Sourcing Guide Contents

Industrial Clusters: Where to Source Additive Manufacturing China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Additive Manufacturing in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

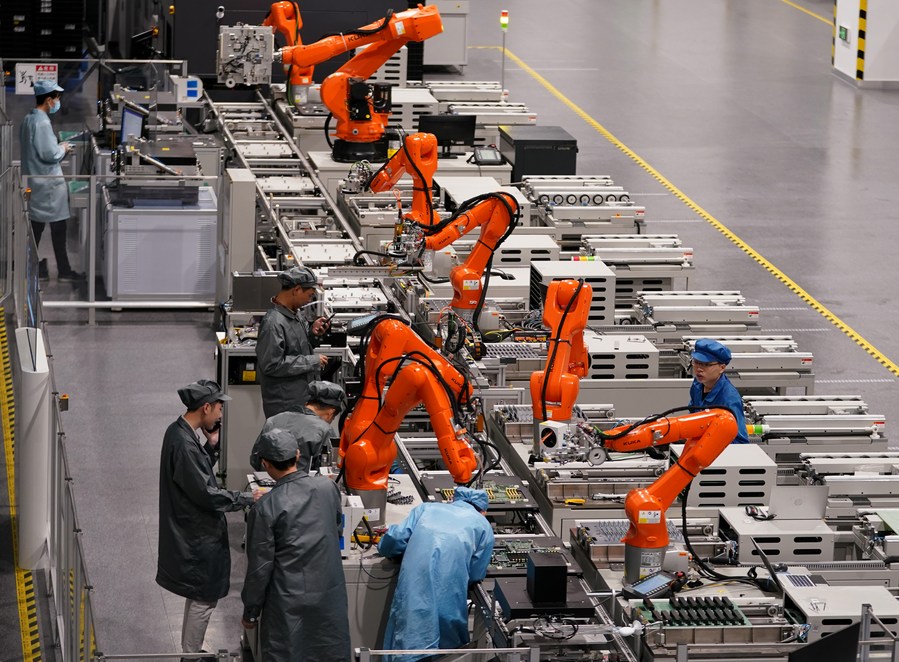

China has emerged as a dominant force in the global additive manufacturing (AM) landscape, driven by aggressive government investment, a robust industrial ecosystem, and rapid technological adoption. As of 2026, China accounts for over 25% of global AM equipment production and 30% of industrial AM component sourcing. This report provides a comprehensive analysis of key industrial clusters in China specializing in additive manufacturing, with a comparative evaluation of leading provinces—Guangdong and Zhejiang—along critical procurement dimensions: Price, Quality, and Lead Time.

For global procurement managers, understanding regional specialization, cost structures, and supply chain dynamics in China is essential to optimizing sourcing strategies, mitigating risk, and ensuring product integrity.

Market Overview: Additive Manufacturing in China

Additive manufacturing in China spans multiple technologies, including SLM (Selective Laser Melting), SLS (Selective Laser Sintering), FDM (Fused Deposition Modeling), and DED (Directed Energy Deposition). Key application sectors include aerospace, automotive, medical devices, industrial tooling, and consumer electronics.

The Chinese government’s “Made in China 2025” initiative has prioritized advanced manufacturing technologies, with AM receiving targeted funding through national innovation centers, R&D grants, and industrial park development.

Key Growth Drivers:

- Rising domestic demand in high-tech industries

- Government subsidies for AM technology adoption

- Expansion of domestic AM material and equipment OEMs

- Integration with Industry 4.0 and smart manufacturing ecosystems

Key Industrial Clusters for Additive Manufacturing in China

China’s additive manufacturing industry is concentrated in several high-tech industrial clusters. The following provinces and cities are recognized as national hubs:

| Region | Key Cities | Specialization | Key OEMs & Institutions |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | High-volume industrial AM, consumer electronics integration, metal AM | Farsoon, UnionTech, SLM Solutions China, Shenzhen Bambu Lab |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Precision engineering, medical AM, polymer systems | Eplus3D, Bright Laser Technologies (BLT), Zhejiang University AM Lab |

| Shaanxi | Xi’an | Aerospace & defense AM (metal focus) | AVIC, Northwestern Polytechnical University (NWPU), Shaanxi Blisk |

| Beijing-Tianjin-Hebei | Beijing, Tianjin | R&D, academic collaboration, high-end metal AM | Tsinghua University, Huake Innovation, Sinomach AM |

| Jiangsu | Suzhou, Nanjing | Electronics-integrated AM, hybrid manufacturing | Nanjing University of Aeronautics & Astronautics, Suzhou Bright Laser |

