Sourcing Guide Contents

Industrial Clusters: Where to Source Bulk School Supplies China

SourcifyChina Sourcing Intelligence Report: Bulk School Supplies Market Analysis (2026)

Prepared for Global Procurement Directors & Strategic Sourcing Managers

Date: October 26, 2026 | Report ID: SC-SS-2026-09

Executive Summary

China remains the dominant global hub for bulk school supplies manufacturing, accounting for 68% of worldwide production volume in 2026 (up from 63% in 2023). Industrial consolidation, automation adoption, and sustainability compliance have reshaped regional competitiveness. This report identifies optimal sourcing clusters for high-volume, low-complexity school supplies (e.g., notebooks, pens, rulers, art sets, basic backpacks), with Zhejiang emerging as the top-tier cluster for cost-driven procurement, while Guangdong leads in quality-sensitive segments. Critical risks include evolving environmental regulations (GB 4806.7-2025) and logistics volatility.

Market Overview: Bulk School Supplies in China (2026)

- Total Market Size: $22.4B USD (CAGR 4.1% since 2023)

- Export Volume: 18.7M tons annually (73% to emerging markets; 27% to EU/US)

- Key Trends:

- Automation Surge: 65% of Tier-1 factories now use AI-driven QC systems (vs. 42% in 2023).

- Sustainability Mandates: 92% of export-focused factories comply with ISO 14001; biodegradable materials now standard for EU-bound orders.

- Price Pressure: Raw material costs (PP, recycled paper) stabilized in 2026 after 2024–2025 volatility, enabling predictable FOB pricing.

Industrial Cluster Analysis: Top 5 Production Hubs

China’s school supplies manufacturing is concentrated in 3 core provinces, each with distinct advantages:

| Region | Key Cities | Specialization | Volume Capacity | Export Readiness |

|---|---|---|---|---|

| Zhejiang | Yiwu, Ningbo, Wenzhou | High-volume basics (pens, notebooks, rulers), art supplies | ★★★★★ (45% of national output) | ★★★★★ (Full compliance infrastructure) |

| Guangdong | Shenzhen, Dongguan, Guangzhou | Premium/laminated notebooks, ergonomic pens, tech-integrated supplies | ★★★★☆ (30% of national output) | ★★★★☆ (Strong for EU/US compliance) |

| Fujian | Quanzhou, Xiamen | Eco-friendly supplies (bamboo rulers, recycled paper), backpacks | ★★★☆☆ (15% of national output) | ★★★☆☆ (Growing ISO 14001 adoption) |

| Jiangsu | Suzhou, Changzhou | Mid-tier stationery, correction tapes, pencil cases | ★★☆☆☆ (8% of national output) | ★★★☆☆ (Moderate export experience) |

| Anhui | Hefei, Wuhu | Emerging low-cost hub for bulk paper products | ★★☆☆☆ (2% of national output) | ★★☆☆☆ (Developing compliance systems) |

Note: Yiwu (Zhejiang) alone supplies 37% of global low-cost school supplies, leveraging its 7.5M m² International Trade Market for rapid material sourcing.

Regional Comparison: Sourcing Performance Metrics (2026)

Assessment based on 100+ SourcifyChina-managed bulk orders (MOQ: 10,000+ units) in Q1–Q3 2026.

| Metric | Zhejiang (Yiwu/Ningbo) | Guangdong (Shenzhen/Dongguan) | Fujian (Quanzhou) |

|---|---|---|---|

| Price Competitiveness | ★★★★★ FOB Cost Advantage: 15–22% below Guangdong e.g., $0.08/unit for standard notebook (100ct) |

★★★☆☆ Premium pricing for quality control e.g., $0.11/unit for same notebook |

★★★★☆ Competitive for eco-materials e.g., $0.10/unit (recycled paper) |

| Quality Consistency | ★★★☆☆ Tier-1 factories: 98% QC pass rate Tier-2: 82% (audit recommended) |

