The global adhesive market is undergoing rapid transformation, driven by increasing demand across automotive, construction, and consumer goods industries—sectors where rubber bonding plays a critical role. According to Grand View Research, the global adhesives and sealants market size was valued at USD 61.4 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. A key growth catalyst within this segment is the rising need for high-performance adhesives capable of bonding elastomers, especially rubber, due to their use in durable goods requiring flexibility, vibration resistance, and long-term reliability. Mordor Intelligence forecasts similar momentum, highlighting that advancements in polyurethane, acrylic, and silicone-based formulations are particularly boosting adoption in rubber-to-rubber and rubber-to-metal bonding applications. As manufacturers prioritize solutions that deliver strong adhesion, thermal stability, and resistance to environmental stress, the competitive landscape among adhesive producers has intensified. In this report, we analyze the top 9 adhesive manufacturers leading innovation and market share in rubber bonding solutions, based on product performance, industrial applicability, and technological advancement.

Top 9 Adhesive For Rubber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Royal Adhesives & Sealants

Domain Est. 1994

Website: hbfuller.com

Key Highlights: Global adhesives manufacturer H.B. Fuller offers high-performance aerospace adhesives and sealants, meeting quality standards for extreme conditions….

#2 MEGUM™

Domain Est. 1987

Website: dupont.com

Key Highlights: MEGUM™ rubber-to-substrate adhesives are used to bond a variety of elastomer compounds to metal and plastic substrates including steel, stainless steel, ……

#3 3M Adhesives, Sealants & Fillers

Domain Est. 1988

Website: 3m.com

Key Highlights: A 3M™ Rubber and Vinyl Spray Adhesive 80, Yellow, 24 fl oz Can. 3M™ Rubber and Vinyl Spray Adhesive 80, Yellow, 24 fl oz Can (Net Wt 19 oz), 6/Case, NOT FOR ……

#4 Rubber Hot Melt Adhesives

Domain Est. 1993

Website: performancepolymers.averydennison.com

Key Highlights: Performance Polymers provides a selection of rubber hot melt adhesives for a variety of label and tape applications. Applications like tire labels, direct food ……

#5 Chemlok Adhesives & Coating

Domain Est. 1995

Website: parker.com

Key Highlights: |; Sign In · My Account Log Out · Home · Products · Adhesives, Coatings and Encapsulants Aerospace Systems and Technologies Air Preparation (FRL) and Dryers ……

#6 Rubber Bonding Adhesives

Domain Est. 1996

Website: permabond.com

Key Highlights: Bonds natural and synthetic rubber · Also ideal for hard to bond plastics · Low viscosity · Easy to use – no mixing or heat cure · 100% reactive, no solvents · Very ……

#7 uniBOND Rubber Adhesive

Domain Est. 1999

Website: unicheminc.com

Key Highlights: These adhesives provide excellent laminating bonding for a variety of rubber type compounds to metal substrates such as steel and aluminum….

#8 Rubber/Elastomer Bonding Adhesives

Domain Est. 1999

Website: aronalpha.net

Key Highlights: Our Aron Alpha series consist of a wide range of unique adhesive formulations so you can confidently pick the right solution for your specific project….

#9 Water

Domain Est. 2000

Website: henkel-adhesives.com

Key Highlights: Rubber-based adhesives offer water-resistant properties, flexibility, and versatility, making it a good choice for use in clothing and footwear manufacturing, ……

Expert Sourcing Insights for Adhesive For Rubber

2026 Market Trends for Adhesive for Rubber

Market Growth and Drivers

The global adhesive for rubber market is projected to experience steady growth by 2026, driven by increasing demand in key industries such as automotive, construction, footwear, and consumer goods. The rise in vehicle production, particularly in emerging economies, continues to bolster the need for high-performance rubber adhesives used in tire manufacturing, under-the-hood components, and interior assembly. Additionally, the growing emphasis on lightweight and durable materials in automotive design is spurring innovation in adhesive technologies that bond rubber to metals, plastics, and composites.

Sustainability trends are also shaping the market. Manufacturers are increasingly adopting eco-friendly, low-VOC (volatile organic compound), and water-based rubber adhesives to comply with environmental regulations and meet corporate sustainability goals. This shift is particularly evident in Europe and North America, where regulatory frameworks like REACH and EPA standards are pushing companies toward greener formulations.