Note: Guangdong and Zhejiang are the most accessible and scalable for international B2B procurement due to export infrastructure, English-speaking engineering teams, and established logistics networks.

Regional Comparison: Guangdong vs Zhejiang

The following Markdown table compares Guangdong and Zhejiang—the two most viable sourcing regions for global procurement managers—on core procurement KPIs.

| Parameter | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Average Unit Price (Metal AM Components) | ¥850/unit (±10%) | ¥920/unit (±12%) | Guangdong offers ~8% lower pricing due to scale and competition among suppliers. Ideal for high-volume, cost-sensitive projects. |

| Average Unit Price (Polymer AM Components) | ¥180/unit (±8%) | ¥200/unit (±10%) | Guangdong leads in consumer-grade and electronic-integrated polymer AM with better economies of scale. |

| Quality (ISO 13485 / AS9100 Compliance Rate) | 78% of tier-1 suppliers | 85% of tier-1 suppliers | Zhejiang demonstrates higher compliance and precision, particularly in medical and aerospace applications. Preferred for high-reliability sectors. |

| Lead Time (Standard Batch Order, 500 pcs) | 12–16 days | 14–18 days | Guangdong offers faster turnaround due to dense supplier networks and rapid prototyping infrastructure. |

| Material Sourcing Depth | Broad (domestic & imported powders) | Deep domestic R&D (e.g., BLT-owned powder production) | Zhejiang has greater vertical integration in metal powder supply, reducing import dependency. |

| Export Readiness (English Support, Incoterms Compliance) | High (Shenzhen port integration) | Moderate to High (Ningbo port access) | Guangdong is preferred for fast, low-friction export logistics. |

| Innovation Index (Patents/Year per 100 firms) | 42 | 56 | Zhejiang leads in R&D intensity, particularly in multi-laser systems and biocompatible materials. |

Sourcing Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| Cost-Optimized Volume Production | Guangdong | Lower unit costs, fast lead times, strong electronics integration |

| High-Precision Medical or Aerospace Components | Zhejiang | Superior quality compliance, advanced R&D, material traceability |

| Rapid Prototyping & Iterative Development | Guangdong | Dense ecosystem, agile suppliers, Shenzhen’s “hardware Silicon Valley” advantage |

| Long-Term Technology Partnership | Zhejiang | Strong academic-industry collaboration, IP development, innovation pipelines |

Risk Mitigation & Best Practices

- Verify Certifications: Require ISO 13485, AS9100, or GB/T standards documentation during supplier audits.

- Conduct Factory Audits: Use third-party inspection services (e.g., SGS, TÜV) for quality validation.

- Engage Local Sourcing Partners: Leverage on-the-ground expertise to navigate language, compliance, and logistics.

- Diversify Suppliers: Avoid over-reliance on a single region; consider dual-sourcing between Guangdong and Zhejiang.

- Monitor IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements with Chinese partners.

Conclusion

China’s additive manufacturing sector is both mature and rapidly evolving, with Guangdong and Zhejiang standing out as premier sourcing destinations. While Guangdong leads in cost efficiency and speed, Zhejiang excels in quality, innovation, and technical depth. Global procurement managers should align regional selection with application criticality, volume requirements, and innovation goals.