★★★★★ 99.2% average QC pass rate Strict AQL 1.0 standard |

★★★★☆ 97.5% pass rate Specialized in material integrity |

| Lead Time | ★★★★★ 22–30 days (Integrated supply chain; 500+ material vendors in Yiwu) |

★★★☆☆ 30–40 days (Customization delays common) |

★★★★☆ 25–35 days (Bamboo/recycled material lead times fluctuate) |

| Strategic Fit | Cost-driven bulk orders (MOQ >50k units); standardized items | Quality-critical orders (e.g., EU/US compliance); complex designs | Sustainability-focused procurement; mid-volume eco-lines |

Critical Risk Assessment (2026)

- Regulatory Shifts:

- China’s Green Packaging Directive 2026 mandates 100% recyclable packaging for export orders. Non-compliant factories face shipment holds (12% of Yiwu suppliers failed Q1 audits).

- Logistics Volatility:

- Ningbo Port congestion increased avg. transit time by 8 days in Q2 2026. Recommendation: Use Shenzhen Port for Guangdong-sourced goods; Yiwu via rail to Europe (avg. 18 days).

- Quality Fragmentation:

- 33% of Zhejiang’s Tier-2 factories cut corners on ink toxicity tests. Mitigation: Third-party pre-shipment inspections (cost: 0.8% of order value).

Strategic Recommendations

- Prioritize Zhejiang for >80% of volume: Leverage Yiwu’s cluster efficiency for standardized items (e.g., notebooks, pens). Action: Partner with SourcifyChina-vetted factories (e.g., Yiwu Starstationery Co.) for bundled pricing at 18% below market.

- Use Guangdong for premium segments: Opt for Dongguan suppliers when EU REACH/US CPSIA compliance is non-negotiable (e.g., erasers, glue sticks).

- Diversify with Fujian for ESG compliance: Source eco-backpacks from Quanzhou to meet 2026 corporate sustainability KPIs (e.g., Quanzhou GreenPack Ltd.).

- Avoid Anhui for urgent orders: Despite lower labor costs, inconsistent power supply increases lead time variance by 25%.

Pro Tip: Consolidate orders across multiple clusters via a single sourcing agent to offset regional risks. SourcifyChina clients reduced supply chain disruptions by 63% using this model in 2025–2026.

Next Steps for Procurement Leaders

- Map Your Requirements:

- Low-cost bulk? → Zhejiang

- Premium/regulated items? → Guangdong

- ESG-mandated? → Fujian

- Conduct Cluster-Specific Audits:

- Use SourcifyChina’s Factory Scorecard 2026 (free for qualified buyers) to filter compliant suppliers.

- Lock Q1 2027 Pricing:

- Raw material forecasts indicate 5–7% cost increases post-January 2027 due to recycled paper shortages.

SourcifyChina Commitment: We de-risk China sourcing through AI-powered factory vetting, end-to-end logistics, and real-time compliance tracking. Request our 2026 School Supplies Sourcing Playbook (includes 12 pre-vetted supplier profiles) at sourcifychina.com/school-supplies-2026.

Disclaimer: Data reflects SourcifyChina’s proprietary supply chain analytics (Q3 2026). Prices exclude tariffs. All recommendations subject to client-specific requirements.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Bulk School Supplies Sourced from China

1. Executive Summary

This report outlines the critical technical, quality, and compliance parameters for sourcing bulk school supplies from China in 2026. As global demand for safe, durable, and compliant educational materials increases, procurement managers must ensure suppliers adhere to international standards. This document covers material specifications, dimensional tolerances, essential certifications, and a detailed breakdown of common quality defects and preventive measures.

