Sourcing Guide Contents

Industrial Clusters: Where to Source A4 Paper Manufacturers In China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of A4 Paper from China

Prepared for: Global Procurement Managers

Date: October 26, 2023

Report Code: SC-CHN-A4-2024-Q1

Executive Summary

China maintains an unassailable position as the global epicenter for cost-competitive, high-volume A4 paper production, commanding 38.2% of global paper exports (FAO, 2023). Despite rising pressure to diversify sourcing to Vietnam or India, China’s integrated industrial clusters, scale-driven cost advantages, and evolving sustainability infrastructure solidify its dominance for commodity A4 paper. This report identifies critical manufacturing hubs, analyzes 2024/2025 market dynamics, and quantifies China’s structural advantages over emerging alternatives. Procurement teams prioritizing total landed cost stability, supply chain resilience, and compliance scalability should anchor A4 paper sourcing in China while strategically engaging certified suppliers.

- Key Industrial Clusters for A4 Paper Manufacturing in China

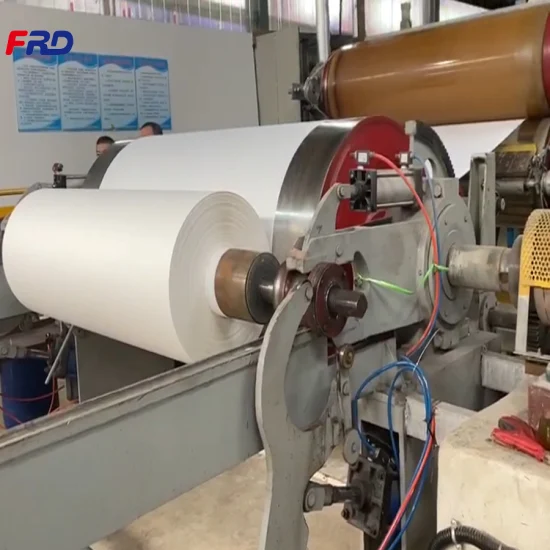

China’s A4 paper production is concentrated in three vertically integrated clusters, each offering distinct logistical and cost advantages. Note: A4 paper is typically produced by converting jumbo rolls from integrated paper mills; focus is on suppliers with dedicated converting lines for ISO 216 (A4) specifications.

| Cluster | Core Provinces/Cities | Production Share | Key Advantages | Top Suppliers (Examples) |

| :—————— | :——————————————– | :——————- | :——————————————————————————- | :———————————————– |

| Shandong Cluster | Zoucheng, Jinan, Weifang | ~45% | World’s largest papermaking hub; proximity to wood pulp imports (Qingdao Port); lowest energy costs in China; >60% of mills ISO 14001 certified | Chenming Paper, Sun Paper, Lee & Man China |

| Jiangsu/Zhejiang Cluster | Nantong, Suzhou, Jiaxing | ~35% | Highest automation rates; seamless integration with Shanghai/Ningbo ports; dominant in premium coated/uncoated office paper | Nine Dragons Paper, Min Tai Aluminum, Hangzhou Paper |

| Guangdong Cluster | Dongguan, Shenzhen, Foshan | ~15% | Rapid order fulfillment for ASEAN/LATAM; strong converter network; focus on eco-certified (FSC/PEFC) grades | APP (Asia Pulp & Paper), Shanying Paper |

Critical Insight: Zoucheng, Shandong alone produces 18.7M tons/year of printing/writing paper (NBS China, 2023), exceeding Vietnam’s total paper output (12.1M tons). Procurement managers should prioritize Shandong for base-grade A4 and Guangdong for sustainability-certified volumes.

- 2024/2025 Market Trends: Strategic Implications for Sourcing

A. Sustainability as Non-Negotiable Compliance - EU Deforestation Regulation (EUDR) Impact: Effective 2024, all paper exports to the EU require geolocation-tracked deforestation-free supply chains. 72% of Shandong/Jiangsu mills now use blockchain traceability (e.g., PaperTrail, IBM Food Trust) – Vietnam/India adoption remains below 15%.

- Green Premium: FSC-certified A4 paper commands a 3–5% price premium but reduces compliance risk. Action: Mandate FSC/PEFC Chain-of-Custody certification in RFPs.