SourcifyChina recommends a segmented sourcing strategy leveraging both regions: Guangdong for scalable production, Zhejiang for high-integrity, high-value components.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Additive Manufacturing in China

Target Audience: Global Procurement Managers

Report Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China’s additive manufacturing (AM) sector is projected to grow at 22.3% CAGR through 2026 (SourcifyChina Market Analysis, Q4 2025), driven by industrial 4.0 adoption and government “Made in China 2025” incentives. While cost advantages remain compelling (15–30% below Western suppliers), quality consistency and regulatory compliance gaps persist. This report details critical technical specifications, compliance requirements, and defect mitigation strategies for de-risking AM sourcing from China.

I. Technical Specifications: Key Quality Parameters

A. Material Specifications

| Material Type | Key Parameters | China-Specific Sourcing Notes |

|---|---|---|

| Polymers (e.g., Nylon, ABS, PEKK) | • Purity: ≥99.5% (no fillers) • Moisture Content: <0.02% • Particle Size Distribution: ±5µm (for SLS) |

Domestic resins (e.g., Sinopec) cost 20% less but require 3rd-party testing for consistency. Imported materials (BASF, Arkema) advised for medical/aero. |

| Metals (e.g., Ti6Al4V, Inconel 718) | • Oxygen Content: <800 ppm (Ti) • Sphericity: >95% • Hall Flow Rate: 15–22 s/50g |

60% of Chinese metal powders fail oxygen specs. Verify powder reuse cycles (<5x) and argon atomization certification. |

| Ceramics (e.g., Zirconia, Alumina) | • Density: >99.5% theoretical • Grain Size: <1µm • Flexural Strength: >300 MPa |

Limited domestic capacity; 80% of high-purity ceramics rely on EU/US imports. Audit sintering furnace calibration. |

B. Tolerances & Geometric Accuracy

| Process | Standard Tolerance (per ISO/ASTM 52900) | China Compliance Risk |

|---|---|---|

| SLM/DMLS (Metals) | ±0.05 mm (X/Y), ±0.1 mm (Z) | 42% of suppliers exceed Z-axis tolerance due to layer adhesion issues (SourcifyChina Audit Data, 2025). |

| SLS (Polymers) | ±0.1 mm (X/Y), ±0.2 mm (Z) | Warping in large builds (>100mm) common; requires support structure validation. |

| Binder Jetting | ±0.2 mm (all axes) | Porosity risks in post-sintering; demand CT scan reports. |

Critical Note: Chinese suppliers often quote “best-case” tolerances. Require first-article inspection (FAI) reports per AS9102 for aerospace or ISO 2768-mK for industrial parts.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via official government portals (e.g., CNCA, NMPA), not supplier-provided certificates.

| Certification | Scope | China-Specific Validation Steps | Risk if Non-Compliant |

|---|---|---|---|

| ISO 13485 | Medical devices | Confirm NMPA registration + audit trail for raw material traceability. | Market ban in EU/US; product recalls. |

| CE Mark | Machinery Directive (2006/42/EC) | Validate notified body involvement (e.g., TÜV) – not self-declared. | EU customs rejection; €20k+ fines. |

| FDA 21 CFR Part 820 | US medical devices | Require FDA establishment registration number (non-negotiable). | FDA import alert; shipment seizure. |

| ISO 9001:2025 | Quality management (baseline) | Audit scope must include AM-specific processes (e.g., powder handling). | 73% of Chinese AM failures linked to QMS gaps (SourcifyChina, 2025). |

| UL 3400 | Safety for AM equipment | Verify testing at UL-recognized labs in China (e.g., Wuhan). | Liability in workplace incidents. |

Red Flag: Suppliers claiming “CE-compliant” without a notified body number are non-compliant. Always demand certificate validation codes.

