The global acetaminophen (paracetamol) market continues to expand, driven by rising demand for over-the-counter analgesics and antipyretics, particularly in emerging economies. According to Grand View Research, the global paracetamol market size was valued at USD 1.27 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increased incidences of fever and pain-related conditions, expanded access to healthcare, and the widespread use of acetaminophen in pediatric and geriatric formulations. Mordor Intelligence further supports this trajectory, highlighting steady demand across both developed and developing regions due to the drug’s favorable safety profile when used as directed. With supply chain dynamics and API (active pharmaceutical ingredient) production heavily concentrated in Asia, a handful of manufacturers dominate global output. The following list identifies the top five acetaminophen manufacturers based on production capacity, global reach, regulatory compliance, and market influence.

Top 5 Acetaminofeno Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Contact Us & Customer Care

Domain Est. 1996

Website: tylenol.com

Key Highlights: Looking to contact TYLENOL®? Reach us via email or phone, or connect with us on social media. Also, check out some common FAQs….

#2 Panadol: Paracetamol

Domain Est. 1997

Website: panadol.com

Key Highlights: As one of the world’s leading paracetamol-based pain relievers, Panadol’s clinically-proven products can treat your pain and get you feeling yourself again….

#3 Pain Reliever & Fever Reducer for Adults & Kids

Domain Est. 1997

Website: motrin.com

Key Highlights: For relief from muscle aches, fevers, cramps, & more, MOTRIN® is pain relief you can count on. Learn how MOTRIN® can help relieve pain for you & your child….

#4 TYLENOL® Professional

Domain Est. 2007

Website: tylenolprofessional.com

Key Highlights: Access information and professional resources about TYLENOL® (acetaminophen) products including dosing information, samples, patient resources and more….

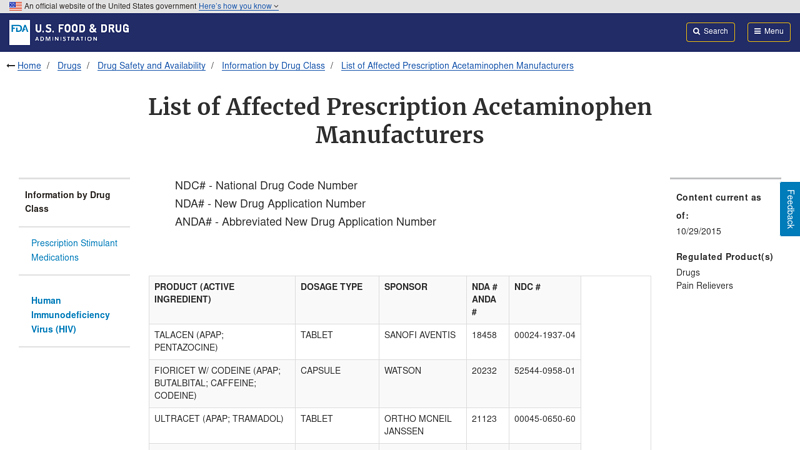

#5 List of Affected Prescription Acetaminophen Manufacturers

Domain Est. 2000

Website: fda.gov

Key Highlights: List of Affected Prescription Acetaminophen Manufacturers ; TABLET; ORAL, MIKART ; TABLET; ORAL, WATSON LABS ; ACETAMINOPHEN; BUTALBITAL; CAFFEINE; ……

Expert Sourcing Insights for Acetaminofeno

H2: Market Trends for Acetaminophen (Acetaminofeno) in 2026

As the global pharmaceutical and over-the-counter (OTC) healthcare market evolves, acetaminophen—known internationally as acetaminofeno in Spanish and Portuguese-speaking regions—is expected to maintain a strong market presence in 2026. Driven by widespread demand for pain relief and fever-reducing medications, the acetaminophen market is poised for steady growth, shaped by several key trends.

1. Rising Global Demand for OTC Pain Relief

The increasing prevalence of chronic pain conditions, migraines, and post-surgical discomfort continues to fuel demand for accessible analgesics. Acetaminophen remains a first-line treatment due to its efficacy, safety profile when used appropriately, and availability without a prescription. Emerging markets in Latin America, Southeast Asia, and Africa are witnessing expanded access to OTC medications, contributing significantly to volume growth.

