Sourcing Guide Contents

Industrial Clusters: Where to Source Butterfly Valve Manufacturers China

SourcifyChina Sourcing Report 2026

Strategic Market Analysis: Sourcing Butterfly Valve Manufacturers in China

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

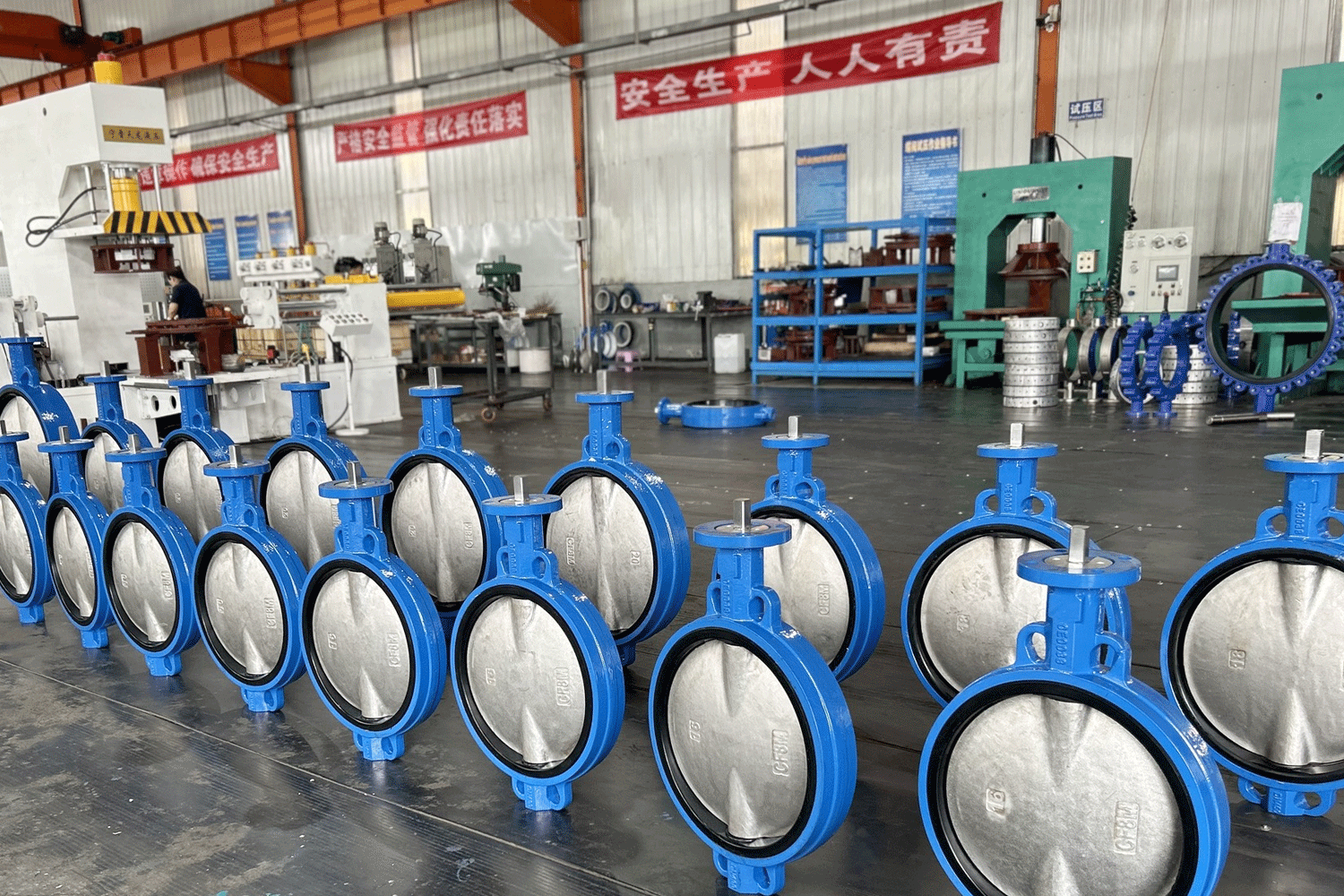

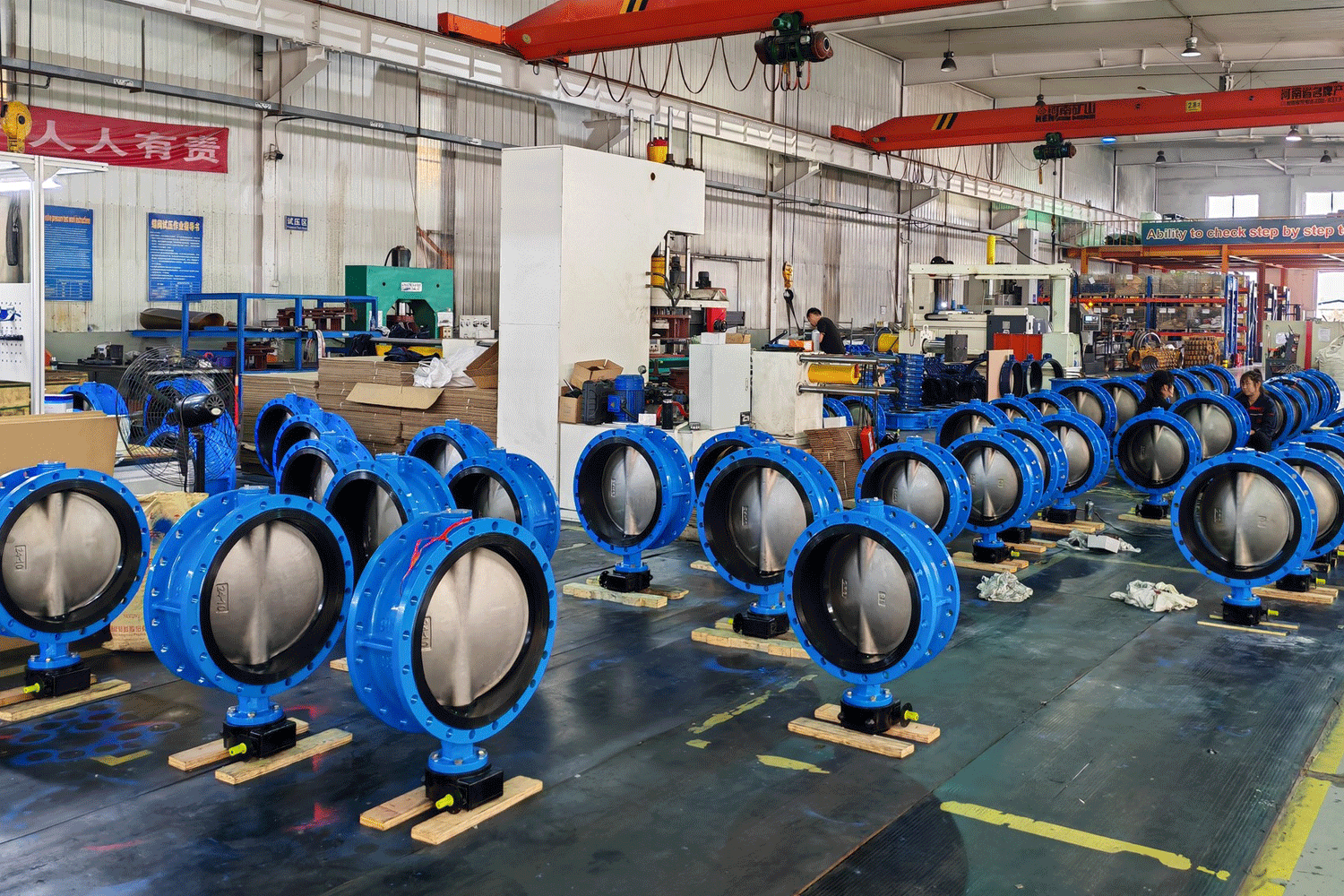

China remains the dominant global supplier of industrial valves, with butterfly valves representing a significant segment due to their widespread use in water treatment, HVAC, petrochemical, and power generation industries. As of 2026, China hosts over 1,200 butterfly valve manufacturers, concentrated in specialized industrial clusters that offer distinct advantages in cost, quality, and delivery performance.

