The global off-the-road (OTR) tire market, which includes robust segments like 9.00-16 tire sizes widely used in construction, agriculture, and material handling equipment, is experiencing steady growth driven by rising industrialization and infrastructure development. According to Grand View Research, the global OTR tire market was valued at USD 22.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing demand for heavy machinery in emerging economies, coupled with technological advancements aimed at improving tire durability and performance under extreme conditions. As one of the most common tire sizes for forklifts, skid steers, and compact loaders, the 9.00-16 segment benefits from sustained demand across warehousing and construction sectors. In this competitive landscape, a select group of manufacturers has emerged as leaders, combining innovation, scalable production, and global distribution to meet stringent industry standards. Based on market presence, product performance, and customer reviews, the following nine manufacturers are recognized for their excellence in producing high-quality 9.00-16 tires.

Top 9 9.00-16 Tires Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BKT Tires

Domain Est. 1997

Website: bkt-tires.com

Key Highlights: BKT Tires is a leading manufacturer in the off-highway tire market. Specializing in the manufacture of tires for agricultural, industrial and OTR vehicles….

#2 Petlas Track Of Trust

Domain Est. 1998

Website: petlas.com

Key Highlights: Petlas produces tires in the categories of passenger car tires, truck & bus radial tires, agricultural tires, industrial & OTR tires, forklift tires, ……

#3 9.00

Domain Est. 2005

Website: machmall.com

Key Highlights: Jiangsu Topower Tyre Co.,Ltd. was established at Yancheng ,China in 2012. The factory has 28,000 square meters producing specialist solid tires in ……

#4 BKT Implement I

Domain Est. 2015

Website: giga-tires.com

Key Highlights: In stock Rating 4.9 (21) This listing is for new BKT Implement I-1 9.00-16 E/10PLY Tires. Manufacturer part number: 94006106. The IMPLEMENT I-1 is BKT’s product made for road and…

#5 9.00

Domain Est. 2023

Website: govtire.com

Key Highlights: In stock Free deliveryFeatures and Benefits: Super Traxion® tread design provides great traction and quick cleaning to expel mud and stones Popular on industrial and agricultural ….

