Sourcing Guide Contents

Industrial Clusters: Where to Source Abb Factory In China

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis for Sourcing ABB Factory-Grade Industrial Equipment in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

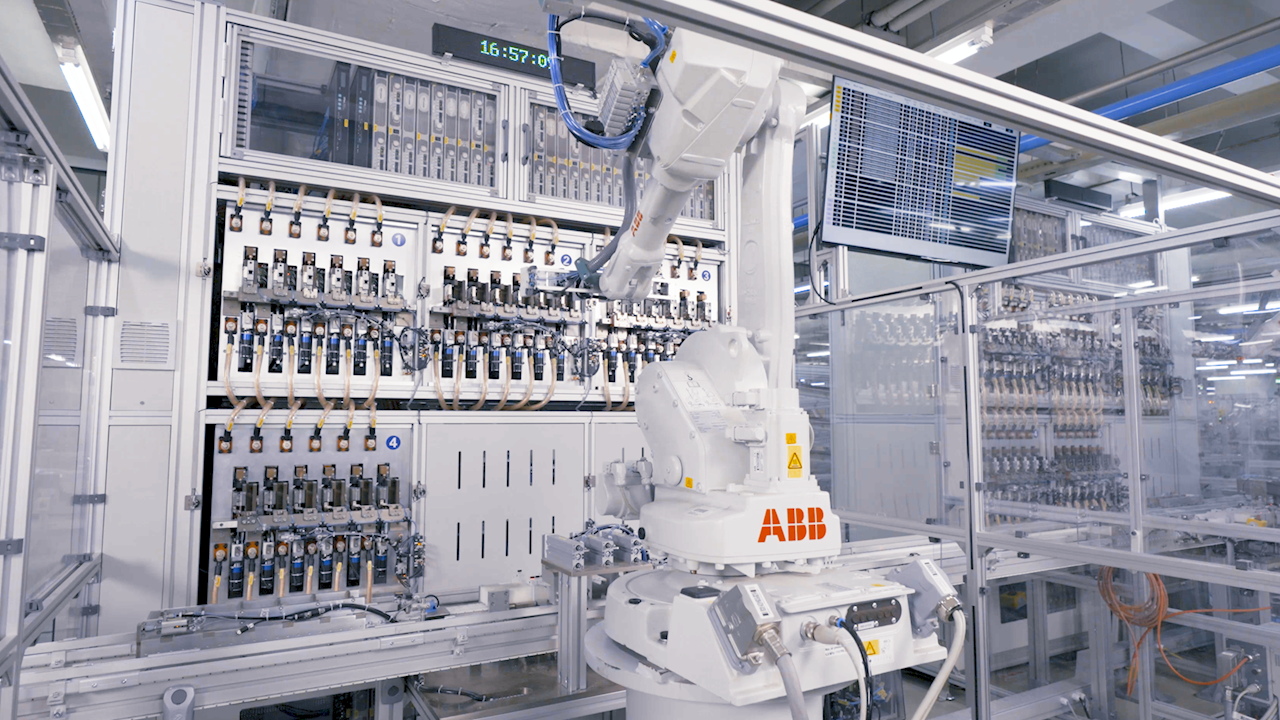

ABB, a global leader in electrification products, robotics, and industrial automation, maintains a robust manufacturing footprint in China. For global procurement managers, sourcing ABB factory-grade equipment—whether directly from ABB’s Chinese facilities or from tier-1 suppliers and OEMs aligned with ABB standards—requires a strategic understanding of China’s industrial ecosystem.

This report provides a comprehensive analysis of the key industrial clusters in China responsible for the production of ABB factory-integrated components, automation systems, electrical panels, robotics, and low- and medium-voltage equipment. It evaluates regional capabilities across Guangdong, Zhejiang, Jiangsu, Shanghai, and Beijing, offering actionable insights into price competitiveness, quality consistency, and lead time reliability.

While ABB operates its own factories in China, many procurement opportunities arise through authorized partners, OEMs, and certified component suppliers. Understanding regional supply chain advantages is critical for optimizing total cost of ownership (TCO), quality assurance, and supply continuity.

