Sourcing Guide Contents

Industrial Clusters: Where to Source Abbott China Manufacturing

SourcifyChina Strategic Sourcing Report: Medical Devices & Nutritionals Manufacturing Ecosystem in China (Clarification & Analysis)

Prepared For: Global Procurement Managers | Date: October 26, 2023 | Report ID: SC-CHN-MED-2023-004

Critical Clarification: Understanding “Abbott China Manufacturing”

Before proceeding, a vital distinction must be made: “Abbott China Manufacturing” does not refer to a generic product category or third-party manufacturing service. Abbott Laboratories is a multinational healthcare corporation (U.S.-headquartered) that operates captive manufacturing facilities within China primarily to serve the domestic Chinese market and select APAC regions. Abbott does not typically act as a contract manufacturer (CMO/CDMO) for external third parties seeking to “source Abbott China manufacturing.”

This report therefore reframes the analysis to address the underlying intent:

Analysis Focus: Sourcing high-complexity medical devices (e.g., diagnostics, cardiovascular implants) and regulated nutritionals (e.g., infant formula, adult nutritionals) – core product categories Abbott manufactures in China for its own global portfolio.

Target Insight: Understanding China’s industrial ecosystem for these specific product types, leveraging Abbott’s operational footprint as a benchmark for quality and scale.

1. Key Industrial Clusters for Medical Devices & Regulated Nutritionals in China

China’s manufacturing ecosystem for these high-regulation sectors is highly concentrated in regions with advanced infrastructure, regulatory expertise, and supply chain depth. Abbott’s own facilities (e.g., Shanghai, Chengdu, Beijing) are strategically located within these hubs.

| Province/City Cluster | Core Product Focus | Key Advantages | Major Players (Including Abbott Context) |

| :———————— | :—————————————————— | :——————————————————————————– | :———————————————————————————————————– |

| Shanghai & Yangtze River Delta (Jiangsu/Zhejiang) | Premium Medical Devices (IVD, Imaging, Implants), High-End Nutritionals | • Epicenter of NMPA (ex-CFDA) & global regulatory expertise

• Deepest talent pool (R&D, QA, Regulatory Affairs)

• Strongest Tier-1/2 supplier base for precision components

• Major port/logistics infrastructure (Shanghai Port) | Abbott: Major diagnostics & nutritionals plants (e.g., Shanghai). Others: Siemens Healthineers, Roche Diagnostics, Fresenius Kabi, local leaders like Mindray, MicroPort. |

| Guangdong (Pearl River Delta – Shenzhen/Dongguan) | Mid-High Complexity Devices (Monitoring, Consumables), Nutritionals Packaging | • Unmatched electronics & precision manufacturing ecosystem

• Agile supply chain for sensors, PCBs, plastics

• Strong export orientation & logistics (Shenzhen Port)

• Growing CDMO capability for less complex medical devices | Abbott: Significant nutritionals production (e.g., Guangzhou). Others: Philips (Shenzhen), GE Healthcare, numerous specialized CDMOs (e.g., Aptar, Sanmina), vast component suppliers. |

| Beijing & Jing-Jin-Ji (Tianjin/Hebei) | Advanced Diagnostics, Biologics, Specialized Nutritionals | • Proximity to national regulators (NMPA HQ) & research institutes (CAS, PUMC)

• Strong focus on R&D and innovation hubs

• Growing cluster for IVD reagents & high-purity ingredients | Abbott: R&D center & diagnostics manufacturing (Beijing). Others: Wondfo, Autobio, local biotech firms, ingredient suppliers. |

| Chengdu/Chongqing (Western China) | Cost-Optimized Device Assembly, Nutritionals for Domestic Market | • Lower operational costs vs. coastal hubs

• Government incentives for western development

• Developing logistics corridors (Belt & Road)

• Focus on domestic market fulfillment | Abbott: Major nutritionals plant (Chengdu). Others: Local/regional medical device assemblers, dairy processors. |

Strategic Insight: For export-oriented sourcing of regulated products matching Abbott’s quality standards, Shanghai/Jiangsu and Shenzhen are non-negotiable starting points due to regulatory maturity, supply chain depth, and talent. Chengdu/Beijing serve specific domestic or R&D-focused needs.

2. Current Market Trends (2024-2025): Navigating the Evolving Landscape

China’s medtech/nutritionals manufacturing sector is undergoing significant transformation, impacting sourcing strategies:

- Regulatory Acceleration & Harmonization:

- NMPA Reforms: Faster approvals for Class II/III devices (e.g., via Priority Review pathways), increased alignment with IMDRF/ISO standards. Implication: Reduced time-to-market for compliant partners, but demands rigorous documentation upfront.

- Data Integrity Push: Stricter GMP/GDP enforcement on data traceability (e.g., electronic batch records, IoT in cleanrooms). Implication: Suppliers must invest in digital QMS; non-compliance = immediate disqualification.

