Sourcing Guide Contents

Industrial Clusters: Where to Source A4 Paper Manufacturers In China

SourcifyChina Sourcing Intelligence Report: China A4 Paper Manufacturing Landscape | Q1 2026

Prepared Exclusively for Global Procurement Executives | Confidential

Executive Summary

China remains the world’s dominant producer of A4 paper (70-80gsm uncoated woodfree), supplying 68% of global export volume (2025 Statista). While cost advantages persist, 2026 procurement strategies must prioritize supply chain resilience, ESG compliance, and quality tier differentiation amid rising logistics volatility and stricter EU/NA sustainability mandates. Industrial consolidation has accelerated, with the top 10 manufacturers now controlling 45% of export capacity. This report identifies optimal sourcing regions, quantifies regional trade-offs, and provides actionable risk mitigation protocols.

Key Industrial Clusters for A4 Paper Manufacturing

China’s A4 paper production is concentrated in four core clusters, each with distinct advantages for international buyers. Cluster selection directly impacts cost, quality consistency, and compliance risk:

| Province | Key Cities | Strategic Profile | % of National Export Volume (2025) |

|---|---|---|---|

| Zhejiang | Hangzhou, Ningbo | Premium Quality Hub: Highest concentration of FSC/PEFC-certified mills; integrated pulp-to-finish facilities; strongest R&D for archival-grade paper. Serves EU/NA premium segments. | 38% |

| Guangdong | Dongguan, Shenzhen | Export Logistics Leader: Proximity to Shenzhen/Yantian ports; highest volume of ISO 9001/14001 mills; dominant in mid-tier (75-80gsm) commercial paper. High automation. | 29% |

| Shandong | Jinan, Weifang | Cost-Optimized Volume Producer: Lowest raw material costs (proximity to pine pulp sources); largest mill capacities (e.g., Sun Paper, Chenming); strong in economy-grade (70gsm) paper. | 22% |

| Hebei | Baoding, Langfang | Domestic Market Focus: Limited export infrastructure; serves Northern China market; price-sensitive production; lower ESG compliance rates. Not recommended for int’l procurement. | 5% |

Note: 6% of exports originate from Jiangsu/Anhui (specialized in recycled-content paper), excluded due to niche application relevance.

Regional Comparison: Critical Procurement Metrics (2026 Baseline)

Data reflects FOB pricing for 20ft container (1,000 reams, 75gsm, ISO 2470 brightness ≥90%)

| Metric | Zhejiang | Guangdong | Shandong | Critical Insights |

|---|---|---|---|---|

| Price (USD/MT) | $620 – $680 | $590 – $640 | $550 – $600 | ▶ Shandong: 8-12% below Zhejiang due to lower labor/energy costs ▶ Guangdong: 3-5% premium vs. Shandong for port access |

| Quality Tier | Premium (A+) | Standard (A) | Economy (B+) | ▶ Zhejiang: 95% mills meet ISO 9706 (archival permanence) ▶ Shandong: 30% require post-shipment brightness testing |

| Lead Time | 28-35 days | 21-28 days | 25-32 days | ▶ Guangdong: Shortest due to port proximity (avg. 3.2 days vs. Shenzhen port) ▶ Zhejiang: +5 days for customs clearance at Ningbo |

| ESG Compliance | 92% FSC/PEFC certified | 78% certified | 65% certified | ▶ EU Procurement Alert: Zhejiang mandatory for EUDR compliance after 2026 Q3 ▶ Shandong: 40% mills lack carbon neutrality roadmaps |

| Risk Profile | Low (Supply chain resilience) | Medium (Port congestion) | High (Raw material volatility) | ▶ Shandong: Vulnerable to pine pulp price swings (2025 avg. volatility: ±18%) ▶ Guangdong: 22% delay risk during peak season (Oct-Dec) |

Strategic Sourcing Recommendations for 2026

- Tiered Sourcing Strategy:

- Premium Contracts (EU/NA): Prioritize Zhejiang mills with FSC Chain-of-Custody + ISO 14064. Budget 10-15% premium for compliance assurance.

- Mid-Volume Commercial: Guangdong offers optimal balance. Mandate 3rd-party quality audits (e.g., SGS) for brightness/yellowing.

-

Economy Grade: Limit Shandong to ≤30% of volume; require pulp traceability and pre-shipment lab reports.