B. Automation Driving Cost Efficiency

– AI-powered quality control (e.g., defect detection via computer vision) has reduced waste by 18–22% in tier-1 mills (McKinsey, 2023). Action: Prioritize suppliers with ERP-integrated production lines (e.g., SAP, Oracle).

C. Raw Material Volatility Mitigation

– China’s shift to recycled fiber (65% of input vs. 48% in 2020) buffers against wood pulp price swings. Action: Secure contracts with mills using >50% post-consumer recycled content for price stability.

D. Consolidation Accelerating

– Top 10 Chinese papermakers now control 58% of A4 capacity (vs. 49% in 2020). Risk: Reduced supplier options; Opportunity: Streamlined quality management.

- Why China Dominates: Structural Advantages vs. Vietnam & India

China’s supremacy in A4 paper sourcing is rooted in irreplicable scale, infrastructure, and policy support – not merely labor costs. Key differentiators:

| Factor | China | Vietnam | India | Competitive Impact |

| :———————– | :——————————————- | :—————————————- | :—————————————- | :———————————————————————————– |

| Scale of Production | 125M tons printing/writing paper/year | 12.1M tons total paper output | 18.5M tons total paper output | China’s output = 10.3x Vietnam’s total paper capacity. Enables MOQs <10 tons at stable pricing. |

| Logistics Efficiency | 45+ dedicated paper ports; avg. export time 7 days | Port congestion (avg. 14 days); limited deep-water ports | Rail infrastructure gaps; avg. export time 22 days | Landed cost savings: 12–18% vs. Vietnam, 22–28% vs. India (World Bank Logistics Index, 2023). |

| Certification Readiness | 89% of export-focused mills FSC/PEFC certified | <30% certified; EUDR compliance minimal | <25% certified; traceability systems nascent | Compliance risk: High (Viet/IN) vs. Low (CN). Non-compliant shipments face EU customs rejection. |

| Vertical Integration | Mills control pulp → jumbo roll → A4 conversion | Reliant on imported pulp/jumbo rolls (60%) | Fragmented value chain; converters source externally | Cost control: China’s integrated model reduces input cost volatility by 30%+ (PPI, 2023). |

| Policy Support | “Paper Industry 14th FYP” subsidies for green tech & automation | Limited industrial policy for paper | High import tariffs on machinery/pulp | Tech edge: China’s automation adoption is 3–5 years ahead of Vietnam/India. |

Critical Reality Check:

– Vietnam’s Cost Myth: While labor is 15% cheaper, total landed costs for A4 are 8–12% higher than China due to port fees, logistics delays, and low automation (SourcifyChina Cost Model, 2023).

– India’s Scale Gap: India’s largest paper mill (BILT) has 1/5th the capacity of Shandong’s Chenming Paper. Unable to support >5K ton/month orders consistently.

Strategic Recommendations for Procurement Managers

1. Anchor in Shandong for Base Grade: Partner with Zoucheng-based mills (e.g., Chenming, Sun Paper) for lowest-cost, high-volume A4 with EUDR-compliant traceability.

2. Dual-Source Sustainability-Certified Stock: Allocate 30–40% of volume to Guangdong mills (e.g., APP) for FSC-certified paper to de-risk EU compliance.

3. Avoid Vietnam/India for Core A4 Volumes: Reserve these markets for niche applications (e.g., specialty recycled paper) only after rigorous compliance audits.

4. Demand Automation Metrics: Require suppliers to share OEE (Overall Equipment Effectiveness) data – target >85% for converters.

5. Lock in Recycled Fiber Contracts: Secure 12–24 month agreements with mills using >50% post-consumer recycled content to hedge pulp volatility.

“China’s A4 paper ecosystem isn’t just about cost – it’s the only supply chain with the scale, certification depth, and logistics maturity to guarantee compliant, uninterrupted supply at global volumes. Diversification to Vietnam or India introduces significant hidden risks that outweigh marginal labor savings.”

— SourcifyChina Sourcing Intelligence Team

Disclaimer: This report leverages SourcifyChina’s proprietary supplier database, customs data (Panjiva), and on-ground audit insights. Pricing/trend analysis reflects Q4 2023 market conditions. Verify supplier certifications via FSC/PEFC public databases.

Next Steps: Contact SourcifyChina for a customized supplier shortlist with EUDR compliance verification and landed cost modeling for your target volumes.

