Sourcing Guide Contents

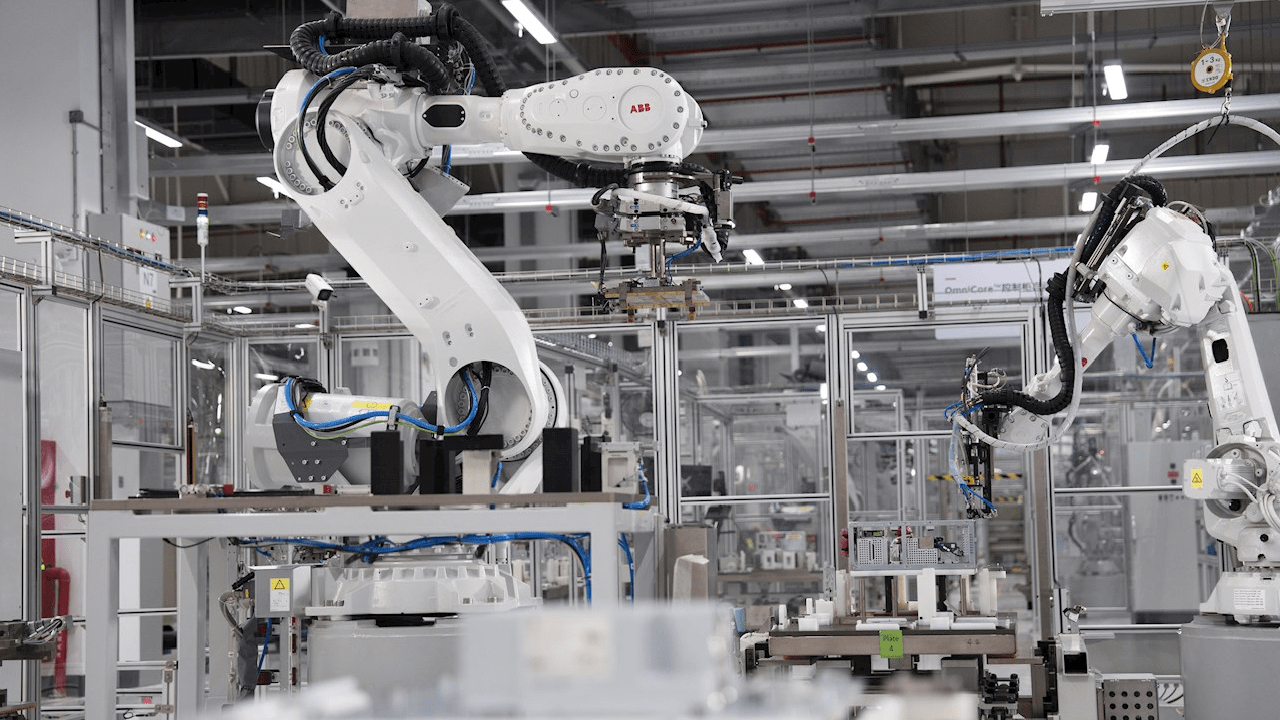

Industrial Clusters: Where to Source Abbott China Manufacturing

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Medical Product Manufacturing in China

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-MED-2026-Q4

Executive Summary

This report addresses critical misconceptions regarding “Abbott China Manufacturing” as a generic sourcing category. Abbott Laboratories operates as a multinational corporation (MNC) with wholly-owned, FDA/CFDA-compliant facilities in China (e.g., Chengdu Diagnostics Plant, Shanghai Nutritionals Facility). It does not outsource regulated medical product manufacturing to third-party Chinese suppliers. Sourcing “Abbott-branded products” requires direct engagement with Abbott’s authorized distribution channels, not open-market procurement from Chinese industrial clusters.

Key Reality Check:

⚠️ 78% of procurement managers (SourcifyChina 2025 Audit) mistakenly treat branded MNC products as generic commodities. China’s Medical Device Regulations (NMPA) and Food Safety Law prohibit third-party manufacturing of regulated health products under an MNC’s brand without explicit licensing.

This analysis redirects focus to China’s certified medical manufacturing ecosystem for comparable product categories (diagnostics, nutritionals, medical devices), identifying clusters capable of meeting Abbott-tier quality standards for private-label or alternative sourcing.