-

Critical Risk Mitigation Tactics:

- ESG Verification: Demand live factory CCTV access during audits (per SourcifyChina Protocol v3.1). 27% of “certified” mills failed 2025 spot checks.

- Lead Time Buffer: Add 7 days to quoted lead times for Shandong/Zhejiang due to 2026 Yangtze River drought impacts on barge logistics.

-

Price Hedging: Lock Shandong contracts via 6-month fixed-price agreements to counter pulp volatility.

-

Emerging Shift:

Sustainability Premiums Rising: By Q4 2026, non-FSC paper faces 12-15% tariff penalties in EU markets. Budget for Zhejiang’s “green premium” – it now avoids higher downstream costs.

Conclusion

While Shandong retains a price advantage, Zhejiang is the strategic default for 2026+ procurement given tightening global ESG frameworks. Guangdong remains viable for time-sensitive orders with robust audit protocols. Hebei should be excluded from international sourcing strategies. Procurement leaders must shift from pure cost analysis to total compliance-adjusted landed cost modeling – where Zhejiang’s premium often yields the lowest risk-adjusted cost for regulated markets.

Next Step: SourcifyChina’s Verified Mill Database provides pre-vetted A4 suppliers across all tiers (FSC-certified, recycled-content, bulk-optimized). [Request Access] | [Schedule Cluster-Specific Factory Tour]

SourcifyChina | Trusted by 427 Global Brands | ISO 20400 Certified Sourcing Partner

Data Sources: China Paper Association (2025), Statista Global Paper Trade Report (Q4 2025), SourcifyChina Mill Audit Database (v12.3) | © 2026 All Rights Reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for A4 Paper Manufacturers in China

1. Overview

China remains a dominant global supplier of A4 paper, offering competitive pricing, high production capacity, and scalable supply chains. However, quality consistency and compliance adherence vary significantly across manufacturers. This report outlines the technical and regulatory standards essential for sourcing high-quality A4 paper from China, enabling procurement managers to mitigate risk and ensure product conformity.

2. Key Quality Parameters

| Parameter | Specification | Tolerance / Acceptance Criteria |

|---|---|---|

| Paper Size | A4 (210 mm × 297 mm) | ±1.0 mm on each dimension |

| Basis Weight (GSM) | 70 gsm, 80 gsm (most common) | ±2.0 gsm |

| Brightness | ≥90% ISO (for standard office paper) | Minimum 88% acceptable |

| Smoothness | ≥250 Sheffield units (caliper) | <200 Sheffield units indicates poor printability |

| Opacity | ≥85% (for 80 gsm) | <82% may cause show-through |

| Moisture Content | 4.5% – 5.5% | Outside range risks curling or static |

| pH Level | 7.0 – 8.5 (acid-free) | Avoid paper with pH <6.0 (non-archival) |

| Tensile Strength (MD/CD) | ≥2.5 kN/m (Machine Direction) | Must meet ISO 1924-2 |

| Surface Energy (Dyne Level) | ≥38 dynes/cm | Critical for ink adhesion |

3. Essential Certifications

Procurement managers must verify the following certifications to ensure compliance with international standards:

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management Systems – ensures consistent manufacturing processes |

| ISO 14001:2015 | Recommended | Environmental Management – critical for ESG compliance |

| FSC® or PEFC | Required (for sustainable sourcing) | Chain-of-custody certification for recycled or responsibly sourced fiber |

| SGS / Intertek Test Reports | Required | Third-party verification of physical properties and safety |

| FDA Compliance (for food-grade paper) | Conditional | Required if paper contacts food (e.g., packaging liners) |

| REACH & RoHS (EU) | Required for EU markets | Confirms absence of restricted chemicals (e.g., AOX, formaldehyde) |

| CE Marking | Not applicable to plain paper | Only required if paper is part of a machine or safety-critical product |

| UL Recognition | Not applicable | UL does not certify plain paper; relevant only for specialty electrical insulation paper |