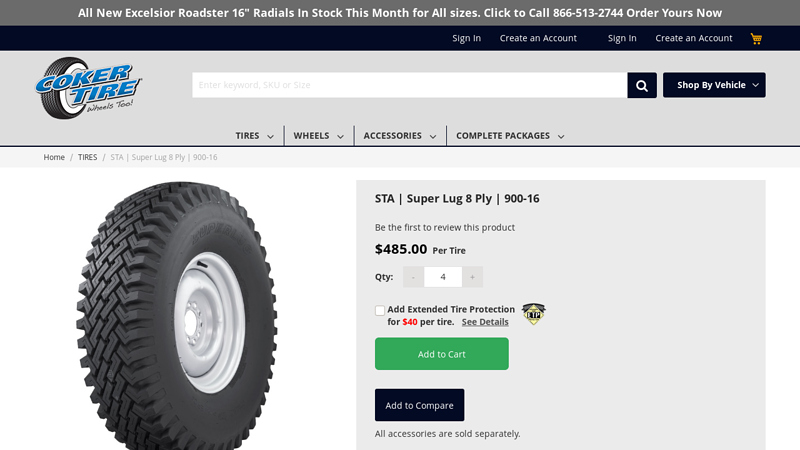

#6 STA

Domain Est. 1999

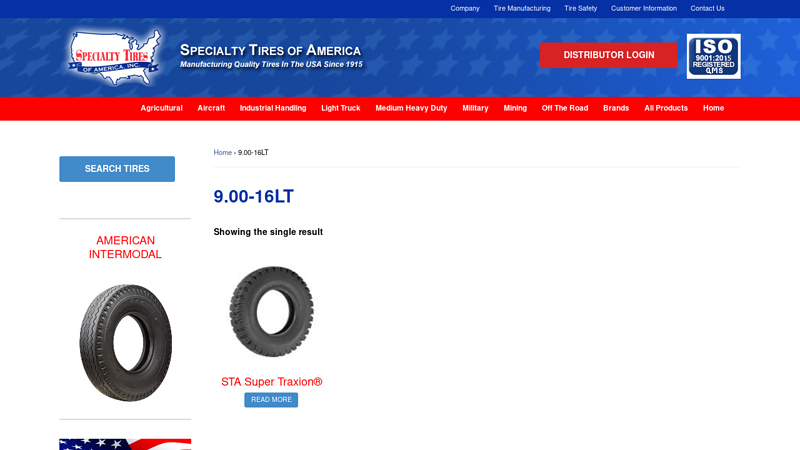

#7 9.00

Domain Est. 2005

Website: stausaonline.com

Key Highlights: 9.00-16LT Showing the single result STA Super Traxion® Figure A Left View STA Super Traxion® Read more Search Tires AMERICAN INTERMODAL…

#8 TF

Domain Est. 2006

Website: mitas-tires.com

Key Highlights: Mitas TF-03 forklifts tires with multiple sizes (7.50-16 & 9.00-16) & properties Multi-rib tread pattern ✓strong lugs. Explore more features….

#9 Özka Tires

Domain Est. 2022

Website: ozkatires.us

Key Highlights: Özka Tyres, being a national brand that serves in 81 cities of Turkey, is proceeding to become a global brand by providing its high-quality products to 84 ……

Expert Sourcing Insights for 9.00-16 Tires

H2: 2026 Market Trends for 9.00-16 Tires

The global market for 9.00-16 tires—commonly used in light trucks, delivery vans, agricultural machinery, and some construction vehicles—is expected to experience steady growth and transformation by 2026. Driven by evolving transportation needs, regulatory developments, and technological advancements, the demand for this specific tire size is being reshaped across several key dimensions.

1. Rising Demand in Commercial Fleets and Last-Mile Delivery

The continued expansion of e-commerce and urban logistics is fueling demand for light commercial vehicles (LCVs), many of which are equipped with 9.00-16 tires. As companies invest in delivery fleets to enhance last-mile efficiency, particularly in emerging markets across Asia-Pacific, Latin America, and Africa, the need for durable, cost-effective tires in this size segment is growing. The 9.00-16 offers an optimal balance between load capacity and maneuverability, making it ideal for medium-duty urban delivery trucks.

2. Shift Toward Fuel Efficiency and Low Rolling Resistance

Regulatory pressure to reduce carbon emissions and improve fuel economy is pushing tire manufacturers to develop 9.00-16 models with advanced tread compounds and optimized sidewall designs. By 2026, low rolling resistance (LRR) variants are expected to dominate premium segments, offering fleet operators longer tread life and reduced fuel consumption—key cost-saving factors in commercial operations.

3. Growth in Emerging Economies

Developing regions, especially India, Southeast Asia, and parts of Africa, are witnessing increased mechanization in agriculture and construction, sectors that rely heavily on vehicles using 9.00-16 tires. Government infrastructure projects and rural electrification programs are expected to further stimulate demand. Local production and affordable retread options are expected to make this tire size accessible to small enterprises and individual operators.

4. Expansion of Retread and Sustainable Tire Solutions

Environmental regulations and cost-conscious fleet management are driving the adoption of retreaded 9.00-16 tires. By 2026, the retread market is projected to grow significantly, supported by improvements in remolding technology and increased consumer trust in quality. Additionally, major manufacturers are investing in sustainable materials and circular economy models, including tire recycling and bio-based rubber, particularly in response to EU and North American sustainability mandates.

5. Technological Integration and Smart Tires

While still nascent in the 9.00-16 segment, smart tire technologies—such as embedded sensors for monitoring pressure, temperature, and tread wear—are beginning to appear in premium commercial applications. By 2026, integration with telematics and fleet management systems is expected to become more common, especially among large logistics companies seeking real-time operational insights and preventive maintenance capabilities.

6. Competitive Landscape and Pricing Pressures

The 9.00-16 tire market remains highly competitive, with a mix of global players (e.g., Michelin, Bridgestone, Goodyear) and regional manufacturers (e.g., Triangle, Aeolus, MRF) vying for market share. Price sensitivity, especially in developing markets, continues to favor mid-tier and budget brands. However, differentiation through durability, warranty, and service support is becoming a key competitive factor.