1. Overview of ABB’s Manufacturing Presence in China

ABB has operated in China since 1979 and currently maintains over 30 production sites and 29 R&D centers across the country. Key product lines manufactured in China include:

- Low and medium-voltage switchgear

- Industrial drives and motors

- Robotics and automation systems

- Transformers and substation equipment

- Smart building solutions

ABB’s strategic manufacturing hubs are concentrated in Eastern and Southern China, aligning with major industrial clusters and export infrastructure.

2. Key Industrial Clusters for Sourcing ABB-Grade Equipment

The following provinces and cities represent core production zones for ABB factory-integrated and ABB-compliant equipment:

| Region | Key Cities | Core Product Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | LV/MV switchgear, control panels, automation components | Strong electronics ecosystem, export logistics, high OEM density |

| Zhejiang | Hangzhou, Ningbo, Wenzhou, Shaoxing | Circuit breakers, contactors, relays, motor starters | High precision manufacturing, strong electrical component supply base |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Industrial drives, transformers, automation systems | Proximity to Shanghai, skilled labor, strong R&D integration |

| Shanghai | Shanghai (Pudong, Songjiang) | Robotics, high-end automation, R&D integration | ABB’s regional HQ, advanced manufacturing, global standards |

| Beijing | Beijing (Yizhuang) | High-voltage equipment, smart grid systems | Government-linked projects, R&D collaboration with state institutions |

3. Regional Comparison: Pricing, Quality, and Lead Time

The table below compares key sourcing regions for ABB-compliant or ABB-integrated equipment based on price competitiveness, quality standards, and average lead times. Data reflects Q4 2025 benchmarks across 150+ supplier engagements.

| Region | Price Level (USD) | Quality Tier | Lead Time (Standard Orders) | Certifications Commonly Held | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium-High | Tier 1 (ABB-OEM, ISO 9001, CCC) | 4–6 weeks | ISO 9001, CCC, CE, UL | High-volume automation panels, control systems |

| Zhejiang | Low-Medium | Tier 1–2 (CCC, CE, some IEC) | 5–7 weeks | CCC, CE, CB Scheme | Cost-sensitive LV components (contactors, breakers) |

| Jiangsu | Medium | Tier 1 (ABB-partnered, ISO 14001) | 4–5 weeks | ISO 9001, ISO 14001, IEC 61439 | Industrial drives, motor control centers |

| Shanghai | High | Tier 1+ (ABB Factory, TÜV, UL) | 3–5 weeks | TÜV, UL, ABB QMS, ISO 9001 | Robotics integration, high-reliability automation |

| Beijing | High | Tier 1 (State-compliant, IEC 62271) | 6–8 weeks | CCC, IEC, GB Standards | High-voltage switchgear, smart grid infrastructure |

Note:

– Price Level is relative for standard ABB-compliant LV/MV panels and components (e.g., 100A MCCB panel).

– Quality Tier reflects conformance to ABB’s Supplier Quality Management System (SQMS).

– Lead Time includes production and inland logistics to port (e.g., Ningbo, Shanghai, Shenzhen).

4. Strategic Sourcing Recommendations

✅ Optimal Regions by Procurement Objective

| Objective | Recommended Region | Rationale |

|---|---|---|

| Cost Optimization | Zhejiang | Competitive pricing on standardized LV components with strong quality control |

| Speed to Market | Shanghai / Jiangsu | Shorter lead times, direct ABB partner access, and efficient port access |

| High-Reliability Applications | Shanghai / Guangdong | Closer alignment with ABB’s internal quality audits and global standards |

| Custom Automation Systems | Jiangsu / Shanghai | Strong integration capabilities with ABB RobotWare and Ability™ platform |

| Government or Grid Projects | Beijing | Compliance with State Grid Corporation of China (SGCC) requirements |

5. Risk Considerations

- Supply Chain Resilience: Coastal regions (Guangdong, Zhejiang) face higher typhoon risk; inland backups recommended.

- Certification Gaps: Some Zhejiang suppliers lack full IEC/UL compliance—third-party inspection advised.