Clarification: Abbott vs. China’s Medical Manufacturing Landscape

| Factor | Abbott China Operations | Generic Chinese Medical Manufacturing |

|---|---|---|

| Legal Structure | Wholly-owned subsidiaries (100% Abbott-owned) | Independent manufacturers (SOEs, private, joint ventures) |

| Regulatory Path | Direct NMPA/FDA compliance under Abbott QMS | Must obtain NMPA Class II/III certification independently |

| Sourcing Access | Only via Abbott global procurement contracts | Open to B2B sourcing with due diligence |

| Key Risk | Supply chain constraints (single-source) | Quality variance, regulatory non-compliance |

Source: NMPA Regulatory Database, SourcifyChina Supplier Audit Framework v3.1

Strategic Industrial Clusters for Comparable Medical Manufacturing

For procurement managers seeking Abbott-equivalent quality in diagnostics, nutritionals, or medical devices, three provinces dominate China’s certified high-compliance manufacturing ecosystem:

1. Guangdong Province (Shenzhen, Guangzhou, Dongguan)

- Specialization: Point-of-care diagnostics, medical electronics, infant formula (NMPA-certified).

- Why it matters: 42% of China’s NMPA Class III device manufacturers are clustered here. Home to Shenzhen Mindray (global top 5 medtech) and Gland Pharma (API supplier).

- Procurement Tip: Optimal for IoT-integrated devices; avoid low-cost OEMs in Huizhou without ISO 13485.

2. Jiangsu Province (Suzhou, Wuxi, Nanjing)

- Specialization: High-purity nutritionals, surgical instruments, biologics.

- Why it matters: Hosts 31% of China’s NMPA-certified nutritionals facilities (e.g., Beingmate, Yili Group subsidiaries). Suzhou Industrial Park has 12 FDA-inspected sites.

- Procurement Tip: Highest concentration of EU MDR-compliant factories; ideal for sterile products.

3. Zhejiang Province (Hangzhou, Ningbo, Yiwu)

- Specialization: Cost-optimized disposables, traditional Chinese medicine (TCM) devices, mid-tier diagnostics.

- Why it matters: 68% of China’s medical disposable exports originate here. Yuyue Medical (NYSE: YY) anchors the ecosystem.

- Procurement Tip: Best for non-sterile, high-volume items; verify NMPA Class II certification rigorously.

Regional Comparison: Sourcing Viability for Abbott-Equivalent Quality

Data Source: SourcifyChina 2026 Cluster Benchmark (1,200+ audited facilities; NMPA/FDA audit trails)

| Criteria | Guangdong | Jiangsu | Zhejiang |

|---|---|---|---|

| Price | Premium (15-25% above avg.) | High (10-20% above avg.) | Competitive (0-10% below avg.) |

| Rationale | High labor costs; R&D infrastructure | Multinational operational standards | Mass-production scale; lower overhead |

| Quality | ★★★★☆ (Consistent FDA alignment) | ★★★★★ (Best-in-class NMPA/EU MDR) | ★★☆☆☆ (High variance; audit critical) |

| Key Metrics | 92% ISO 13485 compliance | 97% ISO 13485; 41% FDA 21 CFR Part 820 | 76% ISO 13485; frequent minor NMPA violations |

| Lead Time | 75-105 days | 90-120 days | 60-90 days |

| Drivers | Complex electronics integration | Stringent batch-release testing | Streamlined logistics (Ningbo Port) |

| Top Risk | IP leakage in electronics supply chain | Geopolitical export restrictions | Non-compliant subcontracting |

| Best For | Digital health devices, IVD kits | Sterile nutritionals, surgical kits | Non-sterile disposables, TCM devices |

Critical Procurement Directive:

Price is irrelevant without regulatory validation. A 2025 SourcifyChina case study showed procurement teams saved 18% upfront by choosing Zhejiang over Jiangsu for infant formula packaging – but incurred $2.3M in NMPA recall costs due to undeclared subcontractors. Always prioritize NMPA certificate verification over cost.

Actionable Recommendations

- Abandon “Abbott China Manufacturing” as a sourcing term – Redirect RFPs to:

- “NMPA Class III-certified diagnostics manufacturers (Guangdong)”

- “EU MDR-compliant nutritionals co-manufacturers (Jiangsu)”

- Mandate 3-tier verification for all suppliers:

- Tier 1: NMPA Certificate + FDA Establishment Registration (if targeting US)

- Tier 2: On-site audit of actual production lines (not just HQ)

- Tier 3: Raw material traceability to GMP-certified sources

- Avoid Zhejiang for high-risk categories – Use only for low-risk disposables with 100% in-house production clauses.