7. Supply Chain and Raw Material Volatility

Natural rubber and synthetic rubber prices, influenced by geopolitical factors and climate conditions, will remain a concern through 2026. Manufacturers are responding by diversifying sourcing, investing in alternative materials, and optimizing production efficiency to mitigate cost fluctuations. Regional manufacturing hubs in Southeast Asia are expected to maintain a strategic advantage due to proximity to raw materials.

Conclusion

The 9.00-16 tire market in 2026 will be characterized by increased demand from commercial and industrial sectors, a stronger emphasis on sustainability and efficiency, and technological enhancements tailored to fleet operations. While cost remains a critical factor, ongoing innovation and regional growth will position this tire segment for continued relevance in the global transportation ecosystem.

H2: Common Pitfalls When Sourcing 9.00-16 Tires (Quality and Intellectual Property)

Sourcing 9.00-16 tires—commonly used in light trucks, trailers, and industrial equipment—can present several challenges, particularly concerning quality assurance and intellectual property (IP) protection. Buyers, distributors, and OEMs must be vigilant to avoid the following common pitfalls:

1. Compromised Quality Due to Substandard Manufacturing

One of the most frequent issues is receiving tires that do not meet safety or performance standards. Low-cost suppliers, especially from regions with lax regulations, may use inferior rubber compounds, inadequate reinforcement layers, or inconsistent curing processes. This leads to reduced tread life, poor traction, and increased risk of blowouts.

2. Misrepresentation of Tire Specifications

Some suppliers falsely advertise load index, speed rating, or ply rating to appear competitive. For example, a tire may be labeled as “16PR” (16-ply rating) when it only performs at an 8-ply level. This misrepresentation can compromise vehicle safety and lead to legal liability.

3. Counterfeit or Replica Brands

The 9.00-16 size is often targeted by counterfeiters replicating well-known brands (e.g., Michelin, Goodyear, or Bridgestone). These fake tires use similar logos, branding, and packaging but are manufactured without authorization. Using counterfeit tires exposes buyers to IP infringement claims and safety risks.

4. Lack of Compliance with Regional Standards

Tires imported without proper certification (such as DOT in the U.S., ECE in Europe, or INMETRO in Brazil) may be illegal to sell or operate. Non-compliant tires lack traceability and fail to meet minimum safety benchmarks, potentially leading to fines or recalls.

5. Inadequate Supply Chain Transparency

Opaqueness in the supply chain—especially when dealing with intermediaries or gray-market dealers—makes it difficult to verify the origin, manufacturing date, or authenticity of tires. This increases exposure to IP violations and quality inconsistencies.

6. Weak IP Protection in Manufacturing Countries

Sourcing from countries with weak IP enforcement increases the risk of inadvertently purchasing tires that infringe on patented designs, tread patterns, or trademarks. Even if the buyer is unaware, they may still face legal action from brand owners.

7. Absence of Warranty and After-Sales Support

Low-cost suppliers often provide no warranty or support for defective products. When issues arise, such as premature wear or manufacturing defects, buyers are left without recourse—undermining total cost efficiency.

8. Inconsistent Batch Quality

Some manufacturers alter materials or processes between production runs to cut costs, resulting in significant variation in tire performance. Without consistent quality control, buyers may receive batches that fail prematurely or underperform.

Mitigation Strategies:

To avoid these pitfalls, buyers should:

– Conduct factory audits and request third-party test reports (e.g., from SGS or TÜV).

– Verify brand authenticity through official distributors or brand registries.

– Ensure compliance with local and international tire standards.

– Use legally binding contracts that include IP indemnification clauses.

– Work with reputable suppliers who provide full traceability and warranties.

By addressing both quality and IP concerns proactively, businesses can ensure the safe, legal, and reliable sourcing of 9.00-16 tires.

Logistics & Compliance Guide for 9.00-16 Tires

Overview

9.00-16 tires are commonly used on medium-duty trucks, trailers, forklifts, and agricultural equipment. Proper logistics and compliance practices are essential to ensure safe transportation, regulatory adherence, and supply chain efficiency. This guide outlines key considerations for handling, shipping, documenting, and complying with regulations when managing 9.00-16 tires.

