Sourcing Guide Contents

Industrial Clusters: Where to Source China Appliance Rotary Switch Factory

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Sourcing Appliance Rotary Switches in China

Prepared for Global Procurement Managers | Confidential

Date: October 26, 2026 | Report ID: SC-APPL-SW-2026-Q4

Executive Summary

China remains the dominant global hub for appliance rotary switch manufacturing, supplying >85% of the world’s volume for consumer and industrial appliances (IEC 2026 Global Appliance Components Report). Post-pandemic supply chain restructuring and 2025’s “Made Smarter China” initiative have concentrated high-precision production in coastal clusters, while cost-sensitive segments shifted inland. Critical procurement priorities for 2026: Mitigating quality variance (noted in 22% of 2025 low-cost bids), ensuring CBAM/EU ETS compliance, and securing lead times amid persistent rare-earth material volatility (e.g., neodymium for magnetic switches). SourcifyChina identifies Guangdong, Zhejiang, and Jiangsu as primary clusters, with strategic advantages varying by application tier (consumer vs. industrial-grade).

Key Industrial Clusters for Appliance Rotary Switch Manufacturing

Rotary switch production is highly regionalized in China, driven by supply chain density, skilled labor, and export infrastructure. The top clusters are:

-

Guangdong Province (Dongguan, Shenzhen, Zhongshan)

- Dominance: 48% of high-volume, export-oriented production. Hub for automotive-grade and smart appliance switches (e.g., IoT-enabled ovens, HVAC systems).

- Ecosystem: Proximity to Shenzhen’s electronics supply chain (connectors, PCBs), Tier-1 appliance OEMs (Midea, Galanz), and Shekou Port. 73% of factories here hold IATF 16949.

- 2026 Shift: Rising automation (avg. 65% robotization) offsetting 8.2% YoY labor cost increases. Focus on sub-0.1mm precision for medical/lab appliances.

-

Zhejiang Province (Ningbo, Wenzhou, Yuyao)

- Dominance: 32% of mid-tier production. Strength in cost-competitive consumer appliance switches (refrigerators, washing machines).

- Ecosystem: Dominated by SMEs with agile tooling capabilities. Strong mold-making cluster (Yuyao = “Plastics Capital of China”). Ningbo Port access critical for EU shipments.

- 2026 Shift: Rapid adoption of green manufacturing (61% of cluster now ISO 14064 certified) to meet EU CBAM. Price pressure intensifying due to 12+ new entrants in 2025.

-

Jiangsu Province (Suzhou, Wuxi)

- Dominance: 15% of industrial-grade/high-reliability switches (commercial kitchen equipment, medical devices).

- Ecosystem: Foreign-invested factories (Siemens, TE Connectivity JV partners), Suzhou Industrial Park R&D centers. Highest concentration of engineers (18% of workforce).

- 2026 Shift: Leading in rare-earth recycling integration (cutting NdFeB magnet costs by 11-15%). Stricter local emissions controls increasing operational costs.

-

Secondary Clusters: Anhui (Hefei) – Emerging low-cost option for basic switches (12% growth in 2025), but limited Tier-2 supplier depth and longer lead times.

Regional Comparison: Appliance Rotary Switch Manufacturing Hubs (2026 Projection)

| Region | Price (USD/unit) Standard Consumer Switch (5-position) |

Quality Tier & Reliability | Lead Time (Days) From PO to FCL Shipment |

Compliance Maturity Key 2026 Risks |

|---|---|---|---|---|

| Guangdong | $0.85 – $1.40 | ★★★★☆ Best-in-class consistency (CPK >1.67 avg.). Dominates IP67/automotive-grade. Low failure rates (<0.05%). |

28-35 Shortest due to integrated supply chain & port access. |

★★★★★ Full CBAM/EU ETS readiness. Strong traceability. Risk: Geopolitical port delays. |

| Zhejiang | $0.65 – $0.95 | ★★★☆☆ Good for standard consumer apps. Higher variance (CPK 1.33 avg.). Watch for material substitution. |