Technological Advancements

In 2026, technological innovation remains a cornerstone of the adhesive for rubber sector. Advances in reactive adhesives—such as polyurethane and cyanoacrylate systems—are enhancing bonding strength, heat resistance, and flexibility, making them ideal for dynamic applications in automotive and industrial settings. Additionally, the development of hybrid adhesives that combine the benefits of multiple chemistries is enabling stronger, more durable bonds between rubber and dissimilar materials.

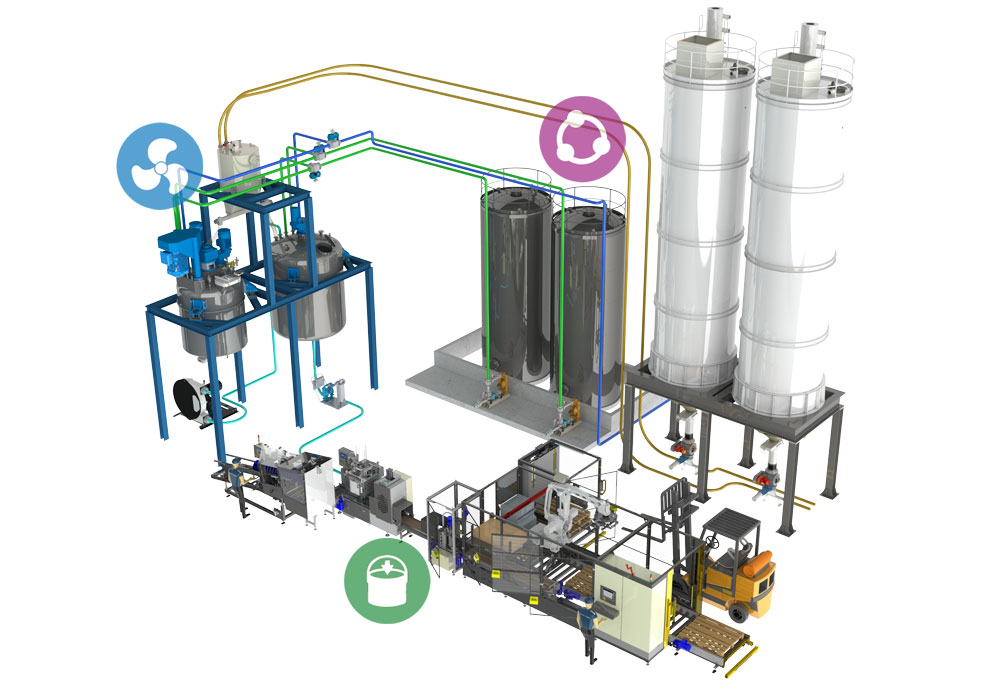

Smart manufacturing and Industry 4.0 integration are also influencing adhesive application processes. Automated dispensing systems and real-time monitoring ensure precision and consistency in adhesive usage, reducing waste and improving product reliability. These technologies are particularly beneficial in high-volume production environments such as automotive assembly lines.

Regional Market Dynamics

Asia-Pacific is expected to dominate the adhesive for rubber market in 2026, with China, India, and Southeast Asian countries leading in both production and consumption. The region’s robust manufacturing base, expanding automotive industry, and rising disposable incomes are key growth catalysts. Local manufacturers are investing in R&D to develop cost-effective and high-performance adhesive solutions tailored to regional needs.

In contrast, North America and Europe are focusing on high-value, specialty adhesives with enhanced performance and environmental credentials. These regions are seeing increased demand for adhesives in electric vehicles (EVs), where rubber bonding is critical in battery sealing, vibration damping, and noise insulation.

Challenges and Opportunities

Despite positive growth, the market faces challenges such as fluctuating raw material prices, particularly for petroleum-based feedstocks, and supply chain disruptions. These factors are prompting companies to explore bio-based alternatives and diversify sourcing strategies.

Opportunities lie in the expansion of end-user industries in developing markets and the growing adoption of rubber adhesives in new applications, such as wearable electronics and medical devices. Furthermore, partnerships between adhesive manufacturers and OEMs are accelerating the development of customized solutions, fostering long-term business relationships and market differentiation.