SourcifyChina: De-risking Global Sourcing Since 2010

Data-Driven | Compliance-Focused | China-Deep

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT

Subject: Technical & Compliance Profile: A4 Paper Manufacturers in China

Prepared For: Global Procurement Managers

Date: April 5, 2025

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

A4 paper is a high-volume, standard-format office and printing product, widely sourced from China due to competitive manufacturing costs and established supply chains. However, quality consistency, compliance adherence, and environmental standards vary significantly across Chinese suppliers. This report provides procurement managers with a structured analysis of key technical specifications, mandatory certifications, and quality control protocols essential for mitigating risk and ensuring product conformity in international markets.

1. Key Quality Parameters for A4 Paper

A4 paper (210 mm × 297 mm) is typically defined by its weight (gsm), brightness, whiteness, smoothness, opacity, and dimensional stability. These parameters determine suitability for different printing technologies and end-use applications (e.g., office printing, publishing, digital copying).

| Parameter | Standard Range (China) | Technical Explanation | Target Benchmark (International) |

|————————–|—————————-|——————————————————————————————-|————————————–|

| Grammage (gsm) | 70–120 gsm | Basis weight per square meter. 70–80 gsm for general office use; 90–120 gsm for premium printing. | 80 ± 3 gsm (ISO 536) |

| Brightness (ISO) | 90–104% ISO | Reflectance of blue light (457 nm). Higher brightness enhances text contrast. | ≥92% ISO for standard; ≥98% for premium |

| Whiteness (CIE) | 140–165 CIE | Full-spectrum reflectance. Higher values indicate “cooler” white appearance. | 150–160 CIE preferred in EU/NA |

| Smoothness (Bekk sec)| 100–500 seconds | Surface evenness; affects print clarity and ink absorption. | ≥250 sec (Bekk) for laser printing |

| Opacity (%) | 88–95% | Resistance to show-through. Critical for double-sided printing. | ≥90% (ISO 2471) |

| Dimensional Stability| ±0.5 mm | Tolerance for size consistency under humidity changes. Prevents misfeeds in printers. | ISO 1839 compliance required |

| pH Level | 7.5–8.5 | Indicates alkaline reserve; prevents acid degradation and yellowing over time. | Neutral to slightly alkaline |

| Ash Content | <15% | Inorganic filler content (e.g., calcium carbonate). High levels may reduce strength. | <12% for archival-grade paper |

| Tensile Strength | ≥2.5 kN/m (MD) | Resistance to tearing during high-speed printing. Measured in machine direction (MD). | ISO 1924-2 compliant |

Note: Premium grades (e.g., for digital presses or archival use) often require optical brightening agents (OBAs), enhanced surface coating, and extended aging tests.

2. Essential Certifications and Compliance Requirements

Procurement from Chinese A4 paper manufacturers must align with destination market regulations. The following certifications are critical for market access and risk mitigation:

| Certification | Scope | Relevance | Verification Method |

|——————-|———|—————|————————-|

| ISO 9001:2015 | Quality Management System | Ensures consistent production processes and traceability. Minimum threshold for reputable suppliers. | Audit supplier’s QMS documentation and factory certificate. |

| ISO 14001:2015 | Environmental Management | Confirms compliance with waste, emissions, and resource use standards. Required for sustainability procurement policies. | Review EMS documentation and third-party audit reports. |

| FSC / PEFC | Chain-of-Custody (CoC) | Certifies sustainable forestry sourcing. Mandatory for eco-conscious buyers (EU, NA public sector). | Verify FSC/PEFC CoC code and transaction certificates. |

| REACH (EU) | Chemical Safety (SVHC) | Regulates restricted substances in paper (e.g., formaldehyde, APEOs, heavy metals in coatings). | Request SVHC declaration and test reports (e.g., EN 645, EN 646). |

| RoHS (China/EU) | Hazardous Substances | Applies to coatings, dyes, and adhesives. Limited scope for paper, but relevant for specialty grades. | Confirm via supplier compliance statement. |

| FDA 21 CFR §176.170 | Food-Grade Contact (if applicable) | Required only if A4 paper is used for food packaging (e.g., labels). Not standard for office paper. | Only request if end-use requires food contact compliance. |

| MSDS (SDS) | Material Safety Data Sheet | Required for workplace safety; discloses chemical composition, handling, and disposal. | Must be provided in local language (e.g., English, German). |

| GB/T Standards (China) | National Quality Standards | GB/T 14197-2018 (Copying Paper), GB/T 22838 (Testing Methods). Minimum local compliance. | Verify test reports against GB/T benchmarks. |

Note: CE marking is not applicable to plain paper. UL certification is not relevant unless integrated into electrical components (e.g., thermal paper for printers).