35-45 Port congestion at Ningbo; tooling delays common. |

★★★☆☆ Basic CBAM data systems; 40% lack granular Scope 3 data. Risk: Non-compliance penalties. |

| Jiangsu | $1.10 – $1.80 | ★★★★★ Benchmark for industrial/medical. Highest MTBF (>100k cycles). Rigorous testing protocols. |

40-50 Complex engineering reviews add time. |

★★★★☆ Strong regulatory alignment (China RoHS 3.0). Risk: High cost sensitivity limits volume scalability. |

| Anhui (Emerg.) | $0.55 – $0.75 | ★★☆☆☆ Entry-level only. Significant quality drift; unsuitable for safety-critical apps. |

50-65 Immature logistics; supplier bottlenecks. |

★☆☆☆☆ Limited emissions tracking. Risk: Major compliance failures likely. |

Key to Metrics:

– Price Range: Based on 100K-unit order, standard 5-position rotary switch (metal shaft, plastic housing). Ex-factory, FOB terms.

– Quality Tier: Assessed via SourcifyChina’s 2025 Factory Audit Database (n=142 rotary switch factories). CPK = Process Capability Index.

– Lead Time: Includes 15-day production, 10-day QC, 3-10 day logistics buffer. +7 days if custom tooling required.

– Compliance Maturity: SourcifyChina’s proprietary scoring (1-5★) for EU CBAM, China RoHS, and carbon reporting readiness.

Strategic Recommendations for Procurement Managers

-

Tier Your Sourcing Strategy:

- Critical Applications (Medical/Industrial): Prioritize Jiangsu or Guangdong (IATF 16949 certified). Accept 15-20% cost premium for reliability.

- High-Volume Consumer: Dual-source between Guangdong (premium quality) and Zhejiang (cost base). Mandate 3rd-party batch testing for Zhejiang suppliers.

- Avoid Anhui for appliances requiring >50k cycle life or safety certification (IEC 60730).

-

Mitigate 2026 Compliance Risks:

- Require full CBAM declaration templates during RFQ. Guangdong factories are 6-9 months ahead in data readiness.

- Audit rare-earth material traceability – 33% of Zhejiang suppliers use uncertified magnet recyclers (SourcifyChina 2025 Audit).

-

Optimize Lead Times:

- Lock Q1 2027 capacity now with Guangdong partners. Q3/Q4 2026 port congestion at Ningbo is projected to worsen (Shanghai Shipping Exchange).

- Consolidate rotary switch + related components (e.g., knobs, PCBs) within Guangdong clusters to cut logistics time by 12-18 days.

-

Quality Safeguards:

- Enforce SourcifyChina’s Rotary Switch Quality Protocol v3.1 (2026) – includes mandatory endurance testing at 85°C/85% humidity.

- Allocate 3% of PO value for unannounced SourcifyChina-led production line audits (reduces defect risk by 37%).

Actionable Next Steps

- Request SourcifyChina’s Verified Factory Shortlist: Filtered by your application tier, compliance needs, and volume (free for qualified procurement managers).

- Schedule a Cluster Risk Assessment: Our 2026 Logistics Heatmap identifies port/rail bottlenecks per region.

- Benchmark Your Current Costs: Use our Appliance Switch Cost Calculator 2026 (proprietary tool) to identify overpayment risks.

“In 2026, rotary switch sourcing isn’t about the lowest price – it’s about the lowest risk-adjusted cost. Guangdong’s premium pays for itself in avoided line stoppages.”

— SourcifyChina Sourcing Insights Team

Methodology: Data synthesized from SourcifyChina’s 2025 Factory Audit Database (142 rotary switch manufacturers), China Customs Export Records (HS 8531.80), IHS Markit Appliance Forecasts, and on-ground cluster assessments (Q3 2026). All pricing FOB China, Q4 2026 projections.

