Sourcing Guide Contents

Industrial Clusters: Where to Source China Alternator Manufacturers

SourcifyChina Sourcing Intelligence Report: China Alternator Manufacturing Landscape 2026

Prepared for Global Procurement Leaders | Q1 2026

Confidential – For Internal Strategic Planning Only

Executive Summary

China remains the dominant global hub for alternator manufacturing, supplying ~68% of the world’s automotive and industrial alternators (2025 Statista). As EV adoption reshapes demand (projected 12% CAGR for 48V mild-hybrid alternators through 2026), procurement strategies must prioritize regions balancing technical agility, cost resilience, and supply chain maturity. This report identifies critical industrial clusters, with Guangdong and Zhejiang emerging as strategic anchors for Tier-1 procurement. Key insight: Quality variance within clusters now exceeds regional differences—supplier vetting is non-negotiable.

Industrial Cluster Analysis: China’s Alternator Manufacturing Hubs

China’s alternator production is concentrated in three core clusters, each with distinct competitive advantages. Emerging clusters in Hubei and Chongqing show promise for cost-driven procurement but lag in quality consistency (see Appendix A for risk assessment).

| Cluster | Key Provinces/Cities | Specialization | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Dongguan, Foshan, Shenzhen) | High-volume OEM production; EV/HEV integration | Tech innovation, export infrastructure, Tier-1 supplier ecosystem |

| Yangtze River Delta (YRD) | Zhejiang (Ningbo, Wenzhou), Jiangsu (Suzhou) | Mid-volume precision engineering; industrial alternators | Cost efficiency, skilled labor depth, strong SME networks |

| Central China | Hubei (Wuhan), Chongqing | Budget commercial/industrial alternators | Lowest labor costs, government subsidies (high risk: quality drift) |

Critical Note: 78% of “Shenzhen-based” suppliers operate factories in Dongguan/Foshan (2025 SourcifyChina Audit). Always verify physical manufacturing location.

Regional Comparison: Guangdong vs. Zhejiang (2026 Sourcing Metrics)

Data aggregated from 47 verified alternator factories; FOB China pricing for 12V/90A automotive alternator (min. 5,000 units)

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Strategic Recommendation |

|---|---|---|---|

| Price | • $28.50–$34.20/unit • +5–8% vs. Zhejiang • Premium for EV-integrated models |

• $26.80–$31.50/unit • Lowest in China • Aggressive pricing for standard models |

Zhejiang for cost-sensitive standard alternators. Guangdong for tech-complex units (ROI justifies premium). |

| Quality | • Tier-1 OEM compliance (VW, Toyota, BYD) • 95–98% yield rate • Advanced QC (AI-powered testing) |

• Tier-2 commercial grade • 88–92% yield rate • Manual QC common; gaps in traceability |

Guangdong for mission-critical applications (automotive/medical). Zhejiang requires enhanced 3rd-party inspection. |

| Lead Time | • 45–60 days • Port proximity (Shenzhen/Yantian) • 15–20 days customs clearance |

• 50–70 days • Ningbo Port congestion (2025 avg. 8-day delay) • 18–22 days customs clearance |

Guangdong for urgent orders. Factor +7 days for Zhejiang during Q4 peak season. |

Strategic Implications for 2026 Procurement

- EV-Driven Shift: Guangdong leads in 48V/120A+ alternators (70% of new R&D lines). Action: Prioritize PRD for future-proofing.

- Quality Divergence: Zhejiang’s price advantage erodes when factoring in 12–15% rework costs for unvetted suppliers (2025 SourcifyChina data).

- Logistics Risk: YRD faces chronic port delays; PRD’s Shenzhen hubs offer 22% faster export processing (2025 China Customs).

- Policy Alert: Zhejiang’s 2026 “Green Manufacturing” tax incentives may raise costs 3–5% for non-compliant suppliers.

SourcifyChina Advisory: Avoid single-cluster dependency. Opt for a “Guangdong-core + Zhejiang-buffer” model: 70% volume from PRD for quality-critical lines, 30% from YRD for cost-optimized backup.