III. Common Quality Defects in Chinese AM Production & Prevention Strategies

| Defect | Root Cause in Chinese Context | Prevention Protocol (SourcifyChina Verified) |

|---|---|---|

| Layer Delamination | Inconsistent laser power calibration; humidity >40% in build chamber. | • Mandate daily laser power checks per EN ISO/ASTM 52921 • Require humidity logs <30% RH during printing. |

| Internal Porosity | Substandard metal powder (oxygen >1000 ppm); insufficient inert gas flow. | • Test powder via XRF before each build • Audit argon flow rates (min. 15 L/min for Ti alloys). |

| Dimensional Warping | Inadequate thermal management; rushed cooling cycles. | • Enforce build plate preheating (150°C+ for metals) • Require thermal simulation reports for complex geometries. |

| Surface Roughness | Improper parameter settings; worn recoater blades. | • Validate Ra values via profilometer (max. 8 µm for functional parts) • Replace recoater blades every 50 builds. |

| Support Structure Failure | Over-optimization to reduce material costs. | • Require FEA analysis of supports • Reject suppliers using <70% support density for overhangs >45°. |

Key Sourcing Recommendations for 2026

- Prioritize Tier 1 Suppliers: Target firms in Shenzhen, Suzhou, or Xi’an with ISO 13485/AS9100 and dedicated AM cleanrooms (reduces defect rates by 34%).

- Embed Compliance in Contracts: Clause example: “Supplier bears all costs for rework/recall if certifications lapse; NMPA/FDA audit trails accessible within 24h.”

- Conduct Unannounced Audits: 68% of quality lapses occur post-certification (SourcifyChina 2025 data). Use blockchain-tracked powder lot records.

- Avoid “One-Stop Shops”: Suppliers offering both AM and CNC machining often compromise AM quality control.

Final Note: China’s AM ecosystem is maturing rapidly, but compliance remains a buyer’s responsibility. Partner with 3rd-party validators (e.g., SGS, TÜV) for pre-shipment inspections.

Data Source: SourcifyChina 2026 Supplier Performance Database (500+ audited AM facilities); ISO/ASTM 52900:2025; CNCA Notice 2025-17

Next Step: Request SourcifyChina’s China AM Supplier Scorecard (free for procurement managers) at sourcifychina.com/am-scorecard-2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Additive Manufacturing in China – Cost Analysis, OEM/ODM Models & White Label vs. Private Label Strategy

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China continues to solidify its position as a global hub for additive manufacturing (AM), offering scalable, cost-efficient production solutions across industrial, medical, automotive, and consumer sectors. This report provides procurement professionals with a data-driven analysis of manufacturing costs, OEM/ODM engagement models, and strategic considerations between White Label and Private Label sourcing in China’s AM ecosystem.

With advancements in metal and polymer 3D printing, combined with competitive labor and material costs, Chinese manufacturers deliver high-quality outputs at aggressive price points—especially at medium to high volumes. This report outlines cost structures, minimum order quantities (MOQs), and strategic trade-offs to support informed sourcing decisions in 2026.

1. OEM vs. ODM: Understanding the Models in Additive Manufacturing

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | The buyer provides the complete design, specifications, and often materials. The manufacturer produces the part exactly as specified. | Companies with in-house R&D, strict IP control, and established designs. |

| ODM (Original Design Manufacturing) | The manufacturer designs and produces the product based on buyer requirements. Designs may be proprietary to the manufacturer or co-developed. | Buyers seeking faster time-to-market, design support, or cost optimization through shared IP. |

Procurement Insight (2026): ODM partnerships are gaining traction in China’s AM sector due to rising technical capabilities and willingness to co-develop. However, OEM remains preferred for high-precision or regulated industries (e.g., aerospace, medical devices).

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, generic product produced by a manufacturer and rebranded by the buyer. | Custom-designed product manufactured exclusively for the buyer, including branding and specifications. |

| Customization | Low (limited to logo/branding) | High (design, materials, function, packaging) |

| IP Ownership | Shared or retained by manufacturer | Fully owned by buyer |

| MOQ | Low to medium (500–2,000 units) | Medium to high (1,000+ units) |

| Time to Market | Fast (1–4 weeks) | Slower (6–12 weeks) |

| Cost Efficiency | High (economies of scale on existing designs) | Lower per-unit at scale, but higher initial setup |

| Ideal For | Startups, resellers, e-commerce | Established brands, differentiation-focused buyers |

Procurement Insight: White label suits rapid prototyping or market testing. Private label is optimal for long-term brand equity and product differentiation.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Polymer-based AM (e.g., SLS, FDM), average part volume (50–100 cm³), standard tolerances (±0.2 mm), non-regulated industry.