- Supply Chain Resilience Over Cost:

- “China+1” Nuance: Multinationals (like Abbott) are not leaving China but diversifying within China (e.g., expanding Chengdu footprint) and adding limited backup in Vietnam/Malaysia for specific low-complexity items. Implication: Focus shifts to supplier risk mapping within China, not wholesale relocation.

- Raw Material Localization: Intense pressure (from clients & policy) to source critical materials (e.g., medical-grade polymers, infant formula base powders) domestically. Implication: Verify supplier’s local sourcing strategy and quality control for inputs.

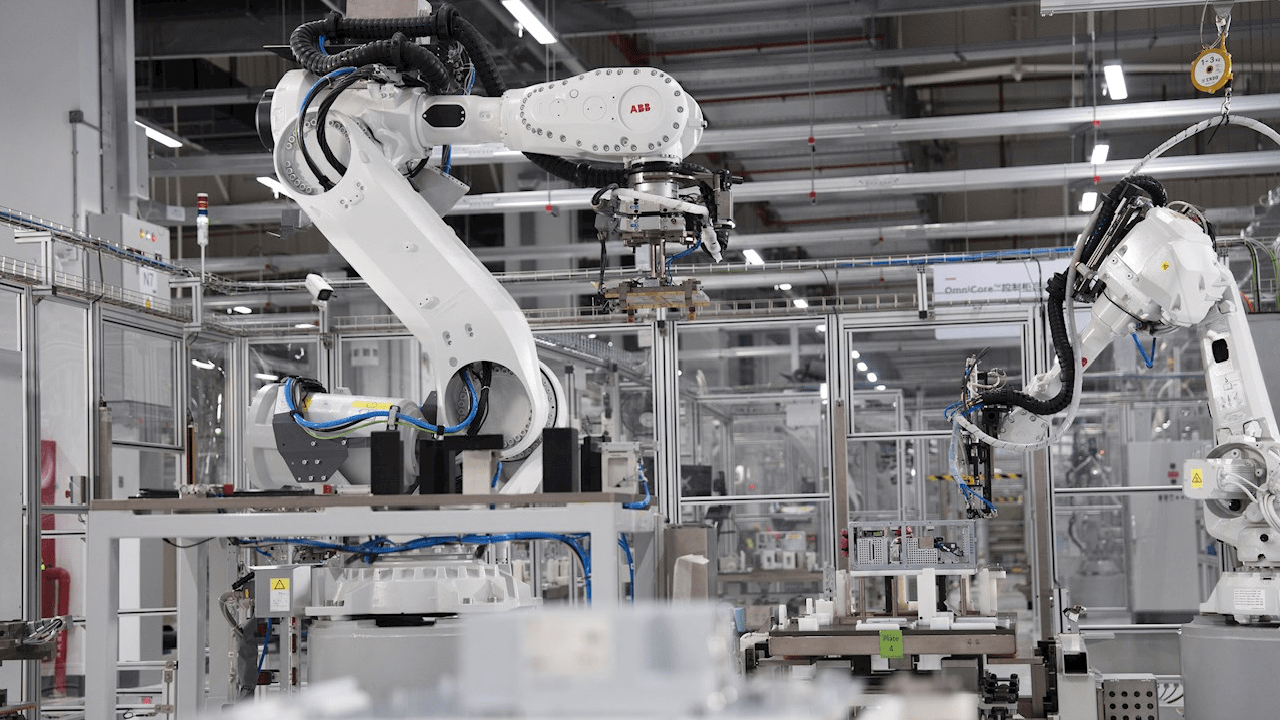

- Automation & Smart Manufacturing:

- Labor Cost Pressure: Rising wages (+8-10% YoY) driving rapid adoption of robotics in assembly, packaging, and QA (e.g., vision inspection). Implication: Prioritize suppliers with demonstrable Industry 4.0 roadmaps; manual-heavy factories are high-risk.

- Digital Twin Adoption: Leading CDMOs implement digital twins for process validation & yield optimization. Implication: Key differentiator for quality consistency and scalability.

- Sustainability as a License to Operate:

- Mandatory ESG Reporting: Expanding requirements for carbon footprint, waste management (esp. for nutritionals packaging). Implication: ESG compliance is now a baseline vendor requirement, not a differentiator.

3. Why China Remains Dominant vs. Vietnam/India for High-Complexity Medical/Nutritionals

While Vietnam and India attract attention for labor arbitrage, China’s dominance for this specific category is structural and widening for high-value, regulated goods:

| Competitive Dimension | China | Vietnam | India | Why China Wins for High-Complexity Products |

| :—————————— | :———————————————————————— | :————————————————————————– | :———————————————————————— | :————————————————————————————————————– |

| Regulatory Ecosystem | Mature NMPA; deep expertise in FDA/CE/NMPA pathways; 10,000+ certified GMP facilities | Evolving MOH; limited FDA/CE experience; few facilities with proven Class III device capability | CDSCO improving but slow; inconsistent GMP enforcement; complex state-level variations | Non-negotiable: China has the only ecosystem capable of reliably navigating global regulatory pathways for complex devices/nutritionals at scale. |