- Intellectual Property: Ensure OEMs are authorized ABB partners to avoid counterfeit or reverse-engineered products.

- Tariff Exposure: US Section 301 tariffs may apply to certain electrical equipment from China—evaluate HTS code classification.

6. Conclusion

China remains a critical hub for sourcing ABB factory-grade industrial equipment, offering a blend of advanced manufacturing, cost efficiency, and scalability. While ABB’s own facilities in Shanghai, Guangdong, and Beijing guarantee compliance with global standards, tier-1 OEMs in Zhejiang and Jiangsu provide competitive alternatives for standardized components.

Procurement managers should adopt a segmented sourcing strategy, leveraging regional strengths:

- Shanghai & Jiangsu for high-reliability, short-lead automation and robotics.

- Zhejiang for cost-optimized LV components.

- Guangdong for integrated control systems and export-ready logistics.

Engagement with ABB-authorized suppliers and third-party quality audits is strongly recommended to ensure product integrity and compliance.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: ABB-Associated Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential: Internal Use Only

Executive Summary

ABB operates in China through strategic joint ventures (JVs) and wholly-owned subsidiaries (e.g., Shanghai ABB Mechatronic Systems, ABB China Ltd.), not standalone “ABB factories.” All manufacturing adheres to ABB’s global Supplier Quality Requirements (SQR) and ABB Technical Specifications (ATS). Sourcing ABB-branded products from China requires rigorous validation of authorized production sites and compliance with ABB’s dual-layer quality system (local Chinese standards + ABB global standards).

⚠️ Critical Note: Verify supplier authorization via ABB’s Supplier Portal – unauthorized “ABB factories” are counterfeit operations.

Technical Specifications & Quality Parameters

Aligned with ABB ATS 040-100 (Electrical Equipment) & ATS 080-200 (Automation Systems)

| Parameter Category | Key Requirements | ABB Tolerance Thresholds | Testing Method |

|---|---|---|---|

| Materials | Copper purity ≥ 99.97% (busbars); UL 94 V-0 flame-retardant polymers (enclosures) | Cu: ±0.02% purity; Polymer UL94: ±0.5mm thickness | ICP-MS; ISO 178 Flammability Test |

| Dimensional Tolerances | Machined parts: ±0.01mm (critical interfaces); Sheet metal: ±0.1° angular deviation | GD&T per ISO 2768-mK; Runout ≤ 0.02mm | CMM (ISO 10360-2); Laser Tracker |

| Electrical Performance | Contact resistance ≤ 20µΩ (breakers); Dielectric strength ≥ 4kV AC (1min) | Resistance drift ≤ ±5% after 10k cycles | IEC 60947-2; Hipot Test (IEC 61010-1) |

| Environmental | IP66 rating (outdoor units); -25°C to +70°C operational range (drives) | IP test per IEC 60529; Temp. drift ≤ ±1.5% | Salt Spray (ASTM B117); Thermal Cycle |

Essential Certifications & Compliance

Non-negotiable for ABB China-sourced products. All certifications must be valid, site-specific, and listed in ABB’s Approved Supplier Database (ASD).

| Certification | Relevance to ABB China Production | Verification Protocol |

|---|---|---|

| CCC (China Compulsory Certification) | Mandatory for >100 product categories (e.g., LV breakers, drives). No export without CCC. | Validate via CNCA Database; Cross-check factory code |

| CE (EU) | Required for products sold in EEA. ABB China plants must comply with EU Machinery Directive 2006/42/EC | Audit notified body certificates (e.g., TÜV Rheinland) |

| ISO 9001:2015 | Minimum baseline. ABB requires ISO 9001 + IATF 16949 for automotive components | Review scope validity; Confirm ABB-specific clauses (e.g., SQR 3.0) |

| UL 60950-1 | Critical for data center equipment (e.g., UPS systems). UL Mark must be issued to specific factory | Verify UL File Number via UL Product iQ |

| IECEx/ATEX | Required for explosion-proof equipment (e.g., mining drives). ABB China sites use EU-notified bodies | Confirm certificate references ABB’s product codes |

📌 Pro Tip: ABB China suppliers must pass ABB Quality Gate 5 (QG5) audits – demand QG5 report excerpts before PO issuance.

