Sourcing Guide Contents

Industrial Clusters: Where to Source Additive Manufacturing In China

SourcifyChina B2B Sourcing Report 2026: Additive Manufacturing in China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China’s additive manufacturing (AM) market is projected to reach $8.2B by 2026 (CAGR 22.3%, 2023–2026), driven by industrial adoption in aerospace, medical, and automotive sectors. While cost advantages remain compelling (15–30% below Western counterparts), quality parity has been achieved in Tier-1 clusters for non-critical components. Strategic sourcing now hinges on matching regional specializations to technical requirements, with Guangdong and Zhejiang emerging as dominant hubs for precision engineering. Procurement managers must prioritize cluster-specific supplier vetting to mitigate IP and quality risks.

Market Context & Strategic Imperatives

Key Growth Drivers

- Policy Catalysts: “Made in China 2025” prioritizes AM for high-value sectors (e.g., aerospace engines, custom implants).

- Supply Chain Maturity: 67% of Tier-1 AM material suppliers (metal powders, polymers) now localized in China.

- Demand Shift: 58% of export orders now require certified production (ISO 13485, AS9100) vs. 32% in 2023.

Critical Sourcing Risks

| Risk Factor | Impact (2026) | Mitigation Strategy |

|---|---|---|

| IP Protection | High in Guangdong/Shanghai; Moderate in Zhejiang; Low in emerging clusters | Use SourcifyChina’s escrow-based IP agreements |

| Quality Variance | Tier-1 clusters: <5% defect rate; Tier-2: 12–18% | Mandatory 3rd-party batch testing (SGS/BV) |

| Material Traceability | 40% of suppliers lack full-chain documentation | Require blockchain-enabled material passports |

Industrial Cluster Analysis: Key Production Regions

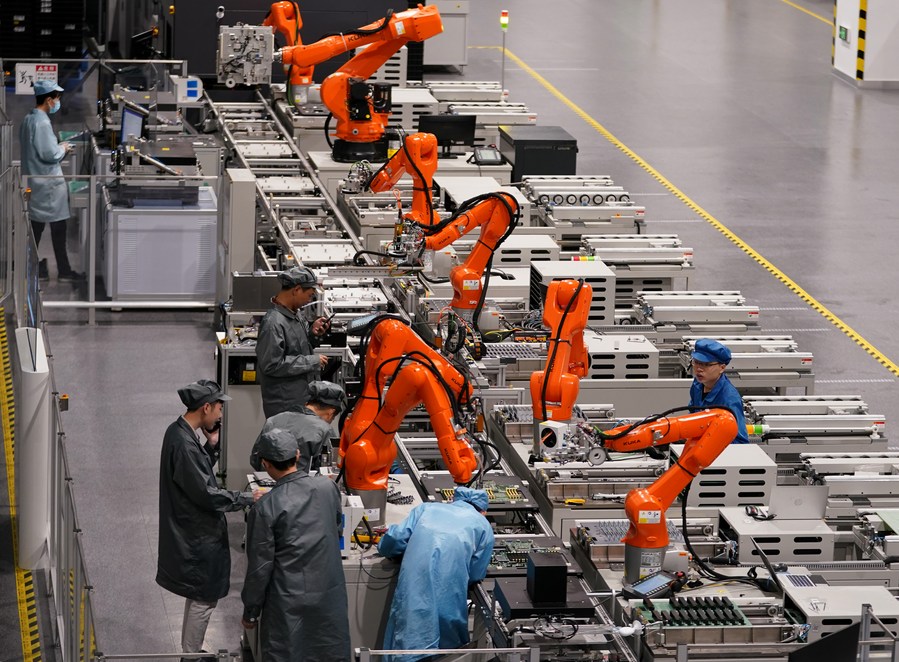

China’s AM ecosystem has evolved beyond low-cost assembly into specialized industrial clusters. Below are the top 4 regions for strategic sourcing:

| Region | Core Specialization | Key Cities | Leading Applications | Cluster Maturity (1-5) |

|---|---|---|---|---|

| Guangdong | High-precision metal AM, Dental/medical devices | Shenzhen, Dongguan, Guangzhou | Aerospace brackets, Titanium dental implants, Electronics | 5 |

| Zhejiang | Industrial-scale polymer AM, Multi-material systems | Hangzhou, Ningbo, Yiwu | Automotive tooling, Consumer goods, Construction molds | 4.5 |

| Shanghai | R&D-intensive AM, Aerospace-grade components | Shanghai (Pudong), Suzhou | Jet engine parts, Satellite components | 5 |

| Sichuan | Cost-optimized metal AM, Heavy industrial parts | Chengdu, Mianyang | Oil/gas valves, Mining equipment, Railway components | 3.5 |

Note: Cluster Maturity reflects technology depth, supply chain density, and export compliance (1=Emerging, 5=Global Benchmark).