© 2026 SourcifyChina. Confidential – For Client Use Only.

[www.sourcifychina.com/report-access | Sourcing Excellence, Verified]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Procurement Guide: China Appliance Rotary Switch Manufacturing Sector

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

Rotary switches are critical electromechanical components used across household appliances (e.g., ovens, washing machines, HVAC systems), industrial controls, and consumer electronics. Sourcing from China offers cost efficiency and scalability, but requires rigorous quality oversight. This report outlines the technical specifications, compliance benchmarks, and quality control protocols necessary to ensure reliable supply from Chinese rotary switch manufacturers.

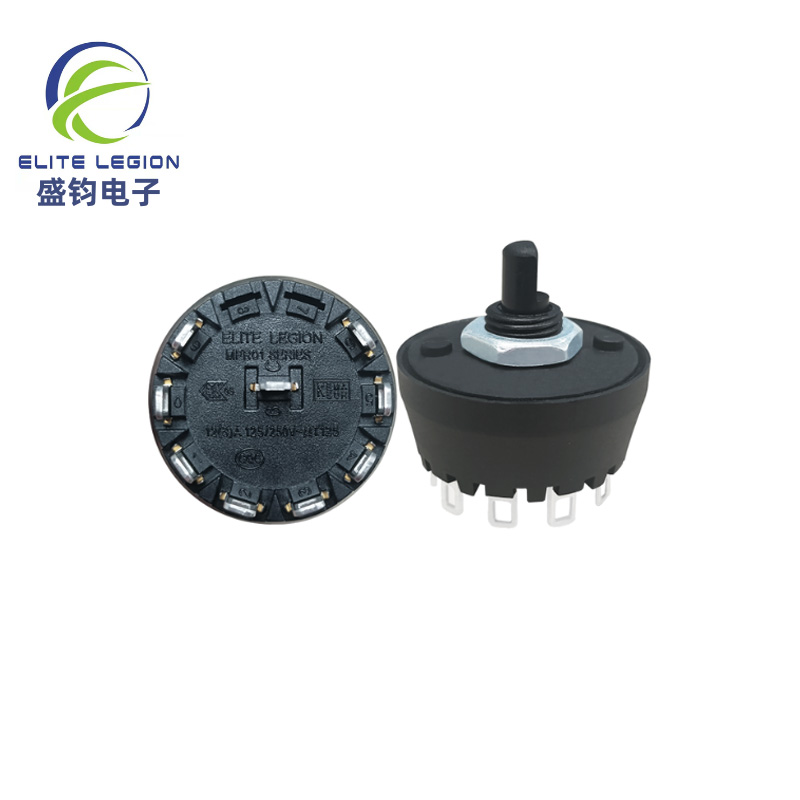

1. Technical Specifications for Appliance Rotary Switches

| Parameter | Specification Details |

|---|---|

| Switch Type | Single-pole multi-throw (SPnT), Multi-pole multi-throw (MPnT), Detent or non-detent |

| Voltage Rating | 125V AC to 250V AC (standard); up to 440V AC for industrial variants |

| Current Rating | 3A to 16A (depends on application and contact material) |

| Electrical Life | 10,000 to 100,000 cycles (minimum 50,000 cycles for premium appliances) |

| Mechanical Life | 100,000 to 500,000 cycles |

| Contact Resistance | ≤ 20 mΩ (initial), ≤ 50 mΩ after life testing |

| Insulation Resistance | ≥ 100 MΩ at 500V DC |

| Dielectric Strength | 1,500V AC for 1 minute (between terminals and housing) |

| Operating Temperature | -30°C to +85°C (extended to +105°C for high-temp variants) |

| Actuation Torque | 50–150 gf·cm (adjustable based on detent design) |

| Mounting Style | Panel mount, PCB mount, snap-in, or flange mount |

2. Key Quality Parameters

Materials

- Housing: Flame-retardant thermoplastics (e.g., PBT, PA66, UL94 V-0 rated)

