The global LED lighting market is experiencing robust expansion, driven by increasing demand for energy-efficient solutions and smart lighting technologies. According to a report by Mordor Intelligence, the global LED market was valued at USD 75.6 billion in 2023 and is projected to grow at a CAGR of 11.2% from 2024 to 2029. A key segment within this growth trajectory is addressable LED tape lighting—renowned for its flexibility, scalability, and integration capabilities in architectural, commercial, and residential applications. This granular control at the individual LED level enables dynamic lighting effects, precise color tuning, and seamless IoT compatibility, making it a preferred choice for designers and integrators alike. As demand surges across smart homes, retail environments, and urban infrastructure, manufacturers are ramping up innovation in performance, addressability protocols (such as SK6812 and WS2815), and durability. Based on market presence, technological leadership, product breadth, and global distribution, the following ten companies stand out as leading addressable LED tape manufacturers shaping the future of dynamic lighting.

Top 10 Addressable Led Tape Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Professional Manufacturer of LED Linear Lighting

Domain Est. 2008

Website: gl-leds.com

Key Highlights: Professional manufacturer of LED linear lighting. Vision: To develop into a high technology, high-end brand and internationally recognized LED lighting group ……

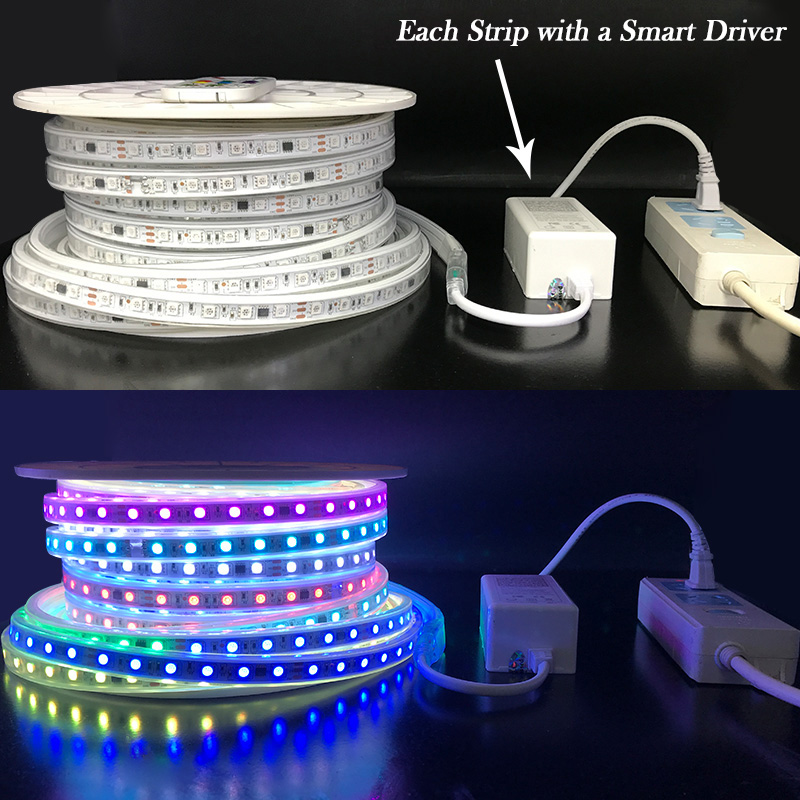

#2 Addressable LED

Domain Est. 2017 | Founded: 2012

Website: addressable-led.com

Key Highlights: Shenzhen LED Color is a professional led strip manufacturer in Shenzhen since 2012 with our skillful workers and experienced engineering team….

