The global POS (Point of Sale) printer market is experiencing steady expansion, driven by the increasing adoption of automated retail and hospitality systems. According to a report by Mordor Intelligence, the global POS terminal market was valued at USD 34.92 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2029. This growth is mirrored in the demand for peripheral devices such as 80mm POS printers—widely used for their high-speed printing and compatibility with modern POS systems. With the retail, food service, and healthcare sectors increasingly digitizing operations, reliable and efficient thermal printers have become mission-critical components. As a result, manufacturers specializing in 80mm POS printers are scaling innovation in connectivity, durability, and energy efficiency. Drawing from industry benchmarks and market performance, the following list highlights the top nine 80mm POS printer manufacturers shaping this evolving landscape.

Top 9 80Mm Pos Printer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Winpal: Thermal Printer Manufacturer

Domain Est. 2019

Website: winprt.com

Key Highlights: Thermal printer manufacturer Winpal delivers advanced thermal printing technology and reliable thermal printing solutions for global businesses….

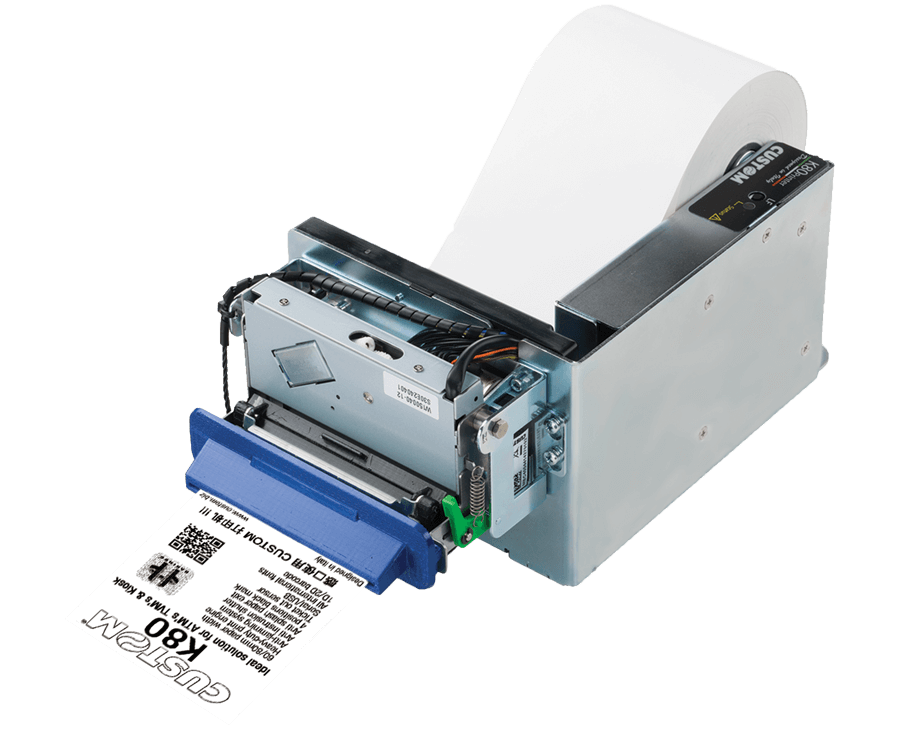

#2 Custom POS 80 Printer Manufacturer

Domain Est. 2021

Website: minjcode.com

Key Highlights: We are a professional manufacturer dedicated to producing high-quality pos 80mm printer. Our products cover thermal printer of various types and specifications….

#3 Point of Sale Thermal Receipt Printers

Domain Est. 1991

Website: epson.com

Key Highlights: Epson’s industry-leading POS receipt printers offer a variety of options to support both traditional and mobile POS systems. Industry’s Fastest Receipt Printer1….