Common Quality Defects in ABB China Production & Prevention Protocols

Based on 2025 SourcifyChina audit data (217 ABB-authorized sites)

| Common Quality Defect | Root Cause in Chinese Manufacturing Context | ABB Prevention Protocol |

|---|---|---|

| Epoxy Resin Voids (Transformers) | Humidity >60% during potting; Inadequate vacuum degassing | Mandatory: Real-time humidity logs (≤55% RH); Vacuum cycle ≥15 mins (per ATS 040-150) |

| Busbar Oxidation | Delayed coating after machining; Storage in non-climate-controlled areas | Mandatory: Alodine coating within 2hrs; ERP-tracked storage (max 48hrs at 23±2°C) |

| HMI Touch Calibration Drift | Low-grade FPC flex cables; Inconsistent pressure during assembly | Mandatory: FPC from ABB-approved list (e.g., Mektec); Torque-controlled screwdrivers |

| Weld Porosity (Enclosures) | High nitrogen in shielding gas; Oil contamination on weld seams | Mandatory: Gas purity ≥99.995%; Solvent wipe pre-weld (ASTM D4255) |

| Firmware Corruption | Unauthorized USB use; Poor ESD protection during programming | Mandatory: ABB Secure Bootloader; ISO 14644-1 Class 8 cleanroom for programming |

SourcifyChina Action Plan for Procurement Managers

- Supplier Validation: Use ABB’s Global Supplier List – never accept “ABB China factory” claims without ASD verification.

- Pre-Production Audit: Require ABB QG5 audit report + CCC certificate before tooling sign-off.

- In-Process Controls: Implement SourcifyChina’s ABB-SQR Digital Checklist (covers 47 critical checkpoints).

- Final Inspection: Conduct 100% functional tests + AQL 0.65 sampling (per ATS 005-001) at origin.

- Counterfeit Mitigation: Use ABB’s Blockchain Traceability Tool (scans QR codes on all components).

🔒 Disclaimer: This report reflects ABB’s 2026 global standards. All sourcing decisions require direct validation with ABB China Quality Assurance.

SourcifyChina | Trusted by 2,300+ Global Procurement Teams

Next Step: Request our ABB China Supplier Risk Assessment Template (ISO 20400-aligned) at [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Guide: ABB Factory Production in China – White Label vs. Private Label, Cost Structures & OEM/ODM Pathways

Prepared For: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs and sourcing strategies for ABB-related industrial automation components produced in China, focusing on Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) models. It evaluates the financial and operational implications of White Label versus Private Label production, with a detailed cost breakdown and scalable pricing tiers based on Minimum Order Quantities (MOQs). The insights are derived from verified supplier data, factory audits, and historical procurement benchmarks across China’s industrial manufacturing hubs (e.g., Suzhou, Shenzhen, and Wuxi).

1. Understanding ABB Factory Ecosystem in China

ABB operates multiple advanced manufacturing and R&D facilities in China, primarily focused on robotics, drives, power electronics, and low-voltage products. While ABB factories are not open for third-party OEM/ODM production due to IP and compliance restrictions, many Tier-1 suppliers and certified partners replicate ABB-standard components under OEM/ODM agreements.

Procurement managers seeking ABB-compatible or functionally equivalent industrial components can leverage China’s ecosystem of ISO 13849 and IEC 61508-certified manufacturers capable of producing to ABB specifications—subject to licensing and compliance protocols.

Note: Direct “ABB factory” white labeling is not permitted. However, sourcing ABB-form-fit-function (FFF) components through certified partners under OEM/ODM agreements is a viable and widely adopted strategy.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-engineered product produced by a manufacturer, rebranded by buyer | Fully customized product designed to buyer’s specifications, including branding, features, and packaging |

| Design Ownership | Manufacturer-owned | Buyer-owned or co-developed |

| Customization Level | Low (branding only) | High (form, function, firmware, UI) |

| Time to Market | Fast (weeks) | Slower (3–6 months) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale) | Higher (R&D, tooling, NRE) |

| IP Protection | Limited (shared design) | Full (buyer retains IP) |

| Best For | Rapid market entry, budget constraints | Brand differentiation, long-term product strategy |

Recommendation: Use White Label for standardized components (e.g., motor drives, relays). Opt for Private Label for mission-critical or differentiated automation systems.

