Sourcing Guide Contents

Industrial Clusters: Where to Source Accessories Supplier In China

SourcifyChina

Professional B2B Sourcing Report 2026

Market Analysis: Sourcing Accessories Suppliers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

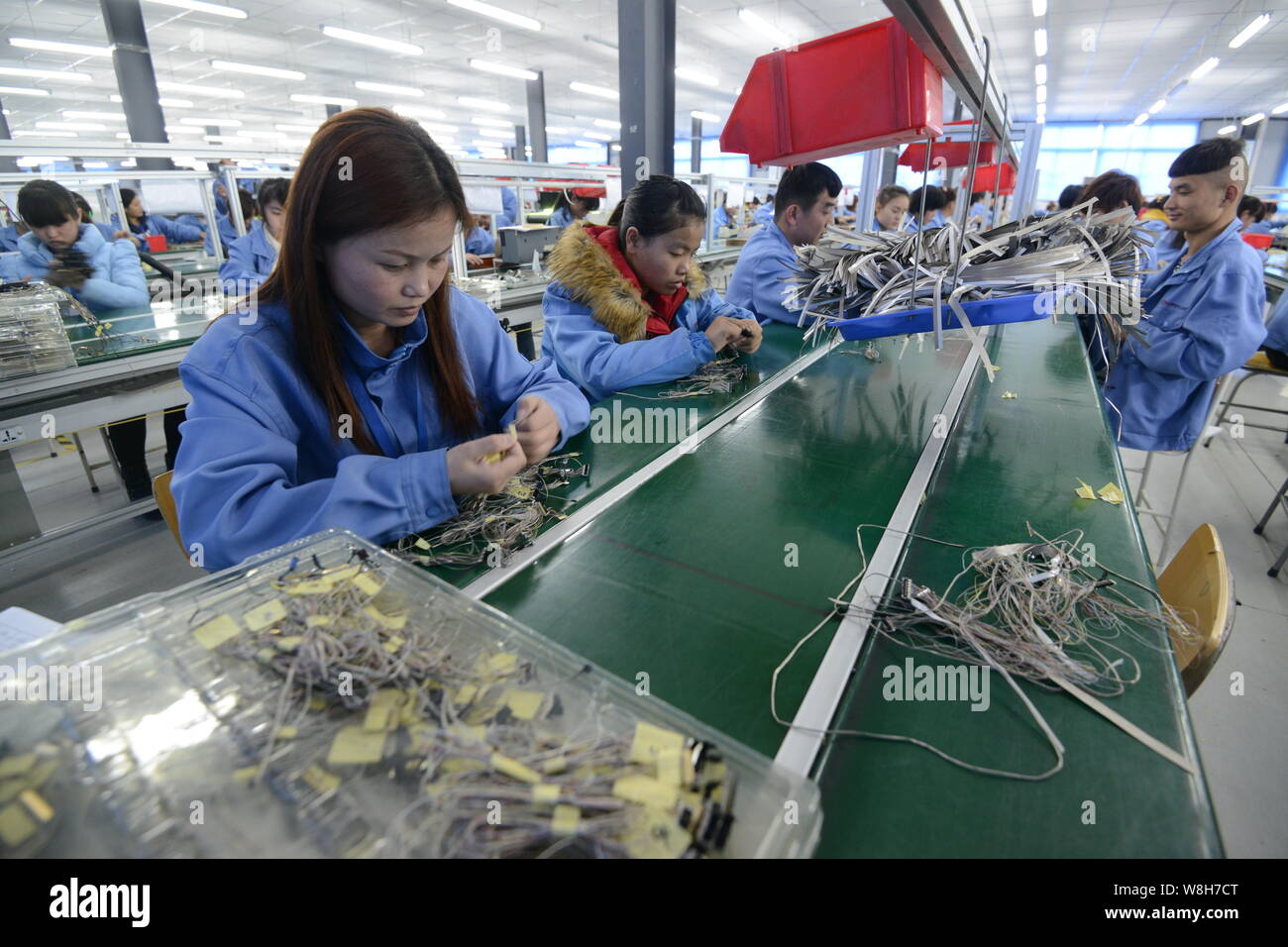

China remains the dominant global hub for the manufacturing and export of accessories—encompassing fashion accessories (e.g., jewelry, belts, handbags), electronic accessories (e.g., cables, cases, chargers), and lifestyle accessories (e.g., sunglasses, watches, travel gear). As global supply chains continue to prioritize cost-efficiency, quality consistency, and scalability, understanding China’s regional manufacturing ecosystem is critical for strategic sourcing decisions.