#4 POS Printer

Domain Est. 2004

Website: bixolon.com

Key Highlights: Durable and Cost-Efficient The SRP-E300 is an entry-level 3-inch (80 mm) thermal POS printer that delivers high-quality printing at speeds of up to 220 mm/sec. ……

#5 POS Printer

Domain Est. 2004

Website: citizen-systems.com

Key Highlights: Our 4” printers are versatile, with the capability to print paper widths of 112mm, 82.5mm and 80mm. These compact units can be used to replace A4 printers, ……

#6 Rongta Tech

Domain Est. 2009 | Founded: 2009

Website: rongtatech.com

Key Highlights: Rongta Tech,established in 2009,we supply 80mm & 58mm bluetooth & wifi thermal receipt printer for iPhone/windows/android,also provide pos printer,mobile ……

#7 POS Printer

Domain Est. 2011

Website: eposnow.com

Key Highlights: $49.99 deliveryShop the best POS printers for your US business at Epos Now. Browse our range of high-speed thermal receipt printers and hardware accessories today….

#8 80mm thermal printer SP

Domain Est. 2012

Website: sprt-printer.com

Key Highlights: The SP-POS891 POS Receipt Printer with multiple communication modes, BTMM interface is also available. Rich connection interface like USB, RS232, Ethernet etc. ……

#9 Milestone

Domain Est. 2020 | Founded: 2012

Website: milestoneiot.com

Key Highlights: Meihengtong/Milestone,established in 2012,we supply 80mm & 58mm bluetooth & wifi thermal receipt printer for iPhone/windows/android,also provide pos printer ……

Expert Sourcing Insights for 80Mm Pos Printer

H2: 2026 Market Trends for 80mm POS Printers

The global market for 80mm POS (Point of Sale) printers is poised for significant transformation by 2026, driven by technological innovation, evolving retail landscapes, and shifting consumer behaviors. As a standard width in thermal receipt printing, the 80mm format remains dominant across retail, hospitality, and logistics sectors. Below is an in-depth analysis of key market trends expected to shape the 80mm POS printer industry in 2026.

1. Growth in Cloud and Mobile Integration

By 2026, cloud-connected POS printers will become the norm, especially in small and medium-sized enterprises (SMEs). The integration of 80mm thermal printers with cloud-based POS systems enables seamless remote management, real-time transaction logging, and centralized data analytics. Mobile-first strategies will accelerate demand for Bluetooth- and Wi-Fi-enabled 80mm printers that support on-the-go printing for delivery services, pop-up stores, and mobile vendors.

2. Rise of Smart and IoT-Enabled Devices

The Internet of Things (IoT) will play a pivotal role in the evolution of 80mm POS printers. Smart printers with embedded sensors and self-diagnostic capabilities will gain traction, reducing downtime and maintenance costs. These devices will communicate with inventory systems, send low-supply alerts, and optimize print settings automatically—boosting operational efficiency across retail and food service environments.

3. Sustainability and Eco-Friendly Innovations

Environmental concerns will drive demand for energy-efficient and sustainable 80mm printers. By 2026, manufacturers will increasingly adopt recyclable materials, low-power consumption designs, and longer-life components. Additionally, the decline in thermal paper reliance—due to concerns over BPA/BPS coatings—will encourage the development of alternative printing technologies or integrated digital receipt options (e.g., email/SMS receipts), reducing paper waste.

4. Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa will represent high-growth regions for 80mm POS printers. Urbanization, digital payment adoption, and government initiatives promoting cashless economies (e.g., India’s Digital India program) will fuel demand. Localized manufacturing and cost-optimized models will enable broader market penetration in these regions.

5. Consolidation and Strategic Partnerships

The competitive landscape will see increased consolidation among hardware manufacturers, software providers, and payment processors. Strategic partnerships—such as printer OEMs collaborating with fintech platforms—will deliver bundled POS solutions. This integration will enhance customer value and create ecosystem lock-in, especially in the integrated retail tech space.

6. Enhanced Security Features

With rising cyber threats, 80mm POS printers in 2026 will incorporate advanced security protocols. Encryption for print data, secure firmware updates, and compliance with PCI-DSS standards will become essential, particularly in sectors handling sensitive customer information such as retail and healthcare.