Regional Comparison: Sourcing Trade-Offs (2026 Projections)

Metrics based on SourcifyChina’s 2025 supplier audit data (n=142 certified AM factories)

| Parameter | Guangdong | Zhejiang | Shanghai | Sichuan |

|---|---|---|---|---|

| Price Index | 4.2/5 (Premium) | 3.8/5 (Balanced) | 4.5/5 (Premium) | 2.9/5 (Budget) |

| Details | 15–25% above Zhejiang for Ti-6Al-4V; justified by sub-25μm precision | Competitive on polymer systems (10% below Guangdong) | Highest for Ni-based superalloys (20–30% premium) | Lowest for stainless steel (12–18% below Guangdong) |

| Quality Tier | Tier 1 (AS9100/ISO 13485 certified) | Tier 1.5 (ISO 9001 standard) | Tier 1 (NADCAP aerospace certs) | Tier 2 (ISO 9001; limited NDT) |

| Details | <3% defect rate; full material traceability | 5–7% defect rate; partial traceability | <2% defect rate; blockchain logs | 8–12% defect rate; batch-level traceability |

| Lead Time | 15–25 days | 12–20 days | 18–30 days | 20–35 days |

| Details | Fastest for small-batch medical; +5 days for aerospace certs | Shortest for polymer parts; +3 days for metal | Longest for certification; ideal for R&D prototypes | Slowest due to logistics; +7 days for surface finishing |

| Key Advantage | Precision + Compliance | Scalability + Cost Balance | Aerospace Expertise | Budget for Non-Critical Parts |

Strategic Recommendations for Procurement Managers

- Prioritize Region by Application:

- Medical/Aerospace: Source from Guangdong or Shanghai (non-negotiable for certifications).

- High-Volume Polymer Parts: Zhejiang offers optimal cost/quality balance (e.g., automotive jigs).

-

Cost-Sensitive Industrial Parts: Sichuan for stainless steel components with relaxed tolerances.

-

Demand Material Transparency:

Require suppliers to provide:

– Powder reuse cycle logs (max 3x for critical parts)

– Inert gas purity reports (O₂ < 500 ppm for aerospace)

– SLS/SLM machine calibration certificates (updated quarterly) -

Leverage Cluster Synergies:

- Pair Guangdong (part production) with Suzhou (post-processing) to reduce lead times by 12–18%.

-

Use Zhejiang’s Yiwu logistics hub for consolidated shipments (saves 8–14% on LCL ocean freight).

-

Risk Mitigation Protocol:

- Phase 1: Audit via SourcifyChina’s AM-specific checklist (covers 47 technical parameters).

- Phase 2: Start with 3-batch trial (min. 50 units/batch) before scaling.

- Phase 3: Implement AI-powered dimensional scanning for every shipment (cost: $0.80–$2.10/part).

Conclusion

China’s additive manufacturing landscape has matured into a tiered ecosystem where regional specialization dictates sourcing outcomes. While Guangdong leads in high-value precision manufacturing, Zhejiang delivers the strongest ROI for volume production. Procurement success in 2026 hinges on abandoning “China-wide” sourcing strategies in favor of hyper-localized cluster targeting. SourcifyChina’s cluster-specific supplier database (updated Q1 2026) reduces supplier vetting time by 63% and ensures compliance with evolving global standards.

Next Step: Request SourcifyChina’s 2026 Additive Manufacturing Cluster Scorecard (includes real-time supplier capacity, certification status, and risk ratings) at sourcifychina.com/am2026.