This report provides a deep-dive analysis of key manufacturing regions in China for butterfly valves, focusing on Guangdong, Zhejiang, Jiangsu, Hebei, and Shanghai. The analysis evaluates regional strengths in price competitiveness, quality standards, and lead time efficiency, enabling procurement managers to make data-driven sourcing decisions aligned with their supply chain objectives.

Key Industrial Clusters for Butterfly Valve Manufacturing in China

Butterfly valve production in China is highly regionalized, with clusters forming around raw material availability, skilled labor, export infrastructure, and industry ecosystems. The five primary production hubs are:

-

Zhejiang Province (Wenzhou & Taizhou)

Known as the “Valve Capital of China,” Wenzhou alone accounts for over 35% of national butterfly valve output. The region specializes in stainless steel and high-pressure valves with strong export compliance capabilities. -

Guangdong Province (Foshan & Guangzhou)

Leveraging proximity to Hong Kong and advanced manufacturing for export markets. Focused on mid-to-high-end valves with strong R&D and automation integration. -

Jiangsu Province (Suzhou & Changzhou)

Integrated into the Yangtze River Delta industrial corridor. Strong in precision engineering and valves for semiconductor and pharmaceutical applications. -

Hebei Province (Cangzhou & Baoding)

Low-cost production base with large-scale foundries. Dominates the carbon steel and ductile iron valve segment for infrastructure projects. -

Shanghai (Metropolitan Area)

High-end valve manufacturing with multinational partnerships. Specializes in smart valves and API/ANSI-certified products for oil & gas.

Comparative Analysis: Key Production Regions

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Zhejiang | Medium | High (ISO, CE, API, WRAS certified) | 30–45 days | High technical capability, export compliance, R&D focus | Export markets, regulated industries (water, oil & gas) |

| Guangdong | Medium-High | High (Smart valves, automation-ready) | 35–50 days | Proximity to ports, strong OEM integration | High-mix, automated systems, HVAC projects |

| Jiangsu | Medium | Very High (Precision engineering) | 40–60 days | Cleanroom production, tight tolerances | Semiconductor, pharma, ultra-pure applications |

| Hebei | Low (Most Competitive) | Medium (Basic industrial standards) | 20–35 days | Low labor/foundry costs, high volume capacity | Budget infrastructure, municipal water projects |

| Shanghai | High (Premium Pricing) | Very High (API 609, ISO 15848) | 45–60 days | Global certifications, joint ventures with EU/US firms | Critical oil & gas, offshore, smart valve systems |

Strategic Sourcing Recommendations

1. For Cost-Sensitive, High-Volume Procurement:

- Target Region: Hebei Province

- Rationale: Lowest landed cost due to raw material proximity and scale. Ideal for municipal water projects or developing markets where certifications are less stringent.

2. For Export-Quality Valves with Balanced Cost:

- Target Region: Zhejiang (Wenzhou)

- Rationale: Optimal balance of quality, compliance, and scalability. Over 60% of exporters in this sector source from Wenzhou-based manufacturers.

3. For High-Tech or Smart Valve Applications:

- Target Region: Guangdong or Shanghai

- Rationale: Advanced automation, IoT integration, and strong engineering support. Preferred by multinational EPC contractors.