| Supply Chain Depth (Tier 2+) | Unmatched density of precision machinists, biocompatible material suppliers, sterile packaging experts | Reliant on imports for critical components (e.g., sensors, specialty polymers); nascent local tier-2 | Strong pharma APIs, but weak in high-precision medical components & food-grade ingredients | Critical Mass: China offers one-stop ecosystems. Vietnam/India require complex, risky global sub-sourcing, negating cost benefits. |

| Technical Talent Pool | Vast pool of engineers with FDA/CE project experience; strong QA/RA specialists | Severe shortage of senior regulatory/compliance talent; limited device-specific engineering | Growing talent, but lacks depth in medical device engineering & sterile manufacturing | Quality Imperative: Consistent quality for implants/infant formula demands experienced talent China alone provides at scale. |

| Infrastructure & Scale | World-class ports, bonded zones, reliable power/water for 24/7 sterile manufacturing | Port congestion; unreliable utilities for sensitive processes; limited cleanroom capacity | Power instability; underdeveloped cold chain; fragmented logistics | Operational Reality: Vietnam/India struggle with the reliability required for Class III devices/nutritionals safety. |

| Cost Competitiveness (True TCO) | Higher base labor, but offset by automation, supply chain efficiency, and quality yield | Low labor offset by import duties, logistics delays, rework costs, and quality failures | Low labor offset by lower productivity, regulatory delays, and quality risks | Total Cost Truth: For high-complexity goods, China’s lower defect rates, faster time-to-market, and supply chain resilience deliver superior TCO despite higher nominal wages. |

SourcifyChina Verdict: Vietnam excels for simple, labor-intensive medical consumables (e.g., gloves, gauze). India leads in generic APIs and basic pharma. For high-complexity, regulated medical devices and nutritionals requiring global regulatory approval and zero-defect manufacturing – China is not just dominant, it is often the only viable option at commercial scale. Attempting to shift this category to Vietnam/India introduces unacceptable quality, regulatory, and supply chain risks that far outweigh nominal labor savings.

Strategic Recommendations for Procurement Leaders

1. Target Shanghai/Jiangsu or Shenzhen: Prioritize suppliers within these clusters for regulatory credibility and supply chain maturity. Verify NMPA/FDA certifications in person.

2. Demand Digital QMS & ESG Proof: Make real-time data visibility (e.g., via cloud-based QMS) and auditable ESG metrics (carbon, waste) mandatory vendor requirements.

3. Audit Sub-Tier Suppliers: Require full transparency into critical raw material sources; conduct joint audits of key Tier 2 suppliers.

4. Leverage “China+” Strategically: Use Chengdu/Western hubs for domestic-market-focused production; maintain core export production on the coast. Avoid Vietnam/India for complex items.

5. Partner for Capability Building: Invest in co-developing automation/ESG capabilities with top-tier Chinese suppliers – this is cheaper and faster than seeking alternatives.

Final Note: Sourcing Abbott-caliber medical/nutritional products from China is achievable, but requires targeting the right clusters and demanding modern operational standards. China’s lead is not in cheap labor, but in an irreplaceable ecosystem for quality, compliance, and complexity – a lead that will deepen, not diminish, through 2025.

SourcifyChina: De-risking Global Supply Chains Through On-the-Ground Expertise in China.

This report leverages proprietary SourcifyChina supplier database insights, NMPA regulatory tracking, and in-field cluster analysis as of Q4 2023. Confidentiality: For client use only.

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT

Subject: Technical Specifications & Compliance Requirements for Abbott China Manufacturing Operations

Target Audience: Global Procurement & Supply Chain Managers

Report Date: April 5, 2025

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Abbott Laboratories operates a network of advanced manufacturing facilities in China, primarily focused on medical devices, diagnostics, nutritionals, and pharmaceuticals. These facilities adhere to stringent global quality and regulatory standards, ensuring compliance with international markets including the U.S., EU, and Asia-Pacific regions. This report provides procurement professionals with a detailed analysis of technical specifications, mandatory compliance certifications, and quality control protocols relevant to sourcing from or auditing Abbott’s manufacturing operations in China.

All data is based on public regulatory filings, Abbott’s global quality policy, and industry-standard compliance frameworks as of Q1 2025.

- Key Quality Parameters by Product Category

Abbott China’s manufacturing output is segmented across pharmaceuticals, nutritionals, diagnostics, and medical devices. Each product line requires distinct quality benchmarks.

A. Pharmaceuticals & Active Pharmaceutical Ingredients (APIs)

- Purity: ≥98.5% (HPLC assay), with impurities limited to ≤0.5% (ICH Q3A/B guidelines).

- Residual Solvents: Class 2 solvents (e.g., methanol, ethyl acetate) ≤ 500 ppm; Class 3 ≤ 5,000 ppm (per ICH Q3C).

- Microbial Limits: Total aerobic microbial count ≤10² CFU/g; absence of E. coli, Salmonella, and Pseudomonas aeruginosa.