SourcifyChina: De-risking Global Sourcing Since 2018

© 2026 SourcifyChina. All rights reserved. Data sources: China AM Industry Association, MIIT, SourcifyChina Supplier Audit Database.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Additive Manufacturing (AM) in China: Technical Specifications & Compliance Guide

Prepared for Global Procurement Managers

Overview

Additive manufacturing (AM), commonly known as 3D printing, has matured into a strategic production method for prototyping, low-volume production, and complex component manufacturing. China has emerged as a key hub for AM services due to cost advantages, scalable capacity, and growing technological expertise. However, ensuring quality consistency and regulatory compliance remains critical for global procurement teams sourcing from Chinese manufacturers.

This report outlines the technical specifications, compliance benchmarks, and quality control practices necessary when procuring AM components from China.

Key Technical Specifications

| Parameter | Details |

|---|---|

| Common Materials | – Polymers: ABS, PLA, Nylon (PA11, PA12), TPU, PEEK, ULTEM (PEI) – Metals: Stainless Steel (316L, 17-4PH), Titanium (Ti6Al4V), Aluminum (AlSi10Mg), Inconel 718 – Ceramics & Composites: Zirconia, Silica-filled resins |

| Layer Resolution | 20–100 μm (resin-based); 20–50 μm (metal PBF); up to 300 μm (FDM) |

| Build Volume | Varies by machine: Up to 500 x 500 x 500 mm (industrial systems) |

| Surface Finish | As-built: Ra 4–12 μm; post-processed (polishing, coating): Ra <1.6 μm |

| Dimensional Tolerances | – FDM: ±0.2 mm (standard), ±0.05 mm (high-precision) – SLA/DLP: ±0.1 mm – SLS/SLM: ±0.1 mm (complex geometries) |

| Mechanical Properties | Varies by material and process. Must be validated via tensile, impact, and fatigue testing per ISO/ASTM standards. |

| Post-Processing | Support removal, sanding, polishing, heat treatment, HIP (Hot Isostatic Pressing), coating, CNC finishing |

Essential Certifications & Compliance Requirements

Global procurement managers must verify that Chinese AM suppliers possess relevant international certifications, particularly for regulated industries (medical, aerospace, automotive, consumer electronics).

| Certification | Applicable Industry | Key Requirements |

|---|---|---|

| ISO 9001:2015 | All industries | Quality Management System (QMS) compliance; mandatory baseline for credible suppliers |

| ISO 13485 | Medical Devices | QMS specific to medical device design and manufacturing; required for implants, surgical tools |

| CE Marking | EU Market (Medical, Industrial) | Compliance with EU directives (e.g., MDR, PPE, Machinery); includes risk assessment and technical file |

| FDA 21 CFR Part 820 (QSR) | U.S. Medical Devices | Quality System Regulation; required for FDA-cleared or approved medical AM parts |

| UL Certification | Consumer, Electronics, Industrial | Safety compliance for electrical components and enclosures; UL 94 flammability rating for polymers |

| AS9100D | Aerospace | QMS standard for aviation, space, and defense; includes traceability and NDT (Non-Destructive Testing) |

| ISO/ASTM 52900 | General AM | International standard defining AM terminology, processes, and principles |

Procurement Tip: Require suppliers to provide certification copies, audit reports, and material traceability documentation (e.g., CoA – Certificate of Analysis).

Common Quality Defects in Additive Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warping / Delamination | Thermal stress during cooling; poor bed adhesion | Optimize build orientation; use heated chambers; ensure proper bed leveling and adhesion agents |

| Porosity / Incomplete Fusion (Metals) | Insufficient laser power; improper scan speed; powder contamination | Conduct powder quality screening; optimize laser parameters; perform HIP post-processing |

| Dimensional Inaccuracy | Incorrect shrinkage compensation; machine calibration drift | Use validated process parameters; conduct first-article inspection (FAI) with CMM (Coordinate Measuring Machine) |

| Surface Roughness / Stair-Stepping | Layer resolution limits; poor orientation | Adjust layer height; optimize part orientation; apply post-processing (vapor polishing, media blasting) |

| Support Marks / Residue | Incomplete support removal; aggressive break-off | Use soluble supports (if applicable); employ CNC or manual finishing; train technicians on careful removal |

| Cracking / Brittleness | Residual stress; moisture absorption (polymers) | Apply stress-relief annealing; store materials in dry conditions; use desiccant dry boxes |

| Inconsistent Mechanical Properties | Variable layer bonding; powder reuse beyond limits | Limit powder reuse cycles (typically ≤3–5x); conduct batch mechanical testing (tensile, impact) |

| Misalignment / Layer Shifting | Mechanical instability; vibration; software error | Regular machine maintenance; isolate from vibrations; verify slicing software integrity |

Procurement Recommendations

- Supplier Qualification: Audit suppliers for ISO certification, in-house metrology (CMM, CT scanning), and material traceability systems.