7. Shift Toward All-in-One and Compact Designs

Retailers optimizing space—especially in urban areas and kiosks—will favor compact, multi-functional 80mm printers. Devices combining receipt printing, barcode scanning, and card payment acceptance in a single unit will gain popularity, streamlining countertop setups and improving user experience.

8. Impact of AI and Predictive Analytics

Artificial intelligence will begin influencing printer operations through predictive maintenance and usage analytics. AI algorithms will analyze print volume patterns to predict supply needs, recommend maintenance schedules, and improve inventory forecasting—enhancing overall business intelligence.

Conclusion

By 2026, the 80mm POS printer market will be characterized by smarter, more connected, and sustainable solutions. While the core function of receipt printing remains, the value proposition will expand to include integration, security, and data-driven insights. Manufacturers and service providers who embrace cloud connectivity, IoT, and eco-innovation will lead the market, positioning 80mm printers not just as transactional tools, but as integral components of modern digital commerce ecosystems.

Common Pitfalls When Sourcing 80mm POS Printers (Quality & IP)

Sourcing 80mm POS printers is a critical decision for retail, hospitality, and service businesses. While these printers are widely available, several common pitfalls—especially related to quality and intellectual property (IP)—can lead to long-term operational issues, legal risks, and increased total cost of ownership.

Poor Build Quality and Reliability

Many low-cost 80mm POS printers on the market, particularly from lesser-known manufacturers, suffer from subpar build quality. Components such as print heads, rollers, and mechanical parts are often made from inferior materials, leading to frequent jams, misalignment, and premature failure. This results in increased downtime, higher maintenance costs, and poor customer experience during transactions.

Inconsistent Print Quality and Speed

Low-tier printers may claim high print speeds and resolution, but real-world performance often falls short. Faded text, smudged receipts, or inconsistent print density are common issues. These problems stem from poor thermal head calibration and low-quality firmware, which can affect readability and compliance with legal or tax receipt requirements.

Lack of Genuine IP and Firmware Risks

A major hidden risk is sourcing printers that infringe on intellectual property. Some manufacturers clone firmware or hardware designs from reputable brands without licensing. These counterfeit or IP-violating devices may work initially but lack long-term support, updates, or security patches. Worse, businesses using such equipment could face legal exposure if IP violations are discovered.

Inadequate After-Sales Support and Spare Parts

Many suppliers, especially online or from regions with weak regulatory oversight, offer little to no after-sales service. Warranty claims are difficult to process, and spare parts (like print heads or cutter assemblies) may be unavailable or incompatible. This lack of support increases downtime and forces early replacement, undermining cost savings from the initial low purchase price.

Non-Compliance with Regional Safety and Certification Standards

Some imported 80mm POS printers lack necessary certifications such as CE, FCC, RoHS, or EAC. Using non-compliant devices can lead to failed audits, fines, or even shipment recalls. Additionally, electrical safety risks may arise from poorly designed power components or substandard insulation.

Hidden Total Cost of Ownership

While a cheap printer may seem cost-effective upfront, poor reliability, high failure rates, and lack of support significantly increase the total cost of ownership. Frequent replacements, technician visits, and lost sales due to downtime can far exceed the price difference of a higher-quality, IP-compliant model.

Conclusion

To avoid these pitfalls, buyers should prioritize reputable suppliers, verify certifications, demand proof of IP compliance (such as licensing agreements), and assess real-world reliability through third-party reviews or pilot testing. Investing in a quality 80mm POS printer with genuine IP protection ensures long-term performance, legal safety, and operational efficiency.

Logistics & Compliance Guide for 80mm POS Printer

This guide outlines the key logistics and compliance considerations for the transportation, import/export, and operation of an 80mm POS (Point of Sale) printer. Adhering to these guidelines ensures smooth supply chain operations and regulatory compliance across global markets.