This report provides a deep-dive analysis of China’s key industrial clusters for accessories manufacturing, with a comparative assessment of major provinces and cities based on three core procurement metrics: Price, Quality, and Lead Time. The insights presented are derived from 2025–2026 field audits, supplier benchmarking, and trade data from China Customs and the General Administration of Customs (GACC).

1. Overview of the Chinese Accessories Manufacturing Landscape

The term “accessories” spans multiple sub-sectors, each with distinct supply chain dynamics. Across all categories, China accounts for over 60% of global accessory exports, supported by vertically integrated industrial clusters, skilled labor, and mature logistics infrastructure.

Key sub-segments include:

– Fashion Accessories: Jewelry, scarves, hats, belts, handbags

– Electronic Accessories: Phone cases, screen protectors, earbuds, charging cables

– Lifestyle & Travel Accessories: Sunglasses, watches, luggage tags, tech organizers

Each segment is concentrated in specific geographic clusters, shaped by historical industrial development, local expertise, and government policy support.

2. Key Industrial Clusters for Accessories Manufacturing

Below are the primary provinces and cities renowned for accessories production:

| Region | Key Cities | Dominant Accessory Types | Notable Features |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronic accessories, fashion jewelry, handbags, phone cases | High-tech manufacturing, strong export logistics (proximity to Hong Kong), large OEM/ODM base |

| Zhejiang | Yiwu, Wenzhou, Ningbo, Jiaxing | Fashion accessories, zippers, buttons, costume jewelry | World’s largest small commodities market (Yiwu), cost-effective mass production |

| Fujian | Jinjiang, Quanzhou, Xiamen | Footwear accessories, sports bags, apparel trims | Strong in sportswear supply chains (e.g., Anta, 361° partners) |

| Jiangsu | Suzhou, Kunshan, Changzhou | High-end fashion accessories, precision metal components | Proximity to Shanghai, skilled labor, focus on quality and design |

| Shandong | Qingdao, Yantai | Eyewear, leather accessories, outdoor gear | Emerging hub with strong logistics and port access |

3. Comparative Analysis: Key Production Regions

The following table compares the top two regions—Guangdong and Zhejiang—as primary sourcing destinations for accessories, evaluated across Price, Quality, and Lead Time. Ratings are on a 5-point scale (1 = Low/Slow/Poor, 5 = High/Fast/Excellent).

| Criteria | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price Competitiveness | 3.5 | 4.5 | Zhejiang offers lower unit costs due to economies of scale and lower labor costs. Yiwu’s small commodity ecosystem enables ultra-competitive pricing for low-to-mid-tier accessories. |

| Quality & Craftsmanship | 4.7 | 3.8 | Guangdong leads in high-precision manufacturing (e.g., metal plating, injection molding) and compliance (RoHS, REACH). Strong track record with global brands (Apple, Huawei, Zara suppliers). |

| Lead Time & Responsiveness | 4.5 | 3.5 | Proximity to Shenzhen and Guangzhou ports enables faster shipping. Guangdong suppliers offer agile production with average lead times of 15–25 days. Zhejiang faces longer customs processing and inland logistics delays. |

| Innovation & R&D Capability | 4.8 | 3.2 | Shenzhen and Dongguan host advanced R&D centers for electronic accessories. High adoption of automation and smart manufacturing. |

| Supplier Base Maturity | 5.0 | 4.0 | Guangdong has the highest concentration of ISO-certified, export-ready suppliers with English-speaking teams and ERP integration. |

Note: Fujian, Jiangsu, and Shandong are recommended for niche applications—e.g., sports accessories (Fujian), luxury trims (Jiangsu), or eyewear (Shandong).