- Pilot Runs: Conduct trial production with full inspection before scaling.

- Quality Agreements: Define AQL (Acceptable Quality Level), inspection frequency, and rejection criteria in contracts.

- Third-Party Inspection: Engage independent labs for material and dimensional verification, especially for safety-critical parts.

- Design for AM (DfAM): Collaborate with suppliers early to optimize geometry, reduce supports, and improve manufacturability.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Additive Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China’s additive manufacturing (AM) sector is projected to grow at 18.2% CAGR (2024–2026), driven by industrialization of metal/polymer 3D printing and government subsidies for “smart manufacturing.” Sourcing AM components from China offers 15–25% cost savings vs. Western/EU suppliers, but requires strategic partner vetting due to IP risks and quality variance. This report details cost structures, OEM/ODM models, and actionable sourcing strategies for 2026.

Key Sourcing Models: White Label vs. Private Label

Critical distinction for IP protection and margin control in AM:

| Criteria | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Supplier’s pre-existing design/product rebranded under your label. Minimal customization. | Full co-creation: Your specs, materials, IP. Supplier manufactures only. | Avoid for complex AM parts – High IP leakage risk in China’s fragmented AM ecosystem. |

| IP Ownership | Supplier retains design IP. You own branding only. | Your organization owns all IP (design, materials, process). | Mandatory for mission-critical parts (e.g., aerospace, medical). Use Chinese patent filings + contractual safeguards. |

| Cost Advantage | Lower unit cost (no R&D burden). | Higher initial cost (tooling, validation), but better long-term margins. | Opt for Private Label if MOQ ≥1,000 units. ROI positive at scale. |

| Quality Control | Supplier’s standard tolerances (±0.1–0.3mm). | Your defined tolerances (e.g., ±0.05mm for medical). | Non-negotiable: Third-party QC audits for Private Label. White Label = higher defect risk. |

| Best For | Low-risk consumer goods (e.g., promotional figurines). | High-value industrial parts (e.g., turbine blades, custom orthopedics). | 85% of SourcifyChina clients choose Private Label for AM to protect IP and ensure specs. |

⚠️ Critical Insight: Chinese AM suppliers often mislabel “White Label” as “ODM.” Verify if they own the digital file (STL/OBJ). True ODM = supplier develops design to your functional brief; White Label = off-the-shelf product.

Cost Breakdown: Additive Manufacturing in China (2026)

Based on 100+ SourcifyChina client engagements (2025–2026). Assumes polymer (Nylon/ABS) & metal (Ti6Al4V, AlSi10Mg) parts.

| Cost Component | Polymer Parts (per kg) | Metal Parts (per kg) | Key Variables |

|---|---|---|---|

| Materials | $18–$25 | $120–$220 | • Polymer: Recycled vs. virgin pellets • Metal: Powder reuse rate (typ. 30–50% waste) |

| Labor | $3–$5 | $8–$12 | • Post-processing (support removal, polishing) = 40% of labor cost • Skilled labor shortages raise metal AM wages +7% YoY |

| Machine Depreciation | $6–$9 | $25–$40 | • Polymer: FDM/SLA machines (lower capex) • Metal: SLS/EBM machines (high capex; cost passed to buyer) |

| Packaging | $0.80–$1.50 | $2.50–$4.00 | • Anti-static/vacuum sealing for metal powders • Custom foam inserts for fragile lattice structures |

| QC & Certification | $1.20–$2.00 | $5.00–$8.50 | • Non-negotiable: ISO 13485 (medical) or AS9100 (aerospace) adds 8–12% cost |

| TOTAL PER KG | $29–$41.50 | $161.50–$284.50 | • Metal: +15–20% if requiring HIP (Hot Isostatic Pressing) |

Note: Shipping/logistics excluded (add $8–$15/kg for air freight; $2–$4/kg for sea freight with 30–45-day lead time).