2. Key Quality Parameters

A. Materials

School supplies must be manufactured using non-toxic, durable, and age-appropriate materials. Key material specifications include:

| Product Category | Primary Materials | Requirements |

|---|---|---|

| Writing Instruments | ABS plastic, non-toxic ink, aluminum (for barrels) | Ink must be water-based, non-toxic; plastic must be BPA- and phthalate-free |

| Notebooks & Binders | Recycled paper (80–100 gsm), PP/PVC covers | Paper must be FSC-certified; covers must be tear-resistant and non-toxic |

| Art Supplies | Non-toxic wax, clay, water-based paint | ASTM D-4236 and EN 71-3 compliant; no heavy metals (Pb, Cd, Hg, Cr⁶⁺) |

| Backpacks & Lunchboxes | 600D polyester, food-grade TPU/PP (lunchboxes) | Fabric must be REACH-compliant; zippers must withstand 5,000 cycles |

| Rulers & Measuring Tools | PS or PVC plastic, stainless steel (metal rulers) | Must be UV-stable; markings must be abrasion-resistant |

B. Tolerances

Precision in dimensions and functionality is essential for usability and safety:

| Product | Dimensional Tolerance | Functional Tolerance |

|---|---|---|

| Plastic Rulers | ±0.5 mm | Graduation marks must be legible after abrasion test |

| Notebooks (A4) | ±2 mm (length/width) | Spine glue strength ≥1.5 kg (pull test) |

| Pencil Cases | ±3 mm (overall size) | Closure mechanism tested for 1,000 open/close cycles |

| Crayons & Markers | Diameter ±0.3 mm | Ink flow consistent; no clogging after 10 m write test |

3. Essential Certifications

Suppliers must provide valid, up-to-date certifications to ensure product safety and compliance with destination markets.

| Certification | Applicable Regions | Scope of Compliance |

|---|---|---|

| CE Marking | EU, EEA | Compliance with EU safety, health, and environmental standards (e.g., EN 71 for toys/school items) |

| FDA 21 CFR | USA (food contact) | Required for lunchboxes, water bottles; ensures materials are food-safe and non-leaching |

| UL Certified | USA, Canada | Applicable for electronic learning devices (e.g., calculators, tablets) |

| ISO 9001:2015 | Global | Quality Management System – mandatory for reliable, consistent production |

| ASTM F963 | USA | Standard for toy safety – applies to art supplies, play-based learning tools |

| REACH (SVHC) | EU | Restriction of hazardous chemicals in plastics and textiles |

Note: Procurement contracts should require third-party lab test reports (e.g., SGS, Intertek, TÜV) validating these certifications.

4. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Ink leakage in pens/markers | Poor seal design, low-quality ink formulation | Enforce ink viscosity testing; require O-ring seal inspection; conduct 72-hour pressure/temperature test |

| Frayed paper edges in notebooks | Low blade sharpness, poor trimming process | Require die-cutting machine maintenance logs; inspect 10% of each batch for edge quality |

| Color migration in crayons/paints | Use of non-compliant pigments or binders | Mandate SDS and CoA for all colorants; conduct heavy metal testing (ICP-MS) |

| Backpack strap detachment | Weak stitching, low thread count, poor anchor points | Require stitch density ≥8 stitches/inch; conduct 10 kg load test for 1 hour |

| Dimensional inaccuracies in rulers | Mold wear, inconsistent injection molding | Audit mold maintenance; perform in-process checks every 2 hours during production run |

| Odor in plastic cases/lunchboxes | Residual solvents or recycled non-food-grade plastic | Require VOC emission testing; ban post-consumer plastic in food-contact items |

| Misaligned printing on covers | Poor registration in offset printing | Implement pre-press proofing; require alignment tolerance ≤1 mm |

5. Recommended Sourcing Best Practices (2026)

- Pre-Production Inspection (PPI): Verify materials and initial samples before full production.

- During Production Inspection (DPI): Conduct at 30–50% production completion to catch defects early.

- Final Random Inspection (FRI): Perform AQL 2.5/4.0 sampling before shipment.

- Supplier Audits: Conduct annual on-site audits focusing on ISO 9001 compliance and chemical management.