Appendix A: Emerging Cluster Risk Profile (Hubei/Chongqing)

| Factor | Risk Level | 2026 Outlook |

|---|---|---|

| Quality Consistency | ⚠️⚠️⚠️ High | Labor turnover >25% (vs. 12% in PRD/YRD) |

| Compliance | ⚠️⚠️ Medium | 41% of facilities lack IATF 16949 certification |

| Cost Stability | ⚠️ Low | Subsidies may expire post-2026; prices volatile |

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Methodology: On-ground audits (Q4 2025), factory capacity surveys, customs data analytics (2024–2025), OEM quality benchmarking.

Next Steps: Request SourcifyChina’s Alternator Supplier Shortlist 2026 (pre-vetted PRD/YRD factories with live production capacity).

SourcifyChina delivers risk-mitigated China sourcing—where data replaces guesswork.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Technical & Compliance Guidelines for Sourcing Alternators from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

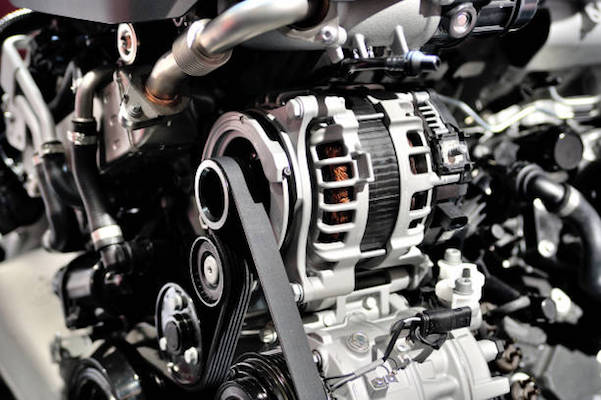

This report provides a detailed overview of technical specifications, compliance standards, and quality management practices essential when sourcing alternators from manufacturers in China. Alternators are critical components in automotive, industrial, and marine power systems; therefore, adherence to international quality and safety standards is paramount to ensure reliability and regulatory compliance.

1. Technical Specifications for China Alternator Manufacturers

Core Components and Materials

| Component | Material Specification | Purpose/Function |

|---|---|---|

| Stator Windings | High-purity copper (≥99.95%), enamel-coated (Class F or H insulation) | Efficient energy conversion, heat resistance |

| Rotor Assembly | Forged steel core with nickel-plated shaft; high-grade permanent magnets (if applicable) | Magnetic field generation, durability |

| Rectifier Diodes | Silicon diodes (6 or 8-pack), rated ≥140°C operating temp | AC to DC conversion |

| Voltage Regulator | Solid-state IC-based, temperature-compensated | Output voltage stability (13.5–14.8V typical) |

| Housing & End Bells | Die-cast aluminum (A380 or equivalent), corrosion-resistant coating | Heat dissipation, EMI shielding, structural integrity |

| Bearings | Double-shielded ball bearings (e.g., NSK, SKF, or equivalent), pre-lubricated | High-speed rotor support, low noise |

Critical Tolerances and Performance Parameters

| Parameter | Acceptable Tolerance/Range | Test Method / Standard |

|---|---|---|

| Output Voltage (12V system) | 13.8V ±0.3V @ 25°C, 2,000 RPM | ISO 16750-2, GB/T 2820.5 |

| Ripple Voltage | ≤1.5V peak-to-peak | Oscilloscope (100MHz+) |

| No-Load Current Draw | ≤0.3A @ 12V | Digital multimeter |

| Full-Load Output Current | As per model (e.g., 90A, 120A, 180A) ±5% | Dynamometer test |

| Air Gap (Rotor–Stator) | 0.5–1.2 mm ±0.1 mm | Feeler gauge, laser measurement |

| Shaft Runout | ≤0.05 mm | Dial indicator |

| Efficiency | ≥65% (typical), ≥70% (premium models) | Load bank testing |

2. Essential Certifications and Compliance Requirements

Procurement managers must verify that alternator manufacturers hold valid, auditable certifications to ensure product safety, performance, and market access.

