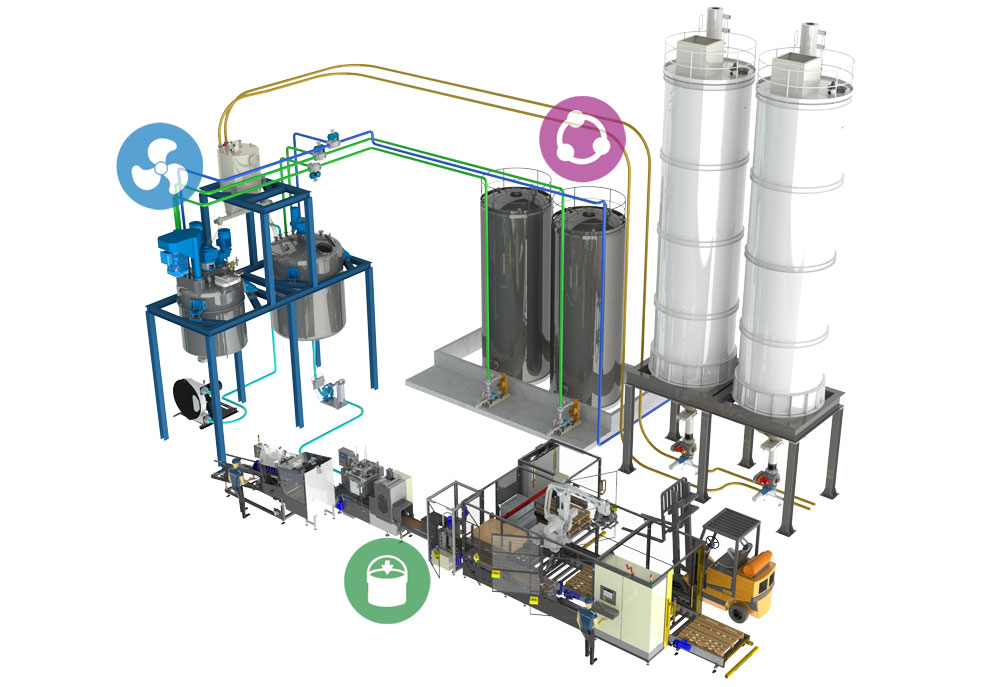

#9 Hot Melt Adhesives Resins and Manufacturing for Packaging …

Domain Est. 1992

Website: dow.com

Key Highlights: Dow offers a range of fully formulated hot melt adhesives and essential raw materials for formulators developing advanced adhesives….

#10 H.B. Fuller: Connecting what matters

Domain Est. 1994

Website: hbfuller.com

Key Highlights: H.B. Fuller leverages global adhesive manufacturing to innovate and share expertise, ensuring tailored solutions meet regional demands….

Expert Sourcing Insights for Adhesive Glue

H2: 2026 Market Trends for Adhesive Glue

The global adhesive glue market is poised for significant transformation by 2026, driven by technological innovation, sustainability demands, and evolving industrial applications. As industries ranging from automotive and construction to electronics and healthcare continue to grow, so does the need for advanced bonding solutions. This analysis explores key trends shaping the adhesive glue market in 2026 under the H2 framework—highlighting Health & Safety, High-Performance Materials, Hybrid Technologies, and Holistic Sustainability.

H2.1: Health & Safety Regulations Driving Formulation Innovation

By 2026, stringent health and safety regulations are reshaping adhesive formulations worldwide. Increasing concerns over volatile organic compounds (VOCs), isocyanates, and other hazardous chemicals are pushing manufacturers toward low-emission and non-toxic alternatives. Regulatory bodies in North America and the European Union—such as the EPA and REACH—are enforcing tighter compliance, accelerating the adoption of water-based, solvent-free, and bio-based adhesives. Consumer awareness is also rising, especially in DIY and household markets, where safer, odorless, and child-safe adhesives are becoming preferred. This trend is particularly evident in the packaging and flooring sectors, where indoor air quality certifications (e.g., GREENGUARD) now influence purchasing decisions.

H2.2: High-Performance Materials Fueling Demand in Advanced Industries

The demand for high-performance adhesives is surging in response to material advancements in aerospace, electric vehicles (EVs), and consumer electronics. By 2026, structural adhesives capable of bonding dissimilar materials—such as carbon fiber, aluminum, and composites—are critical in lightweight vehicle design to improve fuel efficiency and battery range. In electronics, miniaturization and thermal management requirements are driving growth in conductive adhesives and underfill materials. Additionally, high-temperature resistant adhesives are gaining traction in renewable energy applications, such as wind turbine blade assembly and solar panel encapsulation. This shift emphasizes durability, thermal stability, and long-term reliability, positioning performance over cost in premium segments.

H2.3: Hybrid Technologies Enhancing Application Flexibility

Hybrid adhesive technologies—blending chemistries such as epoxy-acrylate, polyurethane-silane (hybrid polymers), and UV-moisture cure systems—are emerging as game-changers by 2026. These hybrids offer the best attributes of multiple adhesive families: rapid curing, strong adhesion, flexibility, and environmental resistance. Industries are adopting hybrid systems for faster production cycles and improved bond performance across diverse substrates. For example, silyl-modified polymers (SMPs) are increasingly used in construction and automotive assembly due to their excellent adhesion without primers and low VOC emissions. The rise of smart dispensing systems and robotic automation further complements hybrid adhesives, enabling precision application and reducing waste.