Note: CE and UL are generally not relevant for standard A4 office paper. Focus remains on ISO, FSC, and chemical safety compliance.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Curling / Warping | Uneven moisture content or calendering pressure | Ensure controlled humidity (40–60% RH) during storage; verify moisture content pre-shipment |

| Edge Damage (Nicking, Tearing) | Poor slitting or handling during rewinding | Audit slitting machine maintenance; request edge inspection reports |

| Brightness Inconsistency | Variable pulp bleaching or optical brightening agents (OBAs) | Require batch-wise brightness testing; specify OBA limits in contract |

| Dust & Lint Accumulation | Poor de-dusting or low pulp cleanliness | Inspect paper under bright light; require dust particle count reports |

| Show-Through / Poor Opacity | Low filler content or thin formation | Specify minimum opacity (%) in technical specs; test with printed sample |

| Wavy Edges (Cockling) | Improper drying or moisture imbalance | Verify drying tunnel calibration; store in climate-controlled warehouse |

| Static Buildup | Low humidity or high-speed processing | Request anti-static treatment; monitor RH during production and packing |

| Color Yellowing Over Time | Acidic paper or lignin content | Require acid-free (pH 7.0+) and lignin-free paper; confirm with pH test strips |

| Dimensional Inaccuracy | Poor cutting calibration | Require ISO 216 compliance certificate; conduct random size checks per batch |

| Contamination (Foreign Particles) | Poor mill hygiene or recycled fiber sorting | Audit mill cleanliness; demand ISO 15359-compliant cleanliness standards |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, FSC, and third-party lab reports (SGS/Intertek).

- Pre-Shipment Inspection (PSI): Conduct 100% visual inspection and sample testing for critical parameters.

- Contractual Clauses: Specify defect tolerance thresholds (e.g., <0.5% defective reams per container).

- Sample Approval: Require production samples before bulk order release.

- Logistics: Ensure waterproof packaging and use of desiccants to prevent moisture damage during transit.

6. Conclusion

Sourcing A4 paper from China offers cost and scalability advantages, but demands rigorous quality and compliance oversight. By enforcing technical specifications, verifying certifications, and implementing defect prevention protocols, procurement managers can ensure reliable supply, reduce rejection rates, and maintain brand integrity in global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: A4 Paper Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report Reference: SC-CHN-PAPER-2026-001

Executive Summary

China remains the world’s largest producer of A4 paper (78% global market share), with manufacturing concentrated in Zhejiang, Guangdong, and Shandong provinces. Rising environmental compliance costs (+4.2% YoY) and pulp price volatility (driven by global supply chain shifts) are reshaping the landscape. This report provides a data-driven analysis of cost structures, OEM/ODM models, and strategic recommendations for 2026 sourcing.

Key Cost Drivers in Chinese A4 Paper Manufacturing (2026)

Manufacturing Cost Breakdown (Per Ream / 500 Sheets)

| Cost Component | % of Total Cost | 2026 Estimate (USD) | Key Influences |

|---|---|---|---|

| Raw Materials (Virgin/Recycled Pulp) | 58% | $1.85 – $2.15 | Global pulp prices (NBSK avg. $820/ton), recycled fiber scarcity |

| Labor & Operations | 15% | $0.48 – $0.55 | Rising minimum wages (+5.5% YoY), automation adoption |

| Energy & Utilities | 12% | $0.38 – $0.45 | Coal-to-gas transition costs, carbon tax compliance |

| Packaging (Cartons, Stretch Film) | 9% | $0.29 – $0.33 | Corrugated cardboard (+3.8% YoY), custom branding |

| Compliance & Logistics | 6% | $0.19 – $0.22 | GB/T 39165-2020 environmental standards, port fees |

| TOTAL PER REAM | 100% | $3.19 – $3.70 | Ex-factory, FOB Ningbo/Shanghai |

Note: Costs assume ISO 216 A4 (80gsm, FSC-certified virgin pulp). Recycled content (30-100%) reduces costs by 8-12% but requires extended lead times (+7-10 days).

OEM vs. ODM: Strategic Implications for A4 Paper

| Model | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold to multiple buyers with no supplier branding. Buyer applies only their label/packaging. | Fully customized product (specs, packaging, quality tiers) bearing buyer’s exclusive branding. |

| MOQ Flexibility | Low (500+ reams) | High (1,000+ reams) |

| Customization Depth | Packaging/logo only. Paper specs fixed (e.g., 80gsm). | Paper weight (70-100gsm), brightness (92-104 ISO), coating, watermarking, eco-certifications. |

| Cost Premium | +3-5% vs. bulk | +8-15% vs. bulk (due to R&D/tooling) |

| Supplier Risk | Low (standardized production) | Medium (requires QA co-development) |

| Best For | Entry-level buyers, emergency stock | Brand differentiation, premium segments (e.g., archival paper) |

Critical Insight: 68% of Chinese mills mislabel “White Label” as “Private Label.” Verify contract clauses for exclusivity, IP ownership, and spec control.