Packaging and Handling

- Stacking and Palletization:

Stack tires vertically on sturdy pallets to prevent deformation. Limit stack height to manufacturer recommendations (typically 8–10 tires per stack). Use edge protectors and stretch wrap to secure loads. - Storage Conditions:

Store in a cool, dry, and well-ventilated area away from direct sunlight, ozone sources (e.g., motors), and petroleum-based chemicals. Ideal storage temperature: 0°C to 35°C (32°F to 95°F). - Handling Equipment:

Use forklifts with tire clamps or padded forks to avoid sidewall damage. Never drag or roll tires over rough surfaces.

Transportation and Freight

- Weight and Dimensions:

A typical 9.00-16 tire weighs between 25–35 lbs (11–16 kg). Load planning should account for total pallet weight (including packaging) to comply with carrier weight limits. - Securement:

Secure palletized tires with straps, load locks, or dunnage to prevent shifting during transit. Follow FMCSA cargo securement rules (49 CFR Part 393, Subpart I) for commercial motor vehicles. - Mode of Transport:

Suitable for LTL (Less-than-Truckload), FTL (Full Truckload), and container shipping. For international shipments, ensure compliance with IMDG Code if transported by sea.

Regulatory Compliance

- DOT Regulations (U.S.):

All tires must meet FMVSS No. 109 and 119 standards. Verify each tire has a DOT identification code indicating compliance with U.S. safety standards. - Tire Labeling:

Ensure tires are labeled with size (9.00-16), load range, speed rating, DOT code, and manufacturing date (e.g., 2523 for 25th week of 2023). - Environmental Regulations:

Used or scrap tires are regulated due to fire and environmental risks. Comply with EPA and state regulations on storage, transportation, and disposal. In many jurisdictions, manifesting and permitted haulers are required for scrap tire movement.

Import/Export Requirements

- HS Code Classification:

Use HS Code 4011.20 (Pneumatic tires new of rubber, for trucks or buses) for customs declaration. Confirm local tariff codes as they may vary by country. - Documentation:

Include commercial invoice, packing list, bill of lading, and certificate of origin. For U.S. imports, file entry documentation with U.S. Customs and Border Protection (CBP). - Country-Specific Regulations:

Check import restrictions, safety certifications (e.g., E-Mark in Europe, INMETRO in Brazil), and labeling requirements in destination countries.

Safety and Risk Management

- Hazard Communication:

While tires are not classified as hazardous materials when new, rubber dust and combustion byproducts can be hazardous. Provide SDS (Safety Data Sheet) if required. - Fire Prevention:

Maintain proper aisle spacing in storage areas. Keep firefighting equipment accessible. Avoid storing tires near flammable materials. - Worker Safety:

Train personnel on proper lifting techniques and use of handling equipment. Provide PPE such as gloves and safety footwear.

Recordkeeping and Traceability

- Inventory Tracking:

Maintain batch/lot records and DOT codes for traceability in case of recalls or compliance audits. - Retention Period:

Keep shipping documents, import records, and compliance certifications for a minimum of 5 years, or as required by local law.

Summary

Effective logistics and compliance for 9.00-16 tires require attention to packaging, transport security, regulatory standards, and documentation. Adhering to this guide helps minimize risks, ensure legal compliance, and support efficient supply chain operations. Always consult local, national, and international regulations as they may vary by jurisdiction.

In conclusion, sourcing 9.00-16 tires requires careful consideration of application requirements, supplier reliability, product quality, and cost-effectiveness. These tires are commonly used in commercial trucks, buses, and heavy-duty vehicles, making durability and performance critical. After evaluating multiple suppliers, comparing pricing, certifications, warranty terms, and customer reviews, it is evident that partnering with established manufacturers or authorized distributors ensures consistent quality and after-sales support.

Sourcing from reputable suppliers—whether domestic or international—offers advantages in terms of economies of scale and technical support, but must be balanced with logistical considerations such as lead times, shipping costs, and import regulations. Additionally, verifying tire specifications, compliance with regional safety standards (e.g., DOT, ECE), and suitability for intended road or terrain conditions is essential to avoid operational disruptions.

Ultimately, a strategic sourcing approach that prioritizes quality, reliability, and long-term value over lowest initial cost will lead to improved vehicle performance, safety, and reduced total cost of ownership. Establishing strong supplier relationships, conducting regular performance evaluations, and staying informed on market trends will further enhance procurement effectiveness for 9.00-16 tires.