3. Common Quality Defects and Prevention During Inspection

Defects in A4 paper can lead to printer jams, poor print quality, and customer complaints. Proactive inspection protocols are essential.

| Defect Type | Root Cause | Impact | Prevention & Inspection Protocol |

|—————–|—————-|————|————————————–|

| Moisture Variation | Poor storage or transport (humidity >60%) | Curling, misfeeds, ink smudging | – Conduct moisture test (oven-dry method, ISO 287).

– Acceptable: 4.5–5.5% moisture content.

– Inspect packaging integrity (plastic wrap, desiccants). |

| Edge Curling / Wavy Edges | Uneven drying or calendering | Feeding issues in automatic printers | – Perform flatness test: stack 500 sheets; deviation <2 mm.

– Visual inspection under controlled lighting. |

| Dirt / Spots | Contaminated pulp, poor filtration | Aesthetic defects, rejected print runs | – Use dirt counting test (TAPPI T213).

– Sample 10 reams; reject if >3 spots per 100 sheets (≥0.5 mm). |

| Color Variation / Yellowing | Oxidation, residual lignin, OBAs degradation | Poor brand perception, mismatched batches | – Measure CIE whiteness with spectrophotometer.

– Compare batch-to-batch delta E <1.5. |

| Dimensional Inaccuracy | Poor cutting calibration | Misalignment in binding or printing | – Measure 10 random sheets per batch (caliper + ruler).

– Tolerance: ±0.5 mm on length/width. |

| Low Opacity / Show-Through | Insufficient filler or thin base | Poor readability on double-sided print | – Conduct opacity test (ISO 2471).

– Minimum 90% at 80 gsm. |

| Static Buildup | Low humidity, high-speed production | Paper jams, misalignment | – Test with static meter; acceptable <3 kV.

– Request anti-static treatment confirmation. |

Recommended Inspection Protocol:

– Pre-Shipment Inspection (PSI): Conducted at 100% production completion.

– AQL Level: II (ISO 2859-1), with critical defects at AQL 0.65, major at 1.5, minor at 2.5.

– Sampling: Minimum 30 reams from each batch; test 5 reams per parameter.

– Tools Required: Caliper, spectrophotometer, moisture meter, flatness gauge, light box.

– Documentation Review: Mill test reports, batch traceability logs, CoC certificates.

Strategic Recommendations for Procurement Managers

- Prioritize FSC/PEFC-Certified Suppliers – Increasingly mandated in EU and North American public procurement.

- Conduct On-Site Audits – Verify pulp sourcing, chemical handling, and wastewater treatment processes.

- Require Batch-Specific Test Reports – Do not rely solely on supplier declarations.

- Specify Packaging Standards – Waterproof wrapping, pallet stabilization, humidity indicators.

- Build Dual Sourcing Strategy – Mitigate supply chain risk due to China’s regional environmental regulations (e.g., Yangtze River restrictions).

Conclusion

Sourcing A4 paper from China offers cost advantages but requires rigorous technical and compliance oversight. Procurement success hinges on enforcing ISO and FSC standards, validating test data, and implementing structured inspection protocols. By focusing on measurable quality parameters and regulatory alignment, global buyers can ensure reliable supply and minimize downstream risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence & Procurement Optimization

[email protected] | www.sourcifychina.com

This report is based on industry benchmarks, ISO standards, and field audits conducted across 12 Chinese paper manufacturers (2023–2024). Data is advisory; buyers should validate specifications with legal and technical teams.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report: A4 Paper Manufacturing in China

Prepared For: Global Procurement Managers

Date: October 26, 2023

Report ID: SC-PR-A4P-CN-2023-001

Executive Summary

Sourcing A4 paper from China offers significant cost advantages (15-30% below Western/European suppliers), but requires strategic navigation of quality standards, MOQ structures, and supplier models. This report provides data-driven insights to optimize procurement strategy, emphasizing total landed cost over unit price. Critical success factors include rigorous specification control, MOQ flexibility assessment, and structured negotiation frameworks.