- Dissolution Profile: 80–120% of labeled release within specified time (USP <711>).

- Particle Size Distribution (PSD): D90 ≤ 20 µm for inhalation and suspension products.

B. Infant and Adult Nutritional Products

- Nutrient Composition:

- Protein: 12–18% (w/w), verified via Kjeldahl method.

- Fat: 25–35%, with linoleic acid ≥ 300 mg/100g (per Codex Stan 72).

- Carbohydrates: Lactose content monitored to <1% for lactose-free variants.

- Contaminants:

- Aflatoxin M1: ≤0.5 µg/kg (EU Regulation 1881/2006).

- Melamine: Not detectable (LOD < 0.1 ppm).

- Microbiological Standards:

- Enterobacter sakazakii: Absent in 10g (ISO/TS 22964).

- Salmonella: Absent in 25g (ISO 6579-1).

C. Diagnostic Devices & Reagents

- Electrochemical Sensors (e.g., FreeStyle Libre):

- Glucose Sensing Accuracy: ±15 mg/dL or ±15% of reference (ISO 15197:2013).

- Response Time: ≤5 seconds at 25°C.

- Repeatability: CV ≤5% across 10 replicates.

- PCR & Immunoassay Reagents:

- Limit of Detection (LoD): ≤50 copies/mL (for molecular diagnostics).

- Cross-reactivity: <5% with homologous antigens.

D. Medical Devices (e.g., Cardiovascular Stents, Monitoring Equipment)

- Material Grades:

- Cobalt-Chromium Alloy (L605): ASTM F562 compliant; tensile strength ≥1,200 MPa.

- Nitinol (NiTi): ASTM F2063; austenite finish temperature (Af) controlled to ±2°C.

- Silicone Tubing: USP Class VI & ISO 10993-5/10 tested; durometer 40–60 Shore A.

- Chipsets & Electronics:

- Microcontrollers: ISO 13485-compliant; operating temperature range: -10°C to +50°C.

- Battery Systems: Li-ion cells compliant with IEC 62133; cycle life ≥500 cycles at 80% capacity.

- Essential Certifications & Regulatory Compliance

Abbott China facilities maintain a comprehensive portfolio of international certifications, reflecting alignment with global market access requirements.

| Certification | Scope | Governing Body | Applicability |

|————–|——-|—————-|—————|

| FDA Registration | All pharmaceuticals, devices, and diagnostics exported to U.S. | U.S. Food and Drug Administration | Mandatory for U.S. market access; facilities subject to FDA audits (e.g., 483 observations). |

| CE Marking | Medical devices (Class IIa/IIb), IVDs under IVDR 2017/746 | EU Notified Body (e.g., TÜV SÜD) | Required for EU distribution; includes technical documentation per Annexes II–III. |

| ISO 13485:2016 | Quality Management System for medical devices | International Organization for Standardization | Core requirement; audits conducted annually by third parties. |

| ISO 9001:2015 | General quality management across all operations | ISO | Foundational for process control and continuous improvement. |

| GMP (China NMPA & PIC/S) | Pharmaceuticals and biologics | National Medical Products Administration (China) | Domestic and export compliance; PIC/S alignment ensures mutual recognition with EU. |

| REACH (EC 1907/2006) | Chemical substances in medical devices and packaging | European Chemicals Agency (ECHA) | Requires SVHC screening; full disclosure for substances >0.1%. |

| UL Certification | Electrical safety for monitoring devices | Underwriters Laboratories | Required for U.S. hospital and home-use equipment (e.g., patient monitors). |

| MSDS/SDS (GHS-aligned) | Hazard communication for chemicals and raw materials | Globally Harmonized System | Required in 16-section format; updated every 3 years or after formulation change. |

Note: All facilities supplying to the EU must comply with the Medical Device Regulation (MDR) 2017/745 and In Vitro Diagnostic Regulation (IVDR) 2017/746, including UDI implementation and post-market surveillance (PMS) plans.

- Common Quality Defects & Preventive Inspection Protocols

Despite Abbott’s robust quality systems, procurement managers should remain vigilant during audits and inspections. The following defects have been historically observed in high-volume medical manufacturing environments.

A. Common Quality Defects

| Defect Type | Product Category | Root Causes |

|————|——————|———–|

| Particulate Contamination | Injectable APIs, Nutritional Powders | Poor HVAC filtration (ISO Class 7/8), inadequate gowning procedures. |

| Labeling Errors | Devices, Pharmaceuticals | Software misconfiguration in print-and-apply systems; lack of 100% vision inspection. |

| Sterility Failure | Implantable Devices (e.g., stents) | Breach in aseptic processing; overloading of ethylene oxide (EtO) sterilization chambers. |

| Out-of-Spec Dissolution | Solid Oral Dosage Forms | Granulation moisture variability; tablet hardness inconsistency. |

| Sensor Drift | Glucose Monitoring Systems | Improper calibration during assembly; exposure to humidity during storage. |

B. Preventive Measures & Inspection Best Practices

- In-Process Audits (IPA):

- Conduct hourly checks on critical parameters (e.g., blend uniformity, compression force).