2. Expansion in Emerging Economies

In countries such as Brazil, Mexico, India, and Indonesia, rising healthcare awareness, urbanization, and growing middle-class populations are enhancing consumer access to self-care medications. Local manufacturing of generic acetaminophen is increasing, reducing costs and improving supply chain resilience. This trend supports higher consumption rates and positions acetaminophen as a staple in household medicine cabinets.

3. Focus on Safety and Regulatory Oversight

Regulatory bodies such as the U.S. FDA, EMA, and ANVISA in Brazil continue to emphasize safe dosing and liver toxicity awareness. In 2026, manufacturers are expected to enhance labeling, adopt child-resistant packaging, and invest in public education campaigns. Digital health tools, including smartphone apps that track dosage and warn against interactions, are becoming more integrated into consumer use.

4. Growth in Combination Therapies

Acetaminophen remains a key ingredient in multi-symptom cold, flu, and sleep aid formulations. The trend toward combination products—such as those with caffeine, antihistamines, or opioids (under prescription)—is expected to sustain market value growth. However, regulatory scrutiny on opioid combinations may limit expansion in certain regions.

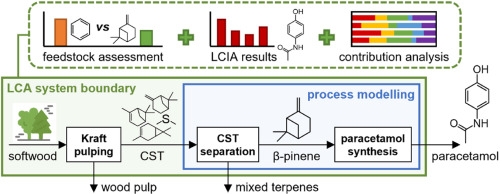

5. Sustainability and Green Manufacturing

Pharmaceutical manufacturers are increasingly adopting environmentally responsible production methods. By 2026, companies producing acetaminophen are likely to emphasize green chemistry practices, reduced waste, and sustainable sourcing of raw materials (e.g., parahydroxyacetanilide derivatives), responding to both regulatory incentives and consumer preferences.

6. E-Commerce and Digital Distribution

The shift toward online pharmacy platforms and telemedicine consultations has accelerated post-pandemic. In 2026, e-commerce is expected to account for a growing share of acetaminophen sales, particularly in urban areas. Digital platforms also enable personalized health recommendations and automated refills, improving patient adherence and brand loyalty.

7. Generic Dominance and Price Competition

With patent protections long expired, the acetaminophen market is highly genericized. Competition remains intense among generic drugmakers, keeping prices low. However, brand equity (e.g., Tylenol) continues to command a premium in markets with high consumer trust, particularly in North America and Western Europe.

Conclusion

By 2026, the global acetaminophen market will be characterized by stable demand, geographic expansion, digital integration, and heightened safety awareness. While innovation in formulation may be limited, strategic investments in distribution, consumer education, and sustainable practices will differentiate leading players. Acetaminofeno will remain a cornerstone of global pain management, reflecting both medical necessity and evolving healthcare consumerism.

Common Pitfalls in Sourcing Acetaminophen (Quality and Intellectual Property)

Sourcing acetaminophen (paracetamol) requires careful attention to both quality assurance and intellectual property (IP) compliance. Overlooking these critical areas can lead to regulatory, legal, and reputational risks. Below are the most common pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Supplier Qualification

Failing to conduct thorough due diligence on manufacturers can lead to sourcing from facilities with substandard quality systems. This includes skipping audits (on-site or virtual), not verifying certifications (e.g., ISO, GMP), and ignoring a supplier’s regulatory history (e.g., FDA 483 observations or import alerts).

2. Poor Raw Material Traceability

Acetaminophen quality heavily depends on the purity of starting materials (e.g., phenol, acetic anhydride). Suppliers may not provide transparent documentation on the origin and testing of raw materials, increasing the risk of contamination or impurities (e.g., p-aminophenol, heavy metals).

3. Inconsistent Batch Testing and Specifications

Accepting products without rigorous batch-specific Certificates of Analysis (CoA) or failing to verify conformance to pharmacopeial standards (e.g., USP, Ph. Eur.) can result in variability in potency, dissolution, or impurity profiles. Some suppliers may falsify CoAs or use outdated testing methods.

