The global rotary encoder market is experiencing steady expansion, driven by rising automation across industrial manufacturing, robotics, and precision motion control systems. According to a 2023 report by Mordor Intelligence, the global rotary encoders market was valued at approximately USD 1.85 billion and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. This growth is fueled by increasing demand for high-accuracy position feedback in applications ranging from CNC machinery to electric vehicles. Within this expanding landscape, the distinction between absolute and incremental rotary encoders plays a critical role in system performance and reliability. As industries prioritize real-time data integrity and fail-safe operation, the demand for advanced absolute encoders has surged, while cost-effective incremental solutions continue to hold strong relevance in high-speed motion control. The competitive market is led by manufacturers who combine innovation, precision engineering, and scalability. Based on market presence, technological capability, and application reach, the following seven companies stand out as the top manufacturers of both absolute and incremental rotary encoders.

Top 7 Absolute Vs Incremental Rotary Encoders Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

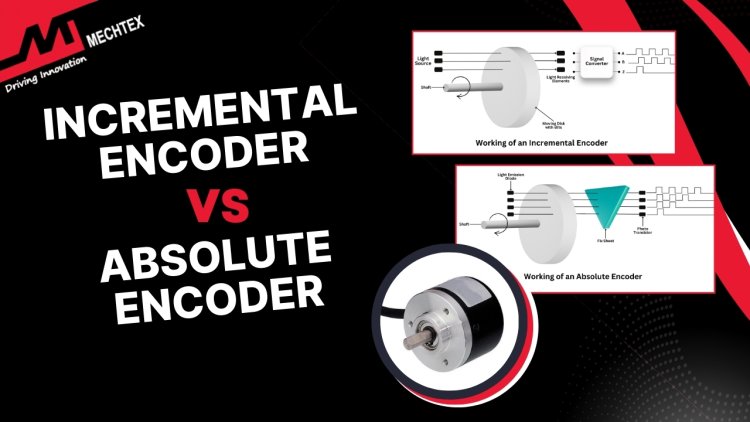

#1 Rotary Encoder Options: Absolute or Incremental?

Domain Est. 1995

Website: digikey.com

Key Highlights: Absolute encoders are more complex than incremental types, and hence, typically, more expensive. Although the price difference is narrowing, an ……

#2 Incremental or Absolute Encoder? Find Out Fast

Domain Est. 1995

Website: usdigital.com

Key Highlights: An incremental encoder can only report a change in position. It may not sound like a big difference, but it’s night and day if the system has a loss of power….

#3 Encoder Products Company

Domain Est. 1996

Website: encoder.com

Key Highlights: At Encoder Products Company (EPC), we take pride in designing, manufacturing, and assembling high-quality rotary encoders right here in Sagle, Idaho, USA….

#4 Dynapar Encoders

Domain Est. 2001

Website: dynapar.com

Key Highlights: Incremental Encoders. Dynapar offers a wide variety of rotary incremental encoders with optical or magnetic sensing for a variety of mounting configurations….

#5 The Differences: Absolute and Incremental Encoders

Domain Est. 2021

Website: novantaims.com

Key Highlights: Absolute rotary encoders provide unique position information the moment they are switched on. This is done by scanning the position of a coded element where all ……

#6 Absolute vs. Incremental Encoder

Website: eltra-encoder.eu

Key Highlights: Incremental and absolute encoders measure an angle of rotation of their shaft or linear displacement using incremental and absolute position coding….

#7 Absolute Encoders vs Incremental Encoders: A Guide

Domain Est. 2015

Website: celeramotion.com

Key Highlights: This paper discusses the key differences between Absolute Encoders vs Incremental Encoders and concludes with a summary of available devices….

Expert Sourcing Insights for Absolute Vs Incremental Rotary Encoders

H2: Market Trends for Absolute vs Incremental Rotary Encoders (2026 Forecast)

As industrial automation, robotics, and precision motion control systems evolve, the demand for rotary encoders—specifically absolute and incremental types—continues to grow. By 2026, several key market trends are shaping the competitive landscape between absolute and incremental rotary encoders, driven by technological advancements, industry adoption patterns, and shifting application requirements.

1. Rising Preference for Absolute Encoders in High-Reliability Applications

The global market is witnessing a steady shift toward absolute rotary encoders, particularly in sectors where position integrity and system uptime are critical, such as aerospace, medical devices, semiconductor manufacturing, and renewable energy. Absolute encoders provide a unique position value upon power-up without requiring a homing sequence, making them ideal for safety-critical and complex automation environments. By 2026, advancements in compact multi-turn absolute encoders with integrated communication protocols (e.g., BiSS, SSI, EtherCAT) are expected to accelerate adoption, especially in smart factories and Industry 4.0 ecosystems.