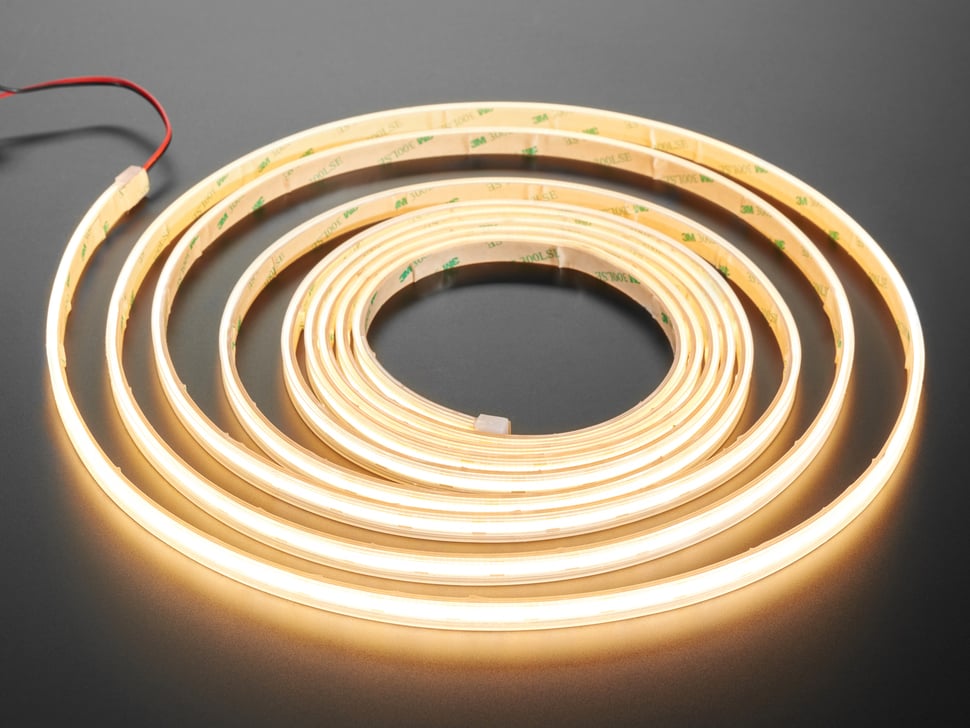

#3 LEDs, Strips Products Category on Adafruit Industries

Domain Est. 2005

#4 LED Linear™

Domain Est. 2006

Website: led-linear.com

Key Highlights: LED Linear™ supplies high quality linear LED lighting solutions based on flexible printed circuit boards worldwide. Our offer is a cost effective, ……

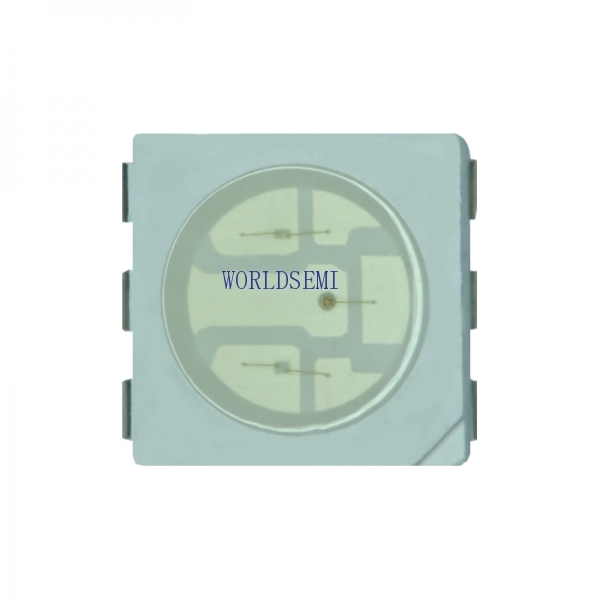

#5 WORLDSEMI CO.,LIMITED

Domain Est. 2007 | Founded: 2007

Website: world-semi.com

Key Highlights: WorldSemi was founded in 2007, we work as the leading LED specialist in IC designer for Constant Current LED Driver IC, Chip Driver LED….

#6 LED Profiles, Strip Lights, Module Lights

Domain Est. 2011

Website: ledbe.com

Key Highlights: 30-day returns Your reliable one-stop linear lighting solution supplier. We offer 300 + aluminum channels, LED strips, controllers, drivers, and accessories….