4. Substandard Packaging and Storage Conditions

Acetaminophen is sensitive to moisture and temperature. Poor packaging (e.g., non-laminate materials) or improper storage during transit (e.g., exposure to humidity) can degrade the active pharmaceutical ingredient (API), compromising stability and efficacy.

5. Lack of Regulatory Compliance Documentation

Sourcing from manufacturers without an active Drug Master File (DMF), CEP (Certificate of Suitability), or equivalent regulatory filing may result in delays or rejections during regulatory inspections or product registration.

Intellectual Property-Related Pitfalls

1. Infringement of Patented Manufacturing Processes

While acetaminophen itself is off-patent, specific synthesis methods, purification techniques, or crystalline forms may still be protected. Sourcing from manufacturers using patented processes without a license can expose the buyer to patent litigation, especially in jurisdictions with strong IP enforcement.

2. Use of Infringing Formulations or Delivery Systems

Even if the API is generic, finished dosage forms (e.g., extended-release tablets, liquid suspensions) may incorporate patented excipients or delivery technologies. Sourcing API intended for such formulations without freedom-to-operate (FTO) analysis can lead to downstream IP conflicts.

3. Insufficient IP Warranty and Indemnification in Contracts

Procurement agreements that lack clear IP warranties and indemnification clauses leave the buyer vulnerable. Suppliers should explicitly warrant they do not infringe third-party IP and agree to defend against any claims arising from their manufacturing processes.

4. Overlooking Regional IP Landscapes

Patent protections vary by country. A process may be free to use in India but still patented in the U.S. or EU. Sourcing decisions must consider the target market’s IP status to avoid customs seizures or market entry barriers.

5. Failure to Monitor Patent Expirations and Litigation

Relying on outdated information about patent status can lead to unintentional infringement. Continuous monitoring of patent databases and litigation involving key competitors is essential for safe sourcing.

Conclusion

To mitigate risks, buyers should implement a robust supplier qualification program, demand complete quality documentation, and conduct thorough IP due diligence—preferably with legal and technical experts. Proactive management of both quality and IP aspects ensures reliable supply and protects against costly disruptions.

Logistics & Compliance Guide for Acetaminophen

Acetaminophen (also known as paracetamol) is a widely used over-the-counter (OTC) and prescription pharmaceutical ingredient. Ensuring proper logistics and regulatory compliance is essential for its safe handling, storage, transportation, and distribution. This guide outlines key considerations for stakeholders involved in the pharmaceutical supply chain.

Regulatory Classification and Oversight

Acetaminophen is regulated as a pharmaceutical substance and is subject to strict quality, safety, and labeling requirements. Regulatory oversight varies by region:

- United States: Regulated by the U.S. Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act. It is listed as a monograph drug in the OTC Drug Review and also used in prescription combination products (e.g., with opioids).

- European Union: Regulated by the European Medicines Agency (EMA) and national competent authorities. Approval is typically granted via centralized, decentralized, or national procedures depending on the medicinal product.

- Other Regions: Countries such as Canada (Health Canada), Australia (TGA), and Japan (PMDA) enforce similar standards. Importers must comply with local Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP) requirements.

All parties in the supply chain must ensure that Acetaminophen is sourced from facilities registered and inspected by relevant authorities.

Manufacturing and Sourcing Compliance

- Only procure Acetaminophen from manufacturers certified under cGMP (current Good Manufacturing Practices).

- Suppliers must provide a Certificate of Analysis (CoA) and, if required, a Drug Master File (DMF) or Active Substance Master File (ASMF).

- Verify compliance with ICH guidelines (e.g., ICH Q7 for APIs) for active pharmaceutical ingredients.

- Confirm that the substance meets pharmacopeial standards (e.g., USP, Ph. Eur., JP).

Storage and Handling Requirements

Proper storage is critical to maintain product integrity:

- Temperature: Store in a cool, dry place at controlled room temperature (typically 15–25°C / 59–77°F). Avoid exposure to excessive heat or freezing.