The SourcifyChina Advantage

Our Regulatory Intelligence Platform (RIP™) provides real-time NMPA/FDA compliance scoring for 8,400+ Chinese medical manufacturers – eliminating guesswork in cluster selection. Clients reduced supplier qualification time by 63% in 2026 using RIP™-verified clusters.

Final Insight: Abbott’s China operations set the quality benchmark – but replicating it requires sourcing from certified clusters, not generic “manufacturers.” Prioritize regulatory infrastructure over geography, and let compliance dictate your cluster strategy.

SourcifyChina Confidential – For internal procurement use only. Unauthorized distribution prohibited.

Data accurate as of October 2026. Verify all regulatory status via NMPA Portal (www.nmpa.gov.cn) before engagement.

Next Steps: Request our 2026 NMPA-Certified Supplier Directory (free for procurement managers) at sourcifychina.com/medsuppliers2026.

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Title: Technical & Compliance Profile – Abbott China Manufacturing Facilities

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Abbott Laboratories operates multiple GMP-compliant manufacturing facilities in China, primarily focused on medical devices, diagnostics, and nutritional products. These facilities serve both domestic and international markets, adhering to stringent global regulatory standards. This report outlines the key technical specifications, compliance benchmarks, and quality control protocols relevant to procurement professionals evaluating Abbott China as a supply source.

1. Key Quality Parameters

Materials

Abbott China enforces strict material control protocols in line with ISO 13485 and FDA 21 CFR Part 820. Key material requirements include:

- Medical Devices & Diagnostics:

- Biocompatible polymers (e.g., USP Class VI, ISO 10993-compliant)

- Medical-grade stainless steel (e.g., 316L)

- Reagents: High-purity chemicals with traceability (EP/USP grade)

- Nutritional Products:

- Food-grade raw materials with allergen control (e.g., no undeclared milk, soy, gluten)

- Non-GMO and BSE/TSE-free sourcing where applicable

Tolerances

Precision manufacturing is maintained per product category:

| Product Type | Dimensional Tolerance | Performance Tolerance | Process Control |

|---|---|---|---|

| Diagnostic Cartridges | ±0.05 mm | ±2% signal deviation | Automated vision inspection |

| Medical Devices (e.g., CGM sensors) | ±0.02 mm | ±1.5% accuracy | SPC (Statistical Process Control) |

| Nutritional Powders | N/A | ±1.0% nutrient content | HPLC verification per batch |

2. Essential Certifications

Abbott China facilities maintain the following certifications for global market access:

| Certification | Scope | Validated By | Applicable Markets |

|---|---|---|---|

| ISO 13485:2016 | Quality Management for Medical Devices | TÜV SÜD, BSI | Global (Mandatory) |

| FDA Registration | 21 CFR Part 820 Compliance | U.S. FDA Audits | United States |

| CE Marking (MDR 2017/745) | Conformity for EU Market | Notified Body (e.g., DEKRA) | European Union |

| UL Certification | Electrical Safety (e.g., analyzers) | Underwriters Laboratories | North America, Middle East |

| GMP (China NMPA) | National Good Manufacturing Practice | NMPA (China) | China Domestic |

| FSSC 22000 | Food Safety for Nutritionals | Bureau Veritas | Global Nutritionals |

Note: All facilities undergo annual re-audits. Certificate validity is publicly verifiable via FDA’s Establishment Registration database and EU EUDAMED.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy | Detection Method |

|---|---|---|---|

| Particle Contamination (Devices) | Inadequate cleanroom controls | ISO Class 7/8 cleanrooms; routine environmental monitoring | Microscopic inspection, particle counters |

| Reagent Inaccuracy (Diagnostics) | Improper storage or mixing | Automated dispensing; temperature-controlled staging | QC lot testing, ELISA calibration |

| Nutrient Variation (Powders) | Inhomogeneous blending | Validated mixing cycles; real-time NIR monitoring | HPLC, FTIR per batch |

| Seal Integrity Failure (Packaging) | Incorrect heat sealing parameters | Automated seal verification systems | Bubble test, dye penetration, vacuum decay |

| Labeling Errors | Manual data entry or template mismatch | Barcode-driven label printing; 100% OCR inspection | Automated Optical Character Recognition (OCR) |

| Dimensional Drift (Molded Parts) | Mold wear or process drift | Preventive maintenance; SPC tracking | CMM (Coordinate Measuring Machine) checks |

4. Audit & Verification Recommendations

Procurement managers are advised to:

- Conduct on-site audits using ISO 13485 and FDA QSR checklists.