#7 aspectPRO Professional Grade LED Lighting

Domain Est. 2014

Website: pro.aspectled.com

Key Highlights: Free delivery over $299.99 60-day returns…

#8 Ecolocity LED

Domain Est. 2014

#9 LED Lighting Systems, Linear LED Lights, LED transformers

Website: qtl.lighting

Key Highlights: Based in Milford, CT QTL offers linear led lights and led transformers for interior and exterior linear led lighting systems to the design community….

#10 Addressable Led Strip Manufacturer in China Best …

Domain Est. 2018

Website: sdiplight.com

Key Highlights: SDIP being one of the finest manufacturers of addressable LED strips provides addressable RGB strip for different environmental and weather conditions….

Expert Sourcing Insights for Addressable Led Tape

H2: 2026 Market Trends for Addressable LED Tape

The addressable LED tape market is poised for robust growth and significant transformation by 2026, driven by technological advancements, expanding applications, and increasing demand for smart, customizable lighting. Key trends shaping the market include:

1. Dominance of Smart Home & IoT Integration:

By 2026, seamless integration with smart home ecosystems (such as Apple HomeKit, Google Home, Amazon Alexa, and Matter-compatible platforms) will become a standard expectation. Consumers will prioritize addressable LED tapes that offer voice control, app-based customization, scheduling, and synchronization with other smart devices. This trend will drive demand for Wi-Fi and Bluetooth-enabled strips with robust cloud connectivity and enhanced cybersecurity features.

2. Advancements in RGBIC and RGBWW Technology:

The market will see increased adoption of RGBIC (Red-Green-Blue-Independent Control) and advanced RGBWW (Red-Green-Blue-Warm White-Cool White) chips, enabling more complex lighting effects like color gradients, dynamic animations, and tunable white light within a single strip. These innovations will enhance design flexibility for architectural, entertainment, and mood lighting applications.

3. Focus on Energy Efficiency and Sustainability:

With growing environmental awareness, manufacturers will emphasize high-efficiency LED chips (e.g., using GaN-on-Si technology) and low-power control systems. Products with longer lifespans, recyclable materials, and compliance with energy standards (like ENERGY STAR) will gain market preference, especially in commercial and municipal projects.

4. Expansion into Commercial and Architectural Applications:

While residential use remains strong, commercial adoption will accelerate in retail, hospitality, offices, and urban infrastructure. Addressable LED tape will be used for dynamic façades, interactive installations, wayfinding, and adaptive ambient lighting that enhances user experience and brand identity. Integration with building management systems (BMS) will become more common.

5. Rise of DIY and Modular Solutions:

Consumer demand for easy installation will drive innovation in plug-and-play kits, magnetic connectors, pre-cut segments, and user-friendly control apps. Modular designs that allow for easy extension, reconfiguration, and repair will appeal to both hobbyists and professional installers, reducing waste and installation time.

6. Growth in Entertainment and Immersive Experiences:

The gaming, live events, and AV sectors will increasingly adopt addressable LED tape for ambient backlighting (e.g., behind TVs and monitors), stage effects, and immersive environments. Synchronization with audio and video content via protocols like HDMI sync or Art-Net will become more sophisticated and accessible.

7. Regional Market Expansion:

Asia-Pacific (especially China, Japan, and India) will experience rapid growth due to urbanization and smart city initiatives. North America and Europe will maintain strong demand driven by smart home penetration and energy regulations. Emerging markets will benefit from decreasing prices and improved supply chains.

8. Competitive Pricing and Market Consolidation:

As production scales and technology matures, average selling prices are expected to decline, making addressable LED tape more accessible. This may lead to consolidation among smaller players, with larger companies focusing on ecosystem development, brand loyalty, and value-added services.