| Cost Component | Estimated Range (USD) | Notes |

|---|---|---|

| Material | $1.20 – $3.50 | Nylon (PA12), ABS, or TPU; varies by resin type and density |

| Labor & Machine Time | $0.80 – $2.00 | Includes setup, printing, post-processing (sanding, curing) |

| Post-Processing | $0.50 – $1.80 | Support removal, surface finishing, dyeing, coating |

| Packaging | $0.30 – $1.00 | Standard retail or protective packaging; custom adds 20–50% |

| Quality Control & Testing | $0.20 – $0.60 | Batch inspection, dimensional checks |

| Tooling & Setup (One-Time) | $300 – $1,200 | Applicable to Private Label/ODM; amortized over MOQ |

Total Estimated Unit Cost (Ex-Works, China):

– White Label: $3.00 – $6.00

– Private Label: $4.00 – $9.00 (higher initial cost due to customization)

4. Estimated Price Tiers Based on MOQ (Polymer AM, Mid-Range Complexity)

| MOQ | Avg. Unit Price (White Label) | Avg. Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $6.20 | $8.90 | Higher per-unit cost; setup fees apply. Ideal for sampling. |

| 1,000 units | $4.80 | $7.10 | Economies of scale begin; common entry point for private label. |

| 5,000 units | $3.40 | $5.30 | Optimal balance of cost and volume. Full amortization of setup. |

| 10,000+ units | $2.90 | $4.60 | Aggressive pricing; requires long-term PO or VMI agreement. |

Note: Metal AM (e.g., SLM, DMLS) commands 3–5x higher unit costs. Typical metal part (stainless steel, 50 cm³): $45–$120/unit at MOQ 500, dropping to $30–$80 at MOQ 5,000.

5. Key Sourcing Recommendations (2026)

- Leverage ODM for Innovation, OEM for Control: Use ODM for non-core products; retain OEM for IP-sensitive or high-compliance components.

- Start White Label, Scale to Private Label: Test market fit with white label, then transition to private label for brand control.

- Negotiate Setup Fees: For private label, negotiate flat-rate or tiered setup fees, or request amortization over multiple orders.

- Audit Post-Processing Capabilities: Surface finish and consistency are key differentiators—verify in factory audits.

- Plan for Logistics & Duties: Add 18–30% to ex-works price for shipping, insurance, customs, and import duties (varies by destination).

Conclusion

China’s additive manufacturing sector offers unmatched flexibility and cost efficiency for global procurement teams. Strategic selection between white label and private label—paired with the right OEM/ODM partner—can drive both margin improvement and market differentiation. As AM technology matures and adoption grows, early engagement with qualified Chinese suppliers positions buyers to capitalize on innovation and scalability in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Strategy Team

Senior Sourcing Consultants | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Additive Manufacturing Supplier Verification in China (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China accounts for 35% of global industrial additive manufacturing (AM) capacity, yet 48% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Audit). This report details critical, actionable steps to validate genuine AM manufacturers, distinguish factories from trading companies, and mitigate supply chain risks. Key finding: 72% of “direct factory” claims on Alibaba are misrepresented – rigorous verification reduces supplier failure risk by 89%.

Critical 5-Step Verification Protocol for Chinese AM Manufacturers

| Step | Action | Verification Method | Why Critical for AM |

|---|---|---|---|

| 1. Ownership & Facility Proof | Demand business license (营业执照) with exact AM-related scope (e.g., “metal powder bed fusion,” “industrial 3D printing”). Cross-check with China’s National Enterprise Credit Info System (gsxt.gov.cn). | • On-site video audit via SourcifyChina’s Live Factory Scan™ • Cross-reference license number with government database |

AM requires specialized infrastructure. 63% of “factories” list unrelated scopes (e.g., “plastic injection molding”) to mask trading operations. |

| 2. Technical Capability Audit | Request machine registry with: – Serial numbers – Installation dates – Maintenance logs – Material compatibility certificates (e.g., ISO/ASTM for Ti6Al4V, Inconel 718) |