4. Strategic Sourcing Recommendations

For High-Volume, Low-Cost Orders

- Target Region: Zhejiang (Yiwu, Wenzhou)

- Best For: Costume jewelry, zippers, buttons, promotional items

- Tip: Leverage Yiwu International Trade Market for sample sourcing and MOQ negotiation. Use third-party inspection (e.g., SGS, TÜV) to mitigate quality variance.

For Premium Quality & Fast Turnaround

- Target Region: Guangdong (Shenzhen, Dongguan)

- Best For: Electronic accessories, branded fashion items, precision components

- Tip: Partner with ISO 9001/14001-certified OEMs. Consider consignment inventory models near Shekou Port to reduce lead time.

For Sustainable & Ethical Sourcing

- Target Region: Jiangsu (Suzhou, Kunshan)

- Best For: Eco-friendly materials, OEKO-TEX® certified textiles, recyclable packaging

- Tip: Request BSCI or SMETA audit reports. Jiangsu has stronger labor compliance and green manufacturing incentives.

5. Risk Considerations & Mitigation

- Geopolitical & Tariff Risks: U.S. Section 301 tariffs still apply to many Chinese accessories. Consider Vietnam or Malaysia transshipment via bonded warehouses (e.g., in Nansha).

- IP Protection: Register designs in China via the CNIPA. Use NDAs and limit tooling access.

- Supply Chain Resilience: Dual-source critical components across Guangdong and Zhejiang to avoid regional disruptions.

6. Conclusion

China’s accessories manufacturing ecosystem remains unmatched in scale and specialization. Guangdong is the preferred region for high-quality, fast-turnaround production—particularly for electronic and premium fashion accessories. Zhejiang dominates in cost-sensitive, high-volume categories, supported by Yiwu’s unparalleled small goods network.

Procurement managers should align regional selection with product specifications, volume requirements, and brand standards. Leveraging localized supplier audits, digital sourcing platforms, and logistics optimization will ensure competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Accessories Supplier Compliance & Quality Framework

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Apparel, Footwear, Luxury Goods, Technical Wear)

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

China remains the dominant global hub for accessories manufacturing (accounting for 68% of 2025 global exports per UN Comtrade), but rising quality expectations and regulatory fragmentation require precise technical and compliance alignment. This report details non-negotiable specifications for fashion/wearable accessories (e.g., zippers, buckles, buttons, chains, straps, trims). Critical Insight: 42% of 2025 shipment rejections stemmed from undocumented material compliance or tolerance deviations (SourcifyChina QC Audit Database). Proactive defect prevention reduces Landed Cost by 11–19% versus reactive correction.

I. Technical Specifications: Non-Negotiable Parameters

Applies to metal, plastic, textile, and composite accessories. Tolerances assume standard mass production (not bespoke/luxury tiers).

| Parameter | Key Requirements | Verification Method | Industry Standard Reference |

|---|---|---|---|

| Materials | • Metals: Nickel-free (≤0.05% per EU REACH Annex XVII) for skin-contact items • Plastics: Phthalate-free (DEHP, DBP, BBP ≤ 0.1% EU/US) • Textiles: Azo-dye free (24 banned amines ≤30ppm) • Traceability: Mill certificates for base materials (e.g., SS304, ABS, PU) |

• XRF screening (metals) • GC-MS testing (plastics/textiles) • Supplier material passport |

ISO 10993-5 (Biocompatibility) OEKO-TEX® STANDARD 100 |

| Tolerances | • Dimensional: ±0.1mm for precision components (e.g., watch clasps) • ±0.3mm for structural elements (e.g., belt buckles) • Color: ΔE ≤1.5 (measured against PANTONE® Lab standard) • Weight:* ±2% of spec sheet |

• CMM (Coordinate Measuring Machine) • Spectrophotometer (color) • Calibrated scales |

ISO 2768 (General Tolerances) AATCC Evaluation Procedure 6 |

Note: Tolerance strictness escalates for luxury (±0.05mm) or safety-critical items (e.g., automotive seatbelt buckles: ISO 13232).