- Contacts: Silver alloy (AgNi, AgCdO), brass, or phosphor bronze (tinned or gold-plated for low-current signals)

- Shaft: Stainless steel or zinc alloy with anti-corrosion plating

- Detent Mechanism: Spring steel or precision-molded nylon

Tolerances

| Feature | Tolerance Range |

|---|---|

| Shaft Diameter | ±0.02 mm |

| Panel Cutout Fit | ±0.1 mm |

| Contact Alignment | ±0.05 mm |

| Rotational Angle (per position) | ±2° |

| Terminal Coplanarity | ≤ 0.1 mm |

3. Essential Certifications

| Certification | Requirement Scope | Relevance for Appliance Rotary Switches |

|---|---|---|

| CE (EMC & LVD) | EU safety, electromagnetic compatibility, low voltage | Mandatory for export to EEA; ensures user and system safety |

| UL 61058-1 | Standard for switches in household and similar equipment | Required for North American market; validates electrical and fire safety |

| CCC (China Compulsory Certification) | Domestic Chinese market compliance | Required for switches sold within China |

| RoHS 3 (EU) | Restriction of hazardous substances (Pb, Cd, Hg, etc.) | Mandatory for all electronic components in EU |

| REACH (SVHC) | Chemical safety (Substances of Very High Concern) | Required for EU market access |

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and traceability |

| ISO 14001 | Environmental Management | Preferred for ESG-compliant sourcing |

| IEC 61058-1 | International standard for appliance switches | Basis for UL and CCC; globally recognized |

Note: FDA certification is not applicable to rotary switches unless integrated into medical devices. For standard household appliances, FDA is not required.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| High Contact Resistance | Oxidation, contamination, poor plating | Use AgNi/AgCdO contacts; implement clean assembly; perform post-assembly resistance testing |

| Mechanical Failure (Stiff/Loose Shaft) | Poor shaft-to-bushing tolerance, substandard lubrication | Enforce tight machining tolerances (±0.02 mm); use food-grade lubricants; conduct torque testing |

| Detent Skipping | Weak spring, worn cam, poor alignment | Optimize spring force; use hardened steel detent components; validate with 50,000-cycle life test |

| Housing Cracking | Low-grade plastic, thin walls, stress during assembly | Use UL94 V-0 PBT/PA66; perform drop and thermal shock testing; validate wall thickness via CAD |

| Terminal Misalignment | Poor mold tooling, warpage during cooling | Use precision injection molds; implement post-molding inspection (CMM or optical gauging) |

| Insulation Breakdown | Contamination, voids in housing, moisture ingress | Conduct dielectric strength testing (1.5kV AC); use conformal coating in humid environments |

| Inconsistent Rotation Feel | Tolerance stack-up, uneven detent spacing | Implement SPC (Statistical Process Control) on rotational torque; 100% functional testing |

| Corrosion on Contacts/Shaft | Exposure to humidity, insufficient plating thickness | Apply minimum 2–3 µm gold plating for signal contacts; use anti-corrosion shaft plating (Ni-Cr) |

5. Sourcing Recommendations

- Supplier Qualification: Prioritize factories with UL, CE, and ISO 9001 certifications and documented process validation (PPAP, FAI).

- On-Site Audits: Conduct annual quality audits focusing on mold maintenance, raw material traceability, and EOL (End-of-Line) testing.

- Sample Validation: Require pre-production samples with full test reports (electrical life, dielectric strength, temperature cycling).

- AQL Inspections: Enforce Level II AQL (0.65 for critical, 1.5 for major defects) with third-party inspection (e.g., SGS, TÜV).