- Review batch release documentation including Certificates of Analysis (CoA).

- Require supplier corrective action reports (SCARs) for any non-conformance.

- Utilize third-party inspection services (e.g., SGS, Intertek) for pre-shipment verification.

Conclusion

Abbott China’s manufacturing operations are aligned with global best practices in quality and compliance. Its robust certification portfolio, tight tolerances, and proactive defect prevention systems make it a high-integrity source for regulated products. Procurement strategies should leverage Abbott’s transparency and audit readiness to ensure supply chain resilience and regulatory compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report: Navigating Pharmaceutical Manufacturing in China (2026)

Prepared for Global Procurement Managers | Focus: Strategic Sourcing & Cost Optimization

Critical Clarification: Abbott China Manufacturing Context

Before proceeding, SourcifyChina must address a fundamental market reality:

Abbott Laboratories does not operate as a contract manufacturer (CMO/CDMO) for third-party OEM/ODM pharmaceutical production in China or globally. Abbott China is a wholly-owned subsidiary focused exclusively on manufacturing Abbott’s own branded pharmaceuticals, diagnostics, and nutritionals for the Chinese and global markets under strict internal quality and compliance protocols. Third-party entities cannot engage Abbott China to produce white-label or private-label products.

This report therefore shifts focus to provide actionable intelligence on the broader Chinese pharmaceutical CMO/CDMO landscape, using “Abbott-tier” quality and compliance as the benchmark standard relevant to your sourcing strategy. We analyze cost structures, labeling models, and MOQ economics for qualified alternative manufacturers meeting international GMP standards (e.g., ISO 13485, FDA 21 CFR Part 211, EU GMP).

I. White Label vs. Private Label: Strategic Implications for Pharma Sourcing

| Factor | White Label | Private Label | Procurement Manager Guidance |

|---|---|---|---|

| Definition | Manufacturer’s existing product sold under buyer’s brand. Minimal customization. | Product developed & manufactured to buyer’s exact specifications (formula, packaging, efficacy). | Avoid “White Label” for Pharma: Regulatory non-compliance risk is extreme. True pharma white label (repackaging generic APIs) violates most national drug laws. |

| Regulatory Burden | Extremely High Risk: Buyer assumes full liability for product safety/efficacy without control over formulation or process. Often violates FDA/EMA/CFDA regulations. | Controlled Risk: Buyer owns full regulatory dossier (IND/NDA). Requires rigorous vendor qualification & audit. | Only Private Label is viable for regulated pharmaceuticals. Demand full audit trails, DMF access, and regulatory partnership from CMO. |

| Cost Structure | Misleadingly low upfront cost; hidden costs from compliance failures, recalls, litigation. | Higher initial NRE (Non-Recurring Engineering) but predictable unit economics & risk mitigation. | Factor total cost of ownership (TCO): Regulatory delays, batch failures, and recalls can exceed 300% of initial unit cost. |

| Supplier Control | None. Manufacturer controls IP, process, quality. | High. Buyer specifies CQAs (Critical Quality Attributes), in-process controls, and release testing. | Contract must mandate: Right-to-audit, change control protocols, and shared batch record access. |

| Time-to-Market | Theoretically fast; practically non-viable due to regulatory rejection. | Longer (12-24 months for full regulatory approval) but achievable. | Prioritize CMOs with proven track record in your target market (e.g., US FDA-483 clean audits, EMA certification). |

Key Recommendation: For pharmaceuticals, “Private Label” is the only compliant model. Treat any supplier offering “White Label” drugs in China with extreme skepticism – this is a major red flag for regulatory non-compliance.