- Humidity: Protect from moisture; relative humidity should generally be below 60%.

- Packaging: Keep in tightly closed, light-resistant containers to prevent degradation.

- Segregation: Store separately from incompatible substances (e.g., strong oxidizers) and non-pharmaceutical products to avoid cross-contamination.

- Shelf Life: Monitor expiration dates and adhere to First-Expired, First-Out (FEFO) inventory rotation.

Transportation and Distribution

Transportation must comply with GDP (Good Distribution Practice) standards:

- Use qualified and temperature-monitored vehicles if required.

- Ensure packaging provides adequate protection against physical damage, temperature excursions, and tampering.

- For international shipments, maintain the cold chain if specified (though Acetaminophen is generally stable at ambient temperatures).

- Utilize tamper-evident seals and track-and-trace systems to prevent diversion and counterfeiting.

- Maintain documentation including shipping records, temperature logs, and chain of custody.

Import/Export and Customs Documentation

International movement of Acetaminophen requires compliance with customs and health regulations:

- Obtain necessary import/export licenses or permits, especially when shipping to or from regulated markets.

- Provide accurate Harmonized System (HS) codes (e.g., 2924.29.30 for acetaminophen in many jurisdictions).

- Include a commercial invoice, packing list, CoA, and, where required, a Certificate of Pharmaceutical Product (CPP) or Statement of Registration.

- Be aware of restrictions or quotas in certain countries, particularly for bulk API shipments.

Labeling and Packaging Compliance

Final product labeling must meet regional regulatory requirements:

- Include the International Nonproprietary Name (INN) “acetaminophen” or “paracetamol.”

- Display strength, dosage form, expiration date, batch number, and storage conditions.

- Include necessary safety warnings (e.g., liver toxicity risk with alcohol or overdose).

- Comply with local language requirements (e.g., bilingual labeling in Canada).

Pharmacovigilance and Adverse Event Reporting

- Distributors and manufacturers must have a pharmacovigilance system in place to collect and report adverse drug reactions (ADRs).

- Report serious or unexpected adverse events to relevant regulatory agencies (e.g., FDA MedWatch, EudraVigilance) per local timelines.

Security and Anti-Counterfeiting Measures

- Implement security measures to prevent theft, diversion, and counterfeiting.

- Comply with track-and-trace regulations such as the U.S. Drug Supply Chain Security Act (DSCSA) or the EU Falsified Medicines Directive (FMD).

- Use serialization and aggregation where required.

Environmental and Safety Considerations

- Follow OSHA (U.S.) or equivalent workplace safety guidelines during handling.

- Dispose of waste Acetaminophen or contaminated materials in accordance with local environmental regulations.

- Provide Safety Data Sheets (SDS) to all handlers, as Acetaminophen may pose health risks if inhaled or ingested in large quantities.

By adhering to this logistics and compliance guide, stakeholders can ensure the safe, legal, and efficient handling of Acetaminophen throughout the global supply chain. Regular audits, staff training, and regulatory monitoring are recommended to maintain ongoing compliance.

Conclusion on Sourcing Acetaminophen

In conclusion, sourcing acetaminophen (also known as paracetamol) requires careful consideration of quality, regulatory compliance, supply chain reliability, and cost-effectiveness. Given its widespread use as an over-the-counter analgesic and antipyretic, ensuring the purity, safety, and consistency of the sourced product is paramount. Procurement should prioritize suppliers with good manufacturing practice (GMP) certification, regulatory approval from recognized authorities (such as the FDA, EMA, or equivalent), and transparent documentation.

Whether sourcing for pharmaceutical production, private labeling, or distribution, conducting due diligence on suppliers—including audits, quality testing, and verification of raw material origins—is essential to mitigate risks related to contamination, adulteration, or supply disruptions. Additionally, building long-term relationships with reliable manufacturers, particularly in major production regions such as China and India, can enhance supply stability.

Ultimately, a strategic and compliant approach to sourcing acetaminophen ensures patient safety, supports regulatory adherence, and strengthens market competitiveness in the pharmaceutical and healthcare sectors.