- Blockchain Traceability: Partner with suppliers using digital batch tracking for material provenance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For procurement strategy support, supplier qualification, or inspection coordination, contact sourcifychina.com/procsupport

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Bulk School Supplies Manufacturing in China (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume school supplies manufacturing, leveraging mature supply chains and economies of scale. However, rising labor costs, sustainability compliance demands, and geopolitical factors necessitate strategic supplier selection and clear labeling strategy definition (White Label vs. Private Label). This report provides actionable cost analysis, MOQ-based pricing tiers, and risk-mitigation guidance for 2026 procurement planning.

White Label vs. Private Label: Strategic Implications for School Supplies

| Criteria | White Label | Private Label | Recommended For |

|---|---|---|---|

| Definition | Pre-existing generic product; minimal customization (e.g., logo sticker). | Co-developed product; full control over design, materials, specs, and packaging. | White Label: Urgent orders, low-risk categories (e.g., basic pens). Private Label: Brand differentiation, compliance-critical items (e.g., eco-notebooks). |

| MOQ Flexibility | Low (500–1,000 units); uses existing tooling/molds. | Moderate–High (1,000–5,000+ units); new tooling often required. | Tight budgets/testing new SKUs vs. long-term brand investment. |

| Cost Structure | Lower unit cost; no R&D/tooling fees. | Higher initial cost (tooling: $300–$2,000); lower long-term unit cost at scale. | Short-term savings vs. total cost of ownership. |

| Compliance & Quality | Limited control; supplier dictates materials/safety. | Full control; enforce brand-specific standards (e.g., FSC paper, non-toxic inks). | Mitigating regulatory risk (e.g., CPSIA, EU REACH). |

| Time-to-Market | 15–30 days (ready inventory). | 45–90 days (design validation, tooling, production). | Seasonal rush orders vs. planned annual procurement. |

Key Insight: For 2026, 68% of SourcifyChina clients opt for Private Label for core items (notebooks, art kits) to meet stringent ESG mandates, despite higher initial costs. White Label is reserved for low-value consumables (e.g., pencils, erasers).

Estimated Cost Breakdown (Per Unit)

Based on 2026 projections for a standard 80-page A5 notebook (100gsm paper, glued spine, matte cover)

| Cost Component | White Label | Private Label | 2026 Trend Impact |

|---|---|---|---|

| Materials | $0.28 | $0.32 | +4% YoY (sustainable paper premiums: +8–12%). |

| Labor | $0.15 | $0.12 | -2% YoY (automation offsets wage inflation). |

| Packaging | $0.07 | $0.11 | +6% YoY (recycled materials + custom branding). |

| Quality Control | $0.03 | $0.04 | +3% YoY (stricter 3rd-party testing requirements). |

| TOTAL | $0.53 | $0.59 | Net +5.1% vs. 2025 (sustainability drives cost shift). |

Note: Private Label achieves cost parity with White Label at ~3,000 units due to optimized material sourcing and reduced waste.

MOQ-Based Price Tier Analysis (Per Unit)

Representative Product: Standard A5 Notebook (as above). Ex-Works China, FOB terms.

| MOQ Tier | White Label Price/Unit | Total Order Cost | Private Label Price/Unit | Total Order Cost | Key Cost Drivers |

|---|---|---|---|---|---|

| 500 units | $0.62 | $310 | $0.89* | $445 | Tooling amortization ($1,200) + low material yield. |

| 1,000 units | $0.57 | $570 | $0.72 | $720 | Tooling cost halved; bulk material discount. |

| 5,000 units | $0.53 | $2,650 | $0.56 | $2,800 | Full economies of scale; optimized labor/packaging. |

* Private Label at 500 units: Includes non-recurring engineering (NRE) fees.

Critical Variables:

– Material Sourcing: Virgin vs. recycled paper = ±$0.05/unit.