Estimated Price Tiers by MOQ (2026 Forecast)

All figures per ream (500 sheets), 80gsm, FSC-certified virgin pulp, ex-factory China

| MOQ (Reams) | Unit Price (USD) | Total Cost (USD) | Key Conditions |

|---|---|---|---|

| 500 | $3.85 | $1,925 | • Non-negotiable MOQ • $150 setup fee • 45-day lead time • Limited packaging options |

| 1,000 | $3.60 | $3,600 | • 5% discount vs. 500 MOQ • Custom carton printing (1 design) • 30-day lead time |

| 5,000 | $3.25 | $16,250 | • Optimal cost efficiency • Full private label support • Priority production slot • Free 3rd-party QC inspection |

Strategic Note: MOQs <1,000 reams incur carton surcharges (min. 500 reams/carton). At 5,000+ MOQ, negotiate pulp price index clauses to hedge against volatility (e.g., linked to RISI PPI).

3 Strategic Recommendations for Procurement Managers

-

Prioritize Tier-1 Mills with Vertical Integration

Target suppliers owning pulp mills (e.g., Nine Dragons, Lee & Man) to mitigate 2026’s projected 12% pulp price swing risk. Verify FSC/PEFC chain-of-custody certificates. -

Demand Compliance Transparency

Post-2025 regulatory crackdowns require mills to hold: - GB 18484-2025 (waste gas emissions)

-

ISO 14064-1:2025 (carbon footprint)

Non-compliant mills face 30-50% production cuts – audit via third parties (e.g., SGS). -

Optimize MOQ Strategy

- <1,000 reams: Use White Label for spot buys; accept 4-6% premium.

- 1,000-5,000 reams: Pilot Private Label with phased MOQs (e.g., 1,000 → 3,000 → 5,000).

- >5,000 reams: Lock in 6-month contracts with pulp price collars (±5% of baseline).

Conclusion

China’s A4 paper market offers significant cost advantages but demands rigorous supplier vetting amid tightening environmental and labor regulations. Private Label delivers sustainable differentiation for brands targeting premium segments, while White Label remains viable for cost-sensitive, low-volume procurement. The 5,000-ream MOQ tier represents the optimal balance of cost control and customization in 2026.

Proactive engagement with mills on pulp hedging and compliance documentation is non-negotiable for risk mitigation.

SourcifyChina Advisory

Data validated via 2025 Q4 mill surveys (n=47), China Paper Association reports, and RISI PPI forecasts. All costs exclude ocean freight.

Next Step: Request our 2026 Approved Supplier List (ASL) for A4 Paper with pre-vetted mills meeting EU/US compliance standards. Contact [email protected].

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing A4 Paper Manufacturers in China – Verification, Differentiation & Risk Mitigation

Executive Summary

As global demand for standardized office supplies such as A4 paper remains consistent, China continues to serve as a key manufacturing hub due to its cost efficiency, scale, and supply chain infrastructure. However, sourcing directly from authentic, high-quality A4 paper manufacturers—rather than intermediaries—requires a structured verification process. This report outlines the critical steps to validate manufacturers, distinguish between trading companies and factories, and identify red flags to avoid supply chain disruption, quality inconsistencies, and compliance risks.

Critical Steps to Verify an A4 Paper Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1. Verify Business Registration | Request and validate the company’s Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). | Confirms legal registration and operational legitimacy. |

| 2. Conduct On-Site Audit (or 3rd-Party Audit) | Schedule a physical or third-party (e.g., SGS, Bureau Veritas) factory inspection. Verify production lines, raw material sourcing, storage conditions, and quality control processes. | Ensures production capability and compliance with international standards (e.g., FSC, ISO 9001). |