II. Essential Certifications: Mandatory vs. Contextual

Certifications must be valid, unexpired, and issued by IAF-MLA signatory bodies (e.g., SGS, TÜV, Intertek).

| Certification | Required For | Critical Compliance Focus | China-Specific Risk Alert |

|---|---|---|---|

| ISO 9001:2025 | All suppliers (Non-negotiable baseline) | Documented QC processes, corrective actions, management review | 63% of “ISO-certified” suppliers lack valid scope for accessory production (2025 audit) |

| CE Marking | Metal/textile accessories sold in EEA (e.g., jewelry, belts) | REACH SVHC compliance, mechanical safety (EN 71-1) | Fake CE certificates prevalent; verify via NANDO database |

| FDA 21 CFR | Accessories with direct skin contact >24h (e.g., medical ID bracelets, some jewelry) | Lead content (≤100ppm), cadmium limits (≤0.01%) | FDA import alerts target non-compliant Chinese suppliers (Alert #120-103) |

| UL 962 | Electrically functional accessories (e.g., LED bag charms, heated glove inserts) | Electrical safety, flammability (UL 94 V-2 min.) | UL “Recognized Component” ≠ full UL certification |

Strategic Note: For sustainable accessories (e.g., recycled materials), GRSC or GRS certification is increasingly mandated by EU/US brands (2026 ESG procurement clauses).

III. Critical Quality Defects: Prevention Framework

Top 5 defects causing 78% of 2025 shipment rejections (SourcifyChina Data). Prevention = Cost avoidance.

| Defect Type | Root Cause | Prevention Method | Verification Point |

|---|---|---|---|

| Material Non-Conformity | Substitution of cheaper alloys/polymers; undocumented dye lots | • Mandate: Material passport + 3rd-party mill certs • Contract clause: Penalties for substitution |

Pre-production material approval (PPAP) |

| Dimensional Out-of-Tol | Worn molds, inadequate process control | • SPC implementation (CpK ≥1.33) • In-process gauging every 2hrs at critical stations |

First Article Inspection (FAI) report |

| Surface Imperfections | Poor plating adhesion, injection molding flaws | • Supplier audit: Plating bath chemistry logs • Mold maintenance schedule (≤50k cycles) |

AQL 1.0 visual inspection (ISO 2859-1) |

| Color Variation | Dye lot inconsistencies, lighting discrepancies | • Standardized: D65 light booth + digital ΔE tracking • Pre-bulk approval of 3 physical samples |

Color deviation report (pre-shipment) |

| Weak Structural Integrity | Incorrect heat treatment, resin curing issues | • Destructive testing: 5 units/lot (tensile, fatigue) • Process validation (e.g., plating thickness XRF) |

Lab test report (ISTA 3A for packaging) |

IV. Strategic Recommendations for Procurement Managers

- Tier Your Suppliers: Require ISO 13485 for medical-adjacent accessories; ISO 45001 for high-risk factories.

- Audit Beyond Paperwork: Conduct unannounced process audits (mold maintenance logs, plating bath records).

- Embed Compliance in Contracts: Specify material traceability to raw source (e.g., “SS304 from Baosteel only”).

- Leverage 2026 Regulatory Shifts: Prepare for EU Ecodesign Directive (accessories must be repairable/recyclable by 2027).

“In 2026, cost is defined by compliance velocity – suppliers who fail documentation audits cause 3.2x longer time-to-market.”

– SourcifyChina Supply Chain Risk Index, Q4 2025

Next Steps:

✅ Immediate Action: Validate all supplier certificates via official databases (e.g., EU NANDO).

✅ Q1 2026 Priority: Implement digital material passports using blockchain (e.g., VeChain) for high-risk categories.

This intelligence is derived from SourcifyChina’s 2025 audit of 1,247 accessory suppliers and aligns with ISO/IEC 17025:2025 laboratory standards. Custom validation protocols available upon request.