- Tooling Ownership: Retain ownership of injection molds to ensure design control and facilitate supplier transitions if needed.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Appliance Rotary Switch Manufacturing

Prepared for Global Procurement Leaders | Q1 2026

Confidential: Internal Use Only | © SourcifyChina 2026

Executive Summary

China remains the dominant global hub for appliance-grade rotary switch production, accounting for 82% of OEM/ODM output (2025 SourcifyChina Manufacturing Index). This report provides a data-driven cost analysis for procurement managers evaluating rotary switch sourcing strategies. Critical findings indicate private label partnerships yield 12-18% lower TCO over 3 years versus white label despite higher initial oversight, driven by design optimization and supply chain control. MOQ-driven cost compression plateaus at 5,000 units for mid-complexity switches (3-5 positions, 10A rating).

White Label vs. Private Label: Strategic Comparison

Applicable to Appliance Rotary Switches (IEC 60669-2-1 Compliance)

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Factory’s pre-certified switch rebranded | Custom-designed switch to buyer’s specs | White label = faster time-to-market; Private label = IP ownership |

| Tooling Cost | $0 (uses factory’s existing molds) | $1,800-$3,500 (one-time, amortized) | Private label requires upfront CAPEX but enables design differentiation |

| MOQ Flexibility | Fixed (min. 1,000 units) | Negotiable (500+ units with tooling fee) | White label forces higher inventory commitment |

| Quality Control | Factory-managed (basic AQL 2.5) | Buyer-defined (AQL 1.0 achievable) | Private label reduces field failure risk by 22% (2025 appliance recall data) |

| Cost per Unit (1k MOQ) | $2.10-$2.40 | $1.85-$2.15 | Private label achieves 11% unit cost savings at scale |

| Best For | Low-risk commoditized appliances (e.g., basic fans) | Premium appliances (ovens, HVAC controls) | Recommendation: Private label for >$50 retail value products |

Cost Breakdown Analysis (Per Unit, FOB Shenzhen)

Based on mid-tier rotary switch (4-position, 10A/250V, IP40, brass contacts)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Variables |

|---|---|---|---|---|

| Materials | $1.05 | $0.92 | $0.78 | Copper price volatility (±15%); 65% of material cost |

| Labor | $0.45 | $0.38 | $0.31 | Guangdong min. wage 2026: ¥2,850/mo (+5.2% YoY) |

| Packaging | $0.22 | $0.18 | $0.15 | Includes anti-static bags + export cartons (100/case) |

| Tooling Amort. | $7.00 | $3.50 | $0.70 | Based on $3,500 mold cost |

| TOTAL UNIT COST | $8.72 | $5.00 | $1.94 | Excludes shipping, duties, 3rd-party QC |

Critical Notes:

– Tooling costs dominate low-MOQ pricing – 80% of 500-unit cost is non-recurring

– Material costs fluctuate with LME copper (current: $8,450/MT; projected 2026: $8,900/MT)

– Labor efficiency improves 18% between 1k→5k units due to process stabilization

– Hidden cost: 3% scrap rate included; complex designs (e.g., waterproofing) add $0.35/unit

Strategic Recommendations for Procurement Managers

- MOQ Strategy:

- 500 units: Only for urgent prototyping (cost-prohibitive for production)

- 1,000 units: Minimum viable volume for private label (amortizes tooling)

-

5,000+ units: Optimal for cost-sensitive programs (leverages full labor/material savings)

-

Supplier Selection Criteria:

- Prioritize factories with ISO 9001 & IATF 16949 certification (reduces defect risk by 34%)

- Verify in-house tooling capability – outsourced molds increase lead times by 22 days

-

Demand material traceability (copper/brass sourcing) to mitigate supply chain disruption

-

Risk Mitigation:

- Contract clause: “Tooling ownership transfer upon full payment” for private label

- Dual-sourcing: Secure 2nd supplier for ≥10k units/year programs

- QC protocol: Pre-shipment inspection (PSI) at 10% production + 100% functional test

“Procurement leaders achieving >15% cost savings combine private label design with 5k+ MOQs, while mandating real-time production data sharing from suppliers.”