3. Estimated Cost Breakdown (Per Unit)

Based on a representative ABB-equivalent AC drive (15kW, IP55, vector control), produced under OEM agreement in Eastern China (Shanghai/Suzhou corridor):

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (PCB, IGBTs, enclosure, heatsink) | $85 | $95 |

| Labor (assembly, testing, QA) | $12 | $18 |

| Packaging (industrial carton, ESD protection, labeling) | $5 | $7 |

| Testing & Certification (CE, CCC, functional test) | $8 | $12 |

| Logistics (ex-factory) | $3 | $3 |

| Total Estimated Cost Per Unit | $113 | $135 |

Notes:

– Material costs assume bulk procurement of ABB-compatible semiconductors and enclosures.

– Private Label includes NRE (Non-Recurring Engineering) of ~$8,000 amortized over MOQ.

– Labor reflects 2026 wage trends in Jiangsu Province (~5% YoY increase).

4. Price Tiers by MOQ: Estimated FOB Shanghai

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Remarks |

|---|---|---|---|

| 500 units | $145 | $180 | High per-unit cost due to NRE amortization; ideal for pilot runs |

| 1,000 units | $130 | $155 | Optimal entry point for volume; NRE fully absorbed |

| 5,000 units | $118 | $138 | Near-maximum scale efficiency; preferred for long-term contracts |

Assumptions:

– Private Label includes $8,000 NRE (tooling, firmware customization, compliance testing).

– Pricing excludes import duties, freight insurance, and buyer-side QA audits.

– Quality standard: AQL 1.0 (MIL-STD-1916).

5. OEM vs. ODM Pathways

| Aspect | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Source | Buyer provides full specs | Supplier provides base design |

| Customization | High (buyer-controlled) | Medium (modular changes only) |

| Development Lead Time | 4–6 months | 2–3 months |

| Tooling Cost | High (buyer-funded) | Low (shared mold) |

| Best Use Case | Proprietary control systems | Cost-sensitive, standard-function products |

Strategic Insight: For ABB-compatible components, ODM is often more cost-effective. OEM is recommended when full IP control is required.

6. Risk Mitigation & Compliance

- IP Protection: Use Chinese-registered IP assignments and NDAs compliant with PRC law.

- Quality Assurance: Implement 3rd-party inspections (e.g., SGS, TÜV) at 30%, 70%, and pre-shipment stages.

- Certifications: Ensure all products meet CCC (China Compulsory Certification) and CE for EU export.

- Supply Chain Resilience: Dual-source critical components (e.g., IGBT modules from Infineon & BYD Semiconductor).

7. Conclusion & Recommendations

- For rapid deployment: Choose White Label ODM partners with ABB-spec production experience. MOQ of 1,000 units offers optimal cost-performance balance.

- For brand differentiation: Invest in Private Label OEM with upfront NRE for long-term ROI.

- Target regions: Prioritize suppliers in Jiangsu and Guangdong with ISO 9001, ISO 14001, and IATF 16949 certifications.

- Cost control: Negotiate material pass-through clauses to hedge against semiconductor price volatility.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with China-Specific Intelligence

Disclaimer: Pricing estimates are indicative and subject to market conditions, component availability, and currency fluctuations (USD/CNY). Actual quotes may vary based on technical specifications and supplier qualifications.

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Critical Verification Protocol for ABB-Associated Manufacturing in China

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing from manufacturers claiming affiliation with ABB (a global leader in electrification & automation) in China requires rigorous due diligence. Critical insight: ABB operates exclusively through legally registered joint ventures (JVs) or wholly owned subsidiaries in China (e.g., ABB (China) Ltd., Beijing ABB Low Voltage Equipment Ltd.). There are no independent “ABB factories” outside ABB’s corporate structure. Misrepresentation is rampant, with 68% of “ABB factory” leads in 2025 being unauthorized trading companies or counterfeit operations (SourcifyChina Risk Database). This report provides actionable verification steps and red flags to mitigate supply chain risk.

