The global acrylic thickener market is experiencing robust growth, driven by rising demand across industries such as paints and coatings, adhesives, textiles, and personal care. According to Grand View Research, the global architectural coatings additives market—of which acrylic thickeners are a critical component—was valued at USD 9.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This expansion is fueled by increasing construction activities, stringent environmental regulations promoting water-based formulations, and the superior rheological performance offered by acrylic thickeners. Mordor Intelligence further projects that the demand for specialty polymer additives, including associative and non-associative acrylic thickeners, will grow steadily, particularly in emerging economies across Asia-Pacific and Latin America. As innovation accelerates and manufacturers focus on sustainable, high-performance solutions, the competitive landscape has intensified. Below are the top 8 acrylic thickener manufacturers leading the market through technological advancements, global distribution networks, and strong R&D investment.

Top 8 Acrylic Thickener Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Viscosity modifiers, Rheology, Acrylic ASE thickener

Domain Est. 2001

Website: arkema.com

Key Highlights: A full range of ASE (Alkali Swellable Emulsions) type acrylic rheology modifiers and thickeners with key advantages during the formulation and the application….

#2 Markets

Domain Est. 2006

Website: methyl-methacrylate-monomers.evonik.com

Key Highlights: THICKENERS. Acrylic thickeners are commonly produced by emulsion polymerization. One of the most important monomers are the so called associative thickeners….

#3 ACRYSOL™ AP-10 Thickener

Domain Est. 1992

Website: dow.com

Key Highlights: Associative thickener that facilitates the formulation of mid to high PVC paints. It offers very high efficiency in building KU viscosity….

#4 Boosting performance: acrylic thickeners!

Domain Est. 1996

Website: byk.com

Key Highlights: Acrylic thickeners are synthetic, high molecular weight copolymers of acrylic acid that are used to adjust the rheology of aqueous systems….

#5 Emulsion thickeners

Domain Est. 1997

Website: scottbader.com

Key Highlights: Texicryl 13-313 is a very efficient thickener with a high, low-shear viscosity and has excellent pigment suspension characteristics….

#6 Thickener for Coatings Industry

Domain Est. 1998

Website: indofil.com

Key Highlights: It is a cross-linked acrylic emulsion copolymer. When emulsion is diluted with water and neutralised with a base, each emulsion particle swells greatly….

#7 Acrylic Thickener

Domain Est. 2007

Website: eagle-chemicals.com

Key Highlights: EAGAHASE HS-095 is Synthetic all Acrylic thickener to gives a clear and viscous solutions when its diluted with water and neutralized with a base ….

#8 Acrylic Emulsion Associative Thickener,Polyurethane Rheology …

Domain Est. 2014

Website: sinogracechem.com

Key Highlights: TH-935 is an associative thickener that provides excellent film build, leveling, outstanding resistance to roller spattering, and resistance to microbial attack ……

Expert Sourcing Insights for Acrylic Thickener

H2: 2026 Market Trends for Acrylic Thickener

The global market for acrylic thickener is poised for steady growth through 2026, driven by rising demand across key end-use industries such as paints and coatings, construction, personal care, and textiles. Acrylic thickeners—water-soluble polymers known for their rheology modification, stability, and ease of formulation—are increasingly favored over traditional thickening agents due to their superior performance and environmental compatibility.

-

Growth in the Paints and Coatings Industry

The architectural and industrial coatings sectors are major consumers of acrylic thickeners. With increasing urbanization, infrastructure development, and renovation activities—especially in Asia-Pacific and Latin America—the demand for high-performance waterborne coatings is rising. Acrylic thickeners enhance viscosity and application properties in latex paints, supporting this shift toward eco-friendly, low-VOC (volatile organic compound) formulations. Regulatory pressure to reduce solvent-based products further accelerates adoption. -

Sustainability and Bio-based Innovations

Environmental regulations and consumer demand for green products are pushing manufacturers to develop bio-based or partially renewable acrylic thickeners. By 2026, expect increased R&D investment in sustainable alternatives, including bio-acrylic hybrids and formulations with lower carbon footprints. Certifications such as Cradle to Cradle or EPA Safer Choice will gain importance in product differentiation. -

Expansion in Personal Care and Cosmetics

The personal care industry is adopting acrylic thickeners (e.g., carbomers) in lotions, gels, and sunscreens due to their clarity, stability, and compatibility with diverse ingredients. The growing demand for premium skincare and clean beauty products—particularly in North America and Europe—will support market expansion. Formulators are increasingly seeking multifunctional thickeners that also offer sensory benefits. -