In conclusion, the 2026 addressable LED tape market will be characterized by intelligence, sustainability, and versatility. Success will depend on innovation in connectivity, user experience, and application-specific solutions across both consumer and professional sectors.

Common Pitfalls When Sourcing Addressable LED Tape (Quality and IP)

Sourcing addressable LED tape can be challenging, especially when balancing performance, durability, and cost. Overlooking key quality and Ingress Protection (IP) rating factors often leads to product failures, customer dissatisfaction, and increased long-term costs. Below are common pitfalls to avoid:

Inadequate IP Rating for the Intended Environment

Choosing LED tape with an insufficient IP rating for its application is a frequent mistake. Using non-waterproof (e.g., IP20) tape in damp or outdoor areas leads to rapid failure due to moisture ingress. Conversely, over-specifying IP68 for indoor applications increases costs unnecessarily. Always match the IP rating—such as IP65 for outdoor signage or IP20 for indoor ambient lighting—to the actual environmental conditions.

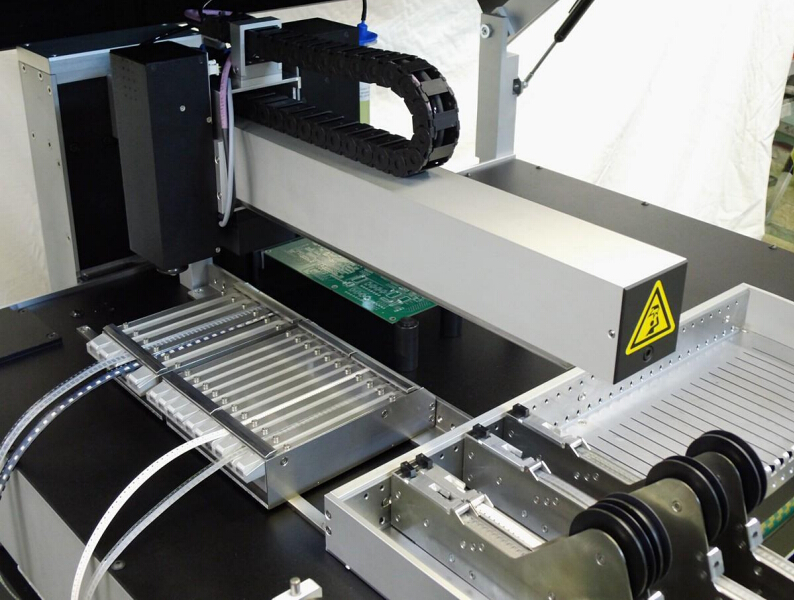

Poor Quality Control and Inconsistent Performance

Low-cost suppliers may offer inconsistent color temperatures, brightness levels, or faulty ICs (e.g., WS2812B, SK6812) due to lax manufacturing standards. This results in visible flickering, dead pixels, or color mismatches across tape runs. Verify manufacturer certifications, request samples, and check for batch consistency before large-scale procurement.

Misleading IP Ratings and Lack of Third-Party Verification

Some suppliers exaggerate or falsify IP ratings without proper testing. A tape labeled “IP65” may lack proper silicone coating or sealing, failing under real-world conditions. Insist on third-party test reports or certifications (e.g., IP test documentation) to validate claims and avoid compromised durability.

Substandard Materials Leading to Premature Failure

Inferior LED tapes often use low-grade FPC (Flexible Printed Circuit) boards, poor soldering, or inadequate encapsulation. These issues cause early degradation, especially under thermal stress or mechanical bending. Look for tapes with copper-layer thickness (e.g., 2 oz copper), high-quality silicone, and robust adhesive backing.

Incompatibility with Controllers and Power Supplies

Not all addressable LED tapes are compatible with popular control systems (e.g., DMX, Art-Net, or Arduino). Mismatches in voltage (5V vs. 12V vs. 24V), data protocols, or power requirements can lead to erratic behavior or damage. Confirm compatibility with your existing ecosystem before sourcing.