Packaging and Transportation

Ensure the 80mm POS printer is securely packaged using anti-static and shock-absorbent materials to prevent damage during transit. Use standardized carton sizes that optimize palletization and container loading for both air and sea freight. Clearly label each package with handling instructions (e.g., “Fragile,” “This Side Up”), shipping marks, and barcode identifiers. Maintain proper humidity and temperature controls, especially for international shipments crossing extreme climates.

Import/Export Documentation

Prepare accurate and complete documentation for customs clearance, including commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. Classify the printer under the appropriate HS Code—typically 8473.30 for parts and accessories of automatic data processing machines. Verify export control requirements; while most 80mm POS printers are not subject to strict controls, confirm compliance with EAR (Export Administration Regulations) or equivalent in your jurisdiction.

Electrical and Safety Compliance

Ensure the POS printer is certified to meet regional electrical safety standards. Key certifications include:

– CE Marking (EU): Complies with Low Voltage Directive (LVD) and Electromagnetic Compatibility (EMC) Directive.

– FCC (USA): Meets Part 15 Class B for electromagnetic interference.

– UKCA (UK): Required for sale in Great Britain post-Brexit.

– PSE (Japan): Mandatory for electrical products sold in Japan.

– KC (South Korea): Required for electrical safety and EMC.

Provide multilingual user manuals and safety labels as required by local regulations.

Environmental and RoHS Compliance

Confirm that the 80mm POS printer complies with the Restriction of Hazardous Substances (RoHS) Directive (EU 2011/65/EU and equivalents) by limiting lead, mercury, cadmium, and other hazardous materials. Include a RoHS compliance declaration with shipments. Additionally, adhere to WEEE (Waste Electrical and Electronic Equipment) regulations by providing take-back or recycling information in applicable regions.

Battery and Power Supply Considerations

If the POS printer includes an internal battery (e.g., for portable models), ensure compliance with UN 38.3 testing requirements for lithium batteries during air transport. Label packages accordingly and provide Material Safety Data Sheets (MSDS) if required. Power adapters must also carry regional certifications (e.g., UL listed in North America, CE in Europe).

Software and Data Security Compliance

If the printer supports network connectivity or stores transaction data, ensure compliance with data protection regulations like GDPR (EU), CCPA (California), or other applicable privacy laws. Disable unnecessary network services by default and provide secure firmware update mechanisms to address vulnerabilities.

Market-Specific Requirements

Verify country-specific requirements before distribution. For example:

– India: BIS (Bureau of Indian Standards) certification may be required.

– Australia/New Zealand: RCM (Regulatory Compliance Mark) for EMC and safety.

– China: CCC (China Compulsory Certification) for certain models.

Partner with local distributors or consultants to ensure full compliance.

Summary

Proper logistics planning and adherence to compliance standards are essential for the successful global deployment of 80mm POS printers. By addressing packaging, documentation, safety, environmental, and regional regulatory requirements, businesses can minimize delays, avoid penalties, and ensure product reliability and safety in all target markets.

Conclusion for Sourcing 80mm POS Printer:

After a comprehensive evaluation of the market, technical specifications, supplier reliability, and cost considerations, sourcing 80mm POS printers presents a strategic opportunity to enhance operational efficiency across retail, hospitality, and service environments. These thermal printers are widely compatible with existing POS systems, offer fast print speeds, and support high-volume transaction environments.

Key advantages include cost-effectiveness due to the absence of ink or toner, reliable performance with low maintenance, and broad availability of consumables such as 80mm thermal paper rolls. Additionally, many models support multiple connectivity options—USB, Ethernet, Wi-Fi, and Bluetooth—allowing seamless integration into diverse business infrastructures.

When sourcing, it is crucial to select reputable suppliers offering certified products (such as those compliant with CE, FCC, and RoHS standards), competitive pricing, and responsive after-sales service. Prioritizing printers with extended service life, warranty coverage, and eco-friendly features further supports long-term sustainability and reduces total cost of ownership.

In conclusion, sourcing 80mm POS printers from trusted manufacturers and suppliers ensures reliability, scalability, and improved customer service, making them a vital component in modern point-of-sale operations. A well-executed procurement strategy will deliver significant value across the organization.