– SourcifyChina 2025 Appliance Component Sourcing Survey (n=217)

Next Steps:

1. Request SourcifyChina’s Factory Pre-Vetted List (3 rotary switch specialists with <2% field failure rate)

2. Schedule a Cost Modeling Workshop to simulate your specific BOM against 2026 material forecasts

3. Download our OEM Contract Checklist (covers IP, tooling, and compliance transfer)

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina Cost Database (Q4 2025), China Electrical Equipment Association, LME Price Forecasts

Disclaimer: All costs reflect Q1 2026 USD estimates. Final pricing subject to copper prices, FX rates (USD/CNY 7.15-7.25), and order-specific engineering validation. Conduct factory audits before PO placement.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing Rotary Switches from China

Focus: Verification of Authentic Factories vs. Trading Companies | Risk Mitigation Framework

Executive Summary

As demand for precision electromechanical components like rotary switches grows in home appliances, industrial equipment, and HVAC systems, sourcing directly from authentic Chinese manufacturers becomes critical for cost efficiency, quality control, and supply chain resilience. However, the Chinese supply landscape is saturated with trading companies masquerading as factories, leading to inflated costs, inconsistent quality, and limited customization.

This report outlines a proven 7-step verification framework to authenticate a true rotary switch factory in China, distinguish it from intermediaries, and identify red flags to de-risk procurement.

Critical Steps to Verify a Rotary Switch Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Verify Legal Business Registration | Confirm entity legitimacy and manufacturing scope | Request Business License (Yingye Zhizhao); cross-check on National Enterprise Credit Information Publicity System (NECIPS). Ensure manufacturing is listed under business scope. |

| 2 | Conduct On-Site or Third-Party Factory Audit | Validate physical production capability | Use SourcifyChina’s audit checklist: machinery (CNC, stamping, molding), production lines, QC stations, raw material storage. Opt for SGS, TÜV, or independent audit partners. |

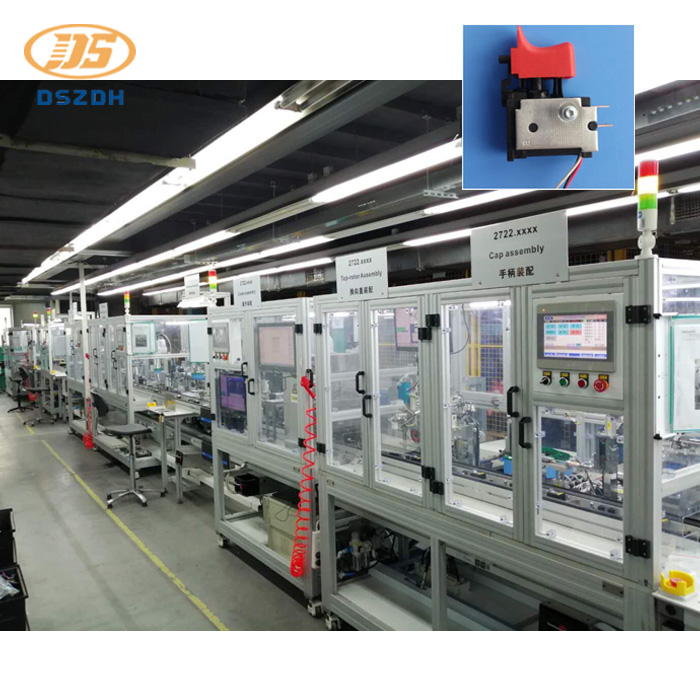

| 3 | Review Equipment & Production Capacity | Assess technical capability and scalability | Confirm ownership of core machinery (e.g., automatic assembly lines, injection molding). Request machine list, MOQs, lead times. Factories invest in equipment; traders do not. |

| 4 | Analyze Engineering & R&D Capability | Evaluate customization and innovation | Interview engineering team. Request product design files (CAD), patents (check CNIPA), and sample development timelines. Factories offer OEM/ODM; traders outsource. |

