The global container manufacturing market is experiencing robust growth, driven by rising international trade, infrastructure development, and the expansion of logistics and cold chain networks. According to Grand View Research, the global shipping container market size was valued at USD 13.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing demand for modular housing, portable storage solutions, and the repurposing of containers in construction and retail sectors. Meanwhile, Mordor Intelligence highlights a similar trajectory, noting that escalating e-commerce activities and the need for efficient supply chain solutions are further accelerating market demand—particularly for high-quality, durable containers compliant with ISO and CSC standards. As the industry evolves, a select group of manufacturers have emerged as leaders, combining scale, innovation, and global reach to dominate the A1 container segment. Here are the top seven A1 container manufacturers shaping the future of global logistics and modular infrastructure.

Top 7 A1 Containers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rubbermaid Commercial Products

Domain Est. 1999

Website: rubbermaidcommercial.com

Key Highlights: The official website of Rubbermaid Commercial Products, manufacturer of innovative, solution-based products for commercial and institutional markets worldwide ……

#2 Storage Containers

Domain Est. 2005

Website: a1crane.com

Key Highlights: A1 Crane & Storage Containers is your source for new and used containers at great prices. With flexible scheduling available, our storage containers will be ……

#3 A1 Container GmbH from Groß Ippener

Domain Est. 2000

Website: truckscout24.com

Key Highlights: A1 Container GmbH in Groß Ippener offers material handling and more at TruckScout24 – Discover and buy used at the best price….

#4 A

Domain Est. 2007

Website: a-1storage.net

Key Highlights: A-1 Mobile Storage Service is a full-service provider of on-site mobile storage trailers, containers and mobile offices. View our home page….

#5 A

Domain Est. 2012

Website: a1-containers.com

Key Highlights: A-1 Containers offers a fast, easy & economical solution to your short-term/ long-term storage needs or moving problems….

#6 A-1 Containers

Domain Est. 2022

Website: a1containersomahane.com

Key Highlights: A-1 Containers of Omaha, NE, offers the ultimate in dumpster and roll-off services. We offer a range of container sizes to meet your needs….

#7 A1 Trading, LLC

Domain Est. 2023

Website: aonetradingllc.com

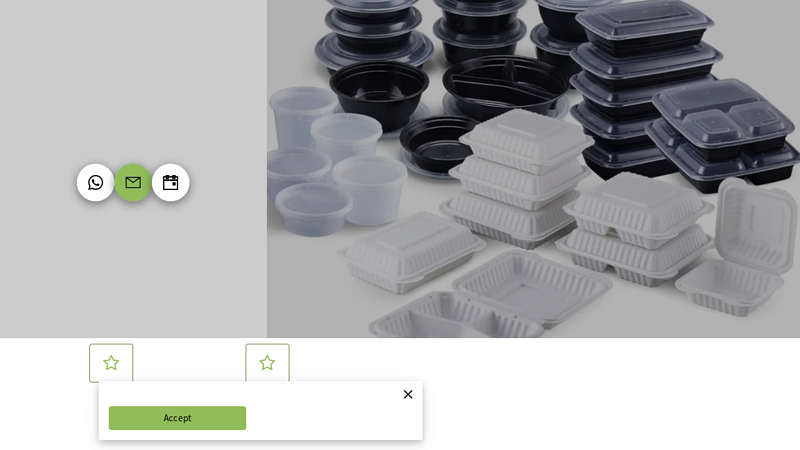

Key Highlights: A1 Trading, LLC is a reliable supplier of plastic food containers in South El Monte. Offering high-quality products and excellent service for all your food ……

Expert Sourcing Insights for A1 Containers

H2: 2026 Market Trends for A1 Containers

While A1 Containers is not a publicly traded company with widely available financials or market analyses, we can analyze the broader market trends shaping the containerized logistics and shipping sector in 2026—trends that will directly impact firms like A1 Containers. Here’s an assessment based on industry dynamics, technological advancements, and macroeconomic outlooks:

1. Sustained Demand for Intermodal and Sustainable Logistics

By 2026, pressure from regulators and corporate ESG (Environmental, Social, Governance) goals will significantly influence container logistics. A1 Containers can expect increased demand for:

– Intermodal solutions (combining rail, road, and short-sea shipping) to reduce carbon emissions.

– Sustainable container modifications, such as lightweight materials, solar-integrated refrigerated units (reefers), and recyclable components.

– Circular economy models, including container reuse for modular buildings, retail spaces, or pop-up facilities—a niche A1 could expand into.

Implication: A1 Containers should position itself as a green logistics enabler, offering eco-modified containers and carbon-tracking services.