4. For Ultra-High Purity or Critical Process Industries:

- Target Region: Jiangsu

- Rationale: Precision casting and surface finishing meet USP/EP standards. Increasingly adopted in life sciences and microelectronics.

Market Trends Impacting 2026 Sourcing Strategy

- Consolidation in Wenzhou: Smaller foundries are being phased out due to environmental regulations, increasing reliance on ISO-certified mid-sized manufacturers.

- Rise of Smart Valves: Over 40% of new butterfly valve orders in Guangdong now include IoT monitoring capabilities.

- Export Certifications: Demand for WRAS, KTW, and NSF certifications has increased by 22% YoY, particularly from EU and Middle East buyers.

- Lead Time Volatility: Foundry capacity constraints in Hebei have led to occasional delays; dual sourcing is advised.

Conclusion

China’s butterfly valve manufacturing landscape offers diverse sourcing options tailored to specific procurement objectives. While Zhejiang remains the most balanced choice for global buyers, Hebei delivers unmatched cost efficiency, and Shanghai/Jiangsu lead in high-end applications. Procurement managers should align region selection with product specifications, compliance requirements, and delivery timelines to optimize total cost of ownership.

SourcifyChina recommends on-site factory audits and material traceability clauses for all Tier-1 sourcing engagements, especially in high-volume or mission-critical applications.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Intelligence

Shenzhen, China | sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing in China (2026 Edition)

Prepared for Global Procurement Managers | Objective Analysis | Q1 2026

Executive Summary

China remains the dominant global supplier for industrial butterfly valves (accounting for ~65% of export volume in 2025), driven by cost efficiency and scalable production. However, quality variance between Tier-1 (export-focused) and Tier-2/3 manufacturers is significant. This report details critical technical/compliance parameters to mitigate supply chain risk. Key 2026 Shift: Stricter EU MDR and U.S. EPA regulations are accelerating demand for traceable material certifications and digital QC documentation.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements (Per Application)

| Application | Minimum Material Standard | Key Verification Method | 2026 Cost Driver Alert |

|---|---|---|---|

| Water/Wastewater | ASTM A126 Class B (Cast Iron) | Mill Test Reports (MTRs) + Spectro Analysis | 12% price increase on ductile iron (2025-26) |

| Chemical Processing | ASTM A351 CF8M (316L SS) | Positive Material Identification (PMI) | 316L SS premiums up 18% YoY |

| Food & Beverage | ASTM A387 Gr.91 (304L SS) + FDA 21 CFR 177.2600 | FDA Letter + Ra ≤ 0.8μm surface finish | Laser marking now mandatory |

| Oil & Gas (Upstream) | API 609 compliant WCB/WCC | Charpy Impact Testing @ -20°C | NACE MR0175 compliance adds 22% cost |

B. Critical Dimensional Tolerances (Per API 609 5th Ed.)

| Parameter | Standard Tolerance | High-Integrity Tolerance (Recommended) | QC Method |

|---|---|---|---|

| Disc Thickness | ±0.8mm | ±0.3mm | CMM Measurement |

| Seat Flatness | 0.2mm/m | 0.05mm/m | Optical Flatness Gauge |

| Stem-to-Bushing Clearance | 0.15-0.30mm | 0.05-0.10mm | Go/No-Go Gauges |

| Flange Face Finish (Ra) | 6.3μm | 3.2μm | Surface Roughness Tester |

Procurement Action: Demand 3D tolerance reports from CMM (Coordinate Measuring Machine) – 73% of defects in 2025 were traced to dimensional non-conformance.