Technological Advancements and Customization

There is a growing trend toward high-efficiency, associative acrylic thickeners that provide better flow and leveling properties while reducing dosage requirements. Manufacturers are focusing on tailored solutions for specific applications, such as high-shear stability in spray coatings or salt tolerance in marine paints. Digital formulation tools and AI-driven product development are expected to streamline innovation. -

Regional Market Dynamics

Asia-Pacific will remain the fastest-growing region due to rapid industrialization, expanding construction sectors, and rising disposable incomes in countries like China, India, and Indonesia. North America and Europe will see moderate growth, primarily driven by replacement demand and regulatory compliance. Localized production and supply chain resilience will become strategic priorities post-pandemic and amid ongoing geopolitical tensions. -

Competitive Landscape and Consolidation

The market is moderately consolidated, with key players such as BASF SE, Dow Inc., Arkema, and Nouryon leading innovation and global supply. Strategic partnerships, mergers, and capacity expansions are expected through 2026 as companies aim to strengthen regional presence and broaden product portfolios.

In summary, the 2026 outlook for the acrylic thickener market is positive, characterized by innovation, sustainability, and growing application diversity. Companies that invest in green chemistry, application-specific formulations, and regional market penetration are likely to gain a competitive edge.

H2: Common Pitfalls in Sourcing Acrylic Thickener (Quality and Intellectual Property)

Sourcing acrylic thickener—a key rheology modifier used in coatings, adhesives, and personal care products—can present significant challenges related to quality consistency and intellectual property (IP) risks. Procurement teams and formulators must be vigilant to avoid the following common pitfalls:

- Inconsistent Quality and Performance Variability

Acrylic thickeners are sensitive to manufacturing processes, raw material inputs, and polymer structure (e.g., molecular weight, branching, neutralization level). Low-cost suppliers may use substandard monomers or deviate from established synthesis methods, resulting in: - Inadequate viscosity build

- Poor batch-to-batch reproducibility

- Incompatibility with formulations (e.g., surfactant sensitivity, pH instability)

- Reduced shelf life or performance under real-world conditions

Mitigation: Require comprehensive technical data sheets (TDS), certificates of analysis (CoA), and third-party testing. Conduct in-house performance trials across multiple batches before scaling supplier commitments.