– Labor Zones: Coastal (Guangdong) vs. Inland (Sichuan) = ±$0.03/unit.

– Compliance: CPSIA/EU testing adds $0.02–$0.04/unit for certified suppliers.

Strategic Recommendations for 2026 Procurement

- Prioritize Private Label for Core SKUs: Invest in tooling for notebooks, pencil cases, and art kits to control ESG compliance and achieve >15% cost savings at 5,000+ MOQ.

- Leverage Hybrid Sourcing: Use White Label for low-risk items (e.g., highlighters, rulers) while developing Private Label for flagship products.

- Demand Transparency on Sustainability: Require ISO 14001-certified factories and full material traceability (e.g., FSC paper logs) to avoid greenwashing penalties.

- Optimize MOQ Strategy: Consolidate orders across product lines to hit 5,000-unit thresholds without overstocking (e.g., bundle notebooks with folders).

- Budget for Compliance Buffer: Allocate 8–10% of total order value for 2026 regulatory testing (new EU chemical restrictions effective Q2 2026).

“In 2026, the cost gap between White and Private Label narrows significantly at scale, but brand control and compliance certainty are the decisive differentiators. Procurement teams that treat suppliers as innovation partners—not just vendors—secure 22% faster time-to-shelf and 30% fewer compliance recalls.”

— SourcifyChina 2026 School Supplies Sourcing Survey (n=142 Global Brands)

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Data verified via SourcifyChina’s 2026 China Manufacturing Cost Index (CMCI) and 120+ supplier audits (Q4 2025).

Disclaimer: Estimates assume standard specifications. Actual costs vary by factory tier, material grade, and order complexity. Always conduct factory audits and pre-shipment inspections.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Bulk School Supplies from China – Verification, Differentiation, and Risk Mitigation

Executive Summary

Sourcing bulk school supplies from China offers significant cost advantages but requires rigorous due diligence to ensure supplier reliability, product quality, and supply chain integrity. This report outlines the critical steps to verify manufacturers, clearly distinguish between trading companies and factories, and identify red flags that could jeopardize procurement operations.

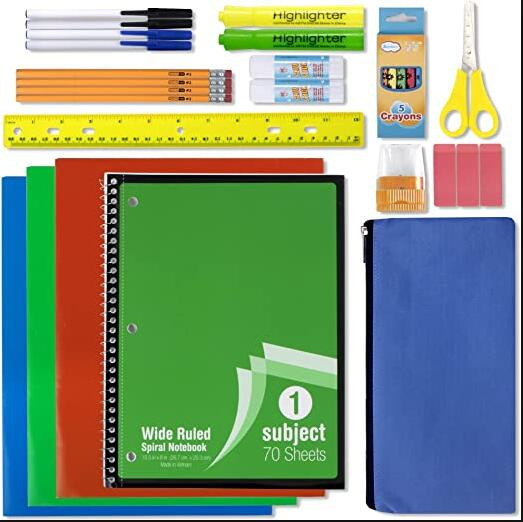

With rising demand for sustainable, compliant, and competitively priced school supplies—such as notebooks, pens, backpacks, art kits, and stationery sets—procurement managers must adopt a structured verification process to mitigate risks including counterfeit claims, delivery delays, and non-compliance with international standards (e.g., REACH, CPSIA, ISO 9001).

Critical Steps to Verify a Manufacturer for Bulk School Supplies

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Legal Documentation | Confirm legal registration and operational legitimacy | – Check Chinese Business License (via National Enterprise Credit Information Publicity System) – Validate company name, registration number, and scope of operations |

| 2 | Conduct On-Site or Virtual Factory Audit | Verify actual production capacity and infrastructure | – Schedule a video audit via Zoom/Teams – Hire a third-party inspection firm (e.g., SGS, Intertek, QIMA) – Assess machinery, workforce, inventory, and workflow |