2. Cost and Simplicity Keep Incremental Encoders Relevant

Despite the growing dominance of absolute encoders, incremental encoders remain prevalent in cost-sensitive and high-speed applications such as conveyor systems, packaging machinery, and basic motor feedback loops. Their simplicity, lower cost, and high resolution capabilities make them a preferred choice where continuous position tracking is sufficient and power cycling is not frequent. In emerging markets, where budget constraints are significant, incremental encoders are expected to maintain a strong foothold through 2026.

3. Convergence of Technologies and Hybrid Solutions

A notable trend by 2026 is the emergence of hybrid or programmable encoders that can operate in both absolute and incremental modes. These flexible devices allow OEMs to standardize designs across multiple applications, reducing inventory complexity and accelerating time-to-market. This convergence is blurring the traditional divide between the two technologies and encouraging broader integration in modular automation platforms.

4. Impact of Digitalization and IIoT Integration

The proliferation of Industrial Internet of Things (IIoT) and predictive maintenance systems is influencing encoder selection. Absolute encoders, with their native digital output and compatibility with real-time data networks, are better aligned with digital twin and condition monitoring applications. By 2026, encoders with embedded diagnostics, wireless connectivity, and edge-processing capabilities—predominantly absolute types—are expected to gain traction in smart manufacturing environments.

5. Regional Dynamics and Industry-Specific Growth

In North America and Europe, stringent safety regulations and the push for automation in advanced manufacturing are boosting absolute encoder demand. In contrast, regions like Asia-Pacific (especially China and India) show balanced growth for both types, driven by expanding automotive, electronics, and infrastructure sectors. The renewable energy sector, particularly wind turbines, is driving demand for rugged, high-performance absolute encoders, while textile and printing industries continue to rely on incremental models.

6. Technological Innovations Reducing Traditional Trade-offs

Ongoing improvements in magnetic and optical sensing technologies are narrowing performance gaps. Magnetic absolute encoders now offer higher resolution and immunity to environmental contaminants, challenging the dominance of optical incremental types in harsh environments. Similarly, digital interpolation techniques are enhancing the resolution of incremental encoders, making them competitive in mid-tier precision applications.

Conclusion

By 2026, the market for rotary encoders will reflect a dual-track evolution: absolute encoders gaining market share in high-value, intelligent systems due to their reliability and digital integration capabilities, while incremental encoders retain relevance in cost-driven and high-speed applications. The trend is not necessarily a replacement but a strategic alignment—where application requirements, total cost of ownership, and system intelligence determine the optimal choice. Manufacturers investing in scalable, interoperable encoder solutions will be best positioned to capitalize on both segments in the evolving automation landscape.

Common Pitfalls When Sourcing Absolute vs Incremental Rotary Encoders (Quality & IP Considerations)

Choosing between absolute and incremental rotary encoders is critical for motion control system performance, but sourcing decisions often overlook key quality and IP-related pitfalls. Being aware of these can prevent costly errors in integration, maintenance, and system reliability.

Confusing Electrical Output with Positioning Capability

A common misconception is equating the encoder’s output signal (e.g., SSI, BiSS, analog) with its functional type. Users may assume that a high-resolution digital output indicates an absolute encoder, but incremental encoders can also provide digital signals (e.g., A/B/Z quadrature with index pulse). Misidentifying the encoder type based on output alone can lead to unexpected system behavior—especially during power loss—where incremental encoders lose position data unless paired with a backup system.

Overlooking IP Rating in Harsh Environments

Both absolute and incremental encoders are available with various IP (Ingress Protection) ratings, but sourcing decisions often prioritize cost or availability over environmental resilience. Using an IP64-rated encoder in a washdown environment (requiring IP67/IP69K) can result in premature failure due to moisture or particulate ingress. Always validate the IP rating against the actual operating conditions, including exposure to coolant, dust, high-pressure cleaning, or outdoor elements.

Assuming Absolute Encoders Are Inherently More Reliable

While absolute encoders provide position data at power-up, they often contain more complex internal electronics (e.g., multiturn gears, battery-backed memory, or ASICs). This complexity can introduce more failure points compared to simpler incremental encoders. Sourcing low-quality absolute encoders from vendors with poor manufacturing standards may lead to higher long-term failure rates, especially in high-vibration or thermally variable environments.

Neglecting Mechanical Compatibility and Mounting Tolerances

Both encoder types must align precisely with the shaft and housing, but sourcing based solely on electrical specs without verifying mechanical fit is a frequent error. Issues like misalignment, shaft runout, or improper coupling can cause bearing wear, signal dropout, or complete encoder failure. Incremental encoders may mask such issues temporarily through index pulse referencing, while absolute encoders may report incorrect positions due to mechanical stress on internal sensors.