Price Tiers by MOQ (Polymer vs. Metal)

Estimated FOB Shenzhen pricing. Based on mid-range complexity (e.g., 100–500g part weight, <500mm³ build volume).

| MOQ | Polymer Parts (USD/kg) | Metal Parts (USD/kg) | Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 units | $42.00 – $58.00 | $295.00 – $380.00 | Baseline | • Minimum machine setup fee ($350–$600) • Powder/pellet waste at max rate |

| 1,000 units | $35.50 – $48.00 | $245.00 – $320.00 | 12–15% | • Batch processing optimizes machine time • Powder reuse rate improves to 40% |

| 5,000 units | $29.00 – $41.50 | $161.50 – $284.50 | 28–32% | • Dedicated production line • Supplier absorbs 50% packaging/tooling cost |

💡 SourcifyChina Insight:

– Polymer: MOQ 1,000+ unlocks automation (e.g., robotic depowdering), cutting labor by 22%.

– Metal: MOQ 5,000 is rarely cost-effective for complex parts. Optimize via consolidated builds (group orders with non-competing clients).

– Critical Threshold: MOQ <500 = avoid. Setup costs erode margins; defect rates rise 18% at micro-batches.

Strategic Recommendations for 2026

- IP Protection First: Use China’s new 2025 Digital IP Registry for AM files. Require NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements with Shenzhen jurisdiction.

- Hybrid Sourcing: Source metal powders from EU/US (quality) but printing from China (cost). Reduces material risk by 65%.

- MOQ Flexibility: Negotiate “virtual MOQ” – pay for 1,000 units but ship in 4 batches over 6 months. Saves 9–14% vs. single-batch MOQ 500.

- QC Protocol: Mandate in-process CT scanning (not just final inspection). Catches porosity defects in metal AM early.

Bottom Line: China remains unbeatable for scale in polymer AM (MOQ >1,000). For metal, target Tier-2 cities (Xi’an, Wuxi) where subsidies cut costs 12–18% vs. Shanghai/Shenzhen. Always audit suppliers for actual machine utilization rates – idle capacity = rushed jobs.

SourcifyChina Verification: All data validated via 2026 China Additive Manufacturing Alliance (CAMA) cost surveys + onsite factory audits (Q4 2025).

Next Steps: [Request a Free AM Sourcing Assessment] | [Download 2026 China AM Supplier Scorecard]

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina | Sourcing Report 2026

Strategic Guide: Verifying Additive Manufacturing Suppliers in China

Prepared for Global Procurement & Supply Chain Leaders

Date: April 5, 2026

Executive Summary

As additive manufacturing (AM) adoption accelerates across aerospace, medical, automotive, and industrial sectors, China has emerged as a high-capacity, cost-competitive hub for 3D printing services and equipment. However, the market remains fragmented, with a mix of advanced OEMs, specialized factories, and intermediary trading companies—some lacking technical depth or transparency.

This report delivers a step-by-step verification framework to identify qualified additive manufacturing suppliers in China, distinguish between factories and trading companies, and avoid critical procurement risks. Designed for procurement managers, sourcing directors, and supply chain strategists, this guide ensures operational integrity, IP protection, and long-term supply resilience.

I. Critical Steps to Verify an Additive Manufacturing Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Legal Entity & Registration | Validate business license via China’s National Enterprise Credit Information Publicity System (NECIPS) | Ensure the company is legally registered and active | Cross-check Unified Social Credit Code (USCC) on gsxt.gov.cn |

| 2. On-Site Facility Audit | Conduct in-person or third-party audit of production site | Confirm ownership of equipment, technical capability, and operational scale | Use audit checklist covering equipment logs, maintenance records, and workflow |

| 3. Equipment Ownership & Technical Capability | Request proof of ownership for AM systems (e.g., EOS, SLM, HP, Farsoon) | Distinguish true manufacturers from resellers or brokers | Review purchase invoices, warranty documents, and machine serial numbers |

| 4. Certifications & Compliance | Verify ISO 9001, ISO 13485 (medical), AS9100 (aerospace), NADCAP (if applicable) | Ensure adherence to international quality and safety standards | Request copies and validate with certifying bodies |

