The global abrasives market is undergoing significant expansion, driven by rising demand across industries such as automotive, metalworking, aerospace, and construction. According to a report by Grand View Research, the global abrasives market was valued at USD 38.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 5.2% during the forecast period of 2023–2028, fueled by increasing industrialization in emerging economies and the growing need for high-precision surface finishing. With silicon carbide, aluminum oxide, and diamond-based abrasives leading material innovations, leading manufacturers are investing in R&D to enhance performance and sustainability. As competition intensifies and application-specific demands evolve, the industry landscape is shaped by a select group of global players driving technological advancement and market consolidation. This list highlights the top 10 abrasives manufacturers at the forefront of this growth trajectory.

Top 10 Abrasives Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Grade Abrasives

Domain Est. 1998

Website: unitedabrasives.com

Key Highlights: United Abrasives is an American manufacturer of industrial grade abrasives and accessories. By adhering to the highest standards of service and production….

#2 Abrasive Technology

Domain Est. 1996

Website: abrasive-tech.com

Key Highlights: Abrasive Technology offers custom, high-quality superabrasive grinding products for industries including aerospace, defense, medical, and dental….

#3 Virginia Abrasives

Domain Est. 2000

Website: virginiaabrasives.com

Key Highlights: Virginia Abrasives Corporation manufactures and distributes construction abrasives products to the equipment rental, professional flooring and industrial ……

#4 Benchmark Abrasives

Domain Est. 2009

Website: benchmarkabrasives.com

Key Highlights: Free delivery over $50 · 30-day returnsBenchmark Abrasives carries a complete line of zirconia flap discs, as well as top-quality general-duty diamond blades and excellent surface…

#5 Empire Abrasives

Domain Est. 2014

Website: empireabrasives.com

Key Highlights: Headquartered in Long Island, New York, Empire Abrasives is an industry leading distributor of premium industrial abrasives from around the world….

#6 CGW ABRASIVES

Domain Est. 2015

Website: cgwabrasives.com

Key Highlights: CGW Abrasives_ Established U.S. Operations in 1990. We are a leading manufacturer of Premium Grinding Wheels, Cutting Wheels, Flap Discs, Coated Abrasives, and ……

#7

Domain Est. 1998

Website: nortonabrasives.com

Key Highlights: As a brand of Saint-Gobain, a world leader in sustainable habitat, Norton offers the widest portfolio of grinding, cutting, blending, finishing, ……

#8 Weiler Abrasives

Domain Est. 1999

Website: weilerabrasives.com

Key Highlights: Weiler Abrasives is the industry leader in manufacturing abrasive products and brushes for every application. View our product selection today!!…

#9

Domain Est. 1999

Website: pearlabrasive.com

Key Highlights: Abrasives. Diamond Tools. Equipment & Accessories. Accessories and Supplies · Cutting · Grinding · Sanding & Surface Prep · Core Bits · Crack-Chaser Blades…

#10 Superior Abrasives – World

Domain Est. 1999

Website: superiorabrasives.com

Key Highlights: World-Class Quality. Coated and nonwoven abrasives. Our product offering tackles the day to day ……

Expert Sourcing Insights for Abrasives

H2 2026 Market Trends for Abrasives

As the global manufacturing and industrial sectors continue to evolve through 2026, the abrasives market is poised for significant transformation, driven by technological advancements, shifting industrial demands, and sustainability imperatives. Below are the key trends expected to shape the abrasives industry in the second half of 2026:

1. Surge in Demand from Automotive and Aerospace Sectors

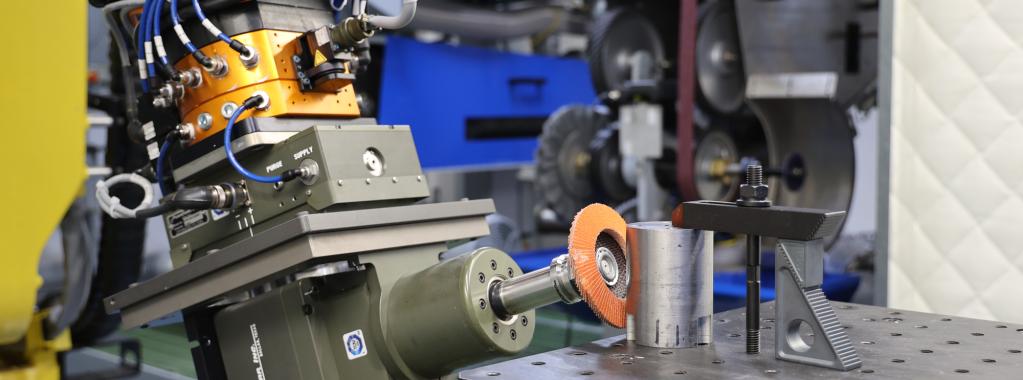

The recovery and expansion of the automotive industry—particularly in electric vehicle (EV) manufacturing—and increased aerospace production are driving demand for high-precision abrasives. Lightweight materials such as aluminum alloys, composites, and advanced steels require specialized abrasive solutions for grinding, polishing, and surface finishing. H2 2026 will see OEMs and Tier-1 suppliers increasingly relying on superabrasives (diamond and cubic boron nitride) for efficiency and precision.