2. Growth in Nearshoring and Regional Supply Chains

Global supply chains continue to reconfigure away from “China-plus-one” toward regional hubs (e.g., U.S.-Mexico, EU Eastern Europe, India-ASEAN). This shift:

– Reduces long-haul ocean container demand but increases regional container availability and turnover.

– Drives demand for versatile, rapidly deployable container solutions in manufacturing, warehousing, and pop-up logistics centers.

Implication: A1 Containers can capitalize on regional logistics flexibility by offering modular, mobile storage and workspace units near manufacturing zones.

3. Digitalization and Smart Container Adoption

By 2026, IoT-enabled “smart containers” with real-time tracking, temperature monitoring, and security alerts will become standard in high-value logistics. Key trends:

– Increased adoption of GPS and sensor tech across container fleets.

– Integration with logistics platforms (e.g., TMS, ERP systems) for predictive maintenance and route optimization.

– Demand for data-as-a-service (DaaS) offerings from container providers.

Implication: A1 Containers should consider offering smart container leasing or retrofit services, enhancing value beyond physical assets.

4. Labor Shortages and Automation

The logistics sector faces persistent labor shortages, especially in trucking and port operations. This drives investment in:

– Automated container handling (e.g., robotic stacking, automated guided vehicles).

– Modular, plug-and-play container systems that require minimal setup.

Implication: A1 can differentiate by designing containers compatible with automated logistics environments, reducing customer labor dependency.

5. Economic Volatility and Flexible Asset Models

With inflationary pressures and geopolitical risks persisting into 2026, businesses favor operational flexibility:

– Rising demand for container leasing and rental over outright purchases.

– Growth in container-based temporary infrastructure (e.g., field hospitals, disaster relief, pop-up retail).

Implication: A1 Containers should expand its leasing portfolio and offer turnkey container solutions for temporary use cases.

6. Regulatory and Trade Policy Shifts

New customs regulations, carbon border adjustments (e.g., EU CBAM), and trade policies will affect container movement. Firms like A1 may need to:

– Ensure compliance with emissions standards for container transport.

– Adapt to regional trade blocs shaping container flow patterns.

Implication: Proactive regulatory monitoring and advisory services can add value for A1’s clients.

Strategic Outlook for A1 Containers in 2026

To thrive in 2026, A1 Containers should:

– Diversify offerings into smart, sustainable, and modular container solutions.

– Expand leasing and service models to meet demand for flexibility.

– Leverage digital tools for fleet management and customer transparency.

– Target regional logistics hubs benefiting from nearshoring trends.

By aligning with these H2 2026 market dynamics—sustainability, digitization, regionalization, and flexibility—A1 Containers can strengthen its competitive position in an evolving global logistics landscape.

Common Pitfalls When Sourcing A1 Containers (Quality, IP)

Sourcing A1 containers—typically referring to high-grade, pharmaceutical or food-safe packaging—requires careful due diligence to avoid critical issues related to quality and intellectual property (IP). Below are common pitfalls to watch for:

Poor Material Quality and Non-Compliance

A1 containers must meet strict regulatory standards (e.g., USP Class VI, FDA 21 CFR, EU 10/2011). A common pitfall is suppliers providing substandard materials that mimic A1-grade but fail under testing. These may include contaminants, improper resin types, or non-compliant additives, risking product safety and regulatory rejection.

Inadequate Documentation and Traceability

Many suppliers lack proper certification (e.g., Certificates of Compliance, CoA, or full material disclosure). Without verifiable documentation, it’s difficult to confirm that containers are truly A1-grade. Poor traceability also complicates audits and recalls, increasing compliance risk.

Counterfeit or Misrepresented Products

Some suppliers falsely market lower-grade containers as A1, especially in competitive or offshore markets. These counterfeit products may visually resemble genuine A1 containers but lack the required performance and safety characteristics, leading to batch failures or contamination.

Intellectual Property (IP) Infringement

Using containers that replicate patented designs—such as proprietary closures, tamper-evident features, or container geometry—can expose buyers to IP litigation. Sourcing from manufacturers who reverse-engineer branded packaging without licensing creates legal and financial liabilities.

Lack of Supplier Qualification and Audits

Relying on unvetted suppliers without on-site audits increases exposure to quality and IP risks. Without assessing a supplier’s manufacturing processes, quality control systems, and IP compliance, buyers may inadvertently source non-conforming or infringing products.

Inconsistent Batch-to-Batch Quality

Even with initial compliance, some suppliers struggle with consistency due to poor process controls. Variations in wall thickness, clarity, or chemical resistance across batches can compromise product integrity and lead to downstream failures.