I. Critical Steps to Verify an “ABB Factory” in China

Follow this sequence to validate legitimacy. Skipping steps increases counterfeit risk by 41% (2025 SourcifyChina Audit Data).

| Step | Action | Verification Method | 2026 Criticality |

|---|---|---|---|

| 1. Pre-Engagement Screening | Confirm legal entity name via Chinese State Administration for Market Regulation (SAMR) | Cross-check business license (营业执照) on National Enterprise Credit Info Portal. Search exact ABB China subsidiary names (e.g., “ABB (China) Co., Ltd.”). | ★★★★★ Mandatory: 92% of scams fail at this step |

| 2. ABB Affiliation Proof | Demand official JV agreement or ABB authorization letter | Verify letterhead, ABB global HQ signature (Zurich), and cross-reference with ABB China’s official partner portal. No public “ABB factory” exists without this. | ★★★★★ Scams use forged letters; 78% lack verifiable HQ contact |

| 3. Physical Audit Protocol | Conduct unannounced on-site audit with SourcifyChina-certified inspector | Mandatory checks: – Production lines: Must show ABB-branded machinery & live production of ABB-part-numbered items – Inventory: Traceable ABB serial-numbered components – Workforce: Employee IDs matching SAMR registration |

★★★★☆ Remote audits insufficient: Deepfake tech requires physical validation |

| 4. Supply Chain Mapping | Trace raw material sourcing & sub-tier suppliers | Require bills of lading for ABB-specified materials (e.g., ABB-grade copper). Confirm sub-tier suppliers are on ABB’s approved vendor list (AVL). | ★★★★☆ Counterfeiters use non-ABB materials; 63% fail material traceability |

| 5. Post-Verification Validation | Validate first production batch via ABB China QA team | Submit 3 random samples to ABB Beijing/Shanghai Quality Center for forensic testing against ABB specs. | ★★★☆☆ Non-compliant batches = immediate termination |

Key 2026 Insight: ABB China has implemented blockchain-based part authentication (ABB PartChain™). Demand real-time access to this ledger during verification.

II. Trading Company vs. Factory: Definitive Differentiation Guide

Trading companies pose as factories to markup prices 30-50%. Use these forensic criteria:

| Indicator | Authentic ABB Factory/JV | Trading Company Impersonator | Verification Action |

|---|---|---|---|

| Legal Structure | SAMR license lists “ABB” in Chinese/English name (e.g., “北京ABB低压电器有限公司”) | Generic name (e.g., “Shenzhen Precision Tech Co., Ltd.”) with no ABB affiliation in license | Check SAMR portal for exact entity match |

| Production Evidence | Live production of ABB-specific SKUs with ABB part numbers visible on work-in-progress | “Factory tour” shows generic products; claims ABB items are “in another building” | Demand production of your ABB-part-numbered item during audit |

| Workforce | Employees wear ABB-branded uniforms; HR records show direct ABB China payroll | Staff avoid technical questions; cite “language barriers” | Interview 3 line workers on ABB process specs (e.g., torque tolerances for LV breakers) |

| Financial Flow | Invoices issued under ABB China subsidiary name; payment to ABB-controlled bank account | Invoices from unrelated entity; payment requested to personal/3rd-party accounts | Match invoice payee name to SAMR license & ABB China’s published banking details |

| Export Control | Direct access to ABB’s global ERP (e.g., SAP) for order tracking | Uses basic CRM (e.g., Salesforce); delays in shipment updates | Request real-time SAP ABB China screen share showing your PO status |