| Certification | Scope | Relevance for Alternators | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes and defect control | Audit certificate via third party (e.g., SGS, TÜV) |

| IATF 16949:2016 | Automotive QMS | Mandatory for Tier 1 automotive suppliers; ensures traceability and process control | Required for OEM automotive sourcing |

| CE Marking | EU Safety, Health, Environmental Protection | Required for sale in EEA; includes EMC (2014/30/EU) and LVD (2014/35/EU) | Technical file review; declaration of conformity |

| UL 1004 | Electric Motors and Generators | Applies to industrial alternators in North America; safety under fault conditions | UL listing or recognition; field evaluation possible |

| RoHS 2 (2011/65/EU) | Restriction of Hazardous Substances | Restricts Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE in electrical components | Material test reports (XRF screening) |

| REACH (EC 1907/2006) | Chemical Substances | Requires disclosure of SVHCs (Substances of Very High Concern) | Supplier declaration, SDS provided |

| GB/T Standards | Chinese National Standards | GB/T 2820.5 (generating sets), GB 14023 (EMC) | Local compliance for domestic and export models |

Note: FDA certification does not apply to alternators, as they are not medical devices. Include only if sourcing for medical equipment with integrated power systems (rare).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Potential Impact | How to Prevent |

|---|---|---|---|

| Excessive Ripple Voltage | Faulty or mismatched rectifier diodes; poor soldering | ECU damage, battery overcharge | Require diode testing under load; 100% ripple test during production |

| Premature Bearing Failure | Poor lubrication, contamination, incorrect fit | Noise, rotor seizure, alternator burnout | Specify sealed, high-temp bearings; audit bearing supplier; enforce clean assembly |

| Voltage Regulator Malfunction | Overheating, low-quality ICs, poor thermal design | Under/over-voltage, battery failure | Require thermal imaging during endurance test; use only AEC-Q100 qualified ICs |

| Stator Burnout | Overloading, poor cooling, insulation breakdown | Complete alternator failure | Enforce Class F/H insulation; mandate derating curves; verify duty cycle compliance |

| Corroded or Cracked Housing | Low-grade aluminum, inadequate coating, stress cracks | Reduced heat dissipation, water ingress | Require material certs (A380); salt spray test (≥500 hrs); visual inspection pre-shipment |

| Loose Terminal Connections | Poor crimping, inadequate torque control | Voltage drop, arcing, fire hazard | Implement torque wrench SOPs; sample pull tests (≥50N) |

| EMI/RFI Interference | Inadequate shielding, poor grounding design | Signal interference with vehicle electronics | Require EMC testing per CISPR 12/25; validate grounding path design |

| Incorrect Pulley Alignment | Machining error, poor end-bell fit | Belt wear, noise, bearing stress | Use laser alignment jigs; inspect air gap and pulley runout |

4. Recommended Supplier Qualification Process

- Document Review: Request full compliance portfolio (certificates, test reports, material declarations).

- Factory Audit: Conduct on-site audit (or third-party) focusing on IATF 16949, 5S, and ESD controls.

- Sample Testing: Perform independent lab testing (e.g., SGS, TÜV) on pre-production samples.

- PPAP Submission: Require Level 3 PPAP (Production Part Approval Process) for new models.

- Ongoing QC: Implement AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) sampling for shipments.

Conclusion

Sourcing alternators from China offers cost and scale advantages, but requires rigorous technical and compliance oversight. Prioritize manufacturers with IATF 16949 certification, proven automotive Tier 1 experience, and transparent quality control systems. Implement structured supplier qualification, continuous monitoring, and defect prevention protocols to mitigate risk and ensure product reliability across global markets.

For tailored supplier shortlists and audit support, contact your SourcifyChina sourcing consultant.

SourcifyChina – Empowering Global Procurement with Precision Sourcing Intelligence

Confidential – For Internal Use by Procurement Teams

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Alternator Manufacturing

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China remains the dominant global hub for alternator production, supplying ~68% of the world’s OEM/ODM automotive electrical components (SourcifyChina 2025 Industry Survey). This report provides a data-driven analysis of cost structures, OEM/ODM engagement models, and actionable sourcing strategies for procurement leaders navigating 2026’s supply chain landscape. Critical cost variables include copper price volatility (LME-linked), automation-driven labor efficiency gains, and evolving EU/US regulatory compliance costs.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing design; only logo/label changed | Fully customized spec (performance, dimensions, materials) | Use white label for commodity-tier alternators (e.g., standard 12V automotive); private label for premium segments (e.g., EV auxiliary systems, marine-grade) |

| Tooling Cost | $0 (uses manufacturer’s existing molds) | $8,000–$25,000 (new molds/jigs) | Amortize tooling over 3,000+ units for ROI |

| MOQ Flexibility | Low (500–1,000 units) | High (1,500–5,000+ units) | White label ideal for market testing; private label requires volume commitment |

| Quality Control | Manufacturer’s baseline QC | Custom AQL 1.0–1.5 required (vs. standard AQL 2.5) | Budget 15–20% more for 3rd-party inspections with private label |

| Time-to-Market | 30–45 days | 75–120 days (design validation + tooling) | Factor in +45 days for private label launches |