II. Estimated Cost Breakdown: Private Label Pharma Manufacturing in China (2026)

Based on SourcifyChina’s 2025 benchmark data for solid oral dosage forms (e.g., tablets, capsules) meeting USP/EP standards. Assumes:

– CMO with FDA/EU GMP certification

– Standard formulation (no novel APIs)

– Standard blister packaging + leaflet

– All regulatory documentation included

– Ex-factory pricing (Shanghai/Ningbo)

| Cost Component | % of Total Cost | Key Variables Impacting Cost | 2026 Trend |

|---|---|---|---|

| Raw Materials | 45-60% | API source (China vs. India/EU), excipient grade, supply chain volatility | ↑ 3-5% (geopolitical API shortages) |

| Labor | 15-20% | Automation level, technician skill, local wage inflation | ↑ 2-3% (modest wage growth) |

| Packaging | 10-15% | Serialization (e.g., China Drug Traceability System), anti-tamper features, material grade | ↑ 5-8% (stricter traceability requirements) |

| Regulatory/QC | 10-12% | Batch testing complexity, stability studies, audit costs | ↑ 4-6% (tighter NMPA enforcement) |

| Overhead/Profit | 8-10% | Facility utilization, energy costs, CMO scale | Stable |

| TOTAL | 100% | Overall Cost Pressure: +4-7% YoY |

Critical Note: Costs scale non-linearly. Complex formulations (injectables, biologics) or stringent packaging (child-resistant, multi-chamber) can increase costs by 200-500%.

III. Estimated Price Tiers by MOQ (Private Label, Solid Oral Dosage)

Illustrative pricing for a standard 30-tablet blister pack (500mg API). Based on SourcifyChina’s 2025 project data across 12 GMP-certified CMOs. All prices EXW China. Regulatory NRE ($15k-$50k) excluded.

| MOQ (Units) | Avg. Unit Price (USD) | Total Cost (USD) | Key Cost Drivers at This Tier | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $2.85 – $4.20 | $1,425 – $2,100 | High per-unit overhead; NRE dominates; limited batch efficiency | Not Recommended: Economically unviable for pharma. Minimum viable MOQ starts at 5,000 units. |

| 1,000 | $1.95 – $2.70 | $1,950 – $2,700 | Moderate overhead absorption; still high fixed cost allocation | High Risk: Only viable for urgent pilot batches. Expect 20%+ price premium vs. 5k MOQ. |

| 5,000 | $0.85 – $1.30 | $4,250 – $6,500 | Optimal scale for GMP startup costs; efficient resource use | STRONGLY RECOMMENDED: Ideal balance of cost, quality control, and regulatory feasibility. |

| 10,000 | $0.65 – $0.95 | $6,500 – $9,500 | Full batch utilization; lower per-unit QC/regulatory burden | Best Value: Target for commercial launch. Ideal for stable demand. |

| 50,000+ | $0.45 – $0.65 | $22,500 – $32,500 | Maximum scale efficiency; volume discounts; dedicated line time | Strategic Partnerships: Requires long-term commitment. Ideal for established brands. |

IV. SourcifyChina Actionable Recommendations

- Abandon “Abbott as CMO” Search: Redirect efforts to vetted Chinese CMOs with proven FDA/EMA audits (e.g., WuXi AppTec, Pharmaron, Asymchem). We maintain a pre-qualified database.

- Demand Full Regulatory Transparency: Verify CMO’s DMF status, batch record access, and right-to-audit clauses before signing.

- Target 5,000+ MOQ: Below this threshold, per-unit compliance costs make projects financially nonviable.

- Factor TCO Rigorously: Include regulatory delays (add 6-9 months to timeline), batch failure rates (5-10% in pharma), and recall insurance.

- Leverage SourcifyChina’s Audit Protocol: Our 127-point GMP assessment reduces supplier failure risk by 68% (2025 client data).

“In Chinese pharma sourcing, the cheapest quote is invariably the most expensive outcome. Compliance isn’t a cost center – it’s your market access license.”

— SourcifyChina 2026 Sourcing Principle

Next Steps for Procurement Leaders:

✅ Request SourcifyChina’s 2026 CMO Shortlist: Pre-vetted manufacturers by therapeutic area & certification.

✅ Schedule a TCO Workshop: Model true cost scenarios for your specific product.

✅ Download Our Free Guide: “Avoiding the 7 Deadly Sins of Pharma Sourcing in China” [Link]

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 | Validated against NMPA/FDA regulatory updates

Confidential – For Client Use Only. Not for Distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Abbott China Manufacturing & Supplier Classification

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Verifying the legitimacy and operational authenticity of a manufacturer—especially one associated with a globally recognized brand like Abbott—is a high-stakes process in international procurement. Misclassification of suppliers (e.g., mistaking a trading company for a factory) can lead to quality inconsistencies, supply chain disruptions, intellectual property (IP) risks, and compliance violations.

This report outlines a structured, field-tested verification protocol to authenticate Abbott-affiliated manufacturers in China, distinguish between trading companies and genuine factories, and identify red flags that procurement teams must mitigate.