2. Adoption of Smart and Digital Abrasives Technologies

Integration of Industry 4.0 principles is leading to the development of “smart abrasives” embedded with sensors or paired with data analytics platforms. These systems monitor wear rates, temperature, and performance in real time, enabling predictive maintenance and optimized tool life. By H2 2026, major industrial players are expected to invest in digital twin applications and IoT-enabled abrasive tools to enhance productivity and reduce downtime.

3. Shift Toward Sustainable and Eco-Friendly Abrasives

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt greener abrasives. This includes water-based or biodegradable bonding agents, reduced-volatile organic compound (VOC) coatings, and recyclable abrasive products. Additionally, closed-loop recycling systems for used abrasive grains are gaining traction, particularly in Europe and North America, where regulatory pressure is strongest.

4. Growth in Superabrasives Market

Superabrasives (diamond and CBN) are witnessing accelerated adoption due to their superior performance in machining hard materials like ceramics, carbides, and hardened steels. The electronics and semiconductor industries—especially in Asia-Pacific—are significant growth drivers. By H2 2026, technological improvements in synthetic diamond production are expected to lower costs and expand accessibility, further fueling market penetration.

5. Regional Shifts and Supply Chain Resilience

Geopolitical dynamics and supply chain disruptions have prompted a reevaluation of sourcing strategies. In H2 2026, companies are increasingly localizing abrasive production or diversifying suppliers to mitigate risks. North America and Europe are investing in domestic manufacturing capabilities, while Southeast Asia emerges as a regional hub for abrasive distribution and light manufacturing.

6. Rising Demand in Emerging Markets

Industrialization in India, Southeast Asia, and parts of Africa is creating new demand for conventional and semi-precision abrasives. Infrastructure development, construction, and metal fabrication sectors in these regions are key growth engines. Localized production and cost-competitive product offerings will be critical for market players aiming to capture this expanding customer base.

7. Consolidation and Strategic Partnerships

The competitive landscape is seeing increased M&A activity and joint ventures as companies seek to expand product portfolios, enhance R&D capabilities, and enter new markets. By H2 2026, strategic alliances between abrasive manufacturers and equipment OEMs are expected to grow, offering integrated finishing solutions that improve customer value.

Conclusion:

By the second half of 2026, the abrasives market will be characterized by innovation, sustainability, and digital integration. Companies that invest in advanced materials, embrace digitalization, and align with global ESG standards will be best positioned to lead in an increasingly competitive and dynamic industrial environment.

Common Pitfalls Sourcing Abrasives: Quality and Intellectual Property (IP) Concerns

When sourcing abrasives—whether for industrial manufacturing, metalworking, or precision finishing—organizations often encounter challenges that can compromise performance, safety, and legal compliance. Two of the most critical areas of risk are quality inconsistencies and intellectual property (IP) infringement. Understanding these pitfalls is essential for making informed procurement decisions.

Quality Variability and Inconsistencies

One of the most prevalent issues in abrasive sourcing is inconsistent product quality, especially when procuring from low-cost or unfamiliar suppliers. Poor-quality abrasives can lead to:

- Reduced performance and efficiency: Substandard materials may wear out quickly, generate excessive heat, or fail to deliver the desired surface finish.

- Increased downtime and costs: Frequent changeouts and tool failures disrupt production and inflate operational expenses.

- Safety hazards: Low-quality abrasives may be prone to disintegration during use, posing risks of injury or equipment damage.

- Lack of traceability and certifications: Many suppliers, particularly in unregulated markets, fail to provide verifiable test reports, material certifications (e.g., ISO, ANSI), or batch traceability.

To mitigate these risks, it’s crucial to:

– Conduct rigorous supplier audits and request third-party quality certifications.

– Perform sample testing under real-world conditions before scaling procurement.

– Establish clear quality specifications in contracts and procurement agreements.

Intellectual Property (IP) and Counterfeit Products

Another significant pitfall is the unintentional procurement of counterfeit or IP-infringing abrasive products. Many reputable abrasive manufacturers invest heavily in proprietary bonding technologies, grain formulations, and performance enhancements protected by patents and trademarks. However, some suppliers mimic these products without authorization, leading to:

- Infringement liability: Purchasing counterfeit goods—even unknowingly—can expose buyers to legal risks, especially in regions with strict IP enforcement (e.g., the U.S. or EU).

- Performance mismatch: Imitation products often fail to match the performance of genuine branded abrasives, leading to inconsistent results.

- Damage to brand reputation: In industries where quality assurance is paramount (e.g., aerospace, automotive), using non-compliant or counterfeit abrasives can undermine customer trust.