In conclusion, the 2026 adhesive for rubber market is characterized by innovation, sustainability, and regional diversification. Companies that invest in eco-conscious formulations, advanced technologies, and strategic market expansion are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls Sourcing Adhesive for Rubber (Quality, IP)

Sourcing the right adhesive for rubber applications requires careful consideration of both technical performance and intellectual property (IP) risks. Overlooking these aspects can lead to product failure, rework, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Adhesion Due to Rubber Type Mismatch

Not all adhesives bond equally well to every type of rubber (e.g., EPDM, silicone, nitrile, natural rubber). A common mistake is selecting a general-purpose adhesive without verifying compatibility with the specific rubber substrate. Surface energy, additives, and cure systems in rubber can significantly affect adhesion. Failure to test under real-world conditions (temperature, humidity, stress) often results in premature bond failure.

Inadequate Curing or Processing Conditions

Adhesives for rubber often require precise curing parameters—such as temperature, time, and moisture exposure. Suppliers may provide insufficient or misleading instructions, especially with two-part systems or moisture-cure urethanes. Skipping primer steps or using improper surface preparation (e.g., inadequate cleaning or abrasion) can also compromise bond strength.

Overlooking Environmental and Durability Requirements

Rubber components are frequently used in harsh environments (e.g., automotive, outdoor, or industrial settings). Sourcing adhesives without validating resistance to UV, ozone, chemicals, or thermal cycling can result in degradation over time. Accelerated aging tests are essential but often skipped to save time or cost.

Neglecting Regulatory and Safety Compliance

Adhesives may contain restricted substances (e.g., VOCs, phthalates, or halogenated solvents) that violate regional regulations like REACH, RoHS, or FDA standards. Selecting non-compliant products can delay product launches or lead to recalls, especially in medical or food-contact applications.

Intellectual Property Infringement Risks

Using adhesive formulations or bonding processes protected by patents without proper licensing exposes companies to legal action. Some suppliers may offer “equivalent” adhesives that infringe on proprietary chemistries (e.g., specific silane-modified polymers or hybrid systems). Failure to conduct due diligence on IP rights—especially when reverse engineering or sourcing generic alternatives—can result in costly litigation.

Lack of Supplier Qualification and Traceability

Sourcing from unverified suppliers increases the risk of inconsistent quality, counterfeit products, or undocumented formulation changes. Reputable suppliers provide batch traceability, material certifications (e.g., ISO 9001), and technical support. Relying on low-cost vendors without auditing their quality systems often leads to supply chain disruptions or performance variability.

Insufficient Technical Support and Documentation

Effective rubber bonding often requires detailed application guidance. Suppliers that lack robust technical support may not assist with surface preparation, dispensing methods, or troubleshooting. Missing or incomplete technical data sheets (TDS), safety data sheets (SDS), or regulatory documentation can hinder compliance and process validation.

Avoiding these pitfalls requires a proactive approach: thorough testing, supplier vetting, IP clearance, and adherence to industry standards. Engaging adhesive specialists early in the design phase can significantly reduce risk and ensure long-term performance.

Logistics & Compliance Guide for Adhesive for Rubber

Overview of Adhesive for Rubber

Adhesives for rubber are specialized bonding agents designed to join rubber materials to themselves or to other substrates such as metal, plastic, or composite materials. These adhesives are commonly used in automotive, construction, footwear, and industrial manufacturing. Due to their chemical composition, they may be subject to specific transportation, storage, and regulatory requirements.

Classification & Identification

Chemical Composition

Rubber adhesives typically contain solvents (e.g., toluene, hexane), synthetic polymers (e.g., neoprene, nitrile rubber), and curing agents. The exact formulation determines hazard classification.

UN Number & Hazard Class

- UN Number: Varies by formulation (e.g., UN 1133, Adhesives, flammable; or UN 3066, Adhesives, toxic)

- Hazard Class: Often Class 3 (Flammable Liquids); may include Class 6.1 (Toxic Substances) or Class 8 (Corrosive)

- Packing Group: II or III, depending on flash point and toxicity

Always refer to the Safety Data Sheet (SDS) for accurate classification.