Insufficient Thermal Management

High-density LED tapes generate significant heat, especially in enclosed fixtures. Poor heat dissipation due to lack of aluminum channels or inadequate ventilation shortens LED lifespan and causes color shift. Ensure proper thermal design and use tapes rated for continuous operation at required brightness levels.

Overlooking Warranty and Supplier Reliability

Many budget suppliers offer little to no warranty or technical support. If issues arise post-installation, resolving them becomes difficult or impossible. Choose reputable suppliers with clear warranty terms, responsive customer service, and a track record in commercial or industrial projects.

Avoiding these pitfalls requires due diligence, sample testing, and clear specifications. Investing time upfront ensures reliable, long-lasting LED tape installations that meet both performance and environmental demands.

Logistics & Compliance Guide for Addressable LED Tape

Overview

Addressable LED tape, also known as individually controllable LED strip lighting, offers dynamic lighting solutions with programmable colors and effects. Due to its electronic nature, integration of integrated circuits (ICs), and power requirements, it is subject to various logistics and regulatory compliance standards globally. This guide outlines key considerations for shipping, handling, and compliance when importing, exporting, or distributing addressable LED tape.

Product Classification and HS Code

- Recommended HS Code: 9405.40 (Lamps and lighting fittings, including searchlights and spotlights, and parts thereof, not elsewhere specified or included)

- Note: Some variations may fall under 8539.50 (Electric filament or discharge lamps, including sealed beam lamp units and ultraviolet or infrared lamps, and arc lamps) or 8543.70 (Electrical machines and apparatus, having individual functions, not specified elsewhere). Confirm with local customs authority based on specific product design.

- Importance: Accurate classification affects tariffs, duties, and import regulations. Misclassification can lead to delays or penalties.

Electrical Safety Compliance

International Standards

- IEC 60598-1: General requirements for luminaires.

- IEC 62368-1: Safety of audio/video, information, and communication technology equipment (applies to controllers and power supplies).

Regional Requirements

- North America (USA & Canada):

- UL 153 or UL 8750 (for LED equipment)

- CSA C22.2 No. 250.0 (Canada)

- FCC Part 15 Class B: Electromagnetic interference (EMI) compliance; essential for digital control signals in addressable LEDs.

- European Union:

- CE Marking required, including:

- LVD (Low Voltage Directive 2014/35/EU) – Electrical safety

- EMC Directive 2014/30/EU – Electromagnetic compatibility

- RoHS Directive 2011/65/EU – Restriction of hazardous substances (lead, cadmium, mercury, etc.)

- REACH Regulation (EC 1907/2006) – Chemical substance registration and restrictions

- UK:

- UKCA Marking (post-Brexit; required for Great Britain; Northern Ireland may follow CE).

- Compliance with UK versions of LVD, EMC, RoHS, and REACH.

- Australia & New Zealand:

- RCM Mark – Regulatory Compliance Mark

- AS/NZS 60598.1 and AS/NZS 62368.1

- China:

- CCC Mark may be required depending on configuration (e.g., integrated power supply).

- GB 7000.1 and GB 17743 for EMC.

Power Supply and Voltage Considerations

- Input Voltage: Typically 5V, 12V, or 24V DC.

- Power Supplies:

- Must be certified (e.g., UL, CE, CCC) and matched to LED tape specifications.

- Include safety documentation (e.g., isolation, overcurrent protection).

- Labeling:

- Clearly mark input/output voltage, current, polarity, and safety warnings.

Packaging and Labeling Requirements

- Safety Labels:

- Include voltage, polarity, IP rating (if applicable), and warnings (e.g., “Do not exceed maximum run length”).

- Language:

- Local language required for consumer-facing labels (e.g., English in US/UK, French in Canada, German in Germany).

- IP Ratings:

- If waterproof (e.g., IP65, IP67), ensure enclosure and installation guidelines are provided.

- Barcodes & Traceability:

- Include GTIN (UPC/EAN) for retail distribution.