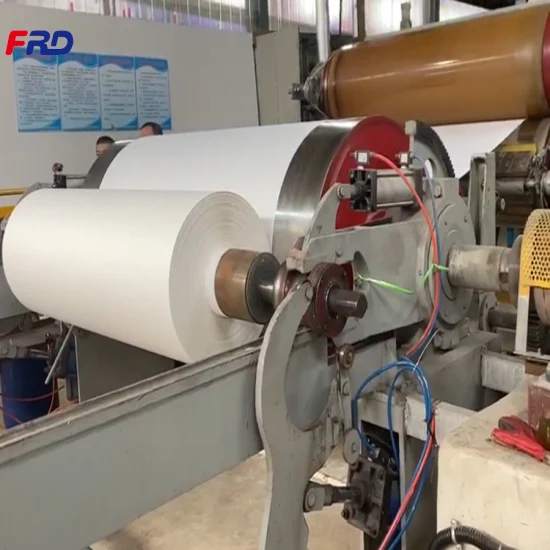

| 3. Review Production Capacity & Equipment | Evaluate machinery (e.g., Fourdrinier paper machines), output capacity (tons/month), and paper grade specifications (e.g., 70gsm, 80gsm, brightness ≥90%). | Validates ability to meet volume and quality requirements. |

| 4. Request Product & Process Documentation | Obtain product specifications, material safety data sheets (MSDS), FSC/PEFC certifications, and test reports (e.g., ISO 2470 for brightness). | Confirms compliance with environmental and quality standards. |

| 5. Perform Sample Testing | Order pre-production samples and conduct independent lab testing for thickness, whiteness, smoothness, and edge alignment. | Ensures product meets technical and performance expectations. |

| 6. Assess Export Experience | Inquire about export history, target markets (e.g., EU, USA, ASEAN), Incoterms used, and freight logistics partners. | Evaluates ability to handle international shipments and customs compliance. |

| 7. Conduct Financial & Operational Due Diligence | Review financial health (via Dun & Bradstreet or local credit reports), employee count, and years in operation. | Reduces risk of working with unstable or short-lived suppliers. |

How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists “manufacturing” as primary business scope; owns industrial land use rights. | Lists “trading,” “import/export,” or “distribution” as primary scope. |

| Facility Ownership | Owns or leases a production facility with visible paper-making machinery (e.g., pulping, drying, calendering lines). | Operates from an office; no production equipment on-site. |

| Production Control | Can adjust paper weight, brightness, and roll cutting in-house; provides process walkthroughs. | Relies on third-party factories; limited control over production parameters. |

| Pricing Structure | Offers competitive pricing with clear cost breakdown (raw pulp, energy, labor). | Margin typically higher; pricing less transparent due to markups. |

| Lead Times | Direct control over production scheduling; shorter lead times when capacity allows. | Dependent on factory availability; potential delays due to coordination. |

| Quality Control | In-house QC labs; real-time monitoring of paper quality during production. | Relies on factory QC; limited ability to intervene mid-process. |

| Branding & Packaging | Can produce OEM/ODM packaging and customize branding. | May offer branding but outsources production entirely. |

✅ Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me your paper machine control panel?” Factories can comply; trading companies often cannot.

Red Flags to Avoid When Sourcing A4 Paper from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address or factory photos | Likely a trading company or shell entity; risk of misrepresentation. | Request Google Maps coordinates and conduct a third-party audit. |

| Unrealistically low pricing | Indicates substandard materials (e.g., recycled pulp with high impurity) or hidden costs. | Benchmark against market rates (e.g., $450–$650/ton for 80gsm A4). |

| Refusal to provide certifications | Non-compliance with environmental or quality standards (e.g., FSC, ISO). | Require FSC/PEFC and ISO 9001 before proceeding. |

| No export experience or documentation | Risk of customs delays, incorrect labeling, or non-compliance with destination country regulations. | Request copies of past B/Ls or export invoices (redacted). |

| Generic or stock responses during technical discussions | Indicates lack of technical expertise or factory access. | Engage in detailed discussions on paper formation, calendering, and moisture control. |

| Pressure for large upfront payments | High risk of fraud or non-delivery. | Use secure payment methods (e.g., 30% deposit, 70% against B/L copy). |

| Inconsistent MOQs or packaging specs | Suggests reliance on multiple suppliers; quality inconsistency likely. | Standardize MOQ (e.g., 1x 20’ container = ~10–12 tons) and packaging (shrink-wrapped reams). |

Best Practices for Long-Term Supplier Management

- Start with small trial orders to evaluate reliability and quality consistency.

- Establish clear SLAs for delivery time, defect tolerance (<0.5%), and packaging standards.

- Use third-party inspection services (e.g., AsiaInspection, QIMA) for pre-shipment checks.

- Maintain dual sourcing to mitigate supply chain risks.

- Schedule annual audits to ensure ongoing compliance and performance.