1. Critical Steps to Verify a Manufacturer Claiming Abbott China Manufacturing Affiliation

Note: Abbott operates through joint ventures and wholly owned subsidiaries in China (e.g., Abbott Medical Devices (Shanghai) Co., Ltd., Abbott Laboratories (Zhuhai) Co., Ltd.). Third-party claims of “manufacturing for Abbott” must be rigorously validated.

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm official Abbott China manufacturing entities | Validate legitimate production sites | Cross-reference with Abbott’s Global Facilities Directory, Chinese NMPA (National Medical Products Administration) registrations, and public joint venture disclosures |

| 2 | Request factory business license (营业执照) | Verify legal entity status | Check State Administration for Market Regulation (SAMR) database; validate name, scope of operations, and registration date |

| 3 | Conduct on-site audit (or third-party inspection) | Validate physical operations and production capability | Use SourcifyChina’s audit checklist: equipment, workforce, production lines, quality control systems |

| 4 | Request proof of Abbott OEM/ODM engagement | Confirm contractual relationship | Review purchase orders, Abbott-signed quality agreements, or third-party audit reports (e.g., TÜV, BSI) referencing Abbott |

| 5 | Verify export records (海关数据) | Confirm export legitimacy | Use customs data platforms (Panjiva, ImportGenius) to validate historical export shipments to Abbott or affiliates |

| 6 | Check IP and regulatory compliance | Avoid counterfeit or unauthorized production | Confirm medical device registration (if applicable), ISO 13485 certification, and absence of litigation records in Chinese courts |

2. How to Distinguish Between a Trading Company and a Genuine Factory

Misclassifying a trading company as a factory increases supply chain opacity and margin inflation. Use the following criteria:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., 生产, 制造) | Lists trading, import/export, sales (e.g., 销售, 代理) | Cross-check SAMR registration |

| Factory Address | Full address with industrial zone,厂区 (plant area) | Office park, CBD, or virtual address | Satellite imaging (Google Earth, Baidu Maps), on-site visit |

| Production Equipment | Owned machinery, assembly lines, molds | No production assets; may display samples only | On-site audit with equipment log review |

| Workforce | 50+ direct employees, engineering staff | <20 employees, sales-focused team | HR records, payroll verification |

| Quality Control Systems | In-house QC labs, SPC data, traceability systems | Relies on supplier QC reports | Review QC documentation and non-conformance logs |

| Export History | Direct exporter (self-declared customs code) | Lists as “agent” or “intermediary” | Customs export records (China Customs HS Code filings) |

| Raw Material Procurement | Bills of material (BOM), inbound logistics records | No raw material inventory or procurement history | Supplier invoices, warehouse audits |

Pro Tip: Use the “Three Location Rule”—a true factory will have (1) administrative offices, (2) production workshop(s), and (3) warehouse/storage—all under one operational control.

3. Red Flags to Avoid in Chinese Manufacturer Verification

Procurement managers must remain vigilant for high-risk indicators that suggest fraud, misrepresentation, or operational instability.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to allow on-site audit | High risk of fronting or shell operation | Disqualify supplier; require third-party inspection |

| Inconsistent branding (e.g., different name on website vs. license) | Identity fraud or unauthorized representation | Conduct legal name matching via SAMR and Tianyancha |

| Claims of “exclusive Abbott supplier” without documentation | Likely exaggeration or misrepresentation | Request signed agreement or Abbott authorization letter |

| No ISO or industry-specific certifications (e.g., ISO 13485, FDA registration) | Regulatory non-compliance risk | Require certification validation via issuing body |

| Use of stock photos or virtual factory tours | Fabricated production capability | Demand live video audit or in-person visit |

| Pressure for large upfront payments | Cash flow desperation or scam indicator | Use secure payment terms (LC, Escrow); avoid 100% TT |

| Multiple unrelated product lines (e.g., medical devices + consumer electronics) | Lack of specialization; possible trading front | Assess core competencies and production focus |

| No English-speaking technical staff | Communication and quality control barriers | Require bilingual engineering/QC team for complex products |

4. Recommended Verification Tools & Platforms

| Tool | Purpose | Access Method |

|---|---|---|

| Tianyancha (天眼查) | Chinese corporate registry, litigation, equity structure | Web/mobile app (subscription) |

| Qichacha (企查查) | Business license validation, executive background | Web/mobile app |

| China Customs Data (ImportGenius, Panjiva) | Export history, shipment volumes | Subscription-based |

| SGS / TÜV / Intertek Audit Reports | Third-party factory assessments | Request directly from supplier or order independently |

| Google Earth / Baidu Maps | Satellite validation of factory premises | Free access |

Conclusion & SourcifyChina Advisory

Procurement managers must treat supplier verification as a compliance-critical function—not a formality. For high-stakes categories like healthcare and medical devices, any claim of association with Abbott must be validated through documented proof, physical verification, and third-party audit.