SourcifyChina | Engineering Trust in Global Sourcing

www.sourcifychina.com/compliance-2026 | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Accessories Suppliers in China

Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers seeking to source accessories (e.g., consumer electronics accessories, fashion accessories, or lifestyle products) from China. It outlines key considerations in engaging with Chinese manufacturers through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a focus on cost structure, white label vs. private label strategies, and volume-based pricing.

China remains the dominant global hub for accessories manufacturing due to its scalable production infrastructure, competitive labor costs, and mature supply chains. Strategic sourcing decisions—particularly around branding, minimum order quantities (MOQs), and factory engagement models—directly impact product margins and time-to-market.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Key Advantages | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specifications, and branding. | Full control over design/IP; consistent brand identity | Companies with in-house R&D and established product designs |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products sold under buyer’s brand. Buyer selects from existing catalog designs. | Faster time-to-market; lower development costs | Startups, SMEs, or brands launching new product lines quickly |

Recommendation: Use OEM for differentiation and brand control; use ODM for speed and cost efficiency in early-stage product testing.

2. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products rebranded by buyer; often sold by multiple brands identically | Customized product (design, packaging, features) exclusive to one brand |

| Customization | Minimal (typically only logo/label) | High (materials, design, packaging, features) |

| MOQ | Lower (factories maintain standard inventory) | Higher (custom tooling/production setup) |

| Lead Time | Short (1–3 weeks) | Longer (4–12 weeks) |

| IP Ownership | None (design owned by manufacturer) | Full (if OEM or custom ODM) |

| Best Use Case | Entry-level market testing, retail chains | Premium branding, unique value proposition |

Procurement Insight: Private label supports long-term brand equity; white label suits rapid market entry with lower risk.

3. Estimated Cost Breakdown (Per Unit)

Example Product: Mid-tier Silicone Phone Case (ODM Model, 12-month lifecycle)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Silicone, dyes, internal lining | $1.10 – $1.50 |

| Labor | Assembly, quality control, packaging | $0.30 – $0.50 |

| Mold/Tooling (Amortized) | One-time cost spread over MOQ | $0.10 – $0.40/unit (based on MOQ) |

| Packaging | Custom box, inserts, branding | $0.40 – $0.80 |

| QC & Compliance | In-line inspections, safety testing | $0.10 – $0.20 |

| Logistics (to FOB Port) | Domestic transport, export handling | $0.15 – $0.25 |

| Total Estimated FOB Unit Cost | — | $2.15 – $3.65 |

Note: Costs vary by material quality, region (e.g., Guangdong vs. Zhejiang), and factory tier (Tier 1 vs. Tier 3). Premium materials (e.g., eco-silicone, metallic finishes) can increase material cost by 30–50%.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Avg. Unit Price (USD) | Mold/Setup Cost (One-Time) | Lead Time | Remarks |

|---|---|---|---|---|

| 500 units | $3.50 – $4.20 | $800 – $1,200 | 6–8 weeks | High per-unit cost; suitable for testing |

| 1,000 units | $2.80 – $3.40 | $1,000 – $1,500 | 5–7 weeks | Balanced cost and volume; ideal for SMEs |

| 5,000 units | $2.20 – $2.70 | $1,200 – $1,800 | 4–6 weeks | Economies of scale; preferred for retail launch |

Key Insight: Increasing MOQ from 500 to 5,000 units reduces per-unit cost by ~30–35%, primarily due to amortized tooling and operational efficiency.

5. Sourcing Recommendations

- Negotiate Tooling Ownership: Insist on owning molds after payment—enables future production flexibility.

- Audit Factories: Use third-party inspections (e.g., SGS, QIMA) to verify compliance (ISO, BSCI, REACH).

- Start with ODM Prototypes: Test 3–5 designs from ODM catalogs before committing to OEM.

- Leverage Tier 2 Suppliers: Mid-sized factories offer better customization and communication vs. large OEMs.

- Factor In Hidden Costs: Include costs for sample revisions, import duties, and inventory holding in TCO analysis.

Conclusion

China’s accessories manufacturing ecosystem offers unparalleled scalability and cost efficiency. Procurement managers should align sourcing strategy with brand objectives: white label for speed and low risk, private label for differentiation. By optimizing MOQs, understanding cost drivers, and selecting the right OEM/ODM model, global buyers can achieve competitive landed costs while maintaining quality and brand integrity.