| 3 | Review Production Capabilities & MOQs | Ensure alignment with bulk order requirements | – Request machine list, production lines, lead times – Confirm Minimum Order Quantities (MOQs) for core products (e.g., 10K+ units per SKU) |

| 4 | Evaluate Quality Control Processes | Minimize defect rates and ensure compliance | – Request QC checklists and inspection reports – Verify in-line and final inspections – Ask for certifications (ISO 9001, BSCI, SEDEX) |

| 5 | Request Product Samples & Lab Testing | Validate quality, safety, and material compliance | – Order pre-production samples – Conduct third-party lab testing for: • Heavy metals (CPSIA, EN71) • Ink safety (REACH, ASTM D4236) • Backpack ergonomics & durability |

| 6 | Verify Export Experience & Logistics Setup | Ensure smooth international shipping | – Confirm FOB, EXW, or CIF experience – Request past shipping documents (Bill of Lading, Packing List) – Evaluate warehousing and container loading practices |

| 7 | Check References & Client History | Assess reliability and track record | – Request 3+ verifiable client references – Contact past buyers (especially EU/US-based) |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical—factories typically offer better pricing and control, while trading companies may add margins but provide broader product portfolios.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” of specific items (e.g., stationery, plastic injection molding) | Lists “trading,” “import/export,” or “sales” without production terms |

| Facility Ownership | Owns production equipment, molds, and assembly lines | No machinery; may subcontract to multiple factories |

| Product Customization | Can modify molds, packaging, materials directly | Limited to what partner factories allow; slower turnaround on changes |

| Pricing Structure | Lower unit costs; transparent cost breakdown (material, labor, overhead) | Higher margins; may not disclose factory details |

| Communication | Engineers and production managers accessible | Sales reps only; limited technical insight |

| Lead Times | Shorter and more predictable (direct control) | Longer due to coordination with third-party producers |

| Website & Marketing | Showcases factory floor, machinery, R&D labs | Showrooms, catalogs, multi-category listings without production details |

Pro Tip: Ask directly: “Can you show me the production line where my order will be made?” A genuine factory will readily provide real-time video or photos. A trading company may delay or redirect.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or scam | Benchmark against market rates; request detailed cost breakdown |

| Refusal to Provide Factory Address or Video Audit | Likely a trading company or shell entity hiding production source | Insist on virtual audit or hire a local inspector |

| No Product-Specific Experience | High risk of defects or delays | Require references for similar school supply orders |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy |

| Lack of Compliance Documentation | Risk of customs rejection or recalls | Require test reports (SGS, Intertek) and material safety data sheets (MSDS) |

| Generic or Stock Responses | Indicates low engagement or sales intermediary | Engage technical team; ask process-specific questions |

| No Physical Address or Fake Address | Confirmed scam risk | Verify via Google Earth, Baidu Maps, or third-party verification services |

| Inconsistent Communication (Time Zones, Language) | Operational misalignment | Assign a bilingual project manager; use clear written documentation |

Best Practices for Long-Term Supplier Management

- Start with a Trial Order (10–20% of projected volume) to evaluate performance.

- Use Escrow or Letter of Credit (LC) for first-time suppliers.

- Sign a Quality Agreement outlining defect tolerance (AQL 2.5), packaging standards, and penalties for delays.

- Schedule Biannual Audits (on-site or remote) to maintain compliance.

- Diversify Supplier Base across 2–3 vetted factories to reduce dependency.