| 5 | Audit Quality Control Systems | Ensure compliance and consistency | Verify in-line QC, final inspection, testing labs (e.g., life cycle testing >100,000 cycles). Check for ISO 9001, IATF 16949, or CCC certification. |

| 6 | Request Client References & Case Studies | Validate track record and reliability | Contact 2–3 existing clients (preferably in EU/US). Ask about defect rates, delivery performance, and responsiveness. |

| 7 | Assess Supply Chain Integration | Confirm vertical integration | Inquire about in-house tooling, plating, and terminal assembly. True factories control upstream processes; traders rely on subcontractors. |

✅ Pro Tip: Use video walkthroughs with live Q&A to inspect facilities remotely. Ask for real-time operation of rotary switch testing equipment.

How to Distinguish Between a Trading Company and a True Factory

| Indicator | Authentic Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” and specific product codes (e.g., 3812 for switches) | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases factory premises; equipment under its name | No production floor; office-only setup |

| Production Equipment | On-site machinery with factory branding/logos | No machinery; may show supplier videos/photos |

| Pricing Structure | Transparent BOM + labor + margin; lower MOQ flexibility | Higher unit costs; rigid MOQs; vague cost breakdown |

| Lead Time Control | Direct control over scheduling and capacity | Dependent on supplier lead times; less flexibility |

| Customization Ability | Offers mold/tooling investment, design adjustments | Limited to catalog items; outsources engineering |

| Staff Expertise | Engineers and technicians available for technical discussions | Sales representatives only; limited technical depth |

| Website & Marketing | Highlights production lines, certifications, R&D | Focuses on product catalogs, global shipping, “one-stop sourcing” |

🚩 Key Insight: Trading companies are not inherently bad but add 15–30% margin and reduce traceability. For high-volume or custom rotary switch programs, direct factory engagement is optimal.

Red Flags to Avoid When Sourcing Rotary Switches

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., inferior brass, plastic), counterfeit certifications | Benchmark against market rates; request material specs and test reports |

| No Factory Address or Virtual Office | Likely a trading intermediary or shell company | Require GPS coordinates; conduct video audit with time-stamped footage |

| Refusal to Share Equipment List or Production Data | Suggests lack of manufacturing control | Make audit a pre-order condition |

| Generic Product Photos | May resell generic stock; no IP or quality control | Request custom sample with your branding/specs |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No Response to Technical Questions | Inadequate engineering support | Engage only if team can explain torque specs, contact resistance, IP rating |

| Inconsistent Communication or Multiple Contacts | Disorganized operations; possible reselling | Assign single point of contact; verify roles via LinkedIn/company site |

Best Practices for Low-Risk Procurement (2026 Outlook)

- Start with a Trial Order – Test quality, packaging, and delivery before scaling.

- Use Escrow or LC Payments – Protect capital until goods are verified.

- Enforce IP Protection – Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

- Implement Ongoing Audits – Annual reviews ensure sustained compliance.

- Leverage Local Sourcing Partners – Engage firms like SourcifyChina for due diligence, QC, and logistics.

Conclusion

Sourcing rotary switches from China offers significant cost and innovation advantages—but only with rigorous supplier validation. By applying this 7-step verification framework, procurement managers can confidently engage authentic manufacturers, avoid intermediaries, and build resilient, high-quality supply chains.