Underestimating Electromagnetic Interference (EMI) Susceptibility

Incremental encoders, with their high-frequency square-wave signals, are more prone to EMI in electrically noisy environments (e.g., near VFDs or high-current lines). Sourcing encoders without adequate shielding or differential signaling (e.g., RS422) can result in signal jitter or false counts. Absolute encoders transmitting serial data are also vulnerable, but errors may be caught via checksums—making protocol choice (e.g., BiSS vs. SSI) an important quality differentiator.

Ignoring Vendor IP and Long-Term Support

Sourcing encoders from vendors with unclear intellectual property (IP) ownership or limited documentation can create long-term risks. Proprietary communication protocols or undocumented pinouts may lock users into a single supplier, complicating maintenance and upgrades. Additionally, counterfeit or reverse-engineered encoders—common in low-cost markets—may lack proper IP protection and fail to meet safety or performance claims, undermining system integrity.

Failing to Validate Calibration and Long-Term Drift

High-quality absolute encoders undergo precise factory calibration, but cheaper variants may exhibit significant position drift over time or temperature cycles. Incremental encoders depend on consistent pulse spacing, which low-quality optical or magnetic sensors may not maintain. Sourcing without reviewing calibration certificates, temperature stability specs, or lifecycle testing data can result in degraded accuracy and increased downtime.

By addressing these pitfalls early in the sourcing process—focusing on verified IP ratings, mechanical and environmental compatibility, and vendor transparency—engineers can ensure reliable, long-term performance regardless of encoder type.

Logistics & Compliance Guide: Absolute vs Incremental Rotary Encoders

When selecting rotary encoders for industrial, automation, or motion control applications, understanding the logistical and compliance implications of Absolute and Incremental encoders is critical. This guide outlines key considerations to ensure seamless integration, regulatory adherence, and operational reliability.

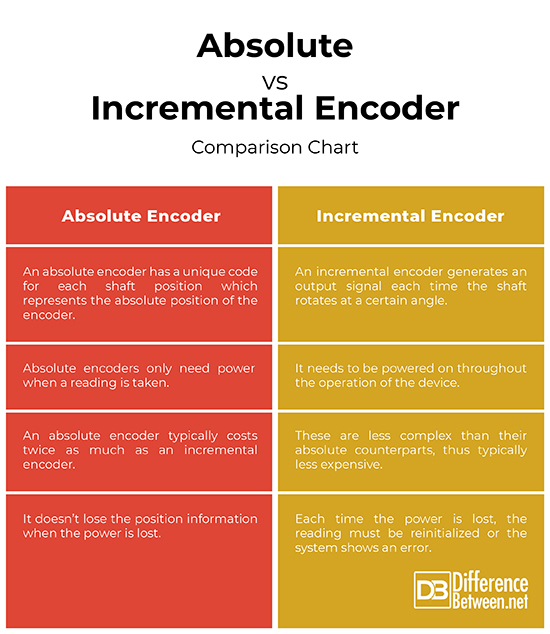

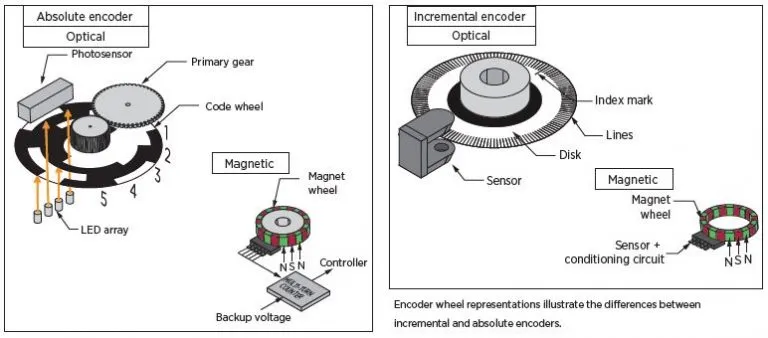

Definition and Functional Differences

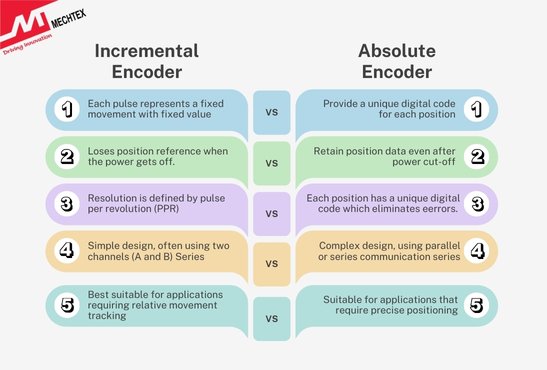

Absolute Encoders provide a unique digital position value for each shaft angle, retaining position data even after power loss. This makes them ideal for applications requiring precise positioning upon startup.