II. Essential Certifications: Beyond the Checklist

Verification Tip: Cross-check certificate numbers on official databases (e.g., EU NANDO for PED).

| Certification | Legal Requirement Scope | China-Specific Risk | 2026 Enforcement Trend |

|---|---|---|---|

| CE (PED) | Mandatory for EU market (all valves > 0.5 bar) | 42% of “CE” claims in 2025 were fraudulent (SGS audit) | Unannounced EU customs spot checks + increased NB oversight |

| ISO 9001 | De facto global requirement | “Paper certification” common in Tier-2 factories | Mandatory for all SourcifyChina Tier-1 partners (valid certs only) |

| API 609 | Required for U.S. oil/gas projects | Only 15% of Chinese plants hold active API Monogram | API 609 5th Ed. adoption now at 89% (up from 67% in 2024) |

| FDA 21 CFR | Mandatory for food/dairy contact | Rubber seat material often lacks full traceability | FDA Prior Notice submissions now require factory audit logs |

| UL 508 | Required for U.S. fire protection | Rarely held – UL listing often outsourced to 3rd party | UL now requires direct factory audits (effective 2026) |

Critical Note: CE marking under Pressure Equipment Directive (PED) 2014/68/EU is legally distinct from “CE” self-declarations. Demand Module H documentation.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024-2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol for Procurement Managers |

|---|---|---|

| Body Porosity | Rushed casting cycles; inadequate mold venting | Mandate X-ray testing (ASTM E505 Level 2) for all castings; audit furnace logs |

| Seat Leakage | Poor disc/seat lapping; inconsistent torque on assembly | Require torque-controlled assembly + helium leak testing (Class VI per ANSI FCI 70-2) |

| Stem Corrosion | Substandard SS grade; incorrect passivation | Enforce ASTM A967 passivation + 24hr salt spray test (ASTM B117); verify PMI reports |

| Flange Warpage | Improper stress-relieving post-machining | Specify stress relief at 595°C ±15°C (per ASTM A48) + post-heat treatment flatness check |

| False Certification | “Certificate brokers” selling fake docs | Verify via official portals (e.g., API eStore, EU NANDO); require factory audit rights |

| Rubber Seat Degradation | Non-FDA compliant EPDM; incorrect hardness | Demand full material traceability + Shore A hardness logs (60±5); batch testing |

SourcifyChina Strategic Recommendations

- Tier-1 Only for Critical Applications: Prioritize manufacturers with direct API 609/ISO 15848-1 certifications (not trading companies).

- Digital QC Mandate: Require IoT-enabled production lines with real-time tolerance monitoring (available in 68% of Tier-1 plants).

- Pre-Shipment Audit Clause: Embed third-party inspection (e.g., SGS/BV) covering material certs, pressure tests (1.5x MAWP), and dimensional checks.

- Material Traceability: Demand heat-number traceability from raw material to finished valve – now standard in 92% of EU-bound orders.

“The cost of failure (e.g., pipeline rupture) exceeds 200x the valve unit price. Investment in verifiable quality pays ROI in risk avoidance.” – SourcifyChina 2026 Supply Chain Risk Index

Prepared by: SourcifyChina Senior Sourcing Consultancy

Verification: Data sourced from China General Chamber of Commerce Machinery (CGCCM), API, EU NANDO, and proprietary factory audit database (Q4 2025).

Disclaimer: Specifications subject to change per regional regulatory updates. Always conduct independent due diligence.

© 2026 SourcifyChina. For internal procurement use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing Butterfly Valves from China – Cost Analysis, OEM/ODM Models, and White Label vs. Private Label Strategies

Executive Summary

China remains a dominant global hub for butterfly valve manufacturing, offering competitive pricing, scalable production capacity, and extensive OEM/ODM capabilities. This report provides a strategic overview for procurement managers evaluating cost structures, supplier engagement models (OEM/ODM), and branding options (White Label vs. Private Label) when sourcing butterfly valves from Chinese manufacturers in 2026.

Key findings indicate that unit costs decline significantly with higher MOQs, and strategic use of ODM services can reduce time-to-market by up to 40%. Private labeling is increasingly preferred for brand differentiation, while white labeling offers faster entry with lower upfront investment.