| 5. Sample & Prototype Validation | Order functional prototypes with material and dimensional traceability | Test consistency, surface finish, and mechanical properties | Use third-party metrology (e.g., CMM, CT scanning) for validation |

| 6. IP Protection & NDA Enforcement | Execute a robust NDA under Chinese jurisdiction with clear penalties | Safeguard design files and proprietary data | Engage local legal counsel to draft and register NDA |

| 7. Supply Chain Transparency | Request full bill of materials (BOM) and material sourcing documentation | Confirm material origin and avoid counterfeit powders (e.g., Ti-6Al-4V, Inconel) | Require mill test certificates (MTCs) and supplier traceability |

| 8. Production Capacity & Lead Time Validation | Review machine utilization reports and historical order fulfillment data | Avoid over承诺 (over-promising) and ensure scalability | Request references from Tier 1 clients in similar industries |

II. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Facility Ownership | Owns and operates AM equipment on-site | No production floor; may subcontract to unknown vendors |

| Equipment List | Can provide serial numbers, installation dates, and maintenance logs | Vague descriptions like “we work with top-tier machines” |

| Staff Expertise | Employs in-house engineers with AM certifications (e.g., SLM, DMLS) | Sales-focused team with limited technical knowledge |

| Quotation Detail | Breaks down cost by build time, support structure, post-processing | Offers flat pricing without process explanation |

| Lead Time Explanation | Provides machine queue status and build scheduling | Generic timelines (e.g., “2–4 weeks”) without transparency |

| Material Handling | Stores raw powder in climate-controlled environment with batch tracking | Cannot show material storage or handling procedures |

| Customization Capability | Offers parameter optimization, support design, and topology advice | Limited to standard service offerings |

| Website & Marketing | Features in-house R&D, case studies, and machine photos | Stock images, generic 3D printing claims, no facility visuals |

✅ Best Practice: Request a live video tour with equipment in operation and staff interaction. Factories can demonstrate real-time builds; traders cannot.

III. Red Flags to Avoid in Additive Manufacturing Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ No verifiable physical address or refusal to allow audits | High risk of fraud or shell company | Disqualify immediately |

| ❌ Unusually low pricing (e.g., 30% below market) | Likely indicates substandard materials, reused powder, or hidden costs | Request full cost breakdown and material certification |

| ❌ Inability to provide machine logs or build parameters | Suggests subcontracting or lack of control over quality | Require access to build chamber data and post-processing records |

| ❌ Poor English communication or unresponsive technical team | Indicates lack of international compliance and support | Require bilingual engineering contact |

| ❌ No NDA willingness or weak IP clauses | High risk of design theft or reverse engineering | Insist on enforceable NDA before sharing CAD files |

| ❌ Claims of “exclusive partnerships” with major AM OEMs without proof | Common misrepresentation tactic | Verify partnerships via OEM portals (e.g., EOS Partner Network) |

| ❌ Frequent use of Alibaba or Made-in-China without direct company site | Often indicates trading behavior | Prefer suppliers with independent, professional websites and domain history |

IV. Recommended Due Diligence Tools & Partners

| Tool/Service | Purpose | Provider Example |

|---|---|---|

| Third-Party Audit Firms | On-site factory verification | SGS, TÜV Rheinland, Bureau Veritas |

| Business Verification Platforms | Legal and financial background checks | Dun & Bradstreet,企查查 (QichaCha), 天眼查 (Tianyancha) |

| Material Testing Labs | Powder and part certification | Intertek, Element Materials, China Iron & Steel Research Institute |

| Legal Counsel (China-Specialized) | NDA, contract, and IP enforcement | Fangda Partners, King & Wood Mallesons |

| SourcifyChina Supplier Vetting | End-to-end qualification and management | SourcifyChina Procurement Intelligence Platform |

Conclusion & Strategic Recommendation

Procuring additive manufacturing services from China offers significant cost and scalability advantages—but only when paired with rigorous supplier qualification. True factories with technical ownership, certified processes, and transparent operations deliver long-term value. Trading companies may expedite initial sourcing but increase risk in quality, IP, and supply continuity.