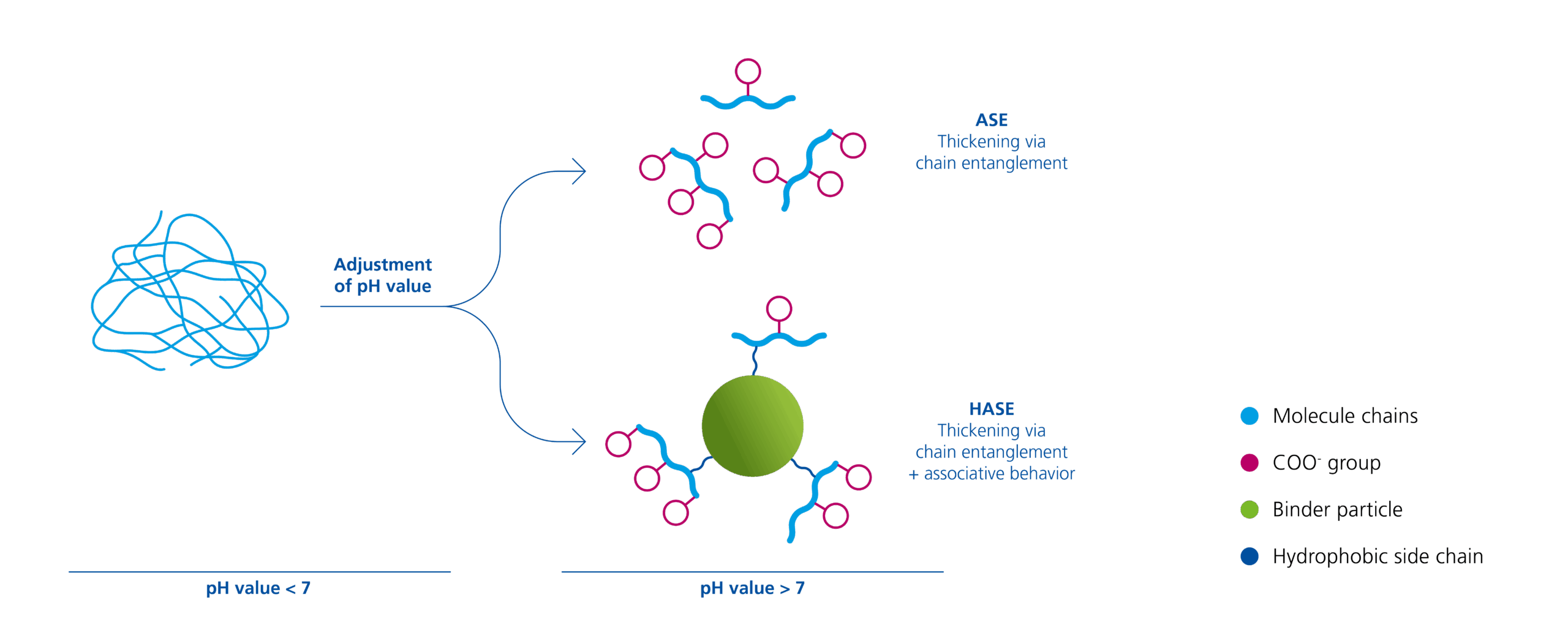

- Misrepresentation of Product Type (e.g., HASE vs. ASE vs. HEUR)

Suppliers may inaccurately label or blend chemistries to mimic high-performance types (e.g., marketing a basic ASE thickener as a HASE). This leads to formulation failures and wasted R&D time. - ASE (Alkali-Swellable Emulsion): Water-in-oil emulsion, pH-dependent thickening

- HASE (Hydrophobically modified Alkali-Swellable Emulsion): Enhanced water and electrolyte resistance

- HEUR (Hydrophobically modified Ethoxylated Urethane): Non-ionic, shear-thinning, excellent flow control

Mitigation: Demand full disclosure of chemistry type and request analytical verification (e.g., FTIR, GPC) when performance deviates.

- Intellectual Property (IP) Infringement Risks

Many acrylic thickener formulations are protected by patents covering monomer composition, synthesis process, or application-specific performance. Sourcing from manufacturers who reverse-engineer or copy patented products exposes buyers to: - Legal liability for contributory infringement

- Supply chain disruption if IP disputes lead to injunctions

- Reputational damage with downstream customers

Mitigation: Conduct IP due diligence. Prefer suppliers with their own patented technologies or licensing agreements. Include IP indemnification clauses in procurement contracts.

-

Lack of Regulatory Compliance Documentation

Especially critical in cosmetics, pharmaceuticals, and eco-labeled products, non-compliant thickeners may contain restricted substances (e.g., residual monomers like acrylic acid above ICH limits). Absence of REACH, FDA, or COSMOS certification can block market access.

Mitigation: Require full regulatory documentation (e.g., SDS, compliance statements) and audit suppliers’ quality management systems (e.g., ISO 9001). -

Opaque Supply Chain and Raw Material Traceability

Poor traceability increases risk of contamination or adulteration. Some suppliers source base polymers from unverified toll manufacturers with questionable quality controls.

Mitigation: Audit supply chain transparency. Require mapping of all production steps and raw material sources.

Avoiding these pitfalls requires a strategic sourcing approach that balances cost with technical validation and legal compliance. Partnering with reputable, transparent suppliers who invest in R&D and IP integrity ensures long-term formulation success and supply security.

H2: Logistics & Compliance Guide for Acrylic Thickener

1. Product Overview

Acrylic Thickener is a water-based rheology modifier used in coatings, adhesives, inks, and architectural paints to control viscosity and improve application properties. It is typically supplied as a liquid emulsion and classified as non-hazardous under most regulatory frameworks, though specific formulations may vary.

2. Transportation & Logistics

2.1 Packaging & Storage

– Packaging: Typically supplied in HDPE drums (20–200 L), intermediate bulk containers (IBCs, 1000 L), or bulk tankers.

– Storage Conditions:

– Store in a cool, dry, well-ventilated area.

– Temperature range: 5°C to 35°C (41°F to 95°F). Avoid freezing and prolonged exposure to high heat.

– Keep containers tightly closed to prevent contamination and water evaporation.

– Shelf life: Typically 12 months from date of manufacture when stored properly.