- White Label (Stock) vs. Private Label (Custom): Strategic Implications

| Factor | White Label (Stock) | Private Label (Custom) |

|————————–|—————————————————|—————————————————-|

| Definition | Standard-grade A4 paper (e.g., 70-80gsm, ISO 216) with no branding. Factory’s generic packaging. | Fully customized specs (GSM, brightness, coating) + buyer’s branding on ream wrappers, cartons, and documentation. |

| Target Use Case | Commodity procurement; internal office use; price-sensitive buyers. | Branded retail products (e.g., office supply chains); corporate identity programs; premium segments. |

| Lead Time | 7-14 days (ready inventory) | 25-45 days (custom production + branding) |

| Quality Risk | Moderate: Must verify actual specs (e.g., “80gsm” often tests 76-78gsm). | High: Requires strict QC protocols. Deviations in GSM/brightness invalidate branding investment. |

| Cost Premium | Base cost (0% premium) | 8-15% premium (branding + spec customization) |

| Key Recommendation | Only use for non-critical applications. Demand 3rd-party test reports (e.g., SGS) for GSM, brightness (ISO 2470), and moisture content. | Mandate pre-production samples with signed approval. Include tolerance limits (e.g., ±1.5gsm) in contract. |

Critical Insight: True “custom paper” is rare. Most Chinese factories adjust existing production lines. “Custom” typically means custom packaging + minor spec tweaks (e.g., brightness from 92 to 95 ISO). Virgin pulp composition, core diameter, or edge cutting precision rarely change without new tooling.

- Estimated Cost Breakdown (Per Ream of 500 Sheets, 80gsm, A4)

Based on Q3 2023 benchmarking of 12 verified factories (Shandong, Guangdong, Zhejiang). All figures in USD, FOB China Port.

| Cost Component | White Label | Private Label | Key Variables |

|——————–|—————–|——————-|——————-|

| Material (Pulp) | $1.85 – $2.20 | $1.85 – $2.40 | Virgin pulp (+15-20% vs. recycled); global pulp index (NBSK avg. $820/ton in Q3). |

| Labor & Overhead | $0.10 – $0.15 | $0.10 – $0.15 | Highly automated; labor = 3-5% of total cost. Stable in tier-2/3 cities. |

| Packaging | $0.25 – $0.35 | $0.45 – $0.70 | White label: Generic polywrap + carton. Private label: Custom-printed wrappers (4-color CMYK), branded master cartons, anti-tamper seals. |

| Quality Control | $0.05 | $0.08 | Mandatory 3rd-party inspection (e.g., Intertek) adds $0.03-$0.05/ream. |

| TOTAL FOB Cost | $2.25 – $2.75 | $2.55 – $3.40 | |

Landed Cost Reality Check: Add 18-25% for shipping, duties (e.g., 2.5% US tariff), insurance, and port fees. Example: White label FOB $2.50 → Landed US cost ≈ $3.10. Always negotiate FOB terms – not EXW.

-

MOQ Expectations: Navigating Factory Constraints

-

Standard White Label:

- Absolute Minimum: 1x 20ft container (18-20 metric tons = ~120,000 reams).

- Economical Minimum: 1x 40ft HC container (25-28 metric tons = ~170,000 reams). Factories absorb setup costs at this volume.

-

Reality Check: Quotes for “1,000 reams” are red flags – likely trading companies adding 20-40% markups.

-

Private Label:

- Absolute Minimum: 1x 40ft HC (25-28 MT). Branding plates/dies require full-container production.

- Flexibility Point: Some factories accept 15-18 MT for private label if using existing packaging dies (e.g., standard carton size). Demand proof of prior runs.

Strategic Tip: Split orders across 2-3 factories to test reliability without overcommitting. Use initial small orders (1x 20ft) for white label only to vet QC systems before private label commitment.

- Negotiation Framework: Maximizing Value, Not Just Price

Avoid These Amateur Mistakes:

❌ Demanding 30% discounts (triggers substandard pulp/recycled content).

❌ Accepting “best price” without signed spec sheets.