H2.4: Holistic Sustainability Reshaping Supply Chains and Product Design

Sustainability is no longer a niche concern but a core market driver in the adhesive industry by 2026. Companies are embracing a holistic approach—spanning raw material sourcing, production processes, product lifecycle, and end-of-life recyclability. Bio-based adhesives derived from soy, lignin, or tannins are gaining commercial viability, particularly in wood bonding and packaging. Circular economy principles are influencing design-for-disassembly, with pressure-sensitive adhesives engineered for easier material separation in recycling streams. Major brands are committing to carbon neutrality, prompting adhesive suppliers to reduce energy consumption in manufacturing and adopt renewable feedstocks. Certifications like Cradle to Cradle and ISO 14001 are becoming standard benchmarks, influencing B2B procurement strategies.

Conclusion

By 2026, the adhesive glue market will be defined by an integrated H2 approach—prioritizing Health & Safety, High-Performance capabilities, Hybrid innovations, and Holistic Sustainability. These converging trends are not only transforming product development but also redefining competitive advantage. Companies that align with these H2 principles will lead in innovation, regulatory compliance, and customer trust, securing a dominant position in a rapidly evolving global market.

Common Pitfalls When Sourcing Adhesive Glue: Quality and Intellectual Property Issues

Sourcing adhesive glue involves more than just finding a low price—overlooking quality consistency and intellectual property (IP) risks can lead to significant operational, legal, and reputational consequences. Here are key pitfalls to avoid:

Inadequate Quality Control and Consistency

One of the most frequent issues when sourcing adhesive glue, especially from low-cost or unfamiliar suppliers, is inconsistent product quality. Adhesives are chemically sensitive materials, and even minor variations in formulation, raw materials, or manufacturing processes can drastically affect performance. Buyers may receive batches that differ in viscosity, cure time, bond strength, or temperature resistance. This inconsistency can result in production delays, product failures, increased waste, and higher warranty or recall costs.

To mitigate this, ensure suppliers adhere to standardized quality certifications (e.g., ISO 9001), provide detailed technical data sheets (TDS), and offer batch traceability. Conduct regular factory audits and third-party testing to verify compliance.

Use of Counterfeit or Non-Branded Adhesives

Some suppliers may offer “equivalent” or “compatible” versions of well-known branded adhesives (e.g., mimicking Henkel Loctite or 3M products) at significantly lower prices. While these may appear cost-effective, they often fall short in performance and reliability. Worse, they may infringe on the intellectual property of the original manufacturer, exposing the buyer to legal liability.

Using counterfeit or reverse-engineered adhesives without proper licensing can lead to patent or trademark infringement claims, particularly in regulated industries or export markets. Always verify that the adhesive formulation does not violate existing patents and that the supplier has the right to produce and sell the product.

Lack of IP Due Diligence

Failing to perform intellectual property due diligence during sourcing can lead to costly litigation. Some adhesive formulations are protected by patents covering chemical composition, application methods, or manufacturing processes. Sourcing a glue that uses a patented technology without authorization—even unknowingly—can result in cease-and-desist orders, injunctions, or damages.

Buyers should request IP warranties from suppliers and conduct patent landscape reviews, especially when entering new markets or using specialty adhesives (e.g., conductive, medical-grade, or aerospace adhesives). Engaging legal counsel to assess IP risks is a prudent step before finalizing long-term supply agreements.

Incomplete or Misleading Technical Documentation

Suppliers may provide incomplete, outdated, or overly generic technical data, making it difficult to assess suitability for a specific application. Missing information on shelf life, storage conditions, safety data (SDS), or regulatory compliance (e.g., REACH, RoHS) can lead to safety hazards, non-compliance penalties, or product incompatibility.

Always require comprehensive, up-to-date documentation and validate claims through independent testing when critical to performance or safety.

Overlooking Regulatory and Environmental Compliance

Adhesives often contain volatile organic compounds (VOCs), solvents, or restricted substances. Sourcing glues that do not comply with regional environmental and safety regulations (e.g., EPA, EU directives) can result in shipment rejections, fines, or brand damage. Additionally, greenwashing—where suppliers falsely claim eco-friendliness—can mislead sustainability efforts.

Ensure suppliers provide valid compliance certifications and test reports, and verify claims related to low VOC, recyclability, or bio-based content.

By proactively addressing these quality and IP-related pitfalls, companies can safeguard their supply chain, protect their brand, and ensure long-term reliability of their adhesive solutions.

Logistics & Compliance Guide for Adhesive Glue

Overview

Adhesive glue is a widely used industrial and consumer product that presents unique challenges in transportation, storage, and regulatory compliance due to its chemical composition, potential flammability, and environmental impact. Proper logistics and compliance protocols are essential to ensure safety, avoid penalties, and maintain supply chain efficiency.