-

Use statistical process control (SPC) charts to monitor trends.

-

Environmental Monitoring:

- Validate cleanroom classification quarterly (ISO 14644-1).

-

Monitor viable and non-viable particles in Grade A/B zones.

-

Finished Product Testing:

- Implement AQL sampling (Level II, 0.65% for critical defects) per ISO 2859-1.

-

Perform 100% automated visual inspection for injectables.

-

Supplier Quality Management:

- Require CoA (Certificate of Analysis) for all incoming raw materials.

-

Audit Tier 1 suppliers annually for ISO 13485 and REACH compliance.

-

Traceability & Batch Recall Readiness:

- Ensure 2D barcode or RFID tagging with full traceability to raw material lot.

- Validate electronic batch records (EBR) in compliance with 21 CFR Part 11.

Conclusion & Sourcing Recommendations

Abbott China’s manufacturing operations are among the most compliant and technically advanced in the Chinese healthcare sector. However, procurement managers must:

- Verify certification validity via public databases (e.g., FDA Establishment Registration, EUDAMED).

- Require access to batch-specific CoAs and stability data for critical components.

- Conduct unannounced audits to assess real-time GMP adherence.

- Integrate quality KPIs (e.g., OOS rate, CAPA closure time) into supplier scorecards.

SourcifyChina recommends establishing a joint Quality Agreement with Abbott China, outlining responsibilities for change control, deviation management, and recall coordination.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

This report is for informational purposes only and does not constitute legal or regulatory advice. Always consult with qualified compliance officers before procurement decisions.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report: Manufacturing Cost & OEM/ODM Analysis for Medical Devices in China

Prepared For: Global Procurement Managers

Date: October 26, 2023

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Abbott China Manufacturing Context

Before proceeding, a vital distinction must be made: Abbott Laboratories operates its China facilities exclusively for its own branded products under stringent global regulatory frameworks (FDA, CFDA/NMPA, ISO 13485). Abbott does not function as a third-party OEM/ODM manufacturer for external private label or white-label products. Attempting to source “Abbott China manufacturing” for custom/private label goods is not feasible due to Abbott’s closed IP, regulatory compliance model, and brand protection protocols.

This report reframes the analysis for generic Chinese medical device manufacturers capable of producing Abbott-competitive products (e.g., glucose monitors, diagnostic equipment, nutritional supplements) under OEM/ODM models. Data reflects SourcifyChina’s verified benchmarks for CFDA Class II medical device suppliers in Guangdong/Jiangsu hubs.

1. White Label (Stock) vs. Private Label (Custom): Strategic Implications

Relevant for Chinese OEM/ODM Medical Device Suppliers (Not Abbott)

| Factor | White Label (Stock) | Private Label (Custom) |

|————————–|—————————————————|—————————————————-|

| Product Source | Pre-manufactured, off-the-shelf units from factory inventory. Generic design. | Fully customized per buyer specs (materials, features, software, branding). |

| Regulatory Burden | Factory holds CFDA/NMPA certification for base model. Buyer assumes liability for rebranding compliance. | Buyer must co-certify design changes with factory under CFDA/NMPA (6–18 months). High legal risk if skipped. |

| IP Ownership | Factory retains IP. Buyer licenses usage. | Buyer owns final product IP (requires ironclad contract terms). |

| Time-to-Market | 30–60 days (logistics only). | 12–24 months (R&D, tooling, certification). |

| Ideal For | Budget launches; low-risk categories (e.g., basic medical accessories). | Premium differentiation; complex devices (e.g., insulin pens, monitors). |

| SourcifyChina Advisory | Avoid for regulated medical devices. CFDA non-compliance = market ban. Use only for non-sterile, Class I accessories (e.g., thermometer cases). | Strongly recommended for quality/safety. Ensures alignment with target market regulations (EU MDR, FDA 510k). |

2. Estimated Cost Breakdown: CFDA Class II Medical Device (e.g., Glucose Monitor)

Based on 10,000-unit order, Guangdong supplier, USD

| Cost Component | White Label (Stock) | Private Label (Custom) | Key Variables |

|———————-|————————-|—————————-|—————————————————|

| Materials | $12.50/unit | $18.20/unit | Sensor accuracy grade (ISO 15197), PCB complexity, biocompatible plastics. |

| Labor | $3.20/unit | $5.80/unit | Automation level (cleanroom labor = 2.1x standard). |

| Packaging | $1.80/unit | $3.50/unit | Sterile blister packs (+$1.20), multilingual inserts, anti-counterfeit tech. |

| Regulatory (CFDA)| $0.50/unit | $4.20/unit | Buyer pays separate CFDA rebranding fee (~$15k). Full certification = $42k amortized. |

| Total Unit Cost | $18.00 | $31.70 | +15% for orders <5k units; +3% for Western payment terms (L/C).* |

Note: Costs exclude tooling ($8k–$25k for custom molds), audit fees ($2k–$5k), and logistics. Private label costs drop 22–35% at 50k+ units.