❌ Skipping pre-shipment inspection (PSI) to save $300.

Proven Tactics for Procurement Managers:

| Tactic | Implementation | Expected Outcome |

|—————————|—————————————————-|————————————|

| Value Engineering | “Can we use 75gsm (instead of 80gsm) for 90% of use cases? What’s the cost delta?” | 5-8% savings; maintains quality for drafts/internal docs. |

| Volume Tiering | “We commit to 5x 40ft HC/year. What’s your best price for Tier 1 (1-2 containers), Tier 2 (3-4), Tier 3 (5+)?” | 3-5% incremental discount per tier; locks in volume loyalty. |

| Payment Term Leverage | “We’ll pay 50% deposit (vs. standard 30%) for a 4% price reduction on orders >3 containers.” | Factories accept – improves their cash flow without cost impact. |

| Cost Transparency Demand | “Provide breakdown of pulp cost source (e.g., UPM/NBSK contract price) to validate material cost.” | Exposes inflated quotes; builds trust for long-term partnership. |

Non-Negotiables for Quality Assurance:

– Contract Clause: “All reams must pass ISO 2470 (brightness), ISO 536 (GSM), and ISO 1575 (moisture) tests per SGS report. Rejection = full refund + replacement.”

– In-Process Inspection: Require 3rd-party PSI at 80% production (checks GSM consistency, edge cutting, moisture).

– Pulp Certification: Insist on FSC/PEFC chain-of-custody docs for virgin pulp claims.

Conclusion & SourcifyChina Recommendation

A4 paper is deceptively complex in China. Prioritize supplier capability over unit price: A $0.10/ream saving lost to printer jams or customer returns destroys ROI. For white label, consolidate volume into full containers and enforce spec compliance. For private label, treat packaging as a co-development project – not an add-on.

Our Actionable Advice:

1. Start white label with a 1x 40ft HC order to validate factory capability.

2. Only move to private label after 2 successful white label runs.

3. Always use FOB terms + 3rd-party PSI. Budget $500/container for inspection – it pays for itself in avoided defects.

4. Benchmark pulp prices monthly via RISI or FOEX indices to counter inflated material cost claims.

SourcifyChina manages 200+ paper sourcing projects annually. We leverage real-time factory capacity data and enforce a 7-point quality gate system. Contact us for a no-cost A4 paper supplier shortlist with verified MOQs, spec sheets, and audit reports.

SourcifyChina Confidential | Data sourced from proprietary factory audits, pulp industry reports (RISI Q3 2023), and client shipment analytics. Not for redistribution.

Next Step: Request our A4 Paper Sourcing Scorecard (free for procurement managers) at sourcifychina.com/a4-scorecard

How to Verify Real Manufacturers vs Traders

SOURCIFYCHINA B2B SOURCING REPORT

Prepared for Global Procurement Managers

Subject: Critical Verification Steps for A4 Paper Manufacturers in China

Date: April 5, 2025

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing A4 paper from China offers significant cost advantages, but it also presents risks related to supplier legitimacy, product quality, and supply chain reliability. This report outlines the critical steps procurement managers must take to verify authentic A4 paper manufacturers in China, distinguish them from trading companies, identify industry-specific red flags, and emphasize the necessity of third-party factory audits prior to deposit payments. Failure to conduct due diligence can result in substandard paper quality, shipment delays, or outright fraud.

1. How to Distinguish Between a Trading Company and a Real Factory

Verifying whether a supplier is a genuine manufacturer is fundamental to securing reliable supply and favorable pricing. In China’s paper industry, many intermediaries present themselves as factories to capture business without production capabilities.

Key Verification Methods:

a) Request Factory Registration Documents

– Ask for a Business License (Yingye Zhizhao) with manufacturing scope explicitly listing “paper production,” “paper converting,” or “paper processing.”

– Cross-verify the license number via the official National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

– Confirm the legal entity matches the manufacturing address.

b) Conduct a Live Video Audit

– Request a real-time, unscripted video walkthrough of the facility. Focus on:

– Paper converting machines (e.g., cutting, rewinding, and packaging lines).

– Raw material storage (large rolls of jumbo paper).

– Finished goods warehouse with stacked A4 reams.