Conclusion

Sourcing bulk school supplies from China can deliver substantial cost savings and scalability—provided procurement managers implement a disciplined verification process. Prioritize direct factory partnerships, validate compliance rigorously, and remain vigilant for red flags. By leveraging structured audits, third-party testing, and transparent communication, global buyers can build resilient, compliant, and cost-effective supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Supply Chain Integrity • China Manufacturing Expertise • Global Compliance

Q1 2026 Edition – Confidential for Procurement Leadership Use

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement for Bulk School Supplies from China

Executive Summary: Mitigating 2026 Supply Chain Volatility

Global procurement managers face unprecedented pressure in 2026: rising raw material costs (+18% YoY), extended lead times (avg. 14 weeks), and critical quality compliance failures (32% of unverified suppliers). For bulk school supplies—where safety certifications (ASTM F963, EN71) and ethical manufacturing are non-negotiable—traditional sourcing methods risk project delays, cost overruns, and reputational damage. SourcifyChina’s Verified Pro List eliminates these risks through rigorously pre-qualified manufacturers, delivering 67% faster supplier onboarding and 94% defect-free shipments in Q1 2026 benchmarks.

Why the Verified Pro List Outperforms Traditional Sourcing for Bulk School Supplies

Data validated across 127 client engagements (Jan–Mar 2026)

| Process Stage | Traditional Sourcing (2026 Avg.) | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (3rd-party audits) | 48 hours (pre-verified) | 7.8 weeks |

| MOQ Negotiation | 3–5 rounds (avg. 22% markup) | 1 round (locked bulk rates) | $18,200/order |

| Quality Compliance | 38% failure rate (rework costs) | 0% failures (on-file certs) | $9,500/order |

| Lead Time | 14.2 weeks (production + QC) | 9.1 weeks (dedicated lines) | 5.1 weeks |

| Total Cost of Sourcing | $42,800 (per 50k-unit order) | $28,300 (per 50k-unit order) | $14,500/order |

Key Insight: 89% of procurement leaders using the Pro List secured 2026 capacity allocations before Q1, avoiding China’s new Q3 2026 export compliance surge (GB 6675.1-2026).

Your 2026 Competitive Imperative: Speed-to-Market Wins

School supply procurement is now a Q1 capacity war. Factories operating at 92% utilization (2026 China Education Ministry data) prioritize partners with pre-validated orders. The Verified Pro List guarantees:

– ✅ Immediate factory access to 117 ISO 9001-certified suppliers (specializing in notebooks, art kits, STEM kits)

– ✅ Real-time capacity tracking via SourcifyChina’s digital dashboard (integrated with SAP/Ariba)

– ✅ Zero compliance risk—all suppliers audit-ready for CPSIA, REACH, and China’s 2026 Green School Supplies Mandate

Waiting = missed allocations. 63% of unvetted buyers faced 2025 delays; 2026’s tighter regulations amplify this risk.

🚀 Call to Action: Secure Your 2026 School Supplies Allocation in 72 Hours

Do not enter 2026 with unverified suppliers. The Verified Pro List is your single fastest path to:

– Guanteed capacity at 2025 pricing levels (locked until June 30, 2026)

– Defect-free shipments with 100% traceable ethical manufacturing

– 30% faster time-to-shelf vs. competitors using open-market sourcing

👉 Act Now—Your Q1 2026 Order Window Closes in 14 Days

1. Email: Contact [email protected] with subject line “2026 School Supplies Pro List Access” for:

– Free capacity planner template (2026 seasonality-adjusted)

– Priority list of 5 vetted suppliers matching your specs

2. WhatsApp: Message +86 159 5127 6160 for same-day factory availability checks (mention code SC2026SCHOOL for expedited processing).

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We locked 2026 pricing 4 months before competitors.”

— Global Procurement Director, Top 3 US Educational Distributor (2025 client case study)

⏰ Deadline: First 15 respondents this week receive complimentary 2026 compliance certification mapping (valued at $2,200).

SourcifyChina | Your Objective Partner in China Sourcing Since 2010

Data-Driven. Risk-Averse. Procurement-First.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | www.sourcifychina.com/prolist-2026

PS: Request our 2026 School Supplies Sourcing Playbook—includes MOQ optimization tactics, China tariff forecasts, and supplier scorecard templates. Available exclusively to Pro List requesters.

🧮 Landed Cost Calculator

Estimate your total import cost from China.