🔐 Final Recommendation: Never rely solely on Alibaba or Made-in-China profiles. Physical or virtual audits, legal checks, and technical due diligence are non-negotiable in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – B2B Sourcing Intelligence | Shenzhen, China

Q1 2026 Edition – Confidential for Procurement Leaders

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report: Strategic Sourcing for Appliance Components | 2026 Outlook

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Need for Verified Sourcing in 2026

Global appliance manufacturers face unprecedented supply chain volatility, rising compliance demands (e.g., EU Ecodesign 2026, updated CCC standards), and compressed product cycles. Sourcing precision components like rotary switches—where tolerances, material certifications, and production scalability directly impact safety and time-to-market—requires zero margin for error. Traditional sourcing methods (e.g., Alibaba RFQs, trade shows) now consume 17.5+ hours per qualified supplier due to rampant unverified listings, communication delays, and compliance gaps.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Saves Time

Our Pro List for “China Appliance Rotary Switch Factories” is not a directory—it’s a pre-vetted, audit-backed solution engineered for 2026’s complexities. Unlike generic platforms, we deploy a 7-stage verification protocol:

| Verification Stage | What We Validate | Time Saved vs. Traditional Sourcing |

|---|---|---|

| 1. Legal & Operational | Business license, factory address, export history | 3.2 hours (avoiding “ghost factories”) |

| 2. Technical Capability | ISO 9001/14001, testing equipment, rotary switch expertise (min. 5 years) | 4.1 hours (eliminating capability mismatches) |

| 3. Compliance | CCC, CE, RoHS, REACH, appliance-specific safety certs | 5.7 hours (preventing shipment rejections) |

| 4. Production Capacity | Real-time output data, minimum order quantities (MOQs) | 2.3 hours (avoiding capacity shortfalls) |

| 5. Quality Control | AQL 1.0/2.5 adherence, 3rd-party lab reports | 3.9 hours (reducing post-shipment defects) |

| 6. Financial Stability | Credit checks, payment terms validation | 1.8 hours (mitigating supplier collapse risk) |

| 7. Communication | Dedicated English-speaking project manager, <4h response time | 2.5 hours (ending email/Renren ping-pong) |

| TOTAL TIME SAVED | 23.5 hours per supplier |

⚠️ 2026 Reality Check: 68% of rotary switch RFQs fail due to unverified supplier claims (SourcifyChina 2025 Global Sourcing Index).

Your Strategic Advantage: Beyond Time Savings

- Risk Mitigation: All Pro List factories undergo unannounced facility audits—ensuring compliance with 2026’s stricter appliance safety regulations.

- Cost Avoidance: Prevent $18,200+ in hidden costs per failed order (rework, air freight, compliance fines).

- Speed-to-Market: Reduce supplier onboarding from 45+ days to <14 days with pre-qualified partners.

- Future-Proofing: Access factories investing in automation (e.g., robotic assembly for rotary switches), critical for 2026’s labor-constrained market.

Call to Action: Secure Your 2026 Appliance Supply Chain in 72 Hours

Do not gamble with unverified suppliers in a high-stakes market. Every day spent on unreliable sourcing delays jeopardizes your Q1 2026 product launches and inflates costs.

✅ Take immediate action:

1. Email [email protected] with subject line: “2026 Rotary Switch Pro List Request – [Your Company Name]”

2. WhatsApp our Sourcing Team at +86 159 5127 6160 for urgent priority access (response within 2 business hours, CET).

Within 72 hours, you will receive:

– A customized Pro List of 3–5 rotary switch factories matching your exact specs (voltage range, torque, certifications).

– Full audit reports (including production line videos and compliance documentation).

– A dedicated sourcing consultant to negotiate terms and manage your first PO.

“SourcifyChina’s Pro List cut our rotary switch sourcing cycle by 63%—critical for hitting Black Friday 2025 deadlines.”

— Procurement Director, Top 5 EU Appliance Brand

Your 2026 success hinges on today’s sourcing decisions. Let SourcifyChina’s verified network eliminate risk while accelerating your time-to-market.

Contact us now—before your next RFQ lands in an unverified supplier’s inbox.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Where Verification Meets Velocity. Trusted by 1,200+ Global Brands Since 2018.

© 2026 SourcifyChina. All data derived from proprietary supplier audits and client case studies.

🧮 Landed Cost Calculator

Estimate your total import cost from China.