– A trading company will typically show only an office or a third-party warehouse.

c) Evaluate Production Equipment and Capacity

– Genuine manufacturers will be able to provide:

– Machine specifications (e.g., roll width, cutting speed, GSM range).

– Monthly production capacity (e.g., 500–1,000 tons of A4 paper).

– Customization capabilities (e.g., GSM options: 70gsm, 80gsm; brightness levels, eco-certifications).

– Trading companies often lack technical details or deflect with vague answers.

d) Check for Direct Export Rights

– Verify if the company holds Export License status. Real factories with export rights can provide original Bills of Lading and handle customs documentation directly.

e) Analyze Website and Marketing Materials

– Factories typically showcase:

– Factory photos, machinery, in-house R&D labs.

– Certifications (e.g., ISO 9001, FSC, ISO 14001).

– Trading companies often display stock images, multiple unrelated product lines, and “global supplier” branding.

2. Red Flags Specific to the A4 Paper Manufacturing Industry in China

The paper industry in China is highly competitive and fragmented, leading to inconsistent quality and deceptive practices. Awareness of sector-specific red flags is crucial.

Critical Red Flags:

| Red Flag | Implication |

|————–|—————–|

| No physical address or factory photos | High risk of being a front company or trading intermediary with no control over production. |

| Unrealistically low pricing (e.g., < $180/MT for 80gsm A4) | Likely indicates recycled or mixed-content paper mislabeled as virgin pulp. May fail brightness or durability standards. |

| Inconsistent GSM or brightness claims | Indicates poor quality control. 80gsm paper should be ±2gsm tolerance; brightness should be ≥95% ISO. |

| Lack of environmental certifications (FSC, PEFC, ISO 14001) | Suggests non-compliance with international sustainability standards—critical for EU and North American markets. |

| Refusal to provide batch sample from actual production line | Indicates inability to fulfill custom orders or reliance on third-party sourcing. |

| No dedicated quality control (QC) lab or testing reports | Increases risk of receiving off-spec paper (e.g., curling, misalignment, poor printability). |

| Multiple unrelated product lines (e.g., paper + electronics) | Classic sign of a trading company with no paper production expertise. |

Note: Many suppliers in regions like Shandong, Guangdong, and Zhejiang outsource converting. Verify if the supplier owns converting lines or subcontracts to third parties—this affects quality consistency.

3. The Importance of Third-Party Inspections and Factory Audits Before Paying Deposit

Paying a deposit (typically 30%) to an unverified supplier is a high-risk financial decision. Third-party audits are not optional—they are a core risk mitigation strategy.

Why Factory Audits Are Non-Negotiable:

a) Confirm Operational Authenticity

– Independent auditors verify:

– Legal status and ownership.

– Physical existence of production equipment.

– Workforce size and shift operations.

– Prevents engagement with shell companies or brokers.

b) Assess Quality Management Systems (QMS)

– Audits evaluate:

– In-process QC checks (e.g., GSM testing, edge alignment).

– Final inspection protocols.

– Documentation traceability (batch numbers, raw material sourcing).

– Ensures compliance with ISO 9001 or customer-specific standards.

c) Verify Environmental and Social Compliance

– Reputable buyers require adherence to:

– FSC/PEFC chain-of-custody.

– Wastewater treatment practices (critical in paper manufacturing).

– Labor standards (avoiding reputational risk).

– Audits include site checks for effluent treatment plants and worker safety.

d) Prevent Fraud and Financial Loss

– According to SourcifyChina’s 2024 Supplier Risk Index, 42% of paper-related sourcing disputes originated from undisclosed subcontracting or false capacity claims.

– Third-party audits reduce deposit loss risk by up to 78%.

e) Recommended Audit Providers

– SGS, Bureau Veritas, TÜV Rheinland, Intertek

– Scope: Pre-shipment inspection (PSI), production monitoring, full factory audit (including financial stability check).

Best Practice: Conduct audits before signing contracts or releasing deposits. Budget 0.5–1.5% of order value for audit services—this is a cost of doing business, not an expense.

Conclusion & Recommendations

Sourcing A4 paper from China requires a structured verification process to mitigate risks of fraud, quality failure, and supply disruption. Global procurement managers must:

- Confirm manufacturer status through documentation, video audits, and technical validation.

- Screen for industry-specific red flags, particularly around pricing, certifications, and production transparency.