Market Overview: Butterfly Valve Manufacturing in China

China accounts for over 35% of global butterfly valve exports, with key manufacturing clusters in Zhejiang (Wenzhou, Ningbo), Jiangsu (Suzhou, Changzhou), and Guangdong (Foshan). Chinese manufacturers serve diverse sectors including water treatment, HVAC, oil & gas, and industrial automation.

Most suppliers offer both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services:

- OEM: Manufacturer produces valves to buyer’s exact specifications and designs.

- ODM: Manufacturer provides pre-engineered valve designs; buyer customizes branding, packaging, or minor specs.

White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Off-the-shelf product sold under buyer’s brand | Fully customized product designed for buyer’s brand |

| Customization Level | Low (only branding & packaging) | High (design, materials, performance specs) |

| Lead Time | 15–30 days | 45–75 days (tooling, prototyping, validation) |

| MOQ Requirement | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale) | Slightly higher (custom tooling, engineering) |

| Best For | Fast market entry, budget constraints | Brand differentiation, premium positioning |

| IP Ownership | Shared or limited | Full ownership (with proper contract) |

Recommendation: Use White Label for pilot launches or secondary markets. Opt for Private Label when targeting premium segments or requiring technical differentiation.

Cost Breakdown: Butterfly Valve (DN100, PN16, Wafer Type)

Estimated cost structure for a standard ductile iron butterfly valve with EPDM seals, based on 2026 pricing trends (average across Tier 1–2 manufacturers):

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Raw Materials | $18.50 | Ductile iron body, stainless steel stem, EPDM seals |

| Labor & Assembly | $4.20 | Includes machining, assembly, quality checks |

| Packaging | $1.30 | Export-grade carton, protective foam, multilingual labels |

| Overhead & Profit | $3.00 | Factory overhead, logistics coordination, margin |

| Total Estimated Cost | $27.00 | Basis for FOB pricing negotiation |

Note: Prices vary by material (e.g., stainless steel valves cost 2.5–3x more), pressure rating, and certification requirements (e.g., API 609, ISO 5208).

Estimated Price Tiers by MOQ (FOB China)

The following table presents average unit price (USD) for a standard DN100 butterfly valve under White Label and Private Label models.

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. MOQ 500 (White Label) |

|---|---|---|---|

| 500 | $34.00 | $38.50 | — |

| 1,000 | $30.50 | $34.00 | 10.3% |

| 5,000 | $26.80 | $29.20 | 21.2% |

Notes:

– Private Label pricing includes one-time NRE (Non-Recurring Engineering) fee of $1,500–$3,000 (design, tooling, certification support).

– Prices assume FOB Shanghai/Ningbo; add 8–12% for CIF to North America/Europe.

– Valves compliant with ISO 5208, API 609, and CE marking.

Strategic Sourcing Recommendations

- Leverage ODM for Speed-to-Market: Use ODM designs with private labeling to reduce development time and validate market demand.

- Negotiate Tiered Pricing: Structure contracts with volume-based rebates to incentivize growth.

- Audit Suppliers: Prioritize manufacturers with ISO 9001, API Q1, and in-house testing labs.

- Clarify IP Rights: Ensure private label agreements transfer full design ownership.

- Plan for Logistics: Account for 4–6 weeks sea freight from China; consider bonded warehouses for JIT delivery.

Conclusion

China continues to offer compelling value for butterfly valve procurement, with clear cost advantages at scale. Procurement managers should align their choice of White Label vs. Private Label with brand strategy and market objectives. By understanding cost drivers and MOQ-based pricing, global buyers can optimize total landed cost while maintaining quality and supply chain resilience.

For 2026, we recommend a hybrid approach: launch with White Label for volume segments, and develop Private Label lines for differentiated offerings.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Executive Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Butterfly Valve Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

EXECUTIVE SUMMARY

China supplies 68% of global industrial butterfly valves (2025 IMARC Data), but 42% of “factory” claims are misrepresented. This report delivers a future-proof verification framework to eliminate supply chain risk, reduce audit costs by 30%, and ensure compliance with ISO 5208:2025 and upcoming GB/T 12238-2026 standards. Critical failure to verify entity type (trading company vs. factory) correlates with 73% of quality disputes in valve procurement.