- Batch/lot numbers for quality tracking.

Shipping and Handling

Transportation Regulations

- UN38.3 Certification (for lithium batteries, if applicable):

- Not typically required for LED tape alone, but if shipped with lithium-based power banks or controllers, compliance is mandatory.

- Classification: Generally non-hazardous if no batteries included.

- Packaging:

- Use anti-static bags for IC-embedded strips.

- Protect against bending, moisture, and crushing.

- Coiled reels should be stored flat to prevent damage.

Temperature and Humidity

- Storage Conditions:

- 5°C to 35°C (41°F to 95°F), relative humidity <60%.

- Avoid condensation during transit.

Environmental and Sustainability Compliance

- WEEE Directive (EU):

- Producers must register and provide take-back options for electronic waste.

- Label product with “crossed-out wheeled bin” symbol.

- Battery Directive (if applicable):

- Restricts use of hazardous materials in batteries.

- Conflict Minerals (U.S. Dodd-Frank Act):

- Supply chain due diligence required if sourcing from conflict-affected regions.

Documentation Requirements

- Technical File:

- Includes circuit diagrams, bill of materials, test reports, user manual.

- Declaration of Conformity (DoC):

- Must be issued for CE, UKCA, FCC, and other certifications.

- Test Reports:

- From accredited labs (e.g., TÜV, SGS, Intertek) for safety, EMC, and RoHS.

- Customs Documentation:

- Commercial invoice, packing list, bill of lading/air waybill.

- Certificate of Origin if claiming preferential tariffs (e.g., USMCA, RCEP).

Import/Export Controls

- Export Compliance:

- Check EAR (Export Administration Regulations) in the U.S. – most LED tapes are EAR99 (low concern), but verify.

- Restricted Destinations:

- Avoid shipping to embargoed countries without proper authorization.

- Duty Optimization:

- Use FTAs (Free Trade Agreements) where applicable to reduce tariffs.

Warranty and Customer Support

- Warranty Period:

- Clearly state duration (e.g., 2–3 years) and conditions.

- Support Documentation:

- Include installation guide, troubleshooting, and contact details.

- Software/Firmware:

- If product uses proprietary control apps or protocols (e.g., WS2812B, SK6812), ensure compliance with software distribution laws and data privacy (e.g., GDPR).

Summary Checklist

- [ ] Correct HS code assigned

- [ ] Safety certifications obtained (UL, CE, UKCA, RCM, etc.)

- [ ] EMC and RoHS compliance verified

- [ ] FCC/ISED certification (if applicable)

- [ ] Proper labeling and user manuals in local language

- [ ] Secure, static-safe packaging

- [ ] Technical file and DoC prepared

- [ ] WEEE registration (EU)

- [ ] Shipping documentation complete

By following this guide, importers, distributors, and manufacturers can ensure that addressable LED tape products meet global logistics and regulatory requirements, reducing risk and enabling smooth market access.

Conclusion for Sourcing Addressable LED Tape

Sourcing addressable LED tape requires a careful evaluation of several key factors including quality, compatibility, supplier reliability, pricing, and technical support. These flexible lighting solutions offer dynamic control over color and animation, making them ideal for creative, architectural, and functional lighting applications. However, variations in quality—such as LED chip type (e.g., SK6812 vs. WS2812B), waterproofing, density of LEDs per meter, and power requirements—can significantly impact performance and longevity.

To ensure a successful integration, it is essential to source from reputable suppliers who provide detailed product specifications, consistent batch quality, and reliable customer support. Additionally, considering factors like minimum order quantities, lead times, certifications (e.g., UL, CE), and warranty terms helps mitigate risks in both prototyping and large-scale projects.

In conclusion, while addressable LED tape offers exceptional versatility and visual impact, a strategic sourcing approach—prioritizing quality, technical compatibility, and supplier credibility—is crucial to achieving reliable, scalable, and cost-effective lighting solutions.