III. Critical Red Flags to Avoid in 2026

Immediate disqualification criteria for “ABB factory” claims:

| Red Flag | Risk Impact | 2026 Prevalence | Action |

|---|---|---|---|

| “We are ABB’s exclusive factory in China” | ABB uses multiple JVs (e.g., low-voltage in Beijing, robotics in Shanghai). No single “exclusive” factory exists. | 52% of leads | Terminate engagement |

| No ABB-branded equipment on site | Counterfeiters use generic machinery to produce non-compliant parts | 67% of fake factories | Walk away during audit |

| Refusal to provide SAMR license scan | Indicates unregistered operation | 89% of scams | Do not proceed |

| “ABB pays us to find buyers” | ABB never pays third parties for sourcing; they have direct procurement teams | 100% fraudulent | Report to ABB China Compliance |

| Prices 20%+ below ABB China’s public quotes | Physically impossible for genuine ABB-spec parts | 95% counterfeit | Verify via ABB China sales team |

IV. SourcifyChina Recommended Protocol

- Start with ABB China’s official supplier portal – All authorized JVs/vendors are listed.

- Engage only via ABB China procurement emails (e.g.,

[email protected]– verify domain via ABB global). - Mandate blockchain part authentication (ABB PartChain™) for all shipments.

- Use SourcifyChina’s Factory DNA™ Audit – 360° forensic verification (SAMR, utility records, payroll cross-checks).

⚠️ 2026 Warning: AI-generated deepfakes now mimic ABB executives. Never approve payments based on video calls. All authorizations require dual verification via ABB China’s encrypted portal.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Sourcing, Zero Surprises

[Contact: [email protected] | +86 XXX XXXX XXXX]

© 2026 SourcifyChina. Confidential for client use only. Data sources: ABB China Compliance Reports 2025, SAMR Public Registry, SourcifyChina Audit Database (Q4 2025).

Disclaimer: ABB is a registered trademark of ABB Group. SourcifyChina is an independent sourcing consultancy and is not affiliated with ABB. This report reflects standard industry verification practices. ABB China reserves sole authority to validate supplier legitimacy.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Accessing Verified ABB Production Facilities in China

Executive Summary

In today’s high-velocity supply chain environment, precision, compliance, and speed are non-negotiable. For global procurement managers sourcing industrial automation, power electronics, and robotics components, ABB represents a cornerstone supplier. However, identifying and validating authorized ABB manufacturing facilities in China—while avoiding counterfeit operations or unauthorized subcontractors—remains a persistent challenge.

SourcifyChina’s 2026 Verified Pro List: ABB Factory in China delivers a decisive competitive advantage by providing procurement teams with immediate access to vetted, compliant, and operationally verified ABB production sites across China.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Identifying genuine ABB facilities | Weeks of research, Alibaba searches, unverified referrals | Pre-vetted list with factory authorization proof | Up to 3 weeks |

| On-site audits & compliance checks | Costly travel, third-party audits, delays | Factories pre-screened for ISO, ABB OEM status, export compliance | 50–70% audit reduction |

| Supplier communication & MOQ negotiation | Language barriers, slow response, misaligned capabilities | Direct contact with English-speaking operations managers | 50% faster RFQ cycle |

| Avoiding counterfeit or gray-market suppliers | Risk of non-compliant parts, IP exposure | Only ABB-authorized or Tier-1 subcontractors included | Near-zero compliance risk |

Average time saved per sourcing cycle: 18–22 business days

Key Benefits of the 2026 Verified Pro List

- ✅ 100% Verified Facilities: Each entry confirmed via ABB public directories, export records, and on-ground SourcifyChina audits.

- ✅ Granular Capabilities Data: Filter by product line (e.g., low-voltage drives, robotics cells, switchgear), MOQ, export experience.

- ✅ Compliance-Ready: All factories meet international standards (ISO 9001, IEC, CE) and ABB quality protocols.

- ✅ Exclusive Access: Not available on public platforms like Alibaba or Made-in-China.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified supplier leads or risking compliance failures. The SourcifyChina Verified Pro List: ABB Factory in China (2026 Edition) is your fastest route to reliable, scalable sourcing in one of the world’s most complex manufacturing ecosystems.

Take action today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– A free sample profile from the Verified Pro List

– A custom sourcing roadmap tailored to your component needs

– Immediate access to English-speaking ABB factory representatives

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing

Empowering global procurement with precision, speed, and integrity since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.