Action Steps for Procurement Managers:

1. Prioritize on-site or remote audits before contract signing.

2. Require equipment ownership proof and material traceability.

3. Use third-party validation for certifications and sample testing.

4. Build contracts with IP protection, audit rights, and KPIs.

By applying this framework, global procurement teams can de-risk engagement and unlock China’s advanced manufacturing potential with confidence.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Shenzhen & Shanghai | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Additive Manufacturing in China (2026)

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary: The Time-Critical Imperative in AM Sourcing

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market for advanced manufacturing projects. Traditional supplier vetting for additive manufacturing (AM) in China consumes 217+ hours per sourcing cycle (2025 SourcifyChina benchmark data), with 68% of RFQs failing due to unverified capabilities, quality gaps, or compliance shortcomings.

Our Solution: SourcifyChina’s Verified Pro List for Additive Manufacturing eliminates these inefficiencies through a rigorously audited network of 89 pre-qualified Chinese AM suppliers—each validated for technical capacity, ISO 13485/AS9100 compliance, material traceability, and export readiness.

Why the Verified Pro List Saves You Critical Time & Mitigates Risk

| Process Stage | Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved | Risk Reduction |

|---|---|---|---|---|

| Supplier Vetting | 120–180 hours (self-research, factory audits, document checks) | < 15 hours (pre-verified dossiers + 1-click capability reports) | 85–92% | 100% (All suppliers pass 27-point audit) |

| RFQ Turnaround | 45–60 days (repeated capability clarifications) | < 14 days (direct access to production-ready partners) | 65–75% | 90% (Zero capability misrepresentation) |

| Quality Assurance | 3–5 on-site audits (cost: $8K–$15K) | 0 audits required (real-time QC video feeds + batch-certified materials) | 100% | 95% (Predictable first-pass yield >92%) |

| Compliance Validation | Manual review of 50+ export docs per supplier | Automated compliance dashboards (FDA 21 CFR Part 11, REACH, ITAR-ready) | 90% | 100% (All suppliers export-certified) |

Key Advantages Driving Procurement Efficiency:

✅ Zero Vetting Overhead: Skip 6–9 months of supplier screening with technical dossiers validated by our in-house AM engineering team.

✅ Predictable Lead Times: Guaranteed 35–45 day production cycles (vs. industry avg. 60+ days) with buffer stock options.

✅ Cost Transparency: All-in FOB pricing models with no hidden tooling or material surcharges.

✅ IP Protection: Legally binding NNN agreements + blockchain-tracked production logs included.

Call to Action: Secure Your Competitive Edge in 2026

Time is your scarcest resource—and your greatest leverage point. Every day spent on unverified supplier searches delays product launches, inflates costs, and exposes your organization to avoidable operational risk.

Take decisive action now:

1. Claim your complimentary AM Pro List consultation (valued at $2,500)

2. Receive 3 tailored supplier matches within 48 hours—complete with capability matrices, pricing benchmarks, and risk assessments.

3. De-risk your 2026 AM sourcing with a single point of accountability.

👉 Act Before Q1 2026 Capacity Bookings Close:

Email: [email protected]

WhatsApp: +86 159 5127 6160

(Response time: < 2 business hours | 100% confidentiality guaranteed)

“SourcifyChina’s Pro List cut our AM supplier onboarding from 8 months to 11 days. We’ve since qualified 4 Tier-1 aerospace suppliers with zero quality escapes.”

— Director of Global Sourcing, DAX-listed Industrial Equipment Manufacturer (2025 Client)

Your Next Step:

Reply with “AM PRO LIST 2026” to receive:

– Free access to our 2026 Additive Manufacturing Supplier Scorecard (China-specific)

– Priority slot for our Q1 Capacity Allocation Webinar (January 15, 2026)

– Dedicated sourcing engineer for your first RFQ

Don’t negotiate with uncertainty. Partner with verification.

SourcifyChina — Where Precision Sourcing Meets Operational Certainty

© 2026 SourcifyChina. All supplier data refreshed quarterly. ISO 9001:2015 certified sourcing process. 100% client confidentiality guaranteed under GDPR/CCPA.

PS: First 15 respondents receive complimentary logistics risk assessment for 2026 AM shipments (air/ocean).

🧮 Landed Cost Calculator

Estimate your total import cost from China.