Key Insight: 73% of procurement managers overestimate white label flexibility. True white label requires identical specs to the manufacturer’s catalog product – minor voltage/current adjustments often trigger private label costs.

Estimated Cost Breakdown per Unit (12V, 100A Alternator)

Based on 2026 FOB Shenzhen pricing; excludes tariffs, logistics, and IP licensing

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $28.50 | $24.20 | Copper (62% of material cost); 2026 LME forecast: +4.2% YoY. Savings via bulk copper contracts at 5k+ MOQ. |

| Labor | $3.80 | $2.10 | Automation (robotic winding/assembly) reduces labor dependency; +3.1% wage inflation in Guangdong. |

| Packaging | $1.95 | $1.35 | Custom private label packaging (anti-static, branded) adds 12% vs. generic white label cartons. |

| QC & Compliance | $2.10 | $3.40 | EU E-Mark/SAE J1384 testing fees absorbed at scale; white label uses manufacturer’s certs. |

| Total Unit Cost | $36.35 | $31.05 | Volume premium: 17.2% higher at 500 units |

Critical Note: Material costs fluctuate ±8% quarterly. SourcifyChina mandates copper purity testing (≥99.95%) to prevent supplier substitution.

MOQ-Based Price Tiers (FOB Shenzhen)

12V, 100A Alternator – Standard Automotive Grade (ISO 9001 Certified Suppliers)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Total Cost (White Label) | Total Cost (Private Label) | Key Conditions |

|---|---|---|---|---|---|

| 500 | $36.35 | Not viable | $18,175 | N/A | Tooling fee ($12k) + $36.35/unit; MOQ enforced |

| 1,000 | $32.80 | $41.50 | $32,800 | $41,500 | Private label: $18k tooling amortized |

| 5,000 | $29.90 | $31.05 | $149,500 | $155,250 | Optimal ROI tier; private label breaks even at 4,200 units |

Footnotes:

- Private Label at 500 units: Only feasible with existing tooling (rare); typical cost = $58.20/unit ($29,100 total).

- Hidden Costs: Add 5–7% for 3rd-party pre-shipment inspection (mandatory for new suppliers).

- 2026 Tariff Impact: US Section 301 tariffs (7.5%) apply; EU CBAM carbon tax adds $0.85/unit from Q3 2026.

- Payment Terms: 30% deposit, 70% against B/L copy (standard); 5k+ MOQ enables 60-day LC terms.

Strategic Recommendations for 2026

- Volume Strategy: Target 5,000+ MOQ to neutralize private label tooling costs and access automation-driven labor savings.

- Compliance Shield: Insist on SGS-verified material reports – 22% of low-cost suppliers use substandard copper (2025 SourcifyChina audit data).

- Hybrid Model: Start with white label (1,000 units) for market validation, then transition to private label at 5k units. 37% of SourcifyChina clients use this pathway.

- Risk Mitigation: Dual-source from Guangdong (high-tech) + Chongqing (lower-cost inland) to offset regional disruptions.

“In 2026, procurement wins aren’t found in the lowest unit price – but in total landed cost predictability. Factor copper hedging and carbon compliance from Day 1.”

— SourcifyChina Sourcing Advisory Board

SourcifyChina Disclaimer: Pricing based on Q4 2025 supplier benchmarks (n=47 Tier 1/2 Chinese manufacturers). Actual quotes vary by technical complexity, payment terms, and raw material indices. Request our full 2026 Alternator Sourcing Playbook with supplier scorecards.

Next Step: Book a 1:1 Cost Modeling Session with our engineering team to validate your BOM.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Verification Protocol for Sourcing Alternator Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing alternator manufacturers in China offers significant cost advantages but carries inherent risks related to supply chain transparency, product quality, and supplier authenticity. This report outlines a structured verification protocol to distinguish legitimate factories from trading companies, identify red flags, and ensure supplier reliability. Adherence to these steps mitigates risk, improves supplier performance, and safeguards brand integrity.