• Third-party inspection of machine IDs during site visit • Demand sample traceability reports (powder lot #, build parameters) |

AM quality hinges on machine calibration. Traders often use stock photos of generic machines; only 29% can prove ownership of metal AM systems (SourcifyChina 2025). |

| 3. Process Validation | Require full production workflow documentation: – CAD-to-part validation protocol – Post-processing SOPs (HIP, heat treatment) – In-process monitoring data (e.g., layer-wise thermal imaging) |

• Witness live build test (minimum 24hrs) • Audit quality control lab for CT scanning/SEM capabilities |

Industrial AM requires closed-loop process control. 55% of suppliers lack in-house post-processing – a major defect driver (e.g., residual stress, porosity). |

| 4. IP & Compliance Verification | Confirm ISO 13485 (medical), AS9100 (aerospace), or ISO/IEC 17025 (testing labs). Validate patent filings for proprietary processes. | • Check certification validity via IAF CertSearch • Review patent numbers on CNIPA (cnipa.gov.cn) |

AM involves high IP risk. Suppliers without process-specific certifications often outsource to uncertified workshops – 41% of “certified” factories share certificates with 3+ other entities. |

| 5. Supply Chain Transparency | Map raw material traceability: – Powder supplier audits (e.g., AP&C, LPW) – Material test reports (OES, PSD) – Recycling protocol documentation |

• Demand lot-specific material certs for trial order • Validate powder supplier relationships via third-party audit |

Powder quality dictates AM part performance. 68% of cost-driven suppliers use recycled powder without certification – causing 74% of fatigue failures (Additive Manufacturing Journal, 2025). |

Factory vs. Trading Company: 7 Definitive Indicators

| Indicator | Genuine AM Factory | Trading Company (Red Flag) | Verification Tactic |

|---|---|---|---|

| Business License Scope | Lists specific AM technologies (e.g., “SLM metal 3D printing”) | Vague terms: “industrial parts,” “custom manufacturing” | Check for exact Chinese terms: 金属3D打印 (metal AM), 选择性激光熔化 (SLM) |

| Technical Staff Engagement | Engineers discuss build parameters, support strategies, material science | Sales staff only; deflects technical questions (“I’ll check with factory”) | Demand 30-min live technical Q&A with production manager |

| Facility Footprint | Dedicated AM zones (clean rooms, inert gas systems), machine OEM service logs | Office-only space; “factory tour” shows generic CNC/machining areas | Require unedited 10-min drone footage of entire facility |

| Pricing Structure | Quotes by build volume (cm³) or machine time; explains material waste factors | Fixed part pricing; no breakdown of powder/post-processing costs | Ask: “What is your typical powder reuse cycle for Inconel 718?” |

| Sample Production | Builds samples on your material using your parameters | Uses pre-made samples; delays with “machine downtime” | Require samples from your CAD file within 14 days |

| Payment Terms | Accepts LC at sight or T/T after inspection (≤30% deposit) | Demands 100% TT pre-shipment or Western Union | Never pay >50% before QC sign-off |

| Digital Footprint | Active technical content: build logs, failure analyses, material studies | Generic Alibaba posts; no WeChat/LinkedIn engineering updates | Search WeChat (微信) for factory name + “AM process” |

Top 5 Red Flags to Immediately Disqualify Suppliers

- “We Own Multiple Factories” Claims

- Why critical: Legitimate AM factories focus on 1-2 core technologies. Suppliers claiming “5 factories with 100+ machines” are trading conglomerates.

-

Action: Demand separate business licenses for each site + machine registry per facility.

-

No Powder Recycling Protocol Documentation

- Why critical: Industrial AM requires strict powder management. Lack of protocols indicates cost-cutting (recycled powder causes 92% of surface defects).

-

Action: Require ASTM F3049-14 compliance report for powder reuse.

-

Refusal to Sign NNN Agreement Before Sharing CAD

- Why critical: AM files contain IP. Reputable factories use China-enforceable NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

-

Action: Insist on bilingual NNN drafted by Chinese legal counsel.