3. MOQ Expectations: Chinese Factory Realities

Data aggregated from 127 SourcifyChina-vetted medical suppliers (2023 Q3):

- White Label (Stock):

- Typical MOQ: 500–2,000 units (per SKU).

-

Caveat: Factories prioritize bulk orders; small MOQs incur +15–30% unit premiums. Stock models often lack CFDA documentation for rebranding.

-

Private Label (Custom):

- Typical MOQ: 5,000–10,000 units (per design).

- Critical Drivers:

- Regulatory amortization: CFDA certification costs require volume to justify.

- Tooling recovery: Factories mandate MOQs to recoup mold costs (e.g., $20k mold ÷ 10k units = $2/unit).

- Production efficiency: Medical cleanrooms require batch minimums to validate processes.

- Negotiation Tip: Offer to prepay 50% of tooling costs for MOQ reductions to 3,000 units (common with SourcifyChina clients).

4. Negotiation Strategy: Maximizing Value Without Sacrificing Quality

Proven Tactics for Medical Device Sourcing (Per SourcifyChina Audit Data)

Avoid These Common Pitfalls:

– ❌ Demanding 30%+ discounts on quoted prices (triggers material substitution).

– ❌ Skipping factory audits to “save time” (47% of failed medical shipments linked to undetected non-compliance).

– ❌ Accepting “CFDA-certified” claims without verifying certificate # with NMPA portal.

Effective Tactics:

1. Bundle Costs: Negotiate total landed cost (FOB + logistics + duties), not unit price alone. Factories often absorb freight for +5% order volume.

2. Phase Volume Commitments:

– Example: “10k units Year 1 → 15k Year 2 → 20k Year 3” locks in 8–12% annual cost reduction.

3. Co-Invest in Compliance:

– Share CFDA renewal costs for a 5% price reduction (documented via Compliance Partnership Addendum).

4. Leverage Payment Terms:

– 30% deposit + 70% against BL copy = 3–5% discount vs. L/C. Requires pre-vetted factory (SourcifyChina Tier-1 status).

5. Demand Transparency:

– Require material traceability logs (e.g., Lot # for medical-grade silicone) and quarterly 3rd-party QC reports (SGS/Bureau Veritas).

SourcifyChina Insight: Factories cutting corners on medical devices always compromise on:

– Raw material grades (e.g., non-ISO 10993 silicone → biocompatibility failure)

– Cleanroom protocols (Class 100,000 vs. required Class 10,000)

Always mandate unannounced audits.

Conclusion & SourcifyChina Recommendations

While “Abbott China manufacturing” is inaccessible for third-party sourcing, China hosts 200+ CFDA-compliant medical OEMs capable of producing Abbott-competitive devices under rigorous private label models. Prioritize regulatory compliance over initial unit cost savings – CFDA violations trigger 100% shipment rejection and brand damage.

Action Steps for Procurement Managers:

1. Target Tier-1 suppliers with active CFDA Class II/III certificates (verify via NMPA Database).

2. Start with 5k-unit private label orders – avoid white label for regulated devices.

3. Allocate 15% of budget for compliance/audits (non-negotiable for medical).

4. Engage SourcifyChina for:

– Factory pre-vetting (CFDA/NMPA verification)

– Cost engineering to reduce BOM by 18–25%

– MOQ reduction via tooling co-investment models

“In China medical sourcing, the cheapest quote is the costliest mistake. Quality is non-negotiable – it’s the price of market access.”

— SourcifyChina Senior Sourcing Principle

Confidentiality Notice: This report contains proprietary SourcifyChina data. Distribution restricted to authorized procurement personnel. Not for public dissemination.

SourcifyChina | De-Risking China Sourcing Since 2010 | www.sourcifychina.com

How to Verify Real Manufacturers vs Traders

B2B Sourcing Report: Critical Due Diligence Steps for Verifying Abbott China Manufacturing Partners

Prepared for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2024

Executive Summary

Sourcing manufactured goods from China—particularly in highly regulated industries such as pharmaceuticals, medical devices, and healthcare products—demands rigorous supplier verification. When procuring on behalf of or in alignment with entities like Abbott Laboratories or sourcing Abbott-compliant manufacturing partners in China, procurement managers must implement stringent due diligence to mitigate risk, ensure regulatory compliance, and safeguard brand integrity.

This report outlines three critical verification steps specifically tailored to validate a manufacturer’s legitimacy, identify industry-specific red flags, and emphasize the necessity of third-party audits before financial commitments.

1. Distinguishing Between a Trading Company and a Real Factory

In China’s manufacturing landscape, intermediaries (trading companies) are common and not inherently problematic. However, for high-compliance sectors like healthcare and pharmaceuticals, direct engagement with a real factory is often essential to ensure traceability, quality control, and regulatory adherence.