To protect against IP-related risks:

– Source only from authorized distributors or directly from OEMs.

– Verify product authenticity through batch numbers, packaging, and digital traceability tools.

– Include IP indemnification clauses in supplier contracts.

Conclusion

Sourcing abrasives involves more than just comparing prices. Quality inconsistencies and IP violations can result in operational inefficiencies, safety risks, and legal complications. A proactive approach—emphasizing due diligence, supplier verification, and contractual safeguards—can help organizations avoid these common pitfalls and ensure reliable, compliant abrasive supply chains.

Logistics & Compliance Guide for Abrasives

Regulatory Classification and Hazard Communication

Abrasives, while often perceived as inert materials, can pose physical, health, and environmental hazards depending on their composition, form (e.g., powder, grit, wheels, belts), and manufacturing process. Proper classification under global regulations such as the Globally Harmonized System (GHS) is essential. Many abrasive products may be classified as:

– Harmful if inhaled (due to respirable crystalline silica in certain minerals like quartz or alumina)

– Causes skin or eye irritation

– May cause respiratory irritation

– Danger of serious eye damage (especially loose granular or powdered abrasives)

Manufacturers and suppliers must provide Safety Data Sheets (SDS) in compliance with local regulations (e.g., OSHA HazCom 2012 in the U.S., CLP Regulation in the EU). Labels must include GHS pictograms, signal words, hazard statements, and precautionary statements.

Transportation and Shipping Requirements

Abrasives are generally non-hazardous for transport when in solid, non-dusty form (e.g., grinding wheels, sanding belts). However, powdered or granular abrasives may be subject to regulations if they contain hazardous components:

– IMDG Code (Maritime): Evaluate for hazardous properties; most industrial abrasives ship as non-regulated if below thresholds for hazardous constituents.

– IATA DGR (Air): Granular or powdered abrasives may require testing for hazardous dust generation; if respirable crystalline silica exceeds 1%, classification under Class 9 (Miscellaneous Dangerous Goods) may apply.

– 49 CFR (U.S. Ground): Non-hazardous unless containing regulated substances above threshold limits.

Ensure proper packaging to prevent dust release and physical damage during transit. Use sealed, moisture-resistant containers for powders and rigid packaging for fragile abrasive tools.

Storage and Handling Best Practices

- Dry, ventilated storage: Prevent moisture absorption, especially for coated abrasives, which can degrade.

- Segregation: Store away from flammable materials and reactive chemicals.

- Dust control: Use local exhaust ventilation when handling loose abrasives; provide appropriate PPE (respirators, gloves, eye protection).

- Stacking: Avoid over-stacking; use pallets and secure loads to prevent collapse.

Environmental, Health, and Safety (EHS) Compliance

- Occupational Exposure Limits (OELs): Monitor air for respirable crystalline silica (e.g., quartz), especially during sandblasting or grinding. Adhere to limits set by OSHA PELs, ACGIH TLVs, or EU Indicative Occupational Exposure Limit Values (IOELVs).

- Waste Disposal: Spent abrasives may be classified as hazardous waste if contaminated with oils, metals, or regulated substances. Follow RCRA (U.S.) or Waste Framework Directive (EU) guidelines.

- Dust Management: Implement engineering controls (e.g., dust collectors) and safe work practices to minimize airborne particulates.

International Trade and Customs Compliance

- HS Codes: Common classifications include:

- 6804: Grinding or polishing stones.

- 6805: Articles of stone or other mineral substances used for sharpening or polishing.

- 3206: Artificial corundum, silicon carbide, or other abrasives, in powder or granular form.

- Import/Export Controls: Verify no restrictions apply; some countries regulate abrasives containing silica above certain concentrations.

- Documentation: Include accurate product descriptions, SDS, and commercial invoices reflecting chemical composition.

Quality and Industry Standards

Ensure compliance with relevant standards such as:

– ANSI B7.1: Safety requirements for the use, care, and protection of abrasive wheels (North America).

– EN 12413: Specifications for bonded abrasive products (EU).

– ISO 525: Classification and conformity assessment for coated abrasives.

Adherence to these standards supports both safety and market access.

Recordkeeping and Audits

Maintain up-to-date SDS, shipping documentation, training records (e.g., GHS, handling procedures), and compliance certifications. Conduct regular internal audits to ensure alignment with evolving regulations in target markets.

In conclusion, sourcing abrasives suppliers requires a strategic approach that balances quality, cost, reliability, and service. Through thorough market research, evaluation of supplier credentials, and analysis of certifications and production standards, businesses can identify partners that align with their operational needs and quality expectations. Key factors such as consistent product performance, timely delivery, technical support, and scalability should be prioritized to ensure long-term supply chain efficiency. Additionally, fostering strong supplier relationships and maintaining a diverse supplier base can mitigate risks related to disruptions and market volatility. Ultimately, a well-executed sourcing strategy not only enhances product quality and process efficiency but also contributes to cost savings and competitive advantage in the marketplace.