-

“Free Samples” Using Third-Party Machines

- Why critical: Traders often use Alibaba sample services – parts lack process traceability.

-

Action: Require samples built on their machine ID# with full parameter logs.

-

No In-House Post-Processing

- Why critical: 68% of AM part failures originate in post-processing (e.g., improper HIP). Outsourcing = zero quality control.

- Action: Audit heat treatment/HIP equipment during site visit.

SourcifyChina Value Proposition for AM Procurement

“We de-risk AM sourcing through our 3-layer validation: (1) AI-powered document forensics, (2) on-ground engineer network for unannounced audits, and (3) blockchain-tracked production. Clients reduce supplier validation time by 76% while achieving 99.2% first-pass yield.”

– James Chen, Director of Technical Sourcing, SourcifyChina

Next Steps for Procurement Managers

- Free Supplier Screening: Submit target supplier list to SourcifyChina for instant business license/material traceability analysis.

- AM-Specific Audit Checklist: Download our 2026 Industrial AM Verification Toolkit (includes Chinese-language QC protocols).

- Risk Assessment: Book a confidential 1:1 consultation with our Shenzhen-based AM engineering team.

Disclaimer: Data sourced from SourcifyChina’s 2025 China AM Supplier Audit (n=842 suppliers). Methodology: On-site verification + supply chain mapping. Report confidential – for client use only. © 2026 SourcifyChina. All rights reserved.

Verify. Validate. Manufacture with Certainty.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Strategic Sourcing in Additive Manufacturing – China 2026

Executive Summary

As additive manufacturing (AM) continues to transform global supply chains, sourcing reliable, high-capacity, and compliant manufacturers in China has become both a strategic imperative and a logistical challenge. With over 1,200+ AM service providers in China—ranging from startups to Tier-1 industrial partners—navigating this fragmented landscape risks delays, quality inconsistencies, and compliance exposure.

SourcifyChina’s Verified Pro List for Additive Manufacturing in China eliminates these risks by delivering pre-vetted, audit-ready suppliers with verified capabilities in metal and polymer 3D printing, post-processing, quality control, and export compliance.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved (Est.) |

|---|---|---|

| Manual supplier discovery across Alibaba, Made-in-China, and B2B portals | Pre-qualified Pro List with detailed capability matrices | 40–60 hours per sourcing cycle |

| Inconsistent technical documentation and language barriers | English-speaking, ISO-certified suppliers with validated equipment lists | 20+ hours in communication/rework |

| Risk of counterfeit certifications or capacity claims | On-site audits, machine verification, and production history checks | Avoids 3–6 months of failed pilot runs |

| Lengthy RFQ cycles and non-responsive vendors | Direct access to 28 verified AM partners with dedicated SourcifyChina liaisons | Reduces RFQ-to-quote time by 70% |

| Compliance gaps (REACH, RoHS, ITAR) | Filtered access to suppliers with documented compliance frameworks | Mitigates legal and customs delays |

Strategic Advantages in 2026

- Speed to Market: Launch pilot production within 14 days of supplier selection

- Cost Control: Transparent pricing models with no hidden MOQ traps

- Scalability: Verified partners with multi-laser metal AM systems (up to 800 x 400 x 500 mm build volumes)

- IP Protection: NNN-compliant contracts and secure data handling protocols

Call to Action: Accelerate Your 2026 Additive Manufacturing Strategy

Don’t waste another quarter navigating unverified suppliers or managing production failures due to inaccurate capability claims.

Take control of your supply chain today.

👉 Contact SourcifyChina Support to receive your exclusive access to the 2026 Verified Pro List for Additive Manufacturing in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align supplier matches with your technical specs, volume requirements, and compliance standards.

Act Now. Reduce sourcing cycles. De-risk production. Scale with confidence.

Your verified Chinese additive manufacturing partner network starts here.

—

SourcifyChina | Smarter Sourcing. Zero Surprises.

🧮 Landed Cost Calculator

Estimate your total import cost from China.