Incremental Encoders generate pulses relative to movement, indicating speed and direction but not absolute position. They require a homing routine on power-up to establish a reference point.

Understanding these functional differences is essential for logistics planning, as it impacts system design, calibration procedures, and spare part requirements.

Environmental and Installation Logistics

Absolute Encoders:

– Often used in harsh environments where power interruptions are common (e.g., manufacturing plants, outdoor machinery).

– Higher resilience to power cycling reduces the need for recalibration, lowering maintenance logistics.

– May require more complex wiring (e.g., multi-wire interfaces like SSI, BiSS, or CANopen), affecting cable management and installation time.

Incremental Encoders:

– Simpler wiring (typically A, B, and Index signals) facilitates faster installation and lower cabling costs.

– More sensitive to power interruptions; systems must include homing routines, increasing setup and commissioning time.

– Better suited for continuous-operation environments where homing is feasible.

Logistically, incremental encoders may reduce initial installation complexity, while absolute encoders reduce long-term operational downtime.

Supply Chain and Inventory Management

- Absolute Encoders often have longer lead times due to higher complexity and custom communication protocols. Stocking spares may be necessary to avoid production delays.

- Incremental Encoders are more standardized and widely available, simplifying procurement and reducing inventory burden.

- Consider vendor support and global availability—some absolute encoder protocols may be proprietary, limiting supplier options.

Ensure alignment with procurement policies and evaluate multi-sourcing options to mitigate supply chain risks.

Regulatory and Industry Compliance

Both encoder types must comply with relevant international standards:

- EMC Compliance: EN 61000-6-2 (industrial immunity) and EN 61000-6-4 (emission) apply to both types. Absolute encoders with digital interfaces may require additional shielding.

- Safety Standards: In safety-critical applications (e.g., robotics, medical devices), encoders may need certification to IEC 61508 (functional safety) or ISO 13849. Absolute encoders are often preferred due to their inherent position retention.

- Hazardous Locations: For use in explosive atmospheres, encoders must meet ATEX (EU) or IECEx standards. Certification depends on construction, not encoder type, but intrinsic safety design may favor one over the other.

Verify compliance documentation (e.g., Declarations of Conformity, CE/UKCA marks) during procurement.

Data Integrity and Traceability Requirements

- Absolute Encoders support traceability by providing position data without external reference, beneficial in regulated industries (e.g., pharmaceuticals, aerospace).

- Incremental Encoders depend on system-level logic to track position, increasing risk of data loss during power failure unless paired with battery-backed counters or external memory.

For audit and compliance purposes, absolute encoders offer superior data integrity, reducing validation effort in GxP or ISO 9001 environments.

End-of-Life and RoHS Compliance

- Both encoder types must comply with RoHS (Restriction of Hazardous Substances) and REACH regulations in the EU and similar directives globally.

- Ensure suppliers provide material declarations and conflict minerals reporting where applicable.

- Plan for obsolescence: Absolute encoders with proprietary interfaces may face earlier end-of-life risks. Monitor manufacturer lifecycle notifications.

Conclusion and Recommendations

Choose Absolute Encoders when:

– Position retention after power loss is critical.

– Regulatory or compliance frameworks demand high data integrity.

– Downtime for homing routines is unacceptable.

Choose Incremental Encoders when:

– Cost and installation simplicity are priorities.

– Continuous operation allows for reliable homing.

– Standardization and supply chain flexibility are essential.

Evaluate both technical and logistical factors in the context of your compliance obligations, supply chain resilience, and operational environment to make an informed decision.

Conclusion: Sourcing Absolute vs. Incremental Rotary Encoders

When sourcing rotary encoders for motion control applications, the choice between absolute and incremental types depends on the specific requirements of the system in terms of position tracking, power management, cost, and complexity.

Absolute encoders are ideal for applications where knowing the exact position immediately upon power-up is critical—such as in robotics, CNC machines, and automation systems. They provide a unique digital output for each shaft position, eliminating the need for homing routines and ensuring position data is retained even during power loss. While typically more expensive and complex than incremental encoders, their advantages in precision, reliability, and system efficiency often justify the cost in safety- or accuracy-critical environments.

Incremental encoders, on the other hand, are well-suited for cost-sensitive or speed-focused applications where relative motion tracking is sufficient—such as in conveyor systems, tachometers, or basic motor control. They generate pulses to indicate movement and direction but require a reference point (homing) to establish position after power cycles. They are simpler, more robust, and generally less expensive, making them a practical choice for many industrial applications.

In summary, if your application demands immediate position awareness, resilience to power interruptions, and high precision, source absolute encoders. For applications where cost, simplicity, and speed monitoring are primary concerns, and homing is acceptable, incremental encoders are the preferable choice. Careful evaluation of operational needs, system architecture, and lifecycle costs will ensure optimal performance and value in encoder selection.