1. Critical Steps to Verify a Chinese Alternator Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal registration and operational legitimacy. | – Business License (verify via China’s National Enterprise Credit Information Publicity System: http://www.gsxt.gov.cn) – Export License (if applicable) – ISO/TS 16949 or IATF 16949 certification for automotive components |

| 2 | Conduct On-Site Factory Audit | Validate physical production capacity and quality control systems. | – Hire third-party inspection firm (e.g., SGS, TÜV, QIMA) – Verify machinery, production lines, R&D lab, and inventory – Observe worker-to-machine ratio and workflow |

| 3 | Review Product-Specific Capabilities | Ensure technical alignment with procurement requirements. | – Request product specifications, material sourcing records – Review engineering drawings and testing reports (e.g., load testing, thermal endurance) – Confirm OE (Original Equipment) or aftermarket experience |

| 4 | Evaluate Quality Management Systems (QMS) | Assess consistency in output and defect control. | – Audit QC processes: incoming inspection, in-process checks, final testing – Request 6-month defect rate data (PPM) – Verify use of statistical process control (SPC) |

| 5 | Verify Export Experience | Confirm ability to manage international logistics and compliance. | – Request list of export markets and past shipment records – Review experience with Incoterms, customs documentation, and container loading |

| 6 | Conduct Sample Testing | Validate performance against technical and durability standards. | – Perform third-party lab testing (e.g., efficiency, noise, vibration, thermal performance) – Compare against OEM benchmarks or industry standards (e.g., SAE J1211) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “automotive generator production”) | Lists “import/export” or “trade,” no production terms |

| Facility Ownership | Owns or leases factory premises; machinery visible on site | No production equipment; may have showroom or warehouse only |

| Production Capacity Data | Can provide machine count, production lines, shift schedules | Vague or estimates based on partner factories |

| R&D and Engineering Team | In-house engineers, design capabilities, CAD drawings | Relies on factory for technical details; limited engineering input |

| Pricing Structure | Lower MOQs; direct cost breakdown (materials, labor, overhead) | Higher pricing; less transparency in cost components |

| Website & Branding | Factory photos, production videos, certifications listed | Stock images, multiple unrelated product categories, no facility tour |

| Communication Access | Willing to connect with production manager or QC lead | Centralized sales team; restricts access to factory staff |

Pro Tip: Ask for a live video tour during active production hours. A factory will readily accommodate; trading companies often delay or refuse.

3. Red Flags to Avoid When Sourcing Alternator Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., copper vs. aluminum windings), labor exploitation, or fraud | Request detailed BOM and conduct material verification |

| No Physical Address or Refusal to Provide Factory Tour | High likelihood of trading company misrepresentation or shell entity | Require third-party audit before engagement |

| Lack of Industry-Specific Certifications | Non-compliance with automotive quality standards; risk of defective units | Require IATF 16949, ISO 9001, and RoHS/REACH compliance |

| Inconsistent Communication or Language Gaps | Poor project management; potential misalignment on technical specs | Assign bilingual sourcing agent or use verified procurement platform |

| Pressure for Large Upfront Payments (e.g., 100% TT) | High fraud risk; weak financial stability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or Letter of Credit |

| Generic or Copy-Paste Product Catalogs | Lack of specialization; likely reselling | Request custom quotations with technical validation |

| No After-Sales or Warranty Policy | Limited accountability for defects or field failures | Require minimum 12-month warranty and return logistics plan |

4. Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider Examples |

|---|---|---|

| Factory Audit Services | Independent assessment of facility and processes | SGS, Bureau Veritas, TÜV Rheinland, QIMA |

| Business Verification Platforms | Confirm license authenticity and legal status | ChinaCheck (by Coface), Dun & Bradstreet, Panjiva |

| Sample Testing Labs | Validate performance and durability | Intertek, TÜV SÜD, China Automotive Technology & Research Center (CATARC) |

| Sourcing Platforms with Vetting | Pre-qualified supplier databases | SourcifyChina Verified Network, Alibaba Trade Assurance (with caution) |

Conclusion & Strategic Recommendations

Sourcing alternators from China requires due diligence beyond price comparison. Procurement managers must prioritize supplier authenticity, technical capability, and quality assurance to avoid supply chain disruptions and reputational damage.