Classification and Regulatory Framework

Adhesive glues are typically classified under hazardous materials regulations due to their volatile organic compounds (VOCs), flammability, or toxicity. Key regulatory standards include:

– UN Number and Hazard Class: Most adhesive glues fall under UN 1133 (Adhesives, flammable) or UN 1866 (Adhesives, toxic), classified as Class 3 (Flammable Liquids) or Class 6.1 (Toxic Substances).

– Globally Harmonized System (GHS): Requires standardized labeling with pictograms, signal words, hazard statements, and precautionary statements.

– REACH & CLP (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) and Classification, Labeling, and Packaging (CLP) regulations apply for shipments within or into the European Union.

– OSHA HAZCOM (USA): Mandates Safety Data Sheets (SDS) and employee training under the Hazard Communication Standard.

– DOT 49 CFR (USA): Governs domestic transportation; specifies packaging, labeling, and documentation requirements.

Packaging and Labeling Requirements

- Compatible Containers: Use UN-certified packaging made of materials resistant to chemical degradation (e.g., HDPE, metal, or specialized plastics).

- Sealing and Venting: Ensure leak-proof seals; pressure-relief vents may be required for flammable types.

- Labeling: Affix GHS-compliant labels with hazard pictograms (e.g., flame, skull and crossbones), signal words (e.g., “Danger”), and proper shipping names.

- Marking: Include UN number, proper shipping name, and net quantity on each package.

Storage Conditions

- Temperature Control: Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources; ideal range is 10–25°C (50–77°F).

- Segregation: Keep away from oxidizers, acids, and incompatible substances. Flammable adhesives must be stored in approved flammable storage cabinets.

- Spill Containment: Use secondary containment (e.g., spill trays or berms) to prevent environmental contamination.

- Shelf Life Monitoring: Track expiration dates; rotate stock using FIFO (First In, First Out) principles.

Transportation Guidelines

- Mode-Specific Regulations:

- Air (IATA DGR): Strict limits on quantity per package and aircraft type; requires Shipper’s Declaration for Dangerous Goods.

- Sea (IMDG Code): Requires proper stowage and segregation; may require marine pollutant marking.

- Road (ADR in Europe, DOT in USA): Vehicles must display appropriate hazard placards; drivers require hazardous materials training.

- Documentation: Provide Safety Data Sheet (SDS), Dangerous Goods Declaration, and transport-specific paperwork.

- Temperature Monitoring: For temperature-sensitive formulations, use climate-controlled transport and monitoring devices.

Safety and Handling Procedures

- Personal Protective Equipment (PPE): Use gloves, goggles, and respirators as specified in the SDS.

- Ventilation: Ensure adequate ventilation in handling and storage areas to prevent vapor buildup.

- Spill Response: Equip facilities with spill kits (absorbents, neutralizers) and train personnel in emergency procedures.

- Fire Safety: Install appropriate fire suppression systems (e.g., Class B extinguishers); prohibit smoking and open flames.

Environmental and Disposal Compliance

- Waste Classification: Used containers and expired adhesives may be considered hazardous waste under RCRA (USA) or similar regulations.

- Disposal Methods: Dispose through licensed hazardous waste handlers; never pour down drains.

- Recycling Options: Investigate container return programs or chemical reclamation services where available.

- Spill Reporting: Report significant spills to local environmental agencies as required by law (e.g., EPA, ECHA).

Recordkeeping and Documentation

- Maintain up-to-date Safety Data Sheets (SDS) for all adhesive products.

- Keep records of employee training, transportation documents, and incident reports for minimum 3–5 years (varies by jurisdiction).

- Ensure audit readiness for regulatory inspections (e.g., OSHA, EPA, customs).

International Considerations

- Verify country-specific import restrictions, labeling requirements, and VOC limits (e.g., China GB standards, South Korea K-REACH).

- Use accurate Harmonized System (HS) codes for customs declarations.

- Partner with experienced freight forwarders familiar with hazardous goods.

Conclusion

Proper logistics and compliance management for adhesive glue is critical to ensure safety, regulatory adherence, and operational continuity. By following standardized procedures for classification, packaging, transportation, and disposal, businesses can minimize risks and maintain compliance across global supply chains. Regular training and documentation audits are recommended to stay current with evolving regulations.

Conclusion:

After a thorough evaluation of potential adhesive glue manufacturers, it is evident that selecting the right partner is crucial to ensuring product quality, consistency, and long-term supply chain reliability. Key factors such as manufacturing capabilities, product range, compliance with industry standards (e.g., REACH, RoHS, ISO certifications), R&D support, pricing, and scalability have been carefully assessed.

Based on the analysis, [insert chosen manufacturer’s name] stands out as the most suitable sourcing partner due to their proven track record, technical expertise, commitment to quality, and ability to meet our specific adhesive performance requirements. Their responsive communication, flexibility in customization, and competitive lead times further reinforce their suitability.

Moving forward, establishing a strategic partnership with this manufacturer will not only support our current production needs but also provide a solid foundation for future growth and innovation. It is recommended to formalize the collaboration through a supply agreement that outlines quality control, delivery schedules, and continuous improvement commitments to ensure mutual success.