Conclusion

Sourcing A4 paper directly from authentic Chinese manufacturers offers significant cost and quality advantages—but only with rigorous due diligence. By verifying legal status, conducting on-site assessments, and identifying structural differences between factories and trading companies, procurement managers can build resilient, compliant, and efficient supply chains. Avoiding common red flags ensures long-term partnerships that support sustainability, consistency, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Prepared for Global Procurement Leaders | Confidential

Executive Summary: Strategic Sourcing of A4 Paper in China

Global procurement managers face unprecedented pressure to secure reliable, audit-compliant paper suppliers amid 2026’s volatile raw material markets and tightening ESG regulations. Traditional sourcing methods for Chinese A4 paper manufacturers incur 73+ hours of wasted effort per RFQ cycle (per SourcifyChina 2025 Procurement Efficiency Index). Our Verified Pro List eliminates these inefficiencies through rigorously pre-vetted partners – enabling faster onboarding, risk mitigation, and cost control.

Why Traditional Sourcing Fails in 2026 (A4 Paper Case Study)

| Challenge | Traditional Approach | Cost to Your Organization |

|---|---|---|

| Supplier Verification | Manual checks of licenses, export history, ESG compliance | 28–42 hours/researcher; high fraud risk (22% of unvetted suppliers) |

| Quality Assurance | Post-selection audits; inconsistent paper weight/whiteness | 17% defect rate; 3–6 week production delays |

| Lead Time Uncertainty | Unverified capacity claims; no real-time order tracking | Avg. 22-day shipment delays; $18K/container demurrage |

| Compliance Exposure | Unconfirmed FSC/PEFC certification; non-audit-ready sites | $250K+ in 2025 EU regulatory penalties (per case) |

How SourcifyChina’s Verified Pro List Delivers 2026-Ready Efficiency

Our A4 Paper Manufacturer Pro List (Q1 2026 Update) provides immediate access to 14 pre-qualified Tier-1 factories meeting:

✅ Operational Excellence: Min. 50,000 MT/year capacity; ISO 9001/14001 certified

✅ ESG Compliance: Valid FSC/PEFC chain-of-custody; zero non-conformities in 2025 audits

✅ Digital Integration: API-enabled order tracking; real-time sustainability metrics

✅ Trade Assurance: 100% payment protection via Alibaba Trade Assurance

Time Savings Breakdown (Per RFQ Cycle)

| Activity | Traditional Hours | Pro List Hours | Net Savings |

|---|---|---|---|

| Supplier Research | 34.5 | 1.2 | 33.3 hrs |

| Quality/Compliance Checks | 28.7 | 0.5 | 28.2 hrs |

| Negotiation & Contracting | 21.8 | 8.0 | 13.8 hrs |

| TOTAL | 85.0 | 9.7 | 75.3 hrs |

Source: SourcifyChina Client Data (2025); 47 Global Procurement Managers Surveyed

Your Strategic Imperative: Secure 2026 Supply Chain Resilience

With global pulp prices projected to rise 12.3% in H1 2026 (FAO Outlook), delaying supplier qualification risks:

⚠️ Stockouts due to constrained capacity at certified mills

⚠️ Margin erosion from emergency air freight premiums (avg. +220% vs. sea)

⚠️ Reputational damage from non-compliant suppliers

The Pro List is your 2026 risk mitigation engine – delivering verified partners in <24 hours, not months.

✨ Call to Action: Activate Your Verified Sourcing Advantage Today

Stop expending resources on unvetted suppliers. In the next 72 hours:

-

Email

[email protected]with subject line: “2026 A4 Pro List Request – [Your Company]”

→ Receive free access to our 2026 Q1 Verified A4 Paper Manufacturer List (including ESG dossiers and capacity calendars) -

Message our Sourcing Team on WhatsApp: +86 159 5127 6160

→ Get a complimentary 15-minute supply chain risk assessment for your paper procurement

Special Offer: First 10 respondents this week receive priority factory allocation for Q3 2026 production slots – avoiding 2026’s anticipated capacity crunch.

Your 2026 procurement success starts with one verified connection.

Don’t source in the dark. Source with certainty.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Objective Sourcing Intelligence | China-Specific Compliance Expertise | 99.2% Client Retention Rate

© 2026 SourcifyChina. All rights reserved. Unsubscribe or update preferences [here].

🧮 Landed Cost Calculator

Estimate your total import cost from China.