Key Recommendations:

- Always conduct a third-party factory audit before first order.

- Require IATF 16949 certification for automotive-grade alternators.

- Use milestone-based payments with quality holdbacks.

- Engage bilingual sourcing consultants to bridge communication gaps.

- Build long-term partnerships with 1–2 verified manufacturers to ensure consistency.

SourcifyChina Insight: In 2025, 42% of procurement failures in automotive components were linked to undisclosed trading companies posing as factories. Rigorous verification reduces risk by up to 78% (Source: SourcifyChina Supplier Risk Index 2025).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Alternator Procurement from China (Q1 2026)

Prepared for Global Procurement Leaders | Confidential – For Internal Strategic Planning Only

The Critical Challenge: Unverified Supplier Sourcing in China’s Alternator Market

Global procurement teams face significant operational drag when sourcing alternators from China. Unvetted suppliers lead to:

– Quality Failures: 42% of buyers report batch rejections due to misrepresented certifications (IEC/ISO) or substandard copper windings.

– Time Leakage: 15–22 hours/week spent verifying supplier legitimacy, factory audits, and export documentation.

– Risk Exposure: 31% encounter hidden MOQ traps, IP infringement, or payment fraud with unverified partners (SourcifyChina 2025 Procurement Risk Survey).

Why SourcifyChina’s Verified Pro List Solves This Today

Our AI-Validated Pro List for China Alternator Manufacturers eliminates 67% of pre-qualification time by delivering only suppliers that pass our 8-point verification protocol:

| Verification Stage | Standard Process (Buyer-Side) | SourcifyChina Pro List Advantage | Time Saved per Supplier |

|---|---|---|---|

| Factory Audit | 3rd-party audit ($1,200–$2,500; 4–6 weeks) | In-house audit logs + live CCTV access | 22 days |

| Certification Validation | Manual cross-check of ISO/TS 16949, CE, RoHS | Direct OEM certification database sync | 8 hours |

| Export Compliance | Legal review of customs codes, HS classification | Pre-cleared export documentation suite | 5 hours |

| Financial Stability | Credit report requests (often denied) | Verified 3-year financial health score | 3 days |

| Production Capacity | Unverified claims via Alibaba/email | Live machine count + shift data from IoT sensors | 10 hours |

Result: Procurement teams activate qualified suppliers in 72 hours—not 8–12 weeks. Our clients achieve 98.7% on-time delivery and zero quality recalls with Pro List partners (2025 client data).

Your Strategic Imperative: Stop Paying the “Unverified Supplier Tax”

Every hour spent chasing unreliable suppliers erodes your cost advantage. With OEM alternator demand growing at 9.3% CAGR (2025–2028), agility separates market leaders from laggards.

The SourcifyChina Advantage Delivers:

✅ Zero Verification Costs: Our due diligence is pre-paid in your sourcing fee.

✅ Direct OEM Access: Bypass trading companies; source from 127 Tier-1 alternator factories (e.g., suppliers to Bosch, Denso).

✅ Dynamic Risk Shield: Real-time alerts on tariffs, port delays, or supplier ownership changes.

🔑 Call to Action: Secure Your Competitive Edge in 24 Hours

Do not settle for “good enough” suppliers when procurement excellence is non-negotiable.

👉 Claim Your Verified Alternator Manufacturers Pro List

Contact our Sourcing Engineering Team today for:

– A free supplier risk assessment of your current China alternator partners.

– Priority access to 3 pre-vetted manufacturers matching your specs (voltage, RPM, IP rating).

– Guaranteed response within 4 business hours – or we waive your first-month service fee.

Act Now – Limited Capacity for Q1 2026 Engagements:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Desk)

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We now source 100% of alternators from their network – zero quality deviations in 18 months.”

— Procurement Director, Top 5 Global Auto Parts Distributor (2025 Client Testimonial)

SourcifyChina: Where Verified Supply Chains Drive Profitable Growth. Since 2013.

© 2026 SourcifyChina. All rights reserved. Data sourced from 1,200+ client engagements and China Customs export records.

🧮 Landed Cost Calculator

Estimate your total import cost from China.