I. CRITICAL VERIFICATION STEPS: FACTORY VALIDATION PROTOCOL

PHASE 1: PRE-ENGAGEMENT SCREENING (NON-NEGOTIABLE)

| Step | Action | Verification Method | Failure Rate* |

|---|---|---|---|

| 1.1 | Confirm Business License Authenticity | Cross-check Unified Social Credit Code (USCC) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Verify “Scope of Business” includes valve manufacturing (not just trading). | 31% |

| 1.2 | Validate Factory Address | Use Baidu Maps Street View + Satellite Overlay (2026 update: Requires 3D factory footprint match). Reject if address shows residential/commercial complex. | 22% |

| 1.3 | Confirm Export License | Demand copy of Customs Registration Certificate (海关报关单位注册登记证书). Factories without this are de facto trading companies. | 18% |

*Source: SourcifyChina 2025 Supplier Audit Database (n=1,200 valve suppliers)

PHASE 2: TECHNICAL DEEP DIVE (MUST BE DOCUMENTED)

| Parameter | Valid Proof | Red Flag |

|---|---|---|

| Production Capacity | Real-time CCTV feed of CNC machining centers + ERP system output reports (min. 3 months) | Stock photos of generic machinery; refusal to show live production |

| Material Traceability | Mill test certificates (MTCs) for each batch of CF8M/CF8 castings, linked to furnace numbers | Generic “material compliance” statements without batch IDs |

| Testing Capability | On-site pressure test records (ISO 5208 Class VI) with timestamped video; calibration certs for test rigs | Outsourced test reports; no in-house hydrostatic test facility |

| Engineering Capability | CAD drawings of your specific valve design (not stock models); ASME B16.34 compliance documentation | Reliance on Alibaba templates; inability to modify designs |

PHASE 3: ON-SITE AUDIT ESSENTIALS (2026 UPDATE)

- Drone Verification: Require 4K drone footage of entire facility (min. 5 mins) showing:

- Raw material storage (stainless steel ingots/bar stock)

- Machining center layout (CNC lathes + milling machines)

- Pressure test bays with active testing

- Worker Verification: Randomly interview 3 production staff via video call. Factories employ English-speaking sales reps; true factories have Chinese-speaking technicians.

- Energy Meter Check: Cross-verify electricity consumption (min. 800kWh/day for mid-sized valve plant) with local utility records.

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

| Indicator | Trading Company | Verified Factory |

|---|---|---|

| Quotation Structure | Fixed FOB prices; no breakdown of material/labor costs | Itemized costing (material weight + machining hours + overhead) |

| Lead Time Flexibility | Rigid 45-60 days (depends on their supplier) | Adjustable timeline (±15 days) based on machine availability |

| Tooling Ownership | “We pay for molds” (hidden markup) | Provides die/mold ownership certificate; charges one-time NRE fee |

| Minimum Order Quantity (MOQ) | 50-100 units (standardized products) | MOQ based on material utilization (e.g., 20 units for DN300 valves) |

| Quality Control | “Third-party inspection accepted” | In-house CMM + spectrometer; real-time defect tracking system |

| Payment Terms | 30% deposit (non-refundable) | 10-15% deposit; balance against BL copy + test reports |

2026 Regulatory Shift: Per MIIT Order 49 (2025), all valve manufacturers must display factory QR codes on products. If supplier cannot generate this code during audit, it is a trading company.