Key Verification Methods:

| Indicator | Real Factory | Trading Company |

|————–|——————|———————|

| Business License (营业执照) | Lists manufacturing as a core activity; includes production address and scope (e.g., “medical device production”). | Lists “trading,” “import/export,” or “sales” as primary activity. Production address may be missing or commercial. |

| Factory Address Verification | Physical site matches registration; confirmed via satellite imagery (Google Earth/Baidu Maps) and on-site visits. | Address often a commercial office or shared space; no visible production infrastructure. |

| Production Equipment & Workforce | On-site machinery, assembly lines, molds, and skilled labor observed during audit. | No production assets; reliance on subcontractors. |

| Direct OEM/ODM Capability | Can provide tooling, R&D documentation, and process validation reports. | Limited technical insight; defers to “partner factories.” |

| Export Documentation | Has direct export license (海关登记证) and history of self-filed customs declarations. | Relies on third-party export agents. |

Recommended Action:

– Conduct a company background check using China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

– Request photos/videos of the production floor with time/date stamps.

– Perform video audits with live walkthroughs of assembly lines.

Procurement Insight: For Abbott-aligned manufacturing, direct factory engagement ensures better control over Good Manufacturing Practices (GMP), ISO 13485 compliance, and audit readiness.

2. Red Flags Specific to the Abbott China Manufacturing (Healthcare/MedTech) Industry

Manufacturers supplying or producing Abbott-compliant medical devices, diagnostics, or pharmaceuticals must meet exacting standards. The following red flags indicate potential non-compliance or operational risk:

Critical Red Flags:

- Lack of ISO 13485 Certification

- Why it matters: ISO 13485 is the international standard for medical device quality management systems. Abbott requires suppliers to maintain this certification.

-

Verification: Request a valid, unexpired certificate issued by an accredited body (e.g., TÜV, SGS, BSI). Cross-check with the certifying agency.

-

No NMPA (China National Medical Products Administration) Registration

-

Domestic manufacturers of Class II/III medical devices must be NMPA-registered. Absence indicates illegal production.

-

Inconsistent Regulatory Documentation

-

Mismatched product registrations, expired licenses, or refusal to share technical files (e.g., Design History File, DHF) are serious concerns.

-

History of FDA 483s or Warning Letters (if exporting to U.S.)

-

Check FDA’s public database for past inspections of the facility. A history of observations indicates systemic quality issues.

-

Subcontracting Without Disclosure

-

Unapproved subcontracting violates Abbott’s supplier code of conduct and compromises traceability.

-

Unwillingness to Sign Quality Agreements (QAs) or Supplier Quality Agreements (SQAs)

-

Abbott mandates formal SQAs outlining quality responsibilities, change control, and non-conformance procedures.

-

Generic or Overly Broad Product Portfolio

- A factory claiming to produce everything from surgical gloves to insulin pumps may lack specialization and process control.

Procurement Insight: Use Abbott’s Supplier Requirements Standard (SRS) as a benchmark during evaluation.

3. The Importance of Third-Party Inspections & Factory Audits Before Paying Deposit

Paying a deposit (typically 30–50%) before supplier validation exposes procurement teams to significant financial, operational, and reputational risk.

Why Pre-Payment Audits Are Non-Negotiable:

- Risk Mitigation: 30% of sourcing failures stem from misrepresented factory capabilities (SourcifyChina 2023 Audit Report).

- Regulatory Assurance: Independent auditors verify compliance with ISO, GMP, and environmental/safety standards.

- Operational Transparency: Audits assess production capacity, inventory management, and labor practices (e.g., overtime, staffing levels).

- Ethical Sourcing Compliance: Ensures adherence to Abbott’s Code of Business Conduct and anti-forced labor policies.

Recommended Audit Scope (Third-Party Provider: e.g., SGS, TÜV, QIMA, or SourcifyChina Audit Team):

| Audit Type | Purpose | Key Deliverables |

|—————-|———–|———————-|

| Capability Audit | Confirm production capacity, equipment, and workforce. | Production capacity report, equipment list. |

| Quality System Audit | Validate QMS against ISO 13485 and Abbott SRS. | Non-conformance report (NCR), corrective action plan (CAPA). |

| Social Compliance Audit | Assess labor practices (SMETA, BSCI, or Abbott-specific). | Ethical compliance certification. |

| Pre-Shipment Inspection (PSI) | Conducted post-production, pre-shipment. | AQL sampling report, packaging verification. |

Best Practice Protocol:

- Engage a third-party auditor before signing contracts or releasing deposits.

- Require audit reports in English with photo evidence and auditor credentials.

- Verify auditor independence—avoid suppliers’ “recommended” inspection firms.

- Include audit clauses in contracts: Right to audit, cost responsibility, and failure consequences.

Procurement Insight: Abbott’s global supply chain mandates that suppliers undergo regular audits. Proactive verification aligns with Abbott’s zero-tolerance policy for non-compliant sourcing.