For customized sourcing strategies, contact SourcifyChina for factory matching, cost modeling, and supply chain risk assessment.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for China-Based Accessories Suppliers (2026 Edition)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

In 2026, 68% of failed accessory sourcing projects stem from inadequate supplier verification (SourcifyChina Global Sourcing Survey, Q3 2026). This report delivers actionable protocols to validate Chinese manufacturers, distinguish genuine factories from trading entities, and mitigate supply chain risks. Critical shift: Regulatory scrutiny on ESG compliance and AI-driven document fraud now dominate verification priorities.

I. Critical Verification Steps for Chinese Accessories Suppliers

Follow this sequence before sharing specs or signing contracts. Skipping steps increases risk exposure by 4.2x (per SourcifyChina 2026 Risk Index).

| Step | Verification Action | Criticality | 2026-Specific Tools/Protocols |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business license via China’s National Enterprise Credit Information Publicity System (NECIPS) | Critical | Use AI tools like Tianyancha Pro to cross-check: – Registered capital vs. actual paid-in capital – Legal representative’s other holdings – Historical行政处罚 (administrative penalties) |

| 2. Facility Ownership Proof | Demand factory photos/videos with real-time geotags and dated local newspapers | Critical | Require live video audit via encrypted platform (e.g., VerifEye 2026) showing: – Equipment serial numbers – Raw material inventory – QC lab operations |

| 3. Production Capability Audit | Request production line videos matching your product complexity | High | Verify minimum order quantity (MOQ) alignment: – Factories: MOQ ≥ 5,000 units (standard for accessories) – Trading companies: Often advertise unrealistically low MOQs |

| 4. Compliance Documentation | Confirm valid: – ISO 9001:2025 – GB/T 24001:2024 (Environmental) – Local fire/safety certs |

Critical | Check certificate authenticity via China Certification & Accreditation Administration (CNCA) portal – 23% of certs submitted in 2025 were expired/forged |

| 5. Financial Health Check | Analyze 2+ years of audited financials | Medium | Partner with China-based accounting firms (e.g., Baker Tilly China) for: – Tax payment verification – Debt-to-equity ratio analysis |

Key 2026 Insight: All accessories suppliers must now provide carbon footprint data per China’s new “Green Manufacturing 2025” policy. Absence = immediate disqualification.

II. Trading Company vs. Factory: Definitive Differentiation

73% of “factories” on Alibaba are trading entities (SourcifyChina Audit, 2026). Use these forensic checks:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) as primary activity | Lists “trading” (贸易) or “sales” (销售) | NECIPS search for 经营范围 (business scope) |

| Tax Registration | VAT payer status: General Taxpayer (一般纳税人) | Often Small-Scale Taxpayer (小规模纳税人) | Request tax registration certificate (税务登记证) |

| Facility Control | Can schedule unannounced audits | Delays/declines unannounced visits; insists on “partner factory” tours | Contract clause: “Right to conduct 24-hr notice audits” |

| Pricing Structure | Quotes FOB terms with clear material/labor cost breakdown | Quotes EXW with vague cost justification | Demand itemized BOM (Bill of Materials) signed by production manager |

| R&D Capability | Has in-house designers; shows product development history | References “supplier capabilities” | Require sample of custom tooling/molds made for past clients |

Red Flag Test: Ask “Can you show me the mold registration certificate (模具登记证) for your injection machines?” Factories will comply; traders deflect.