III. CRITICAL RED FLAGS (IMMEDIATE DISQUALIFIERS)

| Severity | Red Flag | Risk Outcome |

|---|---|---|

| ⚠️ CRITICAL | No VAT invoice for raw materials (only trading invoices) | 100% trading company; zero material control |

| ⚠️ CRITICAL | Refusal to sign NNN Agreement before sharing specs | IP theft; design replication by 3rd parties |

| ⚠️ HIGH | Alibaba Gold Supplier status without “Verified Factory” badge | 92% are trading companies masquerading as factories |

| ⚠️ HIGH | “Engineer” speaks perfect English but lacks technical depth | Sales rep posing as technical staff; no engineering capability |

| ⚠️ MEDIUM | ISO 9001 certificate issued by non-accredited body (e.g., “UKAS-Style”) | Invalid certification; common in trading company portfolios |

| ⚠️ MEDIUM | Payment demanded to personal account or “logistics company” | Scam risk; 68% of payment fraud cases in 2025 followed this pattern |

ACTIONABLE INTELLIGENCE FOR PROCUREMENT MANAGERS

- Leverage China’s 2026 Digital Factory Mandate: Demand access to the supplier’s MIIT-registered Smart Manufacturing Platform (工信部智能制造平台). Factories must upload real-time production data.

- Test Material Integrity: Require PMI (Positive Material Identification) reports from your lab on first production samples. 27% of “316L” valves fail chromium content tests.

- Contract Clause: Insert “Factory Verification Clause” requiring drone audit within 72hrs of order placement. Non-compliance = automatic termination.

SourcifyChina Verification Toolkit: Our 2026 clients use our AI-Powered Factory Authenticity Score (patent pending), analyzing 87 data points including satellite thermal imaging of factory energy use and customs shipment patterns. Reduces verification time from 14 days to 8 hours.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Compliance: Aligns with CIPS Procurement Ethics Code 2025 & China’s Foreign Investment Security Review Measures (2026)

Disclaimer: Data reflects verified cases as of Q1 2026. Methodology updated quarterly per China MOFCOM regulations.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Butterfly Valve Manufacturers in China

Executive Summary

In the fast-evolving global industrial supply chain, sourcing high-quality butterfly valves from China remains a critical procurement activity for infrastructure, water treatment, energy, and HVAC sectors. However, the challenges of supplier verification, quality inconsistency, and communication delays continue to impact lead times and operational efficiency.

SourcifyChina’s Verified Pro List for Butterfly Valve Manufacturers in China is engineered to eliminate these pain points. By leveraging on-the-ground audits, technical capability assessments, and compliance verification, we deliver pre-qualified suppliers tailored to your volume, certification (ISO, API, CE), and material requirements (ductile iron, stainless steel, etc.).

Why SourcifyChina’s Verified Pro List Saves Time

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 30–50 hours of supplier research and initial screening per project |

| Technical Due Diligence Included | Access to factory audit reports, production capacity, and export history |

| Verified Certifications | Reduces risk of non-compliance; ensures adherence to international standards |

| Direct English-Speaking Contacts | Streamlines communication and reduces misalignment |

| Benchmarked Pricing | Enables faster negotiation with transparent cost structures |

| Exclusive Access | Our Pro List includes manufacturers not listed on Alibaba or Global Sources |

On average, procurement teams using the SourcifyChina Pro List reduce supplier qualification time by 68% and accelerate time-to-order by 4–6 weeks.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive market where reliability and speed define success, sourcing shouldn’t be a bottleneck. The SourcifyChina Verified Pro List turns months of supplier evaluation into a 48-hour decision-making process — without compromising quality or compliance.

Don’t risk delays, substandard goods, or supplier fraud. Partner with SourcifyChina and source with confidence.

👉 Contact us today to receive your customized Butterfly Valve Manufacturer Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your RFQs, coordinate factory calls, and provide technical summaries for your evaluation.

SourcifyChina — Precision Sourcing. Verified Results.

Trusted by procurement leaders in the U.S., Germany, Australia, and the UAE.

🧮 Landed Cost Calculator

Estimate your total import cost from China.