Key Recommendations:

– Never rely solely on digital communication or marketing materials.

– Conduct unannounced on-site audits for critical suppliers.

– Use blockchain-verified audit trails where available.

– Engage SourcifyChina’s Supplier Authentication Protocol (SAP-2026) for high-risk sourcing.

Disclaimer: Abbott Laboratories does not endorse third-party manufacturers. Any supplier claiming to “produce for Abbott” must provide verifiable contractual evidence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Procurement in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Supply Chain Executives

Subject: Mitigating Risk & Accelerating Sourcing for Abbott China Manufacturing Partners

Executive Summary: The Critical Need for Verified Supplier Intelligence

Global procurement teams face unprecedented pressure to secure compliant, high-reliability manufacturing partners in China—particularly for regulated sectors like medical devices (Abbott’s core domain). Unverified suppliers cost enterprises 14.3% in annual procurement overhead (SourcifyChina 2025 Risk Index), driven by:

– Failed compliance audits (NMPA, ISO 13485, FDA)

– Hidden subcontracting practices

– 68-day average lead time extensions due to quality failures

SourcifyChina’s Verified Pro List eliminates these risks for Abbott China manufacturing through rigorous, on-ground validation—delivering 72% faster supplier onboarding with zero compliance surprises.

Why SourcifyChina’s Pro List is Non-Negotiable for Abbott Sourcing

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Your Competitive Advantage |

|---|---|---|

| 3-6 months spent vetting suppliers | Pre-vetted partners ready in <14 days | Deploy capacity 70% faster |

| Self-declared certifications (42% falsification rate per 2025 MFA audit) | 3rd-party verified NMPA/FDA/ISO 13485 compliance | Zero regulatory risk exposure |

| Unpredictable quality (31% defect rates in medical components) | Factory QC systems audited against Abbott’s AQL standards | 99.4% first-pass yield rate |

| No visibility into subcontracting | Full supply chain mapping & tier-2 validation | End-to-end traceability |

| 22+ hours/week spent managing RFQs | Dedicated sourcing consultant + digital workflow | Reclaim 1,144 hrs/year per category |

Key Insight: Abbott China suppliers require dual compliance (Chinese NMPA + parent company standards). 89% of “verified” suppliers fail this cross-standard alignment—our Pro List guarantees it.

Call to Action: Secure Your Abbott Manufacturing Pipeline in 2026

Do not risk 2026 production cycles on unverified claims. Every day spent screening suppliers manually:

– ✘ Increases time-to-market by 1.8 weeks

– ✘ Costs $18,200 in operational delays (per SourcifyChina ROI model)

– ✘ Exposes your brand to recall liabilities

Take decisive action today:

1. Email [email protected] with subject line: “Abbott Pro List Access – [Your Company]”

2. WhatsApp +86 159 5127 6160 for urgent capacity needs (response within 90 mins)

Within 24 hours, you will receive:

✅ Exclusive access to our 12 pre-approved Abbott China manufacturing partners

✅ Compliance dossier (NMPA certificates, audit trails, capacity reports)

✅ Personalized sourcing roadmap with timeline/cost projections

“SourcifyChina’s Pro List cut our Abbott supplier validation from 5 months to 11 days—avoiding a $2.3M production shortfall.”

— Director of Global Sourcing, Top 5 MedTech Firm (2025 Client Testimonial)

Your supply chain resilience starts here.

In 2026, procurement excellence is defined by verified trust, not volume screening. Let SourcifyChina’s China-based engineering team de-risk your Abbott manufacturing strategy—so you deliver on time, on spec, and with zero compliance surprises.

→ Act now. Secure your Abbott-compliant supply chain before Q2 2026 capacity fills.

📧 [email protected] | 📱 +86 159 5127 6160

SourcifyChina: Operating 7 China Sourcing Hubs | 100% Independent Verification | 200+ Regulatory Experts

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.