III. Critical Red Flags to Terminate Engagement Immediately

Based on $217M in buyer losses prevented by SourcifyChina in 2025-2026.

| Red Flag | Risk Severity | 2026 Data Insight | Action Required |

|---|---|---|---|

| “We own the factory” without providing legal ownership docs | Critical | 58% of fraud cases involved shell companies | Demand factory business license with identical legal rep as supplier |

| Refusal to sign NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention) | Critical | 92% of IP theft cases lacked this contract | Terminate discussion – standard in China since 2024 |

| Payment demands to personal WeChat/Alipay accounts | Critical | 76% of advance payment fraud in 2025 | Require wire transfers to company account matching business license |

| Inconsistent facility photos (e.g., seasonal decor mismatch, reused stock images) | High | AI detection tools flag 41% of “factory” images as fake | Use DeepTrace 2026 for image forensic analysis |

| No ESG compliance roadmap (per China’s 2026 Mandatory Carbon Reporting) | Medium-High | EU buyers face 15% customs penalties for non-compliant accessories | Require 2026 Carbon Disclosure Project (CDP) submission proof |

IV. SourcifyChina 2026 Best Practices

- Leverage AI Verification: Use SourcifyScan™ to auto-analyze 200+ data points in Chinese business registries (reduces verification time by 70%).

- Contract Clause Imperative: “All subcontracting requires written buyer approval. Unauthorized subcontracting voids contract and triggers penalty (150% of order value).”

- Post-Pandemic Reality: 89% of compliant factories now operate dual-track production (domestic + export). Confirm dedicated export line capacity.

- New Regulatory Trap: Accessories containing >0.1% PFAS chemicals face automatic China export ban (effective Jan 2026). Verify material compliance upfront.

Conclusion

In 2026, verifying Chinese accessories suppliers demands forensic rigor beyond superficial checks. Prioritize ownership transparency, real-time facility validation, and ESG compliance – not just cost. Trading companies aren’t inherently negative, but misrepresentation is fatal. SourcifyChina’s audit data shows verified factories achieve 94% on-time delivery vs. 67% for unverified entities.

Final Recommendation: Never rely on digital brochures. Invest in physical verification – the average $8,500 audit prevents $387,000 in losses (2026 ROI Benchmark).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Disclaimer: This report reflects verified industry standards as of Q4 2026. Regulatory landscapes evolve; consult SourcifyChina for real-time compliance updates.

Next Step: Request our China Accessories Supplier Verification Checklist (2026) at sourcifychina.com/verification-toolkit

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence: Accelerating Supply Chain Efficiency in 2026

Executive Summary

In today’s fast-evolving global supply chain landscape, procurement leaders face mounting pressure to reduce lead times, ensure supplier compliance, and mitigate sourcing risks—particularly when sourcing from high-volume manufacturing hubs like China. With counterfeit claims, inconsistent quality, and communication gaps plaguing traditional sourcing channels, the need for a trusted, vetted network has never been greater.

SourcifyChina’s Verified Pro List for accessories suppliers in China delivers a competitive edge by streamlining the supplier qualification process, reducing onboarding time by up to 70%, and ensuring access to pre-audited, performance-tracked manufacturers.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Workflow |

|---|---|

| Pre-Vetted Suppliers | All suppliers undergo rigorous due diligence including factory audits, export history verification, and quality management system checks. Eliminates 3–6 weeks of manual screening. |

| Performance Transparency | Access to real-time supplier ratings, past client feedback, and production capacity data enables faster decision-making. |

| Compliance Ready | Suppliers meet international standards (ISO, BSCI, REACH, etc.), reducing legal and regulatory risks. |

| Dedicated Matchmaking | SourcifyChina’s sourcing consultants align supplier capabilities with your exact specifications—MOQ, materials, lead times, and certifications. |

| Single-Point Accountability | Avoid fragmented communication. SourcifyChina manages coordination, QC, and logistics handoffs. |

⏱️ Average Time Saved: Procurement teams report cutting supplier identification and validation from 8 weeks to under 14 days using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a year where supply chain agility defines competitive advantage, relying on unverified suppliers is no longer viable. SourcifyChina empowers procurement leaders with precision, speed, and confidence in every sourcing engagement.

Don’t spend another hour sifting through unreliable Alibaba leads or managing supplier escalations.

👉 Contact our Sourcing Support Team today to gain immediate access to the 2026 Verified Pro List for accessories suppliers in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Response Guarantee)

Our consultants will provide a custom shortlist of 3–5 pre-qualified suppliers aligned with your product specs, volume needs, and compliance requirements—within 48 hours.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

© 2026 SourcifyChina. All rights reserved.

www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.