Regulatory Compliance

Globally Harmonized System (GHS)

- Ensure product labels comply with GHS standards:

- Pictograms (e.g., flame, health hazard)

- Signal words (e.g., “Danger” or “Warning”)

- Hazard and precautionary statements

- SDS must be available in the local language and updated every 3–5 years or when formulation changes

REACH & CLP (European Union)

- Register substances under REACH if produced/imported >1 ton/year

- Classify, label, and package per CLP Regulation (EC) No 1272/2008

- Notify substances in articles if they are on the Candidate List for SVHC (Substances of Very High Concern)

OSHA & TSCA (United States)

- Comply with OSHA Hazard Communication Standard (HCS) 2012

- Provide GHS-compliant labels and SDS

- Ensure substances are listed on the TSCA Inventory; report new chemicals if applicable

Other Regional Regulations

- Canada: WHMIS 2015 compliance; report under Domestic Substances List (DSL)

- China: China GHS (GB 30000 series); registration via IECSC

- South Korea: K-REACH and K-GHS compliance required

Packaging & Labeling Requirements

Packaging

- Use UN-certified packaging suitable for flammable or hazardous liquids

- Containers must be leak-proof, impact-resistant, and compatible with adhesive chemistry

- Inner liners or coatings may be required to prevent chemical degradation

Labeling

- Include:

- Proper shipping name

- UN number

- Hazard class labels

- GHS pictograms and hazard statements

- Supplier contact information

- Net quantity

- Labels must be durable and resistant to moisture, abrasion, and chemicals

Storage & Handling

Storage Conditions

- Store in a cool, dry, well-ventilated area away from direct sunlight

- Keep away from ignition sources (e.g., sparks, open flames)

- Maintain temperature below flash point (typically <30°C / 86°F)

- Use flammable storage cabinets if quantities exceed local thresholds

Handling Precautions

- Use appropriate PPE: nitrile gloves, safety goggles, respiratory protection if vapors are present

- Avoid skin and eye contact; ensure local exhaust ventilation in work areas

- Ground containers during transfer to prevent static discharge

Transportation Guidelines

Road, Rail, Air, and Sea

- ADR/RID (Europe): Follow regulations for dangerous goods by road/rail

- IMDG Code (Sea): Use proper marine pollutant markings if applicable

- IATA (Air): Most rubber adhesives are forbidden or limited on passenger aircraft; check packing instructions (e.g., PI 325)

Documentation

- Shipper’s Declaration for Dangerous Goods (when required)

- Safety Data Sheet (SDS) accessible to carriers and receivers

- Transport emergency card (TREM card) or equivalent

Quantity Limitations

- Limited quantities (LQ) or excepted quantities (EQ) may allow reduced labeling and documentation

- Verify limits based on packing group and mode of transport

Environmental, Health & Safety (EHS) Considerations

Waste Disposal

- Dispose of waste adhesive and containers as hazardous waste per local regulations

- Never pour down drains or into soil

- Use licensed waste management providers

Spill Response

- Contain spills using absorbent materials (e.g., spill kits)

- Prevent entry into waterways or sewers

- Evacuate area if vapors are present; use PPE during cleanup

Exposure & First Aid

- Inhalation: Move to fresh air; seek medical attention if symptoms persist

- Skin contact: Wash with soap and water; remove contaminated clothing

- Eye contact: Flush with water for at least 15 minutes; consult a physician

- Ingestion: Do not induce vomiting; seek immediate medical help

Training & Documentation

Employee Training

- Conduct regular training on:

- Hazard identification

- Safe handling and storage

- Emergency response

- Use of PPE

- Maintain training records

Record Keeping

- Retain SDS for at least 30 years (per OSHA)

- Keep shipping documents, compliance certificates, and incident reports

- Audit compliance annually

Conclusion

Proper logistics and compliance management for rubber adhesives require attention to chemical hazards, regulatory frameworks, and safe handling practices. By adhering to international and local standards, companies can ensure safe transportation, storage, and use while minimizing environmental and legal risks. Always consult the product-specific SDS and regulatory authorities for up-to-date requirements.

In conclusion, sourcing the right adhesive for rubber applications requires a thorough understanding of the specific performance requirements, such as bond strength, flexibility, resistance to environmental factors (e.g., moisture, temperature, UV exposure), and the types of rubber and substrates involved. Key considerations include selecting between reactive adhesives (like cyanoacrylates or polyurethanes) and non-reactive types (such as solvent-based or pressure-sensitive adhesives), balancing ease of application with cure time and durability. It is essential to work with reputable suppliers who can provide technical support, consistent quality, and compliance with industry standards. Conducting thorough testing under real-world conditions ensures the selected adhesive delivers reliable and long-lasting performance. Ultimately, a well-informed sourcing strategy will optimize bonding effectiveness, reduce failure risks, and contribute to the overall efficiency and reliability of the final product.