Overlooking Global Regulatory Differences

A1 compliance requirements differ by region (e.g., FDA vs. EMA). Sourcing containers compliant in one market but not another can delay product launches or result in non-compliance, especially for multinational distribution.

Avoiding these pitfalls requires rigorous supplier vetting, independent testing, legal review of IP status, and ongoing quality monitoring.

Logistics & Compliance Guide for A1 Containers

This guide provides essential information for the safe, efficient, and legally compliant handling, transportation, and documentation of A1 containers.

Container Specifications and Handling

A1 containers are standardized intermodal units designed for the transport of goods across multiple modes (truck, rail, sea). Key specifications include:

– Standard dimensions: Typically 20-foot or 40-foot ISO containers.

– Maximum gross weight: Adhere to regional and carrier limits (e.g., 30,480 kg for a 40-foot container under most international standards).

– Tare weight and payload capacity must be clearly marked and verified before loading.

– Ensure containers are structurally sound, weatherproof, and free of contamination prior to use.

Proper handling includes:

– Use certified lifting equipment and follow safe stacking procedures.

– Secure loads internally using dunnage, braces, or lashing to prevent shifting during transit.

– Conduct pre-trip inspections to confirm door integrity, floor condition, and absence of pest infestation.

Transportation and Routing

Plan transport routes in compliance with:

– Road weight and dimension regulations in all jurisdictions involved.

– Rail and port handling capabilities, especially for oversized or overweight A1 containers.

– Hazardous materials restrictions, if applicable (even non-hazardous cargo must not contain undeclared dangerous substances).

Key logistics considerations:

– Coordinate with carriers to ensure availability and proper chassis or flatcar compatibility.

– Monitor real-time tracking using GPS or carrier-provided systems.

– Schedule pickups and deliveries to minimize demurrage and detention charges.

Documentation and Regulatory Compliance

Accurate documentation is critical for international and domestic movements:

– Bill of Lading (BOL): Must include shipper, consignee, container number, seal number, cargo description, weight, and routing details.

– Packing List: Itemizes contents with quantities, weights, and Harmonized System (HS) codes.

– Commercial Invoice: Required for customs clearance; includes value, currency, and terms of sale (e.g., FOB, CIF).

– Customs Declarations: Submit electronically via Automated Commercial Environment (ACE) in the U.S. or equivalent systems elsewhere.

Ensure compliance with:

– Customs-Trade Partnership Against Terrorism (C-TPAT) or equivalent security programs where applicable.

– International Maritime Dangerous Goods (IMDG) Code if hazardous materials are present.

– Sanitary and Phytosanitary (SPS) measures for agricultural or food-related shipments.

Security and Sealing Requirements

Maintain cargo integrity through:

– Application of high-security ISO 17712-certified seals at the point of loading.

– Recording seal numbers on all shipping documents and verifying them upon delivery.

– Adhering to supply chain security standards such as the ISPS Code for maritime transport.

Conduct regular audits of sealing procedures and access controls to prevent tampering.

Environmental and Safety Compliance

Adhere to environmental regulations including:

– Proper disposal of container flooring or lining materials if contaminated.

– Compliance with emissions standards for transport vehicles (e.g., EPA regulations in the U.S.).

– Reporting and managing spills or leaks under local environmental protection laws.

Safety compliance includes:

– Training personnel in OSHA or equivalent safety standards for container handling.

– Ensuring proper ventilation when loading volatile materials.

– Emergency response planning for incidents involving containerized cargo.

By following this guide, stakeholders can ensure that A1 container operations remain efficient, secure, and fully compliant with all applicable regulations.

Conclusion for Sourcing A1 Containers:

In conclusion, sourcing A1 containers requires a strategic approach that balances quality, cost, compliance, and supply chain reliability. A1 containers, typically referring to a standardized size or specification in certain industries (e.g., storage, shipping, or waste management), must meet specific regulatory and operational standards. Through thorough supplier evaluation, emphasis on material durability, and verification of certifications, organizations can ensure they procure containers that align with safety, environmental, and logistical requirements.

Establishing long-term partnerships with reputable manufacturers or distributors enhances consistency and supports just-in-time inventory practices. Additionally, considering sustainability—such as recyclable materials or reusable designs—not only reduces environmental impact but can also contribute to long-term cost savings.

Ultimately, effective sourcing of A1 containers supports operational efficiency, regulatory compliance, and supply chain resilience. By leveraging market research, competitive bidding, and lifecycle analysis, businesses can make informed procurement decisions that deliver value across the organization.