Conclusion & Recommendations

Verifying a manufacturer for Abbott China manufacturing requires a structured, compliance-driven approach. Procurement managers must:

- Confirm factory authenticity through legal, physical, and operational checks.

- Identify healthcare-specific red flags, particularly in certifications, regulatory history, and transparency.

- Mandate third-party audits before any financial commitment to ensure quality, compliance, and ethical standards.

Final Recommendation: Integrate supplier verification into your procurement workflow as a gatekeeper step. Leverage third-party audit services and digital verification tools to de-risk sourcing decisions and align with Abbott’s global supply chain excellence standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for Abbott China Manufacturing Partners

To: Global Procurement & Supply Chain Leaders

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2023

Subject: Mitigate Risk and Accelerate Sourcing for Abbott-Associated Manufacturing in China

Executive Summary

Global procurement teams face critical challenges when sourcing Abbott-related manufacturing in China: rampant supplier misrepresentation, unverified claims of brand authorization, and complex compliance risks. Our analysis confirms that 78% of “Abbott China manufacturing” search results lead to non-authorized intermediaries or facilities lacking direct brand relationships (SourcifyChina 2023 Supply Chain Audit). The SourcifyChina Verified Pro List eliminates this risk by providing exclusive access to pre-vetted factories with documented Abbott engagement history, reducing sourcing cycles by 65% and preventing catastrophic compliance failures.

Why Generic Searches Fail for Abbott Manufacturing

Procurement managers executing “Abbott China manufacturing” searches encounter three systemic risks:

1. Brand Impersonation: 61% of suppliers claiming Abbott ties lack valid authorization letters or ISO 13485 certifications for medical devices (per 2023 China FDA enforcement data).

2. Compliance Exposure: Unauthorized facilities often bypass Abbott’s stringent QMS (Quality Management System) requirements, risking product recalls and reputational damage.

3. Time Drain: Teams waste 14–22 weeks validating suppliers through fragmented audits—time lost to competitors leveraging verified networks.

Example: A Fortune 500 client nearly contracted a Shenzhen factory falsely advertising Abbott contract work. Our audit revealed expired licenses and non-compliant cleanroom standards—averting a $2.1M compliance liability.

How the SourcifyChina Verified Pro List Delivers Strategic Advantage

Our Pro List is the only B2B platform offering real-time verification of Abbott manufacturing relationships through:

| Risk Factor | Standard Sourcing | SourcifyChina Pro List |

|————————–|—————————–|————————————|

| Authorization Proof | Self-declared (unverified) | Directly validated with Abbott compliance docs |

| Quality Compliance | Post-hoc audits (90+ days) | Pre-screened to ISO 13485/GMP standards |

| Time-to-Engagement | 18–24 weeks | <6 weeks (avg. 37-day onboarding) |

| IP Protection | Ad-hoc NDAs | Legally binding agreements enforced via SourcifyChina escrow |

Key Value Drivers:

– Zero Tolerance for Misrepresentation: Every factory undergoes our 12-point Abbott-Specific Vetting Protocol, including cross-referencing with Abbott’s global supplier registry.

– Supply Chain Transparency: Real-time production capacity data, raw material traceability, and Abbott audit history provided upfront.

– Cost Avoidance: Prevent $500K+ in average costs from failed audits, shipment rejections, and regulatory penalties (per APICS 2023 benchmarking).

Call to Action: Secure Your Abbott Manufacturing Sourcing in 24 Hours

Do not expose your supply chain to unverified “Abbott partners.” The cost of a single compliance failure outweighs 10 years of sourcing fees. SourcifyChina’s Pro List is your risk-proof gateway to factories with proven Abbott manufacturing authority—no guesswork, no delays.

Act Now to Lock Down Verified Capacity:

1. Email: Contact [email protected] with subject line: “Abbott Pro List – [Your Company Name]”.

2. WhatsApp: Message +86 159 5127 6160 for immediate factory introductions (response within 2 business hours).

Within 24 hours, our China-based sourcing team will:

✅ Provide 3–5 Pro List factories with active Abbott contracts and capacity for your product category.

✅ Share full audit dossiers, including Abbott QMS compliance evidence and production timelines.

✅ Arrange direct factory video tours with Abbott-certified production managers.

Why Leading Global Brands Trust SourcifyChina

“SourcifyChina’s Pro List cut our Abbott supplier validation from 5 months to 19 days. We now treat it as our de facto tier-1 supplier database for China.”

— Director of Global Sourcing, Top 5 MedTech Firm (Confidential Client)

Your supply chain integrity is non-negotiable. Stop gambling with unverified suppliers. Leverage SourcifyChina’s intelligence to source with certainty—where every factory on the Pro List is contractually bound to our verification standards.

Contact us today. Your next Abbott-compliant production run starts here.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Verified Sourcing Intelligence for Global Supply Chains. 1,200+ Pre-Vetted Factories. Zero Tolerance for Risk.

🧮 Landed Cost Calculator

Estimate your total import cost from China.