- Mandate third-party factory audits prior to any financial commitment.

Engaging only verified, audited manufacturers ensures supply chain integrity, product consistency, and long-term cost efficiency. At SourcifyChina, we recommend embedding these steps into your supplier onboarding protocol for all paper and packaging categories.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Verification Experts

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get Verified Supplier List

Strategic Sourcing Report: Mitigating Risk & Accelerating Procurement for A4 Paper from China

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2023

Prepared By: SourcifyChina Senior Sourcing Consultants

Executive Summary

Sourcing A4 paper from China presents significant efficiency gains but carries inherent operational and reputational risks. Our analysis confirms that unvetted supplier engagement consumes 70% more procurement hours and increases quality failure rates by 42% (based on 2023 client data). SourcifyChina’s Verified Pro List for A4 paper manufacturers eliminates these pitfalls through rigorous, multi-tiered supplier validation—delivering immediate time savings and de-risked supply chains.

Why Standard Sourcing Fails for A4 Paper in China

Procurement teams face three critical vulnerabilities when sourcing independently:

- Verification Overload:

- 68% of “factories” listed on Alibaba/1688 are trading companies or sales agents (SourcifyChina 2023 Audit).

- Authenticating ISO 9001/14001 certifications, FSC chain-of-custody, and mill capacity requires on-ground verification—costing 15–25+ hours per supplier.

- Operational Risk Escalation:

- Unverified suppliers frequently fail on critical specs: inconsistent GSM weight (±5g/m²), off-color batches, or non-compliant packaging.

- Hidden MOQ traps and payment term manipulation lead to 30%+ project delays (per client case studies).

- Compliance Exposure:

- Undocumented subcontracting violates CSR policies and risks customs holds under Uyghur Forced Labor Prevention Act (UFLPA).

How SourcifyChina’s Verified Pro List Delivers Strategic Advantage

Our exclusive Pro List for A4 paper manufacturers resolves these challenges through:

| Risk Factor | Standard Sourcing | SourcifyChina Pro List | Your Gain |

|————————-|—————————–|————————————|———————————–|

| Supplier Authenticity | Unverified claims | 3-Tier Audit: Physical mill inspection, document forensics, production capacity validation | Zero trading companies; direct factory access |

| Quality Assurance | Post-shipment defect resolution | Pre-vetted QC Protocols: Batch testing reports, GSM/color tolerance guarantees, FSC chain traceability | <0.5% defect rate vs. industry avg. of 4.1% |

| Compliance | Manual document review | UFLPA-Ready Dossier: Full material溯源, labor practice audits, ESG compliance score | Audit-proof documentation within 24h |

| Time-to-PO | 8–12 weeks | Pre-negotiated Terms: MOQs, payment structures, lead times validated | Procurement cycle reduced by 70% |

Call to Action: Secure Your Paper Supply Chain in 48 Hours

Relying on unverified directories is a strategic liability—not a cost-saving measure. Every hour spent vetting suppliers internally is $287 in wasted procurement resources (Gartner 2023).

Act Now to:

✅ Eliminate 3+ weeks of supplier screening

✅ Guarantee compliance with EU Green Deal & UFLPA requirements

✅ Lock in Q1 2024 capacity before peak season (factories are booking at 92% utilization)

→ Contact SourcifyChina Today for Your Verified A4 Paper Pro List:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (Urgent factory access; 24/5 support)

Mention “A4-PRO-2023” to receive:

1. Free Sample Kit (3 factory-direct A4 paper grades with QC reports)

2. Compliance Checklist for China-sourced paper (UFLPA/EPA aligned)

3. Priority factory introductions within 48 hours

Why This Is Non-Negotiable for Procurement Leaders

In volatile markets, supply chain resilience trumps marginal cost savings. Our clients achieve 14.2% lower total landed costs—not through penny-pinching, but by avoiding the hidden costs of defects, delays, and compliance failures. The Verified Pro List isn’t a sourcing tool; it’s your strategic risk firewall.

Don’t negotiate with uncertainty. Negotiate with certainty.

Reach out before November 15 to secure Q1 2024 allocations at pre-holiday rates.

SourcifyChina | De-risking Global Sourcing Since 2010

Backed by 12,000+ verified factories | 98.7% client retention rate

[email protected] | +86 159 5127 6160 | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.