2.2 Handling Precautions

– Use mechanical handling equipment (e.g., forklifts, pallet jacks) to move drums or IBCs.

– Avoid dropping or impact to prevent container damage.

– Use appropriate personal protective equipment (PPE) such as gloves and safety glasses during handling.

– Prevent contamination with foreign materials (e.g., dirt, solvents, metals) which may destabilize the emulsion.

2.3 Transportation Regulations

– Classification: Generally not regulated as a dangerous good under ADR/RID (road/rail, Europe), IMDG (sea), or IATA/ICAO (air) when shipped in standard packaging.

– UN Number: Not assigned (non-hazardous formulation).

– Proper Shipping Name: Not applicable for non-regulated shipments.

– Labeling: No hazard labels required; however, product identification and supplier information must be visible.

– Always confirm classification with the manufacturer’s current Safety Data Sheet (SDS).

3. Regulatory Compliance

3.1 Safety Data Sheet (SDS)

– Maintain the most recent SDS (in accordance with GHS and local regulations).

– SDS sections to review:

– Section 7 (Handling and Storage)

– Section 14 (Transport Information)

– Section 15 (Regulatory Information)

3.2 Global Regulatory Status

– REACH (EU): Registered under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). No SVHCs declared in standard formulations.

– TSCA (USA): Listed on the TSCA Inventory.

– K-REACH (South Korea): Compliant if importer fulfills registration requirements.

– China REACH (IECSC): Listed on the IECSC inventory.

– Australia (AICIS): Assessed and listed under AICIS.

3.3 Environmental & Disposal Considerations

– Spill Response: Contain spill with absorbent material (e.g., sand, clay). Do not flush into drains or waterways. Collect and dispose of according to local regulations.

– Waste Disposal: Dispose of waste material as non-hazardous industrial waste. Follow local, state, and federal regulations.

– Environmental Impact: Low toxicity to aquatic life; however, high concentrations may affect water quality. Biodegradability varies—check product-specific data.

4. Documentation & Labeling Requirements

- Labels: Each container must be labeled with:

- Product name

- Manufacturer/supplier name and contact information

- Batch number

- Net weight/volume

- Precautionary statements (if applicable)

- Transport Documents: Commercial invoice, packing list, and SDS must accompany shipments.

- Customs Declarations: Use correct HS Code (e.g., 3906.90 for acrylic polymers, varies by region). Verify with local customs authority.

5. Import/Export Considerations

- Confirm compliance with destination country regulations (e.g., REACH for EU, TSCA for USA).

- Some countries may require import permits or product notifications.

- Use experienced freight forwarders familiar with chemical logistics.

6. Emergency Procedures

- Inhalation: Not expected to be hazardous; move to fresh air if irritation occurs.

- Skin Contact: Wash with soap and water.

- Eye Contact: Flush with water for at least 15 minutes. Seek medical advice if irritation persists.

- Ingestion: Rinse mouth; do not induce vomiting. Seek medical attention if discomfort occurs.

7. Best Practices Summary

✅ Store between 5°C–35°C, away from direct sunlight

✅ Use dedicated, clean equipment for handling

✅ Maintain up-to-date SDS and compliance documentation

✅ Train personnel on safe handling and spill response

✅ Confirm regulatory status before international shipment

Note: Always consult the manufacturer’s SDS and technical data sheet (TDS) for product-specific information. Regulations may change; verify compliance with local authorities regularly.

Conclusion for Sourcing Acrylic Thickener:

After a comprehensive evaluation of potential suppliers, quality parameters, cost considerations, and technical requirements, sourcing acrylic thickener requires a strategic balance between performance, consistency, and cost-efficiency. Acrylic thickeners play a critical role in achieving desired rheological properties in coatings, adhesives, and construction materials, making the selection of a reliable supplier essential.

Key factors such as product quality (e.g., viscosity stability, pH tolerance, and compatibility with other formulations), regulatory compliance (including VOC content and environmental standards), and supply chain reliability must be prioritized. Supplier audits, sample testing, and long-term collaboration opportunities should guide the final decision.

In conclusion, the optimal sourcing strategy involves partnering with established suppliers who offer technical support, consistent batch-to-batch quality, and scalable supply capabilities. By selecting the right acrylic thickener and supplier, manufacturers can enhance product performance, reduce formulation variability, and maintain competitive advantage in the market. Continuous monitoring and performance reviews will ensure long-term success in the supply relationship.